Best Windshield Replacement Coverage in Idaho (Top 10 Companies in 2026)

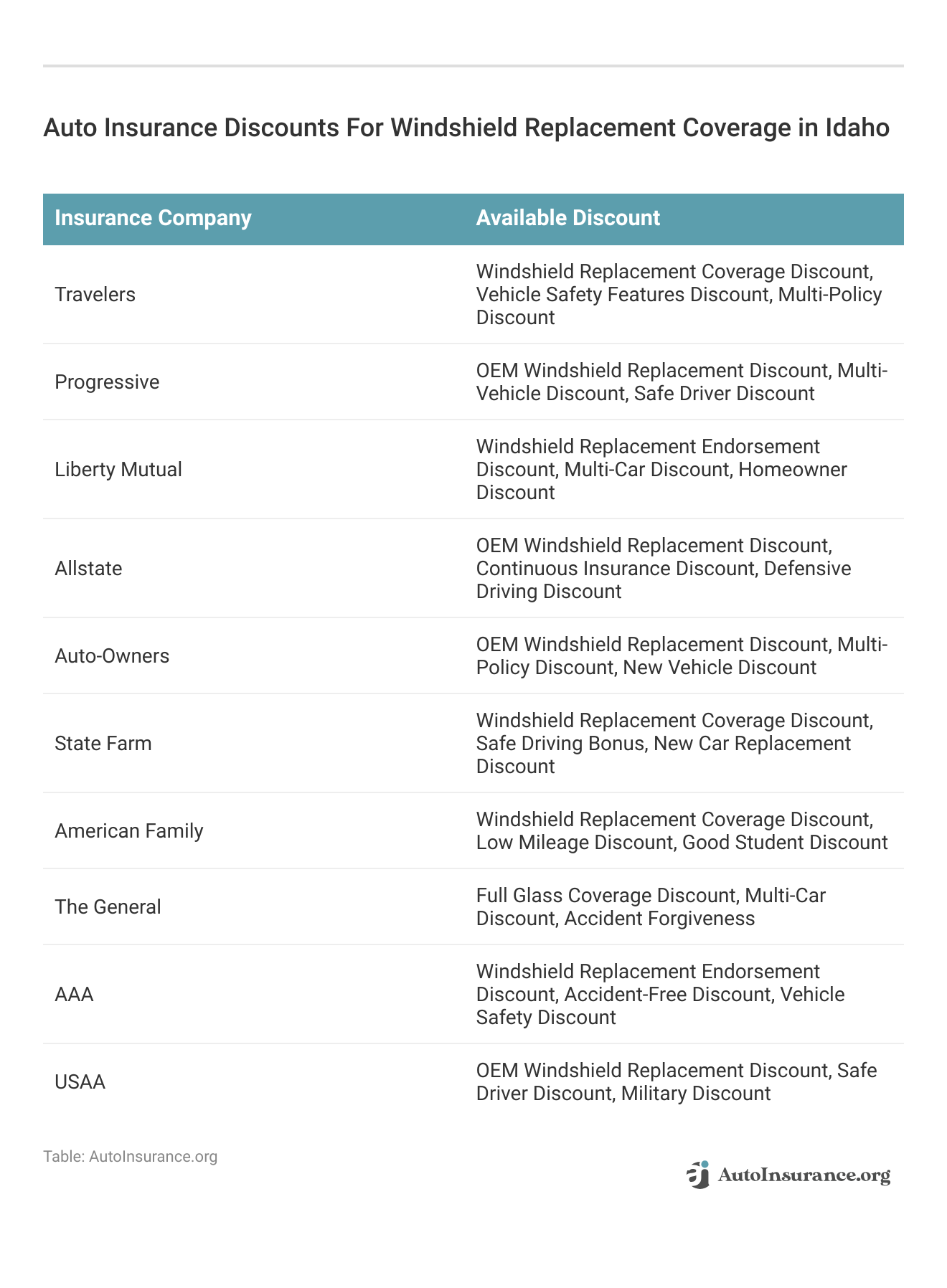

Travelers, Progressive, and Liberty Mutual provide the best windshield replacement coverage in Idaho, starting at only $55 per month. Our goal is to help you compare quotes from these reputable insurers, enabling you to find the perfect coverage and capitalize on personalized discounts tailored to your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated February 2025

Company Facts

Full Coverage Windshield Replacement in Idaho

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in Idaho

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in Idaho

A.M. Best

Complaint Level

Pros & Cons

- Travelers provides appealing rates starting from $78 per month

- Leading insurance providers present choices for windshield replacement

- Variety of discount opportunities exist for windshield replacement coverage

#1 – Travelers: Top Overall Pick

Pros

- Comprehensive Coverage Options: Our Travelers auto insurance review reveals that Travelers offers a wide range of coverage options, including excellent windshield replacement coverage, ensuring that customers can find a policy tailored to their needs.

- Competitive Rates: Travelers provides competitive rates, starting at $78 per month in Idaho, making it an affordable option for many drivers.

- Strong Financial Stability: With a high A.M. Best rating, Travelers demonstrates strong financial stability, providing customers with confidence in their ability to fulfill claims.

