Best Auto-Pay Insurance Discounts in 2025 (Save up to 10% With These 10 Companies)

The best auto-pay insurance discounts come from State Farm, Geico, and Progressive, each providing a 10% discount for automatic payments. These companies excel in delivering reliable savings, easy setup, and user-friendly policies, making them the top picks for securing the best auto-pay discount rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Commercial Lines Coverage Specialist

UPDATED: Apr 8, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 8, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

State Farm, Allstate, and Liberty Mutual provide the best auto-pay insurance discounts, offering up to 10% savings for automatic payments with user-friendly options.

Understanding how auto insurance payment works can help you maximize these electronic billing benefits, ensuring your premium is lowered while your coverage remains uninterrupted.

Our Top 10 Company Picks: Best Auto-Pay Insurance Discounts

| Company | Rank | Savings Potential | A.M. Best | Accepted Payments |

|---|---|---|---|---|

| #1 | 10% | B | Bank Account, Credit Card, Debit Card | |

| #2 | 10% | A+ | Bank Account, Credit Card, Debit Card, E - Wallet | |

| #3 | 10% | A | Bank Account, Credit Card, PayPal |

| #4 | 10% | A+ | Bank Account, Credit Card, Debit Card |

| #5 | 8% | A++ | Bank Account, Credit Card, Venmo | |

| #6 | 8% | A+ | Bank Account, Credit Card, Debit Card, PayPal | |

| #7 | 7% | A++ | Bank Account, Credit Card, Debit Card | |

| #8 | 5% | A | Bank Account, Credit Card, Mobile Wallet | |

| #9 | 5% | A | Bank Account, Credit Card, Debit Card, Venmo | |

| #10 | 5% | A | Bank Account, Credit Card, Debit Card |

By leveraging the auto-pay discounts offered by these leading providers, you can enhance your overall savings and enjoy a hassle-free insurance experience, giving you peace of mind both financially and on the road.

Understanding how insurance works can feel complicated, but finding affordable rates doesn’t have to be. Enter your ZIP code above for the best insurance rates possible.

- State Farm offers top auto-pay discounts for maximum savings

- Auto-pay insurance discounts can save policyholders up to 10% on premiums

- Many providers offer automatic payment options to help reduce late payment fees

Understanding the Electronic Automatic Billing Discount

Electronic automatic billing allows insurance companies to bill you digitally and automatically withdraw premium payments on a monthly, quarterly, or semi-annual basis. This setup often qualifies you for a discount of 5% to 10%, which can lead to significant savings.

Automatic payments also help ensure there are no lapses in coverage, which can happen if a payment is missed. Driving without insurance can have serious consequences. If your coverage lapses and you get into an accident, you may not have the financial backstop offered by an insurance policy.

State Farm’s auto-pay insurance discounts not only lighten your premium load but also reward your commitment to convenience—making savings as effortless as a click.Dani Best Licensed Insurance Producer

In addition, using paperless billing means you receive important alerts directly to your device, such as payment reminders and renewal notices. This reduces the risk of missing or losing key information, making it easier to manage your auto insurance.

Read More: Best Auto Insurance Companies That Don’t Charge Late Fees

Knowing exactly how discounts lower your total month-to-month auto insurance rates can be a little overwhelming. In the following tables, presentation of the monthly rates of both full and minimum coverage auto insurance from leading providers is clearly compared. It will show the costs before and after applying auto-pay discounts that one could avail of, thus enabling buyers to choose the best options for their needs.

Top Auto-Pay Savings: Full Coverage Auto Insurance Monthly Rates After Discount

| Insurance Company | After Discount |

|---|---|

| $130 | |

| $118 | |

| $114 | |

| $110 |

| $122 | |

| $108 | |

| $126 |

| $123 | |

| $115 | |

| $99 |

To lower your auto insurance rates, consider taking advantage of auto-pay discounts, which can lead to significant savings on monthly premiums for full coverage. For instance, USAA’s pre-discount rate of $110 drops to $99 with auto-pay, while Geico’s rate decreases from $120 to $108. Allstate, with a higher pre-discount rate of $145, reduces to $130 when using auto-pay.

Savings from auto-pay discounts typically range from $11 to $15 per month across providers, making it a smart choice for those seeking lower rates without sacrificing coverage.

