Best Safeco Auto Insurance Discounts in 2025 (15% Lower Rates With These 10 Companies)

Multi-policy discounts, accident-free discounts, and multi-car discounts are the best Safeco auto insurance discounts. With these discounts, you can save up to 15%. With the multi-policy discount, you only need to bundle your policies to qualify. Read on to learn more about Safeco’s discounts and incentives.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Apr 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Multi-policy discounts, accident-free discounts, and multi-car discounts are the best Safeco auto insurance discounts where you can save up to 15%.

We’ve dedicated this guide to Safeco’s auto insurance discounts, including the Safeco auto insurance low-mileage discount, see how to get a low mileage auto insurance discount.

Our Top 10 Picks: Best Safeco Auto Insurance Discounts

| Discount | Rank | Savings Potential | Description |

|---|---|---|---|

| Bundling Discount | #1 | 15% | Bundling several policies |

| Accident-Free Discount | #2 | 10% | Staying accident-free |

| Multi-Car Discount | #3 | 8% | Insuring multiple cars |

| Homeowner Discount | #4 | 7% | Owning a home |

| Safe Driver Discount | #5 | 5% | Maintaining a clean record |

| Early Quote Discount | #6 | 4% | Getting a quote in advance |

| Good Student Discount | #7 | 3% | Having good grades |

| New Vehicle Discount | #8 | 3% | Insuring a new car |

| Anti-Theft Discount | #9 | 2% | Anti-theft devices lower rates |

| Electronic Funds Transfer (EFT) Discount | #10 | 2% | Automatic payments |

If you would like to learn more about other offerings from this company, read our Safeco auto insurance review for full details.

If you are ready to buy Safeco auto insurance, enter your ZIP code in our free comparison tool to see Safeco auto insurance discounts and get a Safeco insurance quote compared to other companies.

- Safeco is a subsidiary of Liberty Mutual

- Safeco offers 30 discounts, while Liberty Mutual offers 38

- Notable Safeco discounts include multi-policy, accident-free, and multi-car

How to Qualify for Safeco Auto Insurance Discounts

Qualifying for Safeco auto insurance discounts can be simple if you understand the eligibility criteria and take the necessary steps to meet them.

In this section, we’ll guide you through Safeco’s various discounts and explain how to qualify for each one. Whether it’s maintaining a clean driving record, bundling policies, or taking advantage of other savings opportunities, we’ll show you how to maximize your savings on auto insurance with Safeco.

Apart from discounts you can learn other ways to save on your auto insurance here: How to Lower Your Auto Insurance Rates

Bundle Auto and Home Insurance

Bundling your auto and home insurance with Safeco is one of the most effective ways to qualify for a substantial discount on both policies. Safeco offers a multi-policy discount of up to 15% when you combine these two essential coverages under one provider.

This discount helps you save on your insurance premiums and simplifies your insurance management by consolidating everything into a single policy. Instead of dealing with multiple insurance companies and policies, bundling allows you to manage your coverage needs more efficiently.

The benefits of bundling go beyond just cost savings. When you bundle your auto and home insurance with Safeco, you can have a single point of contact for all your insurance-related inquiries, claims, and updates. This can make it easier to ensure that your home and vehicle are adequately protected and that your coverage aligns with your needs.

Additionally, bundling can often lead to better overall coverage options. Safeco offers customized coverage packages tailored to your unique circumstances, ensuring you receive the best protection for your home and vehicle.

Whether you need comprehensive coverage for your car or additional protection for your home, bundling with Safeco makes it easier to coordinate these coverages under one comprehensive plan.

Select Safeco for your auto and home insurance policies to take advantage of this discount. The savings are automatically applied, making it a seamless way to lower your insurance costs. For homeowners and drivers alike, bundling with Safeco is an intelligent strategy to maximize discounts, simplify insurance management, and ensure comprehensive coverage for the things that matter most.

Read our article on how to save money by bundling insurance policies to learn how you can save more by bundling.

Remaining Accident-Free for a Certain Period

Remaining accident-free for a certain period is a key strategy for qualifying for Safeco’s safe driver discounts. Safeco rewards drivers with a clean driving record, meaning they have not been involved in any at-fault accidents for a specified time.

The exact period required to qualify for this discount may vary, but typically, drivers need to remain accident-free for at least three to five years. That is how long an accident can affect your auto insurance rate

During this time, it’s crucial to adhere to safe driving practices, such as obeying traffic laws, avoiding distractions, and being cautious in adverse weather conditions. The longer you maintain an accident-free record, the more you can save.

