Columbia, SC Auto Insurance (2024)

The cheapest Columbia, SC auto insurance is from GEICO, but rates will vary by driver. Auto insurance in Columbia must meet the South Carolina requirements of 25/50/25 in both liability and uninsured/underinsured motorist coverages. Compare Columbia, SC auto insurance quotes online to find your best deal.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Jun 22, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 22, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Geico is the cheapest Columbia, SC auto insurance company

- Columbia auto insurance is less expensive than the national average

- Columbia drivers commute times are a little longer than average

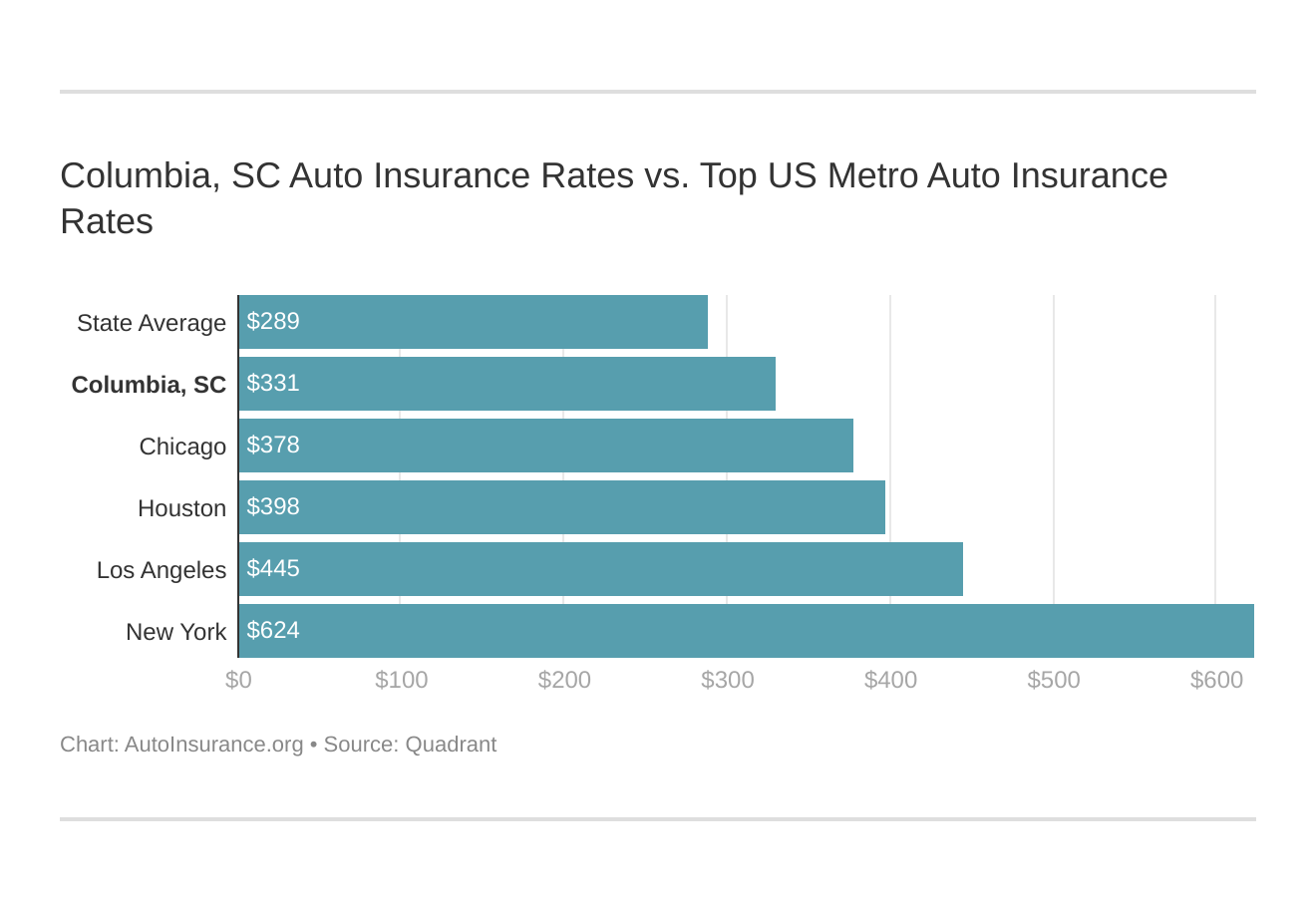

Columbia, SC auto insurance is more expensive than the average South Carolina auto insurance but cheaper than the national average.

The good news is that you can find affordable Columbia, SC auto insurance if you shop around. Compare rates from different companies to find the cheapest auto insurance for you.

