Best Auto Insurance for Seniors in Texas 2026 (Top 10 Providers)

Farmers, USAA, and State Farm have the best auto insurance for seniors in Texas. Cheap car insurance for seniors starts at $36 monthly with USAA, but Farmers and State Farm have great senior car insurance discounts that reward safe driving. Compare average auto insurance rates by age in Texas for the best policy.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Insurance Lawyer

Jeffrey Johnson is a legal writer with a focus on personal injury. He has worked on personal injury and sovereign immunity litigation in addition to experience in family, estate, and criminal law. He earned a J.D. from the University of Baltimore and has worked in legal offices and non-profits in Maryland, Texas, and North Carolina. He has also earned an MFA in screenwriting from Chapman Univer...

Jeffrey Johnson

Updated March 2025

Company Facts

Full Coverage for TX Seniors

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviewsCompany Facts

Full Coverage for TX Seniors

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews

Company Facts

Full Coverage for TX Seniors

A.M. Best

Complaint Level

Pros & Cons

Farmers, USAA, and State Farm have the best auto insurance for seniors in Texas. Farmers is the top pick, with cheap auto insurance for drivers over 70 and more discounts than any other provider.

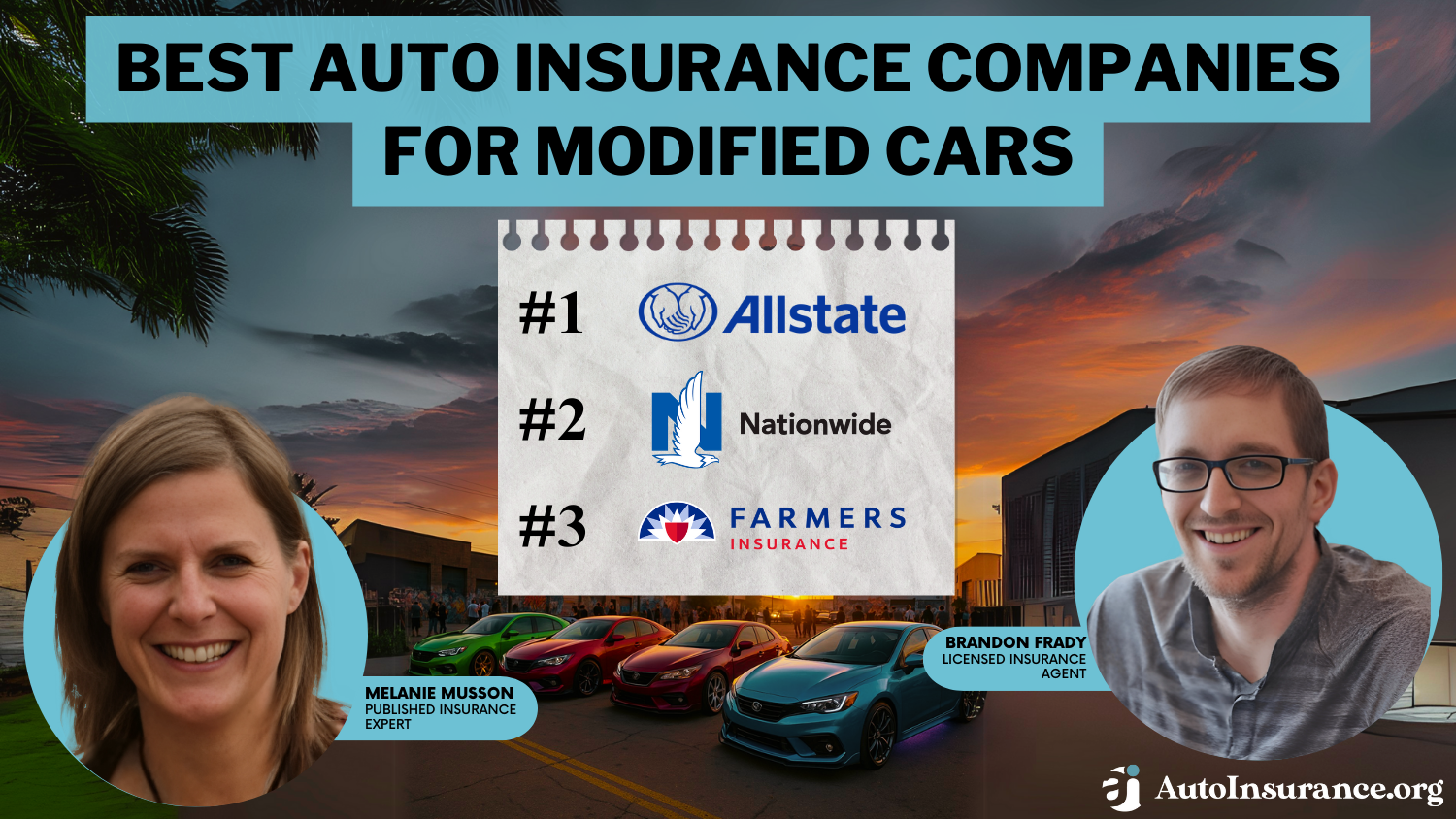

What is the best car insurance for seniors in Texas? These top ten companies stand out for offering comprehensive coverage options, higher medical coverage limits, and affordable add-ons like roadside assistance.

Our Top 10 Company Picks: Best Auto Insurance for Seniors in Texas

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A | Safe-Driving Discounts | Farmers | |

| #2 | 10% | A++ | Military Savings | USAA | |

| #3 | 20% | B | Customer Service | State Farm | |

| #4 | 25% | A | 24/7 Claims | Liberty Mutual |

| #5 | 8% | A++ | Eco-Friendly | Travelers | |

| #6 | 25% | A+ | Pay-Per-Mile | Allstate | |

| #7 | 12% | A+ | Online Tools | Progressive | |

| #8 | 20% | A+ | Usage-Based Insurance | Nationwide |

| #9 | 20% | A | Costco Members | American Family | |

| #10 | 25% | A++ | Cheap Rates | Geico |

USAA specializes in senior discount insurance for military members, and State Farm local agents have high customer service ratings.

If you need cheap Texas auto insurance, seniors can start comparing local providers with our free quote tool. Enter your ZIP code to get started.