The longer you maintain an accident-free record, the more you can save.Michelle Robbins Licensed Insurance Agent

In addition to the financial benefits, staying accident-free contributes to your overall driving safety and protecting others on the road. Safeco’s accident-free discount incentivizes responsible driving and provides a tangible reward for those who prioritize safety behind the wheel. By remaining accident-free, you can lower your insurance costs while enjoying peace of mind on the road.

Ensure a Vehicle That Is Less Than Three Years Old

If you’re buying auto insurance for a new car, you can ask if you qualify for a new car discount with Safeco. Newer vehicles often come with advanced safety features and technologies that can reduce the risk of accidents, making them less risky to insure from an insurance company’s perspective.

Safeco recognizes this lower risk and may offer discounts for insuring a newer vehicle, especially if it has features like anti-lock brakes, adaptive cruise control, or collision avoidance systems.

These discounts are part of Safeco’s broader effort to reward drivers who minimize risk, whether through safe driving habits or by driving a vehicle with the latest safety innovations. Additionally, newer vehicles typically have lower repair costs due to better availability of parts and improved engineering, which can also contribute to lower insurance premiums.

To take advantage of this discount, ensure your vehicle is under three years old and fully equipped with the latest safety features. Not only will you enjoy potential savings on your insurance premiums, but you’ll also benefit from the enhanced protection that comes with driving a newer, safer car. This discount is an excellent way to maximize your investment in a new vehicle while decreasing your insurance costs.

Obtaining a Quote in Advance

This discount is available to drivers who plan and request an insurance quote before their current policy expires or before they need the coverage. By securing a quote in advance, you demonstrate to Safeco that you’re organized and proactive about your insurance needs, which can result in savings on your premium.

This advance quote discount benefits those switching insurance providers or first-time buyers.

Learn more about how to switch auto insurance companies here.

It rewards you for taking the time to compare options and make an informed decision about your coverage. To qualify, you generally need to request a quote a certain number of days—often a week or more—before your desired start date.

Taking advantage of this discount helps you save money and gives you ample time to evaluate your coverage options and ensure you’re getting the best possible rate. By planning and obtaining your Safeco quote in advance, you can reduce your insurance costs while securing the coverage you need without any last-minute stress.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Maximize Savings With Safeco’s Top Insurance Discounts

Safeco offers a variety of discounts that can significantly reduce your auto insurance premiums. Among the most valuable are the multi-policy discount, accident-free discount, and multi-car discount. Each of these discounts targets different aspects of your insurance coverage and driving behavior, allowing you to maximize your savings based on your specific situation.

Multi-Policy Discount (Up to 15%)

The multi-policy discount is one of the most advantageous discounts Safeco offers, allowing you to save up to 15% when you bundle your auto insurance with another policy, such as home or renters insurance. Bundling your policies simplifies your insurance management and leads to substantial savings on both coverages. It’s an excellent option for those looking to streamline their insurance needs while cutting costs.

Accident-Free Discount (Up to 10%)

Safeco rewards safe drivers with an accident-free discount, which can reduce your premiums by up to 10%. This discount is available to drivers who maintain a clean driving record for a certain period, typically three to five years, without any at-fault accidents.

It encourages responsible driving habits and provides financial incentives for those who prioritize safety on the road.

Multi-Car Discount (Up to 8%)

If you insure more than one vehicle with Safeco, you can benefit from the multi-car discount, which offers up to 8% savings. This discount applies when you cover multiple cars under the same policy, making it an ideal choice for families or households with more than one car. It simplifies your insurance management and reduces the overall cost of insuring multiple vehicles.

If you want a bigger multi-car discount and you are wondering which car insurance companies have the biggest multi-car discounts, you can compare Geico, State Farm, and Nationwide.

By taking advantage of these top Safeco discounts, you can lower your insurance premiums while ensuring comprehensive coverage tailored to your needs.

Types of Discounts Offered by Safeco Auto Insurance

Safeco carries several discounts. For example, the multi-policy discount will allow you to bundle Safeco RV insurance with auto insurance. Perhaps you want to bundle your Safeco home insurance with auto insurance for discounts.

Safeco automatic payments will give you small discount on an insurance policy.

There are three different types of discounts that you can ask for when you’re buying insurance. These include driver, vehicle, and policy discounts.

A majority of the savings that you can apply for can be stacked one on the other. With Safeco, you could qualify for 30 different auto discounts. Here’s a breakdown of each of them.

Safeco Defensive Driving Discount

Drivers listed on your policy can affect your rates, especially if they have a poor driving record or recent accidents. However, there are various discounts available through Safeco that can help lower your premiums:

- Defensive Driver: Available for drivers 55 and older who complete an approved course, this discount lasts for three years.

