Best Chevrolet Colorado Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

The best Chevrolet Colorado auto insurance is offered by Progressive, State Farm, and Farmers with rates as low as $47 per month. Progressive stands out with competitive rates and reliable coverage, these companies are the top choices for Chevrolet Colorado owners seeking the best insurance options.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated April 2025

Company Facts

Full Coverage for Chevrolet Colorado

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Chevrolet Colorado

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Chevrolet Colorado

A.M. Best

Complaint Level

Pros & Cons

The best Chevrolet Colorado auto insurance are Progressive, State Farm, and Farmers with rates as low as $47 per month, they are known for their comprehensive coverage and competitive rates.

This article explores how these companies provide competitive rates and robust policies, ensuring reliable protection and peace of mind. Whether you’re looking for coverage options, or customer service, these top insurers are worth considering for your Chevrolet Colorado insurance needs. For affordability, read our article titled “Cheap Chevrolet Auto Insurance“.

Our Top 10 Company Picks: Best Chevrolet Colorado Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 12% A+ Flexible Plans Progressive

#2 17% B Local Agents State Farm

#3 10% A Driving Discounts Farmers

#4 25% A+ Drivewise Program Allstate

#5 20% A+ Vanishing Deductible Nationwide

#6 15% A Teen Safe American Family

#7 10% A Comprehensive Coverage Liberty Mutual

#8 13% A++ IntelliDrive App Travelers

#9 10% A+ AARP Benefits The Hartford

#10 10% A++ Military Focused USAA

You can start comparing quotes for Chevrolet Colorado car insurance rates from some of the best car insurance companies by using our free online tool now.

- Comprehensive coverage options specifically tailored for Chevrolet Colorado trucks

- Insurance to address unique risks for Chevrolet Colorado

- Progressive Insurance is our top pick

#1 – Progressive: Top Overall Pick

Pros

- Flexible Plans: As mentioned in our Progressive auto insurance review they offer a variety of flexible plans, making it easy to find coverage that fits the specific needs of Chevrolet Colorado owners.

- Multi-Policy Discount: With a 12% discount for bundling policies, owners of Chevrolet Colorado can save significantly by combining their auto insurance with other types of insurance.

- A.M. Best Rating (A+): Progressive’s strong financial stability ensures that Chevrolet Colorado owners can trust the company to cover claims reliably.

Cons

- Lower Multi-Policy Discount: The 12% multi-policy discount might be less appealing for Chevrolet Colorado owners compared to higher discounts from other insurers.

- Limited Coverage Options: Some Chevrolet Colorado owners may find Progressive’s coverage options less comprehensive compared to other companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Local Agents

Pros

- Local Agents: State Farm’s local agents can provide personalized service and expert advice tailored to Chevrolet Colorado owners.

- Higher Multi-Policy Discount: With a 17% discount for bundling policies, Chevrolet Colorado owners can enjoy substantial savings.

- Driving Discounts: As outlined in our State Farm auto insurance review they offer additional discounts for safe driving, which can be beneficial for Chevrolet Colorado drivers.

Cons

- A.M. Best Rating (B): The lower A.M. Best rating may concern some Chevrolet Colorado owners about the company’s financial stability.

- Discount Availability: The multi-policy discount may not always apply to all types of policies bundled with Chevrolet Colorado insurance.

#3 – Farmers: Best for Driving Discounts

Pros

- Driving Discounts: Farmers offers various discounts for safe driving habits, which can be advantageous for Chevrolet Colorado owners.

- Customizable Coverage: Provides customizable insurance plans that cater to the specific needs of Chevrolet Colorado owners.

- A.M. Best Rating (A): A solid financial rating ensures reliable claim coverage for Chevrolet Colorado drivers.

Cons

- Lower Multi-Policy Discount: The 10% discount might be less attractive for Chevrolet Colorado owners seeking to bundle their insurance.

- Premium Costs: Some Chevrolet Colorado owners might find Farmers’ premiums higher compared to other insurers.

#4 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: Allstate’s Drivewise program rewards safe driving habits with potential discounts, beneficial for Chevrolet Colorado owners.

- High Multi-Policy Discount: The 25% discount for bundling policies can lead to significant savings for Chevrolet Colorado owners.

- A.M. Best Rating (A+): Strong financial stability ensures dependable coverage for Chevrolet Colorado drivers.

