Best Pay-As-You-Go Auto Insurance in Arizona (Find the Top 10 Providers for 2026)

Nationwide, Allstate and Mile Auto offer the best pay-as-you-go auto insurance in Arizona. You can get cheap AZ low-mileage auto insurance rates if you drive less than 10,000 miles per year. Minimum pay-as-you-go coverage starts at $20/mo. For example, Mile Auto charges an average of $0.08/mi.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated March 2025

3,071 reviews

3,071 reviewsCompany Facts

Pay-As-You-Go Auto Insurance in AZ

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 11,640 reviews

11,640 reviewsCompany Facts

Pay-As-You-Go Auto Insurance in AZ

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviews 12 reviews

12 reviewsCompany Facts

Pay-As-You-Go Auto Insurance in AZ

A.M. Best

Complaint Level

Pros & Cons

12 reviews

12 reviewsNationwide, Allstate and Mile Auto have the best pay-as-you-go auto insurance in Arizona.

When buying pay-as-you-go Arizona auto insurance, consider the following companies. Some offer affordable monthly payments for regular insurance policies, while others offer the option to pay by the mile after a monthly set fee.

Our Top 10 Company Picks: Best Pay-As-You-Go Auto Insurance in Arizona

| Company | Rank | Monthly Rates | Safe Driving Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $20 | 40% | Safe Drivers | Nationwide |

| #2 | $29 | 40% | Comprehensive Coverage | Allstate | |

| #3 | $45 | 30% | Low Mileage | Mile Auto | |

| #4 | $70 | 30% | Tech-Savvy Drivers | Metromile | |

| #5 | $49 | 30% | Tech-Friendly | Root | |

| #6 | $37 | 30% | Low-Mileage Discounts | Travelers | |

| #7 | $42 | 30% | Consistent Rates | State Farm | |

| #8 | $40 | 30% | Snapshot Program | Progressive | |

| #9 | $75 | 20% | Flexible Policies | Hugo | |

| #10 | $129 | 20% | Broad Availability | AssuranceAmerica |

Read on to learn about the top 10 auto insurance companies in Arizona for pay-as-you-go coverage. You can also compare rates with our free tool to quickly find cheap pay-per-mile auto insurance in Arizona.

- Nationwide has the best low-mileage car insurance for Arizona drivers

- Allstate also has great pay-as-you-go full coverage insurance

- All Arizona drivers are required to carry auto insurance

#1 – Nationwide: Top Overall Pick

Pros

- Safe Drivers: Nationwide’s rates are best for safe drivers with clean driving records. Learn more about rates in our Nationwide auto insurance review.

- Bundling Discounts: Purchase more insurance to save more at Nationwide.

- Roadside Assistance: Available 24/7 when added to an auto insurance policy.

Cons

- Data Tracking: To get Nationwide’s low mileage insurance, you must be comfortable with data tracking.

- High-Risk Rates: Savings for low mileage insurance won’t be as significant for higher-risk drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Purchase comprehensive coverage for the best protection in Arizona.

- Milewise Coverage: Pay by the mile with Allstate’s Milewise insurance program. Learn more by reading our Allstate Milewise review.

- Mobile App: Allstate’s mobile app is simple to use and allows drivers to make policy changes or file claims.

Cons

- Complaints: Allstate’s complaint ratio is slightly higher than the norm.

- Telematics Tracking: Your driving data is tracked if you choose pay-per-mile car insurance in Arizona.

#3 – Mile Auto: Best for Low Mileage

Pros

- Low Mileage: Drivers will get the best savings if they are low-mileage drivers. Learn more in our Mile Auto insurance review.

- Telematics-Free: Your driving data isn’t tracked by Mile Auto.

- Simple Pricing Model: You’ll know exactly how much you’ll pay each month based on your mileage.

Cons

- High-Mileage Costs: Mile Auto is not a cost-effective option for high-mileage drivers.

- Coverage Options: Coverage options are just the basics at Mile Auto.

