Best Pay-As-You-Go Auto Insurance in Nevada (Top 10 Companies Ranked for 2026)

With average rates starting at $55 per month, Nationwide, Allstate, and Liberty Mutual have the best pay-as-you-go auto insurance in Nevada. Nationwide and Allstate offer pay-per-mile plans that charge by the mile, while Liberty Mutual offers a UBI program that can help low-mileage drivers save.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated March 2025

3,071 reviews

3,071 reviewsCompany Facts

PAYG Full Coverage in Nevada

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 11,640 reviews

11,640 reviewsCompany Facts

PAYG Full Coverage in Nevada

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviews 3,792 reviews

3,792 reviewsCompany Facts

PAYG Full Coverage in Nevada

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviewsThe best pay-as-you-go auto insurance in Nevada is from Nationwide, Allstate and Liberty Mutual with rates starting as low as $130 per month. PAYG insurance saves low-mileage drivers money with a base rate plus a per-mile fee.

SmartMiles, Milewise, and RightTrack offer PAYG plans, rewarding mileage and safety. Geico, Root, and Progressive offer PAYG plans with different discounts and tracking. The best policy depends on your driving habits, base rate, and discounts.

Enter your ZIP code to compare the best Nevada auto insurance companies and find the most affordable coverage for your driving needs.

