Best Windshield Replacement Coverage in Georgia (Top 10 Companies Ranked for 2026)

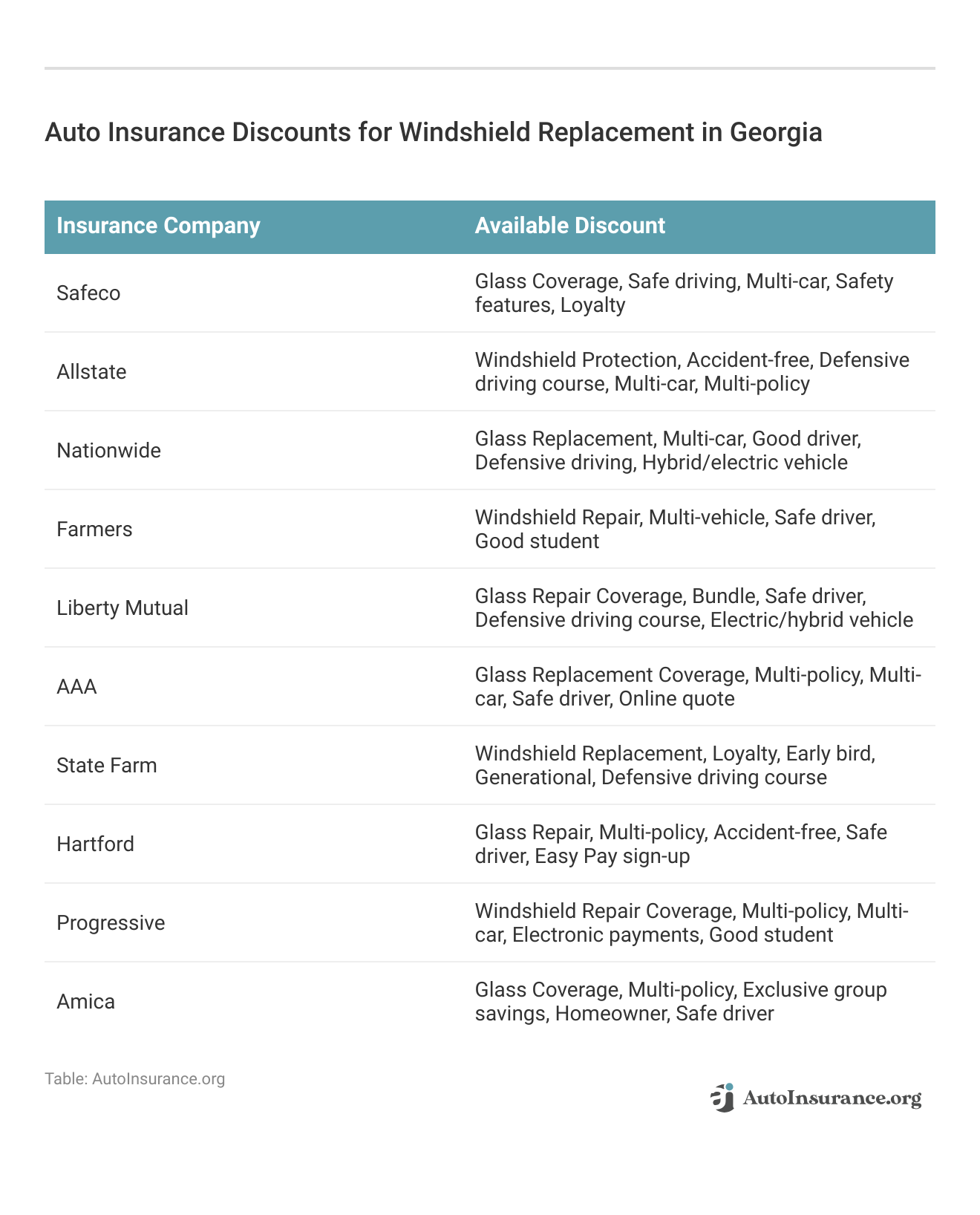

Safeco, Allstate, and Nationwide provide the best windshield replacement coverage in Georgia, starting at just $45 per month. Our goal is to help you compare quotes from these reputable providers, ensuring you get the best coverage with customized discounts for your vehicle and your peace of mind.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Dorothea Hudson has been professionally writing in many spheres since 2013. She has written on entertainment, insurance, finance, travel, technology, AI, renewable energy, crypto, fundraising, and real estate for many websites. Her work has been published for British retailer Marks and Spencer, Kroger Magazine, the Vision Group, and more. Her passions include writing, music, running, travel, te...