- Farmers is the top pick for seniors’ car insurance and discounts

- Farmers senior car insurance rates start at $50 per month

- USAA is the best car insurance in Texas for seniors retired from the military

#1 – Farmers: Top Pick Overall

Pros

- Customizable Coverage Options: Farmers auto insurance for seniors in Texas includes flexible coverage like accident forgiveness and new car replacement.

- Discounts for Safety Features: Our Farmers auto insurance review shows how seniors in Texas can benefit from discounts for vehicles equipped with safety features, lowering premium costs.

- Dedicated Claims Service: Responsive claims process in Texas, ensuring timely support for seniors.

Cons

- Higher Premiums: Farmers’ auto insurance for seniors in Texas may be costly for those on fixed incomes.

- Variable Customer Satisfaction: The quality of service in Texas can vary, impacting seniors’ experience.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Families

Pros

- Cheapest Rates: What is the cheapest car insurance for seniors in Texas? USAA minimum car insurance for pensioners in the military starts at $23 per month, the cheapest on this list.

- Exceptional Customer Service: USAA excels in customer service, crucial for seniors in Texas seeking reliable auto insurance. Get full ratings in our USAA auto insurance review.

- Military Discounts: Its coverage is specifically beneficial for seniors in Texas who are veterans or from military families.

Cons

- Limited Eligibility: Cheap insurance for seniors is restricted to military members and their immediate families, limiting broader access for some Texas drivers.

- No Gap Insurance: USAA does not sell gap insurance for seniors to cover new or leased cars.

#3 – State Farm: Best Local Agent Support

Pros

- Customer Service: State Farm provides personalized auto insurance services for seniors in Texas through local agents with above-average satisfaction reviews in J.D. Power surveys.

- Discounts for Safe Drivers: Our State Farm Drive Safe & Save review explains how seniors in Texas can get discounts for safe driving habits.

- Bundling Discounts: Get the best auto and home insurance for seniors from State Farm with a 17% multi-policy discount.

Cons

- Low Financial Strength: State Farm is ranked lower for financial strength by A.M. Best than other senior auto insurance companies in Texas.