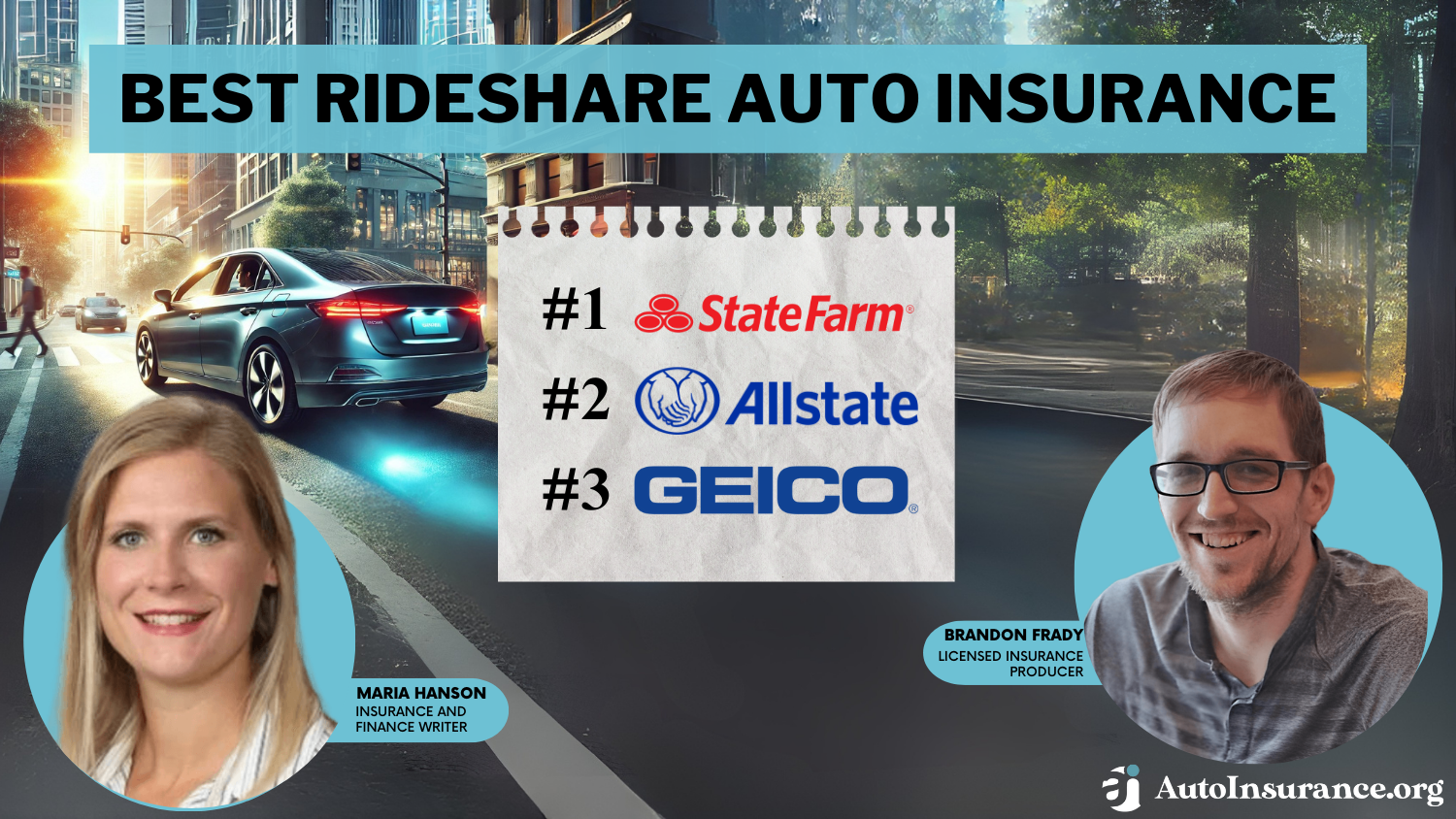

Our Top 10 Company Picks: Best Pay-As-You-Go Auto Insurance in Nevada

| Company | Rank | UBI Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 40% | A+ | Widespread Availability | Nationwide |

| #2 | 40% | A+ | Infrequent Drivers | Allstate | |

| #3 | 30% | A | Customizable Policies | Liberty Mutual |

| #4 | 25% | A++ | Cheap Rates | Geico | |

| #5 | 30% | N/A | Roadside Assistance | Root |

| #6 | 30% | A++ | Military Savings | USAA | |

| #7 | 30% | B | Personalized Service | State Farm | |

| #8 | 30% | A+ | Digital Tools | Progressive | |

| #9 | 30% | A++ | Customer Service | Travelers | |

| #10 | 30% | A | Loyalty Discounts | American Family |

Comparing Nevada cheap car insurance options and reviewing the top insurance companies in Nevada can help you find the best coverage at the lowest rates.

- Nationwide and Allstate offer the best PAYG auto insurance in Nevada

- Few insurers offer true PAYG auto insurance in Nevada

- Low-mileage drivers can take advantage of UBI programs for big savings

Keep reading to discover the best pay-as-you-go (PAYG) auto insurance companies in Nevada, how they work, and which providers offer the most competitive rates and benefits.

#1 – Nationwide: Top Overall Pick

Pros

- SmartMiles: Nationwide’s SmartMiles program offers a flexible pay-per-mile auto insurance plan, making it ideal for low-mileage drivers in Nevada who want to control their costs.

- Low-Mileage Discounts: Low-mileage drivers may be able to earn additional auto insurance discounts in Nevada. Explore more discount opportunities in our Nationwide auto insurance review.

- SmartRide: Earn an auto insurance discount of up to 40% in Nevada by enrolling in the usage-based insurance (UBI) program SmartRide, which offers lower rates for low-mileage drivers.

Cons

- High Base Rate: The fixed base auto insurance rate Nationwide uses in SmartMiles might be high for some Nevada drivers, making it less attractive for very low-mileage users.

- Limited Customization: Nationwide offers fewer customization options for low-mileage auto insurance. You’ll find NV pay-as-you-go auto insurance policies with more choices elsewhere.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best UBI Discounts in Nevada

Pros

- Milewise: Allstate’s Milewise program allows NE drivers to pay based on their actual mileage, making it a great option for those with infrequent driving habits. Learn more in our Allstate Milewise review.

- Drivewise: Drivers who don’t want to sign up for Milewise should consider the UBI program Drivewise, which lowers PAYG insurance rates by up to 40%. See how in our Allstate Drivewise review.

- Safe Driving Discounts: Allstate offers additional auto insurance discounts to Nevada drivers for safe driving behaviors, which apply to pay-as-you-go policies.

Cons

- High Daily Rate: Allstate is usually an expensive auto insurance option, and its daily base rate for Milewise is no exception, making it a pricy pay-as-you-go choice for some Nevada users.

- Mileage Reporting: Some Nevada drivers report errors in mileage tracking on their pay-as-you-go plans, which can lead to billing issues on auto insurance policies.

