Does a denied claim affect my auto insurance rate? (2025)

A denied claim may affect your auto insurance rates, especially if it was a claim for an at-fault accident. Drivers with multiple claims, even denied ones, will pay more for auto insurance. Just one accident can raise rates to an average of $137 per month, compared to $92 per month for no claims.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jun 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

A denied auto insurance claim doesn’t always affect your auto insurance rates, but it could in certain situations, such as if you filed an at-fault claim.

Insurers may still review your claims history, approved or not, when assessing risk, since your driving record and claims history are both factors that affect your auto insurance rates.

- A denied car insurance claim won’t always raise rates

- Driving record and claims history will impact premiums

- Always keep your claim information easily accessible

If you’re curious about how a denied claim could impact your premiums, we recommend comparing quotes from multiple providers. Enter your ZIP code into our free comparison tool to find the lowest rates for car insurance now.

How a Denied Claim Affects Auto Insurance Rates

Even denied claims could impact what you pay for auto insurance, as it causes insurance companies to reevaluate your risk. For example, let’s say you don’t have comprehensive insurance, but file a claim for a broken window from vandalism.

Because you don’t have the proper coverage, your comprehensive auto insurance claim will be denied. If you purchase the proper comprehensive coverage later, you could have higher rates because your insurance company has reevaluated that vandalism is a higher risk in your area.

You may also be labeled a high-risk driver, even if your claim was denied, if you filed a claim for an at-fault accident or a DUI accident.

Any time there is a record of an accident, ticket, or other violation, it will affect your auto insurance rates, regardless of whether the claim was denied or approved. Wondering how much will my insurance go up with an at-fault accident? Take a look at the effect of accidents on auto insurance rates below.

Auto Insurance Monthly Rates by Accident History

| Accident History | Monthly Rates |

|---|---|

| No Claims | $92 |

| One Accident | $137 |

| Two Accidents | $189 |

| Three Accidents | $245 |

Even if your accident claim is denied, a history of accidents on your record will result in rate increases.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What Constitutes a High-Risk Driver

If you have a poor driving record and a lengthy claims history, you may be classified as a high-risk driver. Once again, whether a claim has been approved or denied is not the main factor; the fact that you had an accident is.

Having a long list of tickets and accidents on your record can definitely put you in the high-risk driver’s seat. You may face premium surcharges that reach as high as 60 percent. Insurance companies look for a few things in particular, including:

- Moving violation tickets for things like speeding and unsafe practices

- Criminally negligent driving

- Driving with a suspended license or with no license at all

- Driving under the influence

- Involuntary manslaughter

Your credit score may also play a part in a high-risk classification. A poor credit score, history of paying late, outstanding debts, and lines of credit may be indicators of a high-risk client.

While a car insurance company cannot cancel, refuse to renew or refuse to sell you car insurance based on credit, they can increase rates.

Younger, inexperienced drivers may also fall into the high-risk category and need to buy high-risk auto insurance even without past claims or accidents on their record.

In addition, understanding what constitutes a high-risk driver involves examining various insurance-related factors. For example, steps to take after a car accident that is not your fault are crucial. Properly documenting the accident and notifying your insurance company can help maintain a positive driving record.

However, even if you follow these steps, insurance premium increases after a claim may still occur. This is because insurers often view recent claims as a sign of increased risk. Similarly, insurance costs rise after filing a claim, reflecting the higher risk associated with recent incidents.

Read More: How long does an accident affect your auto insurance rate?

How to Avoid an Insurance Increase After an Accident

Maintaining your own comprehensive file on the accident is crucial for managing your insurance claim and related processes. All receipts, records of expenses, and accident-related documents should be kept in this file. This includes detailed notes of any conversations you had with the police, the other party, lawyers, accident witnesses, and others regarding the accident.

Keeping accurate and thorough records helps support your claim and can be essential if there are disputes or issues with the insurance process.Dani Best Licensed Insurance Producer

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Reasons a Claim May be Denied

Regardless of how valid you feel your claim may be, an insurance company may deny it for a number of reasons. One of the main reasons pointed out by the Illinois Department of Insurance is failure to cooperate.

If you do not fully answer questions asked, refuse to call back, or simply refuse to give out information, your claim may be on shaky ground.

