Best Honda Civic Auto Insurance in 2026 (Top 9 Companies Ranked)

Geico, USAA, and State Farm have the best Honda Civic auto insurance. Geico has cheap car insurance for a Honda Civic at $85/mo. Getting insurance for a Honda Civic is more expensive than other models, but safe drivers can get the lowest rates. Drivers can save up to 25% with Geico's safety features discounts.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated March 2026

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Honda Civic

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage for Honda Civic

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Honda Civic

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsGeico, USAA, and State Farm offer the best Honda Civic auto insurance coverage. However, there are various factors that affect auto insurance rates, so compare Civic quotes from various top providers.

You may also be eligible for certain auto insurance discounts, including Honda Civic safety features, anti-theft, usage-based, or good driver discounts, to offset high Honda Civic insurance costs.

Our Top 9 Company Picks: Best Honda Civic Auto Insurance

| Company | Rank | UBI Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 26% | A++ | Cheap Rates | Geico | |

| #2 | 30% | A++ | Military Families | USAA | |

| #3 | 30% | B | Various Discounts | State Farm | |

| #4 | 30% | A+ | Snapshot Program | Progressive | |

| #5 | 30% | A+ | Drivewise Program | Allstate | |

| #6 | 15% | A | Signal App | Farmers | |

| #7 | 30% | A | RightTrack Program | Liberty Mutual |

| #8 | 40% | A+ | Vanishing Deductible | Nationwide |

| #9 | 20% | A | KnowYourDrive Program | American Family |

There are also other ways to get lower rates, such as buying an older Honda Civic or shopping around for better quotes.

Below, you can evaluate the best Honda insurance companies and learn how to get Honda Civic auto insurance. You can also enter your ZIP code to find cheap quotes for Honda insurance.

- Geico takes the top spot for affordable car insurance for a Honda Civic

- You’ll pay around $85 per month to insure a Honda Civic

- Comparing rates from top providers can help you get the best Civic coverage

#1 – Geico: Best for Cheap Rates

Pros

- Competitive Pricing: You can find the cheapest Honda Civic insurance rates at Geico. Read more about how you can save on Honda Civic coverage in our Geico auto insurance review.

- Various Coverages: You can get various coverage options for your Honda Civic with Geico, including rental reimbursement, roadside assistance, mechanical breakdown.

- Online Platform: Geico also has a sophisticated online platform for paying your premiums, filing Honda insurance claims, and speaking with a customer service agent.

Cons

- Few Local Agents: Unfortunately, you won’t find many in-person offices with Geico.

- Discounts Vary: The availability of certain discounts with Geico may vary by state.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Families

Pros

- Low Rates for Military: USAA has some of the cheapest rates out there for military members, edging out even Geico’s Honda insurance rates in some cases. Read more in our USAA Auto Insurance Review.

- Good Customer Satisfaction: J.D. Power auto insurance studies show USAA has excellent customer satisfaction.

- Coverage Options: USAA offers diverse auto insurance coverage options, including Honda full coverage auto insurance, roadside assistance, rental reimbursement, and rideshare coverage.

Cons

- Few In-Person Offices: USAA isn’t the best choice if you’re looking for in-person service.

- Limited Availability: Only military members and their families qualify for USAA car insurance coverage.

#3 – State Farm: Best for Discount Options

Pros

- Multiple Discounts: You’ll find a wide array of discounts with State Farm, including anti-theft, good student, and good driver. Learn more about them in our State Farm auto insurance review.

- Various Agents: State Farm has a vast agency network for Honda Civic drivers who want personalized customer support.

- Online Platform: State Farm has an excellent website and mobile app for convenient policy management.

Cons

- Discounts Vary: Discount availability with State Farm varies by state.

- No Gap Insurance: Unfortunately, you can’t get Gap insurance coverage with State Farm.

#4 – Progressive: Best for Snapshot Program

Pros

- Snapshot: Read our Progressive Snapshot review to learn how policyholders can save up to 30% on their auto insurance premiums and get cheaper Honda auto insurance coverage.

- Name Your Price: The Progressive Name Your Price tool allows you to customize insurance premiums to fit coverage preferences and lower the cost of insurance for a Honda Civic.

- Various Coverage Types: Progressive offers accident forgiveness, pet collision coverage, and rideshare coverage. Read more in our Progressive Auto Insurance Review.

Cons

- Few Local Agents: Progressive doesn’t offer a lot of in-person offices for Honda Civic drivers who want personalized support.

- Discount Availability Varies: Progressive discount availability varies by state, so talk with a representative to know your options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: Allstate Drivewise is a telematics program that tracks driving behaviors and offers a discount of up to 30% for safe driving.

