Best Eugene, Oregon Auto Insurance in 2025 (Top 10 Companies Ranked)

The best Eugene, Oregon auto insurance comes from top providers like State Farm, USAA, and Progressive that offer rates as low as $70 per month. Obtain comparative analyses from leading providers, who offer auto insurance solutions specifically tailored to address Eugene’s distinctive requirements.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Eugene Oregon

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Eugene Oregon

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Eugene Oregon

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

When it comes to the best Eugene, Oregon car insurance, State Farm, USAA, and Progressive offer top options, with rates starting at just $70 per month. State Farm emerges as the clear frontrunner with it’s various options.

There are specific risks when driving in Eugene, Oregon. In this article, Eugene drivers can ensure they have adequate coverage in case of an accident or unforeseen event. Rates vary by driver, so exploring different quotes can help you find cheap auto insurance.

Our Top 10 Company Picks: Best Eugene, Oregon Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 15% B Reliable Coverage State Farm

#2 10% A++ Military Benefits USAA

#3 5% A+ Coverage Options Progressive

#4 20% A Membership Benefits AAA

#5 10% A+ Extensive Discounts Allstate

#6 8% A+ AARP Discounts The Hartford

#7 12% A Customizable Plans Farmers

#8 8% A++ Comprehensive Coverage Travelers

#9 13% A Broad Coverage Liberty Mutual

#10 8% A+ Safe Driver Nationwide

Get fast and cheap auto insurance coverage today with our quote comparison tool above.

- The best auto insurance company in Eugene, OR is State Farm

- Demographics can also affect your auto insurance in Eugene, OR

- Commute time and vehicle theft impact Eugene, OR auto insurance quotes

#1 – State Farm: Top Overall Pick

Pros

- Pocket-Friendly Protector: As mentioned in State Farm auto insurance review, State Farm’s $150 monthly rate in Eugene undercuts rivals, allowing drivers to allocate more resources to exploring Oregon’s natural wonders while maintaining robust vehicle safeguards against unexpected road mishaps.

- Customizable Safeguards: Eugene motorists can fine-tune their State Farm policies, addressing unique challenges from navigating rainfall-slicked streets to maneuvering through bustling university corridors during peak hours.

- Prudent Driver Perks: State Farm rewards Eugene’s cautious motorists with various incentives, from accident-free bonuses to multi-vehicle discounts, potentially leading to substantial savings over time for those who prioritize road safety.

Cons

- Support Stumbles: Despite attractive pricing, some Eugene policyholders report frustrating interactions with State Farm’s assistance team, citing delays or miscommunications that can tarnish the overall insurance experience.

- Impersonal Approach: State Farm’s vast scale may result in a one-size-fits-all service model, potentially leaving Eugene drivers feeling like anonymous policy numbers rather than valued community members with unique insurance needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Benefits

Pros

- Unbeatable Bargain: As mentioned in our USAA auto insurance review, USAA’s $140 monthly premium in Eugene stands as the city’s most economical option, allowing service members to allocate more resources to family needs or personal pursuits.

- Military-Minded Policies: Eugene’s armed forces personnel benefit from USAA’s tailored coverage, addressing unique scenarios like deployment-related vehicle storage or frequent cross-country relocations that civilian-focused insurers might overlook.

- Elite Support Corps: USAA’s assistance team consistently earns accolades for its efficient, empathetic approach, ensuring Eugene’s military community receives swift, knowledgeable support tailored to their distinctive lifestyle demands.

Cons

- Exclusive Membership: USAA’s focus on military personnel and their immediate families excludes a significant portion of Eugene’s drivers from accessing these competitive rates and specialized services.

- Virtual Vicinity: The absence of USAA offices in Eugene may frustrate members who prefer face-to-face consultations when navigating complex claims or policy adjustments, potentially complicating more intricate insurance matters.

#3 – Progressive: Best for Coverage Options

Pros

- Balanced Budget Option: Progressive’s $160 monthly rate in Eugene offers a middle ground between bare-bones coverage and premium protection, appealing to residents seeking value without sacrificing essential safeguards.