#4 – Metromile: Best for Tech-Savvy Drivers

Pros

- Tech-Savvy Drivers: Tech-savvy customers will find it a breeze to operate Metromile online.

- Customizable Coverages: Pick how much coverage you want on your policy. Learn more in our Metromile auto insurance review.

- Easy-To-Use App: Metromile’s app is easy to operate.

Cons

- High-Mileage Costs: Metromile is not cost-effective for high-mileage drivers.

- Telematics Tracking: Metromile will track your driving habits.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Root: Best for Tech-Friendly

Pros

- Tech-Friendly: Root is easy to manage, even for those who aren’t tech-savvy.

- Good Drivers: Root’s rates are the best for good drivers. Learn more in our review of Root auto insurance.

- Coverage Options: Root offers a better variety of coverages than most other companies with usage-based auto insurance in Arizona.

Cons

- Telematics Tracking: Root does track mileage and driving habits on an app.

- High-Risk Drivers: As rates are based on driving skills, those who speed or drive at night pay more.

#6 – Travelers: Best for Low-Mileage Discounts

Pros

- Low Mileage Discounts: Travelers offer cheaper rates to low-mileage drivers. Explore our Travelers auto insurance review to gain more insights.

- Coverage Options: There are a number of coverage options to add to your cheap low-mileage car insurance policy.

- Loyalty Discounts: Sticking with the company as a provider could result in lower rates.

Cons

- Usage-Based Rate Increases: Trying to save with Traveler’s UBI program could backfire if you drive poorly.

- Telematics Tracking: You must be comfortable with your driving habits being tracked.

#7 – State Farm: Best for Consistent Rates

Pros

- Consistent Rates: State Farm’s rates generally stay consistent thanks to its financial management.

- Agent Network: Get in-person assistance easily through State Farm’s agent network.

- Coverage Options: Read about coverage options from the company in our State Farm auto insurance review.

Cons

- Telematics Tracking: You must have your driving data tracked to qualify for low mileage and good driver discounts.

- High-Risk Rates: State Farm’s usage-based car insurance in Arizona isn’t as affordable for poor drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Letting Progressive Snapshot monitor your driving could result in a discount of up to 30%.

- Online Tools: Take advantage of Progressive’s online app to manage your policy or its free budgeting tool.

- Coverage Options: Learn what Progressive sells in our Progressive auto insurance review, from roadside assistance to comprehensive coverage.

Cons

- Snapshot Rate Increases: Participating in the program could backfire for bad drivers, as rates could increase.

- Telematics Tracking: You must let Progressive track your data to get Arizona low-mileage auto insurance rates.

#9 – Hugo: Best for Flexible Policies

Pros

- Flexible Policies: You can choose minimum or full coverage from Hugo. Learn more in our Hugo auto insurance review.

- Simple Pricing: Pricing is transparent at Hugo, so customers can easily calculate their monthly spending.

- Pause Feature: Customers can turn their coverage off if they aren’t driving for a while.

Cons

- High-Mileage Drivers: Hugo is not an economical choice for high-mileage drivers.

- Add-On Coverage Options: Hugo doesn’t offer as many add-ons as other companies.

#10 – AssuranceAmerica: Best for Broad Availability

Pros

- Broad Availability: AssuranceAmerica is available in more locations than other popular pay-per-mile companies.

- Local Agents: Most customers will be able to get personalized assistance from AssuranceAmerica.

- Flexible Payments: AssuranceAmerica offers flexible payment options to customers.

Cons

- App Features: AssuranceAmerica’s app features may be more limited than its competitors.

