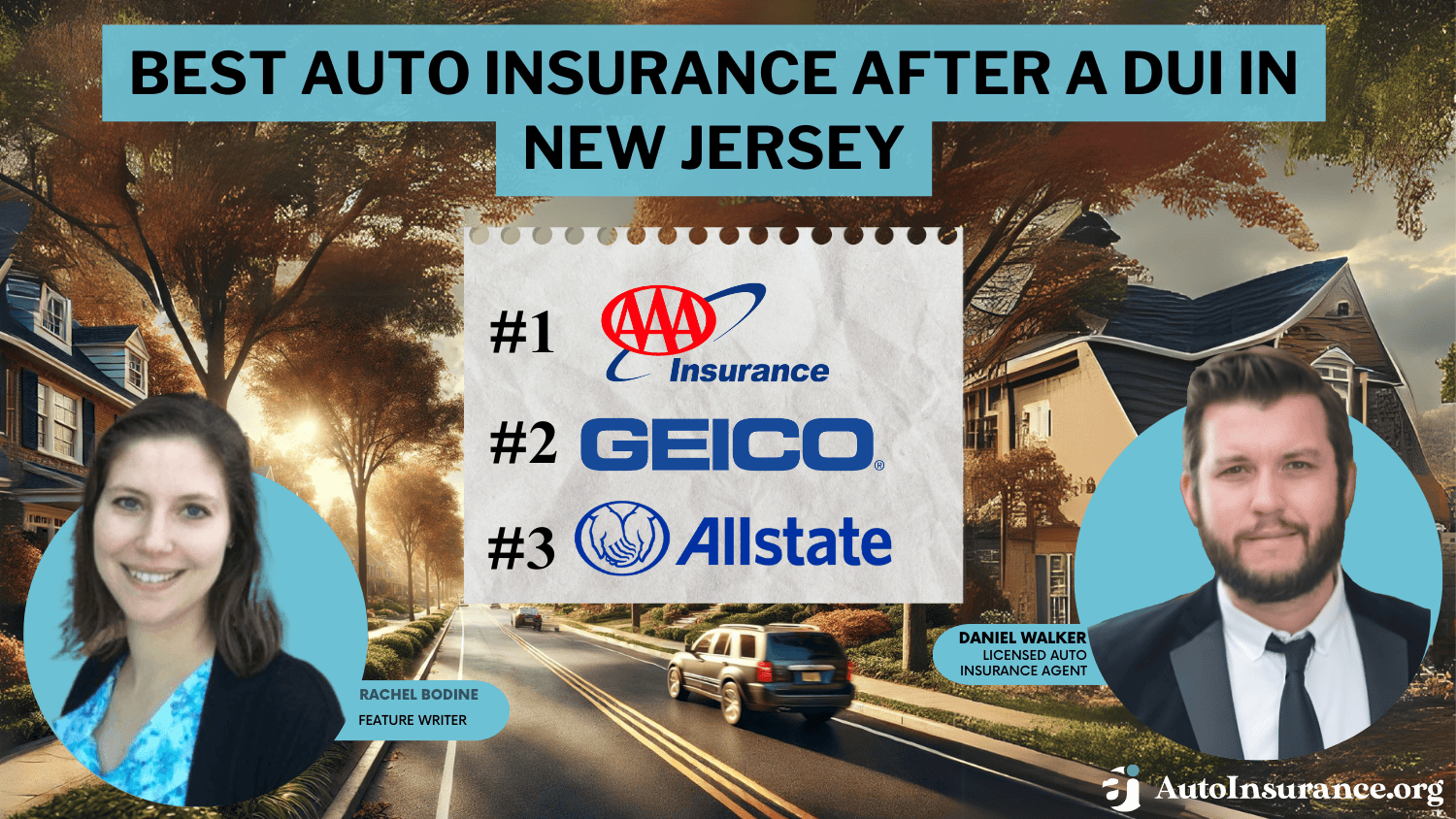

Best Auto Insurance After a DUI in New Jersey (Top 10 Companies for 2026)

AAA, Geico, and Allstate have the best auto insurance after a DUI in New Jersey. DUI insurance rates start at $150 monthly, and AAA members get free roadside assistance. Geico and Allstate offer discounts tailored for high-risk drivers who need cheap car insurance for DUI offenders in NJ.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated March 2025

3,027 reviews

3,027 reviewsCompany Facts

Full Coverage After DUI in NJ

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage After DUI in NJ

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 11,640 reviews

11,640 reviewsCompany Facts

Full Coverage After DUI in NJ

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviewsSecuring the best auto insurance after a DUI in New Jersey can be difficult due to increased premiums and limited options. Insurers often consider drivers with a DUI high risk, resulting in higher rates and stricter coverage terms.