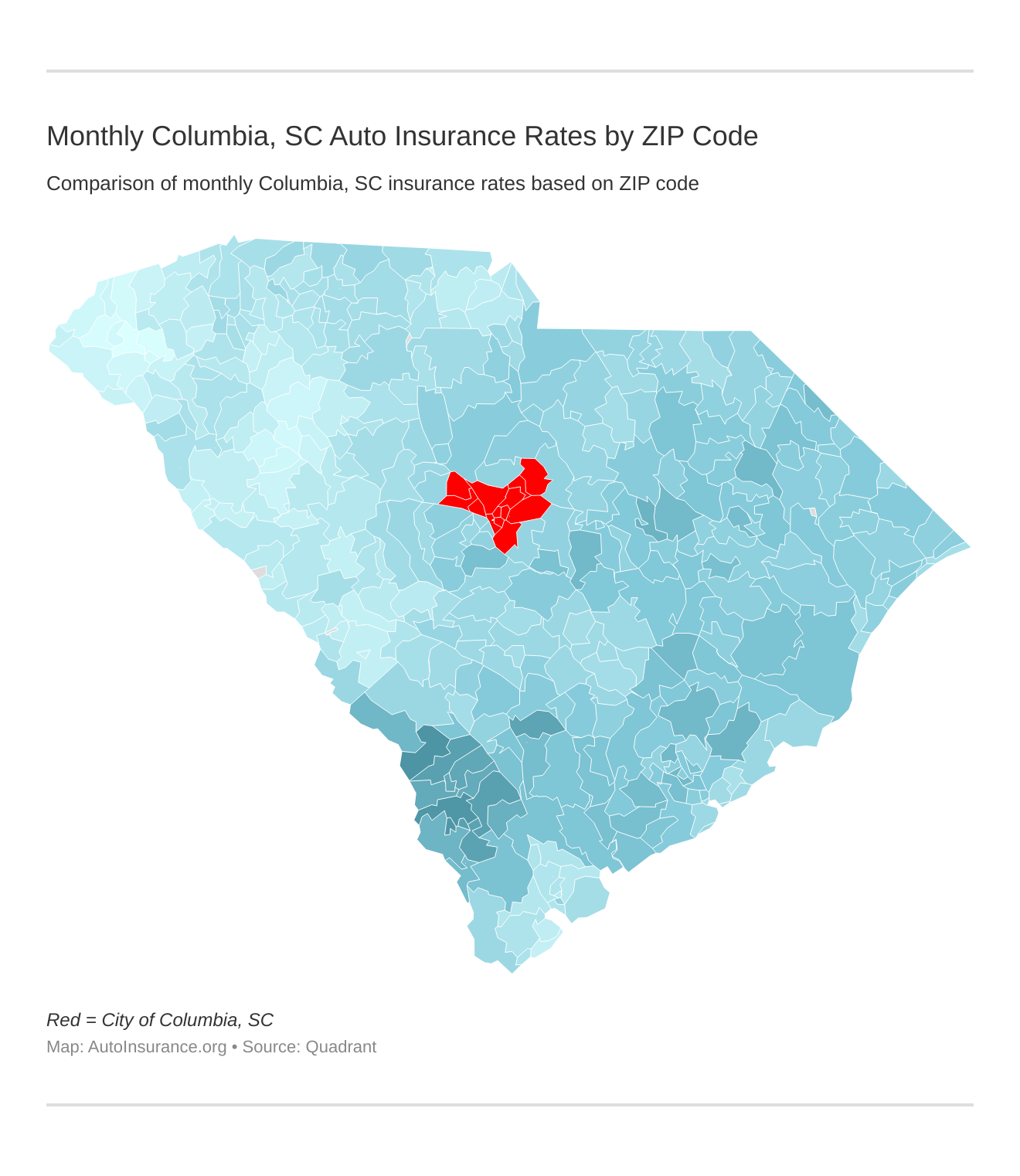

Monthly Columbia, SC Car Insurance Rates by ZIP Code

Find more info about the monthly Columbia, SC auto insurance rates by ZIP Code below:

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Columbia, SC Car Insurance Rates vs. Top US Metro Car Insurance Rates

Which city you live in will have a major affect on car insurance. That’s why it’s vital to compare Columbia, SC against other top US metro areas’ auto insurance rates.

Enter your ZIP code now to compare Columbia, SC auto insurance quotes from multiple companies for free.

What is the cheapest auto insurance company in Columbia, SC?

The cheapest Columbia, SC auto insurance company is Geico, although rates will vary by driver.

The cheapest Columbia, SC car insurance company can be discovered below. You then might be asking, “How do those rates compare against the average South Carolina car insurance company rates?” We cover that as well.