#3 – Liberty Mutual: Best for Diverse PAYG Options in Nevada

Pros

- RightTrack: Save up to 30% on your auto insurance in Nevada by enrolling in RightTrack UBI. While it’s not a pay-per-mile program, RightTrack offers a low-mileage auto insurance discount.

- Custom Coverage Options: You can customize your policy to get the best Nevada pay-as-you-go auto insurance policy. Learn more in our Liberty Mutual auto insurance review.

- Ample Discounts: Liberty Mutual offers a variety of discounts in Nevada, including many that can help you find the cheapest pay-as-you-go auto insurance policy.

Cons

- Telematics Requirement: If you want a pay-as-you-go auto insurance policy from Liberty Mutual in Nevada, you’ll need to install a tracking device, which might raise privacy concerns.

- Customer Service Issues: Although Liberty Mutual offers some of the best pay-as-you-go auto insurance in Nevada, it gets mixed reviews for its customer service responsiveness.

#4 – Geico: Best for Affordable PAYG Rates in Nevada

Pros

- Competitive Pricing: Geico generally offers affordable rates, whether you want the best pay-as-you-go car insurance in Nevada or a standard policy.

- DriveEasy UBI: Nevada drivers can save up to 25% on their auto insurance by signing up for DriveEasy. Learn how in our Geico DriveEasy review.

- 24/7 Customer Support: Geico earns its spot as one of the best pay-per-mile companies in Nevada by offering round-the-clock assistance for auto insurance policyholders.

Cons

- Fewer Add-On Options: Although Geico is one of the largest companies in America, many Nevada drivers looking for pay-as-you-go auto insurance are surprised by Geico’s lack of coverage options.

- Lower Customer Satisfaction: Many Geico customers in Nevada report feeling unsatisfied with the customer service they received on their pay-as-you-go auto insurance policies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Root: Best Roadside Assistance in Nevada

Pros

- Behavior-Based Pricing: Root’s insurance model is entirely based on driving behavior, making it an attractive option for safe drivers in Nevada looking for a true pay-as-you-go policy.

- No Traditional Underwriting: Root bases NV pay-as-you-go auto insurance reviews on driving behavior, so age and credit score don’t matter. Read our Root insurance review for more about the underwriting process.

- Free Roadside Assistance: Every Root pay-as-you-go auto insurance policy in Nevada comes with free roadside assistance.

Cons

- Strict Eligibility Requirements: Since Root bases pay-as-you-go auto insurance rates on driving behaviors, Nevada drivers with less-than-perfect driving records may not qualify for coverage.

- Coverage Limitations: Root focuses on cheap pay-as-you-go auto insurance in Nevada. To keep rates low, it offers fewer coverage options compared to traditional insurers.

#6 – USAA: Best for Military Drivers in Nevada

Pros

- Military Discounts: USAA provides exclusive pay-as-you-go auto insurance discounts for military members and their families in Nevada.

- Comprehensive Coverage: USAA sets itself as one of the best pay-per-mile auto insurance companies in Nevada by offering extensive coverage options tailored to military members.

- SafePilot: While USAA doesn’t currently offer Nevada pay-as-you-go auto insurance, the UBI program SafePilot can save low-mileage drivers up to 30%.

Cons

- Eligibility Restrictions: USAA pay-as-you-go insurance is only available to Nevada military members, veterans, and their families. Check your eligibility in our USAA auto insurance review.

- Limited Availability: It may be an affordable option, but you’ll need to check if USAA’s pay-as-you-go option in Nevada is available in your area.

#7 – State Farm: Best for Personalized Service in Nevada

Pros

- Drive Safe & Save Program: State Farm Drive Safe & Save allows NE drivers looking for pay-per-mile discounts to pay for insurance based on their actual driving habits, ideal for low-mileage drivers.

- Customizable Coverage: Nevada drivers can tailor PAYG policies to fit individual driving habits and needs with State Farm’s car insurance add-on options. See how in our State Farm review.

- Local Agents: State Farm maintains a strong network of local agents throughout Nevada for personalized service on all pay-as-you-go auto insurance policies.

Cons

- Tracking Device Required: State Farm’s pay-per-mile auto insurance in Nevada requires the installation of a telematics device, which might be seen as intrusive.

