Ocean Harbor Auto Insurance Review for 2025 (See Ratings & Cost Here!)

Our Ocean Harbor auto insurance review reveals $67/mo rates. Ocean Harbor offers competitive discounts, including up to 10% for bundling policies and additional savings for safe drivers. Rates vary by age, but Ocean Harbor provides affordable coverage for residents in Florida and California.

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Jun 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Ocean Harbor

Monthly Rates:

$67A.M. Best Rating:

BComplaint Level:

MedPros

- Affordable rates starting at $67 per month

- Discounts up to 10% for bundling policies

- Flexible coverage options with personalized plans

Cons

- Limited availability only in Florida and California

- No online quote tool for instant estimates

Explore our Ocean Harbor auto insurance review, featuring rates starting at $67 a month for residents in Florida and California.

Ocean Harbor Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 2.9 |

| Business Reviews | 3.0 |

| Claim Processing | 2.2 |

| Company Reputation | 3.0 |

| Coverage Availability | 2.0 |

| Coverage Value | 2.8 |

| Customer Satisfaction | 2.0 |

| Digital Experience | 2.5 |

| Discounts Available | 3.7 |

| Insurance Cost | 3.7 |

| Plan Personalization | 3.0 |

| Policy Options | 2.5 |

| Savings Potential | 3.7 |

Ocean Harbor offers competitive coverage options, including discounts of up to 10% for bundling policies and safe driving.

Though available in only two states, Ocean Harbor’s rates, customer service, and best auto insurance discounts make it a strong choice. Read on to learn about its coverage, discounts, and how it compares to top insurers.

- Ocean Harbor offers rates starting at $67 monthly for FL and CA residents

- Discounts up to 10% for bundling and safe driving are available with Ocean Harbor

- Coverage includes liability, collision, and comprehensive options

If you don’t live in California or Florida, you cannot buy Ocean Harbor car insurance. So find the best auto insurance company near you by entering your ZIP code into our free quote tool.

Ocean Harbor Auto Insurance Monthly Rate Comparison

The rates for minimum and full coverage auto insurance vary across different age groups and genders, with younger drivers typically facing higher Ocean Harbor premiums.

Ocean Harbor Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $300 | $450 |

| 16-Year-Old Male | $320 | $480 |

| 18-Year-Old Female | $270 | $410 |

| 18-Year-Old Male | $290 | $440 |

| 25-Year-Old Female | $190 | $300 |

| 25-Year-Old Male | $200 | $320 |

| 30-Year-Old Female | $150 | $250 |

| 30-Year-Old Male | $160 | $270 |

| 45-Year-Old Female | $130 | $220 |

| 45-Year-Old Male | $67 | $133 |

| 60-Year-Old Female | $110 | $195 |

| 60-Year-Old Male | $120 | $200 |

| 65-Year-Old Female | $115 | $180 |

| 65-Year-Old Male | $125 | $190 |

Compared to the top providers, Ocean Harbor can offer competitive rates with minimum and full coverage premiums. Ocean Harbor’s minimum coverage rates are competitive with other providers.

Ocean Harbor Auto Insurance Monthly Rates vs. Top Providers

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $85 | $180 | |

| $87 | $180 | |

| $82 | $170 | |

| $90 | $190 |

| $83 | $172 |

| $95 | $185 |

| $88 | $175 | |

| $78 | $165 | |

| $84 | $178 | |

| $70 | $150 |

Ocean Harbor’s rates are generally in the mid-range as far as full coverage goes, closely competing with other major insurers such as Geico, State Farm, and Progressive. While USAA offers the lowest full coverage rate at $150 a month, Ocean Harbor’s pricing remains competitive.

In order to find the best rate, it’s essential to compare auto insurance rates from various providers to make sure you’re receiving the most competitive coverage for your needs.

Ocean Harbor Auto Insurance by Credit Score

Ocean Harbor’s rates are generally competitive, with monthly premiums for good credit at $150, fair credit at $180, and poor credit at $225. For drivers with good credit, Ocean Harbor offers some of the most affordable rates in the market.