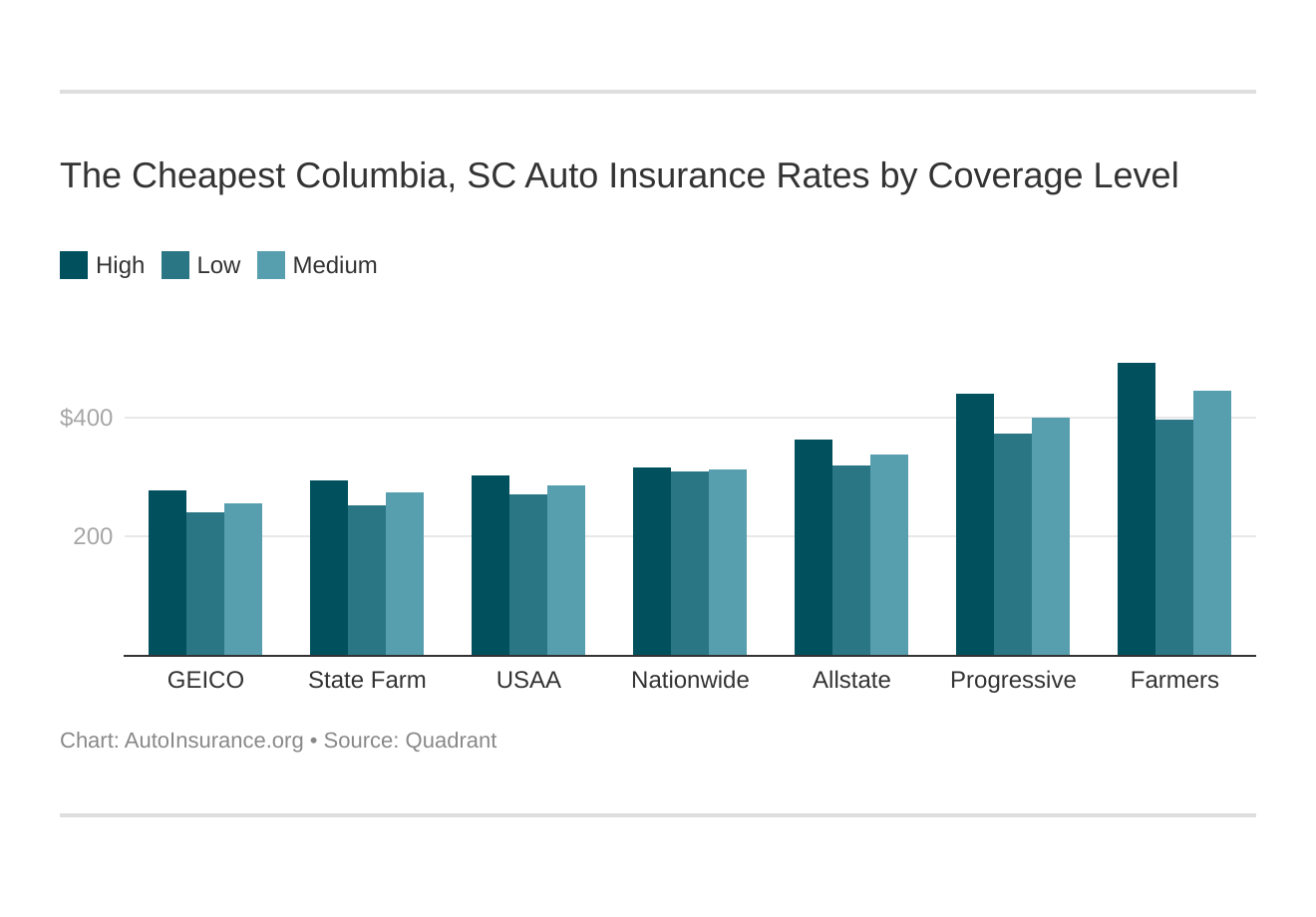

The top Columbia, SC auto insurance companies listed from least to most expensive are:

- Geico – $3,091.82

- State Farm – $3,284.49

- USAA – $3,427.09

- Nationwide – $3,750.87

- Allstate – $4,077.17

- Progressive – $4,845.47

- Farmers – $5,327.46

There are many factors that affect auto insurance rates, such as your age, gender, driving record, and where you live. All of these factors determine your rates so each driver will have different rates.