- Inconsistent Experience Across Agents: Varied service quality across agents in different parts of Texas may affect satisfaction for some senior drivers.

#4 – Liberty Mutual: Best for 24/7 Claims Handling

Pros

- 24/7 Claims Support: Liberty Mutual agents are available 24/7 by phone or online for seniors who need to file auto insurance claims.

- Customization of Policies: Extensive customization options for senior auto insurance in Texas.

- Accident Forgiveness: According to our Liberty Mutual auto insurance review, it protects seniors in Texas from premium hikes after the first accident.

Cons

- Higher Price Point: More expensive car insurance for elderly drivers in Texas starts at $65 a month.

- Customer Service Variability: Service quality can vary, impacting seniors’ experience in Texas.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Eco-Friendly Vehicles

Pros

- Discounts for Hybrid/Electric Cars: Encourages eco-friendly vehicle choices among Texas seniors with specific discounts of up to 10%.

- IntelliDrive Program: The telematics program can lead to discounts for safe-driving seniors in Texas. Learn how in our Travelers IntelliDrive review.

- Industry Experience: Travelers is one of the oldest and most reliable senior car insurance companies in Texas, with a solid A++ financial rating from A.M. Best.

Cons

- Complex Policy Options: The variety of options may be overwhelming for some seniors in Texas.

- Mixed Reviews on Claims Processing: Varied experiences with claims process efficiency for seniors in Texas.

#6 – Allstate: Best Pay-Per-Mile Insurance

Pros

- Best Low-Mileage Rates: Our Allstate Milewise review explains how Texas pay-per-mile insurance can save seniors money by driving less.

- Drivewise UBI Program: Allstate’s usage-based discount can save Texas seniors up to 30%. Get details in our Drivewise review.

- Wide Range of Coverage Options: Comprehensive coverage, including roadside assistance beneficial for seniors in Texas.

Cons

- Higher Rates: If you don’t qualify for Milewise or Drivewise, shop for cheaper auto insurance for seniors at other companies.

- Variable Agent Quality: Senior drivers report different experiences based on the agent in Texas.

#7 – Progressive: Best Online Pricing Tools

Pros

- Name Your Price Tool: Allows seniors in Texas to align auto insurance costs with their budget.

- Loyalty Rewards: Compare senior auto insurance discounts and perks for long-term customers in our Progressive auto insurance review.

- Competitive Rates: Cheap auto insurance for seniors starts at $44 monthly in Texas with Progressive.

Cons

- Customer Service Issues: Progressive is dead last for senior car insurance customer satisfaction in Texas, according to J.D. Power surveys.

- Rate Increases: Progressive is more likely to raise senior auto insurance rates higher at renewal than other Texas insurance companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best Usage-Based Insurance Options

Pros

- SmartRide Program: Explore usage-based discounts rewarding safe driving for seniors in Texas in our Nationwide SmartRide review.

- Vanishing Deductible: Senior drivers who avoid filing car insurance claims in Texas will see their deductible decrease as low as $250.

- Accident Forgiveness: Prevents rate hikes for seniors in Texas after an at-fault accident.

Cons

- Inconsistent Pricing: If you don’t sign up for SmartRide, you’ll likely find more affordable auto insurance for seniors with other Texas providers.

- Claims Satisfaction Variability: Mixed experiences with the claims process for seniors in Texas cause it to rank below average in J.D. Power surveys.

#9 – American Family: Best for Costco Members

Pros

- Exclusive Costco Perks: Seniors with a Costco membership get exclusive discounts and coverage options through American Family.

- My SafetyValet: There is a program promoting safer driving habits, potentially lowering auto insurance rates for seniors in Texas. Learn more in our American Family auto insurance review.

- Generous Discounts: AmFam auto insurance discounts for seniors are bigger than other companies, including up to 20% multi-vehicle discounts and 25% multi-policy discounts.

Cons

- Membership Required: AmFam senior auto insurance rates might be higher without a Costco membership.

- Customer Service Variations: Varied service quality could negatively affect seniors in Texas.

#10 – Geico: Best for Overall Affordability

Pros

- Competitive Rates: Cheap car insurance for senior citizens in Texas starts at $38 per month with Geico.