- Tailor-Made Policies: As mentioned in Progressive auto insurance review, Eugene drivers can craft Progressive plans that mirror their unique needs, from basic protection for rarely-used vehicles to all-encompassing coverage for daily commuters navigating Oregon’s diverse road conditions.

- Tech-Forward Tools: Progressive’s state-of-the-art digital platform resonates with Eugene’s tech-savvy population, offering seamless policy management and claims filing at the touch of a screen, perfect for on-the-go lifestyles.

Cons

- Risk-Based Rate Spikes: Some Eugene motorists, particularly those with complex driving histories, may encounter unexpectedly high Progressive premiums, potentially negating the initial appeal of their competitive base rates.

- Inconsistent Assistance: Eugene policyholders report varying experiences with Progressive’s support team, noting occasional communication breakdowns or delays that can exacerbate the stress of post-accident scenarios.

#4 – AAA: Best for Membership Benefits

Pros

- Holistic Road Protection: As mentioned in AAA auto insurance review, AAA’s Eugene offerings extend beyond mere accident coverage, encompassing a suite of safeguards designed to address the myriad challenges Oregon drivers face, from coastal trips to mountain adventures.

- Membership Bonanza: Eugene AAA policyholders unlock a treasure trove of additional perks, including their legendary roadside support and travel discounts, enhancing the overall value proposition beyond traditional insurance boundaries.

- Community Cornerstone: AAA’s enduring presence in Eugene has cultivated deep-rooted trust, with generations of residents relying on their consistent support and local market expertise to navigate Oregon’s ever-changing driving landscape.

Cons

- Premium Price Tag: AAA’s $170 monthly rate in Eugene may strain the budgets of cost-conscious drivers, potentially pushing some residents to explore more economical alternatives despite the added membership benefits.

- Limited Savings Avenues: Some Eugene motorists might find AAA’s discount options less diverse compared to competitors, potentially restricting opportunities for significant premium reductions and impacting long-term affordability.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Extensive Discounts

Pros

- Policy Crafting Freedom: As mentioned in Allstate auto insurance review, Allstate empowers Eugene drivers to architect uniquely tailored protection plans, addressing specific concerns from navigating dense fog to safeguarding against wildlife collisions on rural Oregon roads.

- Fiscal Powerhouse: Eugene policyholders benefit from Allstate’s robust financial foundation, ensuring reliable claim fulfillment even amidst economic turbulence or widespread natural disasters that could strain lesser-prepared insurers.

- Diverse Discount Palette: Allstate offers Eugene residents a wide spectrum of premium reduction strategies, from rewarding defensive driving course completion to incentivizing home-auto policy bundling, maximizing potential long-term savings.

Cons

- Budget Stretch: Allstate’s $180 monthly premium in Eugene sits at the higher end of the local pricing spectrum, potentially deterring drivers seeking more economical options or those operating on tight financial margins.

- Support Consistency Woes: Some Eugene policyholders report fluctuating experiences with Allstate’s assistance infrastructure, citing occasional hurdles in claim resolution or policy adjustments that can erode trust and satisfaction over time.

#6 – The Hartford: Best for AARP Discounts

Pros

- Mature Driver Champions: As mentioned in The Hartford auto insurance review, The Hartford’s focus on AARP members translates to tailored policies for Eugene’s senior drivers, addressing age-specific concerns like declining reflexes or increased medication use that may affect driving.

- Lifetime Renewability Pledge: Eugene policyholders with The Hartford enjoy the peace of mind that comes with guaranteed policy renewal, ensuring continuous coverage regardless of age-related changes or minor driving infractions.

- RecoverCare Assistance: Unique to The Hartford, this feature provides Eugene drivers with post-accident home care support, covering costs for services like house cleaning or dog walking during recovery periods.

Cons

- Age-Restricted Appeal: The Hartford’s emphasis on mature drivers may limit its attractiveness to Eugene’s younger population, potentially excluding a significant portion of the city’s diverse driving community.

- Premium Positioning: At $175 monthly, The Hartford’s rates in Eugene sit above average, potentially stretching budgets for retirees or those on fixed incomes despite the specialized coverage options.

