Best Alabama Auto Insurance in 2025 (Find the Top 10 Companies Here!)

Erie, Nationwide, and State Farm are the best Alabama auto insurance providers, offering rates starting at $32 per month for minimum coverage. These companies are known for their comprehensive policies and exceptional customer service, making them reliable for diverse driver needs in Alabama.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated October 2025

1,883 reviews

1,883 reviewsCompany Facts

Alabama Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 3,071 reviews

3,071 reviewsCompany Facts

Alabama Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 18,157 reviews

18,157 reviewsCompany Facts

Alabama Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsThe top picks for the best Alabama auto insurance are Erie, Nationwide, and State Farm for their comprehensive auto insurance coverage and excellent customer service.

Discover how these companies offer tailored and affordable options that meet diverse driver needs in Alabama.

Our Top 10 Company Picks: Best Alabama Auto Insurance| Company | Rank | Claim Satisfaction | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 718 / 1,000 | A+ | Cheapest Rates | Erie |

| #2 | 691 / 1,000 | A+ | Add-On Coverages | Nationwide | |

| #3 | 677 / 1,000 | A++ | Customer Service | State Farm | |

| #4 | 670 / 1,000 | A++ | Extensive Discounts | Geico | |

| #5 | 666 / 1,000 | A | Policy Options | Farmers | |

| #6 | 654 / 1,000 | A+ | Usage-Based Discount | Allstate | |

| #7 | 645 / 1,000 | A+ | High-Risk Drivers | Progressive | |

| #8 | 641 / 1,000 | A++ | Young Drivers | Auto-Owners | |

| #9 | 626 / 1,000 | A | Safe Drivers | Liberty Mutual |

| #10 | 606 / 1,000 | A++ | Eco-Friendly Cars | Travelers |

With a focus on coverage and customer satisfaction, you’ll find an in-depth analysis of why these providers are the best choices for reliable and cost-effective auto insurance.

- Alabama Auto Insurance

- Cheapest Teen Driver Auto Insurance in Alabama for 2025 (Only $100/mo!)

- Best Tuscaloosa, Alabama Auto Insurance in 2025

- Best Monroeville, Alabama Auto Insurance in 2025 (Top 10 Companies Ranked)

- Best Marion Junction, Alabama Auto Insurance in 2025

- Best Madison, Alabama Auto Insurance in 2025

- Best Guntersville, Alabama Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best Daleville, Alabama Auto Insurance in 2025

- Best Childersburg, Alabama Auto Insurance in 2025 (Top 10 Companies Ranked)

- Best Boaz, Alabama Auto Insurance in 2025

- Best Birmingham, Alabama Auto Insurance in 2025 (Compare the Top 10 Companies)

Compare their offerings to secure the best policy for your needs and ensure adequate protection on Alabama roads.

- Erie is the top pick for Alabama auto insurance, starting at $32 a month

- The best Alabama auto insurance balances your budget and coverage needs

- Affordable Alabama insurance includes liability and full coverage plans

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

Compare Alabama Auto Insurance Rates

Finding the cheapest auto insurance in Alabama involves more than picking the company with the lowest rates, as factors like credit score and coverage type significantly influence costs. Drivers need to evaluate multiple providers to find the best fit for their unique situations.

Alabama requires drivers to carry bodily injury and property damage liability insurance, with minimum coverage limits of $25,000 per person and $50,000 per accident for bodily injury, and $25,000 per accident for property damage. These minimums are relatively low, so higher limits are recommended if affordable.

State minimum coverage in Alabama can lower rates for older cars, but full coverage is often best for newer vehicles to avoid costly repairs.Brandon Frady Licensed Insurance Producer

Full coverage provides protection against liabilities in accidents and covers other expenses, making it a prudent choice for many drivers. To find the most affordable full coverage, obtaining Alabama auto insurance quotes from various insurers is essential. This approach helps drivers secure the best rates and comprehensive coverage tailored to their needs.

