Best Mazda RX-8 Auto Insurance in 2026 (Find the Top 10 Companies Here)

State Farm, Nationwide, and Allstate offer the best Mazda RX-8 auto insurance options, starting at just $39 per month. These top providers stand out for their competitive rates, comprehensive coverage, and customer service. Explore how these companies can provide excellent value for Mazda RX-8 drivers.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2025

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 11,640 reviews

11,640 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviewsState Farm, Nationwide, and Allstate stand out as the top choices for Mazda RX-8 auto insurance, offering competitive rates and comprehensive coverage.

State Farm leads with the best overall rates, starting at $39 per month, providing excellent value for Mazda RX-8 owners. Nationwide and Allstate also offer strong coverage options, with features tailored to the unique needs of sports car drivers.

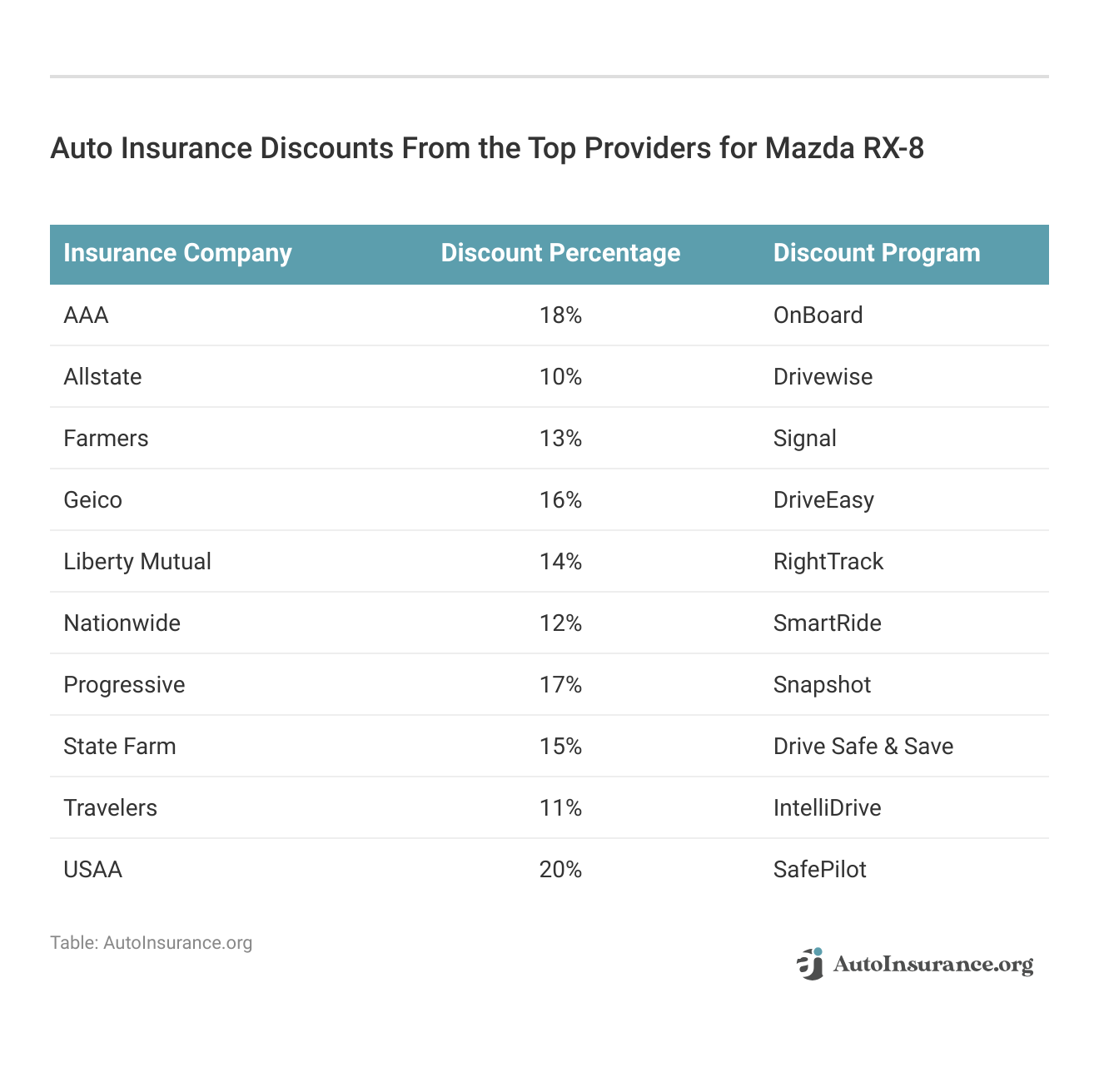

Our Top 10 Company Picks: Best Mazda RX-8 Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A++ | Many Discounts | State Farm | |

