Best Auto Insurance for Hybrid Vehicles in 2026 (Your Guide to the Top 10 Companies)

Geico, Progressive, and State Farm have the best auto insurance for hybrid vehicles. The average hybrid car insurance costs 17% more than gas vehicles, but Geico has rates as low as $75/mo. Progressive budgeting tools also help drivers get cheaper insurance on hybrid cars.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Benjamin Carr

Updated July 2025

Company Facts

Full Coverage for Hybrid Vehicles

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Hybrid Vehicles

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Hybrid Vehicles

A.M. Best

Complaint Level

Pros & Cons

The best auto insurance for hybrid vehicles can be found with Geico, Progressive, and State Farm. Geico gives 25% discounts for driving a hybrid car, plus an additional 5% if you add comprehensive or full coverage.

Other great companies for hybrid vehicle insurance that offer green vehicle auto insurance discounts are below.

Our Top 10 Company Picks: Best Auto Insurance for Hybrid Vehicles

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 25% A++ Competitive Rates Geico

#2 12% A+ Flexible Coverage Progressive

![]()

#3 20% A++ Reliable Service State Farm

#4 25% A+ Strong Reputation Allstate

#5 20% A Hybrid Discounts Farmers

#6 25% A Customized Policies Liberty Mutual

#7 8% A++ Comprehensive Coverage Travelers

#8 25% A Membership Benefits AAA

#9 20% A+ Multi-Policy Discounts Nationwide

#10 10% A+ Personalized Service Erie

Is insurance cheaper for hybrid cars? No. Car insurance for hybrid cars is more expensive since hybrid and electric vehicles (EVs) are more expensive to repair.

Keep reading to get cheap hybrid car insurance and compare quotes with our free tool for the top hybrid vehicle auto insurance companies near you.

- Geico has the best insurance for hybrid cars at $150/mo

- State Farm and Allstate have the best customer service for hybrid drivers

- Farmers has the best hybrid car insurance discounts

#1 – Geico: Top Pick Overall

Pros

- Cheap Rates: Geico is usually cheaper than its competitors with coverage available in all 50 states. Compare rates by state in our Geico auto insurance review.

- Green Vehicle Discounts: Geico offers one of the biggest hybrid vehicle discounts, up to 25%, with an additional 5% if you add comprehensive coverage.

- Usage-Based Discounts: Geico DriveEasy is one of the top three UBI programs in the country. Learn how to sign up in our Geico DriveEasy review.

Cons

- Poor Claims Service: Geico ranks below average in annual J.D. Power surveys, and policyholders complain about long repair times.

- Expensive for High-Risk Drivers: Geico raises rates higher than its competitors for drivers with speeding tickets or DUIs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Flexible Coverage

Pros

- Budgeting Tools: Progressive’s free budgeting tool helps customers see how much coverage they can buy on their budget.

- Multi-Policy Discount: Drivers will earn a discount for purchasing home or renters insurance in addition to auto insurance.

- Online Convenience: Customers can file claims, make policy changes, and more on Progressive’s app or website.

Cons

- Customer Service: Progressive has just average J.D. Power ratings for customer satisfaction. Learn more in our Progressive review.

- UBI Increases Rates: Progressive’s UBI discount program can result in rate increases for poor drivers.

#3 – State Farm: Best for Customer Service

Pros

- Customer Service: State Farm’s customer service is highly rated, and you can learn more about it in our State Farm review.

- Multi-Car Discount: Owners of more than one hybrid vehicle will qualify for a discount at State Farm.

- Coverage Options: State Farm offers convenient add-ons like roadside assistance.

Cons

- Agent Purchases: Policies are purchased through an agent, not online.

- UBI Availability: State Farm’s discount for usage-based driving isn’t available in all states.

#4 – Allstate: Best Reputation

Pros

- Infrequent Drivers: Allstate offers lower rates to drivers who track fewer miles than the average.

- Hybrid Vehicle Discount: Allstate offers a hybrid vehicle discount, as well as several other auto insurance discounts.