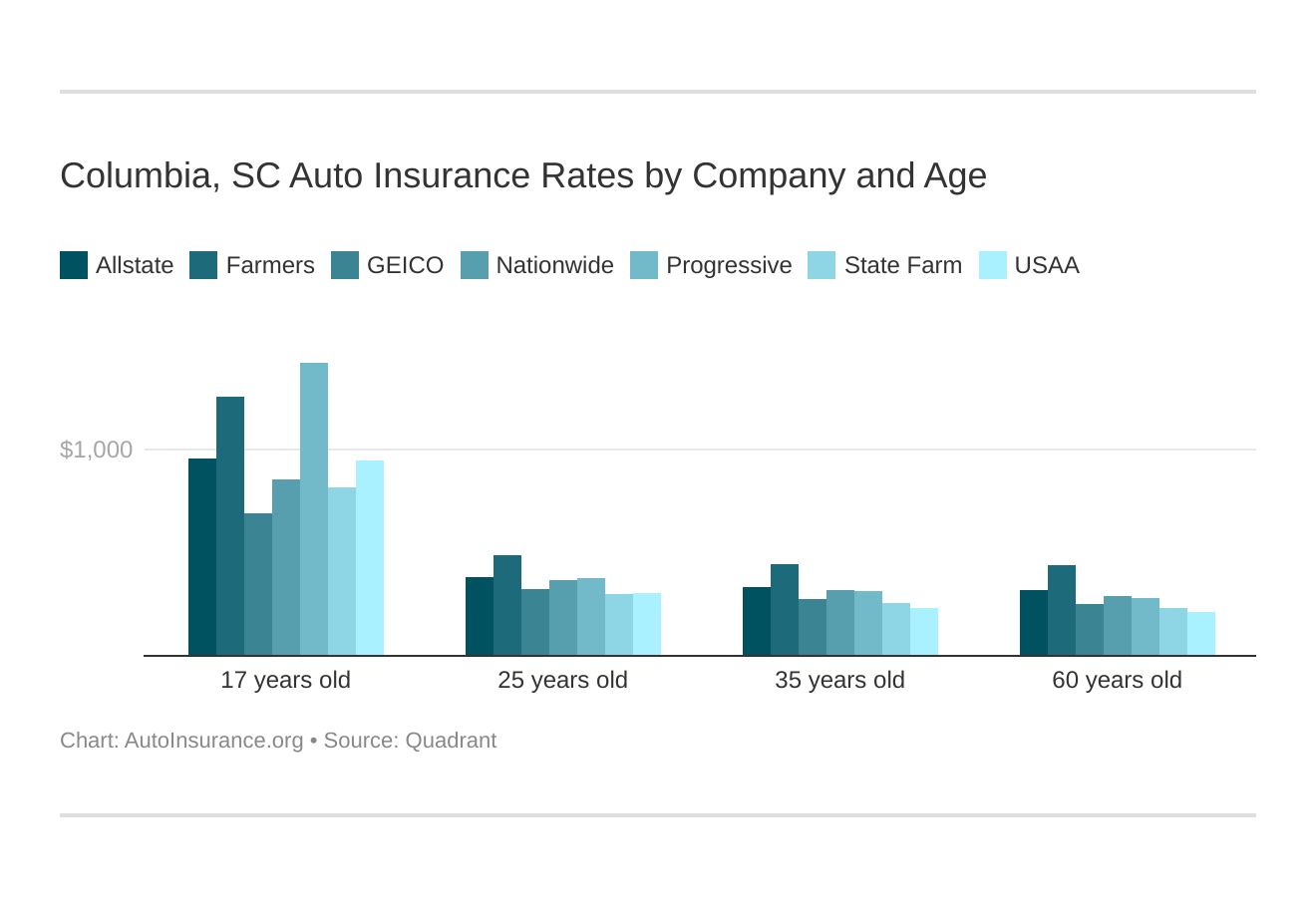

Columbia, South Carolina car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

Your coverage level will play a major role in your Columbia, SC car insurance rates. Find the cheapest Columbia, South Carolina car insurance rates by coverage level below:

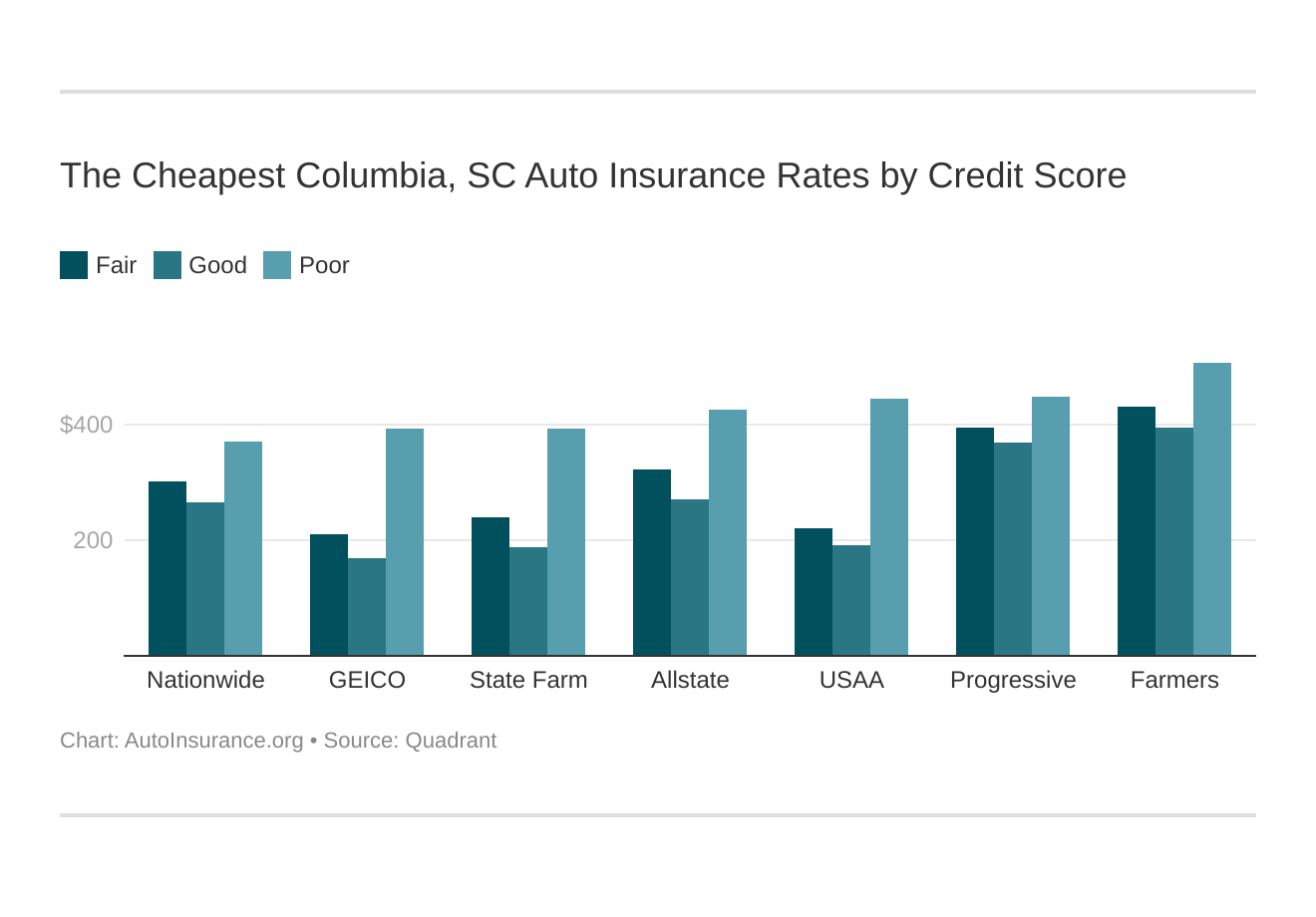

Your credit score will play a major role in your Columbia, SC car insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Columbia, SC car insurance rates by credit score below.