| #2 | 12% | A+ | Usage Discount | Nationwide |

| #3 | 10% | A+ | Add-on Coverages | Allstate | |

| #4 | 18% | A | Online Tools | AAA |

| #5 | 14% | A | Customizable Polices | Liberty Mutual |

| #6 | 20% | A++ | Military Savings | USAA | |

| #7 | 16% | A++ | Custom Plan | Geico | |

| #8 | 11% | A++ | Accident Forgiveness | Travelers | |

| #9 | 13% | A | Local Agents | Farmers | |

| #10 | 17% | A+ | Online Convenience | Progressive |

Discover how these top providers can meet your insurance needs efficiently and affordably. You can start comparing quotes for Mazda RX-8 auto insurance rates from some of the best auto insurance companies by using our free online tool now.

- State Farm offers the best Mazda RX-8 insurance rates starting at $39 monthly

- Nationwide and Allstate also provide excellent coverage and competitive pricing

- Discover top-rated options for Mazda RX-8 insurance tailored to your needs

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: State Farm is known for providing competitive insurance rates for Mazda RX-8 owners. Their pricing is often favorable, especially for Mazda RX-8 drivers with a clean driving record, which can significantly reduce monthly premiums, as highlighted in the State Farm auto insurance review.

- Comprehensive Coverage Options: State Farm provides a broad range of coverage options for Mazda RX-8 drivers, including collision, comprehensive, and liability insurance. They also offer specialized coverage options tailored to the needs of Mazda RX-8 drivers.

- Discount Programs: State Farm offers several discount programs, including multi-policy discounts and safe driver discounts. These can help Mazda RX-8 drivers save on their premiums by meeting certain criteria.

Cons

- Limited Discount Variety: While State Farm provides some discounts, they may not offer as many options as other insurers. This could limit potential savings for Mazda RX-8 drivers who are looking for extensive discount opportunities.

- Higher Premiums for High-Risk Drivers: State Farm’s rates for drivers with poor credit or a history of traffic violations can be higher compared to some competitors. This may impact affordability for Mazda RX-8 drivers who fall into these categories.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Comprehensive Coverage Options

Pros

- Comprehensive Coverage Options: Nationwide offers a diverse range of coverage options that can be customized to fit the needs of Mazda RX-8 owners. This includes protection for customized parts and equipment, which is beneficial for Mazda RX-8 drivers who have modified their vehicle.

- Vanishing Deductible Program: Nationwide’s Vanishing Deductible program allows Mazda RX-8 drivers to reduce their deductible over time as they maintain a clean driving record. This can result in significant savings on out-of-pocket expenses during claims for Mazda RX-8 owners.

- Discounts for Safe Driving: Nationwide offers discounts for safe driving practices and having safety features installed on Mazda RX-8 vehicles. Mazda RX-8 owners who prioritize safety can benefit from these savings, as highlighted in the Nationwide auto insurance review.

Cons

- Higher Premiums in Certain Regions: Nationwide’s insurance rates can be higher in some areas compared to other providers. Mazda RX-8 drivers in these regions might find more affordable options elsewhere.

- Limited Local Agent Presence: In some locations, the availability of Nationwide agents may be limited, which could be a drawback for Mazda RX-8 drivers who prefer in-person service and support.

#3 – Allstate: Best for Extensive Discount Opportunities

Pros

- Extensive Savings Galore: Allstate unfurls an impressive array of discounts tailored for Mazda RX-8 owners, spanning from safe driver perks to multi-policy reductions, and even slashing premiums for Mazda RX-8 models with advanced safety systems.

- Cutting-Edge Initiatives: Through the Drivewise® program, Allstate doles out rewards to Mazda RX-8 drivers who practice safe driving. Utilizing telematics, this program meticulously monitors driving behavior, offering valuable feedback and potential premium discounts for those who excel.

- Rate-Stabilizing Features: With Allstate’s accident forgiveness, Mazda RX-8 owners can breathe easier, knowing that their rates won’t skyrocket after the first mishap, ensuring more predictable and stable premiums.

Cons

- Steep Premiums for Riskier Drivers: Mazda RX-8 owners with blemished driving histories or other risk indicators might discover that Allstate’s rates could climb higher than those offered by competitors, leaving a dent in their wallets, as noted in the Allstate auto insurance review.

- Pricey Add-Ons: Adding appealing coverages like rental car reimbursement and custom parts protection can drive up the overall premium for the Mazda RX-8, potentially stretching budgets and inflating costs beyond expectation.