However, some companies specialize in offering affordable high-risk auto insurance, offering policies that help you stay covered while potentially reducing premiums over time.

To find the best coverage, focus on insurers that cater to DUI drivers and compare quotes to ensure you receive competitive rates. Taking steps such as maintaining a clean driving record, completing state-approved programs, and opting for higher deductibles can improve your eligibility for discounts.

Our Top 10 Company Picks: Best Auto Insurance in New Jersey After a DUI

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A | Policy Perks | AAA |

| #2 | 12% | A++ | Online Convenience | Geico | |

| #3 | 15% | A+ | Youth Discounts | Allstate | |

| #4 | 14% | A+ | Roadside Assistance | Amica | |

| #5 | 18% | A | International Companies | The General | |

| #6 | 13% | B | Customer Service | State Farm | |

| #7 | 17% | A++ | Military Members | USAA | |

| #8 | 16% | A++ | Safe-Driving Discounts | Auto-Owners | |

| #9 | 11% | A+ | Usage-Based Discount | The Hartford |

| #10 | 19% | A | Add-On Coverages | American Family |

Staying informed about your options helps you meet New Jersey’s insurance requirements while managing costs. Enter your ZIP code above to explore insurance options tailored to drivers with a DUI in New Jersey.

- AAA is the top pick for auto insurance in New Jersey after a DUI

- Allstate is more expensive but offers more discounts on DUI insurance

- Drivers with DUIs need a balance of competitive pricing and excellent service

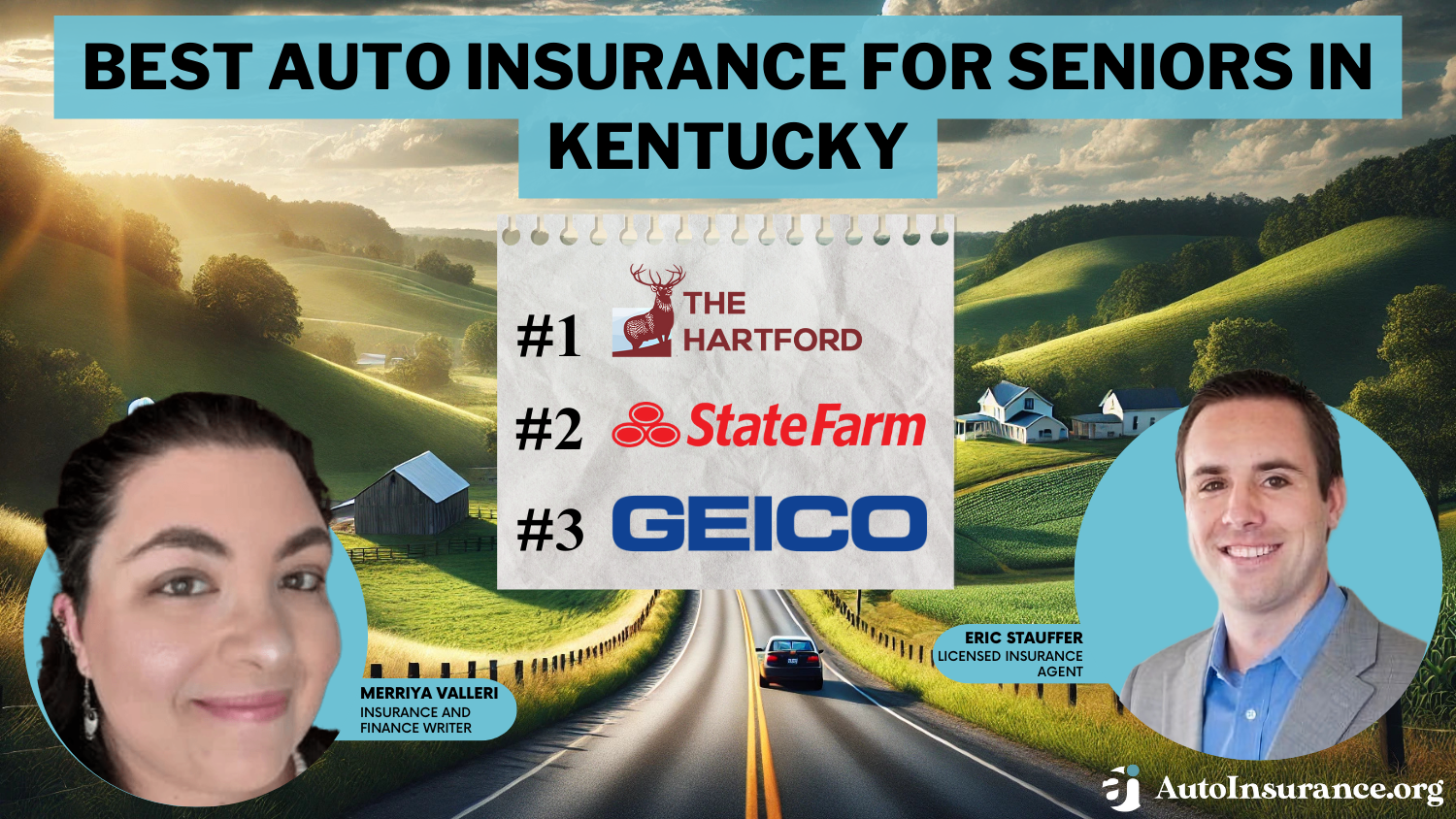

#1 – AAA: Top Overall Pick

Pros

- Extensive Policy Perks: AAA offers robust policy options that benefit New Jersey drivers after a DUI.

- Comprehensive Assistance: Provides thorough support and resources for DUI recovery in New Jersey.

- Customizable Plans: Discover our AAA auto insurance review, highlighting how the company allows for tailored DUI insurance coverage in New Jersey.

Cons

- Cost Considerations: Premiums may be higher for New Jersey drivers with a DUI on their record.

