Best Auto Insurance for Families in 2026 (Your Guide to the Top 10 Companies)

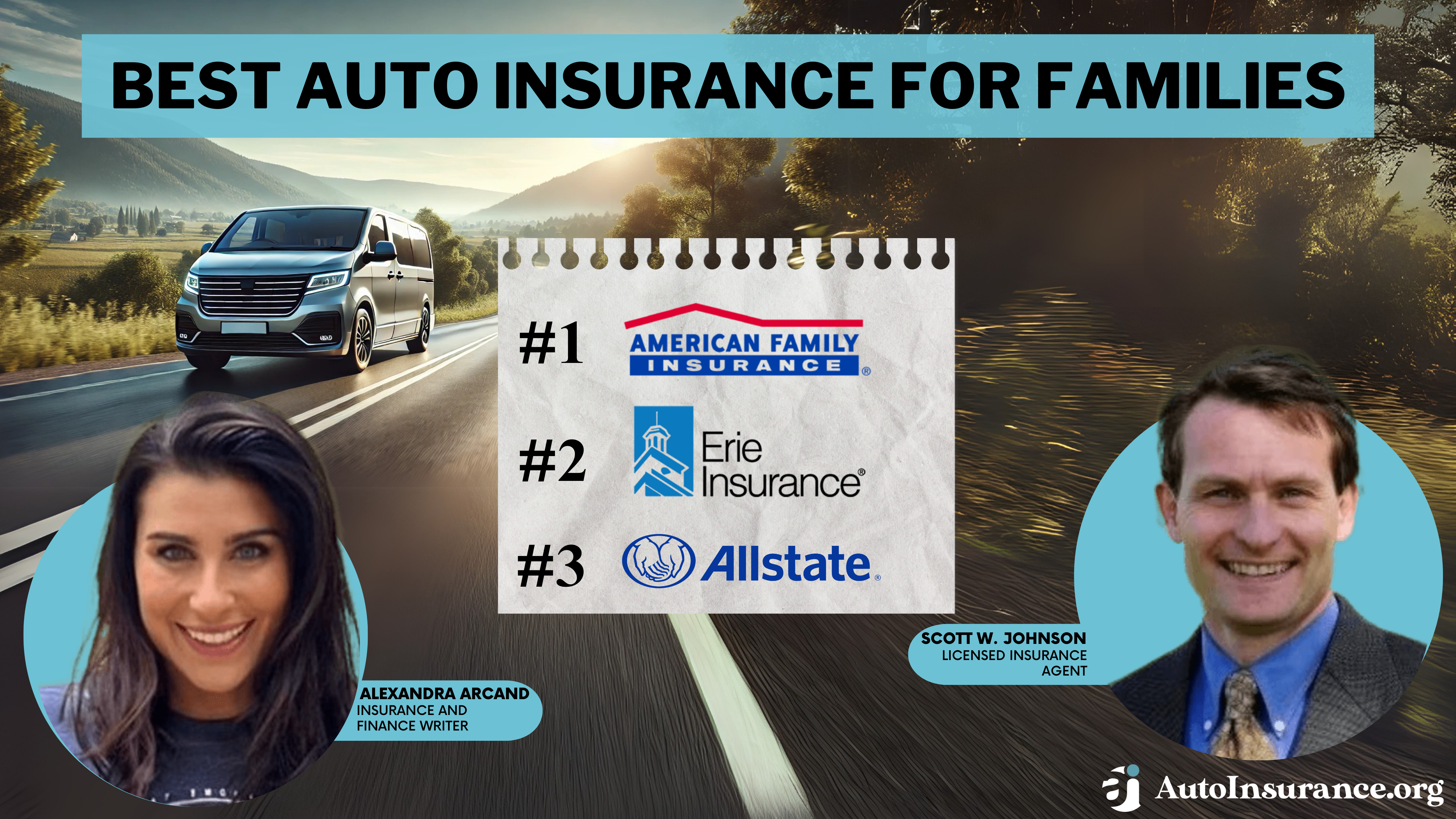

American Family, Erie, and Allstate offer the best auto insurance for families starting at just $22 per month. We're here to help you compare car insurance rates from these top companies, ensuring you get the best coverage and discounts tailored to your vehicle and for your reassurance.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated January 2025

