Best Mercedes-Benz GLC 300 Auto Insurance in 2026 (Find the Top 10 Companies Here)

Auto-Owners, The Hartford, and Nationwide are the top providers for the best Mercedes-Benz GLC 300 auto insurance, offering rates at $85/month. These companies excel in affordability, comprehensive options, and customer satisfaction, making them the best choices for Mercedes-Benz GLC 300 insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated April 2025

563 reviews

563 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

563 reviews

563 reviews 765 reviews

765 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

765 reviews

765 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsAuto-Owners stands out for its exceptional rates and reliable service, making it the top choice. Explore these top providers to find the best insurance for your Mercedes-Benz GLC 300.

Our Top 10 Company Picks: Best Mercedes-Benz GLC 300 Auto Insurance| Company | Rank | UBI Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | A++ | Claims Service | Auto-Owners | |

| #2 | 20% | A+ | Organization Discount | The Hartford |

| #3 | 40% | A+ | Broad Coverage | Nationwide |

| #4 | 30% | A | Loyalty Rewards | American Family | |

| #5 | 30% | A | Discount Options | Liberty Mutual |

| #6 | 30% | A+ | Competitive Rates | Progressive | |

| #7 | 30% | A++ | Comprehensive Options | Travelers | |

| #8 | 25% | A++ | Many Discounts | Geico | |

| #9 | 50% | A | Affordable Rates | Mercury | |

| #10 | 30% | A | Reliable Coverage | Farmers |

Mercedes-Benz GLC 300 insurance rates are more expensive than the average vehicle. Learn how you save on Mercedes-Benz GLC 300 insurance rates in this vehicle guide.

Are you ready to buy Dodge Ram 1500 auto insurance? Compare your Dodge Ram 1500 auto insurance rates by entering your ZIP code in our free online tool above.

- Find the best Mercedes-Benz GLC 300 auto insurance with rates at $85/month

- Auto-Owners offers the best Mercedes-Benz GLC 300 auto insurance

- Discover comprehensive coverage and customer satisfaction from top providers

#1 – Auto-Owners: Top Overall Pick

Pros

- Claims Service: Auto-Owners is renowned for its excellent claims service, making the claims process smooth and efficient for Mercedes-Benz GLC 300 owners.

- Low Monthly Rates: Auto-Owners auto insurance review highlighted their offers competitive monthly rates of $90 for the Mercedes-Benz GLC 300 with minimum coverage.

- Bundling Discounts: Significant discounts for bundling multiple policies, providing savings for Mercedes-Benz GLC 300 owners.

Cons

- Limited Availability: Auto-Owners insurance may not be available in all states, limiting options for some Mercedes-Benz GLC 300 owners.

- Online Services: The company has fewer online services compared to some competitors, which might be less convenient for tech-savvy Mercedes-Benz GLC 300 owners.

#2 – The Hartford: Best for Organization Discount

Pros

- Organization Discounts: The Hartford offers unique discounts for various organizations, benefiting Mercedes-Benz GLC 300 owners affiliated with eligible groups.

- Low Monthly Rates: The Hartford auto insurance review provides competitive monthly rates at $95 for the Mercedes-Benz GLC 300 with minimum coverage.

- A+ Rating: The company’s strong A+ rating ensures reliability and trustworthiness for Mercedes-Benz GLC 300 insurance.

Cons

- Age Restrictions: Some discounts and benefits are primarily available to older drivers, which may not benefit younger Mercedes-Benz GLC 300 owners.

- Higher Premiums: Despite discounts, The Hartford’s premiums might be higher for certain coverage levels compared to competitors for Mercedes-Benz GLC 300 owners.

#3 – Nationwide: Best for Broad Coverage

Pros

- Broad Coverage: Nationwide offers extensive coverage options suitable for various needs, making it ideal for Mercedes-Benz GLC 300 owners.

- Low Monthly Rates: Nationwide auto insurance review provides competitive monthly rates at $100 for the Mercedes-Benz GLC 300 with minimum coverage.

- UBI Discount: A significant 40% discount for using telematics-based usage-based insurance (UBI), benefiting Mercedes-Benz GLC 300 owners who drive less.

