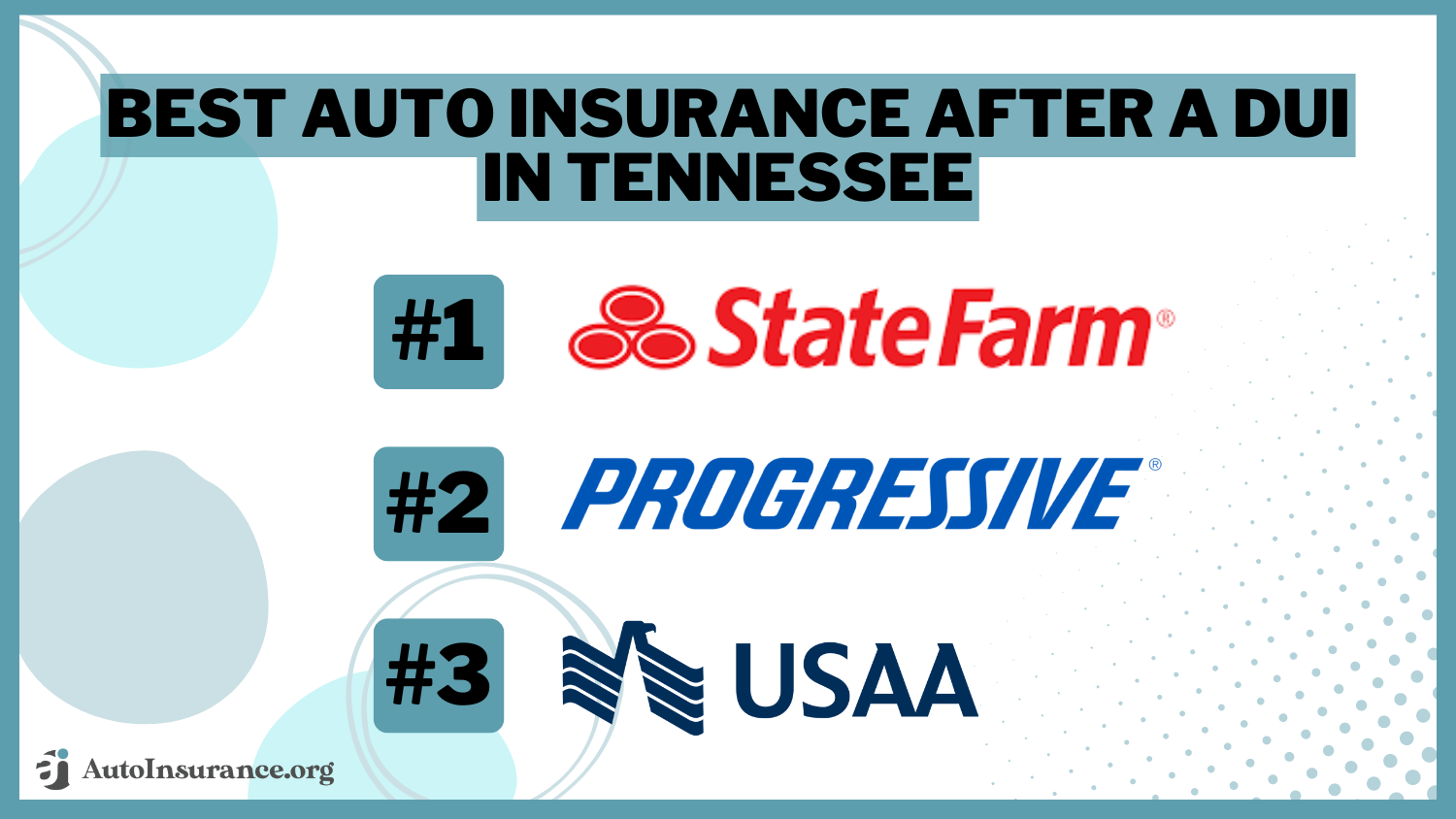

Best Auto Insurance After a DUI in Tennessee (Top 10 Companies Ranked for 2026)

The best auto insurance after a DUI in Tennessee is State Farm, Progressive, and USAA, offering rates as low as $25 per month. State Farm excels in local agent support, Progressive provides competitive rates, and USAA offers unmatched military savings for more affordable high-risk Tennessee auto insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insuranc...

