10 Best Auto Insurance Companies for High-Risk Drivers in 2026 (Top Providers)

The best auto insurance companies for high-risk drivers are Progressive, State Farm and Geico. High-risk drivers can pay as little as $47 per month with the cheapest high-risk auto insurance companies. High-risk drivers can also find discounts for things like completing a defensive driving class.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated May 2025

13,285 reviews

13,285 reviewsCompany Facts

Full Coverage After DUI

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage After DUI

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage After DUI

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

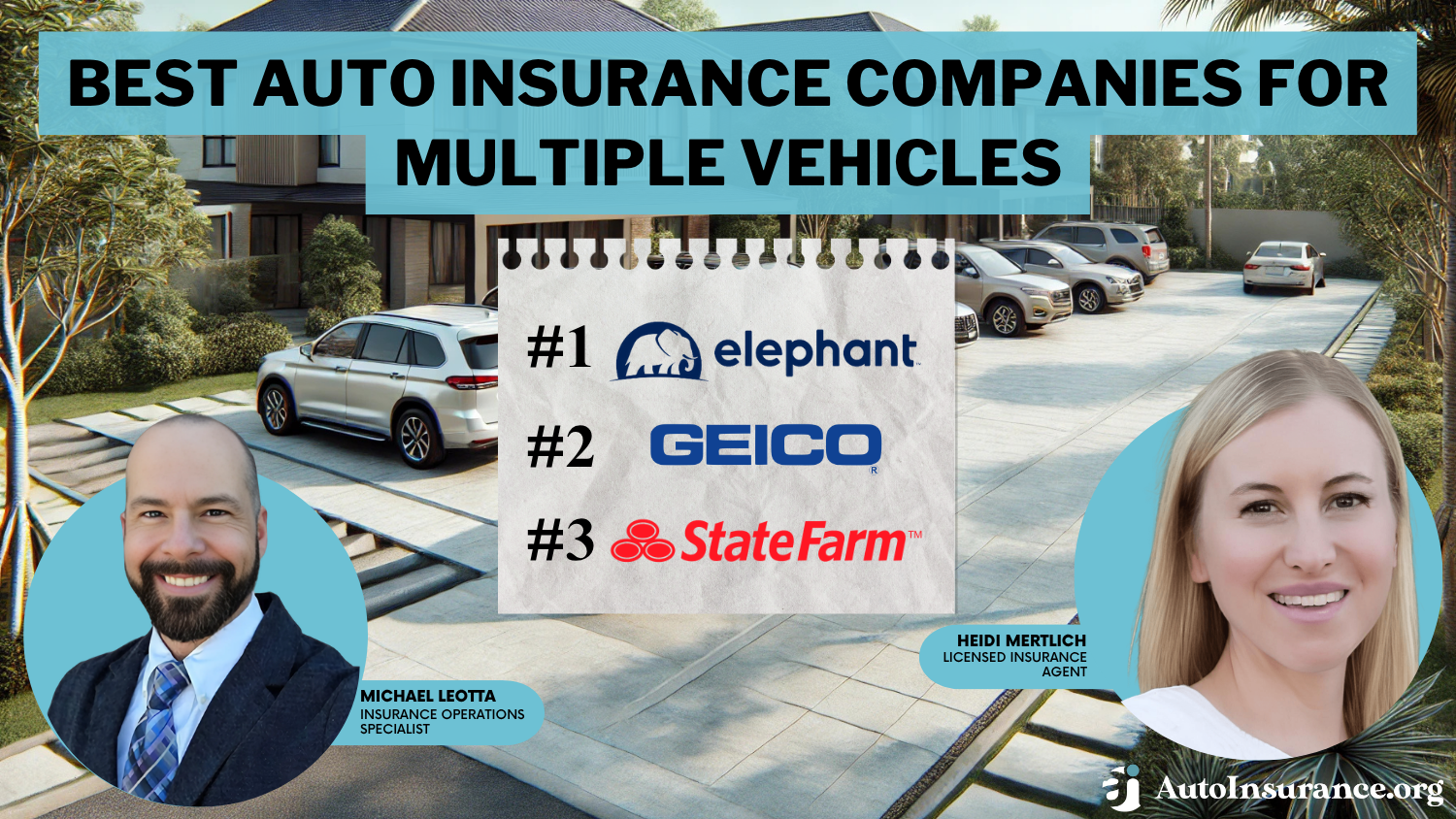

18,157 reviewsOur top three winners for the best auto insurance companies for high-risk drivers include Progressive, Geico, and State Farm. Progressive stands out as our preferred option, with rates for high-risk drivers averaging $160 per month.