#4 – AAA: Best for Comprehensive Coverage Options

Pros

- Comprehensive Protection Packages: AAA rolls out an extensive suite of coverage options tailored for Mazda RX-8 owners, from roadside assistance to safeguarding custom equipment, ensuring every aspect of your vehicle is well-protected.

- Exclusive Member Perks: Beyond insurance, AAA membership unlocks a treasure trove of benefits, including travel discounts and a host of automotive services that elevate the value of being a member, as detailed in the AAA auto insurance review.

- Attractive Member Discounts: Mazda RX-8 owners can take advantage of AAA’s discounts for safe driving, policy bundling, and vehicle safety features, which collectively work to trim down those premium costs.

Cons

- Membership Hurdle: To unlock the full spectrum of rates and benefits, Mazda RX-8 drivers must join AAA, an annual membership fee serving as the gateway to these perks.

- Digital Drawbacks: While AAA shines in many areas, it might fall short in the digital realm, offering fewer online tools and resources for managing policies and processing claims compared to its tech-savvy competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies:Liberty Mutual allows Mazda RX-8 drivers to customize their insurance policies with options like roadside assistance and rental car reimbursement, providing tailored coverage solutions, according to Liberty Mutual auto insurance review.

- Accident Forgiveness and New Car Replacement: Liberty Mutual offers accident forgiveness and new car replacement options, which can be particularly valuable for Mazda RX-8 owners seeking added protection and peace of mind.

- Abundant Discounts: Liberty Mutual unleashes a plethora of discount opportunities, ranging from bundling multiple policies and insuring several vehicles to equipping the Mazda RX-8 with cutting-edge safety features. These myriad savings options can significantly slash premiums for Mazda RX-8 drivers.

Cons

- Elevated Premiums for Newer Models: Owners of newer Mazda RX-8s might encounter steeper premiums, potentially straining their budget and challenging the overall affordability of their coverage.

- Inconsistent Claims Handling: Liberty Mutual has received a spectrum of feedback regarding its claims process, with some Mazda RX-8 owners experiencing notable discrepancies and service issues, which could diminish overall satisfaction and reliability.

#6 – USAA: Best for Competitive Rates

Pros

- Competitive Rates: USAA frequently delivers exceptionally competitive insurance rates for Mazda RX-8 owners, particularly for those with pristine driving records and strong credit scores, making it a top choice for budget-conscious drivers.

- Comprehensive Coverage Options: USAA offers an extensive suite of coverage options, from collision and comprehensive to specialized add-ons, all meticulously designed to cater to the diverse needs of Mazda RX-8 enthusiasts.

- Exclusive Military Benefits: USAA extends distinctive advantages to military members and their families, including special deployment discounts and adaptable payment plans, providing significant perks for eligible Mazda RX-8 drivers.

Cons

- Restricted Availability: USAA insurance is available only to military members, veterans, and their families. This limits access for non-military Mazda RX-8 drivers, as mentioned in the USAA auto insurance review.

- Limited Physical Locations: While USAA offers robust online and phone support, it has fewer physical branch locations, which may be inconvenient for Mazda RX-8 drivers who prefer face-to-face interactions.

#7 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico has earned a reputation for delivering exceptionally competitive rates on Mazda RX-8 insurance. Their pricing frequently ranks among the lowest in the industry, making it a particularly enticing choice for Mazda RX-8 owners who are keen on minimizing their insurance expenses.

- Extensive Online Tools: Geico provides a range of online tools, including a user-friendly mobile app for policy management, making it easy for Mazda RX-8 drivers to manage their insurance and file claims.

- Variety of Discounts: Geico offers numerous discounts, such as those for safe driving, military service, and having multiple vehicles. These discounts can help Mazda RX-8 owners save significantly on their premiums, as noted in the Geico auto insurance review.

Cons

- Less Personalized Service: Geico’s emphasis on digital and phone-based interactions might lead to a more impersonal service experience, especially when contrasted with insurers that offer a broader network of local agents for Mazda RX-8 drivers.

- Potential for Rate Increases: Although Geico’s rates are often competitive, there’s a chance that premiums could rise following accidents or claims, potentially affecting the long-term cost-effectiveness for Mazda RX-8 owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Diverse Coverage Options

Pros

- Diverse Coverage Options: Travelers boasts a rich array of coverage possibilities, offering bespoke protections specifically designed for Mazda RX-8 owners. This extensive selection enables the creation of highly personalized policies that cater to precise needs and preferences.

- Discount Programs: Travelers presents an impressive suite of discount opportunities, including savings for bundling multiple policies, rewards for maintaining a clean driving record, and reductions for equipping your Mazda RX-8 with advanced safety features, as highlighted in the Travelers auto insurance review.