Leslie Kasperowicz

Updated October 2024

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage After a DUI in Tennessee

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage After a DUI in Tennessee

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage After a DUI in Tennessee

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviewsState Farm, Progressive, and USAA offer the best auto insurance after a DUI in Tennessee, with rates starting as low as $25 per month.

State Farm and Progressive have exceptionally low rates for high-risk auto insurance in Tennessee, and USAA offers competitive rates to military members with DUIs.

Our Top 10 Company Picks: Best Auto Insurance After a DUI in Tennessee

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 9% | B | Customer Service | State Farm | |

| #2 | 10% | A+ | Competitive Rates | Progressive | |

| #3 | 8% | A++ | Military Savings | USAA | |

| #4 | 6% | A | Safe Drivers | Farmers | |

| #5 | 7% | A++ | Comprehensive Coverage | Travelers | |

| #6 | 8% | A | Loyalty Discounts | American Family | |

| #7 | 9% | A+ | Usage-Based Discount | Allstate | |

| #8 | 10% | A+ | Multi-Policy Savings | Nationwide |

| #9 | 11% | A | 24/7 Support | Liberty Mutual |

| #10 | 8% | A++ | Fast Claims | Geico |

Comparing these choices will guide you to the best insurance solution for your situation. Find the best Tennessee DUI auto insurance company near you by entering your ZIP code into our free quote tool above.

- State Farm offers the best DUI coverage with rates starting at $25/month

- Progressive is the second-cheapest DUI in Tennessee insurance company

- Compare quotes online for the best auto insurance after a DUI in Tennessee

#1 – State Farm: Top Overall Pick

Pros

- Customizable Coverage: Our State Farm auto insurance review shows how the company tailors coverage to meet specific needs and legal Tennessee DUI auto insurance requirements.

- Local Agent Support: State Farm’s widespread agent network helps drivers navigate the right TN auto insurance coverage after a DUI.

- DUI Driver Resources: State Farm offers tools to improve driving habits, potentially reducing premiums for auto insurance after a DUI in Tennessee.

Cons

- Restricted Discount Eligibility: While State Farm offers various discounts, those with a DUI might find it challenging to qualify for savings.

- Low Financial Ratings: State Farm’s A.M. Best rating is lower than other South Carolina DUI auto insurance companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Competitive Rates

Pros

- Cheap DUI Insurance Rates: High-risk auto insurance in Tennessee after a DUI starts as low as $32/month for minimum coverage with Progressive.

- Driving Rewards: Read our Progressive Snapshot review to learn how to save on auto insurance after a DUI in Tennessee with usage-based coverage.

- Advanced Digital Tools: Progressive’s online platform provides efficient management of policies, claims, and discounts, easing the process for auto insurance after a DUI in Tennessee.

Cons

- Significant Rate Hikes: DUI drivers in Tennessee might face steep rate increases with Progressive if they have multiple DUIs or traffic citations.

-

Variable Customer Service: Progressive’s customer service may be inconsistent, posing challenges for drivers seeking reliable support for auto insurance after a DUI in Tennessee.

#3 – USAA: Best for Military Savings

Pros

- Exclusive Military Perks: USAA provides specialized services for military members and their families, including tailored support for managing the complexities of auto insurance after a DUI in Tennessee.

- Accident Forgiveness: USAA’s accident forgiveness helps military members avoid rate hikes after a DUI, making Tennessee auto insurance more affordable.

- Flexible Coverage: Our USAA auto insurance review presents the company’s extensive policy customization to meet the unique needs of auto insurance after a DUI in Tennessee.

Cons

- Membership Limitations: USAA is restricted to military members, veterans, and their families, which limits accessibility for non-military individuals needing auto insurance after a DUI in Tennessee.

- DUI Premium Hikes: USAA may still impose significant rate increases for DUI drivers with multiple traffic violations, making auto insurance after a DUI in Tennessee potentially costlier.

#4 – Farmers: Best for Safe Drivers

Pros

- Rate Protection: Farmers’ accident forgiveness helps drivers avoid extra rate hikes, crucial for managing costs with auto insurance after a DUI in Tennessee. Read our Farmers review for more.

- Incentives for Safe Driving: Farmers rewards improved driving behaviors post-DUI with discounts and incentives, which can reduce premiums over time for auto insurance after a DUI in Tennessee.

