Best Denver, Colorado Auto Insurance in 2026 (Top 10 Companies Ranked)

USAA, Progressive, and Geico offer the best Denver, Colorado auto insurance, with unbeatable premiums starting as low as $38/month. Learn the way to get the finest auto insurance in Denver, CO. Weigh the leading companies, understand the quirks of the city, and lock down the coverage you need.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated August 2024

6,590 reviews

6,590 reviewsCompany Facts

Full Coverage in Denver CO

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage in Denver CO

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Denver CO

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsUSAA, Progressive and Geico are the top three picks for the best Denver, Colorado auto insurance with premiums starting low as $38/month. Don’t miss out on top-tier coverage at affordable rates from these companies.

Welcome to Denver’s auto insurance scene, where stunning mountain views meet urban life. Curious about the average auto insurance cost per month in the Mile High City? From USAA’s military-friendly rates to Progressive’s competitive pricing, we’ll explore Denver’s 25/50/15 minimum requirements and how local factors like the city’s 25.9-minute average commute impact your premiums.

Our Top 10 Company Picks: Best Denver, Colorado Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 5% A++ Military Members USAA

#2 8% A+ Competitive Rates Progressive

#3 6% A++ Online Convenience Geico

#4 7% A Loyalty Rewards American Family

#5 5% B Financial Strength State Farm

#6 6% A++ Bundling Policies Travelers

#7 9% A+ UBI Discount Allstate

#8 5% A+ Multi-Policy Savings Nationwide

#9 8% A Add-on Coverages Liberty Mutual

#10 7% A+ Tailored Policies The Hartford

If you’re just looking for coverage to drive legally, enter your ZIP code above to compare cheap auto insurance quotes near you.

- Learn how auto insurance rates with a DUI vary in Denver

- Auto insurance rates in Denver vary by credit score

- The overall best auto insurance company in Denver, CO is USAA

#1 – USAA: Top Overall Pick

Pros

- Affordable Premiums: USAA offers a competitive rate of $105 per month in Denver, Colorado, making it a cost-effective choice for military families and veterans in the area. For a detailed understanding, see our USAA auto insurance review.

- Low Deductibles: USAA often provides lower deductibles compared to competitors, reducing out-of-pocket costs for Denver drivers in the event of a claim.

- Strong Financial Stability: USAA’s financial strength ensures reliability in paying out claims, giving Denver drivers confidence in their coverage.

Cons

- Eligibility Restrictions: USAA coverage is only available to military members, veterans, and their families, limiting options for the general population in Denver, Colorado.

- Limited Coverage for Non-Military: Non-military drivers in Denver may find fewer benefits or higher rates if eligible for USAA coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Competitive Rates

Pros

- Snapshot Program: The Snapshot program rewards safe driving behaviors with discounts, benefiting Denver drivers who practice cautious driving habits. Find more information in Progressive auto insurance review for detailed policy insights.

- Customizable Coverage: Progressive offers a range of customizable coverage options, allowing Denver residents to tailor their policies to their specific needs.

- Online Policy Management: Progressive’s website and mobile app offer convenient tools for managing policies, filing claims, and accessing support for Denver residents.

Cons

- Higher Rates for High-Risk Drivers: Progressive may charge higher rates for drivers considered high-risk, which can be a disadvantage for some Denver residents.

- Fewer Coverage Options for Older Cars: Progressive’s coverage options for older vehicles may not be as comprehensive, potentially affecting Denver drivers with classic cars.

#3 – Geico: Best for Online Convenience

Pros

- 24/7 Customer Service: Geico provides round-the-clock customer support, ensuring Denver residents can get help whenever needed. Check out Geico auto insurance review for a full examination of their coverage options.

- Good Driver Program: Geico’s good driver program offers additional savings for Denver drivers with a clean driving record.

- Quick Quote System: Geico’s quick quote system provides fast and accurate insurance quotes, helping Denver drivers easily compare rates and options.

Cons

- Potential Rate Increases: Premiums might increase after the initial policy term or following a claim, impacting long-term affordability for Denver drivers.

- Fewer Discounts for New Customers: Geico may offer fewer initial discounts for new customers compared to some other providers.

#4 – American Family: Best for Loyalty Rewards

Pros

- Broad Coverage Options: American Family offers a wide range of coverage options, including liability, collision, and comprehensive, suitable for Denver drivers with various needs. Uncover the details in American Family auto insurance review for a deep dive into their services.

