10 Cheapest Auto Insurance Companies in 2026 (Save Money With These Providers!)

The cheapest auto insurance companies are Erie, Auto-Owners, and Travelers. Erie offers the lowest rate at $32 per month. Erie provides accident forgiveness, Auto-Owners excels in policy customization, and Travelers offers broad coverage. Compare rates to get the best low-cost policy.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated February 2026

1,883 reviews

1,883 reviewsCompany Facts

Minimum Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 563 reviews

563 reviewsCompany Facts

Minimum Coverage

A.M. Best

Complaint Level

Pros & Cons

563 reviews

563 reviews 1,734 reviews

1,734 reviewsCompany Facts

Minimum Coverage

A.M. Best

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviewsErie, Auto-Owners, and Travelers are the cheapest auto insurance companies, with Erie as the top pick for its accident forgiveness and policy perks.

Our Top 10 Picks: Cheapest Auto Insurance Companies

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $32 | A+ | Personalized Policies | Erie |

| #2 | $47 | A++ | Add Ons | Auto-Owners | |

| #2 | $53 | A++ | Coverage Options | Travelers | |

| #4 | $61 | A+ | Tailored Policies | The Hartford |

| #5 | $62 | A | Claims Service | American Family | |

| #6 | $63 | A+ | Multi-Policy Savings | Nationwide |

| #7 | $65 | A | Roadside Assistance | AAA |

| #8 | $76 | A | Safe-Driving Discounts | Farmers | |

| #9 | $77 | A | High-Risk Coverage | The General | |

| #10 | $96 | A | Customized Coverage | Liberty Mutual |

Auto-Owners stands out for its various insurance alternatives, which cater to a broader range of driver demands, whereas Travelers shines in terms of coverage options.

Each insurer provides various perks, but the best option is determined by factors such as driving history and geography. Learn more about why auto insurance rates vary so much.

- Erie is the top pick for affordable auto insurance with valuable policy perks

- Rates depend on factors like driving record, location, and coverage type

- Comparing multiple quotes helps secure the cheapest auto insurance available

That said, while prices may vary depending on the individual, it’s good to know which companies have a reputation for offering affordable rates. Find cheap auto insurance coverage today using our free quote comparison tool.

Finding The Cheapest Auto Insurance Rates for You

Car insurance rates depend on various factors — location, driving history, credit score, and more — so some insurance companies may be cheaper for certain drivers than others.

Your driving record, location, and coverage type impact your rates. In particular, maintaining a clean record can significantly lower your premium.Kristen Gryglik Licensed Insurance Agent

We’ve grouped auto insurance companies by which is cheapest for various categories, so you can easily find which company is cheapest for your own needs and profile.

Read More: Geico Auto Insurance Review

Below, we’ll detail each category so you can learn more about why each company is the cheapest for certain drivers.

Cheapest Auto Insurance Overall

This table ranks the cheapest auto insurance companies based on minimum and full coverage costs. Erie leads with $32 for minimum and $83 for full coverage, followed by Auto-Owners at $47 and $124.

Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $62 | $166 | |

| $47 | $124 | |

| $32 | $83 |

| $76 | $198 | |

| $96 | $248 |

| $63 | $164 |

| $77 | $331 | |

| $61 | $161 |

| $53 | $141 |

Travelers offers a $53 minimum and $141 for full coverage, while Liberty Mutual charges the highest at $96 and $248.

Liability-only auto insurance policies, which typically include a combination of bodily injury liability coverage and property damage liability coverage, are often the bare minimum coverage required by the state and are the cheapest options.

However, if you have a high-value car, lease or finance your car, or just want more peace of mind, then you may want to get a more comprehensive insurance policy. Of course, the added protection comes at a higher cost (Read More: Comprehensive Auto Insurance).

Cheapest Auto Insurance Companies for Drivers with a Traffic Ticket

Drivers with a traffic ticket face higher insurance rates, but some providers remain affordable. Erie offers the lowest rates at $32 for minimum coverage and $100 for full coverage. Auto-Owners and Travelers also provide competitive pricing under $55. Higher-risk insurers like The General charge nearly four times as much for full coverage.

