Best Driver’s Ed Auto Insurance Discounts in 2025 (Save up to 20% With These 10 Companies)

Save up to 20% with the best driver's ed auto insurance discounts at State Farm, Geico, and Allstate. In addition, some programs offer an online defensive driving course for an insurance discount. We'll help you learn how to get a driver's ed insurance discount for cheaper insurance premiums.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Jun 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

State Farm, Geico, and Allstate have the best driver’s ed auto insurance discounts, with savings of up to 20% on auto insurance policies.

Not all companies offer a driver’s ed discount on insurance. If a company does, you must ensure the driver’s ed class you took qualifies for an auto insurance discount. Take a look at the best companies that offer a driver’s ed insurance discount below.

Our Top 10 Company Picks: Best Driver’s Ed Auto Insurance Discounts

| Company | Rank | A.M. Best | Driver's Ed Discount | Who Qualifies? |

|---|---|---|---|---|

| #1 | A | 20% | Young drivers who complete a driver’s ed course | |

| #2 | A++ | 15% | New drivers who have finished a driver’s ed program | |

| #3 | A+ | 12% | Teen drivers who complete a driver’s ed course | |

| #4 | A++ | 10% | Military families with young drivers in driver’s ed | |

| #5 | A+ | 10% | Drivers under 25 who take a driver’s ed course | |

| #6 | A+ | 10% | Young drivers completing a driver’s ed course | |

| #7 | A | 10% | New drivers who complete a driver’s ed program | |

| #8 | A | 10% | Drivers under 25 who finish a driver’s ed course |

| #9 | A++ | 5% | Young drivers who complete a driver’s ed course | |

| #10 | A | 5% | New drivers who complete a driver’s ed course |

Discover how to obtain a driver’s ed discount code, find the best auto insurance companies offering a driving school car insurance discount, and explore additional discounts that can help reduce insurance rates.

Ready to shop for affordable auto insurance today? Simply enter your ZIP using our free quote tool to get started.

- Insurance companies have different requirements for a driver’s ed discount

- Some driver’s education discounts are solely for teenage drivers or senior citizens

- Drivers must complete the driver’s education course and provide proof of completion

How to Get a Driver’s Ed Auto Insurance Discount

Getting a driver’s ed discount is generally straightforward. You can likely obtain an insurance discount by taking a driver education course, but it is important first to verify if your insurance company provides this benefit.

Additionally, review the insurer’s criteria for an acceptable course and ensure you provide proof of completion to the company. Most auto insurance companies will have a list of what courses they accept for the driver’s ed discount. You can also check the discount amount to determine if insurance is cheaper with driver’s ed and if you can receive a driving school certificate insurance discount.

Driver’s ed is also a great way to help teen drivers get their license, as it gives them practice on the road (Learn More: How to Help Teen Drivers Get Their First License). Read on for a breakdown of each step.

Complete Applicable Driver’s Ed Course

Before enrolling in a driver’s ed class, contact your auto insurance company to confirm that they accept the specific program you plan to take. Some insurers may only offer driving school insurance discounts for courses provided directly by the insurance company or those approved by the DMV. For example, ensure that the course qualifies for USAA defensive driving discounts or Progressive driver’s ed discounts if applicable.

After confirming that your driver education course qualifies for an insurance discount, you must sucessfully complete the course to be eligible for the discount.

Insurance companies typically do not offer a driver education course discount to those who have not finished the course. Drivers must have successfully completed a driver education course in order to qualify for the discount on their auto insurance policy.

Give Your Auto Insurance Company a Copy of Your Driver’s Ed Certificate

After finishing the driver’s ed course, inform your insurer and submit proof of completion. Most insurance companies will require a certificate of completion to apply auto insurance discounts for completing a driving course.

You definitely don’t want to overspend 💰on auto insurance, and you probably wish you didn’t have to buy it at all. At https://t.co/27f1xf131D, we crunched the numbers to help you save🤑. Check this out if you want to find the cheapest coverage 👉: https://t.co/933zXMWCxl pic.twitter.com/qBnsPMVoC0

— AutoInsurance.org (@AutoInsurance) June 5, 2023

If you took an online driver’s ed course for an insurance discount, ensure you provide the necessary documentation to your insurer. If the insurance company provides the driver’s ed course, you probably won’t need to submit proof to receive insurance discounts for taking driver’s ed.

