Best Windshield Replacement Coverage in Nebraska (Top 10 Companies Ranked for 2025)

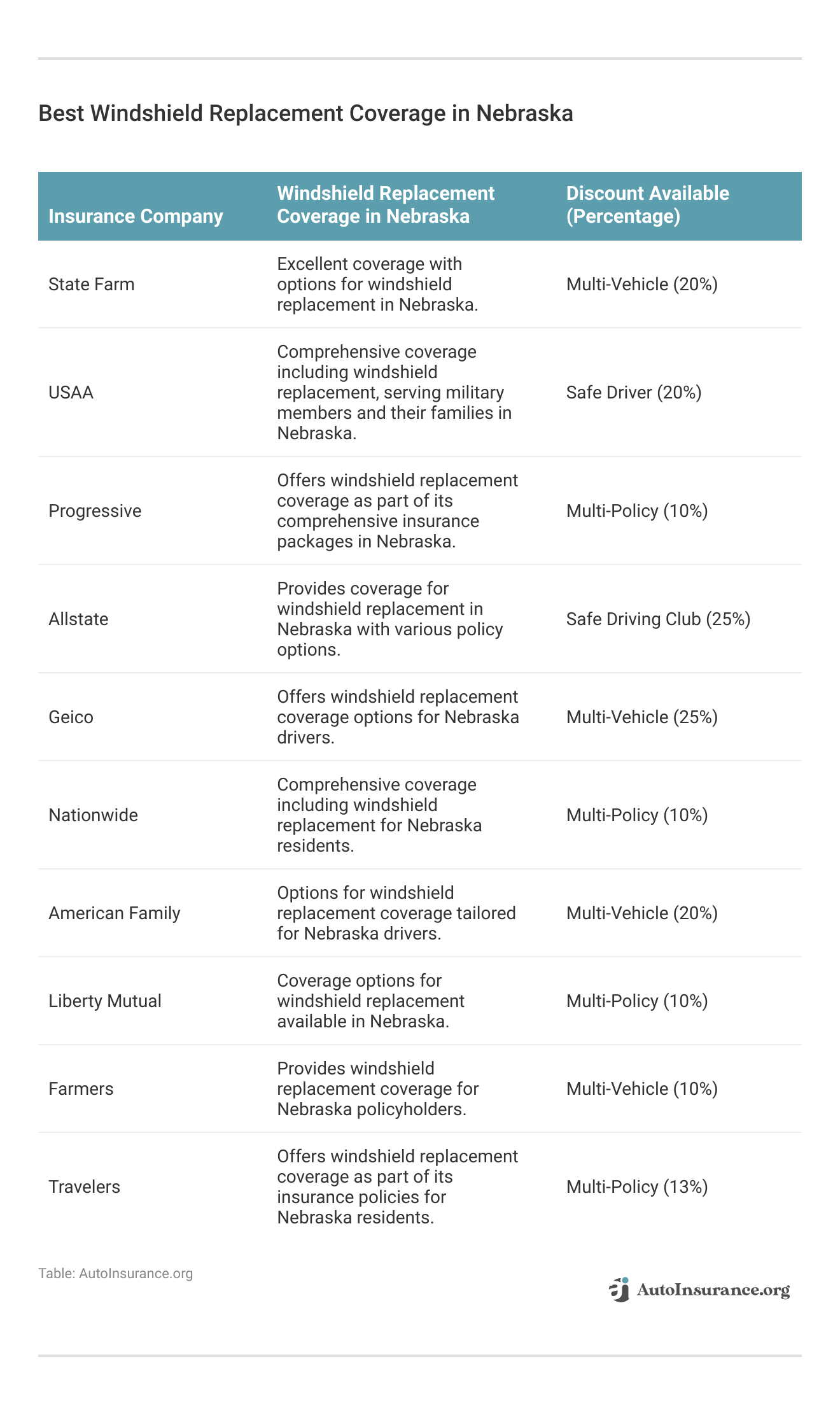

State Farm, USAA, and Progressive provide the best windshield replacement coverage in Nebraska, starting from as low as $51 monthly. Our goal is to help you compare quotes from these reputable companies, ensuring you find the best coverage for your peace of mind, along with customized discounts for your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Laura Berry

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated April 2025

Company Facts

Full Coverage Windshield Replacement in NE

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in NE

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in NE

A.M. Best

Complaint Level

Pros & Cons

- State Farm provides competitive rates starting from $98 per month

- Top insurance companies present opportunities for savings on windshields

- Multiple discount options are available for windshield replacement coverage

#1 – State Farm: Top Overall Pick

Pros

- Personalized Service: State Farm agents provide personalized assistance, helping customers tailor their coverage to their specific needs. Find out more in our State Farm auto insurance review.

- Strong Financial Stability: With high financial ratings, State Farm offers peace of mind knowing they have the resources to handle claims efficiently.

- Multi-Line Discounts: State Farm offers discounts for bundling multiple insurance policies, such as auto and homeowners insurance.