- Eligibility Restrictions: Some perks and discounts may not be available to all DUI offenders in New Jersey.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Online Service

Pros

- Convenient Mobile App: New Jersey drivers can manage DUI insurance policies, make payments, and file claims all through the mobile app or website.

- Flexible Coverage Options: Delve into our Geico auto insurance review to learn about adaptable coverage plans that can be adjusted for DUI insurance in New Jersey.

- Competitive Rates: Geico offers cheap DUI insurance for most drivers in New Jersey, starting at $102 monthly.

Cons

- Poor Customer Service: Geico ranks below average for New Jersey auto insurance customer service and claims processing.

- Premium Fluctuations: DUI insurance rates may increase significantly at policy renewal in New Jersey.

#3 – Allstate: Best for Youth Discounts

Pros

- Youth-Focused Discounts: Offers discounts that help younger New Jersey drivers manage DUI insurance costs.

- Educational Resources: Explore our Allstate auto insurance review for insights into resources and programs aimed at educating young drivers after a DUI in New Jersey.

- Good Hands Recovery: Allstate’s support programs assist young New Jersey drivers navigating DUI recovery.

Cons

- Higher Base Rates: Generally higher rates which can be a concern for younger drivers with a DUI in New Jersey.

- Restrictive Qualifications: Discounts and benefits on DUI insurance have strict qualifying criteria in New Jersey.

#4 – Amica: Best for Roadside Assistance

Pros

- Superior Roadside Assistance: Excellent roadside support with DUI insurance policies in New Jersey.

- Flexible Policies: Offers policy flexibility that can adapt to a DUI recovery scenario in New Jersey.

- Customer Support: See our Amica auto insurance review, praised for high ratings in customer service and DUI insurance claim satisfaction in New Jersey.

Cons

- Cost Post-DUI: Higher DUI auto insurance rates compared to other New Jersey companies.