Ocean Harbor Auto Insurance Monthly Rates vs. Top Competitors by Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $125 | $155 | $210 | |

| $128 | $158 | $215 | |

| $110 | $140 | $190 | |

| $130 | $160 | $220 |

| $118 | $148 | $198 |

| $150 | $180 | $225 |

| $120 | $150 | $205 | |

| $115 | $145 | $200 | |

| $122 | $152 | $202 | |

| $105 | $135 | $185 |

It’s important to note that rates for all providers tend to increase with lower credit scores. However, Ocean Harbor’s rates remain in the mid-range when compared to competitors like Allstate, Liberty Mutual, and Travelers.

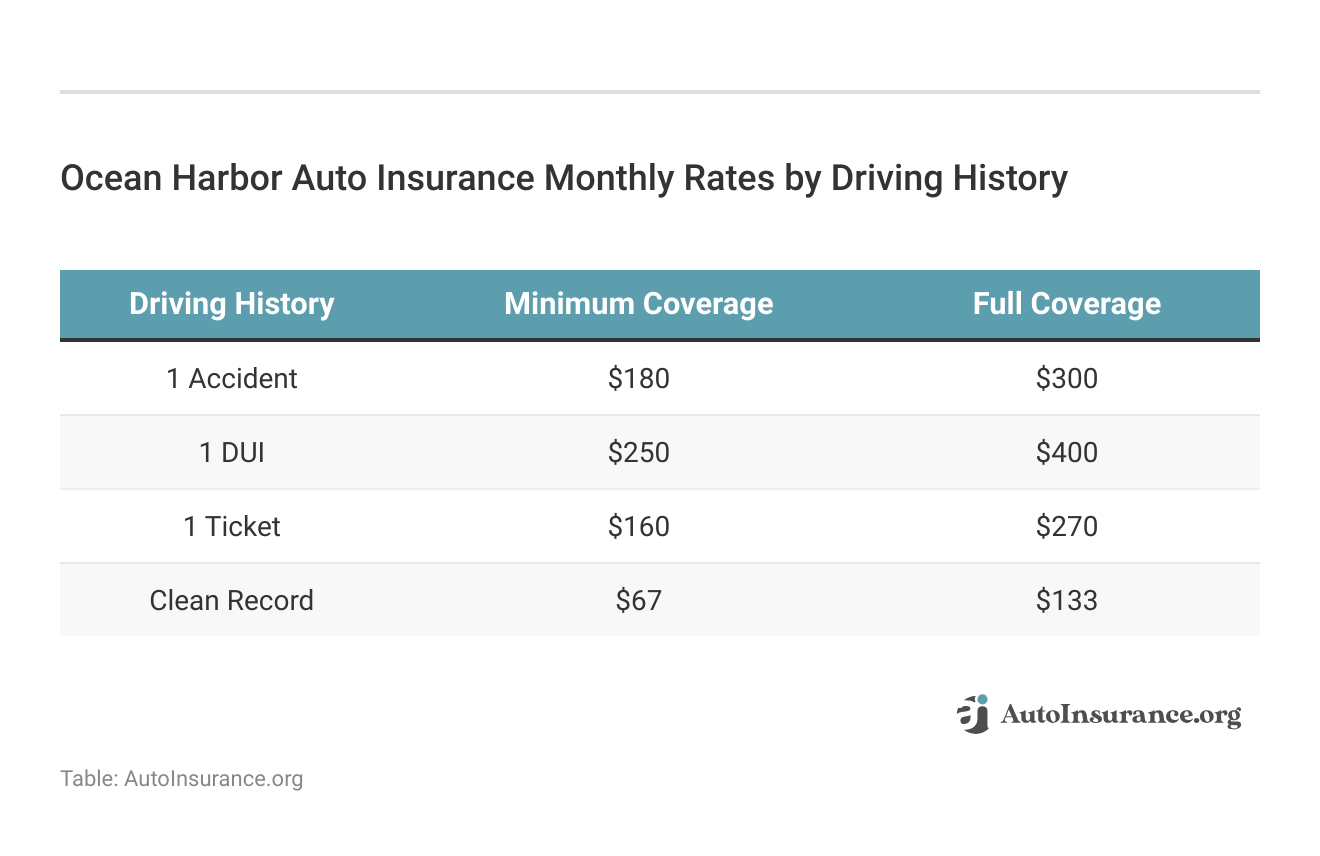

Ocean Harbor Auto Insurance by Driving Record

Ocean Harbor auto insurance provides monthly rates that differ depending on your driving record. Drivers with a clean record usually have the lowest premiums, while drivers who have accidents, DUIs, or tickets pay higher rates.

