Best Nissan Maxima Auto Insurance in 2026 (Find the Top 10 Companies Here)

State Farm, Geico, and USAA are the top picks for the best Nissan Maxima auto insurance, offering a starting rate as low as $32 per month. These providers excel in customer service, coverage options, and discounts, making them ideal choices for Nissan Maxima owners seeking reliable and affordable insurance.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated March 2025

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Nissan Maxima

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Nissan Maxima

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage for Nissan Maxima

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviewsState Farm, Geico, and USAA are the top choices for the best Nissan Maxima auto insurance, offering competitive rates and comprehensive coverage.

With monthly premiums starting as low as $40, these providers stand out for their affordability and robust customer service. State Farm, in particular, leads the pack with its exceptional balance of cost and coverage, making it the ideal option for Nissan Maxima owners.

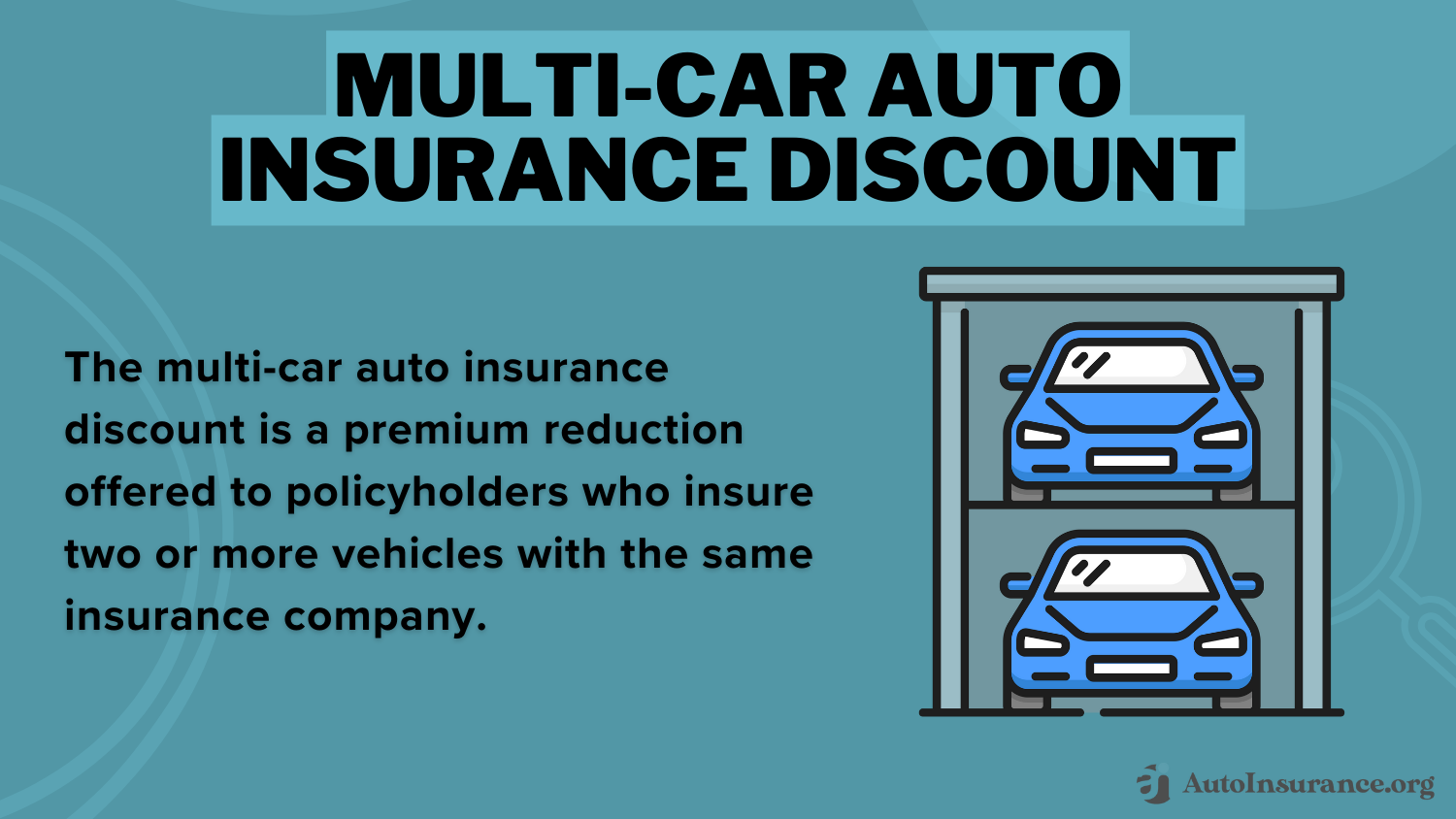

Our Top 10 Company Picks: Best Nissan Maxima Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 13% | B | Many Discounts | State Farm | |

| #2 | 15% | A++ | Custom Plan | Geico | |

| #3 | 10% | A++ | Military Savings | USAA | |

| #4 | 14% | A | Online App | AAA |

| #5 | 12% | A | Local Agents | Farmers | |

| #6 | 16% | A | Customizable Polices | Liberty Mutual |

| #7 | 11% | A+ | Add-on Coverages | Allstate | |

| #8 | 17% | A+ | Online Convenience | Progressive | |

| #9 | 9% | A+ | Usage Discount | Nationwide |

| #10 | 18% | A++ | Accident Forgiveness | Travelers |

Explore your options and secure the best protection for your vehicle today. You can start comparing quotes for Nissan Maxima auto insurance rates from some of the best auto insurance companies by using our free online tool now.

- State Farm, Geico, and USAA offer the best Nissan Maxima insurance rates

- Monthly premiums start at $40, with top coverage and service options

- State Farm is the leading choice for balancing affordability and coverage

#1 – State Farm: Top Overall Pick

Pros

Cons

- Higher Premiums: State Farm often commands higher premiums relative to certain competitors, which might pose a drawback for Nissan Maxima owners in search of the most economical insurance solutions.