Cons

- Claims Process: Some customers report a longer claims process, which could be inconvenient for Mercedes-Benz GLC 300 owners needing quick resolutions.

- Limited Local Agents: Fewer local agents compared to some competitors, potentially impacting personalized service for Mercedes-Benz GLC 300 owners.

#4 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: American Family auto insurance review provides excellent loyalty rewards, benefiting long-term Mercedes-Benz GLC 300 owners.

- Low Monthly Rates: American Family offers competitive monthly rates of $105 for the Mercedes-Benz GLC 300 with minimum coverage.

- Customer Service: High customer satisfaction ratings, ensuring a positive experience for Mercedes-Benz GLC 300 owners.

Cons

- Availability: American Family may not be available in all regions, limiting access for some Mercedes-Benz GLC 300 owners.

- Online Tools: The company’s online tools and resources are not as comprehensive as some competitors, which might be a drawback for tech-savvy Mercedes-Benz GLC 300 owners.

#5 – Liberty Mutual: Best for Discount Options

Pros

- Discount Options: Liberty Mutual offers a wide range of discount options, providing savings opportunities for Mercedes-Benz GLC 300 owners.

- Low Monthly Rates: Liberty Mutual auto insurance review provides competitive monthly rates of $110 for the Mercedes-Benz GLC 300 with minimum coverage.

- Comprehensive Coverage: Offers extensive coverage options, ensuring Mercedes-Benz GLC 300 owners can find policies that fit their needs.

Cons

- Higher Premiums: Despite discounts, Liberty Mutual’s premiums can be higher for certain coverage levels compared to competitors for Mercedes-Benz GLC 300 owners.

- Customer Service: Some customers have reported issues with customer service responsiveness, which could affect Mercedes-Benz GLC 300 owners needing support.

#6 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive is known for offering competitive rates, making it a cost-effective choice for Mercedes-Benz GLC 300 owners.

- Low Monthly Rates: Progressive auto insurance review provides competitive monthly rates of $107 for the Mercedes-Benz GLC 300 with minimum coverage.

- Snapshot Program: The usage-based Snapshot program offers potential savings for Mercedes-Benz GLC 300 owners who drive safely.

Cons

- Customer Complaints: Some customers have reported issues with claims processing, which could be a drawback for Mercedes-Benz GLC 300 owners needing efficient claims resolution.

- Rate Increases: There have been reports of rate increases upon policy renewal, which might affect long-term affordability for Mercedes-Benz GLC 300 owners.

#7 – Travelers: Best for Comprehensive Options

Pros

- Comprehensive Options: Travelers offers a wide range of comprehensive coverage options, ensuring Mercedes-Benz GLC 300 owners can tailor their policies to their needs.

- Low Monthly Rates: Travelers Auto insurance review provides competitive monthly rates of $102 for the Mercedes-Benz GLC 300 with minimum coverage.

- Strong A++ Rating: The company’s strong A++ rating ensures reliability and trustworthiness for Mercedes-Benz GLC 300 insurance.

Cons

- Discount Availability: Some discounts may not be available in all states, which could limit savings opportunities for some Mercedes-Benz GLC 300 owners.

- Online Experience: The online customer experience is less robust compared to some competitors, which might be less convenient for tech-savvy Mercedes-Benz GLC 300 owners.

#8 – Geico: Best for Many Discounts

Pros

- Many Discounts: Geico offers a variety of discounts, making it easier for Mercedes-Benz GLC 300 owners to save on their insurance.

- Low Monthly Rates: Geico auto insurance review provides competitive monthly rates of $85 for the Mercedes-Benz GLC 300 with minimum coverage.

- Strong A++ Rating: The company’s strong A++ rating ensures reliability and trustworthiness for Mercedes-Benz GLC 300 insurance.

Cons

- Customer Service: Some customers have reported mixed experiences with customer service, which could affect support for Mercedes-Benz GLC 300 owners.

- Claims Process: There have been reports of delays in the claims process, which might be inconvenient for Mercedes-Benz GLC 300 owners needing quick resolutions.

#9 – Mercury: Best for Affordable Rates

Pros

- Affordable Rates: Mercury is known for offering affordable rates, making it a budget-friendly choice for Mercedes-Benz GLC 300 owners.