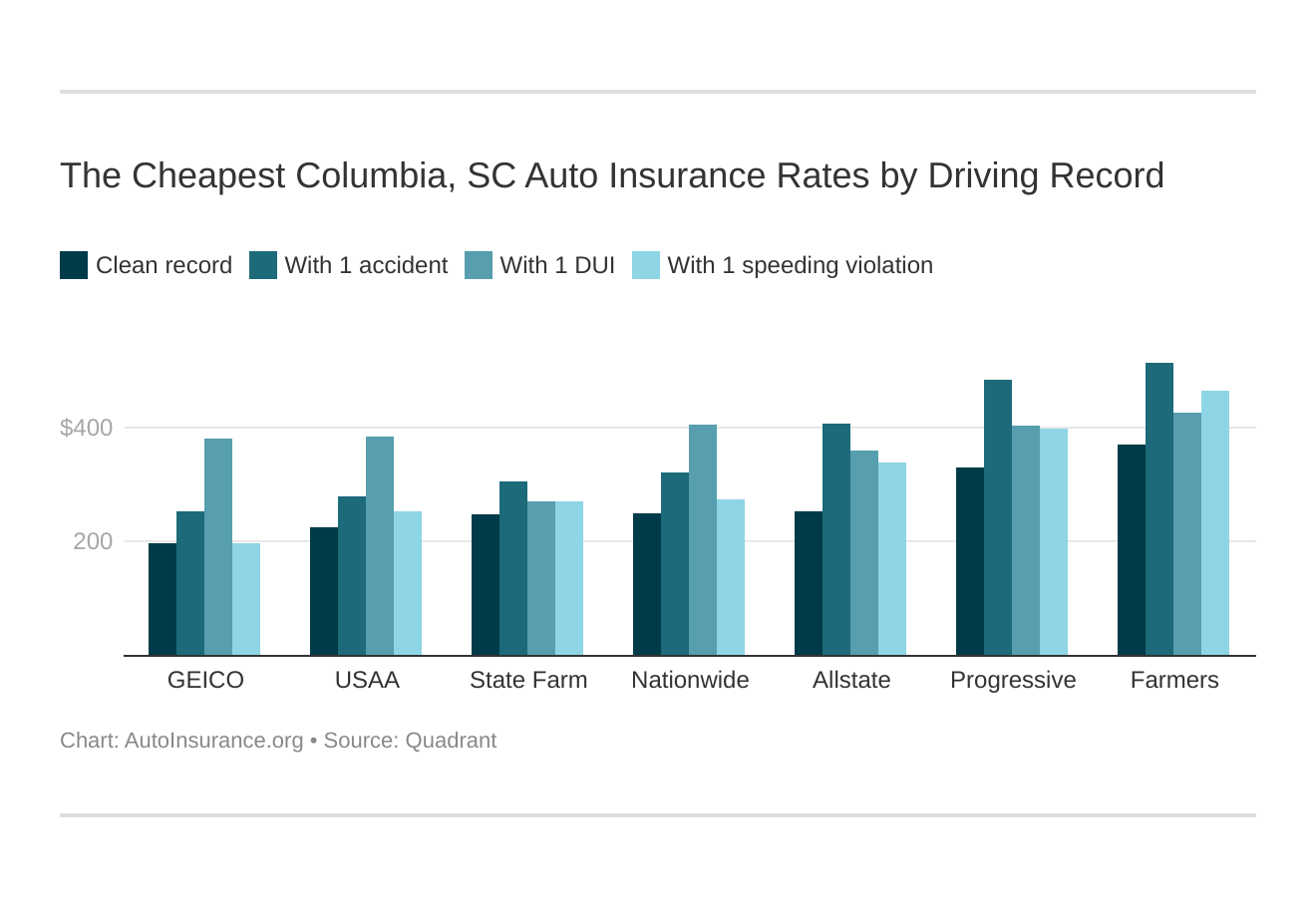

Your driving record will affect your Columbia car insurance rates. For example, a Columbia, South Carolina DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest Columbia, South Carolina car insurance rates by driving record.