- Limited Availability: The presence of local agents might be sparse in some regions, potentially restricting access to personalized service for a segment of Nissan Maxima owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: For Nissan Maxima owners aiming to slash their insurance expenses, Geico emerges as an attractive option, offering rates that are often more competitive than many rivals.

- Wide Range of Discounts: A variety of discounts is on offer, such as those for exemplary driving habits, multi-policy bundling, advanced vehicle safety features, and even affiliations with certain organizations, all contributing to lower premiums for Nissan Maxima owners.

- Telematics Program: Geico’s DriveEasy telematics initiative rewards safe driving with additional discounts, allowing drivers to benefit from their good driving practices, as highlighted in our Geico auto insurance review.

Cons

#3 – USAA: Best for Military Discounts

Pros

Cons

- Limited Eligibility: The fact that USAA is exclusively accessible to veterans, service members, and their families restricts its availability to a larger group of Nissan Maxima owners, as mentioned in the USAA auto insurance review.

- Limited Physical Locations: With fewer brick-and-mortar offices than many other insurers, USAA may present a challenge for Nissan Maxima owners who favor face-to-face interactions and in-person service.

#4 – AAA: Best for Comprehensive Roadside Assistance

Pros

Cons

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Customizable Policies

Pros

- Customized Policies: As seen in our article, “Farmers Auto Insurance Review,” Farmers provides Nissan Maxima owners with the ability to customize their policies to match their unique requirements and preferences. This is made possible by the company’s flexible and customizable coverage options.

- Multiple Discounts: Nissan Maxima owners can reduce their insurance costs by taking advantage of a number of discounts, including those for bundling policies, safe driving, and vehicle safety features. To find out how much you could save, check out our comprehensive guide titled “Farmers Auto Insurance Discounts” to see how much you could save.

- Effective Claims Management: Farmers is renowned for its effective claims management procedure, guaranteeing Nissan Maxima owners obtain timely and equitable payouts.