- Innovative Tools and Resources: Travelers offers several tools and resources, including an intuitive mobile app for managing policies and filing claims, which enhances the overall customer experience for Mazda RX-8 drivers.

Cons

- Higher Rates in Some Areas: Travelers’ insurance rates can be higher in certain regions, which may affect affordability for Mazda RX-8 drivers in those locations.

- Complex Policy Options: The variety of coverage options can sometimes be overwhelming, making it challenging for Mazda RX-8 drivers to select the best policy for their needs without extensive research.

#9 – Farmers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Farmers presents an extensive suite of coverage choices for Mazda RX-8 drivers, encompassing everything from collision and comprehensive protection to tailored add-ons that cater to specific individual requirements.

- Discount Opportunities: Farmers provides a smorgasbord of discount opportunities, including reductions for bundling multiple policies, maintaining a spotless driving record, and equipping your Mazda RX-8 with anti-theft devices.

- Flexible Payment Options: Farmers enhances financial flexibility with diverse payment plans and incentives for settling premiums in full, aiding Mazda RX-8 drivers in managing and optimizing their insurance expenditures.

Cons

- Higher Premiums for High-Risk Drivers: Farmers’ rates may be higher for drivers with poor credit or a history of traffic violations, which could impact affordability for some Mazda RX-8 owners.

- Inconsistent Customer Service: Customer service experiences with Farmers can vary depending on the local agent, leading to potential inconsistencies in service quality for Mazda RX-8 drivers, as noted in our Farmers auto insurance review.

#10 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive frequently offers enticingly competitive insurance rates for Mazda RX-8 drivers, brimming with chances to cut costs through a multitude of discounts and diverse coverage options, according to Progressive auto insurance review.

- Snapshot® Program: Progressive’s Snapshot® program rewards safe driving behaviors with potential discounts, which can benefit Mazda RX-8 drivers who practice safe driving habits.

- Wide Range of Coverage Options: Progressive offers a variety of coverage options for Mazda RX-8 owners, including custom parts protection and roadside assistance, providing comprehensive coverage tailored to Mazda RX-8 drivers.

Cons

- Higher Premiums After Accidents: Progressive’s rates can increase significantly after an accident or traffic violation, which may affect long-term affordability for Mazda RX-8 drivers.

- Mixed Reviews on Claims Handling: While many customers report positive experiences, some have noted issues with the consistency of Progressive’s claims handling and customer service for Mazda RX-8 drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mazda RX-8 Insurance Cost

For Mazda RX-8 owners, insurance costs can vary significantly depending on factors such as driving history, location, and coverage choices. Finding the right insurance provider is crucial for securing the best rates and comprehensive coverage. Discover our comprehensive guide to “Calculating Auto Insurance Costs” for additional insights.

Mazda RX-8 Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $39 | $123 |

| $70 | $209 | |

| $70 | $212 | |

| $60 | $186 | |

| $68 | $192 |

| $55 | $173 |

| $55 | $165 | |

| $49 | $141 | |

| $92 | $290 | |

| $57 | $170 |

This guide explores the factors affecting Mazda RX-8 insurance premiums and highlights top providers offering competitive rates and excellent customer service. Whether you’re a new driver or a seasoned enthusiast, understanding these aspects can help you make an informed decision and save on your Mazda RX-8 insurance costs.

In conclusion, understanding the factors that influence Mazda RX-8 insurance costs can help you find the best coverage at the most affordable rates. The average Mazda RX-8 auto insurance rates is $106 a month.

Mazda RX-8 Auto Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $106 |

| Discount Rate | $63 |

| High Deductibles | $92 |

| High Risk Driver | $227 |

| Low Deductibles | $134 |

| Teen Driver | $389 |

By comparing options from top providers and considering your unique needs, you can ensure that your Mazda RX-8 is well-protected without breaking the bank. Remember to regularly review your policy and take advantage of available discounts to maximize your savings.

Mazda RX-8s Carry High Insurance Costs

When insuring a Mazda RX-8, drivers should be prepared for higher premiums. This sporty car’s powerful performance and unique design can lead to elevated insurance rates due to its higher risk profile. Understanding these costs and exploring options for discounts is crucial for potential owners.

The chart below details how Mazda RX-8 insurance rates compare to other coupes like the Audi S5, Nissan 370Z, and Mercedes-Benz CLA 250. For further details, check out our in-depth “Compare Cheap Online Auto Insurance Quotes” article.