Dorothea Hudson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated February 2025

Company Facts

Full Coverage Windshield Replacement in Georgia

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in Georgia

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in Georgia

A.M. Best

Complaint Level

Pros & Cons

Safeco is the top choice for the best windshield replacement coverage in Georgia, offering comprehensive protection with competitive rates starting at just $198 per month.

Partnering with Allstate and Nationwide, they provide budget-friendly rates and a broad range of comprehensive coverage options tailored to your unique driving needs.

Our Top 10 Company Picks: Best Windshield Replacement Coverage in Georgia

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 23% A Quick Claims Safeco

![]()

#2 21% A+ Comprehensive Coverage Allstate

#3 22% A++ Agency Network Nationwide

#4 22% A Enhanced Protection Farmers

#5 25% A Flexible Coverage Liberty Mutual

#6 20% A Member Benefits AAA

#7 23% B Comprehensive Policies State Farm

#8 18% A+ Deductible Waiver The Hartford

#9 21% A+ Nationwide Coverage Progressive

#10 19% A+ Customer Service Amica

- Safeco provides competitive rates starting at $198 per month

- Major insurance companies offer opportunities to save on windshield cost

- Numerous discount options available for windshield replacement coverage

#1 – Safeco: Top Overall Pick

Pros

- Comprehensive Coverage Options: Safeco offers a wide range of coverage options, including windshield replacement coverage, ensuring customers have ample protection for their vehicles.

- Competitive Rates: Safeco provides budget-friendly rates for windshield replacement coverage, starting at just $198 per month in Georgia, making it an affordable option for drivers.

- Positive Customer Service: Safeco is known for its responsive and helpful customer service, providing peace of mind to policyholders when dealing with claims or inquiries.

Cons

- Limited Availability: Safeco’s coverage may not be available in all areas, limiting access for some drivers who may wish to obtain their services. Read more through our Safeco auto insurance review.

- Deductible Requirements: While Safeco offers competitive rates, some policyholders may find the deductible requirements for windshield replacement coverage to be higher compared to other providers, potentially increasing out-of-pocket costs in the event of a claim.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Comprehensive Coverage

Pros

- Brand Reputation: Allstate is a well-established and reputable insurance provider, known for its reliability and financial stability, offering peace of mind to policyholders.

- Customizable Coverage: Allstate offers customizable coverage options, allowing drivers to tailor their policies to meet their specific needs, including windshield replacement coverage.

- Innovative Technology: Allstate utilizes innovative technology, such as mobile apps and digital tools, to streamline the claims process and provide convenience to policyholders.

Cons

- Higher Premiums: Allstate’s premiums may be higher compared to some other providers, which could make it less affordable for drivers on a tight budget. Use our Allstate auto insurance review as your guide.

- Limited Discounts: While Allstate offers various discounts, some policyholders may find that they qualify for fewer discounts compared to other insurance providers, potentially missing out on opportunities to save on their premiums.

#3 – Nationwide: Best for Agency Network

Pros

- Nationwide Network: Nationwide, as mentioned in our Nationwide insurance review, has a vast network of agents and service centers across the country, providing accessibility and convenience to policyholders when managing their coverage.

- Discount Opportunities: Nationwide offers a range of discounts, including multi-policy discounts and safe driver discounts, helping policyholders save money on their premiums.

- Strong Financial Stability: Nationwide boasts strong financial stability and a solid reputation in the insurance industry, instilling confidence in policyholders regarding the company’s ability to fulfill its obligations.

Cons

- Coverage Limitations: Nationwide’s coverage options may have limitations or exclusions that could impact policyholders’ ability to fully protect their vehicles, including potential restrictions on windshield replacement coverage.

- Customer Service Concerns: Some policyholders have reported issues with Nationwide’s customer service, citing delays in claims processing or difficulty reaching representatives, which may lead to frustration and dissatisfaction.

#4 – Farmers: Best for Enhanced Protection

Pros

- Personalized Service: Farmers Insurance offers personalized service through its network of local agents, allowing policyholders to receive tailored guidance and support based on their individual needs and circumstances.