Cons

- Higher Premiums: Farmers Insurance might not be the ideal pick for Nissan Maxima owners seeking the most cost-effective solutions, as its rates are generally steeper compared to some competitors.

- Mixed Customer Reviews: Varied feedback on customer service suggests that Nissan Maxima owners could face inconsistent service quality, with some experiencing challenges in their interactions.

#6 – Liberty Mutual: Best for Extensive Coverage Options

Pros

- Extensive Coverage Options: Liberty Mutual offers a broad range of coverage, including accident forgiveness to keep your premium stable after your first at-fault accident, and new car replacement coverage which ensures a replacement vehicle one model year newer if your Nissan Maxima is totaled. These features provide valuable protection and mitigate financial impacts for Maxima owners.

- Numerous Discounts: Liberty Mutual provides various discounts to reduce costs for Nissan Maxima owners, such as those for advanced safety features, a clean driving history, and policy bundling with home or renters insurance. These discounts can significantly lower overall premiums.

- Better Car Replacement: With Liberty Mutual’s better car replacement coverage, if your Nissan Maxima is totaled, you receive a replacement vehicle that is one model year newer. This benefit enhances your insurance by ensuring you stay current with the latest vehicle features.

Cons

- Premiums: Liberty Mutual typically offers higher rates, which might not be the best choice for Nissan Maxima owners looking for more affordable insurance options, according to Liberty Mutual auto insurance review.

- Customer Service: Varying feedback on customer service and claims handling suggests that some Nissan Maxima owners might experience challenges with service quality.

#7 – Allstate: Best for Wide Range of Discounts

Pros

- Wide Range of Discounts: Owners of Nissan Maximas can save money on insurance by taking advantage of Allstate’s many discounts, which include those for good driving, multiple policies, and car safety features.

- Comprehensive Coverage Options: Owners of Nissan Maximas can customize their plans with Allstate’s extensive and adaptable coverage options to suit their individual requirements, as highlighted in the Allstate auto insurance review.

- Safe Driving Programs: Allstate’s Drivewise and Milewise programs reward Nissan Maxima owners for safe driving habits, potentially reducing premiums further.

Cons

- Higher Premiums: For Nissan Maxima owners searching for the most affordable solutions, Allstate may not be the best choice because of its generally higher costs when compared to certain other insurers.

- Mixed Customer Satisfaction: Varied feedback on customer service and claims processing suggests that Nissan Maxima owners could potentially face challenges with the quality of service provided.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive offers competitive rates and multiple discount options, making it an attractive choice for Nissan Maxima owners looking to save on insurance costs, according to Progressive auto insurance review.

- Usage-Based Discounts: Progressive’s usage-based insurance program, Snapshot, can provide additional savings for Nissan Maxima owners who demonstrate safe driving habits.

- Comprehensive Coverage: Progressive offers a wide range of coverage options, allowing Nissan Maxima owners to tailor their policies to meet their specific needs.

Cons

- Mixed Claims Satisfaction: Some customers report issues with the claims process, including delays and difficulties in getting claims approved, which could be a concern for Nissan Maxima owners who rely on prompt and efficient service.

- Customer Service Issues: Some customers report issues with customer service quality, which could be a concern for Nissan Maxima owners who value reliable support.

#9 – Nationwide: Best for Extensive Coverage Options:

Pros

- Extensive Coverage Options: Nationwide offers extensive and customizable coverage options, allowing Nissan Maxima owners to tailor their policies to meet their specific needs.

- Variety of Discounts: Various discounts are available for safe driving, vehicle safety features, and bundling policies, helping Nissan Maxima owners save on their premiums.

- Accident Forgiveness: Nationwide offers accident forgiveness, which can prevent premium increases after the first at-fault accident for Nissan Maxima owners.

Cons

- Higher Premiums: For Nissan Maxima owners searching for the most affordable options, Nationwide might not be the best choice because its rates are typically higher than those of some of its rivals.