Mazda RX-8 Auto Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Mazda RX-8 | $33 | $72 | $33 | $151 |

| Nissan 370Z | $28 | $60 | $38 | $140 |

| Mercedes-Benz CLA 250 | $34 | $70 | $33 | $150 |

| Infiniti Q60 | $32 | $62 | $33 | $140 |

| Dodge Challenger | $34 | $57 | $35 | $141 |

| Audi TT | $32 | $60 | $33 | $138 |

In summary, the Mazda RX-8’s insurance costs reflect its sporty nature and associated risks. While these premiums may be higher, careful consideration of coverage options and potential discounts can help manage expenses.

For Mazda RX-8 enthusiasts, it’s essential to balance the thrill of the drive with the financial aspects of ownership. However, there are a few things you can do to find the cheapest Mazda insurance rates online.

Factors Influencing Mazda RX-8 Insurance Costs

The Mazda RX-8 trim and model you choose will affect the total price you will pay for Mazda RX-8 insurance coverage. Explore our detailed analysis on “Factors That Affect Auto Insurance Rates” for additional information.

Age of the Vehicle

Older Mazda RX-8 models typically come with lower insurance costs, making them more budget-friendly for drivers. For instance, insuring a 2011 Mazda RX-8 averages around $107 per month, while the cost to insure a 2010 Mazda RX-8 is slightly lower, at approximately $104 monthly.

Mazda RX-8 Auto Insurance Monthly Rates by Model Year and Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2024 Mazda RX-8 | $25 | $50 | $80 | $365 |

| 2023 Mazda RX-8 | $24 | $48 | $78 | $350 |

| 2022 Mazda RX-8 | $23 | $46 | $75 | $335 |

| 2021 Mazda RX-8 | $22 | $44 | $72 | $320 |

| 2020 Mazda RX-8 | $21 | $42 | $70 | $305 |

| 2019 Mazda RX-8 | $20 | $40 | $68 | $290 |

| 2018 Mazda RX-8 | $19 | $38 | $66 | $275 |

This $3 difference may seem modest, but it reflects how insurance rates tend to decrease as vehicles age. Insurance providers generally view older cars as less expensive to repair or replace, which can result in reduced premiums.

Driver Age

Driver age plays a significant role in determining Mazda RX-8 insurance rates, with younger drivers often facing higher costs. For example, a 30-year-old typically pays about $56 more per year for Mazda RX-8 insurance than a 40-year-old.

Mazda RX-8 Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $808 |

| Age: 18 | $656 |

| Age: 20 | $410 |

| Age: 30 | $191 |

| Age: 40 | $225 |

| Age: 45 | $165 |

| Age: 50 | $200 |

| Age: 60 | $152 |

This difference highlights how insurers assess younger drivers as higher risk due to factors like less experience and a greater likelihood of accidents. As drivers age, particularly into their 40s, they generally benefit from lower insurance rates, reflecting reduced perceived risk.

Driver Location

Where you live plays a crucial role in determining Mazda RX-8 insurance rates, with location-specific factors heavily influencing premiums. For example, drivers in Phoenix might pay approximately $58 less per month for their Mazda RX-8 insurance compared to those in Los Angeles.

This substantial difference arises from various factors, including traffic congestion, crime rates, and the cost of vehicle repairs, all of which tend to be higher in densely populated cities like Los Angeles.

Mazda RX-8 Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $141 |

| Columbus, OH | $102 |

| Houston, TX | $173 |

| Indianapolis, IN | $110 |

| Jacksonville, FL | $185 |

| Los Angeles, CA | $209 |

| New York, NY | $198 |

| Philadelphia, PA | $185 |

| Phoenix, AZ | $135 |

| Seattle, WA | $140 |

Insurers take these elements into account when calculating premiums, which is why a change in location, even within the same state, can lead to significant variations in insurance costs. The example of Phoenix and Los Angeles highlights how where you live can dramatically affect the overall expense of insuring your Mazda RX-8.

Your Driving Record

Your driving record exerts a major impact on Mazda RX-8 insurance premiums. Insurers delve deeply into your driving history to set rates, and a history of traffic violations or accidents can cause your costs to soar.

Mazda RX-8 Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $808 | $825 | $1,100 | $690 |

| Age: 18 | $656 | $730 | $975 | $605 |

| Age: 20 | $410 | $615 | 820 | 515 |

| Age: 30 | $191 | $375 | 500 | 315 |

| Age: 40 | $225 | $340 | 450 | 290 |

| Age: 45 | $165 | $244 | $295 | $203 |

| Age: 50 | $200 | $305 | 405 | 265 |

| Age: 60 | $152 | $290 | 385 | 250 |

Particularly for teenagers and drivers in their 20s, having violations on their driving record can result in a substantial increase in insurance rates. This age group is often seen as higher risk due to a combination of inexperience and statistically higher accident rates.