Our Top 10 Picks: Best Auto Insurance Companies for High-Risk Drivers

| Company | Rank | Defensive Driving Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | A+ | Broad Acceptance | Progressive | |

| #2 | 15% | A++ | Competitive Pricing | Geico | |

| #3 | 15% | A++ | Customer Service | State Farm | |

| #4 | 10% | A+ | Full Coverage | Allstate | |

| #5 | 10% | A+ | Accident Forgiveness | Nationwide | |

| #6 | 10% | A | Generous Discounts | Liberty Mutual |

| #7 | 10% | A | Policy Options | Farmers | |

| #8 | 10% | A+ | SR-22 Support | Dairyland | |

| #9 | 10% | A+ | AARP Members | Hartford |

| #10 | 5% | A | Claims Handling | American Family |

Finding the best auto insurance companies for high-risk drivers can be tricky, and coverage will be expensive.

However, finding the best car insurance for high-risk drivers is possible if you evaluate auto insurance quotes from our list of high-risk auto insurance companies.

- The best high-risk auto insurance companies are Progressive, Geico, and State Farm

- High-risk drivers pay around $160 per month for auto insurance with Progressive

- High-risk auto insurance is for drivers with traffic violations or speeding tickets

When looking for the best high-risk auto insurance, shop around to see which company can offer you the best and cheapest car insurance for high-risk drivers. Enter your ZIP code into our free quote comparison tool to see rates from the best auto insurance companies for high-risk drivers near you.

#1 – Progressive: Top Pick Overall

Pros

- Specialized Coverage: Progressive offers policies for individuals with a history of traffic violations that classify them as high-risk drivers. Read our Progressive auto insurance review to learn more.

- Snapshot Program: For high-risk drivers looking to lower their premiums, participating in the Progressive Snapshot program can lead to potential discounts and lower premiums.

- SR-22 Insurance: Progressive offers cheap SR-22 auto insurance, a certificate of financial responsibility that makes it easier for high-risk drivers to reinstate their driving privileges.

Cons

- Mixed Customer Reviews: Some customers may experience challenges or delays when filing claims or dealing with customer service representatives.

- Potential Rate Increases: Factors such as traffic violations, accidents, or changes in driving habits could lead to premium hikes for high-risk drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Competitive Pricing

Pros

- Competitive Rates: Geico’s affordable premiums can help alleviate some of the financial burden associated with being a high-risk driver.

- Variety of Discounts: Geico’s auto insurance discounts for things like defensive driving courses or bundling policies can benefit high-risk drivers. Learn more in our Geico auto insurance review.

- User-Friendly Online Platform: Geico’s user-friendly online platform makes it easy for high-risk drivers to manage their policies, access resources, and obtain support whenever needed.

Cons

- Expensive for High-Risk Drivers: High-risk drivers should be aware that their Geico premiums may still increase based on factors such as accidents, traffic violations, or changes in driving habits.

- Limited Programs: High-risk drivers looking for more targeted programs or coverage options may need to look elsewhere, as Geico may have fewer specialized programs compared to other insurers.

#3 – State Farm: Best for Exceptional Customer Service

Pros

- Excellent Customer Service: Being a high-risk driver can be stressful enough, but State Farm’s responsive and supportive customer service representatives can make the process smoother.

- Coverage Options: State Farm provides flexibility in choosing coverage that ensures adequate protection on the road. Learn more about your options in our State Farm auto insurance review.

- Defensive Driver Discount: State Farm offers discounts for completing a defensive driving course. This discount is a great way for high-risk drivers to improve their skills and lower their premiums.

Cons

- Few High-Risk Driver Programs: Compared to other insurers that offer targeted programs for high-risk drivers, State Farm’s offerings may be more generalized.

- Potential for Policy Limitations: These limitations could include coverage exclusions, higher deductibles, or stricter eligibility criteria for certain discounts or programs.

#4 – Allstate: Best for Full Coverage Policies

Pros

- Comprehensive Coverage Options: Allstate offers a variety of add-ons that enhance the protection provided by its policies. Find more in our Allstate auto insurance review.

- Accident Forgiveness: Allstate’s accident forgiveness coverage allows you to avoid rate increases after your first at-fault accident.