Cons

- Drivewise Participation: Chevrolet Colorado owners might be concerned about the privacy implications of sharing driving data with Allstate.

- Higher Premiums: As mentioned in our Allstate auto insurance review, despite discounts, Allstate’s premiums might be higher for Chevrolet Colorado owners compared to other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s vanishing deductible feature rewards safe driving, which can benefit Chevrolet Colorado owners.

- Multi-Policy Discount: The 20% discount for bundling policies offers considerable savings for Chevrolet Colorado drivers.

- A.M. Best Rating (A+): High financial stability rating assures reliable coverage for Chevrolet Colorado owners. For more information, read our Nationwide auto insurance review.

Cons

- Vanishing Deductible Eligibility: The requirements for the vanishing deductible might not suit all Chevrolet Colorado drivers.

- Customer Service: Some Chevrolet Colorado owners might find Nationwide’s customer service lacking compared to other providers.

#6 – American Family: Best for Teen Safe

Pros

- Teen Safe Program: American Family’s Teen Safe program promotes safe driving among young Chevrolet Colorado drivers.

- Multi-Policy Discount: Offers a 15% discount for bundling policies, providing savings for Chevrolet Colorado owners.

- A.M. Best Rating (A): Good financial stability ensures reliable claims processing for Chevrolet Colorado drivers (Read More: American Family Auto Insurance Review).

Cons

- Program Availability: Specialized programs like Teen Safe may not be available in all regions for Chevrolet Colorado owners.

- Limited Coverage Options: Chevrolet Colorado drivers might find fewer additional coverage options compared to larger insurers.

#7 – Liberty Mutual: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Liberty Mutual offers extensive coverage options to meet the diverse needs of Chevrolet Colorado owners.

- Multi-Policy Discount: Provides a 10% discount for bundling policies, offering savings for Chevrolet Colorado drivers.

- A.M. Best Rating (A): As mentioned in our Liberty Mutual auto insurance review, they have solid financial rating ensures reliable coverage for Chevrolet Colorado owners.

Cons

- Lower Multi-Policy Discount: The 10% discount might be less attractive for Chevrolet Colorado owners compared to other insurers.

- Premium Costs: Some Chevrolet Colorado drivers might find Liberty Mutual’s premiums higher compared to competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for IntelliDrive App

Pros

- IntelliDrive App: Travelers’ IntelliDrive app monitors driving habits, potentially rewarding Chevrolet Colorado owners with discounts for safe driving.

- Multi-Policy Discount: Offers a 13% discount for bundling policies, providing savings for Chevrolet Colorado drivers.

- A.M. Best Rating (A++): Superior financial stability ensures dependable coverage for Chevrolet Colorado owners.

Cons

- App Intrusiveness: Chevrolet Colorado drivers might find the IntelliDrive app intrusive or challenging to use.

- Coverage Options: As outlined in our Travelers auto insurance review, they have limited additional coverage options compared to some competitors might affect Chevrolet Colorado owners.

#9 – The Hartford: Best for AARP Benefits

Pros

- AARP Benefits: The Hartford offers benefits tailored to AARP members, including discounts and specialized programs for Chevrolet Colorado owners.

- Multi-Policy Discount: Provides a 10% discount for bundling policies, offering savings for Chevrolet Colorado drivers.

- A.M. Best Rating (A+): Strong financial stability ensures reliable coverage for Chevrolet Colorado owners.

Cons

- Limited Demographic: Specialized benefits like AARP discounts may only apply to older Chevrolet Colorado drivers. Learn more in our The Hartford auto insurance review.

- Customer Support: Some Chevrolet Colorado owners might find The Hartford’s customer support less robust compared to larger insurers.

#10 – USAA: Best for Military Focused

Pros

- Military Focus: USAA provides specialized services and discounts tailored to military members and their families, beneficial for Chevrolet Colorado owners with military connections.

- Multi-Policy Discount: Offers a 10% discount for bundling policies, providing savings for Chevrolet Colorado drivers.

- A.M. Best Rating (A++): Superior financial stability ensures reliable coverage for Chevrolet Colorado owners.

Cons

- Membership Restrictions: USAA is only available to current and former military members and their families, limiting accessibility for other Chevrolet Colorado owners.

