Cheap Fiat Auto Insurance in 2026 (Save With These 10 Companies)

AAA, State Farm, and Travelers are our top picks for cheap Fiat auto insurance. AAA has the lowest Fiat car insurance rates on average, with minimum coverage averaging just $32/mo at AAA. State Farm and Travelers also have affordable rates, with multiple auto insurance discounts for Fiat owners.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated March 2025

3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage for Fiat

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage for Fiat

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage for Fiat

A.M. Best

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviewsAAA, State Farm, and Travelers are our top picks for cheap Fiat auto insurance, with AAA ranking number one for the cheapest Fiat car insurance.

There are many factors that affect auto insurance rates for your Fiat, like the chosen model, coverages, and your driving record, but choosing a cheap Fiat insurance company can help.

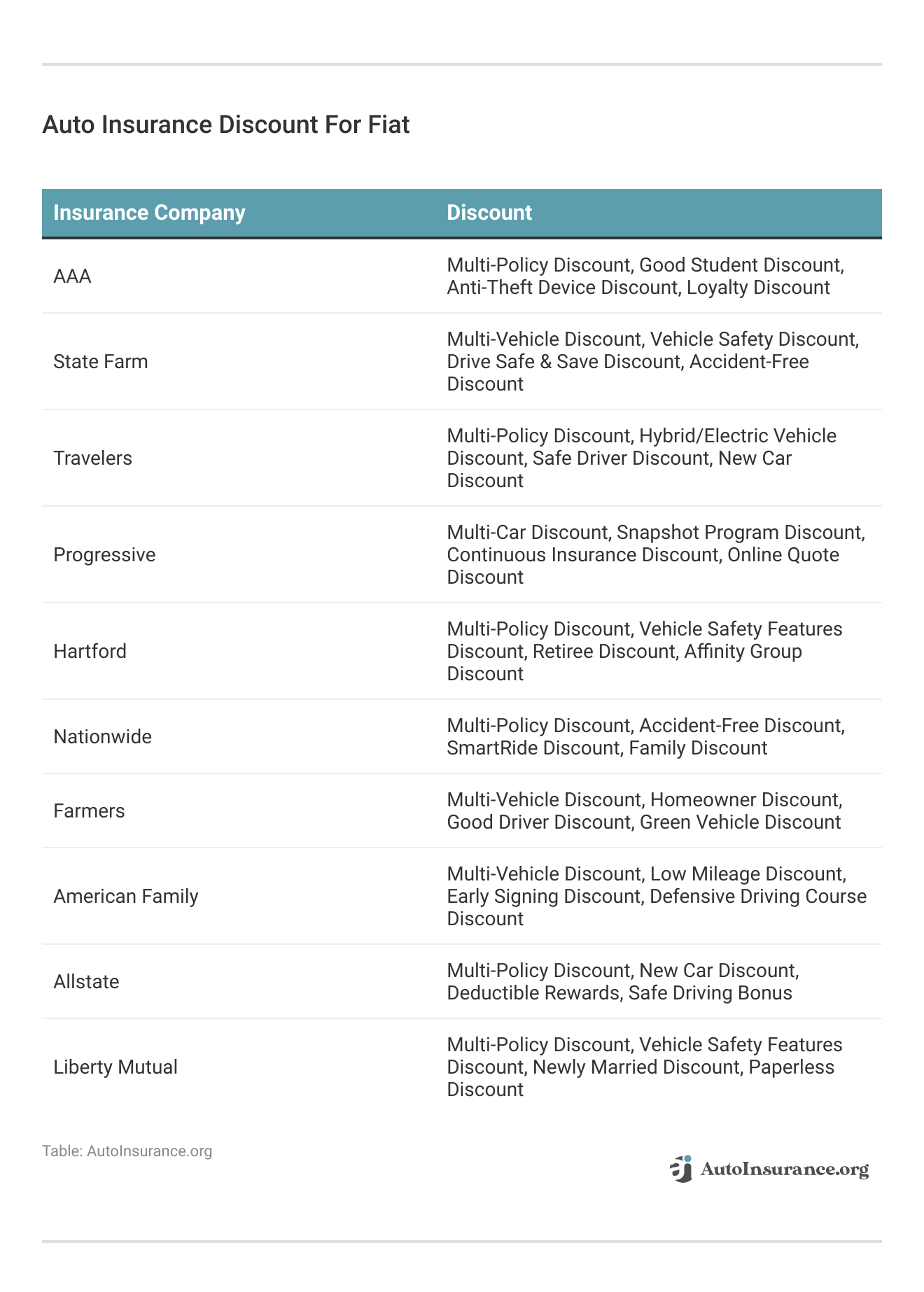

Our Top 10 Company Picks: Cheap Fiat Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $32 | A | Roadside Assistance | AAA |

