Best Chevrolet Corvette Stingray Auto Insurance in 2026 (See Our Top 10 Company Picks)

State Farm, Allstate, and Progressive are the top providers for the best Chevrolet Corvette Stingray auto insurance, with rates starting at $85 per month. Compare rates and coverage options today from leading providers to find the best deal on cheap Corvette Stingray insurance costs.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated October 2024

Company Facts

Full Coverage for Chevrolet Corvette Stingray

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Chevrolet Corvette Stingray

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Chevrolet Corvette Stingray

A.M. Best

Complaint Level

Pros & Cons

Get the best Chevrolet Corvette Stingray auto insurance from the top companies like, State Farm, Allstate, Progressive, starting at $85 per month. Compare quotes to find the cheapest Chevrolet auto insurance and save on your coverage.

Buying a new car is exciting but requires research. If you’re considering a Chevrolet Corvette Stingray, you’ll need all the facts before deciding. We’ve compiled essential information on the Stingray, including insurance rates compared to similar vehicles, safety ratings, features, and costs.

Our Top 10 Company Picks: Best Chevrolet Corvette Stingray Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Competitive Rates State Farm

#2 25% A+ Local Agents Allstate

#3 12% A+ Snapshot Program Progressive

#4 10% A++ Member Benefits USAA

#5 10% A Customized Coverage Liberty Mutual

#6 20% A+ Vanishing Deductible Nationwide

#7 15% A Multiple Discounts Farmers

#8 13% A++ Flexible Policies Travelers

#9 5% A+ AARP Benefits The Hartford

#10 29% A Personalized Service American Family

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

- Find out how safety features affect Corvette Stingray insurance rates

- Get tips to lower Corvette Stingray insurance costs and find discounts

- State Farm is the top pick for comprehensive coverage and competitive rates

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: State Farm offers highly competitive rates, making it an affordable option for Chevrolet Corvette Stingray owners looking to save on insurance costs.

- Wide Range of Coverage Options: State Farm provides a variety of coverage options, allowing customers to tailor their policies to meet specific needs and preferences.

- Discounts for Safe Drivers: State Farm provides significant discounts for safe drivers, learn more in our State Farm auto insurance review.

Cons

- Limited Discounts: Compared to other companies, State Farm offers fewer discounts, which might limit savings opportunities for customers.

- Average Customer Service: State Farm’s customer service is considered average, with mixed reviews regarding responsiveness and resolution of claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Local Agents

Pros

- Local Agents: Allstate has a strong network of local agents, providing personalized service and support to Chevrolet Corvette Stingray owners.

- High Multi-Policy Discount: Allstate offers a generous 25% multi-policy discount, helping customers save significantly when bundling their insurance policies.

- Excellent Financial Strength: With an A+ rating from A.M. Best, Allstate demonstrates exceptional financial strength and reliability.

Cons

- Higher Premiums: Allstate tends to have higher premiums compared to some competitors, which might not be ideal for budget-conscious customers.

- Complex Claims Process: Some customers report that Allstate’s claims process can be cumbersome and time-consuming, learn more in our Allstate auto insurance review.

#3 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s Snapshot program rewards safe drivers with discounts, making it a great option for those with good driving habits.

- Strong Financial Rating: With an A+ rating from A.M. Best, Progressive is financially secure and reliable for handling claims.

- User-Friendly Online Tools: Progressive offers excellent online tools and resources, allowing customers to manage their policies conveniently.

Cons

- Moderate Multi-Policy Discount: Progressive’s multi-policy discount is only 12%, (Read More: Progressive Auto Insurance Discounts).

- Inconsistent Customer Service: Customer service experiences with Progressive can vary, with some customers reporting unsatisfactory interactions.

#4 – USAA: Best for Member Benefits

Pros

- Member Benefits: USAA offers extensive benefits to its members, including discounts, financial products, and exclusive services for military families.

- Outstanding Financial Strength: With an A++ rating from A.M. Best, USAA is one of the most financially stable insurers, ensuring reliability in claims handling.

- High Customer Satisfaction: USAA consistently receives high ratings for customer satisfaction, reflecting its commitment to service excellence.