- Extensive Discounts: Our Geico auto insurance review breaks down a variety of discounts for seniors in Texas, including for safe driving and vehicle safety features.

- Robust Mobile App: Easy management of policies and claims in Texas via its app and website.

Cons

- Impersonal Customer Service: Some seniors in Texas might find the service less personal since Geico relies heavily on digital and online experiences.

- Coverage Options: Basic coverage may not meet all the needs of seniors in Texas seeking more comprehensive options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheap Auto Insurance for Seniors in Texas

What is the best auto insurance for seniors? For minimum coverage, USAA offers the lowest monthly rate on Texas auto insurance at $23, followed by State Farm at $33 and Geico at $38.

Texas Senior Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $114 | $307 | |

| $100 | $268 | |

| $78 | $210 | |

| $59 | $161 | |

| $101 | $271 |

| $87 | $235 |

| $69 | $184 | |

| $51 | $137 | |

| $58 | $154 | |

| $36 | $95 |

For full coverage, USAA also provides the most affordable option at $61 per month, with State Farm at $88 monthly and Geico at $104 a month. Farmers isn’t the cheapest car insurance in Texas for seniors, but drivers can lower rates with the provider’s long list of discounts.

Auto insurance rates by age and city can significantly influence Texas premiums. Many insurers offer cheap auto insurance for senior citizens due to their extensive driving histories and typically safer driving behaviors, but insurance still costs more in cities with traffic and higher theft rates.

Texas Auto Insurance Minimum Monthly Rates by Age, Gender, & City

| Age & Gender | Austin | Dallas | El Paso | Houston | San Antonio |

|---|---|---|---|---|---|

| 30-Year-Old Female | $60 | $65 | $58 | $72 | $62 |

| 30-Year-Old Male | $63 | $68 | $60 | $75 | $65 |

| 40-Year-Old Female | $55 | $60 | $53 | $68 | $58 |

| 40-Year-Old Male | $58 | $63 | $55 | $70 | $60 |

| 50-Year-Old Female | $52 | $57 | $50 | $65 | $55 |

| 50-Year-Old Male | $54 | $59 | $52 | $67 | $57 |

| 60-Year-Old Female | $55 | $60 | $53 | $68 | $58 |

| 60-Year-Old Male | $58 | $63 | $55 | $70 | $60 |

| 70-Year-Old Female | $65 | $72 | $63 | $80 | $68 |

| 70-Year-Old Male | $68 | $75 | $65 | $85 | $70 |

| 80-Year-Old Female | $85 | $90 | $82 | $100 | $88 |

| 80-Year-Old Male | $90 | $95 | $85 | $110 | $92 |

Car insurance rates in every city are lower for seniors than younger drivers, but a clean driving record is key if you want cheap auto insurance in Austin or Dallas. Senior drivers with no recent accidents or traffic violations often qualify for better rates.

Exclusive Texas Auto Insurance Discounts for Seniors

If you’re looking for cheaper auto insurance, senior drivers in Texas qualify for exclusive discounts that can significantly reduce premiums. These include age-related discounts acknowledging safer driving habits associated with older adults, often starting at age 55.

Maintaining a clean driving record helps secure lower rates, as many insurers also offer safe driver discounts, but what are the most popular auto insurance discounts for senior citizens? The table highlights the car insurance discounts available in Texas, including multi-policy, safe driving, and special program discounts.

Auto Insurance Discount Savings Potential by Provider

| Discount Name |  |  | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Adaptive Cruise Control | 10% | 8% | 5% | X | 5% | 8% | 7% | 10% | 9% | 15% |

| Adaptive Headlights | 5% | 5% | 3% | X | 5% | 6% | 4% | 7% | 5% | 8% |

| Anti-lock Brakes | 10% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | X | X |