- Additional Coverage Options: Farmers, as mentioned in our Farmers auto insurance review, provides a variety of additional coverage options beyond basic auto insurance, including specialized coverage for specific vehicles or valuable personal belongings, offering comprehensive protection.

- Strong Claims Handling: Farmers is known for its efficient and effective claims handling process, providing prompt assistance to policyholders when they need to file a claim for windshield replacement or other damages.

Cons

- Potentially Higher Premiums: Farmers Insurance premiums may be higher compared to some other providers, particularly for drivers with certain risk factors or coverage needs, potentially making it less affordable for some policyholders.

- Limited Availability: Farmers Insurance may not be available in all areas or may have limited agent representation in certain regions, which could affect accessibility for potential customers seeking coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 –Liberty Mutual: Best for Flexible Coverage

Pros

- Customizable Policies: Liberty Mutual offers customizable policies that allow policyholders to tailor their coverage to meet their specific needs and budget, including options for windshield replacement coverage.

- Tech-Driven Solutions: Liberty Mutual employs advanced technology and digital tools to enhance the customer experience, such as online policy management and mobile claims processing, providing convenience and efficiency.

- Multi-Policy Discounts: Liberty Mutual offers discounts for bundling multiple insurance policies, such as auto and home insurance, helping policyholders save on their premiums while maximizing coverage. For further insights, refer to our Liberty Mutual auto insurance review.

Cons

- Complex Pricing Structure: Liberty Mutual’s pricing structure may be complex, making it challenging for some policyholders to understand how factors such as deductibles and coverage limits affect their premiums.

- Mixed Customer Service Reviews: While Liberty Mutual strives to provide excellent customer service, some policyholders have reported mixed experiences with responsiveness or clarity when interacting with representatives, leading to potential frustration.

#6 – AAA: Best for Member Benefits

Pros

- Member Benefits: AAA offers various membership benefits beyond insurance, such as roadside assistance and travel discounts, providing added value to policyholders.

- Local Presence: AAA has a strong local presence with numerous branch offices and service centers, making it convenient for policyholders to access assistance and support when needed.

- Discount Opportunities: AAA provides discounts for members, including multi-policy discounts and safe driving discounts, helping policyholders save on their premiums while maintaining quality coverage.

Cons

- Membership Requirement: AAA insurance is only available to AAA members, which may limit access for individuals who are not already members of the organization. Read more through our AAA auto insurance review.

- Limited Coverage Options: AAA’s insurance offerings may have limitations in terms of coverage options or customization compared to some other providers, potentially restricting policyholders’ ability to tailor their policies to their specific needs.

#7 – State Farm: Best for Comprehensive Policies

Pros

- Financial Strength: State Farm is one of the largest and most financially stable insurance companies in the industry, providing reassurance to policyholders regarding the company’s ability to fulfill its obligations.

- Agent Network: State Farm has a vast network of local agents who provide personalized service and support to policyholders, helping them navigate their coverage options and address any concerns. Find out more in our State Farm auto insurance review.

- Claims Satisfaction: State Farm has a reputation for excellent claims satisfaction, with efficient claims processing and responsive customer service, ensuring policyholders receive prompt assistance during stressful situations.

Cons

- Limited Online Tools: State Farm’s online tools and digital resources may be limited compared to some other providers, potentially reducing convenience for policyholders who prefer managing their policies online.

- Potentially Higher Premiums: State Farm’s premiums may be higher compared to some competitors, particularly for certain demographics or coverage types, potentially making it less affordable for some policyholders.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Deductible Waiver

Pros

- Dedicated Customer Support: The Hartford is known for its excellent customer service, providing dedicated support to policyholders and ensuring their needs are met promptly and efficiently.

- Specialized Coverage Options: The Hartford offers specialized coverage options, including unique endorsements or add-ons that cater to specific needs, such as enhanced windshield replacement coverage or roadside assistance.

- Policyholder Benefits: The Hartford provides various benefits to policyholders, such as access to exclusive discounts, rewards programs, and educational resources, enhancing the overall value of their insurance experience.

Cons

- Limited Availability: The Hartford’s insurance products may not be available in all areas or may have limited distribution channels, potentially limiting access for some potential customers. Read more through our The Hartford auto insurance review.