#7 – Farmers: Best for Customizable Plans

Pros

- Occupation-Based Pricing: As mentioned in Farmers auto insurance review, Farmers considers Eugene residents’ professions when calculating premiums, potentially offering lower rates to those in lower-risk occupations like teachers or remote workers.

- Rideshare Gap Coverage: Eugene’s growing gig economy drivers benefit from Farmers’ specialized rideshare insurance, bridging protection gaps between personal use and active ride-hailing periods.

- Flexible Payment Structures: Farmers offers Eugene policyholders various payment options, including pay-per-mile plans for infrequent drivers or those primarily using Eugene’s robust public transit system.

Cons

- Complex Policy Structure: Eugene drivers may find Farmers’ tiered coverage system confusing, with multiple plan levels and add-ons potentially complicating the selection process for those seeking straightforward protection.

- Mixed Local Feedback: Some Eugene policyholders report inconsistent experiences with Farmers’ claim processing, citing occasional delays or communication issues that can exacerbate post-accident stress.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Comprehensive Coverage

Pros

- Green Vehicle Incentives: As mentioned in Travelers auto insurance review, Travelers offers reduced rates for Eugene drivers of hybrid or electric vehicles, aligning with the city’s environmentally conscious ethos and encouraging sustainable transportation choices.

- Decreasing Deductible Feature: Eugene policyholders can see their deductibles shrink over time with Travelers’ unique program, rewarding loyal, claim-free customers with potentially significant savings in the event of an accident.

- New Car Replacement Plus: Travelers goes beyond standard replacement, offering Eugene drivers the next model year if their new car is totaled within five years, accounting for rapid vehicle depreciation.

Cons

- Tech Integration Lag: Some Eugene customers report that Travelers’ digital tools and mobile app functionality fall short of expectations, potentially frustrating tech-savvy users accustomed to seamless online experiences.

- Pricing Volatility: Eugene drivers may experience more frequent rate fluctuations with Travelers compared to other providers, making long-term budgeting for auto insurance more challenging.

#9 – Liberty Mutual: Best for Broad Coverage

Pros

- Teacher-Centric Benefits: As mentioned in Liberty Mutual auto insurance review, Liberty Mutual offers specialized perks for Eugene’s educators, including deductible waivers for incidents occurring on school property or during educational events, recognizing teachers’ unique needs.

- RightTrack Program: Eugene drivers can leverage Liberty Mutual’s usage-based insurance option, potentially earning significant discounts by demonstrating safe driving habits through a mobile app or plug-in device.

- Accident Forgiveness from Day One: Unlike many insurers requiring years of clean driving, Liberty Mutual offers this benefit to Eugene policyholders immediately, protecting against rate hikes after a first-time accident.

Cons

- Quote Consistency Issues: Some Eugene residents report receiving varying quotes for identical coverage when using different contact methods (online, phone, in-person), potentially causing confusion and trust issues.

- Add-On Cost Concerns: While Liberty Mutual’s base rates in Eugene appear competitive at $160 monthly, some drivers find that necessary add-ons can significantly increase premiums, impacting overall affordability.

#10 – Nationwide: Best for Safe Driver

Pros

- Vanishing Deductible Feature: As mentioned in Nationwide auto insurance review, Eugene policyholders can see their deductible decrease by $100 annually (up to $500) for safe driving, offering tangible rewards for cautious behavior on Oregon’s diverse roadways.

- SmartRide Discounts: Nationwide’s usage-based program allows Eugene drivers to save up to 40% based on their driving habits, ideal for those navigating the city’s eco-friendly, lower-speed urban areas.

- Accident Forgiveness Earning: Unlike instant offerings, Nationwide allows Eugene drivers to earn accident forgiveness over time, encouraging long-term safe driving practices and policy loyalty.

Cons

- Above-Average Base Rates: Nationwide’s $190 monthly premium in Eugene ranks as the highest among reviewed providers, potentially deterring cost-conscious drivers despite the potential for significant discounts.