Insurance companies need to determine the number of factors before they are typically willing to pay out a claim, such as:

- Who is at fault for the accident

- The extent of the fault

- The severity of injuries and property damage

- If those injuries or damage are directly related to the accident

Claims that are not backed up by supporting documents, such as medical and repair bills and a police report, may also be denied. Most states have laws governing the amount of time you have to file a claim, and not meeting the deadline can result in a denial.

You must settle an auto insurance claim within a given timeframe, whether it is by accepting the settlement or filing a lawsuit.Daniel Walker Licensed Insurance Agent

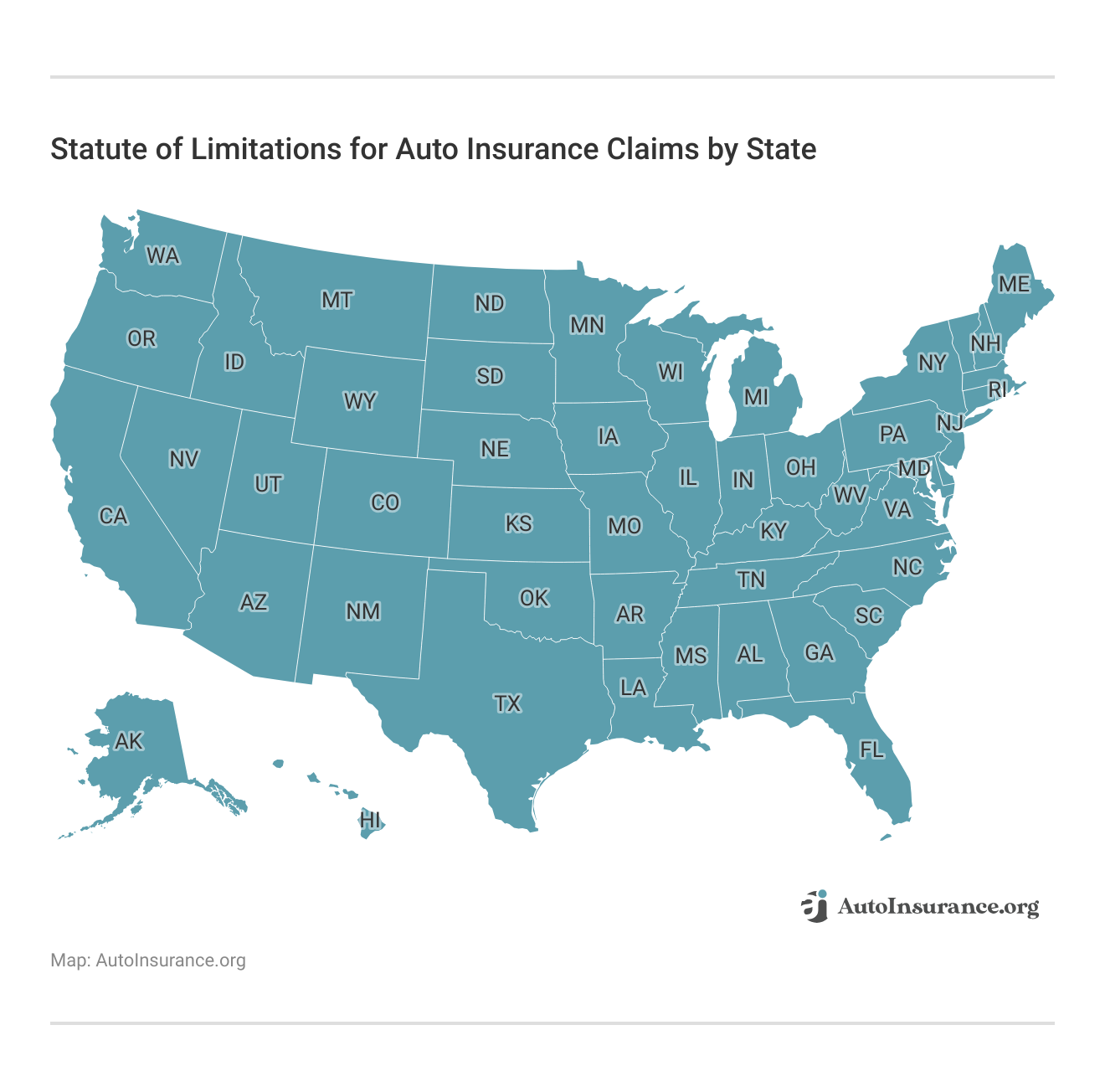

In Illinois, for example, the statute of limitations states that you have two years from the date of the accident to settle bodily injury claims and five years to settle property damage claims. Take a look at the statute of limitations by state below.