- Limited Availability: Some services and DUI coverages may not be available statewide in New Jersey.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – The General: Best for International Companies

Pros

- Global Expertise: Read our The General auto insurance review, detailing how the company leverages international experience to offer competitive DUI policies in New Jersey.

- High-Risk Specialization: Specifically caters to high-risk drivers in New Jersey, including those with DUIs.

- Broad Acceptance: Less stringent acceptance criteria beneficial for affordable DUI car insurance in New Jersey.

Cons

- Higher Pricing: Generally higher rates for high-risk DUI insurance in New Jersey.

- Customer Service Variability: Inconsistent customer service experiences reported for DUI car insurance in New Jersey.

#6 – State Farm: Best for Customer Service

Pros

- Exceptional Customer Service: State Farm is renowned for its customer support for DUI car insurance in New Jersey,

- Recovery Programs: Offers programs designed to help drivers recover from a DUI in New Jersey.

- Agent Accessibility: View our State Farm auto insurance review, which discusses the high availability of New Jersey insurance agents to assist with DUI-related inquiries.

Cons

- Costly Premiums: More expensive than other New Jersey auto insurance companies for DUI car insurance.

- Limited High-Risk Options: Fewer high-risk insurance options compared to specialized providers in New Jersey for DUI car insurance.

#7 – USAA: Best for Military Members

Pros

- Tailored for Military: Specialized services for military members in New Jersey recovering from a DUI.

- Discounted Rates: Take a look at our USAA auto insurance review, where it’s noted for competitive pricing with additional discounts for drivers with DUIs in New Jersey.

- Comprehensive Support: Strong support system for DUI recovery specific to military needs in New Jersey.

Cons

- Eligibility Restrictions: USAA DUI insurance is only available to military members and their families in New Jersey.

- Limited Customization: Fewer options for customization compared to other New Jersey DUI insurance providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Auto-Owners: Best for Safe-Driving Discounts

Pros

- Incentives for Safe Driving: Check out our Auto-Owners auto insurance review, which offers discounts incentivizing safe driving after a DUI in New Jersey.

- Personalized Coverage Plans: New Jersey coverage that can be personalized to DUI recovery needs.

- Responsive Claims Service: Efficient DUI insurance claims handling in New Jersey.

Cons

- Eligibility for Discounts: Safe-driving discounts require stringent criteria for DUI drivers in New Jersey.

- Coverage Limitations: Some coverage options may not be fully accessible to New Jersey drivers with a DUI.

#9 – The Hartford: Best for Usage-Based Discount

Pros

- Usage-Based Savings: Offers discounts based on actual driving behavior post-DUI in New Jersey.

- DUI Recovery Programs: Programs that aid drivers in managing the repercussions of a New Jersey DUI.

- Flexible Adjustment: Read our The Hartford auto insurance review to explore DUI insurance policy adjustments available as driving habits improve in New Jersey.

Cons

- Monitoring Requirements: Constant monitoring can be intrusive to some New Jersey drivers for DUI car insurance.

- Discount Variability: Savings are variable and depend heavily on New Jersey auto insurance laws for DUI.

#10 – American Family: Best for Add-On Coverages

Pros

- Extensive Add-On Options: In line with our American Family auto insurance review, uncover the wide range of add-ons that enhance DUI insurance policies in New Jersey.

- Rehabilitative Discounts: Offers discounts on DUI auto insurance that support rehabilitation and safe driving in New Jersey.

- Supportive Customer Service: Excellent customer service to guide through DUI aftermath in New Jersey.

Cons

- Higher Costs for Add-Ons: Essential add-ons can significantly increase overall DUI insurance rates in New Jersey.

- Complex Policy Management: Managing extensive add-ons can be complex and time-consuming for some New Jersey drivers for DUI.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

DUI Auto Insurance Rates in New Jersey

When selecting the best car insurance with a DUI in NJ, it’s crucial to consider the range of factors that affect auto insurance rates. Evaluating the inclusion of comprehensive coverage can be vital for drivers seeking thorough protection after a DUI.

This table provides a comparative overview of monthly auto insurance rates in New Jersey for drivers with a DUI, broken down by coverage level and provider. It answers the question: What is the best car insurance for a DUI in New Jersey?