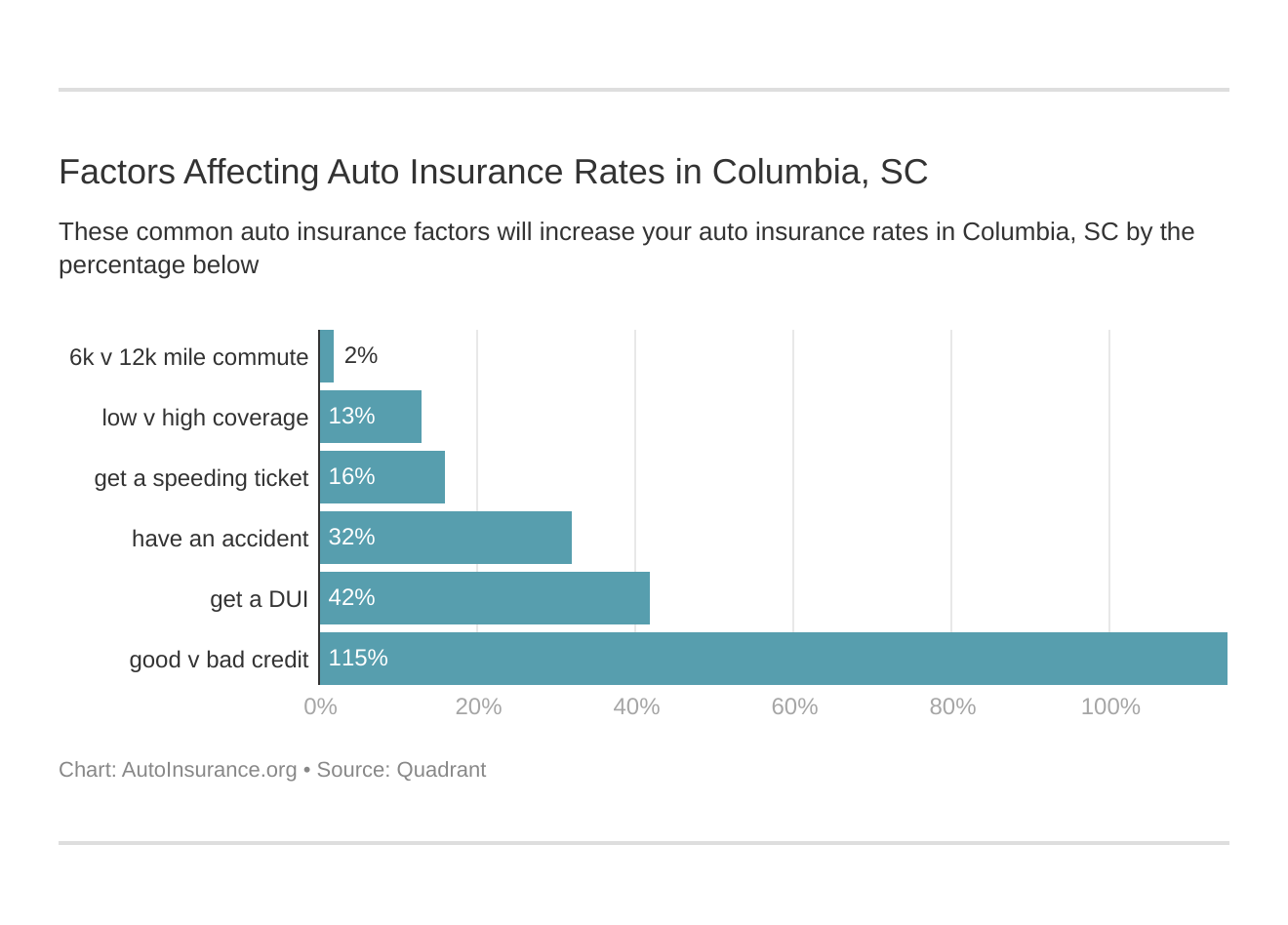

Factors affecting car insurance rates in Columbia, SC may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Columbia, South Carolina car insurance.