- Premium Variability: Drive Safe & Save looks at more than just your mileage, making costs unpredictable for this pay-as-you-go auto insurance option in Nevada.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Progressive: Best Innovative Digital Tools in Nevada

Pros

- Snapshot Program: Nevada drivers looking for cheap pay-as-you-go auto insurance can save up to 30% with the Snapshot UBI program. Compare savings in our Progressive Snapshot review.

- Discount Potential: Progressive offers significant PAYG discounts in Nevada for various things, like maintaining good driving behavior and being a loyal customer.

- Innovative Online Tools: Progressive offers robust online resources, making it easy for Nevada drivers to find the right pay-as-you-go coverage. Explore the digital tools in our Progressive Insurance review.

Cons

- Unexpected Rate Increases: Some Nevada drivers report unexpected rate increases on both standard and pay-as-you-go auto insurance policies.

- Customer Loyalty Issues: Progressive struggles to retain its customers despite being an excellent pay-as-you-go auto insurance company in Nevada.

#9 – Travelers: Best Customer Service Experience in Nevada

Pros

- IntelliDrive: Although it’s not a true NV pay-as-you-go insurance plan, Travelers’ IntelliDrive rewards drivers with discounts up to 30%. See the full discount list in our Travelers IntelliDrive review.

- Discount Savings: Drivers looking for affordable pay-per-mile auto insurance rates in Nevada will find multiple discounts from Travelers, including ones for low-mileage driving and multi-policy bundling.

- Superior Customer Service: Travelers generally gets positive reviews in Nevada for both pay-as-you-go and standard car insurance customer service.

Cons

- Higher Average Rates: Travelers isn’t the most expensive pay-as-you-go auto insurance choice in Nevada, but it’s also not the cheapest Nevada auto insurance. Compare free quotes in our Travelers auto insurance review.

- Limited Agents: Nevada drivers who want easy access to personalized help on their pay-as-you-go auto insurance will likely struggle to find a local Travelers agent.

#10 – American Family: Best Loyalty Discounts in Nevada

Pros

- KnowYourDrive Program: The KnowYourDrive program is the closest thing American Family offers to pay-as-you-go car insurance in Nevada. Drivers can save up to 20%.

- Generous Discounts: American Family offers 18 discounts, including loyalty discounts, for cheaper pay-per-mile car insurance in Nevada. See all discount options in our AmFam insurance review.

- Costco Policies: American Family underwrites auto insurance policies for Costco. Nevada drivers who are Costco members can get cheap insurance in Nevada.

Cons

- Fewer Policy Add-Ons: American Family offers fewer auto insurance add-ons for pay-as-you-go policies in Nevada.

- Limited State Availability: KnowYourDrive offers pay-as-you-go auto insurance in Nevada, but AmFam doesn’t sell insurance in every state. If you leave Nevada, you may need to find a new insurer.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Nevada Pay-As-You-Go Auto Insurance Rates

Whether you buy a PAYG auto insurance policy or enroll in a UBI program, you’ll find average Nevada rates below.

Nevada Pay-As-You-Go Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $60 | $135 | |

| $56 | $133 | |

| $50 | $126 | |

| $58 | $140 |

| $55 | $130 |

| $57 | $134 | |

| $45 | $120 | |

| $52 | $125 | |

| $59 | $137 | |

| $53 | $128 |

While there are many factors that affect auto insurance rates, the most important in pay-as-you-go insurance is how many miles you drive. For instance, check out the table below for a list of the five most common car insurance claims in Nevada and how they affect your rates.

5 Most Common Auto Insurance Claims in Nevada

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Rear-End Collision | 30% | $3,500 |

| Fender Bender | 20% | $1,800 |

| Single Vehicle Accident | 15% | $4,200 |

| Side-Impact Collision | 10% | $6,000 |

| Theft Claim | 5% | $9,000 |

So, it’s critical to compare rates from the best auto insurance companies in Nevada to find the right policy for you.

While pay-per-mile plans offer significant savings over traditional policies for low-mileage drivers, there are pitfalls to be aware of. For example, what happens if you want to go on a road trip?

Many PAYG companies cap the amount of miles you’ll be charged for in a single day, but you should research your options before you buy a policy.