Additionally, when dealing with insurance claims, there are several reasons why a claim might be denied. For example, you might receive a notice of denial of medical coverage if the expenses are not covered under your policy. A rejected personal injury protection claim can occur due to insufficient documentation or exclusions in your policy, or a diminished value claim may be rejected if there is a dispute over the value.

Similarly, a company may deny your auto insurance claim might happen if there are policy violations or errors in the claim submission. Understanding the specific issues with your insurance claims is crucial for resolving the problem.

Different types of claims may also face unique challenges. For instance, a comprehensive claim might be denied if the damage is not covered by your policy. Additionally, if you have Progressive insurance coverage for a car that caught on fire, the coverage might be limited based on the specifics of the fire and your policy details.

Each insurance company has its own criteria for processing claims, so reviewing the reasons for any denial is essential for addressing and potentially rectifying the issue.

Fraudulent Insurance Claims

Fraud is another reason a claim may be denied, provided the insurance company recognizes the fraud. It is not always the policyholder who is fraudulent, either. Sometimes, there may be driving app errors that lead to a denial, or car repair shops or mechanics may engage in fraud using a number of techniques.

Car repair shops may over-inflate the estimate of how much it costs to repair a vehicle, bill you for repairs that were not authorized by your insurance company, or charge for new auto parts when they merely pounded out dents instead of replacing a part.

They may also report lost or damaged parts that were never lost or damaged, or charge for new parts when they used parts culled from the junkyard.

Keeping a keen eye on your repair bills and making sure you know the details behind each charge can help you spot fraud on your own.

You can report it by contacting your state’s insurance commissioner.

Also, when handling insurance claims, it’s crucial to understand how various actions can affect your insurance rates and coverage. For instance, insurance rates might increase if someone hits your car because insurers may view this as an increased risk and subsequently raise your premiums.

Additionally, filing an insurance claim could raise rates, even for minor incidents like a scratch on your car. This is relevant when you report a minor accident to your insurance company, as it might lead to higher insurance costs in the future.

If your claim is denied, it’s important to know what actions your insurance company will take if it denies your claim. This involves understanding the reasons behind the denial and taking appropriate steps to address the situation.

Learn More: What to Do if Your Auto Insurance Company Won’t Pay a Claim

Ensuring you correctly complete and submit a claim form and provide all necessary documentation can help resolve issues and prevent further complications. By managing your claims effectively and addressing potential issues transparently, you can better navigate the claims process and avoid unnecessary increases in your insurance premiums.

How to File an Auto Insurance Claim

Although every car insurance company may have slightly different procedures for filing a claim, the process typically involves several standard steps, according to the Wisconsin Office of the Commissioner of Insurance.

- Notify Insurance Company: The first step is notifying your insurance company of the accident by contacting them or your agent directly.

- Collect Documents: Your goal is to find out what specific forms, documents, and other supporting evidence in order to substantiate your claim, such as a copy of the police report.

- Provide Additional Information: Even though you submitted all the necessary paperwork, your insurance company may still contact you for additional information.

- Appeal Claim if Necessary: Suing an insurance company for denying a claim might be necessary if you believe the denial was unjustified.

One of the standard forms you may encounter while filing a claim is known as a proof of loss form. You may need to submit any medical bills and repair bills related to your claim. Being truthful is necessary for filing a claim, as is ensuring you answer all inquiries with the greatest amount of information possible.

Read More: How to Make an Auto Insurance Claim When Not at Fault

You should also provide your own insurance company with any legal documents or papers you received from the other party to help your company compile a comprehensive file on the accident in case you are sued and brought to court.

Car insurance companies may defend you in court under the liability portion of your car insurance policy.

Moreover, filing a claim involves understanding the potential issues that may arise. For example, a State Farm rate increase after an accident can occur if the insurer views you as a higher risk following a claim. If your car insurance claim is denied or even your travel insurance claim is denied, it’s crucial to review the reasons provided by the insurer.

Properly handling insurance claims requires following the correct procedures and providing necessary documentation to support your case.

If you find that the insurance is not paying a claim, you may need to consider further actions. Addressing issues such as a car insurance claim denied or a travel insurance claim denied effectively involves understanding and following the proper steps to resolve disputes.