Auto Insurance Monthly Rates After a Ticket

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $154 |

| $62 | $194 | |

| $47 | $150 | |

| $32 | $100 |

| $76 | $247 | |

| $96 | $302 |

| $63 | $196 |

| $77 | $396 | |

| $61 | $194 |

| $53 | $192 |

Traffic tickets not only carry a small fine, but they can have a significant impact on car insurance rates. When you receive a traffic ticket, it typically means you’ve violated a traffic law or regulation, which can be seen by insurance companies as an increased risk.

On average, the cost of auto insurance can increase anywhere from $125 to $330 more per year after getting a traffic ticket.

To learn more about how tickets can impact your insurance and how to lower your premiums after getting one, see our article “How does a speeding ticket affect auto insurance rates?”

Read More: Clearcover Auto Insurance Review

Cheapest Auto Insurance Companies After a Car Accident

Your car insurance rates will increase if you get in a car accident and you are found to be at fault. Your car insurance rates can increase anywhere from $250 to $640 annually, depending on the type of car insurance policy that you have.

Maintaining a good, safe driving record is one of the best things you can do to keep your auto insurance premiums low. Erie is the cheapest insurance company for drivers with an accident on their record, offering coverage as low as $45 per month. Take a look at the other insurance companies with reasonable rates below.

Auto Insurance Monthly Rates After an Accident

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $71 | $189 |

| $94 | $251 | |

| $69 | $182 | |

| $45 | $118 |

| $109 | $282 | |

| $129 | $335 |

| $88 | $230 |

| $179 | $467 | |

| $89 | $235 |

| $76 | $199 | |

| U.S. Average | $91 | $244 |

Accidents won’t stay on your driving record forever. If you are able to maintain a safe driving record, then the accident will eventually fall off of your record, and you will be able to get cheaper insurance again. For more details, read our article titled “How long does an accident stay on your record?”

The best auto insurance companies for high-risk drivers may offer discounts for completing an approved defensive driving program. You may also want to consider raising your deductible to lower your premium.

Cheapest Auto Insurance Companies After a DUI

A DUI on a record automatically means higher insurance rates. However, there are still options to find cheaper auto insurance coverage. Usually, regional insurance companies compete with each other to offer affordable auto insurance rates for drivers with a DUI.

Auto Insurance Monthly Rates After a DUI

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $81 | $211 |

| $104 | $276 | |

| $72 | $185 | |

| $60 | $153 |

| $105 | $275 | |

| $178 | $447 |

| $129 | $338 |

| $237 | $607 | |

| $93 | $239 |

| $112 | $294 | |

| U.S. Average | $112 | $295 |

Generally, these regional companies have lower overhead costs than big insurance companies and can help their customers save. Compare multiple companies to find the most affordable auto insurance quotes.