Alabama Auto Insurance Monthly Rates by Coverage Level

Insurance Company Minimum Coverage Full Coverage

$52 $143

$47 $124

$32 $83

$64 $177

$42 $118

$77 $215

$45 $128

$53 $149

$52 $144

$37 $104

Optional coverages in Alabama include comprehensive, collision, gap, modified car insurance, non-owner car insurance, rental reimbursement, roadside assistance, and uninsured/underinsured motorist insurance. While optional coverages add cost, they provide better financial protection. Drivers convicted of DUIs face penalties such as fines, license suspension, and increased insurance rates.

Cheapest Auto Insurance in Alabama for At-Fault Accidents

At-fault accidents can raise your rates substantially, so it’s important to check which companies have the cheapest Alabama auto insurance rates with an accident on your record. You’ll probably save the most with Travelers auto insurance based on the average monthly rates.

Alabama Auto Insurance Monthly Rates by Driving Record| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $52 | $65 | $80 | $104 | |

| $47 | $59 | $73 | $94 | |

| $32 | $40 | $50 | $64 |

| $64 | $80 | $99 | $128 | |

| $42 | $53 | $65 | $84 | |

| $77 | $96 | $120 | $154 |

| $45 | $56 | $70 | $90 | |

| $53 | $66 | $82 | $106 | |

| $52 | $65 | $80 | $104 | |

| $37 | $46 | $57 | $74 |

Progressive initially offers some of the cheapest car insurance in Alabama, but it becomes expensive post-accident. Evaluating companies based on your driving history is crucial. Some offer accident forgiveness, preventing rate increases after your first at-fault accident.

This feature can save you a lot of money after your first accident. It’s important to research and discover the auto insurance for accident forgiveness.

In addition, regional factors such as theft rates, traffic, and the number of claims can impact your Alabama insurance quotes. Enter your ZIP code to instantly get affordable premiums from top-rated insurers near you.

Cheapest Auto Insurance in Alabama for Bad Credit

Insurance companies often increase rates for drivers with bad credit, as they are seen as higher risk for missing payments. This can lead to issues like canceled coverage and driving without insurance. However, you can still find savings by seeking out the best auto insurance companies with bad credit.

Alabama Auto Insurance Monthly Rates by Credit Score| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $52 | $53 | $58 | |