- Drivewise: Allstate Drivewise, a usage-based insurance program, provides high-risk drivers with an incentive to practice safe driving habits.

Cons

- Higher Premiums: If you need cheap car insurance for high-risk drivers, Allstate is usually higher compared to other companies.

- Claims Handling Issues: While Allstate generally receives positive feedback for its coverage options and discounts, some customers report challenges or delays when filing claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best Accident Forgiveness Coverage

Pros

- Nationwide Availability: Nationwide offers car insurance in all but three states. Check out our Nationwide auto insurance review to see if you can get high-risk driver insurance services in your area.

- Vanishing Deductible: Nationwide’s vanishing deductible program rewards drivers for practicing safe driving habits by reducing their deductible over time for each accident-free year.

- Nationwide SmartRide: Nationwide’s SmartRide program encourages high-risk drivers to adopt safer driving practices and potentially qualify for discounts on their insurance premiums.

Cons

- Premium Pricing: Nationwide may assign higher premiums to high-risk drivers to offset the increased likelihood of claims and financial losses associated with insuring them.

- Limited Coverage and Discounts: Nationwide’s limited availability restricts options for high-risk individuals who may need coverage outside of the company’s service areas.

#6 – Liberty Mutual: Best for Generous Discounts

Pros

- Nationwide Availability: Liberty Mutual’s high-risk insurance is available in all 50 U.S. states, including the District of Columbia. (Read more: Liberty Mutual auto insurance review).

- Flexible Payment Options: Liberty Mutual offers flexible payment options, including automatic, one-time, or telephone payments, allowing high-risk drivers to choose a payment plan that fits their budget.

- Liberty Mutual’s RightTrack: Liberty Mutual RightTrack is a great usage-based program for drivers with an at-fault accident or speeding ticket on their record.

Cons

- Rate Increases: Many customers report that their Liberty Mutual premiums increased unexpectedly, particularly those who already had higher rates after an accident or DUI.

- Customer Service Experience: Liberty Mutual’s customer service reviews are generally positive; however, some customers may report difficulties when filing claims.

#7 – Farmers: Best for High-Risk Policy Options

Pros

- Strong Financial Stability: Farmers has an A rating from A.M. Best and an A+ rating from the BBB. Learn more in our Farmers auto insurance review.

- Many Coverages: Farmers Insurance provides optional coverages that high-risk drivers may find beneficial, such as roadside assistance, rental car reimbursement, rideshare, etc.

- Farmers Signal Discount: Farmers’ Signal is a UBI program that encourages high-risk individuals to improve their driving habits over time, potentially lowering their auto insurance premiums.

Cons

- No Gap Insurance: Farmers doesn’t have gap insurance (also known as Guaranteed Asset Protection), so if you want this type of coverage, you’ll have to look elsewhere.

- Limited Availability: There are a few states where Farmers’ availability may be more limited or where it may not offer high-risk auto insurance coverage at all.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Dairyland: Best for SR-22 Auto Insurance Needs

Pros

- Specialized Coverage Options: Dairyland offers coverage tailored specifically to high-risk drivers. Learn more about this coverage in our Dairyland auto insurance review.

- High-Risk Acceptance: Dairyland has a reputation for being more willing to insure individuals with bad driving records or those who have been denied coverage elsewhere.

- Free SR-22 and FR-44 Filings: Dairyland provides SR-22 and FR-44 insurance, which are often required for drivers with serious violations such as DUIs or multiple traffic offenses.

Cons

- Higher Premiums: Dairyland ranks as the most expensive insurer among our list of the top auto insurance companies for high-risk drivers, with rates averaging $368 per month.

- High Complaint Level: According to the NAIC, Dairyland has a complaint index score of 3.44, suggesting it receives approximately three times as many complaints as the national average.

#9 – The Hartford: Best for AARP Members

Pros

- Unique Coverages: The Hartford offers a variety of coverage options, like accident forgiveness and new car replacement.

- AARP Discounts: AARP members can enjoy a range of membership benefits and discounts. For example, AARP members save up to 10% on their insurance premiums with The Hartford.

- Usage-Based Program: Upon enrollment in TrueLane by The Hartford, you can immediately receive a 12% discount on your insurance premiums.

Cons

- Eligibility Requirements: The Hartford auto insurance policies are available only to AARP members and are specifically tailored to drivers 50 or older. Learn more in The Hartford auto insurance review.