- Coverage Limitations: As mentioned in our USAA auto insurance review, Coverage options may be restricted based on military status and location, affecting some Chevrolet Colorado drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chevrolet Colorado Insurance Cost

Understanding the monthly rates for Chevrolet Colorado insurance can help you choose the best provider and coverage level to suit your needs. Here’s a breakdown of the costs from various insurance companies:

Chevrolet Colorado Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$87 $228

$62 $166

$76 $198

$96 $248

$63 $164

$56 $150

$47 $123

$61 $164

$53 $141

$32 $84

The rates for minimum coverage vary, with USAA offering the lowest rate at $50 per month, making it an attractive option for those looking to save on insurance costs. Full coverage auto insurance, which includes comprehensive and collision coverage providing broader protection for your vehicle, sees USAA again offering the lowest rate at $125 per month, followed closely by State Farm at $130 per month.

When selecting the best insurance company and coverage level, consider your budget, coverage needs, provider reputation, and available discounts. Determine how much you are willing to spend on insurance monthly; minimum coverage is cheaper but offers less protection.

Evaluate your driving habits and the value of your Chevrolet Colorado to decide if full coverage is necessary. Research the customer service and claims handling reputation of each provider to ensure a smooth experience if you need to file a claim.

look for any discounts you may be eligible for, such as safe driver discounts, multi-policy discounts, or military discounts.Daniel Walker LICENSED AUTO INSURANCE AGENT

By comparing the rates and considering these factors, you can ensure that you get the best protection for your Chevrolet Colorado at a price that fits your budget. Start by comparing rates using the table above and narrowing down your options.

Are Chevrolet Colorados Expensive to Insure

The chart below details how Chevrolet Colorado insurance rates compare to other trucks like the Chevrolet Silverado, Toyota Tacoma, and GMC Sierra 2500HD.

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Chevrolet Colorado | $21 | $37 | $31 | $102 |

| Chevrolet Silverado | $27 | $47 | $35 | $124 |

| Toyota Tacoma | $25 | $40 | $33 | $110 |

| GMC Sierra 2500HD | $28 | $55 | $35 | $133 |

| Dodge Ram | $30 | $47 | $35 | $127 |

| Chevrolet Silverado 2500HD | $30 | $57 | $35 | $138 |

| Ford Ranger | $21 | $39 | $31 | $105 |

The Honda CR-V’s lower loss probabilities across various coverage types indicate it is a cost-effective choice for insurance. Its strong performance in minimizing losses can help drivers secure better rates.

Read More: GMC Auto Insurance

What Impacts the Cost of Chevrolet Colorado Insurance

The Chevrolet Colorado trim and model you choose can impact the total price you will pay for Chevrolet Colorado insurance coverage.

Age of the Vehicle

Older Chevrolet Colorado models generally cost less to insure. For example, auto insurance for a 2020 Chevrolet Colorado costs more compared to a 2010 model due to depreciation.

Chevrolet Colorado Auto Insurance Monthly Rates by Coverage Type

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Chevrolet Colorado | $23 | $40 | $37 | $110 |

| 2023 Chevrolet Colorado | $21 | $37 | $31 | $102 |

| 2022 Chevrolet Colorado | $20 | $35 | $33 | $101 |

| 2021 Chevrolet Colorado | $19 | $35 | $33 | $101 |

| 2020 Chevrolet Colorado | $19 | $34 | $35 | $101 |

| 2019 Chevrolet Colorado | $18 | $33 | $36 | $100 |

| 2018 Chevrolet Colorado | $17 | $32 | $37 | $99 |

| 2017 Chevrolet Colorado | $15 | $25 | $38 | $91 |

When insuring a Chevrolet Colorado, the vehicle’s age significantly impacts insurance costs, with older models generally offering more affordable rates.

Driver Age

Driver age can significantly affect the cost of Chevrolet Colorado car insurance. For instance, a 20-year-old driver typically pays much more for their insurance than a 30-year-old driver.

Chevrolet Colorado Auto Insurance Monthly Rates by Age

| Age | Monthly Rates |

|---|---|

| Age: 18 | $656 |

| Age: 20 | $225 |

| Age: 30 | $191 |

| Age: 40 | $178 |

| Age: 50 | $157 |

| Age: 60 | $152 |

Younger drivers tend to pay higher insurance rates for a Chevrolet Colorado, with costs generally decreasing as drivers age.