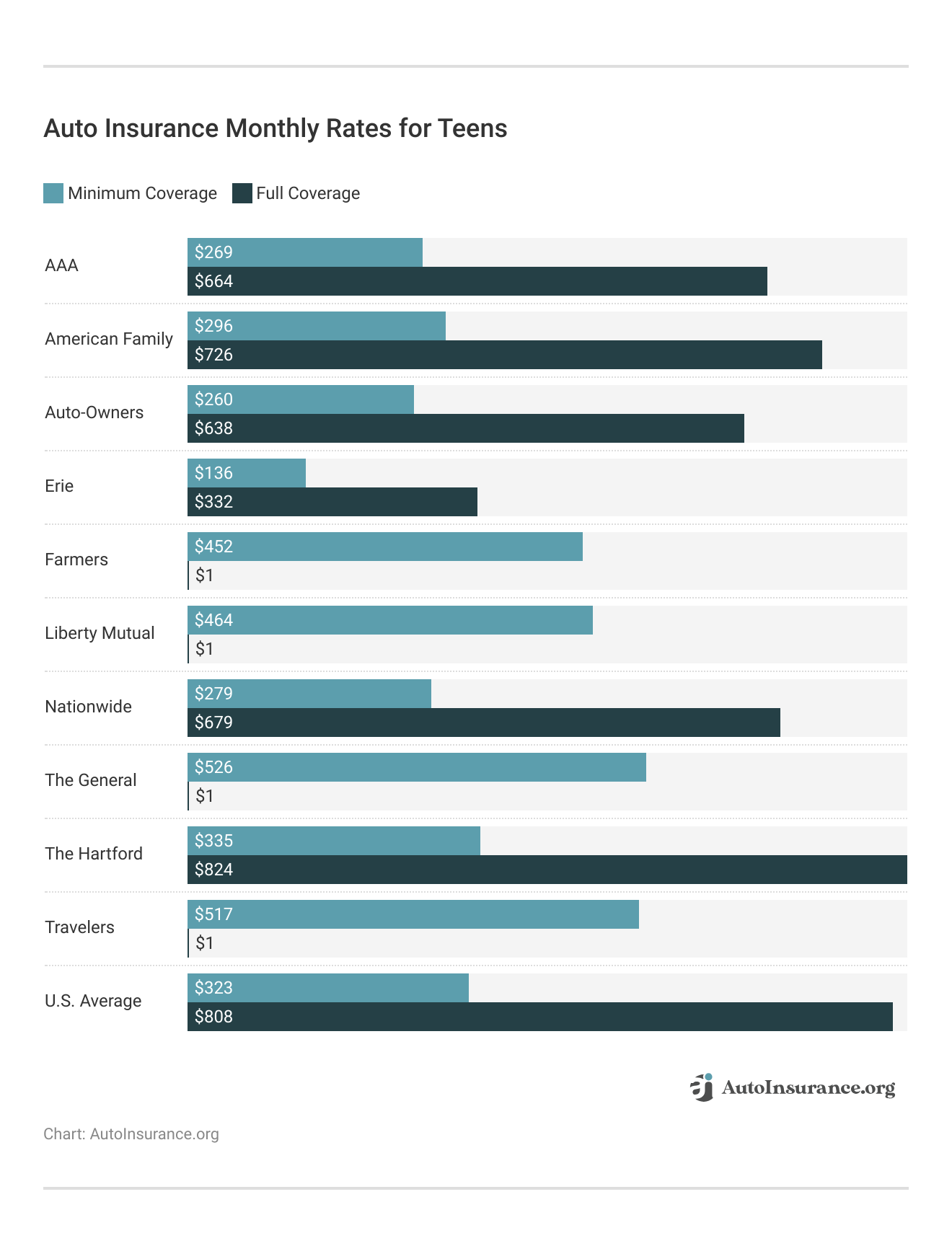

Cheapest Auto Insurance Companies for Teens

For most teen drivers, the cheapest option for insurance is for the teen to stay on their parents’ auto insurance policy. Erie offers the cheapest teen auto insurance, purchasing their own policy and offering rates as low as $136 per month.

Statistically, teenage males are more likely to get into crashes and file claims. They’re also more likely to participate in risk-taking behaviors like speeding or not wearing a seatbelt.

In states where insurers can consider gender when setting rates, teenage males have higher rates than teenage female drivers. However, teenage males can reduce their rates by keeping a clean driving record and participating in safe driving programs.