- Claims Process Delays: Some customers report delays in the claims process, which could be a concern for Nissan Maxima owners who rely on prompt and efficient service, as noted in the Nationwide auto insurance review.

#10 – Travelers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Travelers offers comprehensive coverage options, including gap insurance and new car replacement, which can be beneficial for Nissan Maxima owners.

- Discounts: Multiple discounts are available for safe driving, bundling policies, and vehicle safety features, helping Nissan Maxima owners reduce their insurance costs.

- Claims Service: Generally positive reviews for their claims service ensure that Nissan Maxima owners receive prompt and fair settlements, as highlighted in the Travelers auto insurance review.

Cons

- Higher Premiums: Travelers generally has higher premiums compared to some competitors, which may not be ideal for Nissan Maxima owners seeking the most affordable options.

- Mixed Customer Service Reviews: Customers who have experienced problems with customer care suggest that owners of Nissan Maximas may experience variations in the quality of their services.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring the Expenses of Insuring a Nissan Maxima

When it comes to protecting your Nissan Maxima, understanding the costs associated with auto insurance is crucial. This guide delves into the various factors that influence insurance rates for the Nissan Maxima, including vehicle age, driver demographics, and coverage options. Discover our comprehensive guide to “How to Estimate the Auto Insurance Costs for a New Car” for additional insights.

Nissan Maxima Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $87 | $228 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

By exploring these elements, you can make informed decisions and find the most cost-effective insurance for your Maxima. The average Nissan Maxima auto insurance costs are $1,576 a year or $131 a month.

Nissan Maxima Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Discount Rate | $77 |

| High Deductibles | $113 |

| Average Rate | $131 |

| Low Deductibles | $165 |

| High Risk Driver | $280 |

| Teen Driver | $480 |

In summary, comprehending the insurance costs for your Nissan Maxima helps you choose the right coverage and provider. By considering factors like vehicle age, driving history, and location, you can secure the best protection at a reasonable rate. Make sure to compare quotes and review your options to ensure you get the most value for your insurance investment.

The Cost of Insuring a Nissan Maxima

Comparing the Nissan Maxima’s insurance costs to those of rival sedans, such as the Honda Civic, Volkswagen Passat, and Buick Regal, as shown in the chart below. For further details, check out our in-depth “Auto Insurance Quotes Online” article.

Nissan Maxima Auto Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Nissan Maxima | $33 | $55 | $31 | $131 |

| Honda Civic | $23 | $55 | $35 | $128 |

| Volkswagen Passat | $28 | $50 | $33 | $123 |

| Buick Regal | $26 | $45 | $33 | $117 |

| Audi A3 | $24 | $47 | $33 | $117 |

| Nissan Altima | $26 | $48 | $33 | $119 |

| Ford Taurus | $29 | $50 | $33 | $125 |

However, there are a number of steps you can take to identify and secure the most cost-effective insurance rates for your Nissan when searching online. By utilizing various strategies and comparison tools, you can find the best deals and ensure you are getting the lowest possible rates.

Factors That Affect the Cost of Insuring a Nissan Maxima

Although the typical monthly insurance rate for a Nissan Maxima averages around $135, the actual cost of your policy can fluctuate based on several personal factors. Learn more by visiting our detailed “Factors That Affect Auto Insurance Rates” section.

Your insurance premium may be higher or lower depending on your specific profile, which includes variables such as your age, the location where you live, your driving history, and the particular model year of your Nissan Maxima. These factors collectively influence how insurers assess your risk and set your premium, leading to a range of potential costs that might deviate from the average rate.