- Coverage Options: AssuranceAmerica’s add-ons aren’t as numerous as other companies. Learn more in our AssuranceAmerica auto insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding How Arizona Pay-As-You-Go Insurance Works

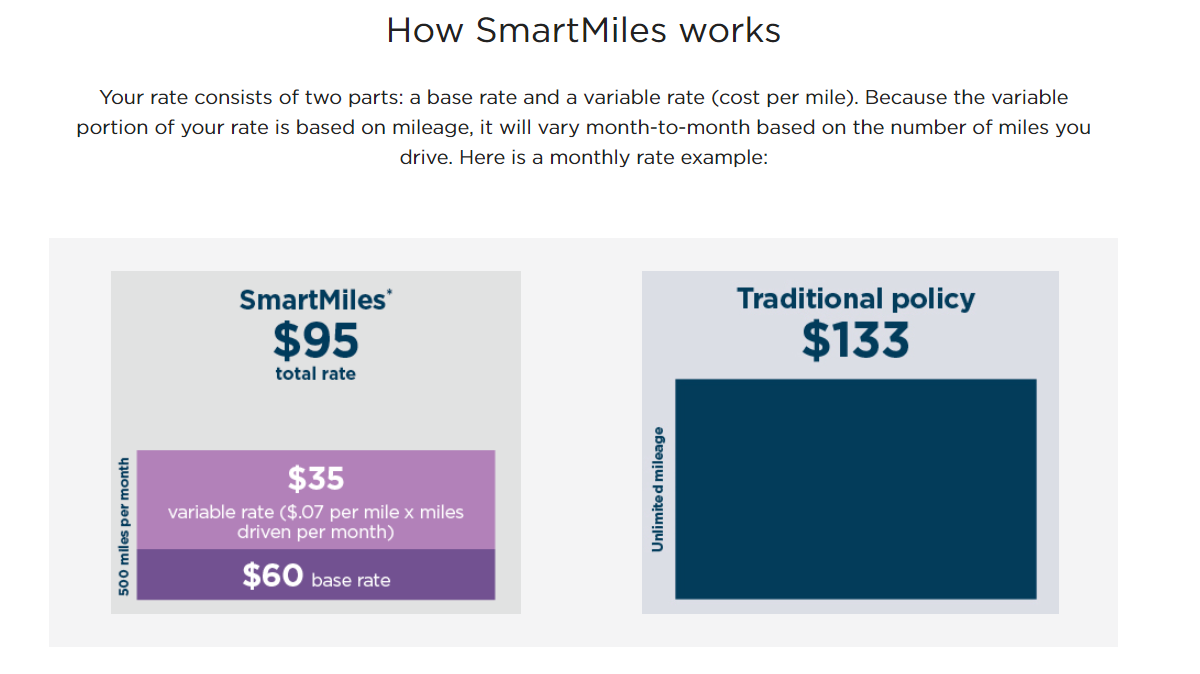

The best pay-as-you-go auto insurance companies tend to operate similarly. If you choose a pay-per-mile company like Nationwide’s SmartMiles, it will operate as you see below.

If the company you chose doesn’t offer a pay-per-mile option but a usage-based discount, it will track your data and award a discount based on your driving habits and mileage.

Deciding to Buy Pay-As-You-Go Auto Insurance in Arizona

Take a look at the average rates below to get a better idea of how annual mileage affects your auto insurance rates.

Arizona Auto Insurance Monthly Rates by Age, Gender, & Annual Mileage

| Age & Gender | 6,000 Miles | 10,000 Miles | 12,000 Miles | 15,000 Miles |

|---|---|---|---|---|

| 16-Year-Old Female | $290 | $310 | $325 | $340 |

| 16-Year-Old Male | $310 | $330 | $345 | $360 |

| 20-Year-Old Female | $240 | $255 | $270 | $285 |

| 20-Year-Old Male | $260 | $275 | $290 | $305 |

| 30-Year-Old Female | $180 | $190 | $200 | $210 |

| 30-Year-Old Male | $190 | $200 | $210 | $220 |

| 40-Year-Old Female | $170 | $180 | $185 | $195 |

| 40-Year-Old Male | $175 | $185 | $190 | $200 |

| 50-Year-Old Female | $160 | $165 | $170 | $180 |

| 50-Year-Old Male | $165 | $170 | $175 | $185 |

| 60-Year-Old Female | $155 | $160 | $165 | $175 |

| 60-Year-Old Male | $160 | $165 | $170 | $180 |

| 70-Year-Old Female | $165 | $170 | $175 | $185 |

| 70-Year-Old Male | $170 | $175 | $180 | $190 |

With low-mileage auto insurance companies, you get rewarded for driving less with lower rates. However, bear in mind that your location in Arizona may impact your Arizona pay-per-mileage reimbursement amount, as some areas are riskier and come with higher rates.