Driver Location

Your location can greatly influence Chevrolet Colorado insurance rates. For example, drivers in New York may pay significantly more than drivers in Seattle due to factors like traffic density and local accident statistics.

Chevrolet Colorado Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $230 |

| Columbus, OH | $200 |

| Houston, TX | $250 |

| Indianapolis, IN | $220 |

| Jacksonville, FL | $240 |

| Los Angeles, CA | $270 |

| New York, NY | $290 |

| Philadelphia, PA | $260 |

| Phoenix, AZ | $230 |

| Seattle, WA | $220 |

Urban areas typically have higher rates due to factors like higher traffic, increased likelihood of accidents, and higher repair costs. Meanwhile, suburban or rural areas often enjoy lower rates due to less traffic and fewer accidents.

Your Driving Record

Your driving record can have an impact on the cost of Chevrolet Colorado car insurance. Teens and drivers in their 20’s see the highest jump in their Chevrolet Colorado car insurance rates with violations on their driving record.

Chevrolet Colorado Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 18 | $448 | $560 | $720 | $530 |

| Age: 20 | $385 | $480 | $615 | $455 |

| Age: 30 | $210 | $260 | $335 | $245 |

| Age: 40 | $190 | $235 | $300 | $220 |

| Age: 50 | $175 | $215 | $275 | $205 |

| Age: 60 | $160 | $200 | $255 | $190 |

Maintaining a clean driving record is crucial for keeping insurance costs down. Violations such as accidents, DUIs, or tickets can result in significantly higher premiums, especially for younger drivers. It’s essential to drive safely and adhere to traffic laws to avoid these financial penalties.

Learn More: Cheapest Teen Driver Auto Insurance in Colorado

Safety Ratings

Your Chevrolet Colorado car insurance rates are tied to the vehicle’s safety ratings. High safety ratings can lead to lower insurance premiums as they indicate a reduced risk of injury and damage in the event of an accident.

Chevrolet Colorado Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Marginal |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Chevrolet Colorado’s strong safety ratings in most categories can positively impact insurance rates. Insurers often offer lower premiums for vehicles that perform well in safety tests, as they are considered less risky to insure.

Crash Test Ratings

Chevrolet Colorado crash test ratings can also impact the cost of your car insurance. Higher crash test ratings typically translate to lower insurance premiums due to the increased safety of the vehicle. See Chevrolet Colorado crash test results below:

Chevrolet Colorado Crash Test Ratings

| Vehicle | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| Chevrolet Colorado | 4 stars | 4 stars | 5 stars | 3 stars |

| Chevrolet Colorado | 4 stars | 4 stars | 5 stars | 3 stars |

| Chevrolet Colorado | 4 stars | 4 stars | 5 stars | 3 stars |

| Chevrolet Colorado | 4 stars | 4 stars | 5 stars | 3 stars |

| Chevrolet Colorado | 4 stars | 4 stars | 5 stars | 3 stars |

The consistent crash test ratings of the Chevrolet Colorado demonstrate its reliability in protecting occupants during collisions. This reliability can lead to more favorable insurance rates, as insurers recognize the reduced risk associated with vehicles that have strong crash test performance.

Chevrolet Colorado Safety Features

The Chevrolet Colorado is equipped with a comprehensive suite of safety features designed to protect passengers and potentially lower insurance costs. According to AutoBlog, the 2020 Chevrolet Colorado includes driver and passenger airbags, front and rear head airbags, and front side airbags to provide extensive protection in the event of a collision.

The vehicle also features 4-wheel ABS and 4-wheel disc brakes, ensuring optimal stopping power and control. Electronic stability control and traction control help maintain vehicle stability and prevent skidding, especially in challenging driving conditions.

Additionally, the daytime running lights enhance visibility, making the vehicle more noticeable to other drivers. These advanced safety features collectively contribute to making the Chevrolet Colorado a safer vehicle, which can result in lower insurance premiums.

Loss Probability

The lower percentage means lower Chevrolet Colorado auto insurance rates; higher percentages mean higher Chevrolet Colorado car insurance rates. The Chevrolet Colorado’s insurance loss probability varies for each form of coverage.