2,235 reviews

2,235 reviewsCompany Facts

Full Coverage for Families

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews

Company Facts

Full Coverage for Families

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Families

A.M. Best

Complaint Level

Pros & Cons

- American Family presents competitive pricing starting from $22 per month

- Leading insurance companies offer potential savings for families

- Discounts guarantee the best auto insurance for big and small families

#1 – American Family: Top Overall Pick

Pros

- Innovative Policy Features: American Family offers unique coverage options.

- User-Friendly: Through intuitive mobile apps and online tools, American Family simplifies policy and claims management for customers.

- Financial Security: American Family’s strong financial foundation ensures policyholders have a dependable and stable insurance provider.

Cons

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Erie: Best for Cheap Rates

Pros

- Cost-Effective Premiums: Our Erie auto insurance review unveils competitive rates that are friendly to various budgets.

- Flexible Coverage Choices: Erie offers policies that can be tailored to individual needs.

- Savings Opportunities: Erie provides various discounts, including those designed specifically for automobiles.

Cons

- Sparse Local Agent Network: Erie primarily operates through online and phone channels, with limited physical agent presence.

- Coverage Restrictions: Some policy enhancements may not entirely fulfill the requirements of classic cars.

#3 – Allstate: Best for Bundling Discounts

Pros

- Personalized Discounts: Allstate offers customized discount opportunities for policyholders.

- Financial Strength: Allstate boasts a robust financial backing from a stable corporation.

- Superior Customer Assistance: Allstate is celebrated for its responsive and easily accessible customer support.

Cons

- Coverage Restrictions: Certain policy enhancements may not entirely align with individual needs. Utilize our Allstate auto insurance review for insights.

- Claims Processing Challenges: Policyholders may face delays or complications throughout the claims procedure.

#4 – Nationwide: Best for Coverage Options

Pros

- Extensive Array of Coverage Options: Nationwide presents an extensive array of coverage options, empowering customers to customize policies according to their unique needs.

- Safe Driving Rewards Program: The Vanishing Deductible initiative by Nationwide incentivizes safe driving behavior by gradually reducing deductibles over time.

- Membership Savings: Nationwide offers exclusive discounts for diverse affiliations and memberships, enhancing affordability for select groups.

Cons

- Customer Satisfaction Disparity: Customer satisfaction ratings vary across the board, as highlighted in our Nationwide insurance review, with some clients reporting average experiences.

- Premium Variability: Premium rates may fluctuate based on geographic location and individual profiles, potentially impacting overall affordability.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Geico: Best for Multi-policy Discounts

Pros

- Tailored Coverage Solutions: Geico delivers custom-tailored coverage options for automobiles.

- Cost-Effective Premiums: Geico provides budget-friendly rates. Jumpstart your affordability journey with insights from our Geico auto insurance review.

- Savings Options: Geico presents various discount opportunities, including those specifically tailored for vehicles.

Cons

- Limited Agent Accessibility: Geico predominantly operates through local agents, potentially limiting universal access.

- Policy Limitations: Certain policy enhancements may not comprehensively meet the requirements of automobiles.

#6 – Liberty Mutual: Best for Loyalty Rewards

Pros

- Customized Plans: Liberty Mutual provides tailored coverage options for auto insurance policies.

- Budget-Friendly Rates: Liberty Mutual offers cost-effective pricing.

- Outstanding Customer Care: Liberty Mutual is highly esteemed for its prompt and user-friendly service.

Cons

#7 – Farmers: Best for Customizable Policies

Pros

- Tailored Protection Plans: Farmers, as highlighted in our Farmers auto insurance review, customizes coverage to suit individual needs.

