Best Auto Insurance for Drivers with Epilepsy in 2026 (Top 10 Companies)

Allstate, State Farm, and Geico provide the best auto insurance for drivers with epilepsy, starting at just $43 per month. We'll help you compare insurance rates for cars from major providers for your assurance, ensuring you get the best coverage and discounts for your vehicle.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated March 2025

Company Facts

Full Coverage for Drivers With Epilepsy

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Drivers With Epilepsy

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews

Company Facts

Full Coverage for Drivers With Epilepsy

A.M. Best

Complaint Level

Pros & Cons

- Allstate presents competitive pricing starting from $30 per month

- Competitive insurance companies offer potential savings for those with epilepsy

- Discounts guarantee the best auto insurance for drivers coping with epilepsy

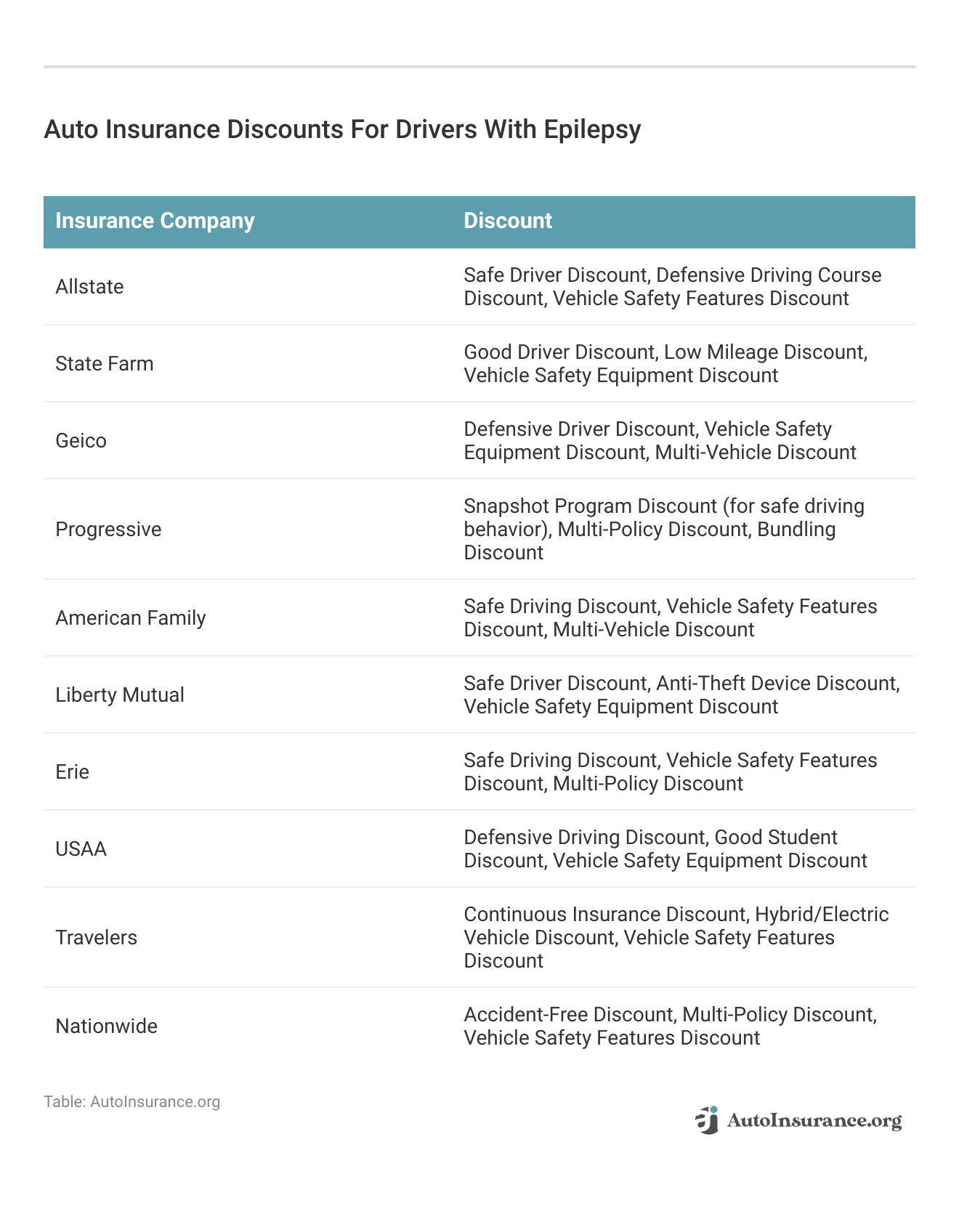

#1 – Allstate: Top Overall Pick

Pros

- Discount Opportunities: Allstate offers customized discount options for individuals.