Cons

- Limited Discounts: While Travelers offers competitive rates, they may have fewer discount opportunities compared to some other providers, potentially resulting in higher premiums for certain drivers.

- Mixed Customer Service Reviews: Some customers have reported mixed experiences with Travelers’ customer service, with occasional delays or difficulties in claims processing.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Biggest Discount

Pros

- Innovative Technology: Progressive offers innovative technology such as Snapshot, which tracks driving habits to potentially lower premiums for safe drivers, providing added value to customers.

- Wide Range of Discounts: In our Progressive auto insurance review, Progressive provides numerous discount opportunities, including multi-policy, safe driver, and multi-car discounts, helping customers save on their premiums.

- Quick Claims Processing: Progressive is known for its efficient claims processing, with many customers reporting quick resolution and payment for claims.

Cons

- Higher Rates for High-Risk Drivers: While Progressive offers competitive rates for many drivers, those with poor driving records or high-risk profiles may face higher premiums compared to other insurers.

- Limited Coverage Options in Some Areas: In certain regions, Progressive may have limited coverage options available, potentially restricting choices for customers seeking specific types of coverage.

#3 – Liberty Mutual: Best for Quick Claims

Pros

- Personalized Coverage Options: Liberty Mutual offers personalized coverage options, allowing customers to tailor their policies to their individual needs, including comprehensive windshield replacement coverage.

- Strong Online Tools: Liberty Mutual provides robust online tools and resources, making it easy for customers to manage their policies, file claims, and access support.

- Multiple Policy Discounts: Liberty Mutual offers discounts for bundling multiple insurance policies, such as auto and home insurance, providing additional savings for customers.

Cons

- Higher Premiums for New Customers: Some new customers may find that Liberty Mutual’s initial premiums are higher compared to other providers, although discounts may offset this over time.

- Mixed Claims Satisfaction: While Liberty Mutual generally receives positive feedback for customer service, some customers have reported dissatisfaction with claims handling, citing delays or disputes. For further insights, refer to our Liberty Mutual auto insurance review.

#4 – Allstate: Best for Pay-Per-Mile-Rates

Pros

- Name Recognition and Reputation: Allstate is a well-known and reputable insurance provider with a long history in the industry, offering customers a sense of trust and reliability.

- Extensive Coverage Options: Allstate offers a wide range of coverage options beyond just windshield replacement, allowing customers to build comprehensive policies tailored to their needs.

- Drivewise Program: Allstate’s Drivewise program rewards safe driving habits with discounts, providing incentives for customers to drive responsibly and potentially lower their premiums.

Cons

- Higher Premiums for Some Drivers: While Allstate offers competitive rates for many customers, some individuals may find their premiums to be higher compared to other insurers, particularly for certain demographic groups.

- Limited Availability of Local Agents: In some areas, Allstate may have fewer local agents available, which could affect customer service accessibility for those who prefer in-person interactions. Use our Allstate auto insurance review as your guide.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Auto-Owners: Best for Accidents

Pros

- Exceptional Customer Service: Auto-Owners is renowned for its exceptional customer service, with many customers praising the company’s responsiveness, support, and claims handling. Read our Auto-Owners auto insurance review for you guidance.

- Flexible Payment Options: Auto-Owners offers flexible payment options, including various payment schedules and methods, making it convenient for customers to manage their policies.

- Customized Policies: Auto-Owners provides customized policies tailored to individual needs, allowing customers to select the coverage options and limits that best suit their requirements.

Cons

- Limited Availability: Auto-Owners operates primarily in certain regions of the United States, so it may not be available to all drivers, limiting options for those outside its service area.

- Potentially Higher Premiums: While Auto-Owners emphasizes quality service, some customers may find that their premiums are higher compared to other insurers, particularly for certain types of coverage.

#6 – State Farm: Best for Many Discounts

Pros

- Extensive Network of Agents: State Farm boasts a vast network of local agents across the country, providing personalized service and support to customers who prefer face-to-face interactions.

- Stable Financial Strength: With a strong A.M. Best rating, State Farm demonstrates financial stability, assuring customers of its ability to fulfill claims and obligations. Find out more in our State Farm auto insurance review.

- Discount Opportunities: State Farm offers numerous discount opportunities, including multi-policy, safe driver, and vehicle safety discounts, helping customers save on their premiums.

Cons

- Potentially Higher Rates for Young Drivers: Young drivers, particularly those with limited driving experience, may face higher premiums with State Farm compared to other insurers, due to the company’s risk assessment practices.

- Limited Online Tools and Resources: While State Farm provides basic online tools for policy management and claims filing, some customers may find the online experience less robust compared to other insurers.

#7 – American Family: Best for Young Volunteers

Pros

- Youthful Driver Discounts: American Family offers discounts specifically tailored for young drivers, making it an attractive option for families with teenage drivers looking to save on insurance premiums.

- Community Involvement: American Family is known for its community involvement and support, fostering a positive reputation and sense of trust among customers.

- Customizable Policies: American Family provides customizable policies, allowing customers to tailor their coverage to their unique needs, including options for windshield replacement coverage.