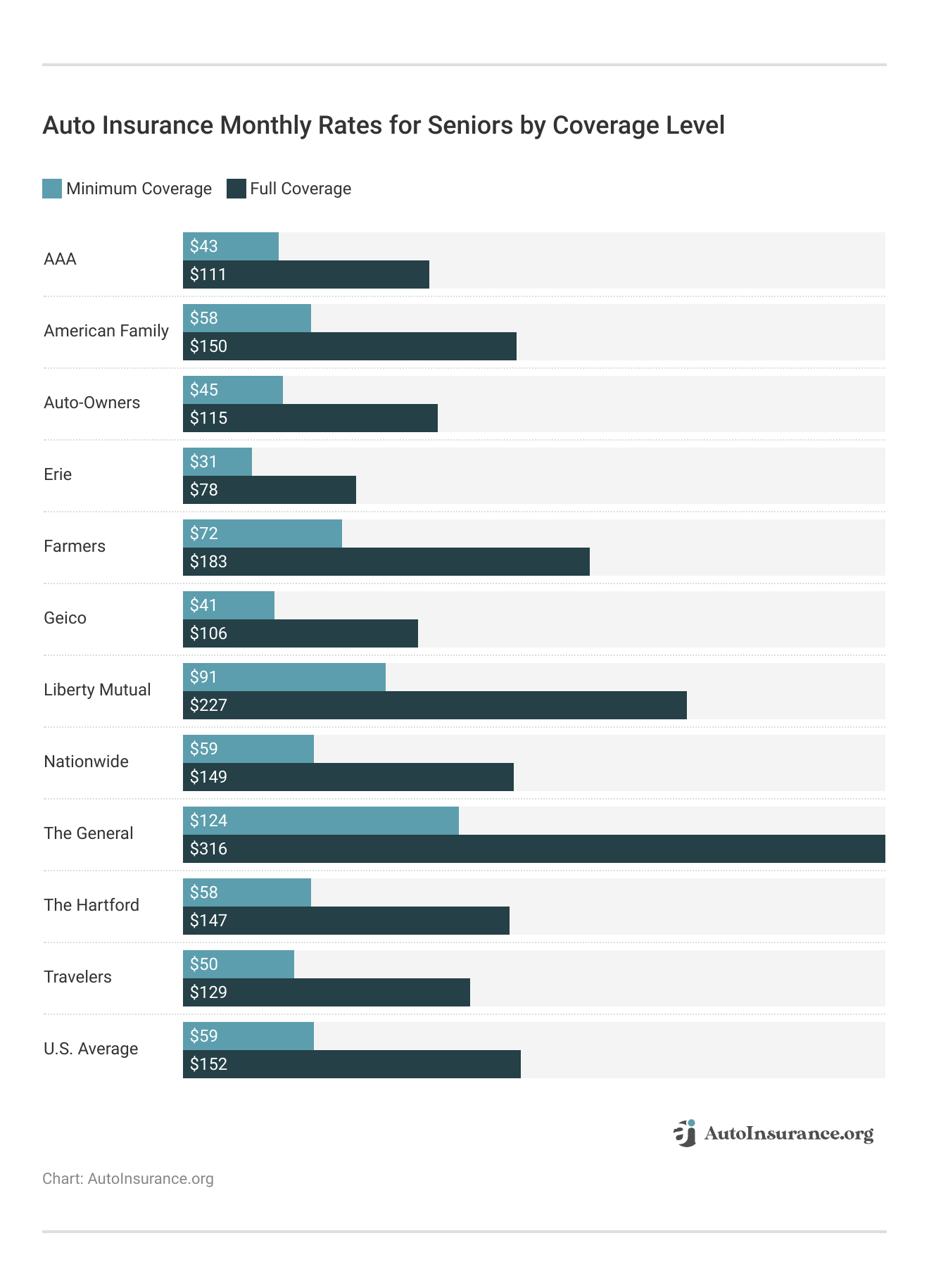

Cheap Auto Insurance Companies for Seniors

Senior drivers may see their rates slowly increase as they age since insurance companies view them as higher risk due to age-related factors like slowing reflexes and declining eyesight. However, comparing rates can help find savings on auto insurance for seniors. The cheapest car insurance company for senior drivers is Erie.

Senior drivers can also participate in driving safety courses to earn a safe driving discount if it’s available from their insurance provider. Maintaining a good driving record and shopping around will also go a long way to finding car insurance that fits a senior driver’s needs and budget.

Senior male drivers pay slightly more than female senior drivers for car insurance. However, in states where basing rates on gender is banned, rates will be the same for male and female senior drivers with the same driving record and demographic information. If you’re 80 and looking for auto insurance, see our article on cheap auto insurance for drivers over 80.

Cheapest Auto Insurance Companies by State

Auto insurance rates vary widely between states. The table below shows which companies offer the cheapest coverage in each state.