| $47 | $48 | $52 | |

| $32 | $33 | $35 |

| $64 | $65 | $71 | |

| $42 | $43 | $47 | |

| $77 | $79 | $86 |

| $45 | $46 | $50 | |

| $53 | $54 | $59 | |

| $52 | $53 | $58 | |

| $37 | $38 | $41 |

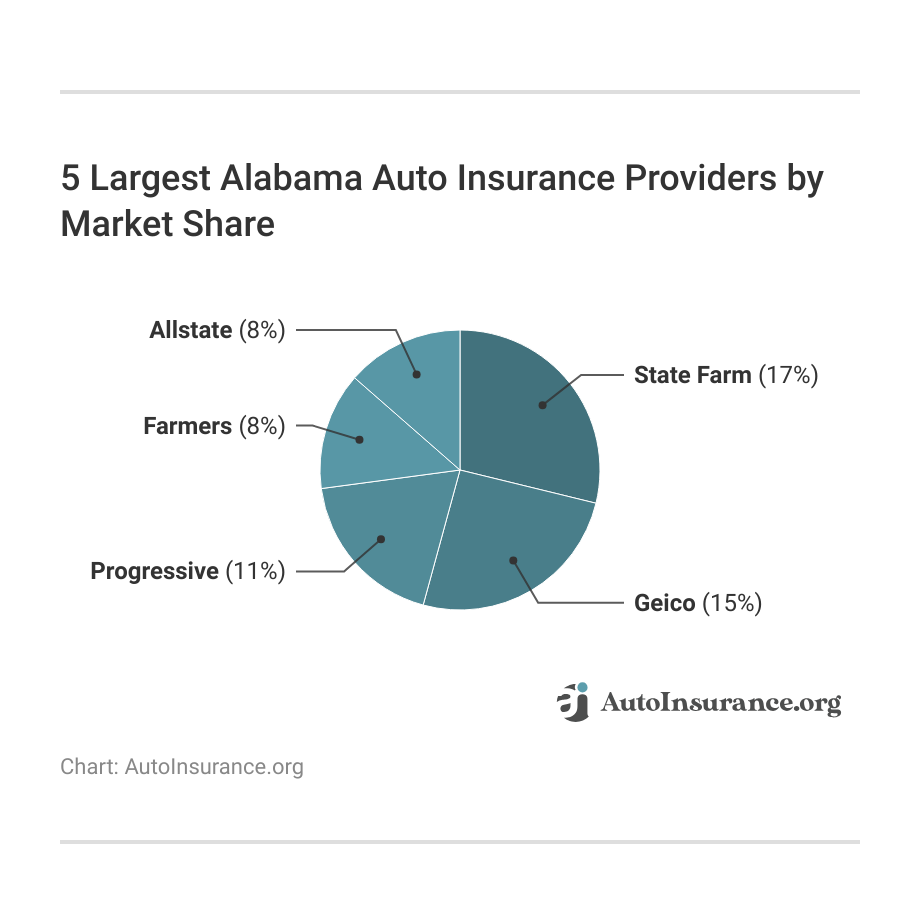

Geico and Nationwide are some of the best choices for drivers with poor credit scores. To accurately compare their rates, obtaining an Alabama car insurance quote is essential. Conversely, Liberty Mutual and Allstate auto insurance are among the more expensive options, often costing thousands of dollars more than the most affordable Alabama car insurance companies.

Cheapest Auto Insurance in Alabama for Young Drivers

Young drivers should stay on their parents’ policy for the cheap auto insurance in Alabama, but if that isn’t possible, they should take extra care when shopping for insurance. Auto insurance rates for teens are some of the highest compared to other demographics, as seen below:

Alabama Auto Insurance Monthly Rates by Age| Company | Age 16 | Age 25 | Age 35 | Age 45 | Age 55 | Age 65 |

|---|---|---|---|---|---|---|

| $243 | $64 | $58 | $52 | $48 | $50 | |

| $260 | $60 | $55 | $47 | $45 | $46 | |

| $136 | $38 | $35 | $32 | $30 | $31 |

| $405 | $82 | $77 | $64 | $60 | $62 | |

| $126 | $46 | $42 | $42 | $40 | $41 | |

| $336 | $85 | $78 | $77 | $73 | $76 |

| $206 | $60 | $56 | $45 | $44 | $45 | |

| $507 | $80 | $74 | $53 | $50 | $53 | |

| $232 | $69 | $65 | $52 | $49 | $50 | |

| $470 | $41 | $39 | $37 | $36 | $37 |

Young drivers pay up to three times more than other drivers, and there are many reasons why auto insurance costs more for young drivers. However, your choice of Alabama auto insurance company could save you money on your rates.

Cheapest Auto Insurance in Alabama by City

The table compares auto insurance costs across cities like Birmingham, AL, and Guntersville, AL, highlighting differences in rates based on location.

Alabama Auto Insurance by CityIt includes options for various coverages, such as liability, collision, and comprehensive, allowing drivers to identify the best insurance options for their specific city.

Top Auto Insurance Discounts in Alabama| Company | Anti- Theft | Bundling | Good Driver | Low Mileage |

|---|---|---|---|---|

| 10% | 25% | 25% | 30% | |

| 12% | 16% | 25% | 30% | |

| 15% | 25% | 23% | 30% |

| 10% | 20% | 30% | 10% | |

| 25% | 25% | 26% | 30% | |

| 35% | 25% | 20% | 30% |

| 5% | 20% | 40% | 20% | |

| 25% | 10% | 30% | 30% | |

| 15% | 17% | 25% | 30% | |

| 15% | 13% | 10% | 20% |

The table highlights auto insurance discounts from top providers for Alabama drivers. Allstate offers discounts for multi-policy, safe driving, and anti-theft devices. American Family provides discounts for loyalty and low mileage. Farmers includes discounts for bundling and usage-based insurance via their Signal app. Liberty Mutual offers discounts for military personnel and accident-free records.

