Cheap Scion Auto Insurance in 2026 (Save With These 10 Companies!)

The top picks for cheap Scion auto insurance are Erie, Safeco, and AAA. Erie has the cheapest minimum rates for Scions, with an average rate of only $22/mo. While Scion rates depend on the model you own, comparing rates from the cheapest Scion companies will help you get an affordable policy.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated January 2025

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Scion

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 1,278 reviews

1,278 reviewsCompany Facts

Min. Coverage for Scion

A.M. Best Rating

Complaint Level

Pros & Cons

1,278 reviews

1,278 reviews 3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage for Scion

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsErie, Safeco, and AAA are the top choices for cheap Scion auto insurance.

Even though Toyota discontinued the Scion in 2016, you’ll still need proper auto insurance coverage if you own one.

Our Top 10 Company Picks: Cheap Scion Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $22 | A+ | Filing Claims | Erie |

| #2 | $27 | A | Diminishing Deductible | Safeco | |

| #3 | $32 | A | Roadside Assistance | AAA |

| #4 | $39 | A+ | Usage-Based Insurance | Progressive | |

| #5 | $43 | A+ | Exclusive Benefits | The Hartford |

| #6 | $44 | A+ | Deductible Options | Nationwide |

| #7 | $44 | A | KnowYourDrive Program | American Family | |

| #8 | $53 | A | Great Add-ons | Farmers | |

| #9 | $61 | A+ | Drivewise Program | Allstate | |

| #10 | $68 | A | Unique Benefits | Liberty Mutual |

You’ll find the best auto insurance companies offering the coverage you want at affordable prices in the table below.

To find cheap auto insurance for your Scion, use our free tool to compare rates from several local companies.

#1 – Erie: Top Overall Pick

- Scion Auto Insurance

Pros

- Filing Claims: Most customers will find Erie’s claim filing process simple.

- Customer Service: The company has a reputation for providing great customer service (read more: Erie Review).

- Payment Options are Flexible: You can choose how to pay, such as paying in full or by month.

Cons

- Aviability: Unfortunately, not every state carries insurance from Erie.

- App Services: Erie’s app doesn’t let customers check as many things as other apps.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Safeco: Best for Diminishing Deductible

Pros

- Diminishing Deductible: Safeco reduces deductibles for safe driving. Our Safeco review goes over more ways to save at the company.

- Online Management: Safeco customers can manage policies and claims online.

- Bundling Savings: Home and auto insurance holders can earn up to 15% off.

Cons

- Customer Service: Not all customers are happy with Safeco’s customer service.

- High-Risk Rates: Accidents, DUIs, and tickets can drive up your rates beyond the average at Safeco.

#3 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: The company’s roadside assistance program is well-known and reliable.

- Financial Reliability: AAA is financially stable. Learn more about the company in our AAA review.

- Membership Benefits: AAA members can use their membership card to get discounts on products other than auto insurance.

Cons

- Fee for Membership: Customers may not save as much as expected due to the membership fee.

- Coverages Vary by Location: AAA’s add-on coverages may not all be available in some areas.

#4 – Progressive: Best for Usage-Based Insurance

Pros

- Usage-Based Insurance: Progressive’s UBI program can help lower costs for Scion owners.

- Tools Easy to Use: Progressive’s apps, websites, and other tools are simple to navigate. Check out our Progressive review for more information on the company.

- Add-On Coverages: Progressive has less common auto insurance coverages like pet injury reimbursement.

Cons

- Availability of UBI discount: Some drivers won’t have Progressive’s UBI discount in their state.

- Agent Availability: Some areas don’t have a local agent available.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – The Hartford: Best for Exclusive Benefits

Pros

- Exclusive Benefits: The Hartford offers exclusive benefits to AARP members. Learn more in our The Hartford review.

- Customer Ratings: The majority of customers are pleased with the level of service they receive from The Hartford.

- Bundling Discount: Save by purchasing home and auto insurance.

Cons

- Young Driver Discounts: The Hartford’s discounts aren’t tailored to younger drivers.

- Availability of Coverages: The Hartford’s add-on coverages may not be available to purchase in some areas.

#6 – Nationwide: Best for Deductible Options

Pros

- Deductible Options: Customers can increase or decrease deductible amounts to change rates at Nationwide.

- Financial Stability: Ratings show Nationwide is reliable. Read a Nationwide review for more information.

- Optional Coverages: Customers can choose from roadside assistance, gap insurance, and more.

Cons

- Discount Availability: Customers may not be offered all of Nationwide’s discounts in their state.