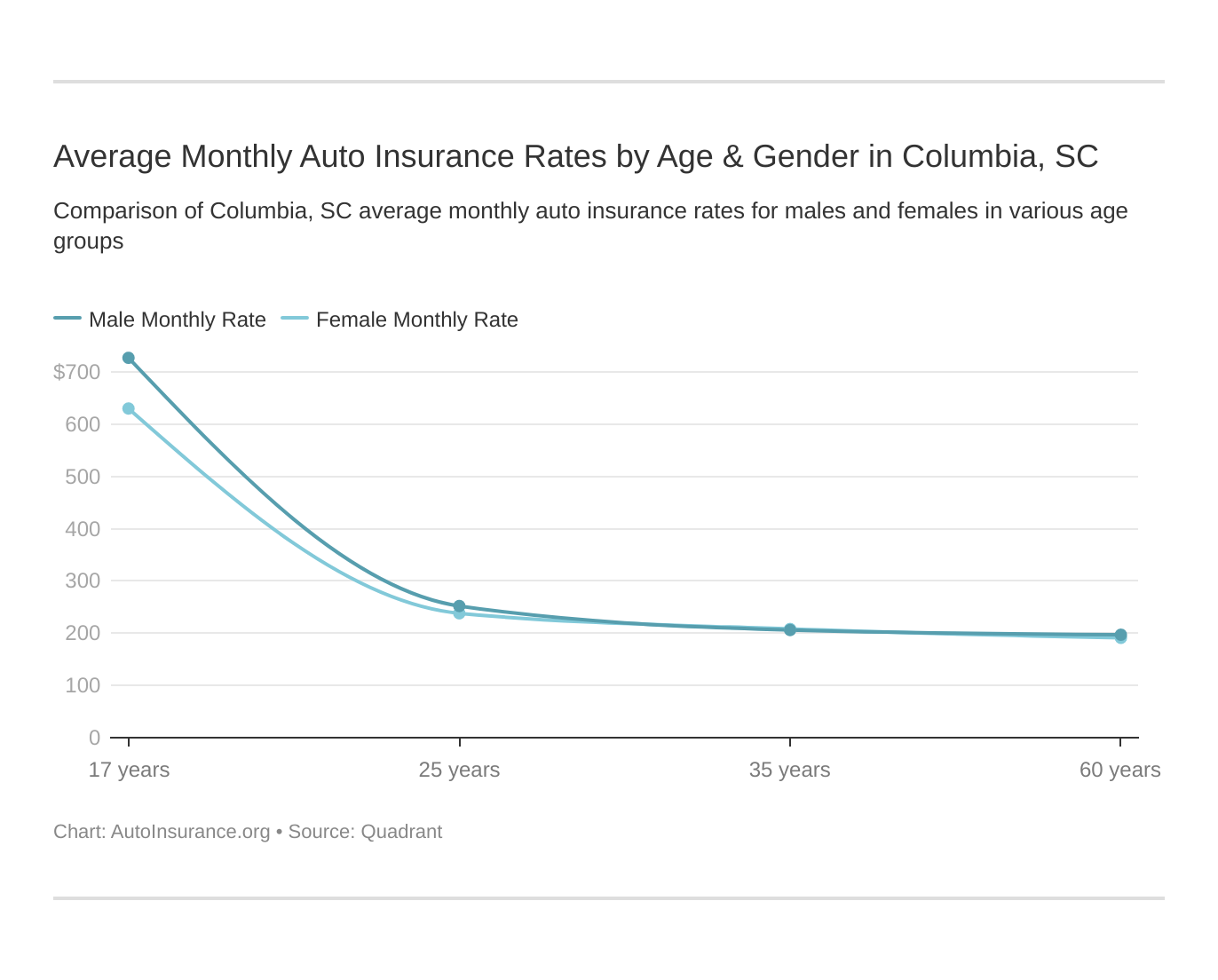

These states no longer use gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a large factor because young drivers are considered high-risk drivers in Columbia. SC does use gender, so check out the average monthly car insurance rates by age and gender in Columbia, SC.

What auto insurance coverage is required in Columbia, SC?

South Carolina requires that drivers carry at least a minimum amount of auto insurance. Columbia drivers must carry at least:

- $25,000 per person and $50,000 per incident for bodily injury liability

- $25,000 per incident for property damage

- $25,000 per incident for uninsured/underinsured motorist property damage coverage

- $25,000 per person and $50,000 per incident for uninsured/underinsured motorist bodily injury coverage

These minimums are very low, and drivers should consider raising these limits and carrying additional coverages. In a serious accident, these low minimums won’t fully cover you, and you’ll be left to pay out of pocket for anything not covered.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What affects auto insurance rates in Columbia, SC?

Traffic affects your auto insurance rates since more cars on the road equal more chances of being in an accident.

INRIX ranks Columbia, SC as the 54th most congested city in the U.S.

City-Data shows that most drivers in Columbia commute about 35 minutes, higher than the national average. Most drivers tend to commute alone, but a large number takes public transit or walks,

Theft can also cause your rates to increase. According to the FBI, there were 791 motor vehicle thefts in one year in Columbia.

Columbia, SC Auto Insurance: The Bottom Line

Columbia car insurance can be expensive, but you can save money by shopping around. Before you buy Columbia, SC auto insurance, compare quotes to see which company can offer you the best deal.

Enter your ZIP code now to compare Columbia, SC auto insurance rates for free near you.

Frequently Asked Questions

How can I save money on Columbia, SC auto insurance

To save money on your Columbia, SC auto insurance, consider the following tips:

- Shop around and compare quotes from different insurance companies to find the best deal.

- Increase your deductible, but make sure you can afford to pay the higher amount out of pocket if needed.

- Maintain a good driving record and avoid traffic violations.

- Consider bundling your auto insurance with other policies, such as homeowners or renters insurance, for potential discounts.

- Inquire about available discounts, such as safe driver discounts, multi-policy discounts, or discounts for certain safety features in your vehicle.

Do I need to notify my insurance company if I move within Columbia, SC?

Yes, it’s important to notify your insurance company if you move to a new address within Columbia, SC. Your premium rates may be affected by your new location, and your insurance company needs accurate information to ensure proper coverage. Failure to update your address may result in issues when filing claims or even potential policy cancellation.

Can I temporarily suspend my Columbia, SC auto insurance coverage if I won’t be using my vehicle for a certain period?

In Columbia, SC, it is typically not possible to suspend your auto insurance coverage for a specific period if you own a registered vehicle. South Carolina requires continuous auto insurance coverage for all registered vehicles, even if they are not being used. If you no longer need coverage, you may consider canceling your policy or exploring other options with your insurance company.

Can I get auto insurance coverage if I have a poor driving record or past accidents in Columbia, SC?

Yes, it is generally possible to get auto insurance coverage in Columbia, SC even if you have a poor driving record or a history of accidents. However, insurance companies may consider you a higher risk and may charge higher premiums. It’s advisable to compare quotes from different insurance companies to find the best rates available to you.

What should I do if my auto insurance rates in Columbia, SC increase significantly?

If you experience a significant increase in your auto insurance rates in Columbia, SC, consider taking the following steps:

- Contact your insurance company and inquire about the reason for the increase.

- Review your policy to ensure that all information is accurate and up to date.

- Shop around and compare quotes from other insurance companies to see if you can find a better rate.

- Consider adjusting your coverage options or increasing your deductible to potentially lower your premiums.

- If you believe the rate increase is unjustified, you can file a complaint with the South Carolina Department of Insurance.

Can I use my Columbia, SC auto insurance coverage when driving in other states?

Yes, your Columbia, SC auto insurance coverage typically extends to other states within the United States. However, it’s always recommended to review your policy or contact your insurance company to confirm the specifics of your coverage when driving in other states.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.