Cons

- Potentially Higher Rates: While State Farm offers extensive coverage options, their rates may be higher compared to some other providers.

- Limited Online Tools: Some customers may find State Farm’s online interface and mobile app less intuitive compared to other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Exceptional Customer Service: USAA is renowned for its top-notch customer service, with dedicated representatives and support for military members and their families.

- Competitive Rates: USAA often provides competitive rates, especially for military members, veterans, and their families. Read more in our USAA auto insurance review.

- Comprehensive Coverage Options: USAA offers a wide range of coverage options, including special protections for military service-related incidents.

Cons

- Limited Eligibility: USAA membership is restricted to military members, veterans, and their families, excluding the general public.

- Availability Restrictions: Some services may not be available in certain areas or to all members, particularly those stationed overseas.

#3 – Progressive: Best for Online Convenience

Pros

- User-Friendly Online Tools: Progressive offers intuitive online tools and a user-friendly mobile app for managing policies, filing claims, and accessing resources.

- Competitive Rates: Progressive often provides competitive rates and discounts for safe driving habits, bundling policies, and other factors.

- Variety of Discounts: In our Progressive auto insurance review, Progressive offers a wide range of discounts, making it easier for customers to save money on their premiums.

Cons

- Mixed Customer Service Reviews: While Progressive excels in online services, some customers report mixed experiences with their customer service representatives.

- Limited Availability: Progressive may not be available in all areas, limiting options for potential customers in certain regions.

#4 – Allstate: Best for Add-on Coverages

Pros

- Extensive Coverage Options: Allstate offers a wide range of coverage options, including add-on coverages like accident forgiveness and roadside assistance.

- Innovative Features: Allstate’s innovative tools, such as Drivewise and QuickFoto Claim, provide added convenience and potential discounts for safe driving and easy claims processing.

- Local Agent Support: Allstate’s network of local agents provides personalized assistance and expertise, ensuring customers get the support they need.

Cons

- Higher Premiums: Some customers may find Allstate’s premiums to be higher compared to other insurers, especially for certain coverage options. Use our Allstate auto insurance review as your guide.

- Limited Discounts: While Allstate offers various discounts, some customers may find that they don’t qualify for as many discounts as they would with other providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

5 – Geico: Best for Cheap Rates

Pros

- Affordable Rates: Geico is known for offering competitive rates and discounts, making it a popular choice for budget-conscious customers.

- Convenient Online Services: Geico’s online platform and mobile app make it easy to manage policies, file claims, and access resources anytime, anywhere.

- Strong Financial Stability: Geico’s strong financial stability provides reassurance that they can handle claims efficiently and effectively.

Cons

- Limited Coverage Options: Geico’s coverage options may be more limited compared to some other insurers, especially for specialized coverages.

- Minimal Agent Interaction: While Geico offers some agent support, customers who prefer more personalized assistance may find the level of interaction to be insufficient. Read more in our Geico auto insurance review.

#6 – Nationwide: Best for Usage Discount

Pros

- Multi-Policy Discounts: Nationwide, as mentioned in our Nationwide insurance review, offers significant discounts for bundling multiple policies, such as auto and homeowners insurance.

- Nationwide Network: With a large network of agents and service centers across the country, Nationwide provides convenient access to support and resources.

- Member Benefits: Nationwide offers various member benefits, such as accident forgiveness and vanishing deductibles, to reward safe driving and loyalty.

Cons

- Average Customer Satisfaction: Nationwide’s customer satisfaction ratings are generally average, with some customers reporting issues with claims processing and customer service.

- Limited Availability: Nationwide may not be available in all areas, limiting options for potential customers in certain regions.

#7 – American Family: Best for Student Savings

Pros

- Personalized Service: American Family agents offer personalized service, taking the time to understand each customer’s needs and provide tailored coverage solutions.

- Loyalty Discounts: American Family rewards customer loyalty with discounts for staying with the company for an extended period, helping to lower premiums over time.

- Variety of Coverage Options: American Family offers a wide range of coverage options, including specialized coverages for unique needs like classic cars or RVs.

Cons

- Limited Availability: American Family’s coverage may be limited to certain regions, restricting options for customers outside of those areas.

- Mixed Claims Experience: Our examination of American Family insurance review reveals, while many customers have positive experiences with American Family’s claims process, some report delays or complications in claim resolution.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual offers customizable policies, allowing customers to tailor coverage to their specific needs and budget. For further insights, refer to our Liberty Mutual auto insurance review.

- Multi-Policy Discounts: Liberty Mutual provides significant discounts for bundling multiple policies, such as auto, home, and life insurance.

- Technology-Driven Solutions: Liberty Mutual utilizes innovative technology, such as their mobile app and online tools, to streamline the insurance process and enhance customer experience.

Cons

- Higher Premiums: Some customers may find Liberty Mutual’s premiums to be higher compared to other insurers, especially for certain coverage options.