Top Auto-Pay Savings: Min. Coverage Auto Insurance Monthly Rates After Discount

| Insurance Company | Before Discount | After Discount |

|---|---|---|

| $85 | $76 | |

| $78 | $70 | |

| $74 | $67 | |

| $70 | $63 |

| $82 | $74 | |

| $72 | $65 | |

| $80 | $72 |

| $78 | $70 | |

| $76 | $68 | |

| $65 | $59 |

Enrollment in auto-pay thus serves to save up to hundreds of dollars on auto insurance. For example, USAA post-discount auto rate is low at $59, whereas Allstate insurance is at $76, American Family and Progressive at $70 each, Erie at $63, and Auto-Owners at $67 are competitive rates.

Farmers, Geico, and State Farm also provide options, allowing consumers to compare rates easily. By choosing auto-pay, customers simplify their payments and benefit from discounts, making it essential for budget-conscious drivers to make informed choices.

Auto-pay insurance discounts reward policyholders for their commitment, making coverage more affordable while ensuring timely payments.Brandon Frady Licensed Insurance Producer

Choosing auto-pay can lead to substantial savings on both full and minimum coverage auto insurance policies. As shown in the tables, top providers like State Farm, Allstate and Liberty Mutual offer some of the most competitive rates after applying the auto-pay discount.

By enrolling in automatic payments, drivers can lower their monthly premiums while enjoying the convenience of hassle-free payments. These discounts can add up over time, making auto-pay a valuable option for cost-conscious policyholders.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Unlocking Your Electronic Automatic Billing Discount

Qualifying for the electronic automatic billing discount is a breeze. All you need is an email address, a bank account, and your routing number. Once you’ve found the perfect car insurance quote, you’ll enter the billing details and choose automatic billing as your payment method.

Your premium will be automatically withdrawn each month on the same day your coverage begins. For instance, if your coverage starts on the 18th, expect your payment to be deducted from your account every month on that date. And don’t worry—if you ever miss a payment due to insufficient funds, most companies offer a helpful 10-day grace period during which you can log in and set up your payment.

Once you opt for automatic billing, the discount kicks in immediately, reducing your monthly premium. Insurance companies aim to simplify this process to encourage more customers to enroll and enjoy the benefits.

Many online insurance providers, including big names like Progressive and Allstate, feature this discount prominently on their websites. To get started, you’ll typically need to enter your vehicle and personal information to receive your quote. Enjoy the savings while enjoying peace of mind with automatic payments.