- Distant Student: A discount for resident students attending college more than 100 miles away.

- Driver’s Ed: Offered to drivers under 21 who have been accident-free for the past 36 months.

- Safeco Good Student Discount: For students with a GPA of 3.0 or higher; the discount decreases by 1 percent for each year of driving experience.

- Further Education: Available to policyholders who have earned a Bachelor’s degree or higher.

Additional discounts include savings for homeowners, certain occupations such as business owners, teachers, firefighters, police officers, and educators, as well as for active and retired military personnel. Safeco also offers discounts for maintaining a stable residence for over a year and for teens who participate in safety programs.

Safeco also has a discount called the Safeco Claims-Free Cash Back. Claims-Free Cash Back is a Safeco program where customers with 12-month Superior or Ultra policies can get 5 percent cash back each year for having no claims in the past six months of their policy.

The Safeco Auto Insurance good student discount renews routinely.

Read more: Auto Insurance Discount for American Federation of Teachers (AFT) Members

Vehicle Discounts From Safeco

If your car is stocked with features, you may be able to save money on your premiums by getting discounts. Most auto insurance companies will offer you some type of savings if you have a newer car packed full of safety features. Safeco offers the following vehicle discounts:

- Anti-lock Brakes

- Anti-theft (passive alarm or active alarm that disables the engine)

- Daytime Running Lights

- Newer Vehicle

- Forward Collision Warning

In addition to these discounts, Safeco provides savings for vehicles with low mileage, specifically those driven 4,000 miles or less per year. You can also benefit from discounts for vehicles equipped with passive restraint systems or vehicle recovery services like LoJack or OnStar. Additionally, cars with VIN etching for enhanced security may qualify for further discounts.

See how discounts can affect your auto insurance quote by entering your ZIP code in the FREE comparison tool.

Read more: How to Get an Anti-Theft Auto Insurance Discount

Policy Discounts From Safeco

Policy discounts can range from discounts for the payment method that you choose or for getting quotes early before you sign up for the policy.

These discounts are usually applied off of the total policy premium, and they can be combined with other options in the other categories. Safeco policy discounts include:

- Continuous Coverage: Qualifies you for a discount after being with a company for one year or more, with higher discounts for those who have been with a carrier for five or more years.

- RightTrack: Offers a 5 percent discount for each vehicle when you sign up, with the potential for up to 30 percent off based on your driving behaviors.

- Early Quote: Available when you pay your premium eight days or more before the policy effective date.

- Full Payment: Provides a discount when you pay your premium in full.

- Good Credit Insurance Score: Rewards drivers with a strong credit score.

Safeco also offers rewards for long-term policyholders, such as the Tenure Loyalty Reward after two years. Drivers with good credit and a stable residence can benefit from financial stability discounts. You can also save by bundling multiple insurance policies with Safeco or insuring more than one vehicle. Finally, policyholders who have remained at the same residence for a year or more may qualify for additional savings.

Safeco’s RightTrack is one of the few usage-based insurance devices that is actually plugged into your vehicle to ensure accurate data collection. It also works with the app installed on your mobile device to show real-time data.

This tool is particularly useful if you have a teen driver in your family. Other usage-based insurance programs use only an app on a mobile device and rely on telematic readings based on internal functions of your mobile device such as the compass, GPS, and position detectors.

Why get a discount for good credit? According to the Federal Trade Commission, individuals with good credit present less risk than those with poor credit.

If you’d like to see which Safeco discounts you’ll qualify for, the best way to find out is to get online insurance quotes.