- User-Friendly Mobile App: Allstate has an excellent mobile app for filing claims and paying premiums. See how you can benefit from Allstate’s sophisticated online system in our Allstate auto insurance review.

- Various Coverage Options: With Allstate, you can get different insurance on a Honda Civic, such as accident forgiveness, new car replacement coverage, and a safe-driving bonus.

Cons

- High Rates for Some Drivers: Some drivers may see higher-than-average rates with Allstate, so always get multiple Honda car insurance quotes before you decide.

- Low Customer Ratings: Allstate has relatively low customer satisfaction ratings from J.D. Power’s 2023 study.

#6 – Farmers: Best for Signal App

Pros

- Signal: Civic drivers could save up to 15% on their car insurance by participating in Farmers Signal, the company’s telematics program.

- Customizable Policies: You can customize your insurance for your Honda Civic to fit your needs and budget at Farmers. Learn more in our Farmers auto insurance review.

- Local Agents: Farmers have a vast array of local agents if you prefer to do business in person.

Cons

- Few Online Tools: Farmers doesn’t have a great website or mobile app for policy management.

- Not Available in all States: You can’t get a Farmers policy in Alaska, Delaware, Florida, Hawaii, Maine, New Hampshire, Rhode Island, Vermont, Washington, D.C., or West Virginia.

#7 – Liberty Mutual: Best for RightTrack Program

Pros

- RightTrack: Save up to 30% on your auto insurance with RightTrack, Liberty Mutual’s telematics program.

- 24/7 Claims Assistance: Civic drivers who need to file a claim at odd hours can rest easy with Liberty Mutual’s 24/7 customer support.

- Online Tools: Liberty Mutual offers a great mobile app and website for policy customization and management. Read more in our Liberty Mutual auto insurance review.

Cons

- Limited Agent Availability: Unfortunately, you won’t find many local agents with Liberty Mutual. Check with Civic insurance groups in social media sites to check availability.

- High Complaint Index: Liberty Mutual has an NAIC complaint index more than two times higher than average.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: For every year Civic drivers practice safe driving, Nationwide reduces your deductible by $100, up to $500 total. Read More: Nationwide Auto Insurance Review

- Good Customer Satisfaction: Nationwide has excellent customer satisfaction ratings, according to J.D. Power.

- Various Coverages: Nationwide has various coverage options, including vanishing deductible, car key replacement, accident forgiveness, and pet injury coverage.

Cons

- Few Local Agents: Nationwide doesn’t offer a lot of local agents.

- Limited Availability: Despite its name, you can’t buy Nationwide car insurance for a Honda Civic in all states.

#9 – American Family: Best for KnowYourDrive Program

Pros

- Good Customer Satisfaction: American Family has an excellent rating in the 2023 J.D. Power auto insurance study. Read more in our American Family auto insurance review.

- Various Add-on Coverages: You can find gap insurance, rideshare insurance, and accidental death and dismemberment coverage at American Family.

- Local Agents: American Family offers a great agency network.

Cons

- Not Available Nationwide: You can’t get an American Family policy in all U.S. states.

- Few Online Tools: American Family doesn’t have the best online resources.

Average Honda Insurance Rates vs. Honda Civic Auto Insurance

While Geico is the best company for Honda insurance, the type of Honda model you pick affects your rates, making it important to compare auto insurance rates by make and model.

How much is insurance for a Honda Civic? Take a look at the table below to compare Civic rates to other Honda models:

Honda Auto Insurance Monthly Rates by Model & Coverage Level

| Model | Minimum Coverage | Full Coverage |

|---|---|---|

| Honda Accord | $49 | $131 |

| Honda Accord Hybrid | $56 | $153 |

| Honda Civic | $57 | $154 |

| Honda CR-V | $42 | $114 |

| Honda Fit | $42 | $113 |

| Honda HR-V | $50 | $136 |

| Honda Insight | $70 | $190 |

| Honda Odyssey | $49 | $134 |

| Honda Passport | $54 | $147 |

| Honda Pilot | $49 | $134 |

| Honda Ridgeline | $54 | $147 |

So, which cars have the lowest auto insurance premiums? Of all the Honda models, the Honda Fit is the cheapest, averaging $113 for full coverage. Insurance on Honda Civic models averages $154 per month for full coverage, which is still relatively affordable compared to other vehicles in its class.

However, certain factors like trim level and model year can affect your Honda Civic car insurance cost. For example, Honda Civic Si insurance rates are higher due to their performance-oriented nature. Honda Civic coupe insurance rates also tend to be slightly higher than sedan models.