Mazda RX-8 Safety Ratings

The Mazda RX-8, renowned for its distinctive rotary engine and sleek design, is a vehicle that appeals to driving enthusiasts. However, when considering any vehicle, safety is a critical factor.

The RX-8 has undergone various safety evaluations over the years, offering insights into its ability to protect occupants in the event of an accident. While it excels in some areas, its safety ratings reveal both strengths and opportunities for improvement.

Your Mazda RX-8 auto insurance rates are influenced by the safety ratings of the Mazda RX-8. See the breakdown below:

Mazda RX-8 Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Acceptable |

| Roof strength | Marginal |

| Head restraints and seats | Good |

In summary, the Mazda RX-8 combines sporty performance with reasonable safety features, though it shows some limitations in certain areas. For potential buyers, understanding these safety ratings is essential to making an informed decision.

While the RX-8 may not have the highest safety scores across the board, it provides adequate protection for a vehicle in its class, making it a viable option for those who prioritize performance but also value safety.

Mazda RX-8 Crash Test Ratings

The Mazda RX-8 is known for its sporty design and rotary engine, but understanding its crash test ratings is crucial for evaluating its safety. These ratings reveal how the RX-8 performs in crash scenarios, providing important information about its occupant protection.

Mazda RX-8 crash test ratings can impact your Mazda RX-8 auto insurance rates. See Mazda RX-8 crash test results below:

Mazda RX-8 Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Mazda RX-8 | 4 stars | 4 stars | 4 stars | 3 stars |

| 2023 Mazda RX-8 | 4 stars | 4 stars | 4 stars | 3 stars |

| 2022 Mazda RX-8 | 4 stars | 4 stars | 4 stars | 3 stars |

| 2021 Mazda RX-8 | 4 stars | 4 stars | 4 stars | 3 stars |

| 2020 Mazda RX-8 | 4 stars | 4 stars | 4 stars | 3 stars |

In summary, the Mazda RX-8’s crash test ratings offer a glimpse into its safety features and performance in collisions. While it delivers impressive driving dynamics, these ratings are essential for assessing the vehicle’s overall protection and making a well-rounded decision.

Mazda RX-8 Safety Features

While the Mazda RX-8 is celebrated for its impressive performance and distinctive rotary engine, its safety features are just as crucial for safeguarding both driver and passengers. Delving into the RX-8’s safety arsenal reveals how it stands up to the challenges of everyday driving and emergency scenarios, ensuring robust protection in various situations.

Having a variety of safety features on your Mazda RX-8 can help lower your Mazda RX-8 insurance costs. The Mazda RX-8’s safety features include:

- Driver Air Bag

- Passenger Air Bag

- Front Head Air Bag

- Front Side Air Bag

- 4-Wheel ABS

In conclusion, the Mazda RX-8 offers a range of safety features designed to enhance protection and drive confidence. While it excels in certain areas, understanding these features helps assess how well the RX-8 balances performance with safety, ensuring a well-rounded driving experience.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mazda RX-8 Finance and Insurance Cost

Understanding the financing and insurance costs for the Mazda RX-8 is crucial for managing your budget effectively. With its unique design and performance features, the RX-8 presents specific financial considerations.

This guide will help you navigate both the loan options and insurance rates to make an informed decision about your Mazda RX-8 investment. Expand your understanding with our thorough “How Insurance Providers Determine Rates” overview.

Evaluating the financing and insurance costs of the Mazda RX-8 ensures you’re prepared for the financial commitment of owning this distinctive sports car. By comparing loan terms and insurance premiums, you can secure the best rates and manage your expenses efficiently. Make sure to review all options to find the most suitable financial solutions for your Mazda RX-8.

Ways to Save on Mazda RX-8 Insurance

Finding ways to save on Mazda RX-8 insurance can make a significant difference in your overall costs. With various strategies available, you can reduce your premiums while still maintaining the coverage you need.

This guide offers practical tips and strategies to help you reduce your Mazda RX-8 insurance costs. It covers various approaches, from seeking discounts to adjusting coverage, providing insights into how you can lower your premiums while ensuring you still have the necessary protection for your vehicle.

Save more on your Mazda RX-8 auto insurance rates. Take a look at the following five strategies that will get you the best Mazda RX-8 auto insurance rates possible.

- Remove unnecessary insurance once your Mazda rx-8 is paid off.

- Ask about discounts for people with disabilities.

- Move to the countryside.

- Never drink and drive your Mazda rx-8.

- Ask about Mazda rx-8 discounts if you were listed on someone else’s policy.

Implementing effective strategies to save on Mazda RX-8 insurance can lead to substantial savings. By exploring discounts, adjusting coverage levels, and leveraging other cost-saving methods, you can optimize your insurance expenses. Stay proactive and informed to ensure you get the best value for your Mazda RX-8 insurance.