| Anti-Theft | 10% | 15% | X | 23% | 20% | 25% | 5% | 15% | X | X |

| Claim Free | 35% | 5% | 5% | 26% | 8% | 10% | 7% | 15% | 23% | 12% |

| Continuous Coverage | X | 5% | 5% | X | 8% | 10% | 8% | 12% | 15% | 7% |

| Daytime Running Lights | 2% | X | 5% | 3% | 5% | 5% | 5% | 5% | X | X |

| Defensive Driver | 10% | 10% | 8% | 8% | 10% | 5% | 10% | 5% | 10% | 3% |

| Distant Student | 35% | 5% | 8% | 5% | 6% | 10% | 7% | 15% | 7% | X |

| Driver's Ed | 10% | 8% | 5% | 5% | 10% | 7% | 10% | 15% | 8% | 3% |

| Driving Device/App | 20% | 40% | 15% | 5% | 30% | 40% | 20% | 50% | 30% | 5% |

| Early Signing | 10% | 5% | 5% | 5% | 6% | 8% | 5% | 5% | 10% | 12% |

| Electronic Stability Control | 2% | 5% | 3% | 5% | 5% | 8% | 5% | 7% | 8% | 8% |

| Emergency Deployment | 15% | 8% | 5% | 25% | 8% | 10% | X | 7% | 9% | 6% |

| Engaged Couple | 5% | 5% | 3% | 5% | 5% | 5% | 5% | 4% | 5% | 6% |

| Family Legacy | 7% | 5% | 3% | 8% | 6% | 8% | 10% | 6% | 7% | 10% |

| Family Plan | 5% | 7% | 8% | 10% | 8% | 25% | 7% | 7% | 8% | 8% |

| Farm Vehicle | 10% | 5% | 3% | X | 7% | 8% | X | 5% | 9% | 8% |

| Fast 5 | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Federal Employee | X | 8% | X | 12% | 10% | 5% | X | 6% | 7% | 5% |

| Forward Collision Warning | 8% | 5% | 5% | 5% | 5% | 5% | 8% | 6% | 7% | 5% |

| Full Payment | 10% | 5% | 5% | 5% | 5% | 8% | 5% | 6% | 8% | 5% |

| Further Education | 3% | 5% | 5% | X | 5% | 5% | 5% | 4% | 5% | 5% |

| Garaging/Storing | 5% | 5% | 5% | X | 8% | 5% | 5% | 7% | X | 10% |

| Good Credit | X | X | 8% | 8% | 5% | X | 7% | X | 8% | 7% |

| Good Student | 20% | 8% | X | 15% | 23% | 10% | 5% | 25% | 8% | 3% |

| Green Vehicle | 10% | 5% | 5% | 5% | 10% | 7% | 8% | 10% | 10% | 7% |

| Homeowner | 5% | 8% | 5% | X | 5% | 5% | 5% | 3% | 5% | 5% |

| Lane Departure Warning | 5% | 5% | 5% | 5% | X | 5% | 5% | 5% | 5% | 5% |

| Life Insurance | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Low Mileage | X | 5% | X | 5% | X | X | 5% | 30% | X | X |

| Loyalty | 7% | 8% | 6% | 5% | 8% | 5% | 8% | 6% | 9% | X |

| Married | 5% | 5% | 5% | 5% | X | X | 5% | X | 5% | X |

| Membership/Group | 5% | 5% | 5% | X | 10% | 7% | X | 8% | X | 5% |

| Military | X | 5% | 5% | 15% | 4% | 5% | X | X | 5% | X |

| Military Garaging | 10% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 15% |

| Multiple Drivers | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Multiple Policies | 10% | 29% | 5% | 10% | 20% | 10% | 12% | 17% | 13% | X |

| Multiple Vehicles | X | 5% | 5% | 25% | 10% | 20% | 10% | 20% | 8% | X |

| New Address | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| New Customer/New Plan | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| New Graduate | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| New Vehicle | 30% | 8% | 5% | 15% | 6% | 8% | X | 40% | 10% | 12% |

| Newly Licensed | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Newlyweds | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Non-Smoker/Non-Drinker | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Occasional Operator | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Occupation | X | 5% | X | X | 10% | 15% | 5% | 5% | X | 5% |