To find out which insurance companies accept driving school course discount certificates, check with your insurer directly. After informing your insurance company and showing them the certificate, you should get an applicable driver’s ed discount immediately applied to your policy and have lower rates on your next bill.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Companies for Driver’s Ed Discount

Does driver’s ed reduce insurance? Yes, but how much you’ll save depends on what discount amount is offered at an auto insurance company and what their rates are to start with. For example, the driver’s ed Progressive insurance discount is 10%, which is higher than Traveler’s discount.

Below see how much a driver’s ed discount will save you at the best companies.

Auto Insurance Monthly Rates Before & After Driver's Ed Discount

| Insurance Company | Savings | Before Discount | After Discount |

|---|---|---|---|

| 12% | $87 | $77 | |

| 10% | $62 | $56 |

| 10% | $76 | $68 | |

| 15% | $43 | $37 | |

| 5% | $96 | $91 |

| 10% | $63 | $57 | |

| 10% | $56 | $50 | |

| 20% | $47 | $38 | |

| 5% | $53 | $50 | |

| 10% | $32 | $29 |

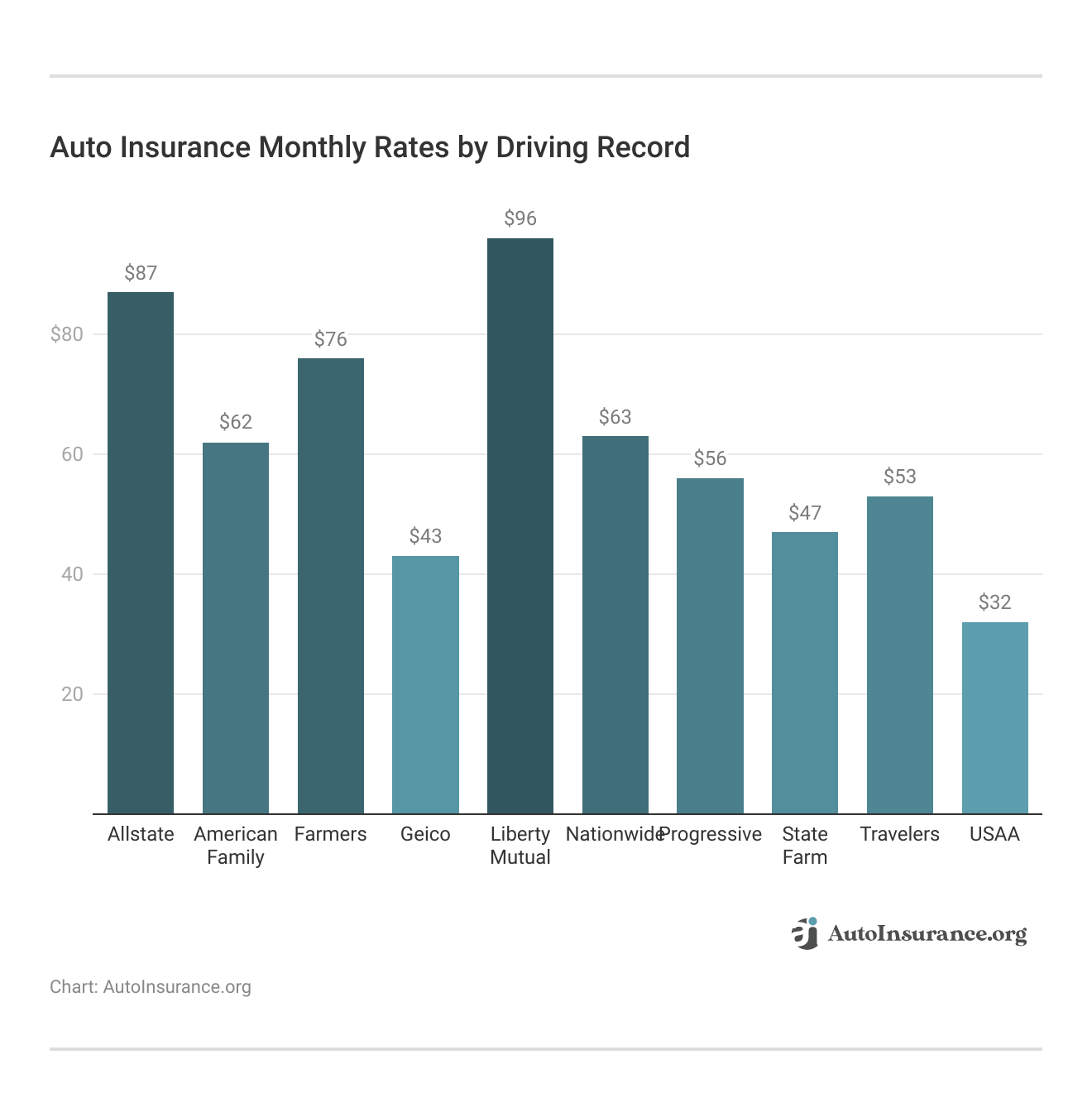

Another factor that will affect what you pay is your driving record. A driver’s ed discount will only reduce rates so far if you are already paying expensive rates. The table below displays rates at the top companies for different driving records.

State Farm has the biggest discount for driver’s ed customers with it’s Steer Clear driving program, and it also has some of the most affordable rates in general (Learn More: What is the Steer Clear program from State Farm?). You can get quotes directly from State Farm, or use a free quote comparison tool to compare multiple companies’ rates.

While the companies listed above are the best for driver’s ed discounts, some other companies still offer insurance discounts. It’s important to check with your company before joining a driver’s ed course with the intention of saving money, as not all companies offer an insurance discount for driver’s ed. The following companies also offer discounts for customers who take driver’s ed courses:

- The Hanover

- The Hartford

Even if your insurance company isn’t listed, it might still offer a program for safe drivers to earn a policy discount, such as using a Driver’s Education of America discount code, an Allstate driver’s ed discount, or a driver’s ed insurance discount with State Farm.