Nationwide features usage-based programs like SmartRide and SmartMiles. Progressive provides discounts for continuous insurance and homeowners. Safeco focuses on low mileage and new car replacement.

State Farm and Travelers offer discounts for safe driving and defensive driving, with Travelers also promoting discounts for hybrid/electric vehicles. USAA highlights discounts for military families and vehicle storage.

Alabama Auto Insurance and DUI Laws

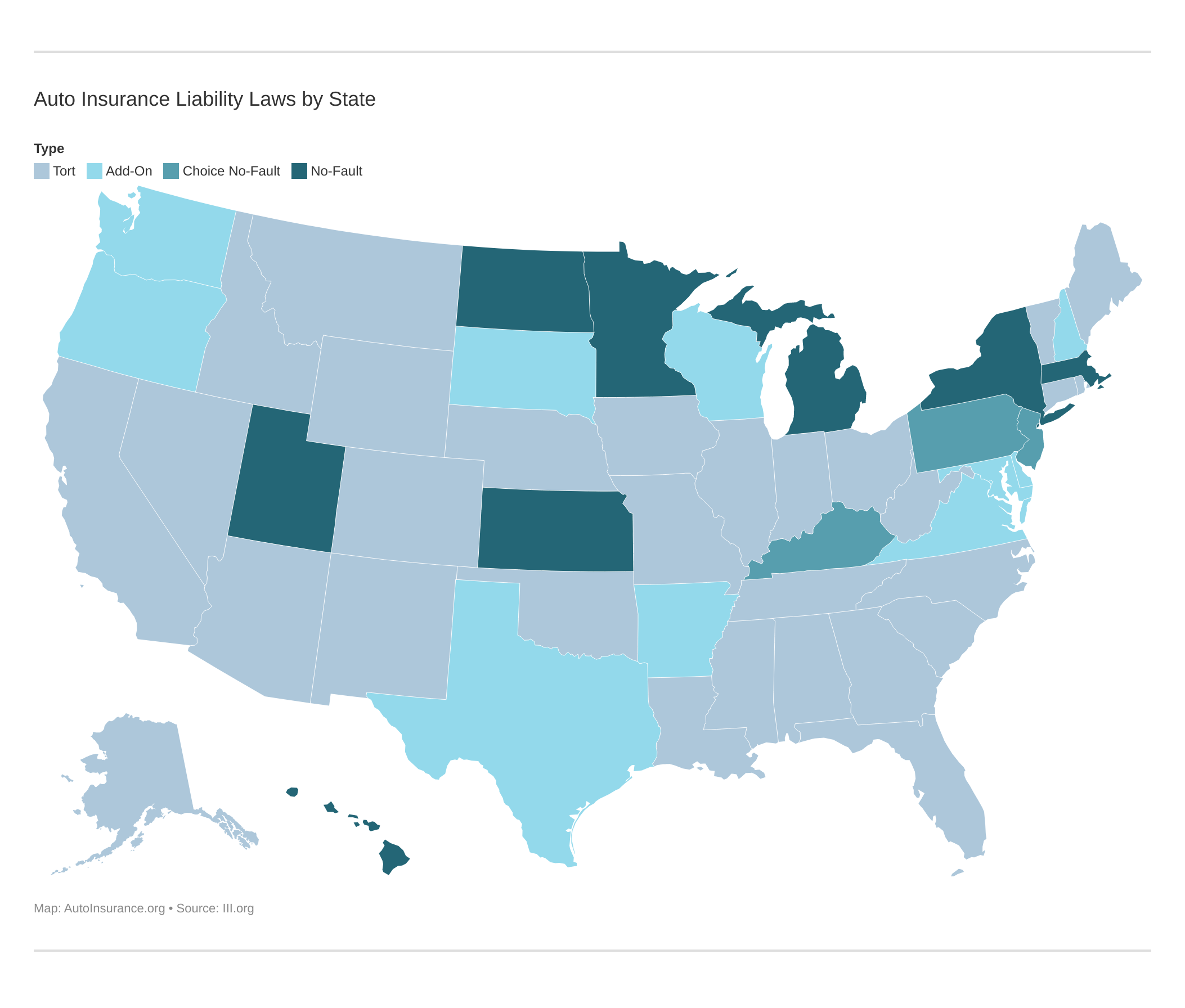

DUI and auto insurance laws significantly influence your insurance costs. States requiring higher coverage amounts tend to have more expensive premiums. Conversely, states with lower coverage limits usually offer cheaper insurance.

High-risk drivers may need an SR-22 certificate to meet Alabama car insurance requirements, which often comes with extra fees and higher premiums.Michelle Robbins Licensed Insurance Agent

Finding affordable insurance involves comparing quotes from multiple providers to identify the best rates and coverage options. This ensures drivers comply with the state’s legal mandates and secure the most cost-effective policy for their needs.

Understanding Alabama’s specific insurance and DUI laws can help you navigate these costs and find car insurance quotes in Alabama.

Case Studies: Finding the Best Alabama Auto Insurance

In Alabama, finding the right auto insurance is crucial for ensuring adequate protection and financial security. Here are three scenarios that highlight how State Farm, Progressive, and Allstate meet the diverse needs of drivers in Alabama.

- Case Study #1 – Comprehensive Coverage: Emily, a homeowner in Montgomery, chooses State Farm for its comprehensive policy that covers accidents, storms, and flooding. The accident forgiveness and multiple policy discounts offer her peace of mind and financial flexibility.

- Case Study #2 – Affordable Rates for High-Risk Drivers: Carlos, a high-risk driver in Birmingham, selects Progressive for its competitive rates and usage-based discount through the Snapshot program, helping him lower his rates by driving safely.