- Expensive for Young Drivers: Young drivers may find The Hartford’s premiums less affordable than those of insurers that offer more competitive rates for this age group.

#10 – American Family: Best Claims Handling Service

Pros

- No. 1 in Claims Handling: With its personalized approach, American Family has earned a reputation for its prompt and efficient claims processing within the insurance industry.

- Strong Customer Satisfaction: American Family ensures that customers can easily reach out for help or information through phone calls, emails, or online.

- Many Add-on Coverage Options: In addition to the standard auto insurance coverage types, American Family offers a few additional options, including gap insurance and rideshare coverage.

Cons

- Limited Availability: American Family car insurance is only available in 19 states. Learn more in this American Family auto insurance review.

- Digital Experience: While American Family excels in many areas, the company’s mobile app functionality and features may not be as comprehensive or intuitive as those offered by competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

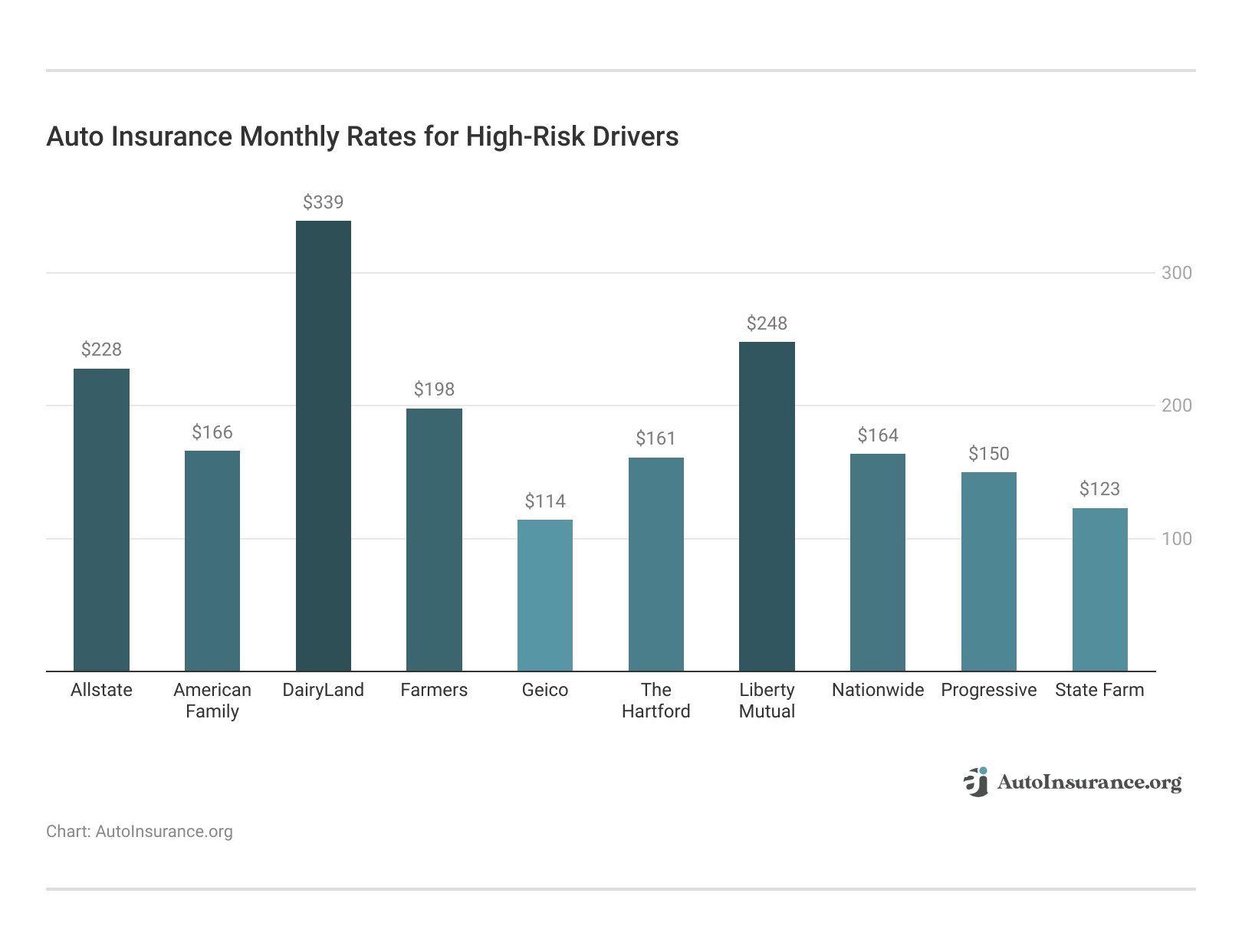

High-Risk Auto Insurance Rates

There are many factors that affect auto insurance rates, and the most significant one is your driving record. Auto insurance companies worry about risk, so high-risk drivers will pay higher rates or get denied coverage altogether, making it hard to find affordable high-risk car insurance. However, you can check out the average cost of high-risk auto insurance from our top companies below.