- Local Presence Limitations: Eugene policyholders may find Nationwide’s physical presence in the area limited, potentially complicating matters for those who prefer face-to-face interactions for complex insurance discussions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Auto Insurance Companies in Eugene, OR

Choose the companies that provide the best coverage options at the lowest rates to fit your budget when looking for cheap auto insurance in Eugene, OR. Look at the table below:

Eugene, Oregon Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

AAA $85 $170

Allstate $90 $180

Farmers $85 $165

Liberty Mutual $87 $160

Nationwide $80 $190

Progressive $80 $160

State Farm $75 $150

The Hartford $88 $175

Travelers $82 $155

USAA $70 $140

Auto insurance rates in Eugene, OR, can vary dramatically depending on your choice of coverage and provider. Whether you’re navigating the city’s frequent rain or planning for long commutes on I-5, it’s essential to find a policy that not only meets your coverage needs but also aligns with your budget.

Factors Affecting Eugene, OR Auto Insurance Rates

Oregon is one of many states that allow gender and credit-based auto insurance. Males usually pay more than females for car insurance.

Meanwhile, customers with good or exceptional credit pay the least for auto insurance. Why? According to Experian, auto insurance companies believe better credit scores correlate to lower chances to file a claim.

What about commute mileage? Driving your vehicle more than average can produce higher auto insurance rates. According to Data USA, Eugene’s average commute time is 17 minutes, which is eight minutes faster than average. This means drivers are more than likely to spend less on commutes due to the low travel frequency.

Read More: Why is auto insurance for young males so expensive?

Why Comprehensive Coverage is Recommended in Oregon, OR

Comprehensive coverage is highly recommended in Eugene due to the risk of vehicle theft and weather-related damages. Although Eugene reported 606 vehicle thefts in 2019, comprehensive coverage protects against such incidents.

Additionally, according to City-Data, Eugene experienced ten flooding disasters and seven winter storms in the same year, making comprehensive coverage crucial for safeguarding against significant repair costs from weather damage.

Comprehensive coverage also helps cover damages from vandalism and falling debris.Michelle Robbins LICENSED INSURANCE AGENT

Considering Eugene’s unpredictable weather and high vehicle theft rate, having comprehensive coverage ensures you’re financially protected against a range of potential risks. It provides valuable peace of mind and security for all Eugene drivers.