| On-Time Payments | 5% | 5% | X | 5% | 5% | 5% | 5% | 5% | 15% | 5% |

| Online Shopper | 5% | 5% | 5% | 5% | 5% | 5% | 7% | 5% | 5% | 5% |

| Paperless Documents | 10% | 5% | X | X | 5% | 5% | $50 | 5% | 5% | 5% |

| Paperless/Auto Billing | 5% | 5% | X | 5% | 5% | 30% | 50 | 20% | 3% | 3% |

| Passive Restraint | 30% | 30% | X | 40% | X | 20% | 5% | 40% | X | X |

| Recent Retirees | 5% | 5% | 5% | 5% | 4% | 5% | 5% | 5% | 5% | 5% |

| Renter | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Roadside Assistance | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Safe Driver | 45% | 8% | X | 15% | 8% | 35% | 31% | 15% | 23% | 12% |

| Seat Belt Use | 5% | 5% | 5% | 15% | 5% | 5% | X | 5% | 5% | 5% |

| Senior Driver | 10% | 5% | X | 5% | 6% | 8% | 7% | 5% | 5% | X |

| Stable Residence | 5% | 5% | 5% | 5% | 5% | X | 5% | 5% | 5% | 5% |

| Students & Alumni | 5% | 5% | 5% | X | 10% | 7% | X | 5% | 5% | 5% |

| Switching Provider | 5% | X | X | 8% | 10% | 8% | X | 8% | 8% | 10% |

| Utility Vehicle | 15% | 5% | 5% | X | 6% | 7% | X | 8% | 9% | 5% |

| Vehicle Recovery | 10% | 5% | 5% | 15% | 35% | 25% | 5% | 5% | X | X |

| VIN Etching | 5% | 5% | 5% | 5% | 5% | X | 5% | 5% | X | X |

| Volunteer | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Young Driver | 15% | 5% | 8% | 8% | 8% | 6% | 7% | 8% | 8% | 50% |

Seniors can also save by bundling auto insurance with other policies like homeowners or life insurance, receiving multi-policy discounts. What is the best car and home insurance for seniors? Allstate, American Family, Geico, and Liberty Mutual offer the biggest bundling discount of 25%.

Seniors who drive less benefit from low mileage discounts. A clean driving record without accidents or violations can result in good driver auto insurance discounts, rewarding consistent, safe driving over time. By completing an approved defensive driving course, not only do you boost your safety habits, but you also become eligible for rate reductions.

The type of vehicle insured also affects costs, as models that are less expensive to repair or are less targeted by thieves may result in lower premiums. Having vehicle safety features like anti-lock brakes and anti-theft systems can reduce insurance costs.Travis Thompson Licensed Insurance Agent

Discount auto insurance for seniors reduces Texas premiums while ensuring extensive coverage. Each insurer offers a unique mix of these discounts, so inquire directly with your provider to maximize savings.