- Customer Ratings: Nationwide customer service is considered just average by most.

#7 – American Family: Best for KnowYourDrive Program

Pros

- KnowYourDrive Program: Save with American Family’s KnowYourDrive (learn more: KnowYourDrive Review).

- Agent Availability: American Family has local agents in most areas. Discover more about its customer service in our review of American Family.

- Roadside Assistance: Customers can add roadside assistance to their policies.

Cons

- Availability: Customers may not have American Family insurance in their state.

- Young Driver Rates: Not all young drivers will be able to find affordable rates at American Family.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Great Add-Ons

Pros

- Great Add-Ons: If you like rounding out your policy with extras, read our Farmers review to see what it offers.

- Loyalty Discounts: Sticking with Farmers will earn customers a discount.

- Financial Ratings: Farmers is considered reliable when it comes to financial management.

Cons

- Discount Availability: Some states may not carry all of Farmer’s discounts.

- Customer Ratings: Some customers weren’t happy with the customer service they received.

#9 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: Allstate’s Drivewise Program is well-rated; learn more about it in our Drivewise review.

- User-Friendly: Allstate customers can easily make changes to their policies.

- Coverage Options: Learn about the company’s coverage options, like roadside assistance, in our Allstate review.

Cons

- High Rates for Some: Drivers with poor driving records may want to consider a different insurance company.

- Customer Service: Some customers weren’t thrilled with its customer service.

#10 – Liberty Mutual: Best for Unique Benefits

Pros

- Unique Benefits: Learn about Liberty Mutual’s unique benefits, such as its discounts, in our review of Liberty Mutual.

- Assistance is Always Available: Liberty Mutual has a 24/7 assistance line.

- Coverages: You have plenty of choices for auto insurance coverage.

Cons

- Agent Availability: You may not be able to find a local agent in your area.

- Driving Record Rates: Liberty Mutual’s rates are more expensive if you have a DUI or other serious offense on your record.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scion Auto Insurance Coverage Options

You have options regarding the coverage you’ll choose for your Scion. However, you must meet your state’s minimum auto insurance requirements to drive in the United States legally. Therefore, you may live in a state that requires little coverage, or your state may force you to purchase Scion car insurance coverage at higher levels.

The standard options for minimum coverage auto insurance in each state include:

- Property Damage Liability: Property damage liability covers you if you cause an accident and damage someone’s car or other personal property. Find the best property damage liability auto insurance companies.

- Bodily Injury Liability: Bodily injury liability auto insurance covers you if you cause an accident and injure or kill one or more people.

- Personal Injury Protection (PIP): Personal injury protection auto insurance coverage helps pay medical bills and may replace lost wages after a covered accident.

- Medical Payments (MedPay): Medical payments coverage helps with hospital bills and doctor visits after a covered accident.

- Uninsured/Underinsured Motorist: Uninsured motorist coverage helps if someone causes an accident but doesn’t carry proper insurance coverage. Learn more about how to sue a driver who is uninsured.

As stated before, some states only require property damage liability and bodily injury liability insurance. Still, if you live in other states, your Scion may need PIP, MedPay, uninsured/underinsured motorist insurance, or any combination. Getting quotes from cheap companies like Erie will help you get the best Scion auto insurance at an affordable rate.

In addition to your state’s mandatory coverage, you can also choose to carry Scion auto insurance coverage that protects you if your car gets damaged:

- Collision Auto Insurance: Collision auto insurance helps if you cause an accident and damage your car. Collision insurance will pay for repairs up to your vehicle’s actual cash value (ACV) once you pay your auto insurance deductible. Collision insurance isn’t a requirement.

- Comprehensive Auto Insurance: Comprehensive auto insurance helps if inclement weather, wild animals, theft, or vandalism cause damage to your Scion. Comprehensive insurance also isn’t a requirement.

If you add collision and comprehensive insurance to your auto insurance policy, you have what’s often called a full coverage policy. Full coverage auto insurance protects you if you cause an accident that damages your car or if your car gets damaged by something other than a car wreck. Learn more about the difference between collision vs. comprehensive auto insurance policies.

Scion Auto Insurance Optional Coverages

In addition to mandatory coverages, collision, and comprehensive insurance, you can purchase other coverage that helps customize your auto insurance policy to fit your unique needs on and off the road. Some of the most common add-on coverage options often include:

- Roadside Assistance Coverage: Roadside assistance coverage includes towing, flat tire repair, and fuel delivery services if you need them for your Scion. If you drive a lot, roadside assistance helps you stay safe on the road.