Cons

- Limited Availability: American Family primarily operates in certain regions of the United States, potentially limiting options for customers outside its service area. Find out more through our American Family auto insurance review.

- Mixed Customer Service Reviews: While many customers praise American Family’s service, some have reported mixed experiences with claims handling and customer support, citing occasional delays or difficulties.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The General: Best for High-Risk Coverage

Pros

- Specialized High-Risk Coverage: The General specializes in providing coverage for high-risk drivers, offering options for individuals who may have difficulty obtaining insurance elsewhere.

- Quick Quote Process: The General offers a quick and straightforward quote process, allowing customers to easily obtain estimates online or over the phone. Read more through our The General auto insurance review.

- SR-22 Filings: The General assists customers with SR-22 filings, which are often required for individuals with past driving violations, providing added convenience for those in need of this service.

Cons

- Higher Premiums for Some Drivers: While The General serves high-risk drivers, premiums may be higher compared to standard insurers, particularly for individuals with multiple violations or accidents on their record.

- Limited Coverage Options: The General may offer more limited coverage options compared to traditional insurers, potentially restricting choices for customers seeking comprehensive policies.

#9 – AAA: Best for Teens

Pros

- Member Benefits: AAA offers various membership benefits beyond just insurance, including roadside assistance, travel discounts, and financial services, providing added value to customers.

- Discount Opportunities: AAA provides discounts for members on insurance premiums, as well as additional savings on related services such as car rentals and hotel bookings.

- Strong Customer Service: AAA is known for its strong customer service reputation, with many customers praising the company’s responsiveness and support.

Cons

- Membership Fees: While AAA offers valuable benefits, membership fees can add to the overall cost for customers, potentially offsetting some of the savings on insurance premiums.

- Limited Availability: AAA operates primarily in specific regions of the United States, so it may not be available to all drivers, limiting options for those outside its service area. Find out more through our AAA auto insurance review.

#10 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA caters specifically to military members and their families, offering specialized coverage options, discounts, and exceptional customer service tailored to their unique needs.

- Financial Strength: With a high A.M. Best rating, USAA demonstrates strong financial stability, providing customers with confidence in their ability to fulfill claims and obligations. Find out more through our USAA auto insurance review.

- Member Satisfaction: USAA consistently receives high ratings for customer satisfaction, with many customers praising the company’s personalized service, claims handling, and overall experience.

Cons

- Limited Eligibility: USAA membership is restricted to military members, veterans, and their families, so it may not be available to the general public, limiting options for those outside this demographic.

- Fewer Physical Locations: While USAA offers online and phone support, it has fewer physical branch locations compared to traditional insurers, potentially affecting accessibility for customers who prefer in-person interactions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Driving my Car with a Cracked Windshield in Idaho

Getting Auto Insurance with Zero Deductible Auto Glass Replacement in Idaho

Idaho Comprehensive Auto Insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Idaho Glass Companies Using Crash or Used Parts

Windshield Replacement Coverage in Idaho: The Bottom Line

Frequently Asked Questions

Does auto insurance in Idaho cover windshield replacement?

Yes, most auto insurance policies in Idaho cover windshield replacement under comprehensive coverage. Comprehensive coverage helps protect against damage to your vehicle that is not caused by a collision, such as theft, vandalism, and certain types of natural disasters, including windshield damage.

Is windshield replacement covered under liability insurance in Idaho?

No, windshield replacement is not typically covered under liability insurance in Idaho. Liability insurance provides coverage for damages and injuries you may cause to others in an accident. It does not cover damages to your own vehicle, including windshield damage. Enter your ZIP code now to begin.

What is the deductible for windshield replacement in Idaho?

Are there any specific requirements for windshield replacement coverage in Idaho?

Some insurance companies in Idaho may have specific requirements for windshield replacement coverage. For example, they may require the use of certain repair shops or require that the replacement be done by a certified technician. It’s advisable to review your policy or check with your insurance provider to understand any specific requirements they may have.

Will filing a windshield replacement claim affect my insurance rates in Idaho?

In Idaho, windshield replacement claims are generally considered comprehensive claims, which often have little to no impact on your insurance rates. However, it’s always a good idea to consult with your insurance provider to confirm their specific policies regarding comprehensive claims and rate adjustments. Enter your ZIP code now to start.

How do Idaho’s regulations impact car insurance deductibles for windshield replacement?

What factors should drivers in Idaho consider before repairing or replacing a cracked windshield?

Drivers in Idaho should consider factors such as safety, visibility, insurance coverage, and potential costs before deciding whether to repair or replace a cracked windshield.

What are the key features of comprehensive auto insurance in Idaho?

Comprehensive auto insurance in Idaho typically covers various damages, including windshield damage caused by non-collision events like theft, vandalism, and certain natural disasters. Enter your ZIP code now to begin comparing.

How does Idaho law regulate the use of aftermarket or recycled materials for windshield replacement?

What options do Idaho drivers have for windshield replacement coverage outside of insurance claims?

Outside of insurance claims, Idaho drivers have the option to choose their windshield replacement provider, allowing them to select the most suitable service for their needs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.