Drivers with clean driving records, for example, are offered the lowest rates, while those with a single accident, DUI, or ticket may pay much higher premiums.

Ocean Harbor applies rates that account for the increased risk of having a history, but may still offer options for cheap auto insurance after a DUI, based on the driver’s situation.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ocean Harbor Auto Insurance Discounts Explained

Ocean Harbor auto insurance provides several discounts to help lower your premiums. You can receive up to 25% off with its safe driver discount, while bundling your home and auto policies could net you a 15% discount.

Ocean Harbor Auto Insurance Discounts

| Discount Name |  |

|---|---|

| Multi-Vehicle | 20% |

| Bundling | 15% |

| Safe Driver | 25% |

| Good Student | 10% |

| Paperless Billing | 5% |

| Pay-in-Full | 10% |

| Anti-Theft | 10% |

| Loyalty | 10% |

| Low Mileage | 8% |

| Defensive Driving | 5% |

Other available discounts include 20% for insuring multiple vehicles, 10% for having an anti-theft device, and 10% for paying your auto insurance premium in full.

To ensure you receive the best possible rate with Ocean Harbor, consider bundling your auto and home policies.Michelle Robbins Licensed Insurance Agent

Ocean Harbor also rewards students with a 10% good student discount and offers savings for low mileage drivers and those who complete a defensive driving course. With discounts ranging from 5% to 25%, Ocean Harbor provides several ways to reduce your auto insurance costs.

Key Coverage Options With Ocean Harbor Insurance

Know your auto insurance coverage to ensure you’re protected on the road. When life takes a detour, you need Ocean Harbor auto insurance to protect yourself and your vehicle. These are the main types of coverage to weigh as you choose a policy.

- Liability Coverage: Covers legal responsibility for bodily injury and property damage to others. Excludes vehicles you own, those with fewer than four wheels, and family member injuries.

- Personal Injury Protection (PIP): Covers injuries from auto accidents, paying 80% of medical expenses, 60% for lost income, and a death benefit. Excludes uncovered vehicles or required coverage drivers.

- Uninsured/Underinsured Motorists Coverage: Pays for bodily injuries when the at-fault party has no insurance or inadequate coverage, including hit-and-run situations.

- Collision Coverage: Covers damage to your car from a crash with something else or another vehicle.

- Comprehensive Coverage: Covers damage from fire, theft, and non-collision incidents, excluding electronics, media, radar detectors, camper bodies, pre-existing damage, and customized equipment.

Selecting the proper coverage is important for safeguarding yourself and your automobile. Ocean Harbor has a variety of choices that range from liability to PIP, the best uninsured and underinsured motorist (UM/UIM) coverage, collision, and comprehensive coverage.

Ocean Harbor Auto Insurance Ratings & Consumer Feedback

Ocean Harbor Casualty Insurance Company has been around since 1986. The company offers auto and home insurance in Florida and California. Ocean Harbor underwrites more than $300 million in premiums, and it’s one of the top 100 insurers for home insurance across the United States.

However, its auto insurance ratings aren’t as high. Ocean Harbor has a mixed record with several agencies. J.D. Power awards the company a score of 746 out of 1,000, indicating below-average customer satisfaction. Consumer Reports rates Ocean Harbor 62 and 100, with mixed reviews and greater than average complaints. A.M. Best gives a B rating, meaning fair financial strength.

Ocean Harbor Auto Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 746 / 1,000 Below-Average Customer Satisfaction |

|

| Score: B- Below Average Business Practices |

|

| Score: 62 / 100 Mixed Customer Feedback |

|

| Score: 3.5 Higher-Than-Average Complaints |

|

| Score: B Fair Financial Strength |

While Ocean Harbor’s business practices and customer satisfaction may not stand out, it maintains fair financial stability in the industry. It’s important to consider these ratings when deciding whether Ocean Harbor is the right provider for you.

This Reddit post from user discusses the challenges of selling auto insurance in Florida, where all companies must be admitted to meet the same standards. The user mentions that many agents prefer to work with only a few companies to receive commissions and bonuses, which can discourage customers from smaller insurers.