How Nevada Pay-As-You-Go Auto Insurance Works

Traditional policies have a flat rate you pay every month (or every six months if you want a pay-in-full auto insurance discount). Your rates might change when your policy renews every six months, but your insurance company will consider the same factors every time for your policy.

Insurers use age, location, gender, driving record, credit score, and vehicle type to set rates.Ty Stewart Licensed Insurance Agent

On the other hand, pay-as-you-go auto insurance is a great way to get cheap auto insurance for infrequent drivers in Nevada, but these plans can be confusing.

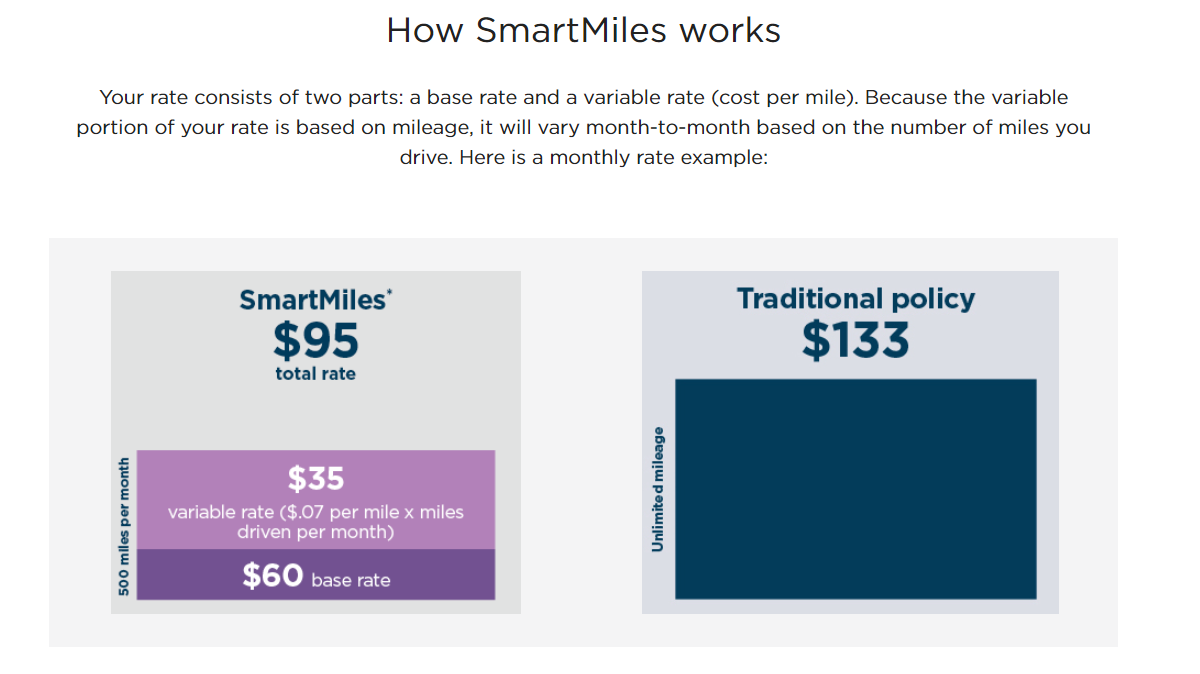

Pay-as-you-go rates have two parts. The first is a flat fee you pay every month, no matter how many miles you drive. The second is a per-mile rate, typically just a few cents.

For example, if your base rate is $37 and the per-mile fee is $0.05, you’ll pay $59.50 if you drive 450 miles in a month. As you can see, there can be significant savings for low-mileage drivers who choose a pay-as-you-go auto insurance plan.

Nevada Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risks | A | Minimal weather impacts, rare severe events |

| Traffic Density | B+ | Congestion in Las Vegas, but rural areas help |

| Average Claim Size | B- | Larger claims due to expensive repairs |

| Vehicle Theft Rate | C | Higher-than-average theft rate in urban areas |

| Uninsured Drivers Rate | D | High rate of uninsured drivers, raising premiums |

However, you’ll still pay a base rate with Nevada PAYG insurance, with the factors above impacting that cost. So, it’s always compare pay-as-you-go auto insurance quotes for your usage-based coverage in NV for the best deal.