- Coverage Options: Allstate offers full and minimum coverage options. Learn more in our review of Allstate.

Cons

- Rates: Allstate’s rates can be more expensive for high-risk drivers.

- UBI Availability: Allstate’s UBI discount isn’t available in all states.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best Hybrid Auto Insurance Discounts

Pros

- Safe-Driving Discounts: Driving safely while participating in the Farmers UBI program can result in a large discount.

- Local Agents: Farmers’ local agents can provide in-person assistance to most customers.

- Hybrid Vehicle Discounts: Farmers offers a hybrid vehicle discount. Learn more about Farmers’ discounts in our Farmers review.

Cons

- UBI Availability: Farmers’ UBI discounts are unavailable in a few states.

- Lacks Gap Coverage: Unfortunately, new hybrid vehicle owners can’t get gap coverage from Farmers.

#6 – Liberty Mutual: Best for Customized Coverage

Pros

- Add-On Coverages: Liberty Mutual’s selection of add-on coverages ranges from gap insurance to rental reimbursement insurance.

- Accident Forgiveness: Liberty Mutual offers accident forgiveness for some drivers.

- Discount Options: Liberty Mutual has bundling discounts, green vehicle discounts, and more.

Cons

- UBI Availability: Liberty Mutual doesn’t offer its UBI discount in all states.

- High-Risk Driver Rates: Liberty Mutual’s rates may be less affordable for DUI and young drivers. Learn more about rates in our Liberty Mutual review.

#7 – Travelers: Best for Comprehensive Coverage

Pros

- Bundling Policies: You can get a bundling discount if you buy more than one type of insurance at Travelers.

- Add-On Coverages: Travelers’ add-on coverages help round out a policy. Read more about its coverage options in our Travelers review.

- Accident Forgiveness: Traveler’s accident forgiveness policy can save safe drivers hundreds of dollars after an accident.

Cons

- High-Risk Rates: Drivers with poor driving records may want to look elsewhere for affordable insurance.

- Customer Service: Travelers has average ratings from J.D. Power for customer service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – AAA: Best Membership Benefits

Pros

- Roadside Assistance: AAA offers some of the best roadside assistance on the market. Learn more about its roadside assistance in our review of AAA.

- Hybrid Vehicle Discount: AAA offers a hybrid vehicle discount to qualifying vehicles.

- Coverage Options: Even though AAA is known for its roadside assistance, it also offers plenty of other coverages.

Cons

- Additional Membership Fee: To purchase auto insurance, you must be a member of AAA and pay an annual membership fee.

- Club Services Vary Across States: If you move, the new club may not offer the same rates, customer service, etc., that you are used to.

#9 – Nationwide: Best for Multi-Policy Discounts

Pros

- Usage-Based Coverage: Nationwide offers usage-based coverage and discounts, which you can read about in our Nationwide insurance review.

- Vanishing Deductibles: Each claims-free policy period will result in a lower deductible at Nationwide.

- Multi-Policy Discount: Nationwide offers a significant discount for bundling home or renters insurance with auto insurance.

Cons

- Availability: Nationwide insurance isn’t available for purchase in a few states.

- DUI Rates: Nationwide is more expensive for DUI drivers.

#10 – Erie: Best for Personalized Policies

Pros

- Personalized Policies: Customers can easily personalize policies with Erie’s coverage options. Learn more about it in our Erie auto insurance review.

- Rate Lock: Erie doesn’t raise rates unless there are policy changes.

- Agent Services: Erie’s agents can help customers with quotes, policy issues, filing claims, and more.

Cons

- Availability: Unfortunately, Erie insurance is not sold in many states.

- Limited Online Services: Erie’s app and website have limited services. For example, you can’t file a claim online with the app.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Hybrid Insurance Costs

Do hybrids cost more to insure? Yes, you will notice that hybrids and EVs have higher monthly rates than standard vehicles.