- Case Study #3 – Discount Variety: Linda, a professional in Huntsville, chooses Allstate for its discounts on safe driving, policy bundling, and anti-theft devices, helping her maintain comprehensive coverage while managing insurance costs.

These case studies illustrate how the best Alabama auto insurance providers offer tailored solutions that address the unique needs of different drivers, ensuring both adequate coverage and financial peace of mind.

Each scenario demonstrates the importance of selecting an insurer that aligns with individual priorities and circumstances.

Top 10 Alabama Car Insurance Companies

Erie, Nationwide, and State Farm have the best car insurance in Alabama. Learn more about why we chose these providers as the best for Alabama drivers.

#1 – Erie: Top Pick Overall

Pros

- Lowest Rates: Erie car insurance starts at just $32 per month, making it the most affordable option in Alabama. Check out our Erie auto insurance review to learn more.

- Best Claims Experience: Known for excellent claims service, Erie scored 718 out of 1,000 in the most recent J.D. Power claims satisfaction study.

- Strong Coverage Options: Offers robust options like accident forgiveness, new car replacement, and pet injury coverage.

Cons

- Limited Availability: Erie isn’t available in every state, so it may not be the best option for Alabama drivers who may later move.

- Few Digital Tools: Lacks many modern online tools commonly found with other insurers, such as the ability to file new claims without needing to call an agent.

#2 – Nationwide: Best for Add-On Coverages

Pros

- Various Coverage Options: Offers a wide range of coverage options, including accident forgiveness, new car replacement, and deductible rewards.

- Customized Policies: In our Nationwide auto insurance review, we allow customers to customize their policies to meet specific needs.

- Strong Financial Stability: Known for its financial strength, ensuring reliable claim handling.

Cons

- Claims Processing Time: Some customers report longer-than-expected claims processing times.