- Low Monthly Rates: Mercury auto insurance review provides competitive monthly rates of $115 for the Mercedes-Benz GLC 300 with minimum coverage.

- Discounts: The company offers a variety of discounts, providing savings opportunities for Mercedes-Benz GLC 300 owners.

Cons

- Limited Availability: Mercury insurance may not be available in all states, limiting options for some Mercedes-Benz GLC 300 owners.

- Coverage Options: The range of coverage options may be more limited compared to some competitors, which might affect Mercedes-Benz GLC 300 owners seeking comprehensive policies.

#10 – Farmers: Best for Reliable Coverage

Pros

- Reliable Coverage: Farmers is known for providing reliable and consistent coverage, ensuring peace of mind for Mercedes-Benz GLC 300 owners.

- Low Monthly Rates: Farmers offers competitive monthly rates of $112 for the Mercedes-Benz GLC 300 with minimum coverage.

- Discount Options: Farmers auto insurance review highlighted their variety of discount options are available, providing savings opportunities for Mercedes-Benz GLC 300 owners.

Cons

- Premium Costs: Despite discounts, Farmers’ premiums might be relatively higher for certain coverage levels compared to competitors for Mercedes-Benz GLC 300 owners.

- Online Services: The company’s online services are not as extensive as some competitors, which might be less convenient for tech-savvy Mercedes-Benz GLC 300 owners.

Mercedes-Benz GLC 300 Insurance Cost

The insurance cost for a Mercedes-Benz GLC 300 varies significantly based on the coverage level and the insurance provider. For minimum coverage, monthly rates range from $85 with Geico to $115 with Mercury.

Mercedes-Benz GLC 300 Auto Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $105 | $225 | |

| $90 | $200 | |

| $112 | $233 | |

| $85 | $180 | |

| $110 | $230 |

| $115 | $235 | |

| $100 | $220 |

| $107 | $225 | |

| $95 | $210 |

| $102 | $223 |

For full coverage auto insurance, rates range from $180 with Geico to $235 with Mercury. The average monthly rate across all providers is $148, but this can decrease to $87 with discounts or increase to $314 for high-risk drivers.

Mercedes-Benz GLC 300 Auto Insurance Monthly Rates by Coverage Type| Category | Rates |

|---|---|

| Average Rate | $148 |

| Discount Rate | $87 |

| High Deductibles | $127 |

| High Risk Driver | $314 |

| Low Deductibles | $186 |

| Teen Driver | $539 |

Teen drivers face the highest costs at $539 per month. High deductibles can lower the monthly rate to $127, while low deductibles increase it to $186.

Expensiveness of Mercedes-Benz GLC 300s to Insure

The Mercedes-Benz GLC 300 is relatively more expensive to insure compared to other SUVs such as the Jeep Grand Cherokee, Volkswagen Touareg, and Chevrolet Traverse. According to the chart, the GLC 300’s monthly insurance rates are $34 for comprehensive coverage, $68 for collision, $33 for minimum coverage, and $148 for full coverage.

Mercedes-Benz GLC 300 Auto Insurance Monthly Rates vs. Other Vehicles| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Mercedes-Benz GLC 300 | $34 | $68 | $33 | $148 |

| Jeep Grand Cherokee | $27 | $47 | $31 | $118 |

| Volkswagen Touareg | $31 | $58 | $33 | $134 |

| Chevrolet Traverse | $28 | $39 | $26 | $105 |

| Honda Pilot | $28 | $39 | $31 | $111 |

| Volvo XC90 | $29 | $50 | $33 | $125 |

| Volkswagen Tiguan | $26 | $45 | $28 | $110 |

In comparison, the Jeep Grand Cherokee’s rates are significantly lower at $27 for comprehensive, $47 for collision, $31 for minimum coverage, and $118 for full coverage.

The Volkswagen Touareg and Chevrolet Traverse also have lower rates for comprehensive and collision coverage, making the GLC 300 one of the costlier options in terms of insurance among the SUVs listed. Learn more about collision vs. comprehensive auto insurance.

Factors That Impacts the Cost of Mercedes-Benz GLC 300 Insurance

The Mercedes-Benz GLC 300 trim and model you choose can impact the total price you will pay for Mercedes-Benz GLC 300 auto insurance coverage. Delve into our evaluation of “Factors That Affect Auto Insurance Rates.”