Many drivers wonder “why the Honda Civic insurance is so high” for certain trims, but compared to other vehicles in its class, the Honda Civic insurance price remains competitive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Impacts Your Honda Civic Auto Insurance Quotes

Various factors impact your Honda car insurance rates, including age, gender, coverage options, and much more. Check out the table below to compare average auto insurance rates by age for Honda Civics:

Honda Civic Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Male | $359 | $808 |

| 16-Year-Old Female | $314 | $883 |

| 20-Year-Old Male | $81 | $213 |

| 20-Year-Old Female | $74 | $197 |

| 30-Year-Old Male | $75 | $198 |

| 30-Year-Old Female | $70 | $183 |

| 40-Year-Old Male | $64 | $171 |

| 40-Year-Old Female | $65 | $170 |

| 50-Year-Old Male | $61 | $161 |

| 50-Year-Old Female | $62 | $162 |

| 60-Year-Old Male | $60 | $156 |

| 60-Year-Old Female | $59 | $151 |

| 70-Year-Old Male | $63 | $166 |

| 70-Year-Old Female | $64 | $167 |

In addition, the age of your vehicle affects your Honda Civic insurance cost per month. Young drivers face the highest rates, with 16-year-olds paying nearly triple the average Honda Civic insurance cost compared to other age groups. The average insurance rates for a Honda Civic tend to stabilize around age 25, with drivers in their 40s and 50s enjoying the lowest premiums.

Auto insurance for new cars is more expensive than for older cars since repair costs are much higher than for older vehicles.Scott W. Johnson Licensed Insurance Agent

Many drivers ask “are Honda Civics cheap to insure?” The answer depends largely on your demographics and the specific model. For instance, insurance cost for a Honda Civic coupe models typically runs higher than sedan versions due to their sportier nature.