- Loyalty Rewards Program: American Family’s Loyalty Rewards program offers discounts and benefits to long-term customers in Denver, helping reduce premiums and enhance coverage over time.

- Easy Claims Process: The claims process with American Family is straightforward and efficient, helping Denver drivers resolve issues quickly.

Cons

- Complex Policy Terms: The terms and conditions of American Family’s policies may be complex, making it harder for some Denver drivers to understand their coverage.

- Inconsistent Discounts: Discount availability and eligibility can vary, potentially leading to inconsistent savings for Denver drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Financial Strength

Pros

- Wide Coverage Options: State Farm provides a broad range of coverage options including liability, collision, and comprehensive, suitable for diverse needs in Denver. For a complete overview, read State Farm auto insurance review for detailed information.

- Roadside Assistance: State Farm includes roadside assistance in its policies, providing support during emergencies for Denver drivers.

- Accessible Online Resources: State Farm offers convenient online tools and a mobile app for managing policies and filing claims, making it easier for Denver residents.

Cons

- Fewer Physical Locations: In Denver, there aren’t many State Farm offices. It can be a bother for folks who like to handle things face-to-face.

- Customer Service Response Time: Some Denver drivers report longer wait times for customer service, which could be a drawback when seeking assistance.

#6 – Travelers: Best for Bundling Policies

Pros

- Savings with Bundling Policies: Travelers offers significant savings when you bundle auto insurance with other types of coverage, such as home or renters insurance. Discover everything you need to know in Travelers auto insurance review.

- Eco-Friendly Discounts: Denver residents with hybrid or electric vehicles may qualify for special rates, aligning with environmental consciousness.

- Online Policy Management: Travelers offers convenient online tools and a mobile app for managing policies and filing claims, making it easier for Denver residents.

Cons

- Less Aggressive Discounts: Travelers may offer fewer aggressive discounts compared to some competitors, which could impact potential savings for Denver residents.

- Website Navigation Issues: Some users find Travelers’ website less user-friendly, which might complicate policy management for Denver residents.

#7 – Allstate: Best for UBI Discount

Pros

- UBI Discount: Allstate’s Usage-Based Insurance (UBI) program offers discounts to Denver drivers who use a telematics device to track their driving habits, rewarding safe driving with lower premiums. Delve into Allstate auto insurance review for a full breakdown of their policies.

- Accident Forgiveness: Allstate’s accident forgiveness program helps Denver drivers avoid increases in their premiums after their first at-fault accident, which is beneficial for maintaining lower long-term insurance costs.

- Solid Service: Allstate consistently supports Denver motorists. Whenever they require assistance, Allstate is ready to provide aid.

Cons

- Higher Deductibles: Certain Allstate policies may feature higher deductibles, leading to increased out-of-pocket costs for Denver drivers in the event of a claim.

- Limited Additional Benefits: The range of additional benefits and features offered by Allstate may not be as extensive as those provided by some competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Multi-Policy Savings

Pros

- Discounts on Multiple Policies: Nationwide offers discounts for Denver drivers when they bundle multiple policies, such as auto and home insurance, which can significantly reduce overall premium costs. Get the lowdown in Nationwide auto insurance review for a thorough look at their coverage.

- Flexible Payment Plans: Nationwide offers plans to pay as you go or once a year. These options help Denver drivers keep their finances in order.

- User-Friendly Online Tools: Nationwide provides an intuitive website and mobile app for easy policy management and claims filing, enhancing convenience for Denver drivers.

Cons

- Mixed Customer Feedback: While generally positive, some Denver drivers report mixed experiences with Nationwide’s customer service and support.

- Claims Processing Delays: There have been reports of delays in claims processing, which could be an issue for Denver drivers needing quick resolutions.

#9 – Liberty Mutual: Best for Add-on Coverages

Pros

- Enhanced Protection: Add-on coverages, such as roadside assistance or rental car reimbursement, provide extra protection and convenience in various situations, enhancing Denver drivers’ overall coverage. Access Liberty Mutual auto insurance review for a detailed examination of their coverage and services.

- Customizable Policies: Liberty Mutual offers a wide range of choices, letting Denver drivers shape their coverage to fit their lives.

- Superior Customer Care: Liberty Mutual stands out for its prompt and attentive customer service, offering support to the drivers in Denver.

Cons

- Limited Local Offices: Liberty Mutual has fewer physical locations in Denver, which might be inconvenient for those who prefer in-person service.