- Financial Security: Allstate benefits from the backing of a financially secure enterprise.

- Exceptional Customer Care: Allstate is celebrated for its prompt and easily reachable service.

Cons

- Coverage Constraints: Certain supplementary policy features may not entirely fulfill individuals’ needs. Refer to our Allstate auto insurance review for guidance.

- Claims Processing: Individuals may experience delays or difficulties during the claims process.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Extensive Discounts

Pros

- Discount Options: State Farm offers a variety of discount opportunities.

- Financial Security: State Farm is backed by a financially stable corporation.

- Outstanding Customer Support: State Farm is known for its responsive and user-friendly service.

Cons

#3 – Geico: Best for Senior Discounts

Pros

- Customized Plans: Geico offers tailored coverage options for vehicles.

- Cost-Effective Rates: Geico provides budget-friendly prices. Start your affordability journey with our Geico auto insurance review.

- Savings Opportunities: Geico offers discounts, including those for automobiles.

Cons

- Limited Agent Availability: Geico mainly operates through local agents, which may not be universally accessible.

- Coverage Limitations: Some policy upgrades may not fully meet the needs of vehicles.

#4 – Progressive: Best for Usage-Based Insurance

Pros

- Tailored Plans: In our Progressive auto insurance review, personalized coverage options are tailored to vehicles.

- Competitive Rates: Progressive offers cost-effective pricing.

- Discount Options: Progressive provides various discount opportunities, including those tailored for vehicles.

Cons

- Claims Processing: Individuals may encounter delays or complications in the claims handling process.

- Restricted Discount Availability: Progressive may not provide as wide a range of discounts as some competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Customer Service

Pros

- Advanced Coverage Options: American Family provides distinctive coverage options.

- User-Friendly Technology: With intuitive mobile apps and online tools, American Family simplifies policy and claims management for customers.

- Solid Financial Stability: American Family’s strong financial footing ensures policyholders have a dependable and stable insurance provider.

Cons

- Possibly Higher Premiums: Some customers may find American Family’s premiums slightly elevated compared to other insurers.

- Mixed Customer Service Reviews: While many customers express satisfaction, some reports in our American Family insurance review highlight challenges with claims processing.

#6 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Personalized Plans: Liberty Mutual provides individualized coverage options for car insurance.

- Competitive Rates: Liberty Mutual offers cost-effective pricing.

- Outstanding Customer Care: Liberty Mutual is highly regarded for its prompt and user-friendly service.

Cons

- Membership Limitations: Liberty Mutual membership is exclusively available to military members, veterans, and their families.

- Variable Availability: Liberty Mutual’s accessibility may vary depending on location. Explore more details in our Liberty Mutual auto insurance review.

#7 – Erie: Best for Filing Claims

Pros

- Affordable Premiums: Our Erie auto insurance review highlights cost-effective rates that are friendly to various budgets.

- Flexible Coverage Choices: Erie offers customizable policies to suit individual needs.

- Savings Opportunities: Erie provides various discounts, including those designed specifically for automobiles.

Cons

- Sparse Local Agent Presence: Erie primarily operates online and over the phone, with limited physical locations.

- Coverage Constraints: Some policy enhancements may not entirely fulfill the requirements of classic cars.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – USAA: Best for Military Drivers

Pros

- Customized Policies: USAA, as highlighted in our USAA auto insurance review, customizes coverage to suit individuals’ needs.

- Affordable Premiums: USAA offers budget-friendly car insurance.

- Discount Opportunities: USAA provides various discounts, including those for car insurance.

Cons

- Restricted Accessibility: USAA primarily operates through local agents, which may be inaccessible in certain regions.