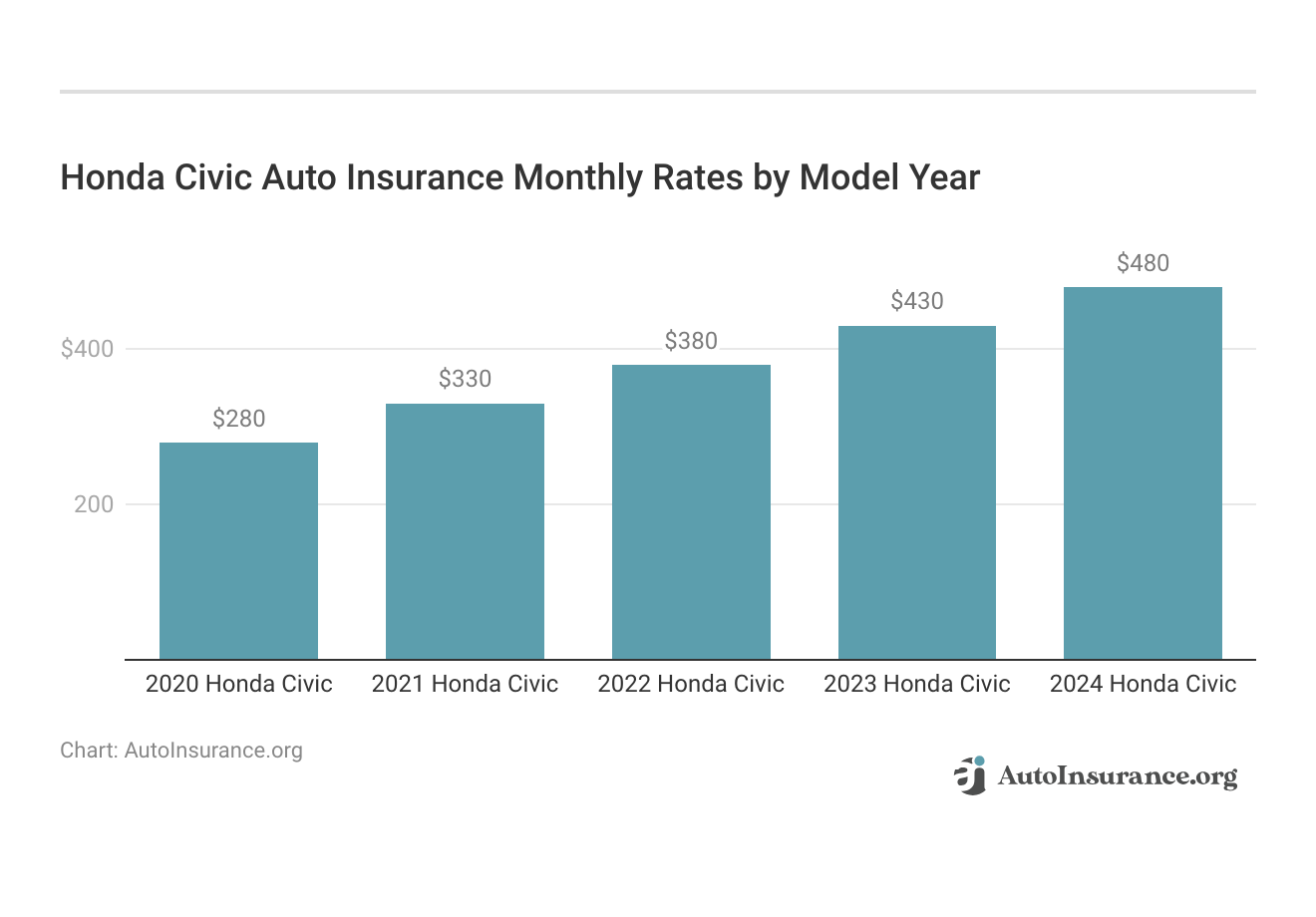

However, car insurance for a Honda Civic is generally reasonable compared to other vehicles in its class. See how the cost to insure a new Civic compares to an older one here:

As shown in the graph, the 2024 Honda Civic insurance cost is the highest at $480 for full coverage, while the 2020 Honda Civic insurance cost remains the most affordable at $280. We can see a steady increase in rates, with the 2021 Honda Civic insurance cost at $330, the 2022 Honda Civic insurance cost at $380, and the 2023 Honda Civic insurance cost at $430.

Always compare average rates and quotes from top providers to find cheap auto insurance for Honda Civics.

Top 5 Ways to Save on Honda Civic Auto Insurance

Why are Honda Civics expensive to insure? High theft rates and repair costs drive premium prices higher. Consider the following tips if you’re looking for lower auto insurance rates for your Honda Civic:

- Locate Discounts: Find auto insurance providers offering various discounts to maximize savings.

- Bundle Policies: Most of the top auto insurance companies offer additional discounts to customers who purchase more than one policy.

- Drop Unnecessary Coverages: If you have an older car that’s not worth much, you could consider dropping full Honda Civic car coverage.

- Increase Your Deductible: The higher your auto insurance deductible, the lower your Honda insurance cost. However, don’t increase your deductible to an amount you can’t afford to pay out of pocket.

- Compare Quotes: Compare Honda Civic quotes from the top providers to find the lowest premiums.

As you can see, there are many ways to get cheaper Civic car insurance coverage, you should also consider checking out different Honda insurance reviews to know which fits your needs.

Where to Buy the Best Honda Civic Auto Insurance

Geico, USAA, and State Farm are the cheapest Honda insurance companies, offering an excellent balance between affordability and good customer service.

Compare insurance costs for Honda Civic from these providers and more by entering your ZIP code below.

Frequently Asked Questions

Are Honda Civics expensive to insure?

Honda Civics are relatively affordable to insure, averaging $85 monthly for full coverage.

Which company offers the best Honda Civic auto insurance?

You can find the best auto insurance for Civics from Geico, USAA, and State Farm.

Who has the cheapest Honda Civic auto insurance, Geico or Progressive?

Generally, Geico offers cheaper average auto insurance rates than Progressive for Honda Civics. However, you should compare quotes to know for sure.

Read More: How to Evaluate Auto Insurance Quotes

Is Allstate or Geico better for Honda Civic auto insurance?

Geico is the best company for Honda Civic insurance. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

Is Liberty Mutual cheaper than Geico for Honda Civic auto insurance?

Generally, Geico offers cheaper rates for Civics than Liberty Mutual.

What type of auto insurance gives you the most coverage?

Full coverage auto insurance, consisting of liability, collision, and comprehensive, offer the most coverage for your Honda Civic.

Read More: Collision vs. Comprehensive Auto Insurance

Does credit score affect Honda Civic auto insurance rates?

Yes, many top car insurance companies consider credit scores when setting insurance rates for your Honda Civic.

How much should I pay for a new Honda Civic?

The MSRP for a 2024 Honda Civic LX sedan is $23,950, and the cost of auto insurance for a 2024 Honda Civic is $480 for full coverage.

How much is car insurance on a new Honda Civic?

Auto insurance for a 2024 Honda Civic costs around $650 monthly for full coverage. (Read More: Auto Insurance for New Cars)

Are Honda Civics cheap to maintain?

Yes, Civics are relatively affordable to maintain and also offer cheap insurance rates. Start comparing total coverage auto insurance rates by entering your ZIP code.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.