| #2 | $33 | B | Multi-Policy Discount | State Farm | |

| #3 | $37 | A++ | Policy Options | Travelers | |

| #4 | $39 | A+ | Usage Discount | Progressive | |

| #5 | $43 | A+ | Add-on Coverages | The Hartford |

| #6 | $44 | A+ | Accident Forgiveness | Nationwide |

| #7 | $53 | A | Customizable Coverage | Farmers | |

| #8 | $44 | A | Customer Service | American Family | |

| #9 | $61 | A+ | Hybrid-Vehicle Discount | Allstate | |

| #10 | $68 | A | 24/7 Support | Liberty Mutual |

To give you a complete picture of Fiat car insurance, we’ll discuss coverage options, the average cost by model year, and much more. Continue reading to learn all about Fiat auto insurance or compare rates now using our free tool.

- Fiat auto insurance averages $137 monthly for full coverage

- Fiat insurance rates vary by model, age, driving record, and more

- Getet affordable Fiat quotes by keeping a clean driving record

#1 – AAA: Top Pick Overall

Pros

- Roadside Assistance: AAA is well-known for its roadside assistance program, which you can read more about in our review of AAA.

- Shopping and Travel Discounts: AAA members can get discounts on more than just auto insurance.

- Multiple Discounts: AAA’s selection of discounts can help make Fiat auto insurance more affordable.

Cons

- Additional Membership Fee: You must join AAA as a member and pay a small fee before buying auto insurance.

- Various Clubs Sell AAA: If you have to move, customer service and coverages may vary, as different clubs sell AAA auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Multi-Policy Discount

Pros

- Multi-Policy Discount: State Farm offers a large discount if you purchase more than one type of insurance.

- Local Agent Availability: State Farm has a huge network of local agents. Learn more about State Farm’s agents in our State Farm review.

- Coverage Options: State Farm offers plenty of options for Fiat owners.

Cons

- Agent Purchases: While you can get a quote online, you must complete your purchase with an agent.

- UBI Discount Availability: State Farm doesn’t offer its UBI discount in a few states.

#3 – Travelers: Best for Policy Options

Pros

- Policy Options: Travelers offers policies for home insurance, renters insurance, car insurance, and many more.

- Financial Strength: Travelers has high ratings for financial management. Learn more about Traveler’s financial ratings in our review of Travelers.

- Coverage Options: Travelers offers gap insurance, roadside assistance, and more.

Cons

- Availability: You won’t be able to purchase Travelers’ insurance in a few states.

- Customer Ratings: Some customer reviews are negative.

#4 – Progressive: Best for Usage Discount

Pros

- Usage Discount: Drivers who drive safely and drive fewer miles on average can earn a discount.

- Budgeting Tool: Progressive offers a free tool that helps drivers see how much coverage they can afford.

- Coverage Options: Fiat owners can choose among a variety of add-ons, which you can learn more about in our review of Progressive.

Cons

- UBI Rate Increases: Unsafe drivers participating in Progressive’s UBI program may see rate increases.

- Customer Reviews: Progressive has average customer satisfaction ratings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – The Hartford: Best for Add-On Coverages

Pros

- Add-On Coverages: The Hartford has great add-ons for policies. Learn more in our review of The Hartford.

- Accident Forgiveness: The Hartford won’t raise rates after qualifying drivers first at-fault accident.

- UBI Program: Safe drivers can participate in The Hartford’s UBI program to earn a discount.

Cons

- Customer Ratings: The Hartford has some negative customer reviews regarding customer service.

- Best for Drivers Over 50: The Hartford’s rates for younger drivers aren’t as competitive.

#6 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Nationwide’s accident forgiveness helps safe drivers avoid rate increases.

- Vanishing Deductible: Safe drivers will also benefit from Nationwide’s vanishing deductibles.

- UBI Program: Nationwide rewards participants who do well in the program with a significant discount.

Cons

- Availability: A few states don’t have Nationwide insurance.

- High-Risk Drivers’ Rates Above Average: DUI drivers and young drivers can be expensive. Find out more about rates in our review of Nationwide auto insurance.

#7 – Farmers: Best for Customizable Coverage

Pros

- Customizable Coverage: Customers can customize their policies with Farmers’ coverage options. Read about coverage in our Farmers review.

- Accident Forgiveness: Safe drivers won’t see rate increases after their first at-fault accident.

- Financial Stability: Farmers has good ratings for financial stability.