Age of the Vehicle

Nissan Maxima Auto Insurance Monthly Cost by Model Year & Coverage Type

| Model Year | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2024 Nissan Maxima | $38 | $61 | $30 | $140 |

| 2023 Nissan Maxima | $37 | $60 | $31 | $138 |

| 2022 Nissan Maxima | $36 | $58 | $32 | $135 |

| 2021 Nissan Maxima | $35 | $57 | $32 | $133 |

| 2020 Nissan Maxima | $33 | $55 | $31 | $131 |

| 2019 Nissan Maxima | $31 | $53 | $33 | $129 |

| 2018 Nissan Maxima | $30 | $52 | $33 | $128 |

| 2017 Nissan Maxima | $29 | $51 | $35 | $127 |

| 2016 Nissan Maxima | $28 | $49 | $36 | $126 |

| 2014 Nissan Maxima | $25 | $44 | $38 | $120 |

This $27 difference highlights how newer vehicles, with their higher value and potentially more expensive repairs, result in higher insurance premiums compared to older models.

Driver Age

The cost of insurance for your Nissan Maxima is significantly influenced by your age. Because younger drivers are perceived by insurance companies as carrying a larger risk, rates are raised. For example, a 30-year-old’s coverage might cost around $69 more annually than a 40-year-old’s.

Nissan Maxima Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $808 |

| Age: 18 | $656 |

| Age: 20 | $206 |

| Age: 30 | $191 |

| Age: 40 | $131 |

| Age: 45 | $169 |

| Age: 50 | $157 |

| Age: 60 | $152 |

This disparity results from the perception that younger drivers carry a larger risk due to factors like inexperience and a higher likelihood of accidents.

As drivers age and gain experience, they are often seen as less of a risk, which frequently results in lower insurance costs. Because of this, age has a significant role in determining insurance costs, with older and more experienced drivers often paying less.

Driver Location

Your location can profoundly influence your Nissan Maxima insurance rates, with significant variations stemming from regional factors like traffic congestion, accident frequencies, and crime statistics. For example, drivers in Los Angeles might encounter insurance premiums up to $73 higher per month compared to those in Phoenix.

Nissan Maxima Auto Insurance Monthly Rates by City

| State | Rates |

|---|---|

| Los Angeles, CA | $225 |

| New York, NY | $208 |

| Houston, TX | $206 |

| Jacksonville, FL | $190 |

| Philadelphia, PA | $176 |

| Chicago, IL | $173 |

| Phoenix, AZ | $152 |

| Seattle, WA | $127 |

| Indianapolis, IN | $112 |

| Columbus, OH | $109 |

This discrepancy arises because urban centers like Los Angeles grapple with denser traffic, higher accident rates, and increased vehicle theft risks, all driving up insurance costs. In contrast, cities with lighter traffic and lower crime rates, such as Phoenix, generally benefit from more affordable premiums.

Understanding how your geographic area impacts your insurance expenses can aid in managing costs more effectively and making well-informed coverage choices.

Your Driving Record

Nissan Maxima Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $480 | $528 | $600 | $690 |

| Age: 18 | $410 | $451 | $513 | $591 |

| Age: 20 | $298 | $324 | $378 | $449 |

| Age: 30 | $137 | $149 | $174 | $245 |

| Age: 40 | $131 | $143 | $168 | $236 |

| Age: 45 | $125 | $137 | $161 | $225 |

| Age: 50 | $120 | $130 | $154 | $218 |

| Age: 60 | $117 | $128 | $150 | $212 |

This demographic typically faces the highest increases in insurance costs when their driving record includes violations, such as speeding tickets or at-fault accidents.

Since younger drivers are statistically more likely to be involved in traffic incidents, insurers view them as higher risk, which translates to steeper insurance rates. Therefore, maintaining a clean driving record is crucial for minimizing insurance expenses and securing the most favorable rates.

Nissan Maxima Safety Ratings

The Nissan Maxima boasts strong crash test ratings, reflecting its commitment to safety and occupant protection. These ratings highlight the vehicle’s ability to withstand and minimize the impact of collisions, making it a reliable choice for safety-conscious drivers.