Arizona Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Glendale | Mesa | Phoenix | Scottsdale | Tucson |

|---|---|---|---|---|---|

| 16-Year-Old Female | $250 | $240 | $260 | $230 | $220 |

| 16-Year-Old Male | $270 | $260 | $280 | $250 | $240 |

| 20-Year-Old Female | $210 | $200 | $220 | $190 | $180 |

| 20-Year-Old Male | $230 | $220 | $240 | $210 | $200 |

| 30-Year-Old Female | $160 | $150 | $170 | $140 | $130 |

| 30-Year-Old Male | $170 | $160 | $180 | $150 | $140 |

| 40-Year-Old Female | $150 | $140 | $160 | $130 | $120 |

| 40-Year-Old Male | $155 | $145 | $165 | $135 | $125 |

| 50-Year-Old Female | $140 | $130 | $150 | $120 | $110 |

| 50-Year-Old Male | $145 | $135 | $155 | $125 | $115 |

| 60-Year-Old Female | $135 | $125 | $145 | $115 | $105 |

| 60-Year-Old Male | $140 | $130 | $150 | $120 | $110 |

| 70-Year-Old Female | $140 | $130 | $150 | $120 | $110 |

| 70-Year-Old Male | $145 | $135 | $155 | $125 | $115 |

Your rates will be higher in correlation with the more crashes and claims filed in your area.

Meeting Arizona Auto Insurance Requirements

All drivers should be aware of Arizona minimum auto insurance requirements before they hit the road.

Arizona auto insurance laws require drivers to carry liability insurance in the amount of 25/50/15.Dani Best Licensed Insurance Producer

The table below shows the difference in cost between full and minimum coverage.

Arizona Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $280 | $600 |

| 16-Year-Old Male | $300 | $650 |

| 20-Year-Old Female | $220 | $470 |

| 20-Year-Old Male | $240 | $510 |

| 30-Year-Old Female | $160 | $340 |

| 30-Year-Old Male | $170 | $360 |

| 40-Year-Old Female | $150 | $320 |

| 40-Year-Old Male | $155 | $330 |

| 50-Year-Old Female | $140 | $300 |

| 50-Year-Old Male | $145 | $310 |

| 60-Year-Old Female | $135 | $290 |

| 60-Year-Old Male | $140 | $300 |

| 70-Year-Old Female | $140 | $305 |

| 70-Year-Old Male | $145 | $310 |

While full coverage costs more, it is still possible to find cheap full coverage auto insurance in AZ by shopping around.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Saving Money on Arizona Auto Insurance

You will find the best auto insurance for low-mileage drivers at the following companies.

Pay-As-You-Go Auto Insurance in Arizona: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $29 | $90 | |