Cons

- No Gap Insurance: Owners of new Fiats won’t be able to get gap coverage at Farmers.

- UBI Availability: Farmer’s UBI discount is not available in five states.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Customer Service

Pros

- Customer Service: American Family’s customer service is great due to the availability of local agents. Read more about it in our American Family review.

- Multiple Discounts: American Family offers loyalty discounts and more.

- Coverage Options: American Family has gap insurance and many more.

Cons

- Availability: American Family is not available across the U.S.

- Rate Competitivity: American Family’s rates for high-risk drivers may not be as affordable.

#9 – Allstate: Best for Hybrid-Vehicle Discount

Pros

- Hybrid-Vehicle Discount: Allstate offers a discount for green vehicles. Learn about Allstate’s other discounts in our review of Allstate.

- Coverage Options: Allstate has rideshare insurance, accident forgiveness, and more.

- Bundling Discount: Allstate offers a large bundling discount if customers purchase more than one type of insurance from Allstate.

Cons

- High-Risk Driver Rates: Drivers with DUIs and young drivers will have higher rates at Allstate.

- UBI Availability: Allstate’s UBI program is unavailable in a few states.

#10 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Support: Liberty Mutual offers 24/7 support to policy holders. Learn more in our Liberty Mutual auto insurance review.

- Coverage Options: Liberty Mutual has roadside assistance, rental car reimbursement, and more.

- Discount Options: Liberty Mutual has bundling discounts, multi-car discounts, and more.

Cons

- Mixed Reviews: Customers gave Liberty Mutual some negative reviews.

- UBI Availability: Liberty Mutual’s UBI program is unavailable in some states.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Average Fiat Auto Insurance Rates

What you pay for Fiat auto insurance depends partly on the model you have and the coverages you choose, as you can see from the average rates below:

Fiat Auto Insurance Monthly Rates by Model and Coverage Level

| Vehicle Model | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2023 Fiat 500X | $25 | $49 | $47 | $139 |

| 2023 Fiat 500L | $25 | $47 | $47 | $136 |

| 2023 Fiat 500 | $24 | $47 | $47 | $135 |

The Fiat 500X costs slightly more on average to insure than the other models, but the average rates for the different Fiat models are fairly similar. Fiat 500 car insurance costs are the cheapest of all models, but only by a few dollars. So you won’t see a huge range in average rates for insurance for a Fiat 500.

Of course, you’ll see a large rate difference if you have a poor driving record or are a young driver, as the insurance company will see you as a higher risk to insure.

Below, you can see Fiat’s average auto insurance rates by age and driving record:

Fiat Auto Insurance Monthly Rates by Model, Age, and Driving Record

| Vehicle Model | High-Risk Driver | 20-Year-Old Driver | 30-Year-Old Driver | 40-Year-Old Driver | 50-Year-Old Driver | 60-Year-Old Driver |

|---|---|---|---|---|---|---|

| 2023 Fiat 500X | $296 | $309 | $142 | $136 | $124 | $122 |

| 2023 Fiat 500L | $290 | $306 | $141 | $135 | $123 | $121 |

| 2023 Fiat 500 | $288 | $475 | $219 | $210 | $191 | $187 |

As you can see, auto insurance for teens is expensive due to factors like driving inexperience and a higher likelihood of filing claims. In addition, you’ll pay higher Fiat car insurance rates if you need high-risk auto insurance.

While you can’t do anything about your age, showing you’re a safe driver by not getting any at-fault accidents, traffic tickets, or DUIs on your record will ensure your Fiat insurance rates go down each year.

Fiat Auto Insurance Coverage Types

Wondering what type of auto insurance you should carry on your Fiat? You must carry your state’s minimum auto insurance requirements, and you can choose from optional Fiat auto insurance coverages to complete your policy. One type of Fiat insurance coverage that most states require is liability auto insurance.

Fiat Auto Insurance Monthly Rates by Coverage Level

Insurance Company Minimum Coverage Full Coverage

$32 $86

$61 $160

$44 $117

$53 $139

$43 $113

$68 $174

$44 $115

$39 $105

$33 $86

$37 $99

Liability insurance protects your Fiat if you cause an accident by paying for the other parties’ medical bills and property damage bills. Most states’ required liability insurance limits are low, so if you can afford a higher limit on your Fiat liability insurance, you should get a higher amount on your Fiat insurance policy to protect yourself from paying out of pocket or getting sued if you cause a serious accident.

In addition to liability insurance, your state may require you to carry medical coverage, such as medical payments or personal injury protection (PIP) auto insurance, to help pay your and your passenger’s medical bills after an accident. Find out which companies offer cheap PIP auto insurance.