How to Save on Pay-As-You-Go Auto Insurance in Nevada

The main way to keep your rates down when you buy a Nevada PAYG policy is to limit your daily miles. However, there are other ways to save on your insurance. One of the easiest ways to find the cheapest car insurance company in Nevada is to find discounts.

In addition, another great tip to find affordable coverage is to compare rates. If you don’t compare rates and instead pick the first company you look at, you’ll probably overpay for your insurance.

Luckily, comparing auto insurance quotes in Nevada is easier than ever. Simply visit a company’s website and fill out their quote request form. It only takes about 10 minutes and some personal information to get a personalized quote.

If you don’t want to spend the time filling out multiple quote request forms, you can use a quote-generating tool to see a variety of quotes from local providers at once.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Best Pay-As-You-Go Auto Insurance in Nevada Today

Whether you find a low-mileage auto insurance discount or enroll in a pay-as-you-go auto insurance policy, there are plenty of ways to find affordable coverage in Nevada as a low-mileage driver. Picking the right option for you takes a little research, but the potential for savings makes it worthwhile.

Now that you have an idea of which company might have the best pay-as-you-go auto insurance, enter your ZIP code into our free comparison tool below to find the best Nevada rates.

Frequently Asked Questions

How does pay-as-you-go auto insurance work in Nevada?

Pay-as-you-go or pay-per-mile auto insurance charges drivers by the mile rather than a flat monthly fee. It’s different than low-mileage auto insurance discounts, which offer a discount on a traditional policy to low-mileage drivers.

How much does auto insurance cost in Nevada?

Auto insurance in Nevada tends to be affordable for most drivers. Low-mileage drivers can expect to pay an average of $54 per month for minimum insurance and $130 per month for full coverage.

Is Progressive in Nevada?

Yes, Progressive is available in Nevada and is one of the best auto insurance Nevada providers.

Who has the cheapest Nevada PAYG auto insurance?

What’s the cheapest car insurance to go with? The cheapest insurance in Nevada varies by driver profile. State Farm and Geico often provide cheap Nevada auto insurance options. The cheapest pay-per-mile insurance company in Nevada depends on the types of auto insurance coverage you need, but Root is usually the cheapest auto insurance in Nevada.

Is Root available in Nevada?

Yes, Root is one of the car insurance companies in Nevada. While it’s an excellent option for low-mileage car insurance, you should make sure to compare rates with other companies. Enter your ZIP code into our free comparison tool to compare Root rates with other affordable PAYG options.

How does Root auto insurance work in Nevada?

Root insurance policies work similarly to other pay-as-you-go options in Nevada, except for how rates are determined. You’ll go through a testing period where Root monitors your behavior. If you don’t drive safely enough, Root will reject your insurance application.

Is Root pay-as-you-go auto insurance cheaper than Allstate in Nevada?

Typically speaking, Root is a more affordable insurance option. However, Allstate’s pay-per-mile option, Milewise, has coverage options that Root doesn’t offer. Check out our Allstate Milewise review to see if Allstate is a better choice for you.

What is the minimum car insurance cost?

The cheapest Nevada car insurance for minimum coverage starts around $40–$50 per month, depending on factors like age and location.

Is AAA available in Nevada?

Yes, AAA offers cheap Nevada insurance, roadside assistance, and coverage throughout the state.

Is Progressive pay-as-you-go auto insurance cheaper than Geico in Nevada?

Geico’s average rates in Nevada are a little lower than Progressive’s. However, Progressive’s maximum discount with Snapshot is a little better than Geico’s DriveEasy, so safe drivers might find lower rates with Progressive. When it comes to low-mileage car insurance, annual mileage affects car insurance rates differently, so it’s always best to compare personalized quotes.

Who is cheaper, Geico or Progressive?

Is Allstate a good insurance company?

Can you drive without auto insurance in Nevada?

Which insurance provider is the cheapest?

Is Progressive Insurance good?

What is the minimum auto insurance coverage in Nevada?

Should you get more coverage than the minimum NV insurance requirement?

Who has the best auto insurance rates in Nevada?

What is the best insurance bundle in Nevada?

How much is car insurance per month in Nevada?

Why is Nevada car insurance so expensive?

Who offers the best auto insurance coverage?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.