- Rental Car Reimbursement: Rental car reimbursement helps you get your money back if you rent a car because your Scion is in the shop following a covered accident. Most auto insurance companies reimburse you up to a specific dollar amount.

If you know you want a uniquely customized policy, you can research companies in your area that are known for offering add-on coverage options to help with that.

If you're considering a Scion auto insurance company but don't know what it offers, speak with a representative to get some answers and a quote before committing.Dani Best Licensed Insurance Producer

Cost of Scion Auto Insurance Coverage

The average cost of auto insurance per month for your Scion will depend on factors like age, gender, marital status, driving history, credit score, and coverage type. However, the cheapest auto insurance companies for Scions will offer the best Scion car insurance rates.

Scion Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $32 | $86 |

| $61 | $160 | |

| $44 | $117 | |

| $22 | $58 |

| $53 | $139 | |

| $68 | $174 |

| $44 | $115 |

| $39 | $105 | |

| $27 | $71 | |

| $43 | $113 |

The average cost for Scion auto insurance is anywhere from $70 to $163 monthly.

Scion FR-S Auto Insurance Rates

The Scion FR-S is more expensive to insure than other models. Auto insurance for a Scion FR-S costs around $157 each month. Scion FR-S insurance costs may vary depending on the year of your model or the current mileage.

As you shop for Scion FR-S insurance, remember to find and compare quotes from several companies. One company may offer much cheaper rates for your Toyota Scion insurance.

Scion tC Auto Insurance Rates

Auto insurance for a Scion tC costs around $190 monthly for a full coverage policy. Unfortunately, Scion tC insurance rates are not cheap. Still, you may find that certain companies in your area offer more competitive Scion car insurance rates.

Scion Auto Insurance Rates by Model

Discover the exact insurance costs for various Scion tC models, enabling a comprehensive comparison to optimize your insurance expenses and make well-informed decisions.