Cheapest Liability-Only Auto Insurance Provider by State

| State | Cheapest Provider | Monthly Rates |

|---|---|---|

| Alaska | $22 | |

| Alabama | $28 | |

| Arkansas | $28 | |

| Arizona | $25 | |

| California | $33 | |

| Colorado |  | $28 |

| Connecticut | $32 | |

| District of Columbia | $29 | |

| Delaware | $43 | |

| Florida | $30 | |

| Georgia | $24 | |

| Hawaii | $22 | |

| Iowa | $16 | |

| Idaho | $15 | |

| Illinois | $18 | |

| Indiana | $22 | |

| Kansas | $24 | |

| Kentucky | $29 | |

| Louisiana | $33 | |

| Massachusetts | $28 | |

| Maryland | $55 | |

| Maine | $15 | |

| Michigan | $47 | |

| Minnesota | $27 | |

| Missouri |  | $23 |

| Mississippi | $27 | |

| Montana |  | $16 |

| North Carolina | $13 | |

| North Dakota | $17 | |

| Nebraska | $18 | |

| New Hampshire | $21 | |

| New Jersey | $47 | |

| New Mexico | $24 | |

| Nevada | $35 | |

| New York | $40 | |

| Ohio | $23 | |

| Oklahoma | $29 | |

| Oregon | $38 | |

| Pennsylvania | $23 | |

| Rhode Island | $32 | |

| South Carolina | $33 | |

| South Dakota |  | $12 |

| Tennessee | $22 | |

| Texas | $33 | |

| Utah | $33 | |

| Virginia | $26 | |

| Vermont | $12 | |

| Washington | $26 | |

| Wisconsin | $21 | |

| West Virginia | $29 | |

| Wyoming |  | $17 |

Tennessee, South Dakota, Vermont, North Carolina, and Maine are some of the cheapest states for auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Affecting Your Auto Insurance Rates

While rates differ by company, all insurers will look at the same basic factors to calculate your auto insurance rates. The main factors affecting your auto insurance rates are as follows:

- Age: Young drivers are more likely to get into accidents, and older drivers face age-related issues like decreased reaction time.

- Gender: Men tend to pay higher rates, as statistics show men get into more accidents. However, insurers can’t consider gender in California, Hawaii, Massachusetts, Michigan, Montana, North Carolina, or Pennsylvania.

- Claims History: If you’ve filed multiple claims, you’ll have higher insurance rates.

- Credit Score: Drivers with lower credit scores are more likely to file claims or miss payments. However, California, Hawaii, Massachusetts, and Michigan insurance companies can’t use credit scores as a factor.

- Driving Record: Traffic tickets, accidents, DUIs, and other similar charges will raise rates.

While you don’t have much control over many of the factors affecting your rates, you can work to reduce costs by keeping a clean driving record and shopping around. You should also know your coverage needs, as you may not need all the insurance extras or low deductibles. Available discounts also affect your insurance rates.

Your driving history will impact your insurance costs the most. The good news is that safe drivers can try usage-based auto insurance to get a lower rate. The driving habits below will ultimately impact how much you pay for car insurance.

Factors That Affect Usage-Based Auto Insurance Discounts

| Factor | Rate Impact |

|---|---|

| Accidents Near Home | Most accidents occur close to home, potentially raising rates. |

| Cellphone Use While Driving | Significantly increases accident risk, which affects rates. |

| Driving Behavior | Rushed driving increases accident risk and potentially rates, while relaxed driving lowers risk. |

| Driving in High-Risk Areas | Frequenting accident-prone or vandalism-prone areas raises rates. |

| Hard Braking Events | Indicates risky driving, which can increase rates. |

| Job & Commuting Mode | Lower rates for public transit users compared to daily car commuters. |

| Mileage | Higher mileage increases rates; lower mileage decreases them. |

| Rush Hour Accidents | Higher risk during rush hour may increase rates. |

| Time of Day (3–6 p.m.) | Higher accident risk during peak commute times may affect rates. |

| Vehicle Usage Classification | Pleasure" use lowers rates; "business" or "commuter" use increases them. |

The ZIP code where you live will also impact your rates based on weather, crime rates, living costs, and similar factors. The exception is California and Michigan, where using ZIP codes to calculate rates is prohibited.

Rates vary drastically by company, so shopping around and comparing rates can significantly reduce your costs.Jeff Root Licensed Insurance Agent

You may be able to reduce your rates by bundling auto insurance with other coverages and discounts. If you find that your rates are increasing or there’s a significant lifestyle change, shop around for new quotes to ensure you’re getting the best deal.