Coverage Options for Senior Drivers in Texas

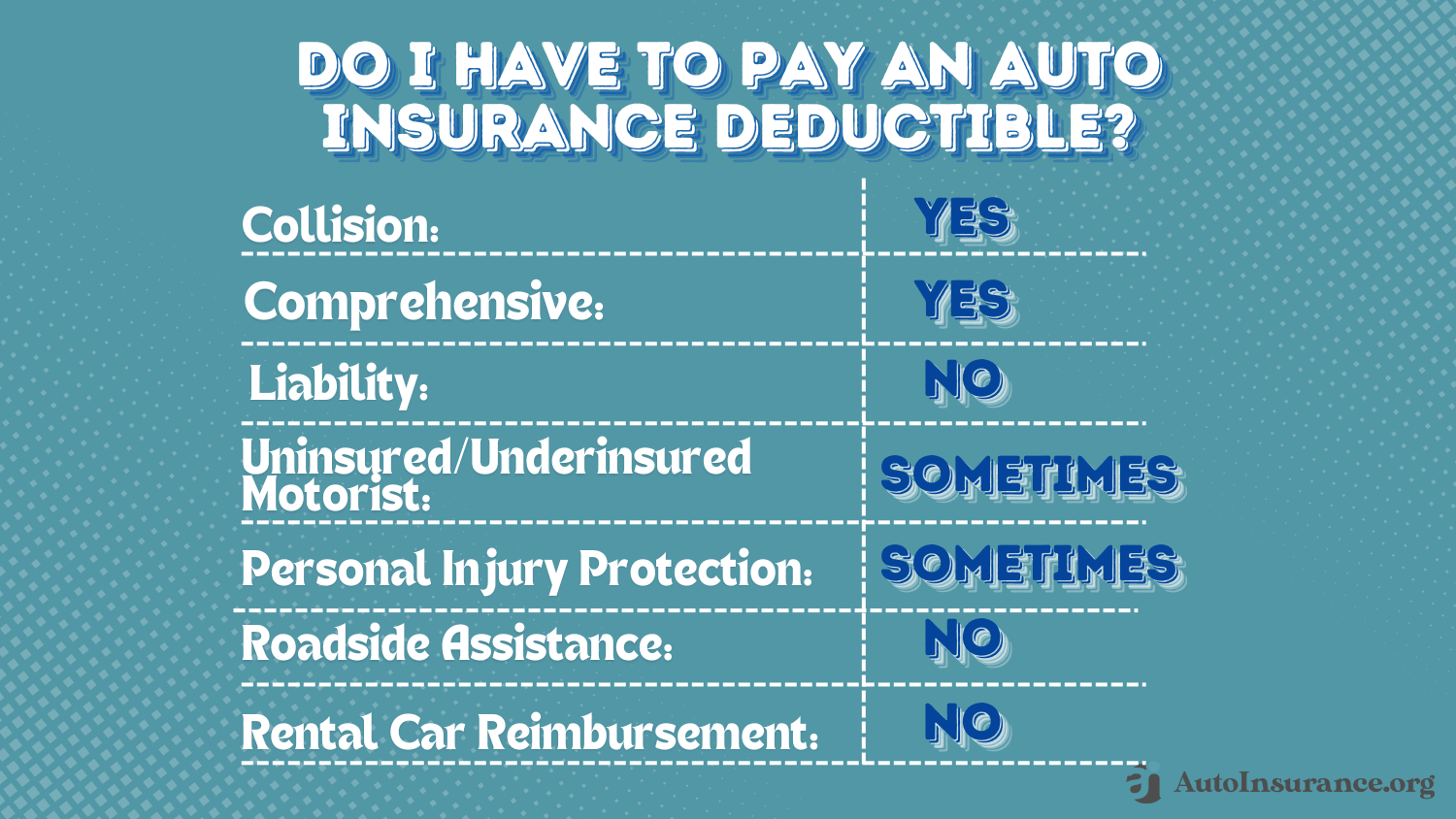

What are the benefits of auto insurance? Insurance providers offer a range of coverage options designed to meet the diverse needs of senior drivers. These options typically include liability coverage, which is mandatory in most states and covers damages to others caused by the insured driver.

The specific coverage needs of seniors, such as higher car insurance, medical coverage, or emergency roadside assistance, can dictate which policies provide the best balance of cost and protection.Laura Berry Former Licensed Insurance Producer

Top Texas providers, such as Farmers, USAA, and State Farm, offer a range of policies, ensuring that seniors have diverse options to choose from based on their coverage needs and budget. Seniors can opt for collision coverage that pays for damages to their own vehicles in the event of an accident, regardless of fault. Comprehensive coverage is another crucial option, protecting against non-collision-related incidents such as theft, vandalism, and natural disasters.

Seniors can also benefit from uninsured and underinsured motorist (UM/UIM) coverage, safeguarding them against costs incurred from accidents with drivers who lack sufficient policy limits. Additionally, many insurers provide personal injury protection (PIP) and medical payments coverage (MedPay), which help cover medical expenses regardless of who is at fault.

Sure, you’ve got car insurance. But what about that golf cart? Or that ATV your kids are always begging to drive? Off-road vehicles come with special risks — and require special insurance. Call to find out more. pic.twitter.com/IChCcSHJaS

— Esther Martinez Insurance Agency (@FarmersD43) May 22, 2024

These varied options allow seniors to customize their insurance to their specific driving habits and financial needs, ensuring they have the right level of protection.

Learn More: Best Auto Insurance in Dallas

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Best Auto Insurance in Texas for Seniors

In Texas, seniors seeking auto insurance require policies that offer both affordability and comprehensive coverage. Here are three scenarios that illustrate how providers meet these needs effectively.

- Case Study #1 – Customized Coverage: Helen, a retiree in Austin, chooses Farmers for its customizable policy options. She ensures she pays only for the coverage she needs with Farmers’ Smart Plan Auto, which lets her tailor coverage with new car replacement and accident forgiveness.