- Elevated Deductibles for Select Plans: Certain policies may come with higher deductibles, increasing out-of-pocket costs for Denver drivers.

#10 – The Hartford: Best for Tailored Policies

Pros

- Comprehensive Coverage Options: The Hartford provides a broad range of coverage options including liability, collision, and comprehensive, suitable for various needs in Denver, Colorado. Read The Hartford auto insurance review for a detailed analysis of their policy offerings.

- Solid financial footing: The Hartford, solid as a rock, pays claims without fail. Denver drivers sleep easy, knowing their coverage holds firm.

- Flexible Billing Choices: The Hartford offers flexible payment options, including monthly and annual plans, helping Denver drivers manage their budgets effectively.

Cons

- Higher Premiums: The Hartford’s premiums are on the higher end at $135 per month, which might be a drawback for budget-conscious drivers in Denver.

- Intricate Policy Provisions: The terms of The Hartford’s policies were thick with detail, and many Denver drivers found it hard to grasp what their coverage really meant.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Budget-Friendly Auto Insurance Companies in Denver, CO

Discover which insurers in Denver, Colorado, offer the lowest rates. Dive into a comparison of best companies in the Mile High City, known for its stunning mountain views and vibrant culture, to uncover the most affordable monthly premiums.

Denver, Colorado Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $50 $130

American Family $45 $120

Geico $40 $115

Liberty Mutual $55 $130

Nationwide $48 $125

Progressive $42 $110

State Farm $47 $120

The Hartford $52 $135

Travelers $46 $125

USAA $38 $105

USAA offers the lowest rates for both minimum and full coverage auto insurance in Denver, CO, making it ideal for budget-conscious drivers. Geico has competitive minimum coverage rates, while Progressive excels in full coverage premiums.

In Denver, Colorado, obtaining auto insurance involves understanding the state’s minimum coverage requirements and costs for different protection levels. Colorado minimum auto insurance requirements include $25,000 per person and $50,000 per accident for bodily injury, along with a minimum of $15,000 for property damage.

With the city’s distinct terrain and lively atmosphere, it’s important to shop around among local insurers to find the best balance of price and coverage.