- Dedicated Customer Service: Farmers agents provide in-depth assistance, guiding DUI drivers through the complexities of choosing the right policy for auto insurance after a DUI in Tennessee.

Cons

- Limited Online Tools: Farmers’ digital resources are less robust than its competitors, which may hinder those who prefer managing auto insurance after a DUI in Tennessee online.

- High Premiums for DUI Drivers: Even with available discounts, drivers with a DUI may face considerably higher premiums, making auto insurance after a DUI in Tennessee potentially costly.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Comprehensive Coverage

Pros

- Wide Coverage Choices: Travelers offers a broad array of options, helping drivers find suitable auto insurance after a Tennessee DUI. For details, see our Travelers review.

- Efficient Claims Support: Travelers offers excellent claims assistance, crucial for managing the impact of a DUI and streamlining the process for auto insurance after a DUI in Tennessee.

- Enhanced Roadside Support: Travelers offers valuable and affordable roadside assistance on Tennessee auto insurance after a DUI.

Cons

- Overwhelming Choices: Travelers offers many coverage options, which can be confusing for drivers managing auto insurance after a DUI in Tennessee.

- Higher Risk Premiums: Travelers DUI auto insurance rates are more expensive than at other South Carolina providers.

#6 – American Family: Best Loyalty Discounts

Pros

- Loyalty Discounts: American Family provides discounts for long-term customers, helping those with a DUI manage Tennessee auto insurance rate increases over time.

- Personalized Support: American Family provides dedicated customer service to help DUI drivers manage their TN auto insurance.

- Customizable Policies: American Family offers flexible options, helping DUI drivers tailor their coverage in Tennessee, which is covered in our American Family review.

Cons

- Geographical Availability: American Family DUI insurance coverage options are only available through The General in Tennessee.

- Potential Premium Increases: Despite discounts, drivers with a DUI may still encounter substantial Tennessee DUI auto insurance rate hikes with American Family.

# 7 – Allstate: Best Usage-Based Discounts

Pros

- Safe Driving Discounts: Allstate’s Drivewise rewards DUI drivers for safe driving, helping lower their TN auto insurance rates over time. See our Allstate Drivewise review for more details.

- New Car Replacement: Allstate DUI auto insurance coverage add-ons help Tennessee drivers replace their cars after a covered claim.

- Wide Agent Network: Allstate’s expansive network of agents offers personalized guidance, helping DUI drivers better understand and manage their auto insurance after a DUI in Tennessee.

Cons

- Additional Risk Charges: Drivers may face added surcharges with Allstate, increasing the overall cost of auto insurance after a DUI in Tennessee.

- Rigid Policy Conditions: Allstate’s strict policy terms may not be as flexible for DUI drivers, potentially complicating the process of securing appropriate TN car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Multi-Policy Savings

Pros

- Risk Reduction Benefits: Nationwide’s accident forgiveness helps DUI drivers avoid future premium increases for auto insurance after a DUI in Tennessee. See our Nationwide auto insurance review.

- Deductible Reduction Incentives: Nationwide’s vanishing deductible program rewards safe driving, potentially lowering out-of-pocket costs for DUI drivers in Tennessee.

- Savings through Bundling: Nationwide offers significant discounts for bundling policies, helping DUI drivers in Tennessee reduce the overall cost of DUI auto insurance.

Cons

- High-Risk Policy Limitations: Nationwide’s offerings may be less tailored for high-risk drivers with a DUI, potentially making it harder to find the best coverage for auto insurance after a DUI in Tennessee.

- Higher Premiums for DUI: Despite discounts, DUI drivers may encounter elevated premiums, making Tennessee auto insurance in Tennessee pricier with Nationwide.

#9 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Help: Liberty Mutual provides constant support for drivers managing their auto insurance after a DUI in Tennessee. Learn more in our Liberty Mutual review.

- Forgiveness Policies: Liberty Mutual offers accident forgiveness, which can help DUI drivers avoid additional Tennessee auto insurance increases.

- Adaptable Coverage Plans: Liberty Mutual’s flexible coverage options allow DUI drivers to customize their policies to meet specific needs and legal requirements for auto insurance after a DUI in Tennessee.

Cons

- Increased Premiums for High-Risk Drivers: Liberty Mutual charges higher rates for auto insurance after a DUI in TN than other high-risk companies.