Cons

- Restricted Eligibility: As mentioned in our USAA auto insurance review, they are limited to military members, veterans, and their families, excluding a significant portion of potential customers.

- Limited Local Presence: USAA has fewer local offices compared to other insurers, which might be a drawback for customers preferring face-to-face interactions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Customized Coverage

Pros

- Customized Coverage: Liberty Mutual offers highly customizable coverage options, allowing Chevrolet Corvette Stingray owners to tailor policies to their specific needs.

- Solid Financial Rating: With an A rating from A.M. Best, Liberty Mutual is financially secure and capable of handling claims efficiently.

- Discount Opportunities: Liberty Mutual provides a range of discounts, including safe driver and multi-policy discounts, helping customers save on premiums.

Cons

- Higher Rates: In our Liberty Mutual auto insurance review, rates can be higher than average, which may not be ideal for price-sensitive customers.

- Mixed Customer Reviews: Customer service reviews for Liberty Mutual are mixed, with some customers reporting dissatisfaction with claims handling and support.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a unique vanishing deductible feature, reducing your deductible amount for every year of safe driving.

- Excellent Financial Strength: With an A+ rating from A.M. Best, for more information, read our Nationwide auto insurance review.

- Wide Range of Discounts: Nationwide provides a variety of discounts, including a 20% multi-policy discount, helping customers lower their insurance costs.

Cons

- Average Customer Service: Nationwide’s customer service is considered average, with some customers experiencing issues with claims resolution and support.

- Higher Premiums for Some Drivers: Premiums with Nationwide can be higher for certain drivers, particularly those with less favorable driving records.

#7 – Farmers: Best for Multiple Discounts

Pros

- Multiple Discounts: Farmers offers numerous discounts, including a 15% multi-policy discount, making it a cost-effective choice for Chevrolet Corvette Stingray owners.

- Strong Financial Stability: With an A rating from A.M. Best, Farmers is financially stable and dependable for claims processing.

- Comprehensive Coverage Options: Farmers provides a wide range of coverage options, allowing customers to customize their policies to suit their needs.

Cons

- Mixed Customer Reviews: Customer reviews for Farmers can be inconsistent, with some customers reporting dissatisfaction with claims handling and customer service.

- Higher Rates for Younger Drivers: Farmers tends to have higher rates for younger drivers. See more details in our page titled Farmers auto insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Flexible Policies

Pros

- Flexible Policies: Travelers offers flexible policy options, allowing Chevrolet Corvette Stingray owners to tailor their coverage to fit their needs.

- Outstanding Financial Strength: With an A++ rating from A.M. Best, Travelers is highly reliable in terms of financial stability and claims processing.

- Wide Range of Discounts: As outlined in our Travelers auto insurance review, they provide a variety of discounts, helping customers save on premiums.

Cons

- Higher Premiums for High-Risk Drivers: Travelers’ premiums can be higher for high-risk drivers, making it less affordable for those with a less favorable driving record.

- Limited Local Agent Presence: Travelers has fewer local agents compared to some competitors, which might be a drawback for customers preferring in-person interactions.

#9 – The Hartford: Best for AARP Benefits

Pros

- AARP Benefits: The Hartford offers exclusive benefits for AARP members, including additional discounts and specialized services.

- Strong Financial Rating: With an A+ rating from A.M. Best, The Hartford is financially secure and reliable for handling claims.

- Comprehensive Coverage Options: The Hartford provides a variety of coverage options, learn more in our The Hartford auto insurance review.

Cons

- Higher Rates for Younger Drivers: The Hartford tends to have higher rates for younger drivers, making it less affordable for this demographic.

- Mixed Customer Service Reviews: Customer service reviews for The Hartford are mixed, with some customers reporting unsatisfactory experiences.

#10 – American Family: Best for Personalized Service

Pros

- Personalized Service: American Family is known for its personalized service, offering dedicated support to Chevrolet Corvette Stingray owners.

- Generous Multi-Policy Discount: American Family offers a substantial 29% multi-policy discount, helping customers save significantly when bundling their insurance policies.

- Solid Financial Stability: With an A rating from A.M. Best, American Family is financially stable and reliable for handling claims.