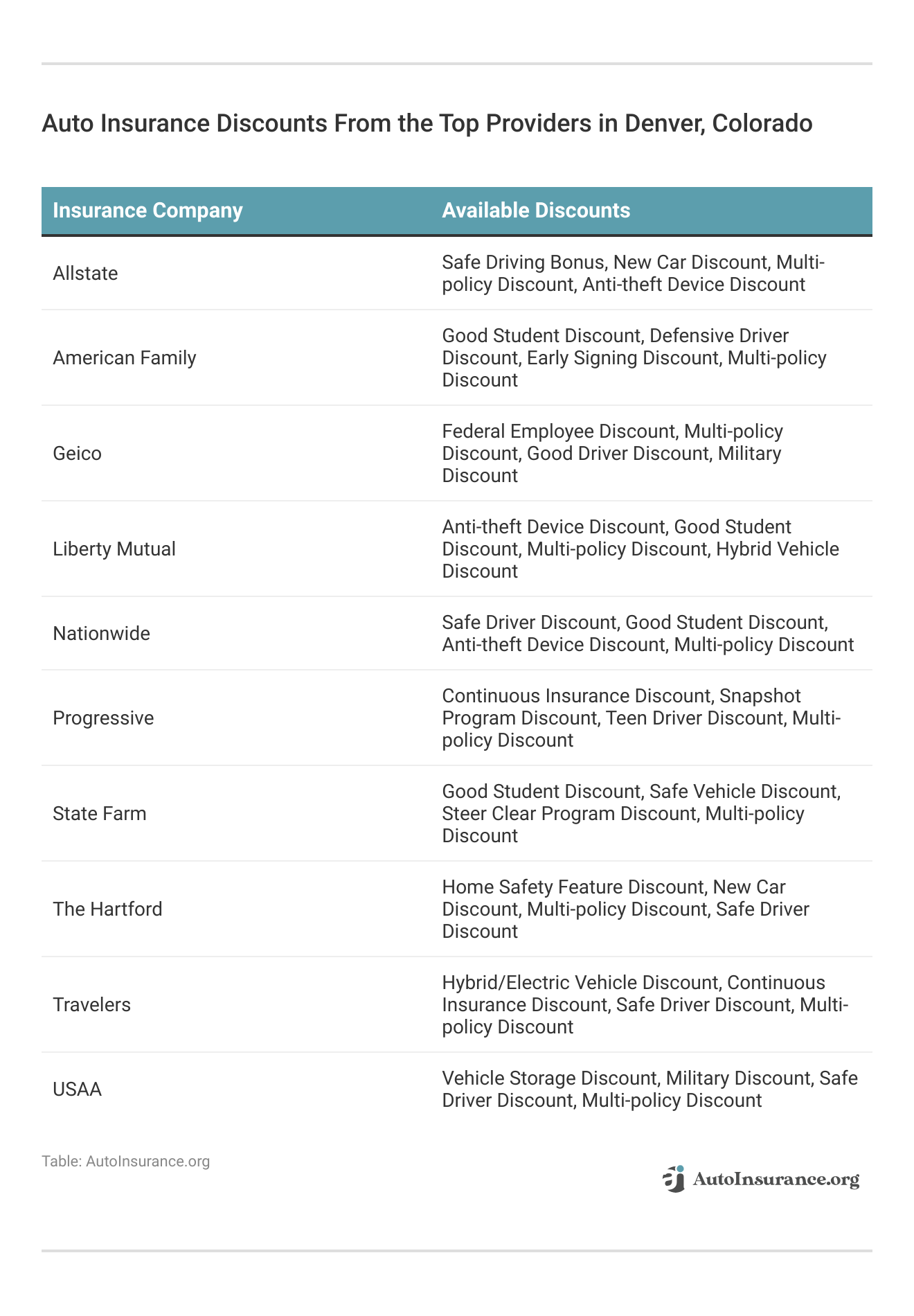

Denver, CO Auto Insurance Discounts

Our chart shows the best Denver, Colorado auto insurance companies and the different ways you can save money with them, like getting rewards for driving safely or having more than one policy. This helps you pick the best deal for you.

Denver, Colorado drivers find themselves sifting through auto insurance discounts from these companies, each offering a chance to save. Allstate and Liberty Mutual present several discount avenues, from safe driving to bundling policies.

Geico and USAA provide special breaks for federal workers and military members.Jeffrey Manola LICENSED INSURANCE AGENT

Progressive and Travelers bring unique discounts for those with continuous coverage and hybrid cars. By digging into these offers, Denver drivers can stretch their dollars and secure the coverage that fits their life.

What Determines Car Insurance Costs in Denver, Colorado

Auto insurance rates in Denver, Colorado, are influenced by several factors, including local traffic conditions and vehicle theft rates. Denver’s average commute time of 25.9 minutes can contribute to higher insurance costs, as longer commutes are often linked to increased rates.

Additionally, Denver ranks 144th globally for traffic congestion, which can also impact insurance premiums. The use of anti-theft devices can help mitigate some of the effects of vehicle theft on insurance costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Denver Auto Insurance Rates According to Driving Record

In Denver, when you look at car insurance, your driving history matters. If you’ve got a clean record, Geico gives you the best deal, while Allstate costs the most. But if you’ve got tickets or accidents, your rates can skyrocket. A DUI, for example, really jacks up the price, with Allstate hitting you hardest compared to Geico.

Denver, Colorado Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| Allstate | $433 | $500 | $493 | $616 |

| American Family | $277 | $390 | $314 | $514 |

| Farmers | $423 | $546 | $499 | $538 |

| Geico | $200 | $316 | $260 | $374 |

| Liberty Mutual | $245 | $287 | $288 | $296 |

| Nationwide | $290 | $397 | $319 | $504 |

| Progressive | $337 | $478 | $393 | $356 |

| State Farm | $296 | $352 | $324 | $324 |

| USAA | $213 | $263 | $241 | $463 |

When specifically looking for the best auto insurance after a dui in Colorado, Liberty Mutual offers the lowest rate. Geico and State Farm also provide relatively lower rates after a DUI. In contrast, Farmers and American Family have higher premiums for DUI violations.

Denver, Colorado DUI Full Coverage Auto Insurance Rates

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $616 |

| American Family | $514 |

| Farmers | $538 |

| Geico | $374 |

| Liberty Mutual | $296 |

| Nationwide | $504 |

| Progressive | $356 |

| State Farm | $324 |

| USAA | $463 |

In assessing automobile insurance premiums in Denver, Colorado, the influence of driving history is paramount. Individuals maintaining an unblemished driving record will find Geico providing the most competitive annual rates, whereas Allstate imposes the highest charges.