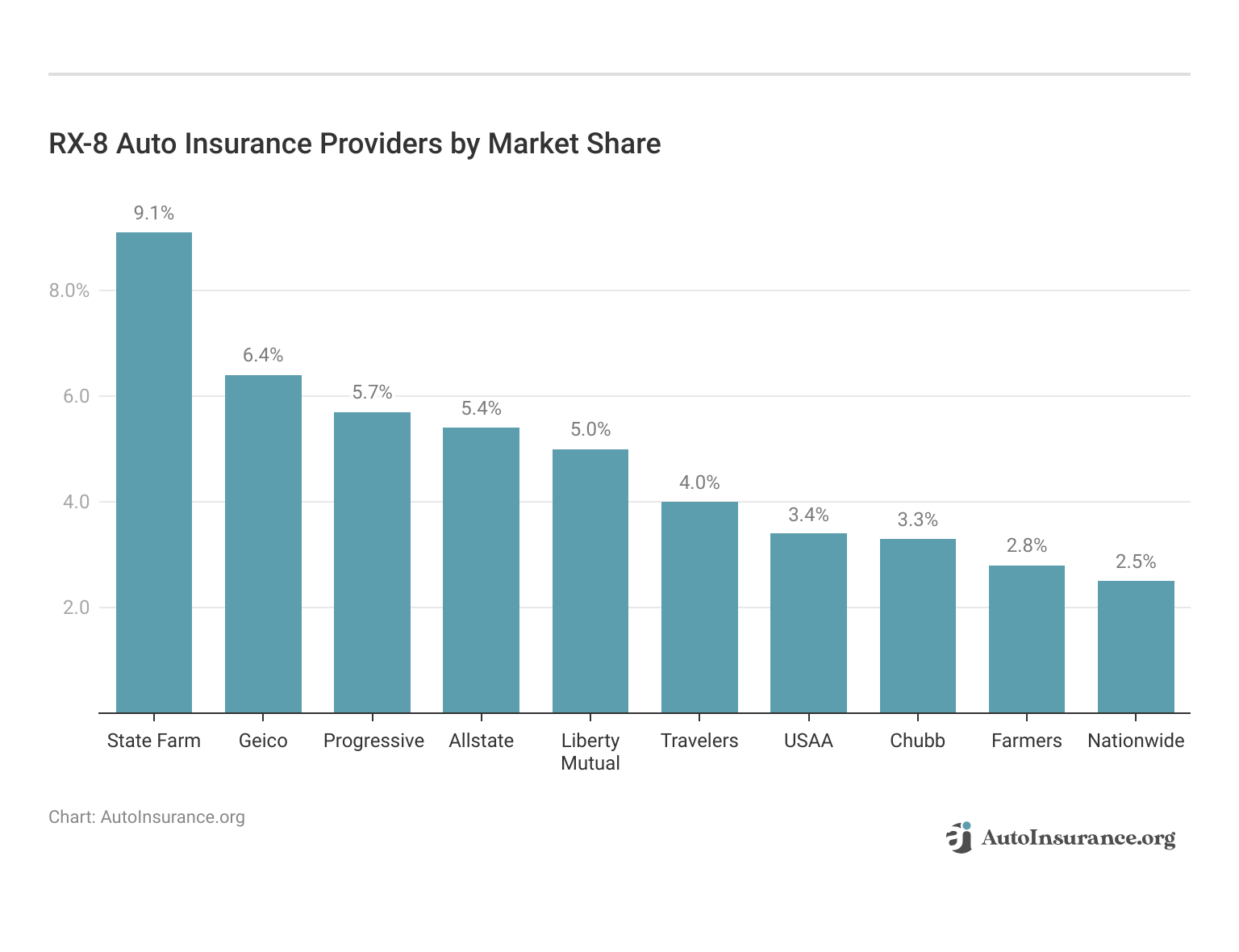

Best Insurance Providers for Mazda RX-8

Choosing the right insurance company for your Mazda RX-8 can impact both your coverage quality and your costs. We’ve evaluated the top insurance providers to help you find the best options for Mazda RX-8 coverage.

Top Mazda RX-8 Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | $65.6 million | 9% | |

| #2 | $46.1 million | 6% | |

| #3 | $39.2 million | 6% | |

| #4 | $35.6 million | 5% | |

| #5 |  | $35 million | 5% |

| #6 | $28 million | 4% | |

| #7 | $23.5 million | 3% | |

| #8 | $23.4 million | 3% | |

| #9 | $20.6 million | 3% | |

| #10 |  | $18.4 million | 3% |

Discover which companies offer the best rates, service, and benefits for your needs. For more information, explore our informative “Best Auto Insurance Companies” page. Selecting the top Mazda RX-8 insurance company ensures you get excellent coverage and value.