Other Discounts That Decrease Auto Insurance Costs

Since not every provider or state offers driver’s ed discounts, it’s important not to depend on a driver’s ed discount to reduce costs. There are plenty of other discounts that may be available at your insurance company and can help you obtain affordable car insurance, which we’ve covered below.

Auto insurance companies offer a few different discounts based on the way you pay for your auto insurance such as:

- Autopay Discounts: Some insurers offer a small discount if you sign up for autopay. Autopay also ensures you don’t get penalized for late payments.

- Early Signing Discounts: Some auto insurance companies will offer discounts for early signing.

- Full Payment Discounts: Paying in full rather than on a payment plan often earns you a discount on a car insurance policy.

- Paperless Discounts: Going paperless for bills and other documents can earn you a small discount. Read more to learn how to get an electronic automatic billing auto insurance discount.

In addition to payment discounts, you can get discounts based on your policy type and the type of vehicle you insure. The best policy and vehicle discounts are:

- Bundling Discounts: You’ll earn a discount if you bundle multiple insurance policies, such as home and auto insurance.

- Car Safety Discounts: The more safety features your car has and the better it performs in a crash, the lower your auto insurance rate will be.

- Multi-Car Discounts: Insurers will offer a multi-car discount if you have more than one car insured by them.

Finally, drivers can save based on how they drive with low mileage and safe driver program discounts.

- Low Mileage Discounts: Some insurers offer a low-mileage auto insurance discount. Generally, drivers must travel fewer than 10,000 miles per year to qualify.

- Safe Driver Program Discounts: Signing up with an insurance company’s safe driving program or having a clean record can earn you a significant discount. You can also earn cash back for being a safe driver.

Applying the auto insurance discounts above and comparing quotes from various insurance providers can lead to savings on your car insurance policy.

Even if your insurer does not offer an insurance discount for driver’s ed, completing a driver’s education course will improve your driving skills.Dani Best Licensed Insurance Agent

Good driving skills will also help drivers avoid accidents and tickets, which will keep auto insurance rates low at most insurance companies.