Fortunately, we found the best car insurance for hybrids with affordable rates from our top companies:

Auto Insurance Monthly Rates for Hybrid Vehicles by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $75 $150

Allstate $90 $173

Erie $85 $165

Farmers $95 $180

Geico $75 $150

Liberty Mutual $85 $165

Nationwide $90 $173

Progressive $85 $165

State Farm $80 $158

Travelers $80 $158

Is hybrid more expensive to insure? Yes, but Geico and AAA are the cheapest car insurance for hybrid cars at $150/mo. Compare Geico vs. AAA car insurance to see which is a better fit for your wallet.

Why Hybrid Vehicle Insurance Rates Cost More

Is hybrid car insurance cheaper or more expensive? Driving a hybrid can cost more to insure than a standard vehicle, and owners of hybrid vehicles may notice that their rates are higher than those of traditional gas vehicles.

Are hybrids more expensive to maintain? Yes, expensive maintenance and repairs are one of the factors that affect auto insurance rates for green vehicles. Where you live also has a huge impact on hybrid insurance rates. For example, hybrid car insurance costs in California will be higher than drivers in landlocked states like Iowa or Tennessee.

Scroll down to explore the most common reasons why hybrids are more expensive to insure.

Hybrid Drivers Clock More Distance

Do hybrids cost more to insure? Yes. Research shows that hybrid car drivers spend more time behind the wheel. Those miles you’re clocking have an impact on your auto insurance rates.

One of the reasons you have to turn in your mileage and model year to your agent is to show your driving profile. The more miles you clock, the more you’re at risk of getting into an accident.Dani Best Licensed Insurance Producer

Hybrid owners clock more miles mainly due to how little money comes from their pockets. It may cost a hybrid owner pocket change to drive to grandma’s house for Christmas instead of stressing over airfare.

Read More: How Annual Mileage Affects Your Auto Insurance Rates: What You Should Know (2024)

Repair Costs Are Substantial

Repairing a hybrid is not a simple task. It takes specialized mechanics to work on all the technology that runs a hybrid. This cost plays a large role in your auto insurance premiums.

The cheapest hybrid cars to insure will also be the cheapest to repair, like a Toyota or Honda model. Take a look at how insurance for hybrid cars varies based on the make and model:

Auto Insurance Monthly Rates for Popular Hybrid Vehicles

| Make & Model | Minimum Coverage | Full Coverage |

|---|---|---|

| Ford Fusion Hybrid | $85 | $198 |

| Honda Accord Hybrid | $88 | $205 |

| Honda CR-V Hybrid | $90 | $212 |

| Kia Sportage Hybrid | $87 | $208 |

| Lexus RX Hybrid | $102 | $260 |

| Toyota Camry Hybrid | $86 | $200 |

| Toyota Prius | $83 | $195 |

The cheapest hybrid to insure is the Toyota Prius. Luxury brands like Lexus will be more expensive, as will larger vehicles like the Honda CR-V or Kia Sportage.

Is insurance on a hybrid more expensive? Yes, because auto insurance companies are looking at the average cost to repair a hybrid in an accident. This might seem minor to some, but when you add that up over thousands of insured hybrids the costs get astronomical.

Even if you buy the cheapest hybrid car to insure, it is important to get quotes from multiple companies to find the best car insurance for hybrid vehicles near you.

Read More: Does auto insurance cover battery replacement?

Aftermarket Parts Are Hard to Find

Does insurance cost more for hybrid cars? Yes, because Auto insurance companies will have to recuperate that cost in some form, which does not lead to cheap auto insurance.

Hybrids are still relatively new. Scrap yards have yet to acquire large surpluses of parts to help mechanics in the repairs of these vehicles.

These repair bills are then turned in to auto insurance companies. These companies tend to frown when a headlight costs a few hundred instead of a few Lincolns.

It’s All About the Sales

Sales were not that huge when hybrids first started coming onto the market. Sales have rapidly increased over the past decade.

While this is a great indicator of how well hybrids are being received, it means the likelihood of having an auto insurance claim come in on a hybrid vehicle is much higher.

There are several cars out on the road that are better when compared to a hybrid car when it comes to miles per gallon. You may have to learn how to pump some diesel fuel instead though.