By considering the leading providers, you can make an informed decision that balances cost and quality. Review your options and choose the insurance company that best meets your Mazda RX-8 needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Free Mazda RX-8 Insurance Quotes Online

Comparing free Mazda RX-8 insurance quotes online is a smart way to find the best coverage at the most competitive rates. Use online tools to easily evaluate offers from multiple insurers and identify the options that suit your needs and budget.

Start your comparison now to ensure you’re getting the best deal on your Mazda RX-8 insurance. Get more insights by reading our expert “Does the price of a car affect auto insurance rates?” advice.

State Farm's extensive network and competitive rates make it the top choice for Mazda RX-8 owners seeking affordable and reliable insurance coverage.Michelle Robbins Licensed Insurance Agent

By comparing free Mazda RX-8 insurance quotes online, you can make an informed choice and secure the best possible coverage for your vehicle. Take advantage of the available tools to streamline your search and find a policy that offers both value and protection.

Begin your quote comparison today to find the perfect insurance for your Mazda RX-8. Save on your Mazda RX-8 auto insurance rates by taking advantage of our FREE comparison tool.

Frequently Asked Questions

How much does auto insurance for a Mazda RX-8 typically cost?

Auto insurance for a Mazda RX-8 varies based on factors such as your location, driving record, age, and coverage choices. To get an accurate cost estimate, obtain quotes from different insurers and consider the various factors that impact the premium.

Can I transfer my current auto insurance to my new Mazda RX-8?

Yes, you can usually transfer your existing auto insurance to your new Mazda RX-8. Contact your current insurer to update your policy with your new vehicle’s details, and they will adjust the coverage and premium. It’s also wise to compare quotes from other insurers to ensure you’re getting the best rates and coverage for your Mazda RX-8.

What should I do if I have further questions about Mazda RX-8 auto insurance?

If you have more questions about Mazda RX-8 auto insurance, reach out to insurance providers directly for tailored information based on your driving history and coverage preferences. Speaking with an insurance agent or broker can also provide personalized guidance to help you find the best coverage for your Mazda RX-8.

<style=”font-weight: 400;”>Explore our detailed analysis on “What is auto insurance?” for additional information.</>

How much does a Mazda RX-8 cost to insure for a 17-year-old?

The insurance cost for a Mazda RX-8 for a 17-year-old is typically higher compared to older drivers. This is due to their higher risk profile and lack of driving experience, which insurance companies factor into their premium calculations.

What are the 2004 Mazda RX-8 insurance rates?

Insurance rates for a 2004 Mazda RX-8 can vary based on the driver’s profile, including their driving record and location, as well as the type and amount of coverage selected. Comparing rates from different insurers can provide a clearer picture of the costs.

Is a Mazda RX-8 considered a sports car for insurance purposes?

Yes, a Mazda RX-8 is generally classified as a sports car for insurance purposes. This classification can lead to higher insurance rates because sports cars are perceived as higher risk due to their performance capabilities.

Get more insights by reading our expert “Types of Auto Insurance” advice.

How do I compare Mazda RX-8 car insurance quotes?

To compare RX8 car insurance quotes effectively, use online comparison tools to gather quotes from multiple insurers. Review the coverage options and rates offered by each provider to determine which policy offers the best value for your needs.

<style=”font-weight: 400;”>Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.</>

Are Mazda RX-8s generally expensive to insure compared to other vehicles?

Mazda RX-8s can be more expensive to insure due to their sports car classification. Rates can be higher because of factors like performance capabilities and theft rates. Comparing quotes from multiple insurers can help you find the best rate for your Mazda RX-8.

What factors can affect the insurance premium for a Mazda RX-8?

Several factors affect the insurance premium for a Mazda RX-8, including your driving record (a clean record usually leads to lower rates), location (with rates varying by local crime and traffic conditions), age and gender (younger drivers often face higher premiums), and coverage options (the type and level of coverage you choose).

<style=”font-weight: 400;”>Continue reading our full “Auto Insurance Premium Defined” guide for extra tips.</>

What is the Mazda RX-8 insurance cost for an 18-year-old?

The insurance cost for a Mazda RX-8 for an 18-year-old can be quite high due to the combination of their inexperience and the vehicle’s classification as a sports car. Younger drivers are often considered higher risk, which significantly increases premiums.

How can I find cheap car insurance for a Mazda RX-8?

Are there any discounts available for Mazda RX-8 car insurance?

What is the Mazda RX-8 insurance group?

How can I lower my Mazda RX-8 insurance cost?

What is included in Mazda RX-8 insurance coverage?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.