- Case Study #2 – Military and Veteran Benefits: Bill, a retired Navy veteran living in El Paso, opts for USAA due to its exceptional services for military personnel and their families. Its military discounts and additional benefits for safe driving provide Bill with a cost-effective solution that honors his service.

- Case Study #3 – Nationwide Reliability: Susan, a senior who frequently visits her grandchildren in multiple states, chooses State Farm for its nationwide coverage. Local agents ensure she receives consistent service wherever she travels, and she earns discounts trough the Drive Safe & Save program.

These case studies showcase how these companies provide targeted solutions that address the unique requirements of senior drivers in Texas. Seniors are also advised to take advantage of all available discounts, such as those for defensive driving courses, multi-policy bundles, or having safety features installed in their vehicles.

Read More: Cheap Auto Insurance for Drivers Over 60

Tips to Save Money on Senior Auto Insurance in Texas

Farmers, USAA, and State Farm stand out with the best auto insurance for seniors in Texas. Farmers is the best car insurance for seniors due to its customizable coverage options and extensive discounts. USAA offers the most affordable rates to military retirees, with top-tier customer service and exclusive military discounts.

One key recommendation is for seniors to review their insurance needs annually, as changes in driving patterns or lifestyle might allow for adjustments that could reduce rates. Bundling auto insurance with homeowners or other policies can lead to significant multi-policy discounts, with savings of up to 25%.

Another tip is to maintain a good driving record, which directly impacts rates. Insurance companies reward safe driving with lower costs.Schimri Yoyo Licensed Agent & Financial Advisor

Car insurance for the elderly is generally less expensive, but comparing quotes from different providers ensures senior drivers get the best deal without compromising coverage quality. Use our free comparison tool to simplify the process and evaluate multiple policies at once. Enter your ZIP code to find the best Texas auto insurance providers for your needs and budget.

Frequently Asked Questions

What is the cheapest auto insurance for seniors in Texas?

The cheapest auto insurance companies for seniors in Texas typically offer basic liability coverage, which provides the bare minimum coverage.

What is the best car and home insurance for seniors?

Seniors get the biggest potential multi-policy discount with Allstate, American Family, Geico, and Liberty Mutual.

How can seniors reduce their Texas auto insurance premiums?

For cheaper car insurance, seniors can take advantage of discounts for safe driving, low mileage, and completing defensive driving courses. Get the best Texas insurance rates by entering your ZIP code into our free comparison tool today.

What types of auto insurance coverage are recommended for seniors in Texas?

The recommended Texas car insurance for senior citizens includes liability coverage, comprehensive auto insurance, collision coverage, and uninsured and underinsured motorist (UM/UIM) coverage.

How does age impact auto insurance rates for seniors in Texas?

Texas car insurance rates for seniors are often lower due to their extensive driving experience and typically safer driving habits. Compare cheap auto insurance companies for drivers over 80.

What should seniors in Texas look for in an auto insurance policy?

Seniors in Texas should look for comprehensive coverage options, affordable premiums, good customer service, and available discounts when selecting a car insurance policy.

Are there specific car insurance discounts for seniors in Texas?

Yes, car insurance for senior drivers comes with exclusive discounts for those over 50 or 60. Seniors in Texas can also access multi-policy discounts, safe driver discounts, defensive driving course discounts, and low mileage discounts. Compare more auto insurance discounts.

Are there any specific programs in Texas to help lower auto insurance costs for seniors?

Is there free auto insurance for seniors in Texas? No, but even without state-sponsored auto coverage, you can still get the cheapest car insurance for seniors in Texas with usage-based programs. Some drivers may also qualify for AARP discounts. Learn how to lower your auto insurance rates.

Can seniors in Texas bundle their auto insurance with other policies for discounts?

Yes, you can bundle home and auto insurance for seniors to receive multi-policy discounts.

Why is uninsured and underinsured motorist (UM/UIM) coverage important for seniors in Texas?

Uninsured and underinsured motorist (UM/UIM) coverage is important for seniors in Texas as it protects them against costs from accidents with drivers who lack sufficient insurance.

How often should seniors in Texas review their auto insurance policies?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.