The post highlights Ocean Harbor auto insurance as a good option for those seeking minimum liability coverage, especially with less-than-ideal credit and looking for cheap auto insurance after an accident. The user also shares a personal experience, noting issues with claims, particularly when undisclosed household members led to higher-than-expected medical bills after an accident.

If you’re filing a claim, you can also use the Ocean Harbor insurance claims phone number to get assistance. To make a payment, Ocean Harbor Insurance offers pay-by-phone for added convenience.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ocean Harbor Auto Insurance Pros and Cons

When choosing an auto insurance provider, it’s important to consider both the benefits and drawbacks of each company. Because of its low rates, Ocean Harbor auto insurance can be a solid choice for drivers seeking only minimum liability coverage or those with less than perfect credit.

- Affordable Minimum Coverage: For those seeking basic coverage at a lower price point, Ocean Harbor offers competitive minimum liability coverage.

- Cheap Rates by Credit Score: The company is an especially good option for those with less-than-ideal credit, as it can be more accommodating than others.

- Variety of Coverage Options: Ocean Harbor offers a range of coverage types, including liability, collision, and comprehensive policies.

However, customer satisfaction ratings highlight areas for improvement, especially in claims processing and customer service.

Ocean Harbor auto insurance provides affordable coverage and is a good option for certain drivers, its lower customer satisfaction ratings and higher-than-average complaints may raise concerns.

- Below-Average Customer Satisfaction: According to ratings from organizations such as J.D. Power, Ocean Harbor has below-average customer satisfaction, which may affect your overall experience.

- Limited Availability: Ocean Harbor services only Florida and California, which means that customers from other states will find it hard to access their services.

While Ocean Harbor offers affordable rates and discounts, some policyholders have faced delays in claims handling. If you need to file a claim, it’s important to understand the process and learn how to file an auto insurance claim effectively to avoid unnecessary setbacks.

Ocean Harbor Auto Insurance Key Considerations

While this Ocean Harbor auto insurance review found low rates, especially for anyone looking for minimum liability coverage or drivers with poor credit, its customer service has faced criticism, and its availability is limited to Florida and California.

Read More: Best California Auto Insurance

Ocean Harbor’s competitive rates and coverage options make it a solid choice for some, but its customer service issues and limited service area may be factors to consider before choosing the provider. Use our free comparison tool to see what auto insurance quotes look like in your area.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What do Ocean Harbor Insurance reviews say about customer satisfaction?

Ocean Harbor Insurance reviews show a mix of feedback, with some customers praising their affordable rates, while others mention challenges with claims processing and customer service.

What are Ocean Harbor Casualty Insurance Company reviews like?

Ocean Harbor Casualty Insurance Company reviews highlight both positive experiences with cost-effective coverage and concerns about slow customer service and higher-than-average complaints compared to other insurers.

Avoid expensive premiums by using our free comparison tool to find the lowest rates possible.

What is Ocean Harbor Insurance Company, and what types of coverage do they offer?

Ocean Harbor Insurance Company provides auto and home insurance coverage, with options including liability, collision auto insurance, comprehensive, and personal injury protection. They primarily serve residents in Florida and California.

Is Sea Harbor Insurance the same as Ocean Harbor Insurance?

No, Sea Harbor Insurance and Ocean Harbor Insurance are different entities. While their names are similar, they offer distinct services, with Ocean Harbor focusing on auto and home insurance in select states, and Sea Harbor primarily related to marine insurance.

Can I make an Ocean Harbor one-time payment for my car insurance?

Yes, Ocean Harbor offers the option to make a one-time payment for your car insurance. This payment method can simplify your billing process, ensuring you don’t have to worry about monthly premiums.

How do Ocean Harbor Insurance rates compare to other providers?

Ocean Harbor Insurance rates are competitive, especially for minimum liability coverage, making it one of the best companies for credit-based auto insurance. The company has some affordable plans, but rates can vary based on your age, driving history, and credit score.

What is the Ocean Harbor Insurance customer service phone number for 24/7 support?

For 24/7 customer service, you can reach Ocean Harbor Insurance at its dedicated customer service phone number. Contacting them directly will ensure you get timely support for your insurance needs or claims.