Infractions such as accidents, DUIs, or speeding violations can substantially elevate these premiums.Kristen Gryglik LICENSED INSURANCE AGENT

A solitary DUI offense results in significantly higher insurance costs, with Allstate’s rates being the steepest in comparison to those offered by Geico.

Auto Insurance Pricing by Demographic Factors in Denver, CO

Auto insurance prices in Denver, CO swing widely. They hinge on age and whether you’re married. Take a married woman of thirty-five; she pays a different price than a single boy of seventeen.

Denver, Colorado Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $308 | $287 | $280 | $282 | $1,100 | $1,157 | $334 | $334 |

| American Family | $255 | $255 | $231 | $231 | $619 | $832 | $255 | $312 |

| Farmers | $285 | $283 | $258 | $279 | $1,133 | $1,145 | $314 | $315 |

| Geico | $179 | $197 | $194 | $224 | $575 | $605 | $163 | $163 |

| Liberty Mutual | $179 | $173 | $153 | $169 | $572 | $623 | $181 | $181 |

| Nationwide | $249 | $253 | $223 | $235 | $642 | $820 | $288 | $235 |

| Progressive | $825 | $921 | $263 | $255 | $234 | $218 | $206 | $205 |

| State Farm | $597 | $752 | $222 | $264 | $198 | $198 | $180 | $180 |

| USAA | $507 | $578 | $249 | $269 | $194 | $192 | $186 | $185 |

For those searching cheap auto insurance for drivers over 60, options like Geico and Liberty Mutual offer competitive rates. Exploring different providers can help you find the best deal tailored to your specific demographic profile.

Finding Cheap Auto Insurance in Denver, CO With Different Credit Scores

Are you looking for the best companies offering credit-based auto insurance in Denver, CO? Rates may fluctuate considerably based on your credit score, underscoring the importance of evaluating various providers.

Denver, Colorado Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Poor Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $652 | $501 | $377 |

| American Family | $485 | $346 | $291 |

| Farmers | $580 | $474 | $450 |

| Geico | $346 | $287 | $229 |

| Liberty Mutual | $398 | $244 | $194 |

| Nationwide | $456 | $362 | $314 |

| Progressive | $444 | $380 | $349 |

| State Farm | $449 | $289 | $233 |

| USAA | $435 | $250 | $201 |

This detailed evaluation will help you make an informed decision, allowing you to secure the best possible insurance plan that aligns with both your financial constraints and personal needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

ZIP Code-Based Auto Insurance Rates in Denver, CO

This table shows why you should think about how ZIP codes affect car insurance rates in Denver, CO. Knowing how costs vary from one place to another can teach you how to judge car insurance quotes well.

Denver, Colorado Full Coverage Auto Insurance Rates by ZIP Code

| ZIP Code | Monthly Rates |

|---|---|

| 80110 | $325 |

| 80202 | $346 |

| 80203 | $352 |

| 80204 | $359 |

| 80205 | $353 |

| 80206 | $350 |

| 80207 | $350 |

| 80208 | $336 |

| 80209 | $335 |

| 80210 | $338 |

| 80211 | $344 |

| 80212 | $333 |

| 80216 | $349 |

| 80218 | $348 |

| 80219 | $367 |

| 80220 | $359 |

| 80221 | $324 |

| 80222 | $343 |

| 80223 | $366 |

| 80224 | $348 |

| 80225 | $326 |

| 80229 | $321 |

| 80230 | $362 |

| 80231 | $345 |

| 80232 | $334 |

| 80236 | $344 |

| 80237 | $333 |

| 80238 | $338 |

| 80239 | $353 |

| 80246 | $361 |

| 80247 | $358 |

| 80249 | $330 |

| 80264 | $338 |

| 80265 | $341 |

| 80266 | $340 |

| 80290 | $342 |

| 80293 | $339 |

| 80294 | $339 |

| 80295 | $341 |

| 80299 | $339 |

Knowing your ZIP code’s impact on insurance rates is essential for making informed decisions. By understanding these differences, you can better evaluate auto insurance quotes and find the most competitive rates.

How Commute Distance Affects Car Insurance in Denver, CO

Grasping how the length of your daily drive affects car insurance in Denver, Colorado, is crucial for securing proper coverage. This table illustrates how rates can vary based on your daily driving habits, helping you identify the best pay-as-you-go auto insurance in Colorado.