- Budget-Friendly Premiums: Farmers offers competitively priced car insurance options.

- Savings Opportunities: Farmers provides a variety of offers, including discounts tailored for car insurance.

Cons

- Agent Accessibility Challenges: Farmers primarily operates through local agents, which may pose accessibility issues in certain regions.

- Coverage Constraints: Some specific additional coverage options may not fully align with policyholders’ requirements.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Progressive: Best for Add-on Coverages

Pros

- Tailored Policy Plans: In our Progressive auto insurance review, personalized coverage options are tailored to suit individual vehicles.

- Competitive Pricing: Progressive offers cost-effective rates.

- Savings Incentives: Progressive provides various discount opportunities, including those tailored specifically for automobiles.

Cons

- Claims Processing Challenges: Individuals may encounter delays or complications during the claims handling process.

- Discount Availability Constraints: Progressive may not provide as extensive a range of discounts as some competitors.

#9 – Safeco: Best for Personalized Policies

Pros

- Customized Protection: Safeco, as highlighted in our Safeco auto insurance review, crafts coverage to match individual needs.

- Budget-Friendly Rates: Safeco provides competitively priced car insurance.

- Savings Opportunities: Safeco offers various promotions, including those tailored for car insurance.

Cons

- Agent Accessibility Challenges: Safeco primarily operates through local agents, potentially posing accessibility issues in certain regions.

- Coverage Constraints: Certain additional coverage options may not fully align with policyholders’ requirements.

#10 – Travelers: Best for Exclusive Benefits

Pros

- Cost-Efficient Premiums: Our Travelers auto insurance review unveils budget-friendly and competitively priced rates.

- Flexible Coverage Choices: Travelers offers policies that can be personalized to suit individual needs.

- Savings Opportunities: Travelers presents a variety of discount programs, including those specifically tailored for vehicle owners.

Cons

- Sparse Agent Presence: Travelers primarily conducts business online and via telephone channels, limiting in-person agent access.

- Policy Constraints: Some supplementary policy features may not entirely fulfill the requirements of automobiles.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Family Car Insurance Plans

Different Types of Auto Insurance Coverages for Families

Impact of Family Packages in the Cost of Auto Insurance

If one of the drivers has a relatively poor driving record or FICO score, it will raise your cost, but it might still be cheaper than getting an individual insurance policy.

Explore where to compare auto insurance rates online for the best deals and savings, ensuring you find the most suitable coverage for your needs. Enter your ZIP code to compare.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance for a Teenager

Discounts on Auto Insurance

Lowering Car Insurance Rates for my Family

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Buying the Right Family Car Insurance Plan

Frequently Asked Questions

What is auto insurance for families?

Auto insurance for families is a type of insurance coverage designed to protect family members and their vehicles from potential risks and financial losses resulting from accidents, theft, or other covered events.

What does auto insurance for families typically cover?

Auto insurance for families usually includes coverage for liability (bodily injury and property damage), collision, comprehensive (damage not caused by collision, such as theft or vandalism), uninsured/underinsured motorist, and medical payments. Enter your ZIP code now to compare.

Are all family members covered under auto insurance policies?

Can I add my teenage driver to my family’s auto insurance policy?

Yes, most auto insurance companies allow you to add teenage drivers to your family policy. However, adding a teenage driver may increase the premium due to their lack of driving experience and higher accident risk.

What factors affect the cost of auto insurance for families?

Several factors can influence the cost of auto insurance for families, including the number of drivers and vehicles insured, driving records of family members, location, vehicle make and model, coverage limits, deductibles, and optional add-ons. Enter your ZIP code now.