The Nissan Maxima’s safety ratings will affect your Nissan Maxima auto insurance rates. See the chart below:

Nissan Maxima Safety Ratings

| Test | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

Overall, the Nissan Maxima’s excellent crash test ratings offer reassurance of its robust safety performance. These ratings underscore the vehicle’s ability to effectively protect occupants in the event of a collision, contributing to a safer driving experience and enhancing peace of mind for both drivers and passengers.

Nissan Maxima Crash Test Ratings

The Nissan Maxima consistently achieves high crash test ratings, reflecting its commitment to advanced safety features and occupant protection. These ratings showcase the vehicle’s ability to perform well in various collision scenarios, providing confidence in its safety standards.

If the Nissan Maxima crash test ratings are good, you could have lower Nissan Maxima auto insurance rates. See Nissan Maxima crash test results below:

Nissan Maxima Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Nissan Maxima 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2023 Nissan Maxima 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2022 Nissan Maxima 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2021 Nissan Maxima 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2020 Nissan Maxima 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2019 Nissan Maxima 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2018 Nissan Maxima 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2017 Nissan Maxima 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2016 Nissan Maxima 4 DR FWD Later Release | 5 stars | 5 stars | 5 stars | 5 stars |

| 2016 Nissan Maxima 4 DR FWD Early Release | 5 stars | 5 stars | 5 stars | 5 stars |

Thanks to its strong crash test ratings, the Nissan Maxima offers excellent protection for both drivers and passengers. This impressive safety performance underscores its reliability and makes it a standout choice for those who prioritize safety in their vehicle selection.

Nissan Maxima Safety Features

A comprehensive array of safety measures intended to safeguard drivers and passengers is standard on the Nissan Maxima. To improve on-road safety, key features include Vehicle Dynamic Control with Traction Control, an improved airbag system, and advanced driver aid systems like Nissan Safety Shield 360.

The Nissan Maxima’s many safety features aid in bringing down insurance costs. The following safety features are available in the 2020 Nissan Maxima:

- Driver Air Bag

- 4-Wheel ABS

- Brake Assist

- Daytime Running Lights

- Child Safety Locks

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Nissan Maxima Ownership Expenses

When financing a Nissan Maxima, lenders typically require you to maintain comprehensive insurance coverage, including both collision and other protective options. This is because the lender has a financial interest in the vehicle until the loan is fully repaid. By requiring extensive coverage, the lender ensures that any potential damage, theft, or loss is covered, protecting their investment.

If the vehicle is significantly damaged or totaled, the insurance payout would go to the lender to cover the outstanding loan balance, ensuring they do not incur a financial loss. This requirement is standard for financed vehicles and helps ensure that both the lender and the borrower are protected.

This typically includes comprehensive insurance, which offers protection against a range of risks beyond collision. To ensure that you are meeting these requirements while also finding the best possible rates, it is essential to thoroughly compare auto insurance options from leading providers.

Utilize our free comparison tool below to evaluate various insurance plans, helping you to select the most appropriate and cost-effective coverage for your Nissan Maxima. Dive deeper into “Does the price of a car affect auto insurance rates?” with our complete resource.

Lower Your Maxima Insurance Bill

Although it might initially appear difficult, lowering your Nissan Maxima’s insurance premiums is completely doable with the appropriate strategy. You can successfully reduce your insurance prices without sacrificing the caliber of your coverage by implementing a number of calculated strategies.

There exist multiple avenues for reducing your Nissan Maxima auto insurance costs, enabling you to attain noteworthy financial gains while maintaining the needed safeguards for your car. Read our extensive guide on “How to Lower Your Auto Insurance Rates” for more knowledge.

For instance, consider these five tips to help you save money:

- Buy winter tires for your Nissan Maxima.

- Reduce modifications on your Nissan Maxima.

- Don’t assume your Nissan Maxima insurance rates are cheaper to insure than another vehicle.

- Improve your credit score.

- Renew your Nissan Maxima insurance coverage to avoid lapses.

You can find savings that really add up by putting these five tips to use and managing your Nissan Maxima insurance costs more skillfully. Spend some time weighing your alternatives and putting these money-saving suggestions into practice to make sure you’re receiving the best deal on your insurance.