Cons

- Limited Availability: American Family insurance is not available in all states, restricting access for some potential customers (Read More: American Family Auto Insurance Review).

- Higher Premiums for High-Risk Drivers: American Family’s premiums can be higher for high-risk drivers, which may not be ideal for those with a less favorable driving record.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chevrolet Corvette Stingray Insurance Rates

Take a look at how insurance rates for similar models to the Chevrolet Corvette Stingray look. These insurance rates for other coupes like the BMW 4 Series Gran Coupe, Infiniti G Coupe, and Nissan 240SX give you a good idea of what to expect.

Chevrolet Corvette Stingray Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $90 $180

American Family $89 $178

Farmers $92 $180

Liberty Mutual $95 $185

Nationwide $88 $175

Progressive $80 $170

State Farm $85 $165

The Hartford $87 $172

Travelers $86 $170

USAA $75 $155

The table above compares monthly rates for minimum and full coverage auto insurance for a Chevrolet Corvette from various providers.

When assessing coupe average insurance rates, understanding coverage levels like comprehensive, collision, and liability can help determine the best insurance policy for your needs and budget.

Insurance Rates for Vehicles Similar to the Chevrolet Corvette Stingray

Compare insurance rates for vehicles similar to the Chevrolet Corvette Stingray across different coverage types including comprehensive, collision, and liability.

Chevrolet Corvette Stingray Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Chevrolet Corvette Stingray | $29 | $57 | $33 | $132 |

| Audi RS 5 | $35 | $74 | $31 | $151 |

| Mazda RX-8 | $21 | $34 | $38 | $106 |

| Mercedes-Benz CLA 250 | $34 | $70 | $33 | $150 |

| Infiniti Q60 | $32 | $62 | $33 | $140 |

| Mitsubishi Eclipse | $19 | $33 | $38 | $104 |

| Chrysler Sebring | $17 | $29 | $39 | $98 |

| Chevrolet Corvette | $41 | $77 | $22 | $149 |

These comparisons highlight varying insurance costs based on vehicle type and coverage level, emphasizing the importance of researching and comparing quotes to find the best insurance deal for your specific car model.

Chevrolet Corvette Stingray Insurance Cost

The cost of Chevrolet Corvette Stingray insurance is influenced not only by the trim and model selected but also by additional factors such as the car’s value, safety features, and likelihood of theft.

Your credit score, annual mileage, and whether you bundle your insurance policies can also impact insurance rates significantly.Jeff Root LICENSED INSURANCE AGENT

It’s advisable to explore various coverage options and compare quotes from multiple insurers to find the best rate tailored to your specific circumstances and location.

Read More: Safest Highways by State

Ways to Save on Chevrolet Corvette Stingray Insurance

If you want to reduce the cost of your Chevrolet Corvette Stingray insurance rates, follow these tips below. Simple actions like moving to an area with better weather and accurately reporting driver information can make a big difference in your premiums.

- Move to an area with better weather

- Tell your insurer about different drivers or uses for your Chevrolet Corvette Stingray

- Tell your insurer how you use your Chevrolet Corvette Stingray

- Check your Chevrolet Corvette Stingray policy carefully to ensure all information is correct