| $129 | $150 | |

| $75 | $130 |

| $70 | $105 | |

| $45 | $58 | |

| $20 | $75 |

| $40 | $85 | |

| $49 | $62 |

| $42 | $80 | |

| $37 | $59 |

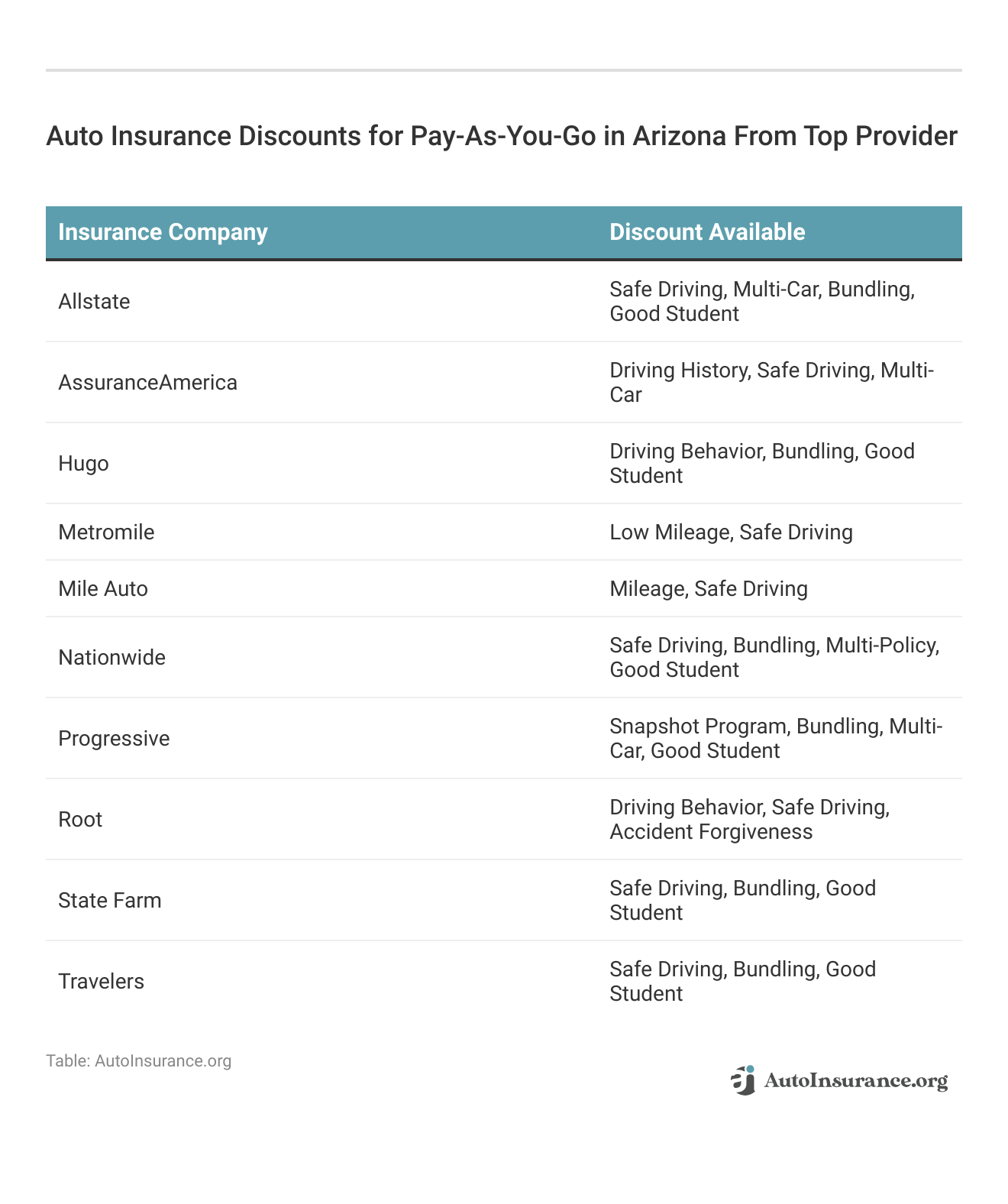

If the rates at your favorite company seem too high, make sure to shop around for discounts to save on your Arizona auto insurance costs.

A number of companies offer a low-mileage auto insurance discount, even if they don’t have pay-per-mile insurance.

Companies may also offer bundling discounts, good driver discounts, and many more.

Get The Best Pay-As-You-Go Auto Insurance in Arizona Online

Pay-as-you-go is a great option to save money, especially for low-mileage drivers looking for affordable, low-income car insurance in Arizona. Now that you know who has the best car insurance for low-mileage drivers, you probably want to know how to buy auto insurance instantly.

You can purchase insurance directly from most companies, but make sure to compare quotes first, especially if you are shopping for low-income auto insurance in Arizona.

Getting the Best Pay-As-You-Go Auto Insurance in Arizona

Pay-as-you-go auto insurance in Arizona offers a flexible and cost-effective alternative to traditional policies, particularly for low-mileage drivers. These plans, also known as pay-per-mile insurance, calculate premiums based on actual driving habits rather than fixed rates.