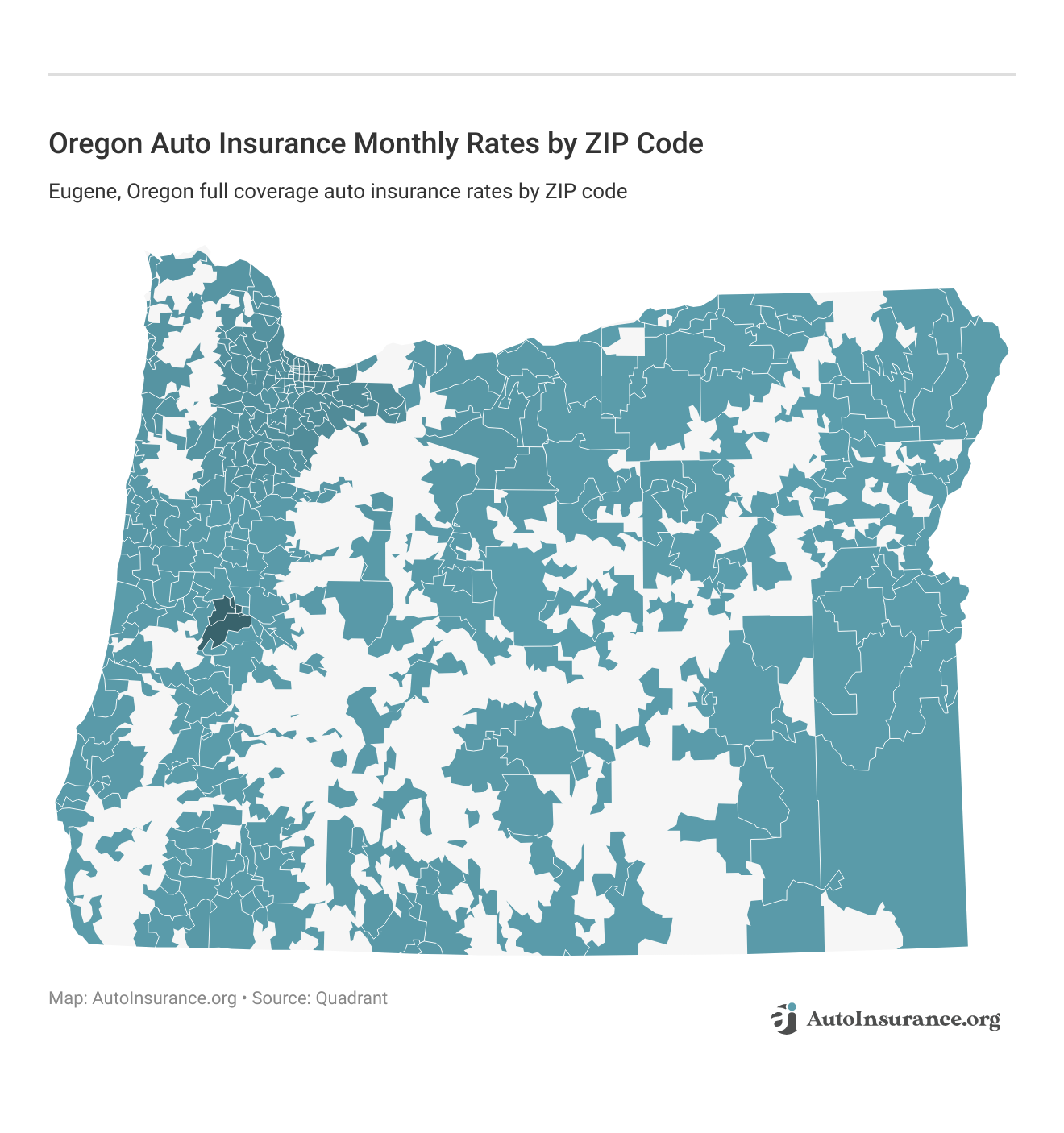

Monthly Eugene, OR Car Insurance Rates by ZIP Code

Examine the comprehensive monthly rates for Eugene’s ZIP codes in the table below to evaluate how your neighborhood compares in terms of insurance expenses.

This breakdown provides insights into how varying neighborhoods and regions within Eugene influence the cost of your car insurance.