Auto Insurance Monthly Rates for High-Risk Drivers by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $130 | $217 | |

| $88 | $258 |

| $167 | $368 | |

| $84 | $248 | |

| $47 | $147 | |

| $96 | $248 |

| $90 | $204 | |

| $85 | $231 | |

| $115 | $181 | |

| $67 | $298 |

When you’re looking for “high-risk auto insurance near me,” take a look at this table to understand how your driving record affects high-risk auto insurance quotes.

As you can see, State Farm auto insurance offers the lowest rates to drivers with accidents, tickets, and DUIs on their driving record, averaging $103 monthly. Geico high-risk insurance is also cheap, especially for drivers with speeding tickets — high-risk insurance with Geico costs around $151 monthly. Read more about the best auto insurance companies for drivers with speeding tickets.

Keep in mind that the rates you’ll see depend on your unique circumstances. For example, a driver with at-fault accidents on their record will pay more than a driver with a clean record, but probably less than a driver with a DUI.

The cheapest company for you depends on a variety of factors aside from your driving record. That’s why it’s so important to compare rates with as many companies as possible — you’ll likely pay higher rates if you don’t.

You may also need SR-22 insurance after serious driving violations. An SR-22 — or FR44 in some states — is a form your insurance company will have to submit to your state’s DMV so you can keep driving.

You’ll not only pay more if you need SR-22 insurance, but you also may find it harder to find an insurance company to work with you. Either way, make sure to tell your provider that you need SR-22 insurance so they can send it in on your behalf.

Who Auto Insurance Companies Consider High-Risk Drivers

Finding insurance companies for bad drivers doesn’t have to be difficult if you understand why certain drivers are considered high risk. High-risk auto insurance is sometimes called non-standard insurance. However, your driving record isn’t the only thing that makes you a high-risk driver.

Drivers are also high risk if they meet these requirements:

- Young drivers

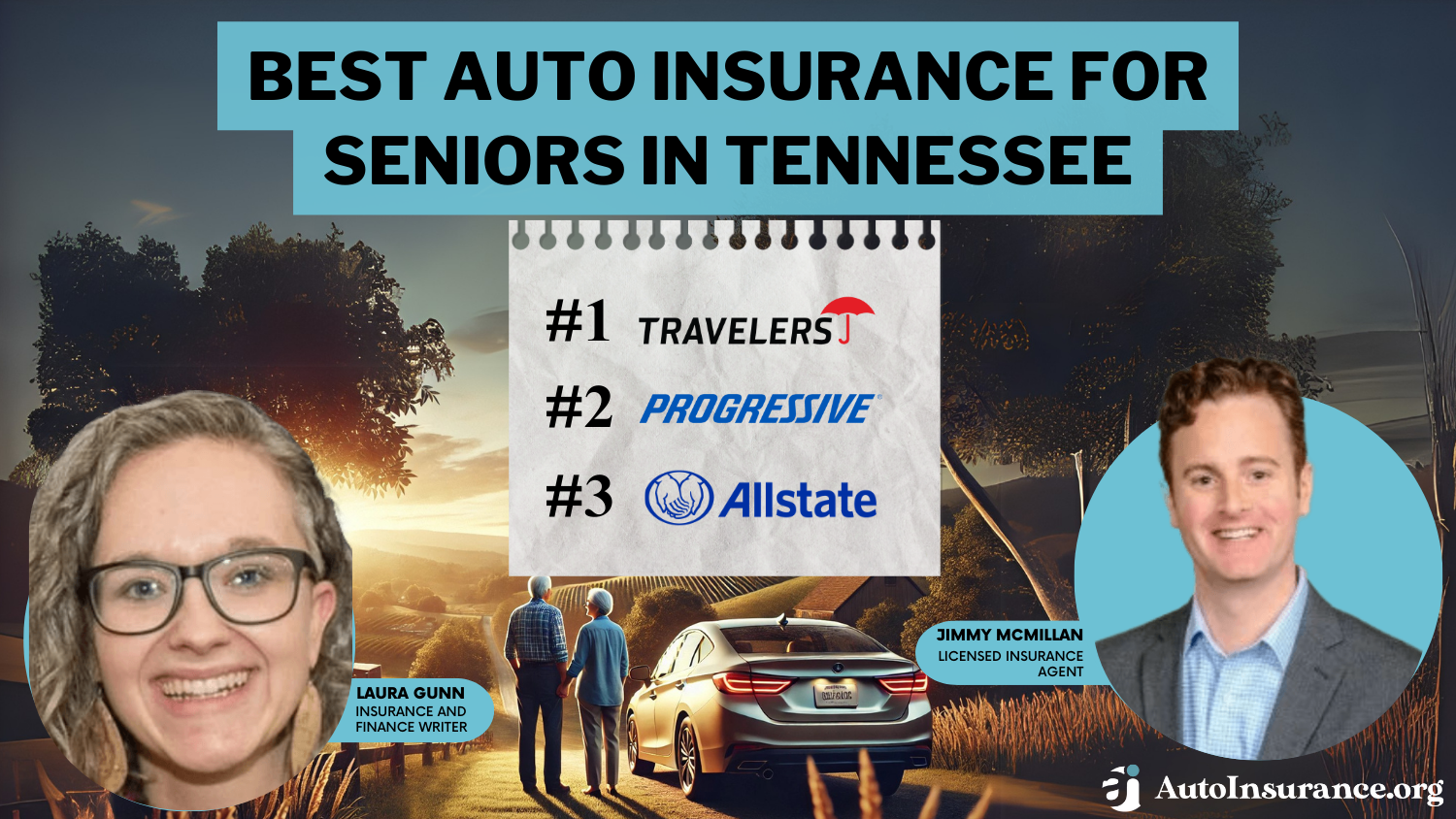

- Older drivers (Read more: Best Auto Insurance for Seniors)

- Have poor credit

- Drive exotic cars

- Have allowed auto insurance to lapse

You might wonder how credit scores affect auto insurance rates and can classify you as a high-risk driver. Insurance companies believe drivers with low credit scores are more likely to miss payments and file claims.

Young drivers lack experience and are more likely to be in an accident, making them a higher risk for insurance companies.Michelle Robbins Licensed Insurance Agent

Allowing your auto insurance to lapse is a big red flag. Insurance companies want to know that you’ll make your payments and drive legally.

Most states require car insurance, but 13% of drivers are uninsured, according to the Insurance Information Institute. Driving without auto insurance can lead to fines, higher rates, driver’s license suspension, and even jail time. You can find cheap insurance for high-risk drivers to drive legally if you only need to meet the state minimum auto insurance requirements.

The type of car you drive can also cause you to be considered a high-risk driver. More expensive cars to repair or replace will raise your auto insurance rates. Read more about how to get a new car auto insurance discount to lower rates for your costly vehicle.

How Drivers Can Save on High-Risk Auto Insurance Coverage

There are many ways to lower your auto insurance rates as a high-risk driver. The easiest way is to take advantage of auto insurance discounts. Most insurance companies offer many discounts, so there are bound to be discounts to help you find cheap high-risk car insurance.

This table shows you the most common auto insurance discounts from some of the top companies.

Auto Insurance Discounts for High-Risk Drivers

| Insurance Company | Anti-Theft | Bundling | Defensive Driving | Good Driver | Good Student |

|---|---|---|---|---|---|

| 10% | 25% | 10% | 25% | 22% | |

| 25% | 25% | 5% | 25% | 20% |

| 5% | 10% | 10% | 10% | 5% | |

| 10% | 20% | 10% | 30% | 15% | |

| 25% | 25% | 15% | 26% | 15% | |

| 35% | 25% | 10% | 20% | 12% |

| 5% | 20% | 10% | 40% | 18% | |

| 25% | 10% | 30% | 30% | 10% | |

| 15% | 17% | 15% | 25% | 35% | |

| 10% | 5% | 10% | 15% | 12% |

Another way to save money on your high-risk insurance policy is to lower your coverage and raise your auto insurance deductibles. While you’ll save money, you should be prepared to have larger out-of-pocket costs in the event of an accident.

You can look for auto insurance companies that don’t check driving records, but that will be hard to find and expensive when you do find one.