- Mixed Customer Service Reviews: While Liberty Mutual offers convenient online services, some customers report mixed experiences with their customer service representatives, citing issues with responsiveness and clarity.

#9 – Farmers: Best for Local Agents

Pros

- Local Agent Support: Farmers’ extensive network of local agents provides personalized assistance and expertise, ensuring customers receive tailored coverage and support.

- Diverse Coverage Options: Farmers offers a wide range of coverage options, including specialized coverages for unique needs like classic cars, motorcycles, and recreational vehicles.

- Strong Community Involvement: Farmers is actively involved in supporting local communities through various initiatives and programs, fostering a sense of trust and goodwill among customers.

Cons

- Higher Premiums: Farmers, as mentioned in our Farmers auto insurance review, stated that some customers may find Farmers’ premiums to be higher compared to other insurers, especially for certain coverage options or in certain regions.

- Limited Online Tools: While Farmers offers online services, including policy management and claims filing, some customers may find their online interface less intuitive compared to other insurers.

#10 – Travelers: Best for Accident Forgiveness

Pros

- Comprehensive Coverage Options: Travelers offers a wide range of coverage options, including add-on coverages like roadside assistance and rental car reimbursement, providing peace of mind for customers.

- Strong Financial Stability: Our Travelers auto insurance review reveals that with high financial ratings, Travelers demonstrates strong financial stability, ensuring they can handle claims efficiently and effectively.

- Accident Forgiveness: Travelers offers accident forgiveness programs that prevent premium increases after the first at-fault accident, rewarding safe driving behavior.

Cons

- Limited Availability: Travelers may not be available in all areas, limiting options for potential customers in certain regions.

- Average Customer Service: While Travelers provides adequate customer service, some customers report average experiences with claims processing and responsiveness.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zero Deductible Full Glass Coverage Law of Nebraska

Aftermarket or Used Parts in Repairs

Before reaching out to a repair shop, especially if you have high-risk auto insurance, carefully examine your policy to sidestep potential complications.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Making the Most of Your Coverage in Nebraska

Frequently Asked Questions

Does auto insurance in Nebraska cover windshield replacement?

Yes, auto insurance in Nebraska typically covers windshield replacement under comprehensive coverage. Comprehensive coverage is an optional insurance coverage that helps pay for damages to your vehicle caused by non-collision events, including windshield damage.

How does windshield replacement coverage work in Nebraska?

If you have comprehensive coverage on your auto insurance policy in Nebraska, and your windshield gets damaged or cracked due to covered perils such as a rock chip, vandalism, or extreme weather, your insurance company can help cover the cost of windshield replacement or repair, depending on the extent of the damage and the terms of your policy. Enter your ZIP code now to start.

Do I have to pay a deductible for windshield replacement in Nebraska?

Will filing a windshield replacement claim affect my insurance rates in Nebraska?

Filing a windshield replacement claim in Nebraska should not directly impact your insurance rates. Windshield claims are typically considered “no-fault” claims and are not likely to result in a surcharge or increase in your premiums. However, it’s always a good idea to check with your insurance provider to understand their specific policies regarding claims and rate adjustments.

Can I choose any windshield repair or replacement service in Nebraska?

In most cases, you can choose the windshield repair or replacement service provider in Nebraska. However, it’s recommended to check with your insurance company beforehand, as they may have preferred or approved providers with whom they have established partnerships. Working with a preferred provider may ensure a smoother claims process and direct billing between the repair shop and your insurance company. Enter your ZIP code now.

What if I don’t have comprehensive coverage in Nebraska?

How do I file a windshield replacement claim in Nebraska?

To file a windshield replacement claim in Nebraska, follow these general steps:

- Contact your insurance provider. Notify your insurance company about the windshield damage and inquire about the claims process.

- Provide necessary information. Be prepared to provide details about the damage, the date and location of the incident, and any supporting documentation or photos if available.

- Schedule an inspection. Your insurance company may request an inspection of the windshield damage or ask you to visit an approved repair shop.

- Follow your insurer’s instructions. Cooperate with your insurance company and follow their guidelines for repair or replacement procedures, including choosing an approved service provider if required.

- Pay any applicable deductible. If a deductible applies to your comprehensive coverage, you may need to pay it directly to the repair shop.

- Complete the claim. After the repair or replacement is completed, ensure that all necessary paperwork is submitted to your insurance company for reimbursement or direct payment to the repair shop.

Which insurance providers offer the best windshield replacement coverage in Nebraska, and what set them apart?

State Farm, USAA, and Progressive are the top providers offering windshield replacement coverage in Nebraska, known for competitive rates and tailored options. To find out more, enter your ZIP code.

How does Nebraska’s absence of zero-deductible full glass coverage laws impact insurance options for windshield replacement?

What are the essential steps for filing a windshield replacement claim in Nebraska?

When filing a windshield replacement claim in Nebraska, it’s crucial to check your policy for coverage details, select a repair vendor, and follow the insurer’s claims process.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.