Getting Auto Insurance Savings With Driver’s Ed Discounts

Taking a driver’s education course can save you money on car insurance, especially from the companies with the best driver’s ed auto insurance discounts. Before enrolling in a driver’s education course, however, it’s crucial to confirm that your insurance provider offers a discount and that they approve the course you plan to take.

After successfully completing the course, you’ll need to provide proof of completion to qualify for the insurance discount. Taking a driver’s education course can save you money on car insurance (Learn More: How to Lower Your Auto Insurance Rates).

Even if you don’t earn a driver’s ed discount, there are still plenty of ways to save on your auto insurance. To find the best car insurance rates in your area, use our free quote comparison tool today to find cheap auto insurance rates online.

Frequently Asked Questions

How much does driver’s ed save you on insurance?

A driver’s ed insurance discount could save you up to 20% with companies such as Geico, Allstate, or State Farm. The driver’s ed discount amount varies by insurer and can also depend on your driving record and other factors. For example, the driver’s ed insurance discount from Progressive is 10%, but the driver’s ed discount on insurance from Liberty Mutual is 5%.

How long does the driver’s ed discount last?

Usually, auto insurance discounts for taking a driving course will apply for three years or more. However, the duration can vary depending on the auto insurance company, so it’s advisable to confirm with your insurer.

How much does defensive driving lower insurance with Geico?

You could save up to 10% on coverage with a Geico driver’s ed insurance discount. The company also has a defensive driving course discount. Read our Geico defensive driving course review to learn more about the program.

Are there any discounts for safe drivers or having a clean record?

Yes, many auto insurance companies offer discounts for safe drivers. Signing up for a safe driving program or maintaining a clean driving record can often earn you a significant discount on your auto insurance premium.

Can I save on car insurance by bundling policies or signing up for autopay?

Yes, bundling multiple insurance policies, such as home and auto insurance, with the same insurance company can often result in a discount. Additionally, signing up for autopay or paperless billing can sometimes lead to a small discount on your premium.

Is it worth taking a driver’s ed course even if I don’t qualify for a discount?

Yes, taking a driver’s ed course can still be valuable in improving your driving skills and making you a safer driver. This can benefit you in the long run by potentially reducing the risk of accidents and qualifying for other discounts or favorable rates in the future (Learn More: How to Get a Good Driver Auto Insurance Discount).

Are there other discounts besides driver’s ed that can decrease insurance costs?

Yes, there are other discounts that can help reduce insurance costs. These include autopay discounts, bundling discounts for combining multiple insurance policies, car safety discounts, early signing discounts, full payment discounts, low mileage discounts, multi-car discounts, paperless discounts, and safe driver program discounts. Each insurance company may offer different types of discounts, so it’s beneficial to inquire about all potential discounts.

Can I get a driver’s ed discount if I already have a clean driving record?

Yes, even if you have a clean driving record, completing a driver’s ed course can still make you eligible for a discount. The discount is often based on the completion of the course rather than your driving history.

Is there an age limit for taking a driver’s ed course?

The age limit for driver’s ed courses varies by state and insurance company. While some programs are primarily designed for new or young drivers to help them save on the best auto insurance for new drivers, there may be options available for drivers of all ages. Check with your auto insurance company for age-related requirements.

Do you get a discount on insurance for taking driver’s ed?

Yes, many auto insurance companies offer discounts for completing a driver’s education course. This discount can vary by insurer but typically ranges from 5% to 10%. Companies like Geico, State Farm, and Progressive are known to provide such discounts.

Does State Farm give a discount for driver’s ed?

Yes, State Farm offers a discount for drivers who complete a driver’s ed course. The discount amount may vary by state, so it’s best to check with State Farm directly to find out the specifics for your policy.

Does driver’s ed lower insurance?

Yes, taking a driver’s ed course can lower your auto insurance premium. Auto insurance companies often offer discounts to drivers who have completed an approved driver’s education program because it demonstrates a commitment to safe driving.

How much is the insurance discount for taking driver’s ed?

The auto insurance discount for taking driver’s ed generally ranges from 5% to 10%. The exact percentage of the discount depends on the insurer and the specifics of the driver’s education program completed.