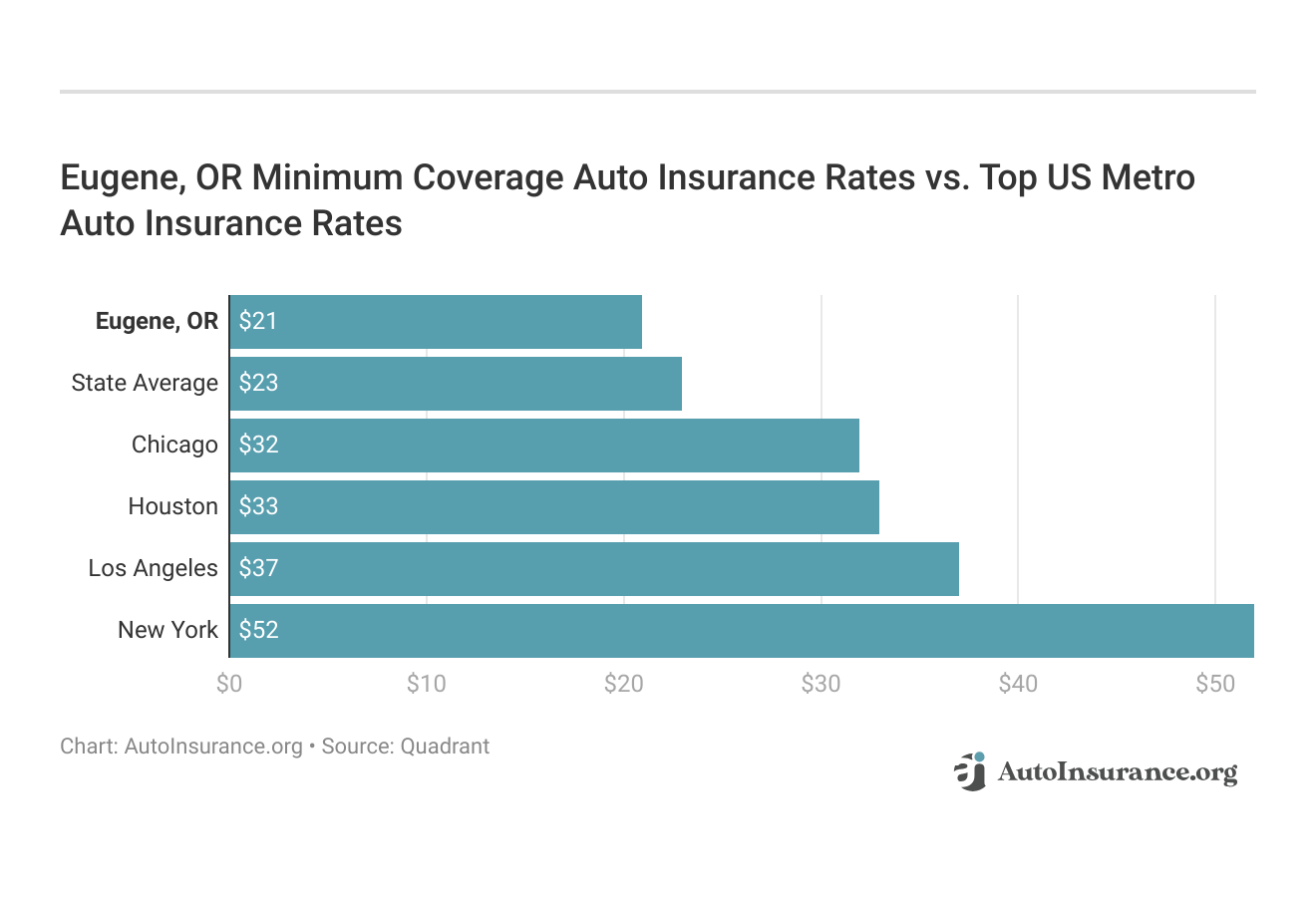

Eugene, OR Car Insurance Rates vs. Top US Metro Car Insurance Rates

Which city you live in will have a major affect on car insurance. That’s why it’s vital to compare Eugene, OR against other top US metro areas’ auto insurance rates.

Comparing Eugene’s auto insurance rates with those of other major U.S. cities highlights significant differences in premium costs. Understanding these variations can help you make more informed decisions about your insurance coverage.