How Safeco Insurance Rates Are Calculated

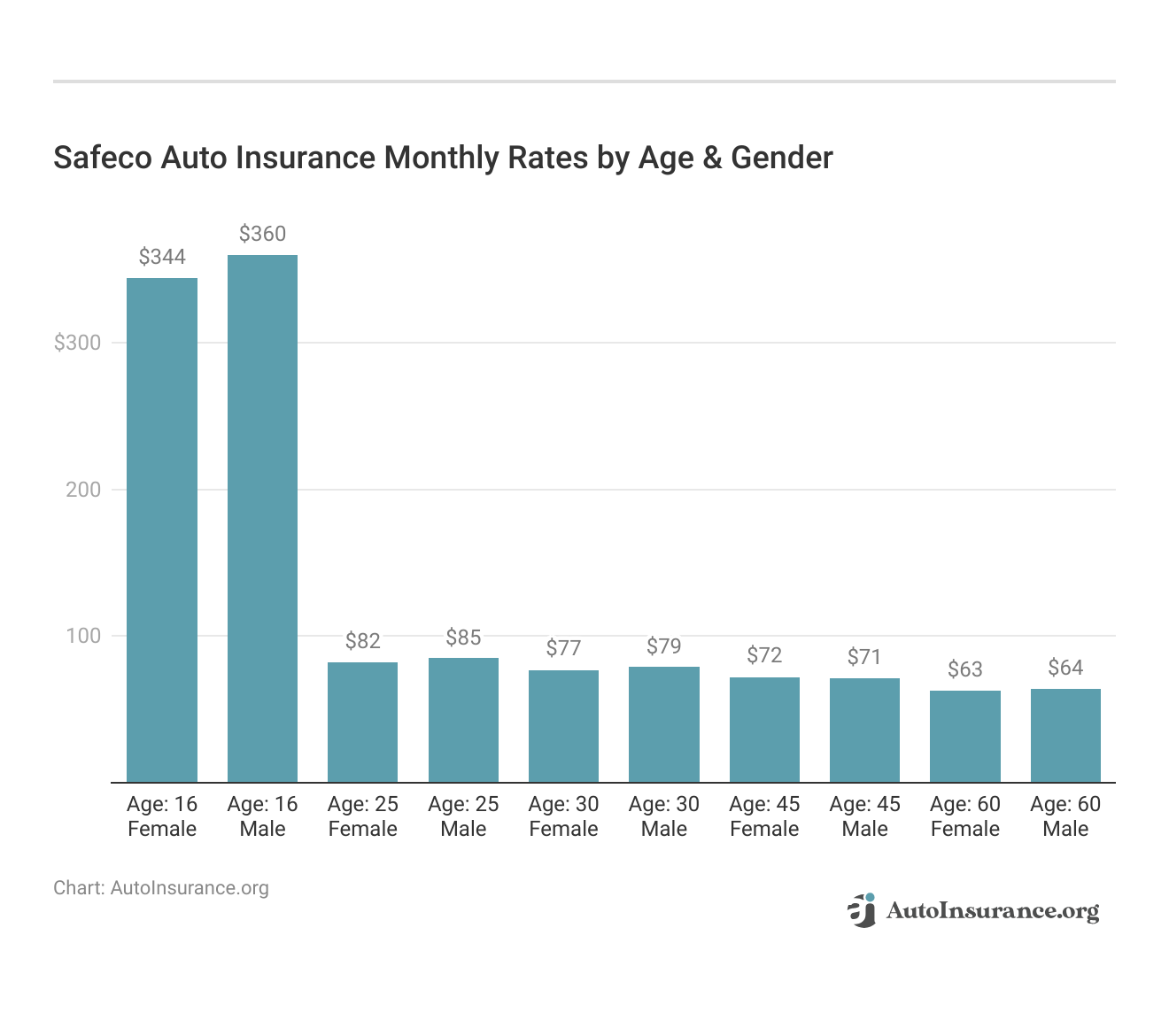

Let’s examine the Safeco annual rates by the age of drivers.

Safeco Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $513 |

| Age: 18 | $417 |

| Age: 25 | $122 |

| Age: 30 | $113 |

| Age: 45 | $101 |

| Age: 55 | $96 |

| Age: 65 | $99 |

Teen drivers have the most expensive rates for auto insurance, while drivers in their 60s pay thousands of dollars less. It’s surprising to see 40-year-old drivers have a higher auto insurance rate than 30-year-old drivers.

To understand why auto insurance discounts are so important, you must first understand how your rates are calculated. There’s an entire process dedicated to ratings.

If companies didn’t invest time and money into pricing their insurance products, they would go out of business after the first round of catastrophic claims were filed.

With RightTrack, you’re in control of your auto policy savings. You’ll get a guaranteed discount just for participating and could save up to $513 per year on your auto insurance premium* once you complete the program.https://t.co/RoZ4nBGZbX

— Safeco Insurance (@Safecoinsurance) October 5, 2023

When insurance companies go into business, they have to set a price per exposure unit. This is what the insurers call a rate.

Auto insurance rates are determined by the company’s statistical analysis of past claims that have been filed. Therefore, the insurer will predict how many losses will be filed, and they will set rates that cover administrative costs, operational costs, and still allow room for a profit.

According to the Insurance Information Institute (III), these losses are recorded by claim adjusters, insurance investigators, and appraisers.

Read more: How to Cancel Safeco Auto Insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How To Shop for Best Auto Insurance Discounts

Everyone who solicits quotes for auto insurance will receive a personalized premium quote. This personalized premium takes the rates for each unit into account and also your rating factors.