Worried a bad driving history will affect your insurance rates?🚗At https://t.co/27f1xf131D, we’re here to help you understand exactly how companies check your records so you can be prepared for any possible rate increases!🤑 Learn more here👉: https://t.co/duhDY6zieo pic.twitter.com/YG5dN9f3EE

— AutoInsurance.org (@AutoInsurance) May 4, 2023

Drivers can also improve their credit score, drive a less expensive vehicle, or take defensive driving courses to help lower rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Best Auto Insurance for High-Risk Drivers

So, what do non-standard auto insurance companies offer? Non-standard high-risk insurance companies offer the same coverages you’d find at standard companies. The best auto insurance companies for high-risk drivers vary from driver to driver. However, you can take advantage of discounts to find cheap high-risk auto insurance.

Still wondering, “How can I find high-risk auto insurance companies near me?” Shop around and compare various companies to find the cheapest insurance for high-risk drivers. In addition, enter your ZIP code to compare free quotes from the best high-risk car insurance companies in your area.

Frequently Asked Questions

What is the best insurance company for high-risk drivers?

State Farm, Geico, and Progressive are the best car insurance companies for high-risk drivers. When you find yourself wondering, “Where can I find high-risk car insurance near me?”, your best bet is to compare quotes. State Farm, Geico, and Progressive have the best overall ratings for high-risk drivers, but you may find a better company in your local area.

How much is high-risk insurance a month?

On average, a high-risk auto insurance policy costs $176 monthly. However, rates vary by violation and other factors, such as age, gender, and types of auto insurance coverage. You may be able to find the best insurance for high-risk drivers for cheaper, depending on where you live.

What does it mean to be high-risk insurance?

High-risk vehicle insurance refers to insurance coverage provided to individuals who are considered to be at a greater risk of filing claims or being involved in accidents compared to the average driver.

Is Progressive good for high-risk drivers?

Progressive is our top pick for the best high-risk insurance providers. It offers auto insurance offers competitive high-risk insurance quotes, specifically for those with poor credit or DUIs.

How can I find car insurance for high-risk drivers near me?

To find affordable high-risk auto insurance, we recommend you shop around and compare quotes from various insurance companies. Use our free online tool by entering your ZIP code to compare high-risk car insurance quotes from different insurers based on location.

How can high-risk drivers save money on auto insurance?

High-risk drivers can take several steps to save money on auto insurance. One way is to take advantage of available discounts offered by high-risk auto insurance companies. These discounts can vary but may include safe driver discounts, good student discounts, or discounts for having certain safety features in your vehicle.

Another option when you’re looking for “auto insurance for high-risk drivers near me” is to lower coverage and raise deductibles, but remember that you’ll pay higher out-of-pocket costs after an accident. Improving your credit score, driving a less expensive vehicle, or completing defensive driving courses can also help lower rates.

Are there any auto insurance companies that specialize in coverage for high-risk drivers?

Yes, some auto insurance companies specialize in providing coverage for high-risk drivers. In fact, if your driving record has too many violations, you may need to find insurance companies that take high-risk drivers.

These companies understand high-risk drivers’ unique needs and challenges and offer tailored coverage options. Although it’s not always the case, they sometimes offer the cheapest high-risk auto insurance, too.

Can having multiple high-risk incidents on my driving record lead to being uninsurable?

While having multiple incidents on your driving record can make it more challenging to find coverage, it doesn’t necessarily mean you’re uninsurable. Some insurance companies specialize in providing affordable car insurance for high-risk drivers. However, having too many violations will make the list of high-risk insurance companies that will work with you smaller.

It’s important to compare rates from the best companies to find the cheapest insurance for high-risk drivers.

Is it possible to remove points from my driving record to improve my insurance rates?

You can sometimes remove points from your driving record by attending traffic school or completing a driver improvement course. These options are available in certain jurisdictions, and the rules and requirements vary. Contact your local Department of Motor Vehicles (DMV) for more information.

How can I improve my credit score to lower my auto insurance rates as a high-risk driver?

To improve your credit score and lower your auto insurance rates as a high-risk driver, you can focus on paying bills on time, reducing credit card debt, and maintaining a low credit utilization ratio. Over time, these actions can positively impact your credit score and potentially lower premiums. Learn how to find cheap auto insurance for drivers with a bad driving record.

What is the cheapest car insurance for high-risk drivers?

Who are the highest risk drivers?

Which category of drivers has the most accidents?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.