Chevrolet Colorado Auto Insurance Loss Probability

| Coverage | Loss |

|---|---|

| Collision | -27% |

| Property Damage | -43% |

| Comprehensive | -36% |

Lower insurance loss probabilities for collision, property damage, and comprehensive coverage suggest that it is less likely to incur high insurance claims. This can lead to lower insurance rates for these coverages, making the Chevrolet Colorado a cost-effective choice for insuring.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chevrolet Colorado Finance and Insurance Cost

If you are financing a Chevrolet Colorado, you will pay more if you purchase Chevrolet Colorado car insurance at the dealership, so be sure to shop around and compare Chevrolet Colorado car insurance quotes from the best companies. To find out more, explore our guide titled “Where to Buy Auto Insurance Online.”

Ways to Save on Chevrolet Colorado Insurance

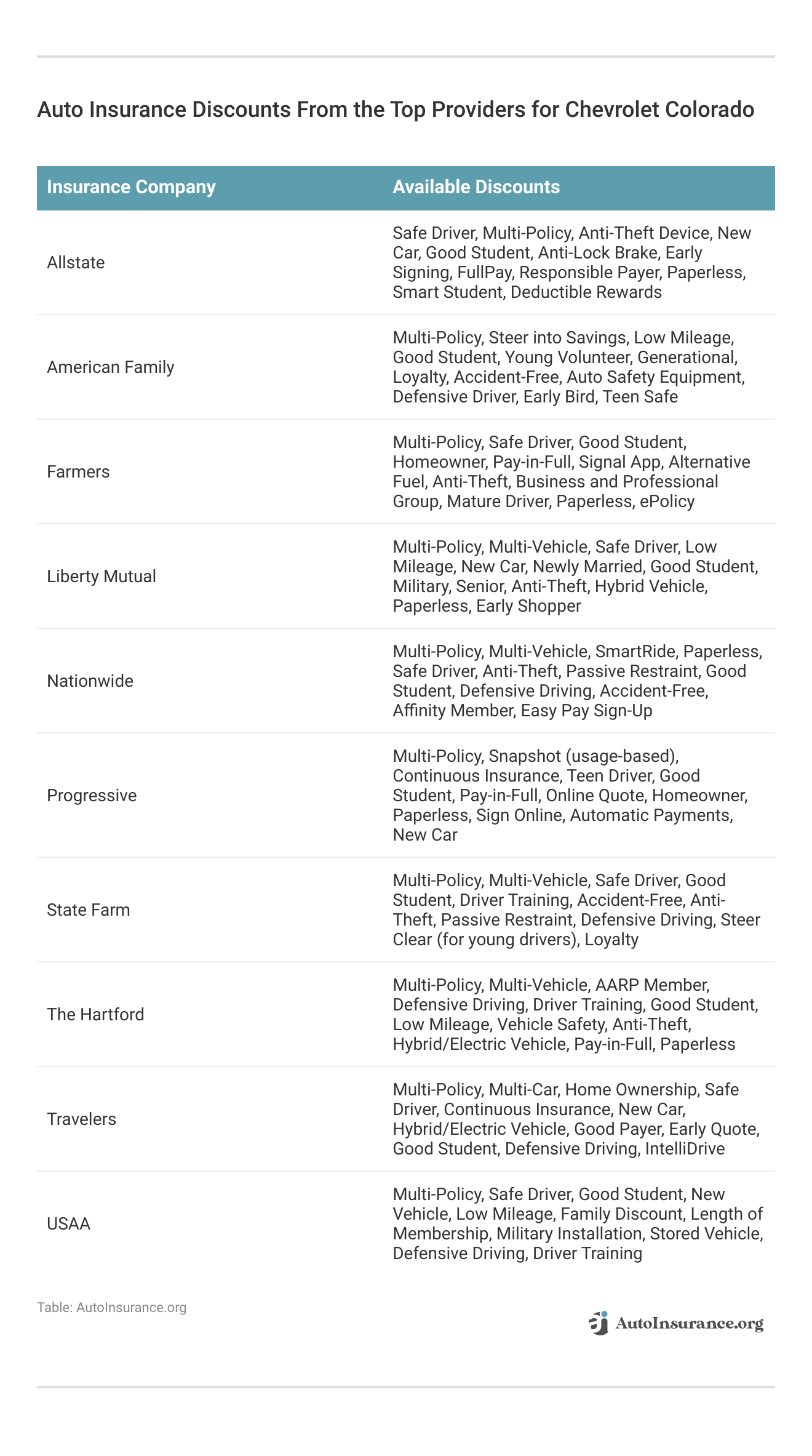

There are numerous ways to save money on your Chevrolet Colorado car insurance. Here are some discounts offered by top insurance providers:

Bundle your Chevrolet Colorado auto insurance with home insurance for potential savings. Understand the different Types of Auto Insurance insurance available for your Chevrolet Colorado to ensure you are getting the best coverage at the best rate.