Age of the Vehicle

Older models of the Mercedes-Benz GLC 300 generally cost less to insure compared to newer ones. This trend is evident when comparing the auto insurance monthly rates across different coverage categories such as comprehensive, collision, minimum coverage, and full coverage.

Mercedes-Benz GLC 300 Auto Insurance Monthly Rates by Category| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Mercedes-Benz GLC 300 | $36 | $70 | $35 | $150 |

| 2023 Mercedes-Benz GLC 300 | $35 | $70 | $35 | $149 |

| 2022 Mercedes-Benz GLC 300 | $35 | $69 | $34 | $148 |

| 2021 Mercedes-Benz GLC 300 | $35 | $69 | $34 | $148 |

| 2020 Mercedes-Benz GLC 300 | $34 | $68 | $33 | $148 |

| 2019 Mercedes-Benz GLC 300 | $34 | $68 | $33 | $148 |

| 2018 Mercedes-Benz GLC 300 | $33 | $67 | $33 | $146 |

| 2017 Mercedes-Benz GLC 300 | $32 | $65 | $35 | $145 |

| 2016 Mercedes-Benz GLC 300 | $31 | $63 | $36 | $142 |

For instance, the insurance for a 2024 model totals $150 for full coverage, while a 2016 model costs $142. The reduction in insurance costs for older models can be attributed to the depreciation of the vehicle’s value and potentially lower repair costs. Overall, insurance rates tend to decrease as the vehicle ages, reflecting its declining market value and the associated lower risk for insurers.

Driver Age

Driver age significantly impacts Mercedes-Benz GLC 300 auto insurance rates, with younger drivers or auto insurance for teens facing substantially higher premiums. For example, a 16-year-old driver pays an average of $680 per month, while an 18-year-old pays $539.

Mercedes-Benz GLC 300 Auto Insurance Monthly Rates by Age| Age | Rates |

|---|---|

| Age: 16 | $808 |

| Age: 18 | $656 |

| Age: 20 | $334 |

| Age: 30 | $191 |

| Age: 40 | $148 |

| Age: 45 | $165 |

| Age: 50 | $135 |

| Age: 60 | $152 |

Rates decrease considerably as drivers age, with 20-year-olds paying $334, and the cost stabilizing around $154 for those in their 30s. Middle-aged drivers enjoy even lower rates, with 40-year-olds paying $148, 45-year-olds $142, and 50-year-olds $135.

The lowest rates are typically for drivers aged 60, at $132 per month. This trend reflects insurers’ views on the relative risk posed by younger, less experienced drivers compared to older, more experienced ones.

Driver Location

Driver location significantly impacts Mercedes-Benz GLC 300 insurance rates, as urban areas typically have higher premiums due to increased risks like traffic congestion, theft, and accidents. For instance, Los Angeles, CA, has the highest monthly rate at $252, reflecting its dense population and higher crime rates.

Mercedes-Benz GLC 300 Auto Insurance Monthly Rates by City| City | Rates |

|---|---|

| Los Angeles, CA | $252 |

| New York, NY | $233 |

| Houston, TX | $231 |

| Jacksonville, FL | $214 |

| Philadelphia, PA | $198 |

| Chicago, IL | $195 |

| Phoenix, AZ | $171 |

| Seattle, WA | $143 |

| Indianapolis, IN | $125 |

| Columbus, OH | $122 |

Conversely, Columbus, OH, has the lowest rate at $122, likely due to lower traffic density and fewer incidents. Rates vary widely across cities, with New York, NY, at $233 and Seattle, WA, at $143, showcasing how geographical factors and local conditions influence insurance costs for the Mercedes-Benz GLC 300.

Your Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $808 | $850 | $1,200 | $810 |

| Age: 18 | $656 | $710 | $980 | $640 |

| Age: 20 | $334 | $450 | $690 | $410 |

| Age: 30 | $191 | $230 | $360 | $200 |

| Age: 40 | $148 | $220 | $350 | $190 |

| Age: 45 | $165 | $244 | $295 | $203 |

| Age: 50 | $135 | $200 | $320 | $180 |

| Age: 60 | $152 | $195 | $310 | $175 |

For instance, a 16-year-old with a clean record pays $680 monthly, but this can spike to $1,200 with a DUI. In contrast, a 30-year-old with a DUI sees their rates rise from $154 to $360. This data underscores the importance of maintaining a clean driving record to keep insurance premiums manageable, especially for younger drivers.