New Jersey DUI Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $150 | $220 |

| $205 | $320 | |

| $174 | $272 | |

| $180 | $290 | |

| $190 | $300 | |

| $146 | $227 | |

| $380 | $594 | |

| $200 | $310 | |

| $210 | $330 |

| $103 | $161 |

AAA offers minimum coverage at $57 and full coverage at $148, while Allstate’s rates are $144 for minimum and $225 for full coverage.

Learn More: New Jersey Minimum Auto Insurance Requirements

Auto Insurance Discounts After a DUI in New Jersey

For drivers in New Jersey recovering from a DUI, understanding available auto insurance discounts is crucial to getting cheap auto insurance after a DUI. Insurers typically offer a range that can significantly lower premiums even after a DUI.

Many companies offer discounted rates for completing approved driving courses designed to reinforce safe driving habits. Moreover, younger drivers might benefit from good student discounts if they can demonstrate academic excellence despite their DUI.

AAA leads the market with 95% customer satisfaction, providing top-tier coverage and support for New Jersey drivers post-DUI.Daniel Walker Licensed Auto Insurance Agent

However, it’s essential to note that while these discounts can make insurance more affordable, the overall premiums might still be higher compared to drivers with clean records.

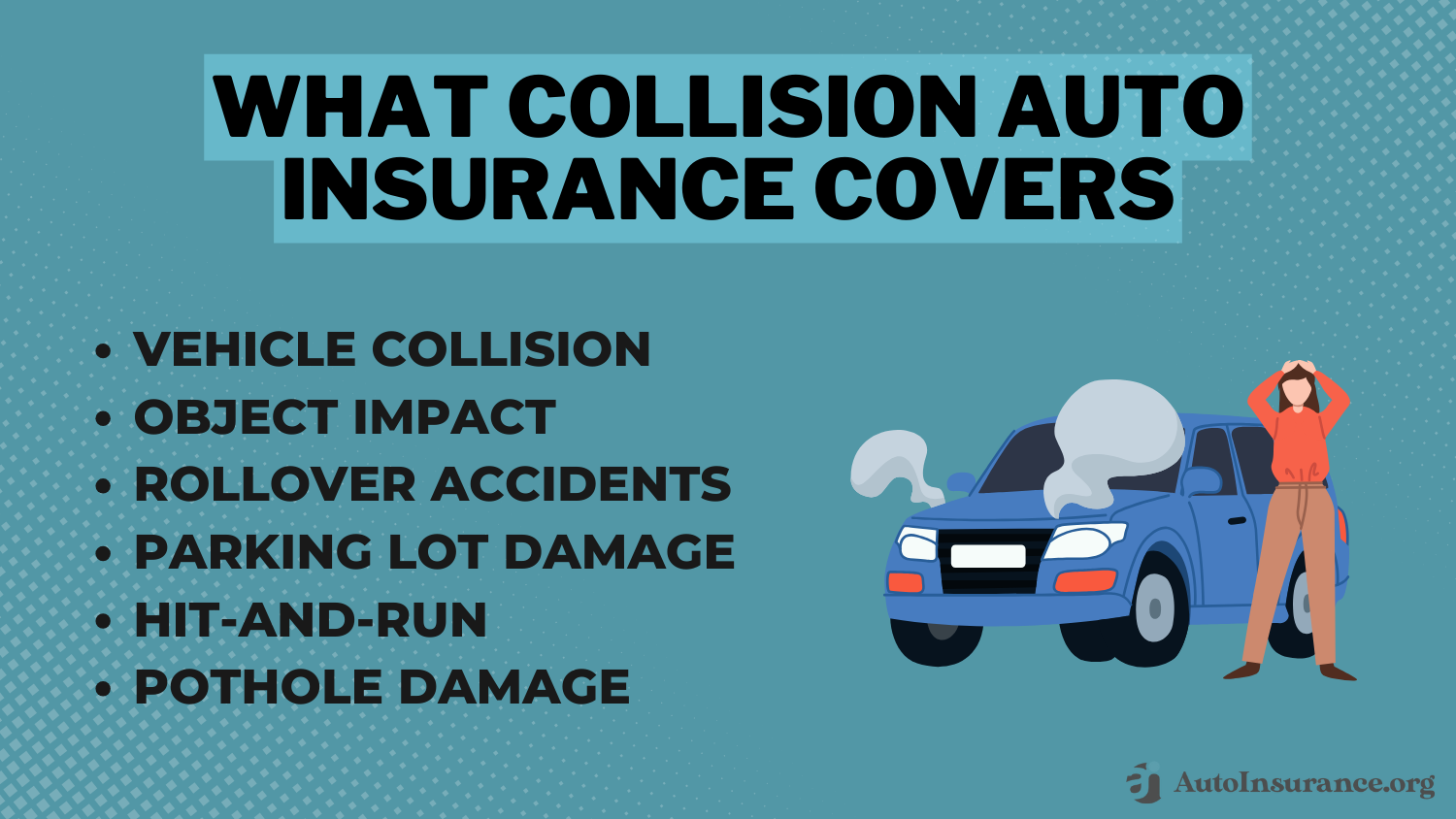

So compare different insurance policies, including what collision auto insurance covers, with tools like free car insurance comparison websites to get the best auto insurance with a DUI in New Jersey.

Other Ways to Save Money on New Jersey DUI Insurance

By implementing these strategies and understanding the benefits of auto insurance, drivers in New Jersey can get the right DUI insurance plans:

- Comparison Shopping: Utilize online tools to compare rates and coverage from the best New Jersey auto insurance companies.

- Seek DUI-Specific Discounts: Many insurers offer discounts for DUI drivers who undertake defensive driving courses or who utilize telematics devices to monitor driving habits.

- Explore Flexible Payment Options: Some insurers provide flexible payment plans, which can ease the financial burden during the recovery period following a DUI.

New Jersey drivers with DUIs should also prioritize customer service. Choosing insurers known for excellent customer service is essential.

For younger drivers and those new to DUI insurance laws, educational resources and personalized agent support can make a significant difference. This addresses the question: What is the recommended car insurance coverage in NJ?