How much does driver’s ed save on insurance in Ontario?

In Ontario, completing a driver’s education course can save you up to 10% on your auto insurance premium, depending on the insurance provider. This discount may vary, so it’s advisable to check with your insurance company for specific savings related to driver’s ed.

How much does driver’s ed save you on insurance in Massachusetts?

In Massachusetts, taking a driver’s ed course can lead to a discount of up to 10% on your car insurance premium. The exact savings may differ among insurance companies, so it’s best to confirm with your insurer. Read our guide on the best Massachusetts auto insurance companies to learn more about Massachusetts insurance.

Does Progressive offer car insurance in California?

Yes, Progressive offers car insurance in California. They provide a range of coverage options and discounts, including those for safe driving and completing driver’s education courses.

Do you need insurance to buy a car in California?

No, you do not need insurance to purchase a car in California, but you must have auto insurance coverage to drive it legally. Proof of insurance is required before you can register the vehicle with the DMV.

Does driver’s ed help with insurance in Florida?

In Florida, completing a driver’s ed course may help with insurance by making you eligible for certain auto insurance discounts. Some insurers offer discounts for drivers who have completed an accredited driver’s education program.

While Florida insurance is more expensive, you can find the best Florida auto insurance by comparing rates. You can enter your ZIP in our free tool to get started.

What are the benefits of driver’s ed in NY?

In New York, benefits of taking driver’s ed include potential insurance discounts, improved driving skills, and meeting the requirements for obtaining a driver’s license. The course can also provide valuable knowledge about road safety and driving regulations.

Does Florida have a defensive driving course to lower insurance?

Yes, Florida offers defensive driving courses that can lead to auto insurance discounts. These courses are designed to improve driving skills and may reduce your auto insurance premium if your insurer recognizes the course for discounts.

What is the cheapest car insurance?

The cheapest auto insurance companies can vary depending on your location, driving history, and coverage needs. Commonly affordable options include companies like Geico, State Farm, and Progressive, but it’s best to compare auto insurance quotes from multiple providers to find the best rate for you.

Who typically has the cheapest insurance?

Insurance rates can vary widely, but some companies that are often noted for providing affordable car insurance include Geico, State Farm, and Progressive. Shopping around and comparing auto quotes is the best way to find the cheapest insurance for your specific situation. Compare rates now with our free quote tool to find the cheapest rate from companies in your area.

What is the cheapest car insurance in California?

The cheapest car insurance in California can vary based on factors such as your driving history and coverage requirements. Companies like Geico, Progressive, and State Farm are known for offering competitive rates. Comparing auto insurance quotes from different insurers will help you find the most affordable option.

Is California car insurance expensive?

California car insurance is generally more expensive compared to many other states due to factors like high population density, higher repair costs, and increased risk of accidents. Rates for new drivers can vary based on individual circumstances, so shopping around for the cheapest teen driver auto insurance in California is essential.

What is California minimum car insurance?

In California, the minimum required car insurance coverage is:

- $15,000 for injury or death to one person

- $30,000 for injury or death to more than one person

- $5,000 for property damage

This is often referred to as 15/30/5 coverage.

What happens if I don’t insure my car in California?

If you drive without auto insurance in California, you could face significant penalties, including fines, vehicle impoundment, and suspension of your driver’s license. It’s also illegal to drive without the required insurance, and you may be liable for any damages or injuries if you’re involved in an accident.

How much does driver’s ed cost in Ontario?

In Ontario, the cost of a driver’s ed course typically ranges from $600 to $1,000. The exact cost can vary based on the provider and the specific package or number of lessons included (Read More: Best Auto Insurance for Drivers With a Canadian License).

How to reduce insurance costs in Ontario?

To reduce your auto insurance costs in Ontario, consider the following strategies:

- Take advantage of available auto insurance discounts (e.g., for completing driver’s ed or having a clean driving record).

- Bundle multiple insurance policies with the same provider for a bundling discount.

- Increase your auto insurance deductible to lower your rates.

- Join a free telematics programs if offered by your auto insurer.

Maintaining a good driver record will also go a long way to keeping auto insurance rates affordable.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.