Mercedes-Benz GLC 300 Safety Ratings

The Mercedes-Benz GLC 300’s impressive safety ratings significantly influence its auto insurance rates. All major safety categories, including small and moderate overlap front tests, side impacts, roof strength, and head restraints, receive a “Good” rating, the highest possible from safety assessments.

Mercedes-Benz GLC 300 Safety Ratings| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

These robust ratings indicate a lower risk of injury during accidents, which can lead to lower insurance premiums. Additionally, the GLC 300 is equipped with an extensive array of advanced safety features such as Electronic Stability Control, ABS, side impact beams, and a comprehensive airbag system.

Features like blind spot assist, active brake assist, and a back-up camera further enhance its safety profile. Insurers often offer discounts for vehicles with such advanced safety technologies, potentially reducing the overall insurance cost for GLC 300 owners.

Mercedes-Benz GLC 300 Crash Test Ratings

The Mercedes-Benz GLC 300 has consistently received strong crash test ratings over the years, with an overall rating of 5 stars for every model from 2016 to 2024. The frontal crash ratings are consistently at 4 stars, while side crash ratings are consistently at 5 stars, and rollover ratings are at 4 stars.

Mercedes-Benz GLC 300 Crash Test Ratings| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Mercedes-Benz GLC 300 | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Mercedes-Benz GLC 300 | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Mercedes-Benz GLC 300 | 5 stars | N/R | 5 stars | 4 stars |

| 2021 Mercedes-Benz GLC 300 | 5 stars | N/R | 5 stars | 4 stars |

| 2020 Mercedes-Benz GLC 300 | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Mercedes-Benz GLC 300 | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Mercedes-Benz GLC 300 | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Mercedes-Benz GLC 300 | 5 stars | 4 stars | 5 stars | 4 stars |

| 2016 Mercedes-Benz GLC 300 | 5 stars | 4 stars | 5 stars | 4 stars |

These solid ratings indicate a high level of safety, which generally helps in keeping auto insurance rates more affordable. Poor crash test ratings could lead to higher insurance rates due to the increased perceived risk, but the GLC 300’s strong performance should contribute positively to its insurance cost profile. Check out our guide “Do you need medical payment coverage on auto insurance?”

Ways to Save on Mercedes-Benz GLC 300 Insurance

To save on Mercedes-Benz GLC 300 insurance, consider several effective strategies. First, obtaining your full, unrestricted license as soon as eligible can reduce premiums by demonstrating driving competence. Second, purchasing a roadside assistance program can offer peace of mind and potentially lower rates.

Third, choosing a GLC 300 model with lower repair costs can result in cheaper insurance. Additionally, comparing quotes online allows you to find the most competitive rates, while inquiring about low mileage discounts can provide further savings for those who drive less frequently. By leveraging these tips, you can significantly reduce your insurance expenses for the Mercedes-Benz GLC 300.

Top Mercedes-Benz GLC 300 Insurance Companies

When insuring a Mercedes-Benz GLC 300, several insurance companies stand out due to their competitive rates and market presence. State Farm leads the pack with $65.6 million in premiums written, capturing 9% of the market share. Geico follows with $46.1 million and a 7% market share, while Progressive and Liberty Mutual each hold 6% and 5%, respectively.

Top 10 Mercedes-Benz GLC 300 Auto Insurance Providers by Market Share| Rank | Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | $65.6 milllion | 9% | |

| #2 | $46.1 milllion | 7% | |

| #3 | $39.2 milllion | 6% | |

| #4 |  | $35.6 milllion | 5% |

| #5 | $35 milllion | 5% | |

| #6 | $28 milllion | 4% | |

| #7 | $23.4 milllion | 3% | |

| #8 | $23.3 milllion | 3% | |

| #9 | $20.6 milllion | 3% | |

| #10 |  | $18.4 milllion | 3% |

Allstate is also notable with $35 million in premiums, sharing the 5% market share with Liberty Mutual. Other key players include Travelers, USAA, Chubb, Farmers, and Nationwide, each contributing to a diversified landscape of insurance options for GLC 300 drivers.