- Premium Costs: While The Hartford offers comprehensive coverage and benefits, its premiums may be higher compared to some other providers, potentially making it less competitive in terms of pricing for certain demographics or coverage needs.

#9 – Progressive: Best for Nationwide Coverage

Pros

- User-Friendly Technology: Progressive offers user-friendly technology and digital tools, such as its online quote tool and mobile app, making it easy for customers to obtain quotes, manage their policies, and file claims.

- Discount Opportunities: Progressive provides numerous discount opportunities for policyholders, including safe driving discounts, multi-policy discounts, and bundling discounts, helping customers save on their premiums.

- Wide Range of Coverage Options: Progressive offers a wide range of coverage options, including comprehensive windshield replacement coverage, giving policyholders flexibility and choice when selecting their insurance plans.

Cons

- Claim Handling Process: In our Progressive auto insurance review, some policyholders have reported issues with Progressive’s claims handling process, citing delays or complications in claims resolution, which may lead to frustration and dissatisfaction.

- Customer Service Concerns: While Progressive offers online and mobile support options, some customers have experienced challenges when trying to reach customer service representatives by phone or email, resulting in potential communication difficulties.

#10 – Amica: Best for Customer Service

Pros

- Excellent Customer Service: Amica is renowned for its exceptional customer service, with high satisfaction ratings among policyholders for the responsiveness and helpfulness of its representatives.

- Financial Stability: Amica boasts strong financial stability and a solid reputation in the insurance industry, providing reassurance to policyholders regarding the company’s ability to meet its financial obligations.

- Discount Opportunities: Amica offers various discount opportunities to help policyholders save on their premiums, including discounts for safe driving, bundling multiple policies, and loyalty rewards.

Cons

- Limited Availability: Amica’s insurance products may not be available in all states or regions, potentially limiting access for individuals seeking coverage outside of the company’s service area.

- Higher Premiums for Some Demographics: While Amica offers comprehensive coverage and excellent service, its premiums may be higher compared to some other providers, particularly for certain demographics or coverage types, potentially making it less competitive in terms of pricing. Read more through our Amica auto insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Full Glass Coverage in Georgia

Zero-Deductible Full Glass Coverage

Repair Service Under Georgia Law

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Updating Your Insurance Policy to Include Full Glass Coverage

The Big Picture: Georgia Windshield Replacement Laws

Frequently Asked Questions

Does auto insurance in Georgia cover windshield replacement?

Yes, auto insurance in Georgia typically covers windshield replacement under comprehensive coverage. This coverage helps pay for damages to your vehicle that are not caused by a collision, such as theft, vandalism, and weather-related incidents like hail or falling objects.

Is windshield replacement covered under liability insurance?

No, windshield replacement is not covered under liability insurance. Liability insurance is designed to cover damages to other vehicles or property when you are at fault in an accident. To have windshield replacement coverage, you need comprehensive insurance. Enter your ZIP code now to begin.

How does the deductible work for windshield replacement claims?

Are there any special requirements or restrictions for windshield replacement coverage in Georgia?

While specific requirements can vary between insurance companies, most policies in Georgia have certain restrictions for windshield replacement coverage. These may include limits on the number of replacements allowed within a certain period, the use of approved repair shops, and requirements for the size or location of the damage.

Will filing a windshield replacement claim affect my insurance premium?

In general, filing a windshield replacement claim should not affect your insurance premium. Comprehensive claims, including windshield replacement, are typically considered “no-fault” claims and are unlikely to result in premium increases. However, it’s always a good idea to review your policy or consult with your insurance provider for detailed information about your specific coverage. Enter your ZIP code now to start.

What are the top three companies for windshield replacement coverage in Georgia?

Is windshield replacement covered under liability insurance in Georgia?

No, windshield replacement is not covered under liability insurance in Georgia. It is typically covered under comprehensive insurance.

What is the starting monthly rate for windshield replacement coverage offered by Safeco in Georgia?

The starting monthly rate for windshield replacement coverage offered by Safeco in Georgia is $198. Enter your ZIP code now to start comparing.

Does filing a windshield replacement claim generally affect your insurance premium?

What is a key benefit of choosing AAA for windshield replacement coverage?

A key benefit of choosing AAA for windshield replacement coverage is the additional membership benefits, such as roadside assistance and travel discounts, which provide added value to policyholders.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.