- Buy your Chevrolet Corvette Stingray with cash, or get a shorter-term loan

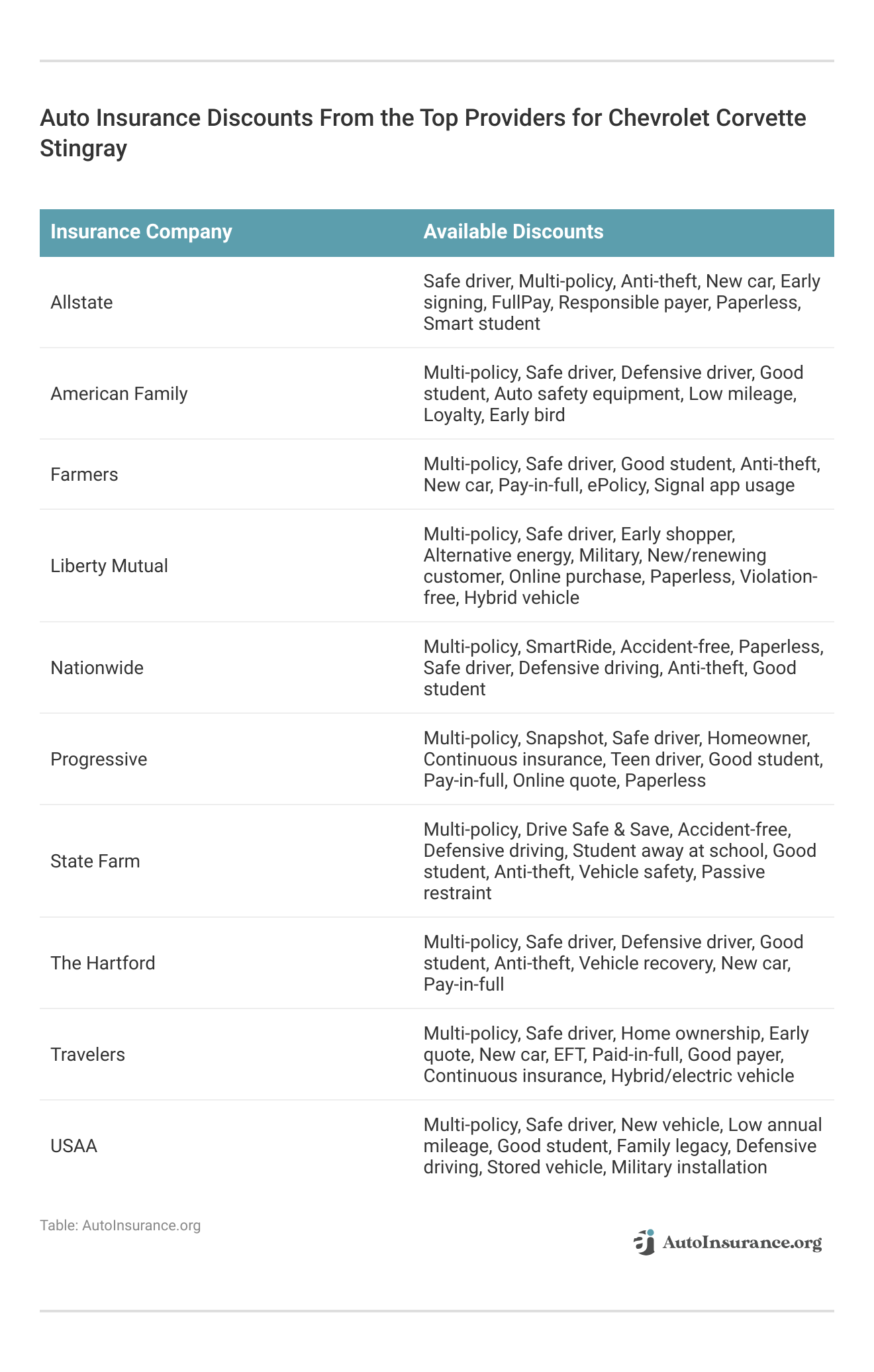

Discover the variety of car insurance discounts offered by top providers for Chevrolet Corvette Stingray to help you save on your premiums.

These discounts from top insurance providers for Chevrolet Corvette Stingray offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Chevrolet Corvette Stingray Insurance Companies

Several insurance companies offer competitive rates for the Chevrolet Corvette Stingray based on factors like discounts for safety features. Take a look at these top car insurance companies that are popular with Chevrolet Corvette Stingray drivers organized by market share.

Largest Auto Insurers by Market Share

Explore the largest auto insurers by market share, ranked by their volume and percentage share in the industry.