- Complex Policy Structures: Liberty Mutual’s extensive policy options may be difficult to navigate, especially for drivers needing straightforward auto insurance solutions after a Tennessee DUI.

# 10 – Geico: Best for Quick Claims Processing

Pros

- User-Friendly Online Platform: Geico’s intuitive online tools make it easy for drivers to manage their policy, pay bills, and file claims efficiently for auto insurance after a DUI in Tennessee.

- Quick and Efficient Claims: Drivers with DUIs in Tennessee can quickly file claims online through the Geico mobile app and track the process of their claims from start to finish.

- Discount Opportunities: Geico offers various discounts, which can help reduce TN auto insurance costs after a DUI. These are the best Geico auto insurance discounts.

Cons

- Higher Risk Premiums: Geico is the most expensive Tennessee auto insurance company after a DUI at $100/month for minimum coverage.

- Limited Personal Assistance: Geico’s focus on digital services may result in less personalized support for DUI drivers managing auto insurance after a DUI in Tennessee.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

High-Risk Auto Insurance Rates After a DUI in Tennessee

High-risk auto insurance in Tennessee costs more than standard rates for safe drivers. A DUI conviction typically leads to higher premiums, as insurers view drunk driving as a significant risk factor.

Tennessee DUI Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $62 | $200 |

| American Family | $52 | $167 |

| Farmers | $39 | $125 |

| Geico | $100 | $322 |

| Liberty Mutual | $36 | $303 |

| Nationwide | $69 | $223 |

| Progressive | $32 | $103 |

| State Farm | $25 | $79 |

| Travelers | $40 | $129 |

| USAA | $34 | $110 |

The specific details of the DUI offense, such as BAC level and any additional charges, also impact rates, and it can affect your rates for several years.

Your overall driving record, including past violations and accidents, influences premium increases alongside the DUI. Shopping around and understanding how each factor affects your premiums will help you make more informed decisions and potentially find more affordable Tennessee auto insurance coverage despite the DUI conviction.

Read More: How Auto Insurance Companies Check Driving Records

Frequently Asked Questions

What is the best insurance to have in Tennessee for a DUI conviction?

The best Tennessee auto insurance after a DUI conviction is often from companies known for their comprehensive coverage and support for high-risk drivers. USAA, Progressive, and State Farm are top choices due to their competitive rates and strong customer service.

How much is DUI insurance in Tennessee and how long does a DUI affect TN auto insurance?

DUI insurance in Tennessee can be significantly more expensive due to the increased risk. A DUI can affect your insurance rates for up to five years, depending on your insurer and driving record.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

What auto insurance is required in Tennessee and what are the four most important insurances related to a DUI?

Tennessee requires liability insurance, including bodily injury and property damage coverage. The four most important types of insurance related to a DUI include auto, health, home, and life insurance.

What is the most trusted Tennessee car insurance company for DUI cases?

The most trusted companies for handling high-risk auto insurance in Tennessee include State Farm, Progressive, and USAA.

How much is auto insurance in Tennessee per month after a DUI?

Monthly car insurance rates in Tennessee for DUI cases vary but can range from $100 to $200, depending on factors like driving history and coverage levels.

What happens after you get a DUI in Tennessee and do you lose your license immediately after a DUI?

After receiving a DUI in Tennessee, you may face immediate license suspension, fines, and increased insurance rates. Your license may be suspended temporarily while your case is processed.

How much is a DUI in Tennessee?

A DUI in Tennessee can cost between $5,000 and $10,000 in fines, legal fees, and increased insurance premiums. Find out the best states for affordable DUI auto insurance.

Which Tennessee insurance company has the highest customer satisfaction after a DUI?

Insurance companies with high customer satisfaction include State Farm, USAA, and American Family.

Which company gives the best insurance in Tennessee for DUI offenses

Progressive and State Farm offer some of the best insurance options for DUI offenses in Tennessee.

Is Tennessee a no-fault insurance state and what is the limit on car insurance in Tennessee?

Tennessee is not a no-fault insurance state. Tennessee minimum auto insurance requires fault-based liability coverage. The minimum liability coverage required is $25,000 per person for bodily injury, $50,000 per accident, and $15,000 for property damage. Compare minimum auto insurance requirements by state.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.