- Customer Service: Mixed reviews about the responsiveness and quality of customer service.

#3 – State Farm: Best for Customer Service

Pros

- Reliable Customer Service: Based on our State Farm auto insurance review, the company is known for its strong customer service and extensive agent network.

- Accident Forgiveness: State Farm offers accident forgiveness, which helps maintain your rate after your first at-fault accident.

- Multiple Discount Options: Provides numerous discounts for safe driving, multiple policies, and defensive driving courses.

Cons

- Higher Rates for Bad Credit: Drivers with poor credit may face higher rates compared to other companies.

- Not the Cheapest for Young Drivers: Young drivers might find more affordable options with other insurers.

#4 – Geico: Best for Discount Options

Pros

- Discount Variety: Offers several discounts, including those for good drivers, military deployment, and vehicles equipped with safety features (Learn More: Geico Auto Insurance Review).

- User-Friendly Platform: Geico’s mobile app and website make it easy to pay bills, access insurance IDs, and manage your policy.

- Low Rates: Geico offers some of the most competitive rates in Alabama, particularly for those who qualify for discounts.

Cons

- Few Local Agents: Limited access to in-person support may be a drawback for Alabama drivers who want help from an agent.

- Limited Add-Ons: Geico offers fewer optional coverages compared to its top competitors.

#5 – Farmers: Best for Policy Customization

Pros

- Customizable Policies: Offers extensive customization options for tailoring coverage to specific needs.

- Usage-Based Discounts: With regard to our Farmers auto insurance review, we provide discounts for using the Signal app, which tracks safe driving.

- Specialty Coverage Options: Includes options like new car replacement and customized equipment coverage.

Cons

- Higher Rates for DUI Drivers: Tends to have higher rates for drivers with DUIs or poor driving records.

- Limited Discount Availability: Fewer discount options compared to some competitors, which might limit savings.

#6 – Allstate: Best for Usage-Based Insurance

Pros

- Big Usage-Based Savings: Alabama drivers can save up to 40% with Allstate Drivewise, which rewards safe drivers who avoid hard braking, speeding, and nighttime driving.

- Accident Forgiveness: Following our Allstate auto insurance review, we provide accident forgiveness to avoid premium hikes after an accident.

- Strong Online and Mobile Tools: Offers a user-friendly app and website for easy policy management.

Cons

- Higher Premiums: Typically has higher rates compared to other insurers, particularly for younger drivers.

- Mixed Claim Processing Feedback: Some customers have reported delays and complications with the claims process.

#7 – Progressive: Best for High-Risk Drivers

Pros

- Built for High-Risk Drivers: Progressive began by specializing in high-risk auto insurance and continues offering coverage to drivers with DUIs, accidents, or SR-22 requirements.

- Usage-Based Discounts: Offers Snapshot, a usage-based program that can lower rates for safe driving habits.

- Extensive Online Tools: As per our Progressive auto insurance review, they provide a robust online platform for managing policies and claims.

Cons

- Higher Rates After Accidents: Can have significant rate increases after the first accident if accident forgiveness is not available.

- Mixed Customer Service Reviews: Some customers report dissatisfaction with claims handling and customer support.

#8 – Auto-Owners: Best for Young Drivers

Pros

- Young Driver Friendly: Auto-Owners’ teen-focused discounts and flexible policy options for families make it a top pick to help new drivers build a strong insurance history.

- Great Customer Service: Auto-Owners provides excellent service through its network of independent local agents. See what real policyholders say in our review of Auto-Owners auto insurance.

- Many Coverage Options: Offers several optional coverages like gap insurance, accident forgiveness, and diminished value coverage.

Cons

- Not in All States: Only available in 26 states and Washington, D.C., limiting drivers who may move out of state.

- No Online Quotes: Quotes and claims with Auto-Owners must be handled through an agent, as the company doesn’t have online quotes or claims filing.