What is Ocean Harbour Casualty Insurance, and what does it offer?

Ocean Harbour Casualty Insurance is an insurance provider that offers auto and home insurance in limited states, including Florida. They provide different types of coverage, including liability, collision, and comprehensive coverage, designed to protect drivers and homeowners.

How can I get Ocean Harbor Casualty Insurance rates for my auto insurance?

To get Ocean Harbor Casualty Insurance rates, you can request a quote through their website or contact an agent directly. Rates will depend on your driving history, coverage needs, and other factors that affect auto insurance rates, such as your age, credit score, and the type of coverage you choose.

How can I get an Ocean Harbor Insurance Florida quote?

Get an Ocean Harbor Insurance Florida quote by visiting the company’s website or contacting an authorized Florida agent. On the auto and home insurance side, they offer competitive rates, and the process to get a personalized quote based on your situation is quick.

What are customers saying in Ocean Harbor Insurance Miami reviews?

Ocean Harbor Insurance Miami has gotten mixed review from their customers. Although some praise their low rates and customer support, others have raised specific concerns about claims handling and availability of certain services. Local reviews will give you a better idea of their service in your area, the Miami area.

What are the benefits of Ocean Harbor Car Insurance?

Ocean Harbor Car Insurance offers competitive rates, including discounts for bundling policies and safe driving, making it one of the best companies for bundling home and auto insurance. It provides various coverage options such as liability, collision, and comprehensive, making it a solid choice for many drivers.

What services are offered by Ocean Harbor Insurance?

Ocean Harbor Insurance offers various services such as auto insurance, home insurance, liability coverage, personal injury protection, and comprehensive insurance options. They also have some discounts for safe driving, bundling policies, and other factors that can help customers save on premiums.

How do I file Ocean Harbor insurance claims?

To file an Ocean Harbor insurance claim, you can contact their claims department by phone or email, depending on your location. It’s important to have all relevant information handy, such as your policy number, accident details, and any supporting documents like a police report.

Does Ocean Harbor offer roadside assistance with its car insurance?

Ocean Harbor does offer roadside assistance as part of its coverage options, making it one of the best auto insurance companies for roadside assistance. This service can help you in emergencies such as a flat tire, dead battery, or getting locked out of your car.

What can I expect from Ocean Harbor customer service?

Ocean Harbor customer service is available to assist with inquiries, claims, and policy management. While customer satisfaction ratings have shown mixed reviews, the company offers support through its call centers and online platforms for policyholders.

What is the Ocean Harbor insurance rating?

Ocean Harbor insurance holds a B rating from A.M. Best, indicating fair financial strength. However, the company also has a D rating from the Better Business Bureau (BBB) and has received a higher-than-average number of complaints.

What factors should I consider when requesting an Ocean Harbor auto insurance quote?

When requesting an Ocean Harbor auto insurance quote, consider your driving history, age, the type of coverage you need, and any available discounts. Ocean Harbor offers personalized quotes based on these factors to help you find affordable auto insurance coverage.

Who owns Ocean Harbor Casualty?

Ocean Harbor Casualty is owned by Pearl Holding Group, which is responsible for managing the company’s operations and overseeing its financial stability in the insurance market.

How do I reach Ocean Harbor auto insurance customer service?

If you need to contact Ocean Harbor Insurance, you can reach their customer service at their Ocean Harbor insurance phone number. For Florida residents, there is a dedicated Ocean Harbor insurance phone number in FL for local inquiries.

Is there an Ocean Harbor Insurance office in Tampa?

Ocean Harbor primarily operates in Florida and California, but it does conduct business in your state. For agents and office information specific to your location, such as Tampa, contact their customer service or visit the official site. Find the best Tampa, Florida auto insurance here.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

CarlosP2023

Excessive rates

Samuel Lundman

Ocean Harbor Casualty Insurance review

Disappointed_that_I_was_taking_a_fraudulent_insurance_company

Refusing to give me my refund of $331 after only a week of i

Ocean_Harbor_Insurance

I do not recommend

MarcCC

SCAM

Barry_

I would never recommended to family or enemy

Sunshine State Gal

Ocean Harbor review

Mindyks78

Worst experience ever!

GtzR

Worst insurance company

NellieCake

Fiesta Ocean Harbor Best Insurance Company Ever