Every company has a different set of rates, and some companies will be more competitive than others for drivers in your risk group. You should get quotes to compare rates, but you should also shop in the marketplace for the best discounts.

To secure the best auto insurance discounts, it's crucial to compare personalized quotes from various providers, as rates and discounts can significantly vary depending on your specific risk profile and eligibility for multiple discounts.Daniel Walker Licensed Auto Insurance Agent

You could have favorable ratings for your risk class, but it helps even more when you’re in a favorable risk group, and you also qualify for dozens of different discounts.

Not all companies offer the same discounts, but knowing what Safeco offers can help you decide if you’ll get a deal by making a switch.

Let’s recap on what you’ve learned about Safeco discounts. In addition to the review, we’ll answer frequently asked questions that appear on search engines across the internet.

If you’re ready to start comparing discounts offered by Safeco and other insurance companies, start by entering your ZIP code in the free comparison tool below and find Safeco auto insurance quotes.

Is Safeco auto insurance company the one for you? Find out now.

Frequently Asked Questions

Is Safeco insurance good?

According to A.M. Best, Safeco has an A+ or excellent rating, which means that the company has a stable outlook and has a superior ability to meet the obligations of its customers. Check out our Safeco Auto Insurance Review for more details on ratings, rates, coverages, and discounts.

What is the low mileage discount for Safeco?

The Safeco insurance low mileage discount works by giving 20% off auto insurance rates for a policyholder who drives 4,000 miles or less during the duration of the policy.

How can I qualify for Safeco auto insurance discounts?

To qualify for Safeco auto insurance discounts, you need to meet specific criteria set by the company. These criteria may vary depending on the type of discount.

For example, to qualify for a safe driver discount, you need to have a clean driving record for a specified period. To qualify for a good student discount, need to provide proof of good grades. Contact Safeco or your insurance agent to learn about the specific requirements for each discount.

Is Safeco insurance cheap?

That would depend on your age, location, the vehicle you drive, credit history, and driving record. Since Safeco is a subsidiary of Liberty Mutual, your auto insurance may be more expensive in some parts of the United States. You can learn more about Liberty Mutual’s insurance options in our complete guide: Liberty Mutual Auto Insurance Review.

Can I combine multiple discounts with Safeco auto insurance?

Yes, in most cases, you can combine multiple discounts with Safeco auto insurance. Safeco encourages policyholders to take advantage of available discounts to maximize savings on their premiums. Combining discounts like the multi-policy discount and safe driver discount can help you save even more. Review details of each discount to ensure eligibility and understand any limitations or restrictions.

Does Safeco offer a car rental discount?

Safeco provides various discounts for their insurance policies, including bundle discounts, low usage discounts, and safety features discounts. However, specific mention of a Safeco rental car discount was not found in the information available.

These discounts may potentially apply to situations involving rental cars, but for precise details and eligibility, reaching out directly to a Safeco agent is recommended. They can offer the most current and comprehensive information on discounts and how they may benefit your particular insurance needs.

Does Safeco offer a senior driver discount?

There is not a specific Safeco senior discount that automatically applies to all older drivers. However, they provide a defensive driving discount that seniors can qualify for, which is available to drivers of any age who complete an approved defensive driving course. Beyond this, there are other ways for senior drivers to save on their Safeco insurance policies .

Does Safeco have accident forgiveness?

Yes. However, accident forgiveness is a perk for being a loyal customer. You would have to be with Safeco for several years to be eligible.

How do I qualify for Safeco low mileage discount?

To qualify for the Safeco low mileage discount, you need to ensure your vehicle is driven 4,000 miles or less during your policy period. This discount provides a substantial saving of 20% off your auto insurance rates, catering specifically to drivers who use their vehicles sparingly.

To take advantage of this discount or to see if you’re eligible for it, contact Safeco directly. They will provide the necessary steps and may require proof of your vehicle’s mileage to apply the discount to your policy.

Does Safeco have a military discount?

Safeco Insurance proudly supports the military community by offering a military discount to those who have served in the United States armed forces. To qualify for the military discount, individuals must provide proof of their military service. This can include a copy of your military ID, discharge papers, or any other document that verifies your service in the armed forces.

How does RightTrack know who is driving?

Safeco’s RightTrack program is a cheap usage-based auto insurance (UBI) program that tracks driving habits to potentially offer discounts on auto insurance. The RightTrack device or mobile app monitors various driving behaviors such as acceleration, braking, nighttime driving, and the total miles driven.

However, one limitation of RightTrack, as with many other UBI programs, is its inability to specifically identify who is driving the vehicle at any given time.

You can find the cheapest insurance coverage tailored to your needs by entering your ZIP code below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.