Your state may also require you to carry uninsured/underinsured motorist auto insurance to help pay your accident bills if the driver who crashes into you has little or no insurance.

Once you meet state requirements, you can choose any other coverages you want on your policy unless you have a lease or loan on your Fiat from your Fiat dealer. Then, your lender will require you to carry comprehensive and collision insurance, also known as full coverage auto insurance. You may also wish to carry Fiat gap insurance if you have a lease or loan.

Even if full coverage Fiat car insurance coverages are optional, I recommend carrying full coverage unless your used Fiat is very old and no longer worth much.Daniel Walker Licensed Insurance Agent

Comprehensive and collision insurance pay for your car repairs, whereas liability insurance only covers other drivers when you cause an accident. Comprehensive auto insurance covers crashes with animals and damages from vandalism, falling objects, and weather. Collision auto insurance covers crashes with other cars and objects like trees.

Ways to Get Cheap Fiat Auto Insurance Quotes

You can follow a few tips if your Fiat car insurance price is higher than you’d like. The first thing is to shop around and get Fiat insurance quotes, as a company may offer a better Fiat insurance rate than your current one. Find out how to ask an auto insurance company for quotes.

Another way to get an affordable Fiat auto insurance policy is to purchase an older Fiat model. Fiat insurance cost by model year varies. For example, while the overall average auto insurance rates for a new Fiat is $137 monthly, you’ll only pay around $106 to insure a 2013 Fiat 500.

If you’ve already shopped around and are with a cheaper auto insurance company, you should see if there are any auto insurance discounts available at the company. For example, some companies offer defensive driver auto insurance discounts if you complete a defensive driver class. Some may also have a safe driver discount for Fiat drivers who participate in its safe driving program.

If no more discounts are available for your auto insurance policy, you can go other routes, such as raising your auto insurance deductible, to get cheap Fiat car insurance rates. However, since raising your deductible means taking on more financial responsibility after an accident, don’t raise it beyond an amount you can’t afford to pay out of pocket.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding Fiat Auto Insurance Savings

Average Fiat auto insurance rates are cheap, with no significant price increases between Fiat models. However, rates will be higher for young Fiat owners or drivers with poor driving records. If your Fiat insurance rates are high, look for car insurance discounts on and compare auto insurance rates to get cheap car insurance for Fiat 500s and other models.

Enter your ZIP code into our free quote comparison tool to find cheap Fiat auto insurance quotes from the best companies.

Frequently Asked Questions

Are Fiats expensive to insure?

No, Fiat car insurance is relatively affordable compared to other cars on the market. A full coverage Fiat auto insurance policy costs around $137 monthly, though rates vary based on a driver’s demographics and driving record.

Where is the cheapest place to buy Fiat auto insurance coverage?

You’ll have to get Fiat auto insurance quotes to find the cheapest company for you. Companies that usually have cheaper-than-average rates include USAA, State Farm, and Geico. However, USAA is strictly for military members, veterans, and their families. Read our USAA auto insurance review for more information.

Can I get discounts on Fiat auto insurance?

Many insurance providers offer discounts for Fiat Auto Insurance. Common discounts may include safe driving discounts, multi-car discounts, bundling discounts (if you have other policies with the same insurance company), and discounts for certain safety features on your Fiat vehicle.

How much is insurance on a Fiat 500 Sport?

Fiat 500 auto insurance costs $135 monthly on average, though your rates vary based on factors like age, gender, and driving record.

What should I do if I need to make a Fiat insurance claim?

Contact your insurance company if you get in an accident or covered incident with your Fiat to file a claim. Your insurer will guide you through how to file an auto insurance claim and provide you with the necessary information and forms to complete.

What kind of car is a Fiat?

It depends on what model of Fiat you purchase. Fiat offers sports cars, compact cars, and more.

Who makes Fiat?

Fiat cars are made by Fiat Chrysler Automobiles (FCA), which has locations in Italy, the U.S., and other countries.

How much does a Fiat cost?

It depends on what model you purchase, but a new Fiat 500 is often over $30,000, which will make Fiat 500 insurance rates about average for most drivers. You can find the best Fiat car insurance quote by trying our comparison tool.

Is Fiat reliable?

Fiat is about average for reliability due to Fiat issues with breakdowns and crash reliability, so other cars on the market rank better in terms of reliability.

Are Fiats good cars?

Fiats are average cars. A few other brands are more reliable and test better than Fiats when you compare auto insurance rates by vehicle make and model.

How many miles does a Fiat last?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.