How to Save on Hybrid Auto Insurance

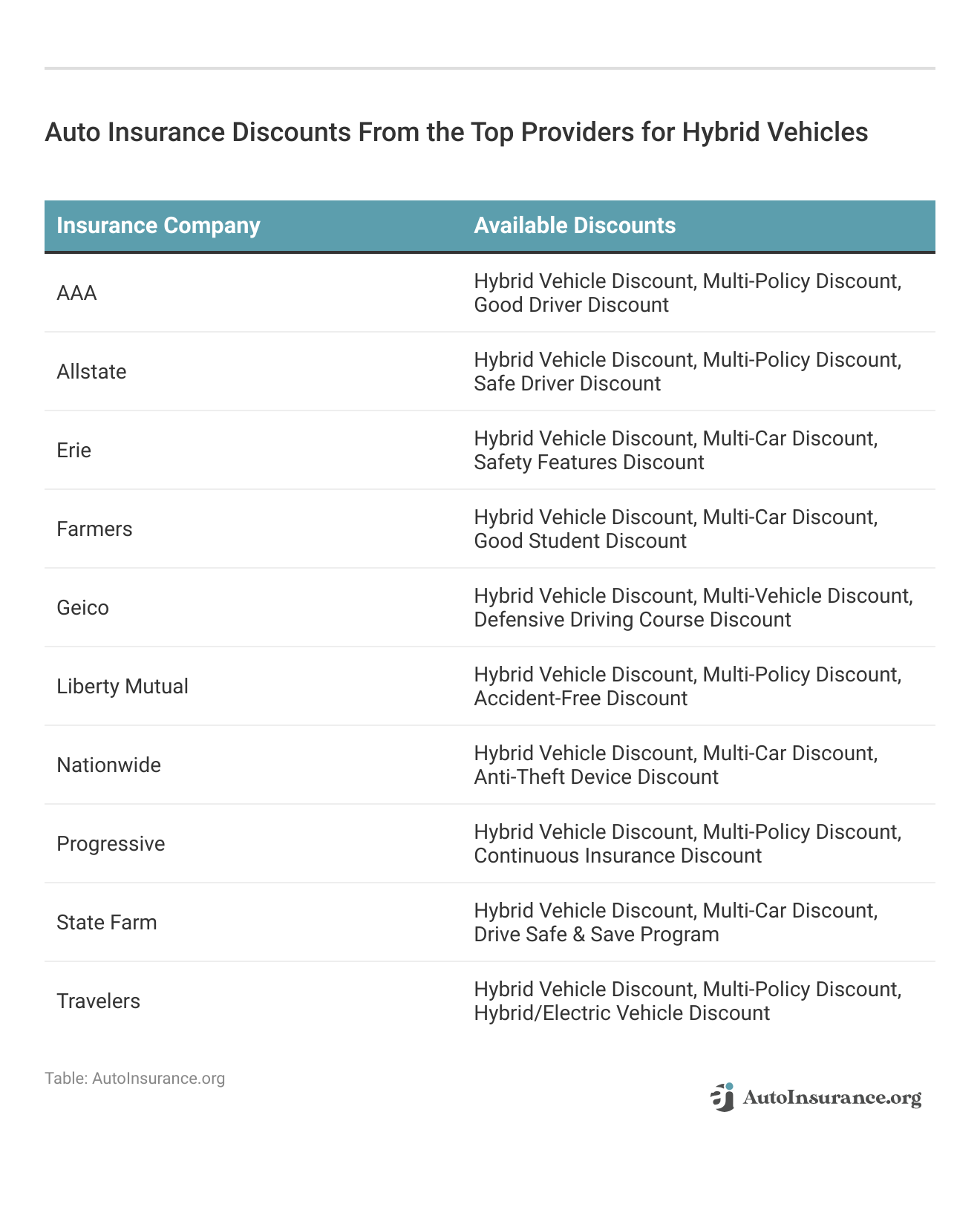

Do hybrid cars cost more to insure? Yes. But luckily, there are a few things you can do to save on your hybrid car insurance rates. The easiest is to shop for auto insurance discounts that can lower your rates.