Is pay per mile car insurance as good as it sounds?

byu/tmarmstr inInsurance

Companies like Metromile, Nationwide, and Mile Auto provide cheap auto insurance for high-risk drivers in Arizona. These pay-per-mile insurance options can be particularly beneficial for high-risk drivers looking to lower their premiums by driving less.

Key benefits include potential savings for infrequent drivers, real-time usage tracking, and customizable coverage. However, factors like mileage limits, telematics tracking, and insurer-specific pricing should be carefully considered. Choosing the best pay-as-you-go auto insurance in Arizona depends on individual driving patterns and coverage needs. Use our free tool to compare Arizona auto insurance quotes.

Frequently Asked Questions

Is Allstate Milewise a good option for pay-as-you-go auto insurance in AZ?

Yes, Allstate Milewise auto insurance is a great option for pay-as-you-go insurance, providing flexible coverage based on miles driven. It’s also a smart choice for those looking for cheap Arizona auto insurance or usage-based car insurance in Arizona with personalized rates.

What is the best pay-as-you-go car insurance company in Arizona?

Nationwide offers the best pay-as-you-go auto insurance by the mile. It’s a top choice for those seeking the best auto insurance in Arizona.

Which Arizona pay-as-you-go auto insurance company has the best rates?

Nationwide has the best rates for cheap usage-based auto insurance, as minimum coverage is only an average of $20/mo in Arizona.

What’s considered very high mileage for pay-as-you-go auto insurance?

Driving more than 15,000 miles per year is considered high mileage, making low-mileage car insurance a smart choice for those who drive less. Pay-by-mile car insurance offers cost savings, and drivers in Arizona can find cheap full coverage auto insurance tailored to their needs.

Is Arizona a no-fault insurance state?

No, Arizona is an at-fault state, so Arizona auto insurance requirements will be different than no-fault states.

Is comprehensive coverage required in Arizona?

The state of Arizona does not require comprehensive auto insurance.

Where can I get a $20 down payment for car insurance?

Some insurers, such as Dairyland and Acceptance Insurance, offer low-down-payment options. Availability depends on your location and driving record.

How do car insurance quotes and monthly payments work?

Quotes estimate your cost based on risk factors. Monthly payments allow you to spread the total premium over time instead of paying it upfront.

Is it illegal to not have car insurance in Arizona?

Yes, it is illegal not to have auto insurance in Arizona. If you are looking for affordable rates, consider cheap auto insurance with no down payment. No down payment car insurance can reduce your initial insurance costs.

Does insurance follow the car or the driver in Arizona?

Arizona car insurance typically follows the car, not the driver.

Which insurance company insures the most cars in Arizona?

Is cheap car insurance in South Carolina with no deposit available?

Who offers cheap car insurance with no down payment?

Who has the best auto insurance rates for seniors in Arizona?

Does Allstate pay-as-you-go offer flexible coverage?

What is minimum coverage insurance in Arizona?

What are the best pay-per-mile car insurance options in Arizona?

Who has the best car insurance rates in Phoenix?

Where can I find cheap car insurance in Florida with a low down payment?

Where can I find pay-per-mile car insurance in Georgia?

Can I get free car insurance for the first month, with no deposit?

How do I make a Go Auto online payment?

What do Hugo insurance reviews by the BBB say?

Are Milewise insurance reviews positive?

What are alternatives to pay-as-you-go insurance like Hugo?

Who offers pay-per-mile car insurance in California?

Which is better: Root vs State Farm?

How does telematics insurance in Arizona work?

What’s the best pay-per-mile car insurance in Texas?

What are pay-low insurance photos?

How much is car insurance in AZ for a 20-year-old?

Who owns Assurance America Insurance?

Where can I get pay-as-you-go insurance in Georgia?

Is pay-as-you-go car insurance with no deposit available?

What’s new with Direct Auto Insurance expansion?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.