Learn More: Factors That Affect Auto Insurance Rates

How to Save Even More with Auto Insurance Discounts

One of the best ways to save on car insurance — in addition to shopping around and getting quotes — is through discounts. The following discounts are generally available with most insurance providers:

Most Common Auto Insurance Discounts

| Vehicle Discounts | Driver Discounts | Personal Discounts |

|---|---|---|

| Active Disabling Device | Claim Free | Emergency Deployment |

| Adaptive Cruise Control | Continuous Coverage | Family Legacy |

| Adaptive Headlights | Defensive Driver | Family Plan |

| Anti-Lock Brakes | Driver's Education | Federal Employee |

| Audible Alarm | Driving Device/App | Further Education |

| Automatic Braking | Early Signing | Good Student |

| Blind Spot Warning | Full Payment | Homeowner |

| Daytime Running Lights | Good Credit | Life Insurance |

| Economy Vehicle | Loyalty | Married |

| Electronic Stability Control | Multiple Policies | Membership/Group |

| Farm/Ranch Vehicle | Multiple Vehicles | Military |

| Forward Collision Warning | New Customer/New Plan | New Address |

| Garaging/Storing | Occasional Operator | New Graduate |

| Green/Hybrid Vehicle | Online Shopper | Non-Smoker/Non-Drinker |

| Lane Departure Warning | On-Time Payments | Occupation |

| Newer Vehicle | Paperless/Auto Billing | Recent Retirees |

| Passive Restraint | Paperless Documents | Stable Residence |

| Utility Vehicle | Roadside Assistance | Student Away |

| Vehicle Recovery | Safe Driver | Student or Alumni |

| VIN Etching | Seat Belt Use | Volunteer |

Generally, you can discover eligible discounts at an insurance company when getting a quote. However, other discounts, such as a safe driving program discount, may not appear in your quoted price.

Taking advantage of these discounts after signing up with a company can help reduce your rates down the road. To learn more about how to qualify for these discounts and how much you could save, see our article on auto insurance discounts.

10 Cheapest Auto Insurance Companies

If you need affordable coverage, these are the top ten cheapest car insurance companies in the U.S. However, some providers may not be available in your state. Compare and evaluate insurance quotes online to find the cheapest company near you.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Erie: Top Pick Overall

Pros

- Strong Financial Standing: Erie has been around for over 90 years and boasts an A+ financial rating by A.M. Best.

- Above-Average Customer Service: Many customers have reported quick and easy claims processes with helpful representatives.

- Multiple Discounts Available: Erie offers a variety of discounts, including multi-policy, safe driving, and teen driver discounts. Learn more in our Erie auto insurance review.

Cons

- Limited Availability: Erie is only available in 12 states, mostly located in the Northeast and Midwest.

- Higher Rates for High-Risk Drivers: Erie tends to have higher rates for drivers with a history of accidents or violations.

#2 – Auto-Owners: Cheapest for Add-Ons

Pros

- Competitive Pricing: Auto-Owners Insurance offers some of the most competitive pricing for add-ons like roadside assistance and custom parts.

- High Customer Satisfaction: Auto-Owners is known for its high level of customer satisfaction, especially in handling claims and customer service.

- Wide Range of Discounts Available: Auto-Owners provides a variety of discounts, including safe driver, multi-policy, paperless billing discounts, and more. Learn more in our Auto-Owners auto insurance review.

Cons

- Limited Availability Online: Unlike some competitors that allow you to quote and buy policies entirely online, Auto-Owners still relies heavily on agents for policy issuance and management.

- Expensive for Certain Demographics: Might not always be the cheapest option for full coverage or for certain demographics.

#3 – Travelers: Cheapest Comprehensive Coverage

Pros

- Comprehensive Coverage Options: Customers can benefit from standard coverage and add-ons like gap, rental, and rideshare insurance.

- Discount Opportunities: Travelers offers safe driver discounts, multi-policy bundling, hybrid/electric vehicle discounts, and more.

- Accident Forgiveness Program: Your rate won’t increase after your first accident if you qualify for this program. Find out if you qualify in our Travelers auto insurance review.

Cons

- Sparse Local Agents: Travelers’ local representation can sometimes be limited.

- Mixed Customer Reviews: While Travelers has many satisfied customers, there are also some negative reviews regarding claims handling and customer service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – The Hartford: Cheapest for Tailored Policies

Pros

- Tailored Policies: The Hartford excels in providing tailored insurance policies that cater to individual customer needs.