- Coverage Restrictions: Certain additional coverage options may not entirely satisfy requirements.

#9 – Travelers: Best for Low-Mileage Drivers

Pros

- Cost-Effective Premiums: Our Travelers auto insurance review uncovers competitive rates that fit various budgets.

- Flexible Coverage Choices: Travelers offers policies that can be tailored to individual needs.

- Savings Opportunities: Travelers provides various discounts, including those designed specifically for automobiles.

Cons

- Sparse Local Agent Network: Travelers primarily operates through online and phone channels, with limited physical agent presence.

- Coverage Restrictions: Some policy enhancements may not fully address the needs of vehicles.

#10 – Nationwide: Best for Simple Claims

Pros

- Diverse Coverage Options: Nationwide offers an extensive array of coverage options, enabling customers to customize policies to their requirements.

- Deductible Reduction Feature: Nationwide’s Vanishing Deductible program incentivizes safe driving by decreasing deductibles over time.

- Membership Savings: Nationwide provides discounts for various affiliations and memberships, improving affordability for specific groups.

Cons

- Mixed Customer Satisfaction: Customer satisfaction ratings differ, as highlighted in our Nationwide insurance review, with some customers reporting average experiences.

- Variable Premiums: Premiums may fluctuate depending on location and individual profiles, potentially affecting overall affordability.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Epilepsy Definition

The Timeframe from Last Seizure

Epilepsy as a Road Hazard

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Affecting Your Auto Insurance Rates if You Have Epilepsy

Frequently Asked Questions

Can I get auto insurance if I have epilepsy?

Yes, individuals with epilepsy can obtain auto insurance. However, the availability of coverage and the rates may vary depending on the insurance provider and the specific details of your condition.

Will having epilepsy affect my auto insurance rates?

It is possible that having epilepsy may impact your auto insurance rates. Insurance companies consider various factors when determining premiums, including your medical history and driving record. Epilepsy may be considered a risk factor, leading to potentially higher rates.

What information should I provide when applying for auto insurance with epilepsy?

Should I disclose my epilepsy diagnosis to the insurance company?

It is important to disclose your epilepsy diagnosis to the insurance company. Failing to disclose relevant information could result in denial of claims or even policy cancellation. Providing accurate information helps ensure that you have the appropriate coverage and protection. Enter your ZIP code now to compare.

Are there specific insurance companies that specialize in covering individuals with epilepsy?

While some insurance companies may have more experience or expertise in covering individuals with epilepsy or other medical conditions, there is no specific list of companies that specialize in this area. It is recommended to reach out to multiple insurance providers to explore your options.

Are there any alternative options if I’m unable to obtain traditional auto insurance due to epilepsy?

Is epilepsy a road hazard?

Epilepsy itself isn’t inherently a road hazard, but seizures while driving can pose significant risks. It’s crucial for individuals with epilepsy to manage their condition effectively, follow medical advice, and adhere to state laws regarding driving to minimize these risks. Enter your ZIP code now for further details.

Does epilepsy affect your auto insurance rates?

Epilepsy generally doesn’t directly affect auto insurance rates. However, factors such as driving record, accident history, and adherence to state regulations may play a role. It’s essential to inform the DMV about your condition and meet any requirements set forth by your state regarding driving with epilepsy.

What is the epilepsy-friendly car insurance?

Epilepsy-friendly car insurance typically refers to policies that accommodate individuals with epilepsy and provide coverage tailored to their needs. While there’s no specific epilepsy-specific insurance, some insurers may offer discounts or special provisions for drivers with medical conditions.

What are some considerations for individuals with epilepsy regarding collision and comprehensive coverage options?

Individuals with epilepsy should consider collision and comprehensive coverage options carefully. Collision coverage helps repair or replace your vehicle if it’s damaged in a crash, while comprehensive coverage protects against non-collision incidents like theft or natural disasters.

For those with epilepsy, it’s crucial to assess their driving habits, seizure frequency, and overall risk factors to determine the level of coverage needed.

Additionally, discussing any specific concerns with insurance providers can help tailor coverage to individual needs and provide peace of mind on the road. Enter your ZIP code now.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.