Cost of Auto Insurance for Scion's by Model

Cost of Auto Insurance for Scion's by Model

Scion tC

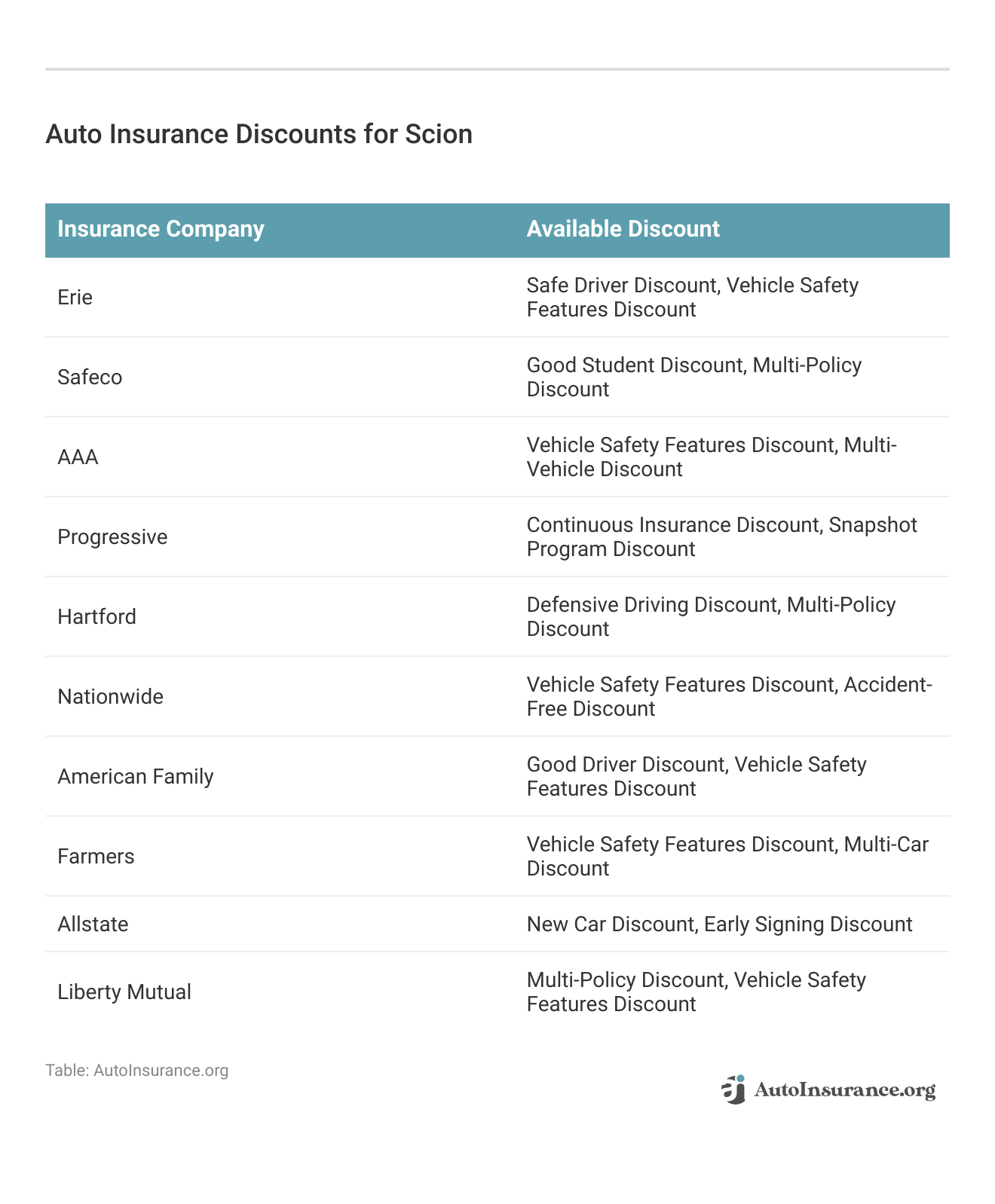

Scion Auto Insurance Discounts

Many companies offer auto insurance discounts. You may get affordable rates for your Scion auto insurance at the cheapest companies if you qualify for discounts.

Some other common auto insurance discounts that can help you get affordable Scion auto insurance include:

- Accident-free auto insurance discount

- Defensive driver auto insurance discount

- Safe driver auto insurance discount

- Good student auto insurance discount

- Military auto insurance discount

- Senior auto insurance discount

- Bundling insurance policies

- Safety device auto insurance discount

- New car auto insurance discount

- Membership auto insurance discount

- Usage-based auto insurance

Drivers can save as much as 25% on their Scion insurance rates. Speak with a representative from any company you’re considering to learn how much you could save on your Scion rates with auto insurance discounts for disabled veterans or bundling discounts. Learn why you need to take a defensive driving class.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Final Thoughts on Finding Affordable Scion Auto Insurance

The average cost of auto insurance for a Scion is around $70 to $163 each month, depending on the type of Scion you drive and the types of auto insurance coverage you need. The Scion model you drive will also impact your Scion insurance quotes.

Once you know the type of Scion auto insurance coverage you want, find and compare Scion auto insurance quotes from several companies to determine which offers the Scion coverage you want at a price that works for you. Compare rates with our free tool today.

Frequently Asked Questions

Is a Scion auto insurance expensive?

The average cost of auto insurance for a Scion is around $70 to $163 each month, depending on the type of Scion you drive and the type of coverage you need. For example, auto insurance for a Scion FR-S costs around $157 each month, while Scion tC auto insurance costs around $190 monthly. Auto insurance discounts like bundling policies may help you save money, whether it’s Scion XD car insurance or Scion FR-S insurance.

Is auto insurance high on a Scion tC?

Auto insurance for a Scion tC costs around $190 monthly for a full coverage policy. Scion tC insurance costs are high due to poor safety ratings and a higher likelihood of theft.

Is Scion FR-S auto insurance expensive?

Auto insurance for a Scion FR-S costs around $157 each month.

Why is Scion discontinued?

Scion was originally created to attract younger drivers, but in 2016, Toyota decided it no longer needed a specific brand to get a youthful demographic. If you are a young driver, make sure to check out our guide to the best auto insurance for drivers under 25.

When did Toyota cancel Scion?

Toyota discontinued Scion in August 2016.

Will Toyota ever make the Scion again?

Yes, Toyota is re-releasing previous Scion models under the Toyota name, including the Toyota Yaris and Toyota CH-R.

Is Scion considered a sports car for auto insurance?

If you are wondering is a Scion FR-S considered a sports car for insurance, along with other models, the answer is yes. Insurance companies consider a Scion FR-S and other models to be sports cars, so you’ll generally see higher auto insurance rates (read more: Best Auto Insurance for Sports Cars).

Can you still get parts for Scion cars?

Yes, many dealerships and body shops carry Toyota and Scion parts.

Does Scion use Toyota parts?

Yes, Scion uses Toyota parts for repairs and replacements. Make sure you have good insurance to pay for repairs on your Scion (read more: Cheap Toyota Auto Insurance).

Are Scion cars expensive to repair after an auto insurance claim?

Depending on your model and the damage, you can spend between $95 and $2500 on Scion repairs.

What’s the cheapest car insurance to go with?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.