- Plenty of Discounts: The Hartford offers a wide range of discounts, allowing customers to save money on their auto insurance. We have explored these discounts in our The Hartford auto insurance review.

- Easy Claims Process: The Hartford provides a streamlined claims process, making it convenient for customers to file and resolve claims.

Cons

- Limited Availability: The Hartford’s insurance coverage is only available in select states, which may limit access for some potential customers.

- Expensive for Young Drivers: The Hartford’s auto insurance may be pricier for young drivers due to their age and driving experience.

#5 – American Family: Best for Claims Service

Pros

- Excellent Claims Service: American Family has a reputation for providing efficient and responsive claims service, making the process easier for customers.

- Customizable Policies: Customers can personalize their auto insurance policies by selecting multiple coverage options that fit their needs.

- Affordable Rates: American Family offers competitive rates and discounts. Learn more in our American Family auto insurance review.

Cons

- Limited Availability: American Family is only available in 19 states, which may make it difficult for some customers to access their services.

- Mixed Customer Reviews: While American Family has a strong reputation for claims service, some customers have reported issues with their policies and billing.

#6 – Nationwide: Cheapest for Multiple Policies

Pros

- Multi-Policy Discounts: Nationwide offers savings for customers who bundle their auto insurance with other policies, such as home or life insurance. Learn more in our Nationwide auto insurance review.

- Good Customer Service: Nationwide has a strong reputation for excellent customer service, with high ratings in satisfaction surveys.

- Plenty of Coverage Options: Customers can tailor their auto insurance policy to fit their needs by choosing from various coverage options.

Cons

- Average Claims Process: Nationwide has received some complaints about its claims process taking longer than expected, which can be frustrating for customers.

- Pricey: While Nationwide offers many discounts, its base prices may still be higher compared to other insurance companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – AAA: Cheapest for Road Assistance

Pros

- Roadside Assistance: AAA offers extensive roadside assistance coverage, which you can read more about in our AAA auto insurance review.

- Strong Reputation: AAA has a long-standing reputation for its reliability and trustworthiness in the insurance industry.

- Discounts and Rewards: AAA has a wide range of discounts and rewards, including good-driver and new young-driver discounts.

Cons

- Membership Requirement: AAA auto insurance typically requires individuals to become AAA members.

- Regional Restrictions: If you move to a different state or region not served by your original AAA club, you may need to change AAA insurance providers.

#8 – Farmers: Cheapest for Safe Drivers

Pros

- Safe-Driving Discounts: Farmers offers a variety of discounts for safe drivers, including those who have completed driver’s education courses or are accident-free.

- Multiple Coverage Options: Customers can choose from a range of coverage options to customize their policy and ensure they have the right amount of protection. Learn about Farmers’ coverage options in our Farmers auto insurance review.

- Strong Financial Standing: With high ratings from industry organizations such as A.M. Best, Farmers has a strong financial standing and can provide peace of mind to customers.

Cons

- Costlier for High-Risk Drivers: Customers with a history of accidents or traffic violations may face higher rates with Farmers compared to other insurance companies.

- Low Customer Satisfaction: Farmers received below-average ratings in customer satisfaction for overall experience and claims handling.

#9 – The General: Cheapest for High-Risk Coverage

Pros

- High-Risk Coverage: The General auto insurance offers coverage specifically for high-risk drivers.

- Quick and Easy Quotes: Customers can get a quote within minutes on The General’s website or by calling their toll-free number.

- Flexible Payment Plans: The General offers flexible payment plans. Find out how to benefit from these plans from The General auto insurance review.

Cons

- Slow Claims Process: According to customer reviews, The General’s claims process can be slow and frustrating.

- Poor Communication: Some customers have reported poor communication from The General regarding their policies and claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Cheapest Customized Coverage Options

Pros

- Coverage Options: Customers can customize their coverage and choose from various add-ons, such as accident forgiveness and new car replacement.

- Nationwide Availability: Liberty Mutual is available in all 50 states. Read more in our Liberty Mutual Auto Insurance Review.

- Excellent Ratings: Liberty Mutual has received an A rating from A.M. Best for financial stability and an A+ rating from the BBB for customer satisfaction.