Discounts for safety features and the overall strong market presence make these companies popular choices among Mercedes-Benz GLC 300 owners. Read thorough our guide “How to Get a Multi-Vehicle Auto Insurance Discount.”

Compare Free Mercedes-Benz GLC 300 Insurance Quotes Online

Comparing free Mercedes-Benz GLC 300 insurance quotes online is a straightforward process that can save you time and money. By using a free online tool, you can quickly access quotes from top auto insurance companies, allowing you to evaluate various coverage options and prices side by side.

This method not only helps you find the most affordable rates but also ensures you get the best coverage for your specific needs. Taking advantage of these online comparison tools can lead to significant savings and better-informed decisions when it comes to insuring your Mercedes-Benz GLC 300. Check out our guide “Where to Compare Auto Insurance Rates.“

Case Studies: Best Mercedes-Benz GLC 300 Auto Insurance

Exploring real-life examples helps to understand how the best Mercedes-Benz GLC 300 auto insurance providers meet diverse needs. Below are three case studies illustrating how top providers excel in offering affordable, comprehensive coverage and exceptional customer service.

- Case Study #1 – Exceptional Rates and Service: A young professional in a busy city needed affordable insurance for their Mercedes-Benz GLC 300. Auto-Owners offered a rate of $85/month with comprehensive coverage, including collision and liability protection. Exceptional customer service ensured a smooth experience, allowing the professional to save on costs while enjoying extensive coverage.

- Case Study #2 – Comprehensive Coverage for Families: A family with multiple drivers and vehicles required broad coverage and multi-vehicle discounts for their Mercedes-Benz GLC 300. The Hartford provided an affordable package that included these discounts and comprehensive options, covering all family members and vehicles, resulting in substantial savings and robust protection.

- Case Study #3 – Balancing Cost and Customer Satisfaction: A small business owner needed reliable insurance for their Mercedes-Benz GLC 300 that balanced cost with high customer satisfaction. Nationwide offered a tailored policy at $85/month, meeting the specific needs of the business owner.

These case studies demonstrate how the best Mercedes-Benz GLC 300 auto insurance providers cater to various needs, from affordability to comprehensive coverage and customer satisfaction. Unlock details in our guide titled “What are the recommended auto insurance coverage levels?”

Auto-Owners offers the best rates and comprehensive coverage for Mercedes-Benz GLC 300 insurance, making it the top choice.Jeff Root Licensed Insurance Agent

By choosing top providers like Auto-Owners, The Hartford, and Nationwide, drivers can secure the best insurance solutions for their Mercedes-Benz GLC 300. Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Frequently Asked Questions

What is the Mercedes-Benz GLC 300?

The Mercedes-Benz GLC 300 is a luxury compact SUV that combines elegant styling, advanced technology, and a comfortable driving experience (Read more: How to Compare Auto Insurance Quotes).

How much does insurance cost for a Mercedes-Benz GLC 300?

Insurance for a Mercedes-Benz GLC 300 can vary, but it generally costs around $85/month. You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

What types of insurance coverage do I need for a Mercedes-Benz GLC 300?