Affordability is another significant factor, with competitive rates and specific discounts for DUI drivers enhancing the overall value of the insurance plan.

How a DUI Affects Insurance and Driving Records in NJ

How long does a DUI affect your insurance in NJ? In New Jersey, a DUI conviction can significantly impact your life and finances, particularly when it comes to car insurance. Insurers view DUI offenders as high-risk drivers, which leads to higher premiums that can remain elevated for three to five years or longer, depending on the insurer’s policy.

You might also ask, what is the penalty for a DUI in New Jersey? They can be severe, including fines, license suspension, mandatory ignition interlock devices, and even potential jail time, particularly for repeat offenders.

A DUI stays on your driving record permanently in New Jersey, although its effect on insurance rates typically lessens over time. Additionally, are DUIs public records in NJ? Yes. DUI convictions are part of the public record, meaning potential employers, insurance providers, and others may access this information during background checks.

Understanding these long-lasting consequences can help drivers make informed decisions about coverage options and potential steps to manage their driving records.

Read More: Can auto insurance companies share information?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: DUI Auto Insurance in New Jersey

Here are three case studies demonstrating how the best high-risk auto insurance companies in New Jersey effectively support drivers with a DUI:

Case Study #1: Personalized Coverage Adjustments

Mark from Hoboken faced higher premiums after a DUI but chose AAA for its customizable insurance plans. AAA provided Mark with affordable high-risk auto insurance options and annual policy reviews to improve his driving record and eventually reduce rates.

Case Study #2: Strategic Use of Discounts

Sandra from Atlantic City chose Geico’s DUI insurance for its convenient online service and efficient DUI policy management. She referred to the Geico Defensive Driving Course review to better understand the benefits. By completing the course, Sandra rebuilt her driving history and qualified for additional discounts, helping to lower her premiums.

Case Study #3: Comprehensive Support for Young Drivers

Tom, a young driver from Trenton, faced high premiums after a DUI. He chose Allstate for its youth-focused discounts and the Allstate DriveWise program, which tracks driving behavior to potentially lower rates. For more information, check out our detailed Allstate DriveWise review.

These case studies highlight how companies provide tailored solutions to help drivers in New Jersey manage their auto insurance needs after a DUI.