Top-Rated Insurance Providers for the Nissan Maxima

When seeking the best coverage for your Nissan Maxima, it’s essential to consider top-rated insurance providers who offer competitive rates and comprehensive protection. Expand your understanding with our thorough “Best Auto Insurance Companies” overview.

Top Nissan Maxima Providers by Market Share

| Rank | Insurance Company | Premium Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.1 million | 9.3% |

| #2 | Geico | $46.1 million | 6.6% |

| #3 | Progressive | $39.2 million | 5.6% |

| #4 | Liberty Mutual | $35.6 million | 5.1% |

| #5 | Allstate | $35 million | 5% |

| #6 | Travelers | $28 million | 4% |

| #7 | USAA | $23.4 million | 3.3% |

| #8 | Chubb | $23.3 million | 3.3% |

| #9 | Farmers | $20.6 million | 2.9% |

| #10 | Nationwide | 18.4 million | 2.6% |

This guide provides an overview of the top insurance companies that offer exceptional, tailored coverage specifically for the Nissan Maxima. By highlighting these leading providers, the guide aims to assist you in making an informed decision about your auto insurance options.

It focuses on companies that excel in delivering customized coverage, ensuring that you find a policy that best meets the needs of your Nissan Maxima while offering comprehensive protection and value.

Choosing the right insurance provider is crucial for securing the best value and coverage for your Nissan Maxima. By selecting one of these top-rated insurance companies, you can ensure optimal protection for your vehicle while benefiting from competitive pricing and excellent customer service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Nissan Maxima Insurance Model Overview

Nissan, known for its diverse range of vehicles from compact cars to sports cars and trucks, offers the popular Nissan Maxima as part of its lineup. Securing the best insurance for your Maxima should be a top priority. Read our extensive guide on “Auto Insurance by Vehicle” for more knowledge.

While finding the right coverage may seem daunting, with a bit of research and effort, you can easily locate excellent insurance options that are both affordable and comprehensive. To get started, simply enter your ZIP code in the Free search tool above to access car insurance quotes tailored to your needs.

The Nissan Maxima is a mid-size four-door sports car available in four trims. The base model, the 3.5 S, starts at $32,420, while the 3.5 SV Premium Package begins at $38,420. It features a standard 3.5-liter engine delivering 290 horsepower.

All models are front-wheel drive with a continuously variable transmission, and higher trims offer optional paddle shifters. The Maxima achieves an estimated 19 mpg city and 26 mpg highway.

Safety is a key feature of the Maxima, with a range of airbags, including front, side, and curtain airbags, as well as seat belts with occupant sensors and crumple zones to protect passengers. Additionally, all new Nissans come with a standard warranty, including a 36-month/36,000-mile limited vehicle warranty and a 5-year/60,000-mile limited powertrain warranty.

Nissan Maxima Insurance: Best Does Not Mean Cheap

Before you start looking for insurance coverage, it’s essential to recognize that “best” doesn’t always equate to “cheap” in the insurance industry. Inexpensive coverage often lacks the protection needed to adequately cover your liability and safeguard your vehicle and assets.

The best car insurance provides comprehensive coverage at an affordable rate. Finding the right balance between adequate protection and cost is achievable, but it requires some effort to locate an insurer offering the best rates for your needs. Continue reading our full “Compare Car Insurance Rates” guide for extra tips.

Nissan Maxima Insurance: Maximize Those Factors You Control

Car insurance companies use a variety of factors to determine auto insurance rates, assessing how likely you are to make a claim in the future. Essentially, these factors allow insurers to predict your risk level and set your rates accordingly.

If you’re statistically more likely to experience a car accident or another type of loss, you’ll face higher premiums to balance that risk. For more information, explore our informative “How Insurance Providers Determine Rates” page.