You may be able to offset the cost of auto insurance for hybrid vehicles a bit with a hybrid car insurance discount, also known as a “green vehicle discount.” While Farmers and Travelers each offer a 10% discount, and Geico offers a 5% discount, if you have a different insurer or are shopping around, ask them about this discount.Justin Wright Licensed Insurance Agent

Farmers has the best hybrid vehicle discounts, but Nationwide offers the best multi-policy discounts to drivers who bundle their hybrid auto policies with homeowners or renters insurance.

Use this table to explore discounts from the best auto insurance companies for hybrid vehicles.

By shopping for hybrid car insurance quotes at the best companies and qualifying for discounts, you can help keep rates low.

Read More: Farmers Auto Insurance Discounts

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Final Word on the Best Hybrid Auto Insurance

Hybrid cars are taking the fast lane by storm. This rise in hybrid sales might benefit the environment, and most auto insurance companies do not like it.

Fortunately, Geico, Progressive, and State Farm have the best auto insurance for hybrid vehicles with cheap rates and big discounts for going green and buying full coverage.

Is insurance cheaper on hybrid cars? No, and it’s predicted that auto insurance rates on hybrid cars will climb higher than those gas-guzzling SUVs. Factors like the amount you drive, the expense of replacement parts and service, and others will also affect hybrid vehicle insurance rates. However, knowing how to lower your auto insurance rates through discounts and comparison shopping will help keep rates affordable.

Want to find the best hybrid car insurance possible? Enter your ZIP code into our free rate comparison tool to save on hybrid auto insurance rates.

Frequently Asked Questions

Are hybrids more expensive to insure?

In general, the rates on auto insurance for hybrid vehicles are comparable to those of their gasoline-powered counterparts. However, factors such as the make and model of the hybrid vehicle, its repair costs, and its safety features may influence the insurance premiums.

Why are hybrids more to insure?

Hybrid vehicles cost more to repair or replace after a claim because parts and skilled technicians are hard to find. Drivers with hybrid cars also clock more miles than other drivers.

Is there a hybrid car insurance discount?

Yes, some insurance companies offer discounts for hybrid vehicle owners. These discounts can vary between providers, but common discounts include those for eco-friendly vehicles, hybrid-specific safety features, and fuel efficiency.

What factors influence the insurance premiums for hybrid vehicles?

The factors affecting the cost of auto insurance for hybrid vehicles are similar to those for traditional vehicles. These factors include the driver’s age, driving history, location, coverage options, deductible amount, the value of the hybrid vehicle, and the cost of repairs and replacement parts (learn more: Factors That Affect Auto Insurance Rates).

Are hybrid vehicles more expensive to repair, and does that affect insurance premiums?

Hybrid vehicles may have slightly higher repair costs due to their advanced technology and specialized components. These increased repair costs can impact insurance premiums, as insurers take into account the potential expenses of repairing or replacing damaged hybrid-specific parts.

Do hybrid vehicles qualify for any special coverage options?

Hybrid vehicles are generally eligible for the same coverage options as traditional vehicles. However, some insurers may offer specialized coverage options for hybrid vehicles, such as coverage for electric motor or battery damage, or coverage for charging equipment.

What is the best car insurance for hybrid vehicles?

Full coverage is the best hybrid insurance, but the cheapest hybrid car insurance will be minimum coverage (read more: When to Buy More Than Minimum Auto Insurance).

How does a hybrid car work?

Hybrid vehicles primarily use electric motors but can also switch to gas.

Are hybrids better than electric?

It depends on what you are looking for in a car, as both have merits and disadvantages.

Are hybrids more expensive to maintain?

Yes, hybrid vehicles tend to be more expensive to maintain, which does raise the insurance cost for hybrid cars (learn more: Best Auto Insurance for Regular Maintenance).

Who offers the best insurance on hybrid cars?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.