Top 10 Chevrolet Corvette Stingray Auto Insurance Providers by Market Share

| Rank | Insurance Company | Volume | Market Share |

|---|---|---|---|

| #1 | State Farm | $65,615,190 | 9.30% |

| #2 | Geico | $46,106,971 | 6.60% |

| #3 | Progressive | $39,222,879 | 5.60% |

| #4 | Liberty Mutual | $35,600,051 | 5.10% |

| #5 | Allstate | $35,025,903 | 5.00% |

| #6 | Travelers | $28,016,966 | 4.00% |

| #7 | USAA | $23,483,080 | 3.30% |

| #8 | Chubb | $23,388,385 | 3.30% |

| #9 | Farmers | $20,643,559 | 2.90% |

| #10 | Nationwide | $18,442,145 | 2.60% |

These rankings provide insights into the leading players in the auto insurance market, showcasing their market dominance and influence on industry trends and customer choices.

Comparing free Chevrolet Corvette Stingray insurance quotes online. You can start comparing quotes for Chevrolet Corvette Stingr insurance from some of the top car insurance companies by using our free online tool today.

Frequently Asked Questions

Is auto insurance more expensive for a Chevrolet Corvette Stingray compared to other vehicles?

The cost of auto insurance for a Chevrolet Corvette Stingray can be higher than average due to several factors. The Stingray is a high-performance sports car known for its power and speed, which often translates to higher insurance premiums.

Read More: Best Auto Insurance for Luxury Cars

What types of coverage should I consider for my Chevrolet Corvette Stingray?

When insuring your Chevrolet Corvette Stingray, it’s important to consider comprehensive coverage, collision coverage, and liability coverage.

Are there any specific discounts available for insuring a Chevrolet Corvette Stingray?

Insurance companies often offer various discounts that can help lower the cost of insuring a Chevrolet Corvette Stingray. Some insurers may offer discounts specifically for sports cars or high-performance vehicles. It’s recommended to check with different insurance providers to explore the available discounts.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Can I insure my Chevrolet Corvette Stingray as a classic car?

Whether you can insure your Chevrolet Corvette Stingray as a classic car depends on various factors, including the specific definition and criteria set by insurance companies for classic car insurance. Generally, classic car insurance is available for vehicles that are older, well-maintained, limited in use, and have historical or collector’s value.

How can I find affordable insurance rates for my Chevrolet Corvette Stingray?

To find affordable insurance rates for your Chevrolet Corvette Stingray, it’s recommended to compare quotes from multiple insurance companies. Each insurer evaluates risk differently, so shopping around can help you find the most competitive rates. arriers on your behalf may also be beneficial.

Are there any specific factors that can affect the cost of insurance for a Chevrolet Corvette Stingray?

Several factors can influence the cost of insurance for a Chevrolet Corvette Stingray. These factors may include the driver’s age, location, driving history, annual mileage, credit history, and coverage options chosen. Additionally, modifications made to the vehicle, such as performance enhancements or aftermarket parts, can impact insurance rates.

Can I get insurance for a leased Chevrolet Corvette Stingray?

Yes, you can get insurance for a leased Chevrolet Corvette Stingray. In fact, leasing companies usually require you to have full coverage insurance, including comprehensive and collision coverage, to protect their investment. Make sure to check the specific insurance requirements of your leasing agreement to ensure compliance.

How does my driving record affect my Chevrolet Corvette Stingray insurance rates?

Your driving record has a significant impact on your Chevrolet Corvette Stingray insurance rates. A clean driving record with no accidents or violations can help you secure lower premiums. Conversely, a history of accidents, traffic violations, or DUIs will likely result in higher insurance costs due to the increased risk you pose to insurers.

Are there any mileage-based insurance options for a Chevrolet Corvette Stingray?

Yes, some insurance companies offer mileage-based or pay-as-you-drive insurance options for a Chevrolet Corvette Stingray. These policies can be beneficial if you don’t drive your Corvette frequently, as premiums are based on the number of miles driven. Companies like Progressive with their Snapshot program offer such options. Learn more in our article titled “Cheap Usage-Based Auto Insurance.”

Does installing an anti-theft device lower my Chevrolet Corvette Stingray insurance premiums?

Installing an anti-theft device can potentially lower your Chevrolet Corvette Stingray insurance premiums. Many insurance companies offer discounts for vehicles equipped with anti-theft devices, as these reduce the risk of theft. Be sure to inform your insurer about any security features your Corvette has to see if you qualify for a discount.

What should I do if my Chevrolet Corvette Stingray is involved in an accident?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.