While not all factors affecting your insurance rates are within your control, focusing on those you can influence is crucial for finding affordable coverage. Start by improving your driving history, as it is the most significant factor in determining rates. Maintain a clean record by avoiding accidents and traffic violations, and consider taking a state-approved driving safety course to potentially lower your points.

Additionally, improving your credit history can positively impact your insurance rates, as insurers often associate good credit with responsible driving. Resources like MyFICO offer guidance on enhancing your credit, which in turn could help reduce your insurance premiums.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Free Nissan Maxima Insurance Quotes Online

While cost isn’t the sole consideration when selecting insurance for your Nissan Maxima, securing comprehensive coverage at a lower price is advantageous. Insurance rates can vary significantly between companies for identical coverage, so obtaining quotes is essential to finding the best deal.

tate Farm's balance of affordability and coverage options makes it the best choice for Nissan Maxima drivers looking for reliable auto insurance.Scott W. Johnson Licensed Insurance Agent

To maximize savings, it’s crucial to gather multiple quotes, as this approach helps you identify the lowest rates without altering your risk profile or coverage needs. To start comparing Nissan Maxima auto insurance quotes for free, use our online auto insurance comparison tool.

Industry experts recommend obtaining at least three quotes from different insurers to compare coverage options effectively. Ensure that you request consistent coverage amounts for each quote to facilitate accurate comparisons. Learn more by visiting our detailed “Compare Cheap Online Auto Insurance Quotes” section.

In addition to traditional methods like visiting an insurance office or calling representatives, you can leverage technology by using online tools or comparison websites to streamline the process. These platforms allow you to complete one application and receive multiple quotes, saving you time and effort.

Frequently Asked Questions

How does the make and model of a Nissan Maxima affect insurance rates?

The make and model affect insurance rates due to factors like repair costs, safety features, and theft rates, with performance-oriented models like the Nissan Maxima potentially resulting in higher premiums.

What factors do insurance companies consider for a Nissan Maxima?

Insurance companies consider factors such as the driver’s age, driving record, location, mileage, and coverage level, along with vehicle-specific details and historical claim data.

Where can I find the cheapest insurance for a Nissan Maxima?

The cheapest insurance for a Nissan Maxima can be found by comparing quotes from various insurance providers and exploring discounts.

Explore our detailed analysis on “Cheapest Auto Insurance Companies” for additional information.

Does the color of a Nissan Maxima impact its insurance cost?

While the color of a Nissan Maxima generally does not significantly affect insurance costs, some insurers may consider it in their pricing models.

What are the best and cheapest Nissan Maxima insurance options?

The best and cheapest Nissan Maxima insurance options are those that offer comprehensive coverage at a competitive price, tailored to your needs.

Which insurance provider offers the lowest Nissan Maxima insurance rates?

The lowest Nissan Maxima insurance rates are offered by different providers based on your profile and driving history; comparing quotes is essential.

Get more insights by reading our expert “Where to Compare Auto Insurance Rates” advice.

How can I find the cheapest second-hand Nissan Maxima insurance?

To find the cheapest second-hand Nissan Maxima insurance, get quotes from multiple insurers and consider factors like the vehicle’s condition and age.

What is the most affordable Nissan Maxima motor insurance?

The most affordable Nissan Maxima motor insurance is typically found through providers offering competitive rates and relevant discounts.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Which Nissan Maxima model has the highest insurance cost?

The highest insurance cost Nissan Maxima model is usually the newest or most high-performance version due to its higher repair and replacement costs.

Continue reading our full “What is the average auto insurance cost per month?” guide for extra tips.

What is the maximum insurance coverage for a Nissan Maxima?

The maximum insurance coverage for a Nissan Maxima includes comprehensive and collision coverage, liability limits, and optional add-ons for complete protection.

What will be the Nissan Maxima car insurance cost?

How does the cost of insuring a Nissan Maxima vary by model year?

Does the red color of a Nissan Maxima affect its insurance cost?

What are the Nissan Maxima car insurance rates and discounts available?

What is the annual maximum benefit in Nissan Maxima auto insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.