#9 – Liberty Mutual: Best for Safe Drivers

Pros

- Wide Range of Discounts: Within our Liberty Mutual auto insurance review, we offer various discounts, including for military personnel and safe drivers.

- Accident Forgiveness: Provides accident forgiveness to keep rates stable after the first at-fault accident.

- Comprehensive Coverage Options: Includes options for new car replacement and rental car reimbursement.

Cons

- Higher Premiums: Generally has higher premiums compared to other major insurers.

- Mixed Customer Service Reviews: Some customers have experienced issues with the claims process and customer support.

#10 – Travelers: Best for Hybrid and Electric Vehicles

Pros

- Green Discount: Provides a green discount, which applies to drivers of hybrid and electric vehicles.

- Competitive Rates: Offers competitive rates, especially for drivers with good credit and clean records.

- Usage-Based Discounts: Explore our Travelers auto insurance review, which highlights how the IntelliDrive program offers discounts for safe driving habits.

Cons

- Mixed Claim Handling: Some customers report dissatisfaction with the claims handling process.

- Limited Local Agents: Fewer local agents compared to some competitors, which may affect personal service.

Maximize Savings on Alabama Auto Insurance With Smart Comparison

Comparing auto insurance options is crucial for finding the best rates in Alabama, where costs vary significantly based on age, driving history, and credit score.

Exploring multiple providers ensures you find the most suitable and cost-effective policy for your needs.

While meeting state minimum liability requirements is essential, opting for comprehensive coverage provides better financial protection.

By entering your ZIP code, you can get instant Alabama car insurance quotes from top providers.

Frequently Asked Questions

How much is car insurance in Alabama?

The cost of car insurance in Alabama starts at $32 per month for minimum coverage and $83 for full coverage. This rate can vary significantly based on factors such as your driving history, the type of vehicle you drive, and your geographic location within the state.

Where can I get an Alabama automobile insurance quote?

You can get an Alabama automobile insurance quote online from various insurers or through local insurance agents. Be sure to check multiple sources for the best rates.

Ready to find affordable car insurance? Get started today by entering your ZIP code below into our free comparison tool.

How can I find affordable car insurance in Alabama?

To find affordable car insurance in Alabama, compare the Alabama car insurance quotes from multiple providers and consider discounts for safe driving, multiple policies, or being a good student.

For more information, check out our extensive guide on “Types of Auto Insurance” for a deeper understanding.

What are Alabama’s minimum car insurance requirements?

Alabama minimum car insurance requirements include $25,000 bodily injury per person, $50,000 per accident, and $25,000 for property damage. Always refer to the Alabama auto insurance law for the latest requirements.

For further information, refer to our detailed guide on “Minimum Auto Insurance Requirements by State” for clarity.

What does the Alabama auto insurance guide recommend for coverage?

The Alabama auto insurance guide recommends at least the state minimum liability insurance. For better protection, consider additional coverage like collision and comprehensive insurance.

What is accident forgiveness insurance, and is it available in Alabama?

Accident forgiveness insurance is a feature that prevents your rates from increasing after your first at-fault accident. Many providers in Alabama offer accident waiver insurance as part of their policy options.

For more information, check out our in-depth resource titled “What is accident forgiveness?” for details.

How do Alabama auto insurance laws affect my coverage?

Alabama auto insurance laws require all drivers to maintain at least the minimum liability coverage. Violating these laws can result in penalties, including fines and license suspension.

What are Alabama SR-22 requirements for high-risk drivers?

Alabama SR-22 requirements include filing an SR-22 form to prove you have the state-mandated liability insurance. This is typically required for drivers who have had their license suspended or revoked due to serious traffic violations.

To explore further, consult our detailed report titled “SR-22 Auto Insurance” for insights.

Can I find cheap car insurance in Alabama that meets legal requirements?

Yes, you can find the cheapest car insurance in Alabama that meets the state’s minimum auto insurance requirements by comparing quotes and taking advantage of discounts for safe driving or bundling policies.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.