By carefully managing these situations and addressing any challenges with your claims process, you can work towards a successful resolution.

Filing a Claim vs. Not Filing a Claim

The auto insurance claims you file go on record, where they are easily searchable by future insurance companies. Any claims filed with the other person’s insurance company are likely to be found out by your own.

Should you avoid filing a claim to prevent rate changes? Some motorists may think the easy answer may be to simply not file a claim after an accident and take care of any damage out of their own pockets.

While this may work at keeping a claim off your record, it also makes the cost of repairs your sole responsibility. Auto repairs can be extremely costly, even in cases where the damage may seem minor. Take a look at the cost of auto repairs below.

Auto Insurance Monthly Rates by Vehicle Part Claim

| Claim Type | Monthly Rates |

|---|---|

| No Claims | $92 |

| Bumper Damage | $115 |

| Windshield Replacement | $108 |

| Door Panel Replacement | $121 |

| Fender Replacement | $127 |

| Headlight Replacement | $112 |

| Hood Replacement | $130 |

| Rear-End Damage | $138 |

| Side Mirror Replacement | $109 |

Keeping claims off your record does not guarantee the accident will be kept off your record. Insurance companies may find out about the accident through police reports, even if you did not file. If authorities were called to the scene, they may create their own reports.

The best way to keep accidents off your record is to drive safely and obey the laws. Having an accident is not the end of the world, and most stay on your driving record for a limited amount of time.

Read More: How long does an accident stay on your record?

Should I file a claim for a minor accident? Understanding the potential consequences is crucial when deciding whether to file a claim. In states like Michigan, where no-fault insurance applies, the claims process differs from other states. Choosing not to file a claim might help you avoid some complications, such as a possible auto insurance claim denial.

However, not filing could mean you are left to cover expenses out of pocket. For example, if two cars backing into each other in a parking lot cause damage, not reporting it might leave you with significant repair costs. Additionally, if you later decide to file a claim but it’s denied, you may have to pay a deductible if your claim is denied.

Filing a claim involves working with an insurance adjuster who evaluates the validity of your claim. If the at-fault driver’s insurance denied the claim, this could complicate getting your damages covered. An auto insurance claim denial may result from various factors, such as mistakes in the claim process or disputes over liability.

Thus, carefully weighing the decision to file a claim versus not filing is important, as it impacts both your immediate costs and future insurance considerations.

Check out car insurance rates now by entering your ZIP in our free tool.

Frequently Asked Questions

Will my auto insurance rates increase if my claim is denied?

In general, if your auto insurance claim is denied, it does not directly affect your auto insurance rates. Insurers typically use claims history and driving records to determine premiums, and a denied claim is not typically factored into this assessment. However, there are a few important considerations to keep in mind.

Can a denied claim indirectly impact my auto insurance rates?

While a denied claim itself may not directly affect your rates, certain circumstances related to the denial can have an indirect impact. For example, if your claim was denied due to a violation of policy terms or fraudulent activity, it can lead to policy cancellation or non-renewal. When seeking new insurance coverage, having a policy canceled or non-renewed can result in higher rates.

If the denial is due to an at-fault accident, even if it’s not directly linked to your rates, your insurer may still consider the incident when calculating future premiums.

How can a denied claim affect my future insurability?

A denied claim can affect your future insurability in a couple of ways. Some insurance companies may be hesitant to provide coverage to individuals who have a history of denied claims, as it may be seen as an indicator of increased risk (Read More: How to Check Your Auto Insurance Claims History).

If you’ve had multiple denied claims, insurers may also view you as a higher-risk customer, which could result in higher premiums or difficulty finding coverage.

Is there any way to avoid a denied claim impacting future rates?

While you cannot directly prevent the impact of a denied claim on future rates, there are steps you can take to mitigate potential consequences:

- Ensure you understand your policy terms and coverage limits to minimize the likelihood of a claim denial.

- Practice safe driving habits to reduce the risk of accidents and claims in the first place.

If your claim is denied, it’s important to address the underlying reasons for the denial and take steps to rectify the situation, if possible.

Will a denied claim be recorded on my insurance history?

Yes, a denied auto insurance claim can be recorded on your insurance history. While it may not directly impact your rates, it can still be part of your claims history, which insurers may consider when assessing your risk profile in the future. It’s important to be aware of and address any denied claims to maintain a favorable claims history.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.