Top Chevrolet Colorado Insurance Companies

Who are the best auto insurance companies for Chevrolet Colorado insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Chevrolet Colorado auto insurance coverage (ordered by market share).

Top 10 Chevrolet Colorado Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65,615,190 | 9.30% |

| #2 | Geico | $46,106,971 | 6.60% |

| #3 | Progressive | $39,222,879 | 5.60% |

| #4 | Liberty Mutual | $35,600,051 | 5.10% |

| #5 | Allstate | $35,025,903 | 5.00% |

| #6 | Travelers | $28,016,966 | 4.00% |

| #7 | USAA | $23,483,080 | 3.30% |

| #8 | Chubb | $23,388,385 | 3.30% |

| #9 | Farmers | $20,643,559 | 2.90% |

| #10 | Nationwide | $18,442,145 | 2.60% |

Many of these companies offer discounts for security systems and other safety features that the Chevrolet Colorado offers. Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Frequently Asked Questions

How much does Chevrolet Colorado insurance coverage cost on average?

The cost of Chevrolet Colorado insurance varies based on factors like driving record, location, and coverage options. It’s important to compare quotes from multiple providers to find the best rate.

What factors can impact the cost of Chevrolet Colorado insurance?

Several factors can affect the cost, including the driver’s age, driving record, location, and the vehicle’s age and safety features. Additionally, the chosen coverage levels and deductibles will influence the overall premium.

Find cheap auto insurance quotes by entering your ZIP code below.

What are some tips to save on Chevrolet Colorado insurance?

Consider bundling policies, maintaining a clean driving record, and exploring available discounts with your insurance provider. Regularly reviewing and updating your coverage can also help ensure you’re getting the best deal.

For additional details, explore our comprehensive resource titled “Cheapest Auto Insurance Companies” for more information.

How do Chevrolet Colorado safety ratings impact insurance costs?

Higher safety ratings can lead to lower insurance rates as they indicate a reduced risk of injury and damage in the event of an accident. Insurance companies often offer discounts for vehicles with high safety ratings.

Are Chevrolet Colorados expensive to insure?

Chevrolet Colorado insurance rates are generally competitive compared to other trucks, making them a cost-effective choice for many drivers. However, rates can vary significantly based on individual circumstances.

How does driver age impact Chevrolet Colorado insurance costs?

Younger drivers typically pay higher insurance rates, while costs generally decrease as drivers age. Mature drivers with more experience on the road are often seen as lower risk by insurers.

To learn more, explore our comprehensive resource on insurance titled “Best Auto Insurance for New Drivers” for further details.

Does the age of the Chevrolet Colorado affect insurance rates?

Yes, older models generally cost less to insure due to depreciation and lower replacement costs. As a vehicle ages, the potential payout for insurers decreases, leading to lower premiums.

What safety features of the Chevrolet Colorado can help reduce insurance costs?

Features like airbags, ABS, electronic stability control, and traction control can contribute to lower insurance premiums by enhancing vehicle safety. Insurers often provide discounts for vehicles equipped with advanced safety features (Read more: Why You Should Take a Defensive Driving Class).

Can location affect Chevrolet Colorado insurance rates?

Yes, urban areas usually have higher rates due to factors like higher traffic and accident rates, while suburban or rural areas often enjoy lower rates. The risk of theft and vandalism in different areas can also impact rates.

How does driving history influence Chevrolet Colorado insurance premiums?

A clean driving record can help keep insurance costs down, while violations such as accidents, DUIs, or tickets can result in significantly higher premiums. Maintaining a good driving history is key to affordable insurance.

Ready to find affordable auto insurance? Get started today by entering your ZIP code below into our free comparison tool.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.