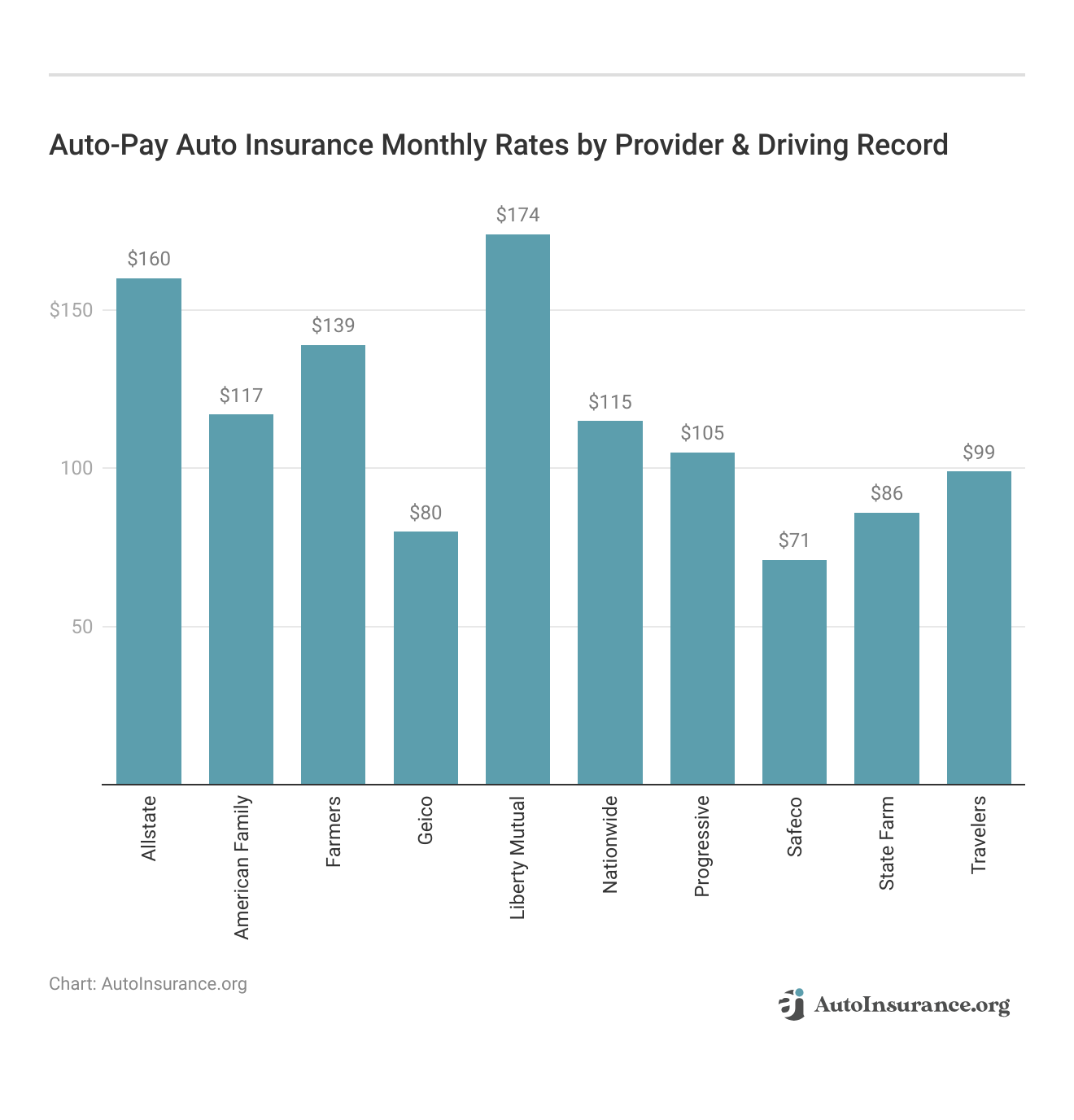

Examine monthly auto insurance rates from leading providers, emphasizing the factors that affect auto insurance rates, particularly driving history. This comparison includes rates for drivers with a clean record, one accident, one DUI, and one ticket, featuring options from companies like Allstate, Geico, and Progressive.

Transparent pricing clarifies how your driving record influences auto insurance premiums, allowing you to find the best rates suited to your circumstances—whether you’re a safe driver or have encountered some challenges.

Maximizing Savings With an Electronic Automatic Billing Discount

If you already have an insurance policy, you can still take advantage of this discount. Many companies will offer a pro-rated discount on all remaining months. If you work with an insurance agent, you can call your agent and ask if your current insurance company offers electronic automatic billing discounts.

You should be able to enroll immediately with just your bank account number, routing number, and policy information, or your agent can assist you with enrollment. If you buy your insurance directly from an insurance company, such as Progressive, you can call their customer service line or go through their online portal to set up automatic payments.

If you aren’t sure if you want to set up recurring payments for your insurance, you can always look at the discount that is provided and decide if it is worth it. When you are in the billing section of your policy, you will be able to see the exact amount you will save for enrolling — typically between 5% – 10%.

If you get multiple auto insurance quotes, you can also compare the discount offered for automatic billing, and it’s worthwhile to check all auto insurance discounts offered to make sure you are taking full advantage of any discounts.

Most Common Auto Insurance Discounts

| Vehicle Discounts | Driver Discounts | Personal Discounts |

|---|---|---|

| Active Disabling Device | Claim Free | Emergency Deployment |

| Adaptive Cruise Control | Continuous Coverage | Family Legacy |

| Adaptive Headlights | Defensive Driver | Family Plan |

| Anti-Lock Brakes | Driver's Education | Federal Employee |

| Audible Alarm | Driving Device/App | Further Education |

| Automatic Braking | Early Signing | Good Student |

| Blind Spot Warning | Full Payment | Homeowner |

| Daytime Running Lights | Good Credit | Life Insurance |

| Economy Vehicle | Loyalty | Married |

| Electronic Stability Control | Multiple Policies | Membership/Group |

| Farm/Ranch Vehicle | Multiple Vehicles | Military |

| Forward Collision Warning | New Customer/New Plan | New Address |

| Garaging/Storing | Occasional Operator | New Graduate |

| Green/Hybrid Vehicle | Online Shopper | Non-Smoker/Non-Drinker |

| Lane Departure Warning | On-Time Payments | Occupation |

| Newer Vehicle | Paperless/Auto Billing | Recent Retirees |

| Passive Restraint | Paperless Documents | Stable Residence |

| Utility Vehicle | Roadside Assistance | Student Away |

| Vehicle Recovery | Safe Driver | Student or Alumni |

| VIN Etching | Seat Belt Use | Volunteer |

If your current insurance company does not offer an automatic payment discount, it might be worth looking into another company for a quote. Consider looking for the same coverage from a company that offers an automatic payment discount as it might net out to be less premium per month, but make sure you evaluate your auto insurance quotes to ensure the coverage is the same.