Denver, Colorado Full Coverage Auto Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $510 | $510 |

| American Family | $366 | $382 |

| Farmers | $502 | $502 |

| Geico | $282 | $293 |

| Liberty Mutual | $279 | $279 |

| Nationwide | $378 | $378 |

| Progressive | $391 | $391 |

| State Farm | $316 | $332 |

| USAA | $287 | $303 |

Some companies, like Allstate and Farmers, keep rates steady, while others, such as American Family and Geico, adjust premiums based on mileage. This shows you must think about how you drive and who insures you when you pick your coverage.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Frequently Asked Questions

How does Denver’s altitude affect my auto insurance premiums?

Denver’s high altitude, being over a mile above sea level, can impact vehicle performance, especially for engines. This factor may be considered by auto insurance companies in Denver, particularly when evaluating vehicles prone to engine issues in high-altitude conditions. This may influence your auto insurance in Denver, CO premiums.

Are there specific auto insurance requirements for electric vehicles in Denver, CO?

As electric vehicles (EVs) become more popular in Denver, auto insurance companies in Denver are tailoring policies to meet the unique needs of EV owners. You might need specialized coverage options, like increased liability limits or coverage for expensive battery repairs, reflecting the higher value and technological complexity of EVs, which can be essential when searching for auto insurance in Denver, CO.

Read More: Electric Vehicle Auto Insurance Discounts

What should I know about insuring my vehicle during Denver’s snowy winters?

Denver’s winters are known for heavy snowfall, which increases the risk of accidents. Drivers should consider comprehensive coverage, which protects against weather-related damages, and collision coverage to cover repairs from accidents due to icy roads. Insurers may also offer discounts for vehicles equipped with winter tires or anti-lock braking systems, making it easier to find cheap car insurance in Denver during the winter months.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Does Denver’s urban setting impact auto insurance rates?

Yes, living in Denver’s urban areas can lead to higher auto insurance Denver rates due to factors like increased traffic congestion, higher accident rates, and the risk of vehicle theft. Insurers may charge more for policies in densely populated areas where accidents and claims are more common, affecting your Denver car insurance rates.

How can I reduce my auto insurance premiums if I only drive in Denver occasionally?

If you’re a low-mileage driver in Denver, consider asking your insurer about pay-per-mile or usage-based insurance. These plans charge premiums based on how much you drive, making them a cost-effective option if you use your car infrequently. This could be a great way to secure cheap auto insurance in Denver.

What are the benefits of bundling auto insurance with other policies in Denver, CO?

Bundling your car insurance in Denver with other policies, like home or renters insurance, can lead to significant discounts. Insurers often offer reduced premiums for customers who purchase multiple types of coverage, helping you save on overall insurance costs. This is a smart strategy when looking for cheap car insurance in Denver, CO.

Are there insurance discounts available for eco-friendly drivers in Denver?

Yes, many car insurance companies in Denver offer discounts for eco-friendly driving habits. If you drive a hybrid or electric vehicle, or participate in a carpooling program, you might qualify for lower rates. Additionally, some insurers reward customers who maintain a low annual mileage, contributing to reduced emissions and cheap car insurance in Denver.

What do I need to know about insuring a classic car in Denver, CO?

Classic car owners in Denver should seek out specialized classic car insurance in Denver, Colorado that offers agreed value coverage, which ensures that your classic car is insured for its full appraised value. This type of insurance also typically provides coverage for spare parts and often has lower premiums due to limited use, which can be an advantage when searching for cheap car insurance in Denver, CO.

How does Denver’s air quality affect auto insurance considerations?

Denver’s air quality can impact the longevity of your vehicle, particularly for older models. While it may not directly affect your car insurance in Denver premiums, maintaining your vehicle to reduce emissions can help in passing inspections and avoiding fines, indirectly protecting your insurance rates from penalties related to non-compliance with local environmental regulations. This is important to keep in mind when comparing car insurance quotes in Denver.

Can I get auto insurance coverage for rideshare driving in Denver, CO?

Yes, if you drive for a rideshare service like Uber or Lyft in Denver, you’ll need additional coverage beyond your personal auto insurance policy. Rideshare insurance covers the gaps between your personal policy and the coverage provided by the rideshare company, ensuring that you’re fully protected while working. This is essential for those seeking auto insurance in Denver, CO that meets all their driving needs.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.