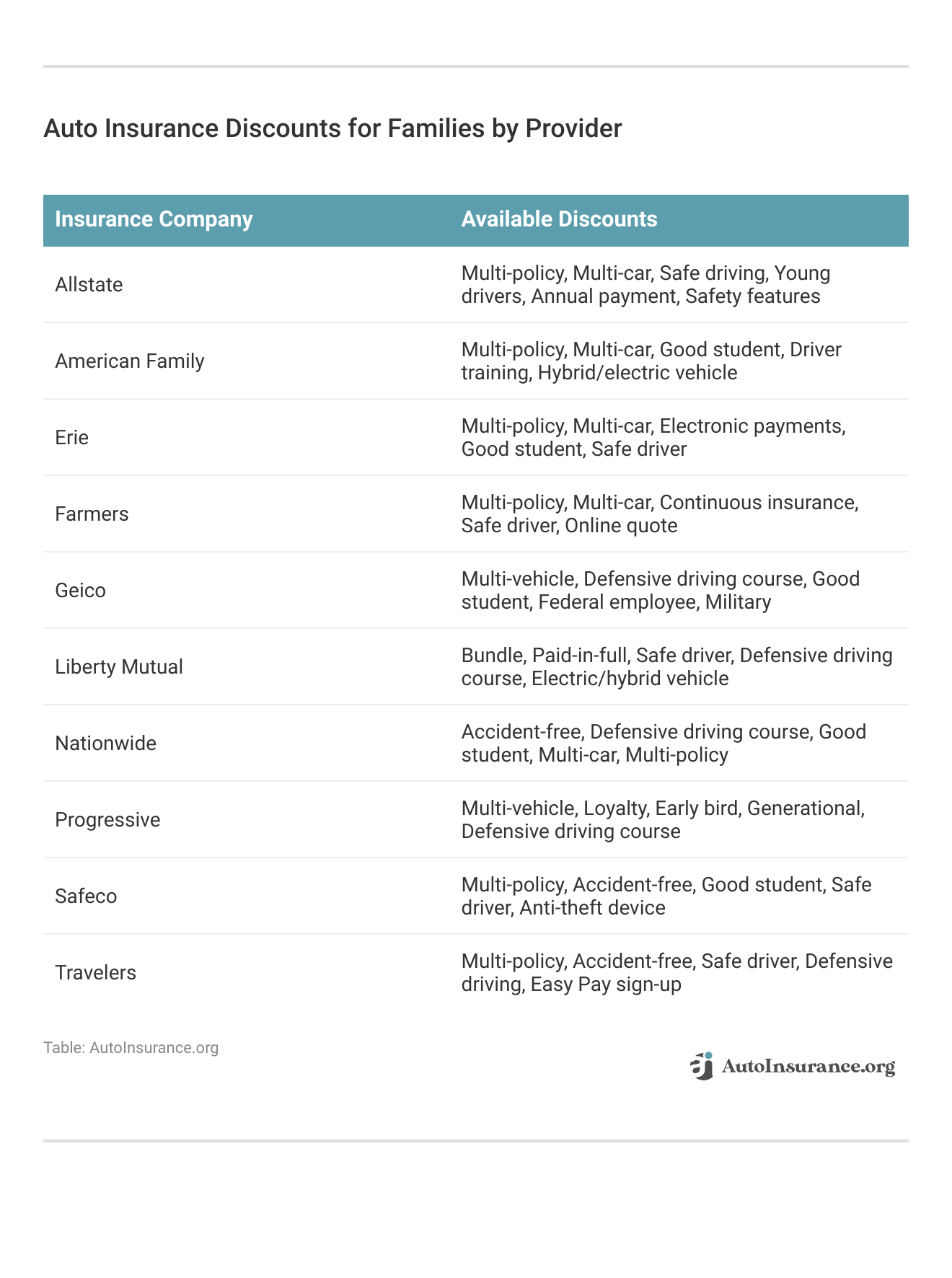

Are there any discounts available for families on auto insurance?

How do car insurance plans work?

How do I buy the right family car insurance plan?

How do I lower my car insurance rates for my family?

How do family packages impact the cost of auto insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.