Cons

- Higher-Than-Average Complaints: According to the National Association of Insurance Commissioners (NAIC), Liberty Mutual has a higher-than-average complaint index in some states.

- Low Claims Satisfaction Ratings: Liberty Mutual received below-average overall and settlement satisfaction ratings.

How to Find the Right Coverage For You

The cheapest type of car insurance is the state minimum liability coverage. Generally, you can save hundreds of dollars by keeping a minimum liability auto insurance policy. However, you should get a full coverage policy if the following is true:

- Your Car Still Has Value: If your car is expensive and fairly new, you could face a huge loss after an accident.

- You Car Has a Loan or Lease: Most lease and loan agreements require you to carry comprehensive and collision insurance on your vehicle until you pay off your loan or lease.

Generally, you shouldn’t drop the optional coverages that protect your assets if you lose a lot of money after your car gets totaled or damaged. On the other hand, if your car gets paid off and is old enough not to be worth much after a collision, it can be beneficial to carry the bare minimum on your car to save money.

If the payments for extra coverages are worth at least 10% of your car’s total value, you can consider dropping them because, in a year or so, you’ll have paid your car’s entire value in add-on coverages. Our free online comparison tool allows you to compare cheap car insurance quotes instantly; just enter your ZIP code to get started.

Frequently Asked Questions

How can I find cheap auto insurance?

The best way to find cheap insurance companies is to get quotes from multiple companies in your area. Rates depend on various factors such as location, driving history, credit score, and more. You can also find cheap auto insurance quotes online by using comparison tools to check multiple providers at once.

While choosing the cheapest, liability-only auto insurance might save you money upfront, it comes with potential risks. Carefully assess your financial situation, vehicle value, and driving habits to determine the right level of coverage for your needs. Striking the right balance between cost and protection is key when selecting your auto insurance policy. To learn more, read our article, “How much car insurance do I need?”

Which company is the cheapest for auto insurance overall?

The cheapest car insurance company, on average, is Geico. However, there are many different factors that determine the cost of car insurance. While Geico may be the cheapest option for most drivers, we suggest comparing quotes from multiple companies to ensure you are getting the best deal possible.

How can you get cheap auto insurance in California?

To secure cheap auto insurance in California, compare quotes from insurers like Geico, Mercury, and Wawanesa. Look for discounts on safe driving, bundling, and low-mileage policies.

Do auto insurance rates vary by state?

Yes, auto insurance rates can vary widely between states. Factors such as state regulations, traffic patterns, and local risks influence insurance rates. It’s important to consider the specific rates and insurance companies available in your state when comparing prices.

What are the top 10 cheapest car insurance companies?

The top 10 cheapest car insurance companies include Erie, Auto-Owners, Travelers, and Geico. Rates depend on location, driving history, and coverage needs, so comparing quotes can help you find the best deal.

Should I get the cheapest car insurance?

When it comes to auto insurance, opting for the cheapest, liability-only coverage may seem attractive from a cost perspective. However, it’s essential to consider your specific circumstances and insurance needs.

What factors affect auto insurance rates?

Auto insurance rates are influenced by factors such as driving record, location, age, type of vehicle, credit score, and coverage needs. You can get the cheapest auto insurance quotes by maintaining a clean driving record, increasing your deductible, and applying for available discounts.

What are the cheapest auto insurance companies?

Erie, Auto-Owners, and Travelers Insurance are the cheapest auto insurance companies. Rates may vary depending on location, driving history, and other factors.

What is the cheapest auto insurance for seniors?

Geico offers the cheapest auto insurance for seniors. Other affordable auto insurance companies may include USAA (available to military members and their families), Nationwide, and State Farm.

What is the cheapest full-coverage auto insurance?

USAA offers the cheapest full-coverage auto insurance, followed by Geico and Progressive. We explored this more in our cheap full-coverage auto insurance guide.

What is the cheapest liability auto insurance?

What are some ways to get cheaper auto insurance?

What is the best and cheapest auto insurance company?

Which states have the cheapest auto insurance rates?

What is the cheapest auto insurance in Michigan?

Where can I get cheap auto insurance?

Which is the most affordable auto insurance in Tennessee?

Who is cheaper, Geico or Progressive?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.