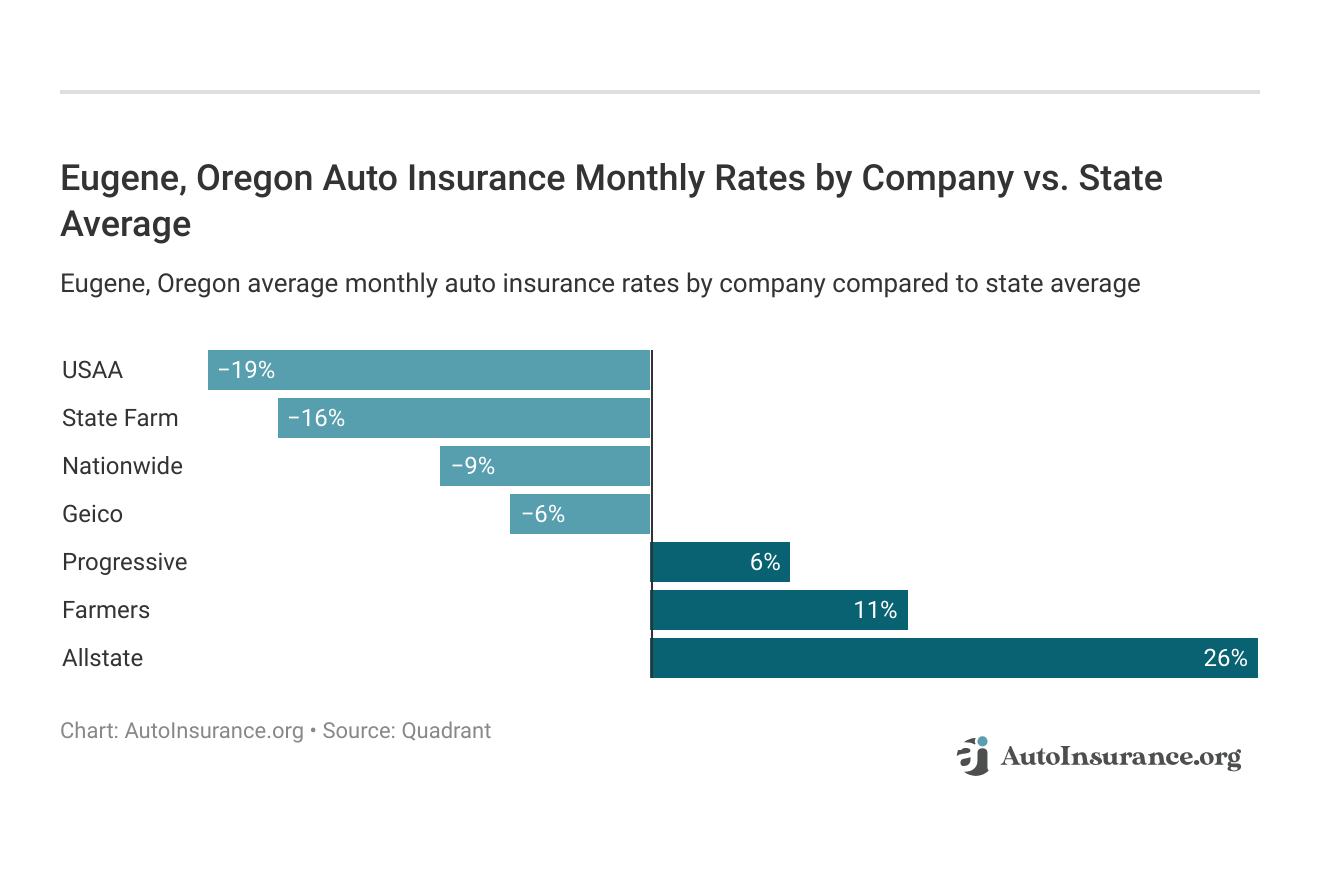

Each insurer offers a variety of discounts tailored to specific factors such as safe driving and multi-policy bundling. Finding the right combination of discounts can help you maximize your savings on auto insurance.

If you’re not a veteran or in the immediate family of someone in the U.S. Armed Forces, you won’t be eligible for a USAA auto insurance policy. Therefore, you’ll have to choose a company available to all potential customers, which includes every other company on the list.

Read More: Best States for Affordable DUI Auto Insurance

This chart lays bare the monthly car insurance costs in Eugene, OR, for four age groups—17, 25, 35, and 60. It reveals how rates shift with each insurer, showing which companies offer the best and worst deals for each age.

This chart shows the effect of credit scores on monthly insurance premiums in Eugene, OR, highlighting differences among major providers such as Nationwide, Geico, and Allstate. State Farm offers the lowest rates for those with good credit, while Allstate remains the most expensive across all credit levels.

A clean driving record is the quickest way to get cheap car insurance. Speeding violations have little effect on your policy at some companies, but accidents and DUIs generate the most expensive auto insurance rates. If you’re a teen or young adult driver, car insurance rates could cost twice as much. We recommended staying under a parent’s policy and pursuing discounts.

Many things can change what you pay for car insurance, like your daily drive, the coverage you pick, any tickets or DUIs, and even your credit history. Keep these in check, and you’ll find the best rates in Eugene.

Several states, including Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania, have made changes to their auto insurance rate calculations by eliminating gender differences.

Regardless of whether or not they consider your gender, age will still be factored into their calculations. Car insurance rates for young drivers typically decrease once they reach the age of 25. For individuals in their 50s and early 60s with a clean driving record, the most favorable rates are available.

Minimum Eugene, OR Auto Insurance Requirements

Drivers in Eugene are required by Oregon law to meet specific minimum auto insurance requirements. Oregon mandates a minimum of $25,000 per person and $50,000 per incident for bodily injury liability, along with $20,000 for property damage, and $15,000 in personal injury protection (PIP).

Oregon’s no-fault system, which is designed to reduce the need for litigation, requires drivers to carry Personal Injury Protection (PIP) that covers medical expenses regardless of fault.