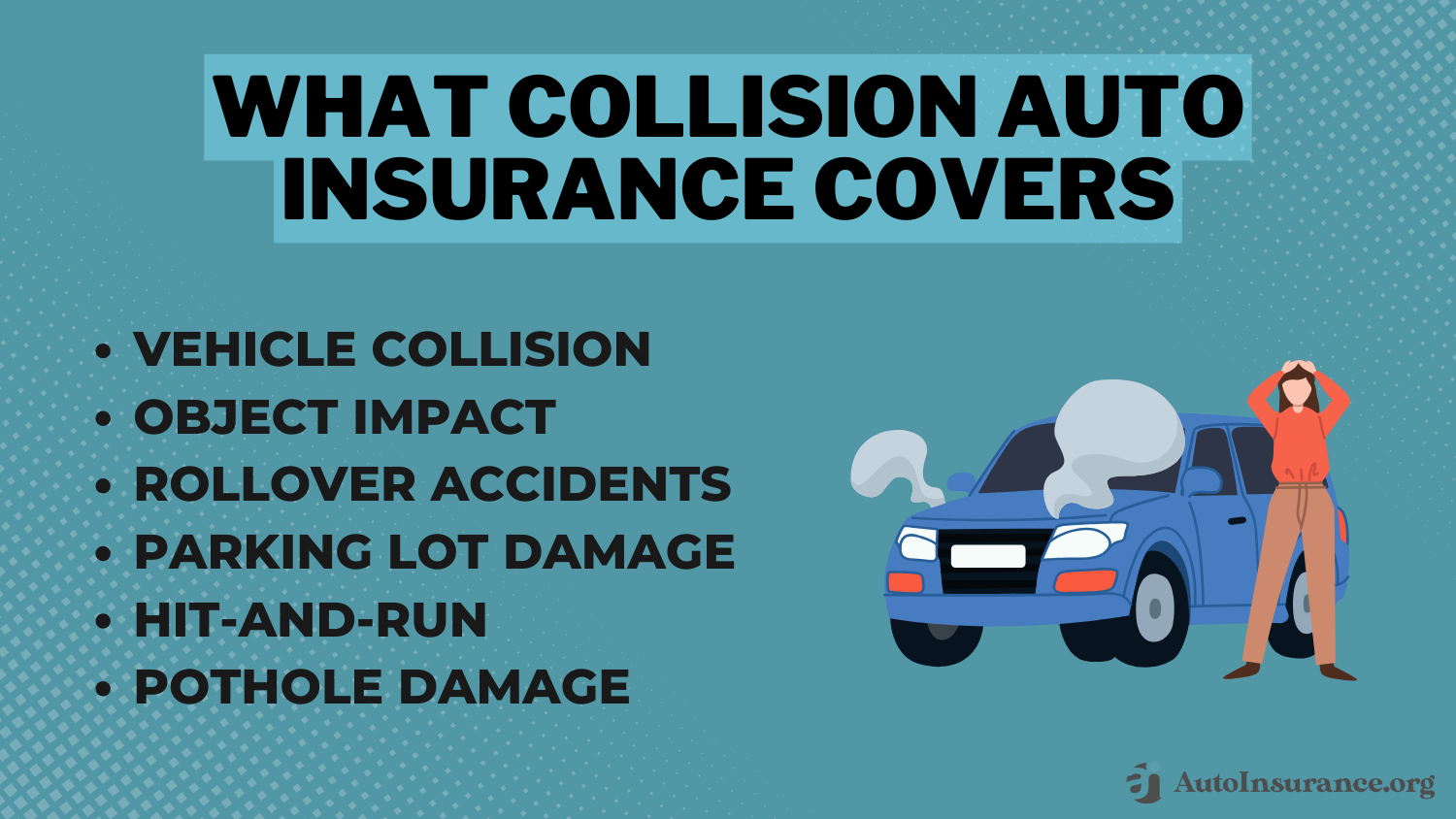

You need liability, collision insurance, comprehensive, and uninsured/underinsured motorist coverage.

Should I choose an authorized Mercedes-Benz repair facility for my GLC 300?

Yes, authorized repair facilities are trained to work on Mercedes-Benz vehicles and use genuine parts.

What steps should I take if my Mercedes-Benz GLC 300 is stolen or totaled?

Report it to the police, notify your insurance provider, provide necessary documentation, and cooperate with your insurance company.

Are there any discounts available for Mercedes-Benz GLC 300 auto insurance?

Yes, you can get discounts for multi-vehicle policies, good driving records, safety features, and loyalty. Explore our guide titled “How Auto Insurance Companies Check Driving Records.”

Who offers the best Mercedes-Benz GLC 300 auto insurance?

Auto-Owners, The Hartford, and Nationwide are top providers, with Auto-Owners being the top pick.

How can I find the best insurance rates for my Mercedes-Benz GLC 300?

Compare quotes from multiple insurance companies to find the best rates.

Does the age of my Mercedes-Benz GLC 300 affect insurance rates?

Yes, older models generally cost less to insure. Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Can my driving record impact my Mercedes-Benz GLC 300 insurance rates?

Yes, a clean driving record can lower your insurance rates, while violations can increase them. Check out our guide “Why You Should Take a Defensive Driving Class.”

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.