Another great way to save is to bundle your auto insurance with other insurance products such as homeowners, renters, or even other vehicle insurance. By purchasing multiple policies from one insurance carrier, you are able to realize savings that could be worth hundreds of dollars a year. It is worth looking into a company that can quote all your insurance needs and offers discounts for bundling.

Read more: How to Get a Homeowners Auto Insurance Discount

Lastly, there is always the option of increasing auto insurance deductibles to lower your overall insurance cost. Your deductible is the dollar amount taken out of an insurance claim and can range from nothing to thousands of dollars. Insurance companies like their insureds to have higher deductibles as it insulates them from smaller claims and makes the payout in the event of a large claim smaller.

If you take a higher deductible, you take more risk, but an insurance company will reward you for taking that risk in the form of a lower premium. You should consider your own financial situation, risk tolerance, and reduction in premium when looking at higher deductibles.

Electronic Automatic Billing Discount on Auto Insurance Key Takeaways

Discovering the best auto-pay insurance discounts can significantly reduce your insurance premiums. Top providers like State Farm, Geico, and Progressive offer enticing 5% to 10% savings for setting up automatic payments. This option not only lowers your premium but ensures you never miss a payment, keeping your coverage intact and hassle-free.

Imagine the peace of mind that comes with knowing your policy is always active while benefiting from the best auto-pay insurance discounts. Additionally, by adjusting your deductibles or bundling insurance policies, you can unlock further savings. This guide encourages you to embrace the ease of auto-pay, allowing you to enjoy cost-effective insurance while staying well-protected on the road.

Frequently Asked Questions

What are auto-pay insurance discounts?

Auto-pay insurance discounts are savings offered by insurers to policyholders who set up automatic payments. These discounts can help reduce overall premium costs, making it easier to manage your insurance expenses.

How can I qualify for the best auto-pay insurance discounts?

To qualify for the best auto-pay insurance discounts, you usually need to enroll in your insurer’s automatic payment plans and maintain consistent payments for a specific period. If you’re considering paying your auto insurance online, these plans can streamline your payment process.

Are auto-pay insurance discounts available for all types of insurance?

Many insurers provide auto-pay insurance discounts across various types of insurance, including auto, home, and renters insurance. However, it’s best to check with your specific provider to confirm availability.

Shopping for insurance can feel overwhelming, but you don’t have to do it alone. Enter your ZIP code below into our free comparison tool to get started.

How do I set up auto-pay to receive the best discounts?

To set up auto-pay for the best auto-pay insurance discounts, log into your insurance account or contact your provider directly. Follow the steps to provide your payment information and select your preferred billing cycle.

Which insurance company offers the most discounts?

State Farm offers the best bundling auto and home insurance discounts with an average 23% discount for multi policies. American Family and Farmers each have an average 18% multi-policy discount.

Will I lose my auto-pay discount if I miss a payment?

If you miss a payment while enrolled in an auto-pay plan, some insurers may revoke your discount until you catch up. It’s essential to maintain your payment schedule to continue receiving the best auto-pay insurance discounts.

For detailed information, refer to our comprehensive report titled “Can you change the date that your auto insurance payment is due?“

At what age is car insurance most expensive?

Young drivers ages 16 to 24 tend to have the most expensive car insurance. Drivers in this age group are often inexperienced and are more likely to get into car accidents and file insurance claims. As a result, car insurance companies often charge higher premiums to young drivers.

How much can I save with the best auto-pay insurance discounts?

Savings from the best auto-pay insurance discounts can vary by provider but generally range from 5% to 15% off your total premium. The exact amount depends on the insurer’s policies and your individual circumstances.

Compare insurance rates today by entering your ZIP code into our free comparison tool below.

Who pays the highest insurance rates?

Drivers with a history of accidents, speeding tickets or other traffic violations typically pay the highest rates.

For additional details, explore our comprehensive resource titled “How long does a speeding ticket affect your auto insurance rates?“

Can I combine auto-pay insurance discounts with other discounts?

Many insurers allow you to stack auto-pay insurance discounts with other discounts, such as multi-policy or safe driver discounts. This can significantly enhance your overall savings on premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Commercial Lines Coverage Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.