If you’re involved in an accident, your own insurance will cover your medical expenses due to the state’s no-fault rules. However, in an at-fault accident with insufficient coverage, the at-fault driver remains responsible for covering the cost of a no-fault driver’s bodily injury and property damage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eugene, OR Auto Insurance Bottom Line

Eugene, OR car insurance rates are much cheaper than the Oregon state average and national average. As you get fast and free auto insurance quotes, you’ll receive discounts based on your vehicle, driving, record, age, and marital status.

If you don’t see any chances to save money on auto insurance, keep comparing companies until you find the best rates. A quote isn’t a contract for you to purchase insurance.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Frequently Asked Questions

How can I find reliable auto insurance quotes in Eugene, Oregon?

Finding reliable auto insurance quotes in Eugene, Oregon, involves comparing offers from various providers. You can start by visiting online comparison sites that specialize in auto insurance quotes for Eugene.

Read More: Cheap Online-Only Auto Insurance

Additionally, reaching out directly to car insurance companies in Eugene can give you a more personalized quote based on your specific needs and driving history.

What are the top car insurance companies in Eugene?

Several car insurance companies in Eugene offer competitive rates and quality service. Some of the most recognized providers include national insurers with local offices, as well as regional companies that specialize in Oregon’s unique driving conditions.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

How do I get accurate car insurance quotes in Eugene?

To get accurate car insurance quotes in Eugene, it’s essential to provide detailed information about your vehicle, driving history, and coverage preferences. Online tools can help you gather quotes from multiple providers, but contacting car insurance agents in Eugene can also ensure you receive a quote that accurately reflects your needs.

What factors influence the cost of car insurance in Eugene?

The cost of car insurance in Eugene is influenced by several factors, including your driving record, the type of vehicle you drive, your age, and your location within the city. Car insurance in Eugene, Oregon, may also be affected by local crime rates and traffic patterns. Comparing rates from different providers can help you find the most affordable options.

Where can I find cheap car insurance in Eugene, Oregon?

Finding cheap car insurance in Eugene, Oregon, requires comparing rates from multiple providers. Look for discounts such as those for safe driving, bundling policies, or having a good credit score.

Read More: 10 Cheapest Auto Insurance Companies

Some companies specialize in offering affordable car insurance in Eugene, or you might find better rates through local agents who understand the specific needs of Eugene drivers.

What are the minimum requirements for car insurance in Eugene, OR?

In Eugene, OR, drivers are required to carry a minimum amount of car insurance as mandated by Oregon state law. This includes liability coverage of at least $25,000 per person and $50,000 per accident for bodily injury, $20,000 for property damage, and $15,000 for personal injury protection (PIP).

These requirements ensure that drivers have the necessary financial protection in case of accidents.

How can I find the best car insurance rates in Eugene?

To find the best car insurance rates in Eugene, it is advisable to compare quotes from multiple providers. Many companies offer online tools to get car insurance quotes in Eugene quickly. Comparing different coverage options, discounts, and customer reviews can help you identify the most affordable and comprehensive car insurance options in Eugene.

What types of auto insurance are available in Eugene, Oregon?

Besides the required liability coverage, drivers in Eugene, Oregon, can opt for various additional auto insurance types, including comprehensive, collision, uninsured/underinsured motorist coverage, and personal injury protection. These additional coverages offer broader protection against risks such as theft, accidents, and natural disasters, which are particularly relevant given Eugene’s weather conditions and driving environment.

Are there options for cheap car insurance in Eugene?

Yes, there are several options for obtaining cheap car insurance in Eugene. Factors like maintaining a clean driving record, choosing a higher deductible, and bundling multiple policies can help lower your insurance premiums.

Read More: How to Find Affordable Auto Insurance Rates Online

Additionally, comparing rates from different auto insurance providers in Eugene and taking advantage of discounts for good driving, safety features, or student status can further reduce costs.

How do I get auto insurance quotes in Eugene, Oregon?

Obtaining auto insurance quotes in Eugene, Oregon, is simple and can be done online or through local agents. Many insurance providers offer tools on their websites where you can enter your information and receive personalized quotes.

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.