AAA consistently delivers tailored coverage that meets the dynamic needs of New Jersey drivers dealing with the consequences of a DUI.Laura Berry Former Licensed Insurance Producer

Each company offers distinct programs and services designed to support individuals through their recovery and improve their insurance rates.

Read More: Best States for Affordable DUI Auto Insurance

The Best Auto Insurance in New Jersey After a DUI

So, what’s the best insurance for a DUI? AAA, Geico, and Allstate have the best auto insurance after a DUI in New Jersey, with comprehensive coverage, flexible payment options, and support through discounts and educational resources.

Knowing where to compare auto insurance rates is essential for finding affordable DUI auto insurance and ensuring you meet New Jersey insurance requirements.

Online comparison tools can help find the most suitable and cost-effective insurance. Enter your ZIP code below to see how much car insurance costs in your area.

Frequently Asked Questions

What is the best insurance for a DUI in New Jersey?

What is the best insurance for a DUI? The best DUI car insurance in NJ depends on factors such as coverage options, customer service, and price. Companies that offer high-risk driver policies and strong support services are recommended.

How much is car insurance in New Jersey after a DUI?

How much will my insurance go up after a DUI in NJ? The cost of auto insurance in New Jersey after a DUI can vary significantly depending on the insurance provider, the driver’s record, and other factors. On average, you can expect your auto insurance premiums to increase by 30% to 100%. Companies like AAA, Geico, and Allstate offer competitive rates starting at around $65 per month.

How long does a DUI stay on record in NJ?

How long does a DUI stay on your record in NJ? In New Jersey, a DUI conviction stays on your driving record permanently. However, its impact on your insurance rates typically lasts for about three to five years.

Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your vehicle.

What is the cheapest New Jersey auto insurance after a DUI?

The cheapest New Jersey car insurance after a DUI often depends on individual circumstances and discounts offered. The cheapest auto insurance companies are AAA, Geico, and Allstate for most New Jersey drivers with a DUI.

Can a DUI be expunged in New Jersey?

No, a DUI conviction cannot be expunged from your driving record in New Jersey. It remains a part of your permanent driving record.

What happens after the first DUI in NJ?

What happens with the first DUI in NJ? After a first DUI in New Jersey, you can expect penalties such as fines, license suspension, mandatory alcohol education programs, and increased insurance premiums. The exact penalties can vary based on the specifics of the offense.

How long does a DUI affect insurance in New Jersey?

How long does a DUI affect car insurance in NJ? A DUI can affect your auto insurance in New Jersey for at least three to five years. During this period, insurance premiums are generally higher due to the increased risk associated with DUI convictions.

See our article “How Auto Insurance Companies Check Driving Records” for additional ideas on how these insurers check your records.

Can you get out of a DUI in New Jersey?

It is challenging to get out of a DUI in New Jersey. However, a skilled attorney can sometimes negotiate reduced charges or penalties. The success of such efforts depends on the case details and legal representation.

How many points is a DUI in New Jersey?

How many points is a DUI in NJ? In New Jersey, a DUI does not result in points on your driving record. Instead, it leads to severe penalties, including fines, license suspension, and increased insurance rates.

Ready to find affordable car insurance? Use our free comparison tool below to get started.

Will I lose my license for a New Jersey DUI?

Yes, in New Jersey, a DUI conviction can lead to a license suspension. The length of the suspension can vary depending on the severity of the offense and whether it is a first-time or repeat offense (Read More: How to Get Auto Insurance Without a License).

What car is most likely to get a DUI?

Does NJ require SR-22?

What is the new law for DUI in New Jersey?

Can a DUI be reduced in NY?

Do you lose your license immediately after a DUI in NJ?

Will NJ DUI show up on a background check?

How to get a DUI off your driving record in NJ?

What is the difference between DWI and DUI in NJ?

How can you check your driving record in NJ?

Can a passenger get a DUI in NJ?

How much liability insurance do I need in NJ?

Can a DUI be dropped in NJ?

Which state has the most DUIs?

Is a DUI a criminal conviction in NJ?

Can you refuse a DUI checkpoint in NJ?

What is SR-22 certification?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.