Best Subaru Impreza Auto Insurance in 2026 (Top 10 Companies Ranked)

Allstate, AAA, and Geico are the top providers for best Subaru Impreza auto insurance, offering rates starting at just $27 per month. These companies deliver the most competitive pricing and tailored coverage for Subaru Impreza owners, ensuring excellent value and reliable protection for your vehicle.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated August 2024

11,640 reviews

11,640 reviewsCompany Facts

Full Coverage for Subaru Impreza

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviews

Company Facts

Full Coverage for Subaru Impreza

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Subaru Impreza

A.M. Best

Complaint Level

Pros & Cons

The top providers for best Subaru Impreza auto insurance are Allstate, AAA, and Geico, known for their superior coverage and customer service.

These companies stand out in the competitive auto insurance market by offering tailored policies that cater specifically to Subaru Impreza owners. With a focus on comprehensive protection, they ensure that every aspect of your vehicle’s safety and liability is covered.

Our Top 10 Company Picks: Best Subaru Impreza Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 15% A+ Tailored Policies Allstate

#2 18% A Exclusive Benefits AAA

#3 12% A++ Organization Discount Geico

#4 10% A Bundling Policies Liberty Mutual

#5 14% A Coverage Options Safeco

#6 17% A Comprehensive Coverage American Family

#7 16% A Specialized Coverage The General

#8 13% A+ Industry Experience The Hartford

#9 19% A+ Customer Service Amica

#10 11% A Safe Drivers Farmers

Choosing the right insurer is crucial for maximizing value and securing reliable insurance for your Subaru Impreza. Learn more in our article titled “Cheap Subaru Auto Insurance.”

Get started on comparing full coverage auto insurance rates by entering your ZIP code.

- Allstate leads as the top pick for Subaru Impreza auto insurance

- Subaru Impreza policies are tailored for optimal coverage and value

- Features such as safety ratings significantly influence insurance costs

#1 – Allstate: Top Overall Pick

Pros

- Customizable Coverage: Allstate offers a variety of coverage options specifically designed to meet the unique needs of Subaru Impreza owners.

- Bundling Discount: Allstate provides a 15% discount for Subaru Impreza owners who bundle their auto insurance with other policies.

- High Financial Rating: With an A+ A.M. Best rating, Allstate assures strong financial stability for Subaru Impreza insurance claims. Find more information about Allstate’s rates in our article titled review of Allstate insurance.

Cons

- Higher Premiums: Despite discounts, Allstate’s premiums may still be higher for Subaru Impreza compared to other insurers.

- Policy Limitations: Some of Allstate’s tailored options for Subaru Impreza might come with higher deductibles or less flexibility in claim handling.

#2 – AAA: Best for Exclusive Benefits

Pros

- Higher Multi-Vehicle Discount: AAA offers an 18% discount for Subaru Impreza owners insuring multiple vehicles.

- Robust Policy Options: Comprehensive policy features that cater specifically to the Subaru Impreza, backed by an A rating from A.M. Best.

- Membership Perks: AAA provides exclusive benefits like roadside assistance and discounts for Subaru Impreza owners. Learn more about AAA roadside assistance in our article titled review of AAA insurance.

Cons

- Membership Required: Subaru Impreza owners must purchase a AAA membership to access auto insurance, adding to overall costs.

- Variable Service Quality: Service can vary by region, potentially affecting the insurance experience for Subaru Impreza owners.

#3 – Geico: Best for Organization Discounts

Pros

- Organization-Based Discounts: Geico offers a 12% discount for Subaru Impreza owners who are members of certain organizations or groups.

- Excellent Financial Stability: Geico’s A++ A.M. Best rating ensures superior capacity for handling Subaru Impreza insurance claims.

- Competitive Rates: Known for generally lower premiums that benefit Subaru Impreza owners looking for cost-effective coverage. Learn more about Geico’s rates in our article titled Geico auto insurance company review.

Cons

- Limited Customization: Geico’s options for Subaru Impreza may not be as tailored as those of competitors, focusing more on standard coverage.

- Customer Service Variability: Some customers may experience inconsistent service levels when dealing with claims for Subaru Impreza.

#4 – Liberty Mutual: Best for Bundling Policies

Pros

- Bundling Advantage: Liberty Mutual offers a 10% discount for Subaru Impreza owners who bundle their auto insurance with other policies.

- Tailored Add-ons: Specific add-ons available for Subaru Impreza to enhance coverage, such as accident forgiveness and new car replacement.

- Solid Financial Rating: Backed by an A rating from A.M. Best, ensuring reliable claim support for Subaru Impreza owners. To see monthly premiums and honest rankings, read our guide titled Liberty Mutual review.

Cons

- Bundling Requirement: To achieve the best rates for Subaru Impreza, customers are encouraged to bundle, which may not suit those seeking standalone auto insurance.

- Rate Fluctuations: Premiums for Subaru Impreza can vary significantly based on individual circumstances and location.

#5 – Safeco: Best for Coverage Options

Pros

- Wide Coverage Selection: Safeco offers a broad array of coverage options for Subaru Impreza, including unique benefits like diminishing deductibles.

- Competitive Multi-Vehicle Discount: A 14% discount on policies when Subaru Impreza owners insure more than one vehicle with Safeco.

- Personalized Policies: Options to personalize policies tailored to the specific needs of Subaru Impreza owners. Check out our Safeco auto insurance review for more details rates, coverages, and discounts.

Cons

- Higher Premiums Without Bundles: Without bundling, rates for Subaru Impreza may be higher compared to other providers.

- Mixed Customer Reviews: Some Subaru Impreza owners may find discrepancies in customer service quality, impacting their insurance experience.

#6 – American Family: Best for Comprehensive Coverage

Pros

- Comprehensive Plan Options: Extensive coverage options that cater specifically to the protection needs of Subaru Impreza owners.

- High Multi-Vehicle Discount: Offering a 17% discount for those who insure multiple vehicles, including Subaru Imprezas. Find out more about American Family in our article titled American Family review.

- Robust Financial Stability: American Family’s A rating from A.M. Best ensures dependable support for Subaru Impreza insurance claims.

Cons

- Availability Issues: American Family’s insurance for Subaru Impreza may not be available in all regions.

- Premium Variability: Premiums can vary widely for Subaru Impreza based on the driver’s profile and location.

#7 – The General: Best for Specialized Coverage

Pros

- Specialty in High-Risk Insurance: Ideal for Subaru Impreza owners who may have a spotty driving record or require specialized coverage.

- Generous Discounts: Offers a 16% multi-vehicle discount for Subaru Impreza owners insuring more than one car. See what discounts you might qualify for in our thorough review of The General auto insurance.

- Flexible Payment Options: Provides flexible payment plans to accommodate Subaru Impreza owners with varying financial situations.

Cons

- Higher Base Rates: Typically, The General has higher base rates for Subaru Impreza, especially for drivers with less-than-perfect records.

- Limited Coverage Features: While offering specialized coverage for Subaru Impreza, the breadth of options may be narrower compared to larger insurers.

#8 – The Hartford: Best for Industry Experience

Pros

- Extensive Industry Expertise: The Hartford leverages decades of experience to offer refined policies for Subaru Impreza owners.

- Competitive Discounts: Offers a 13% discount for multi-vehicle policies, appealing to Subaru Impreza owners with multiple cars. Our article, The Hartford auto insurance review, provides more detail about what this provider has to offer.

- Strong Financial Backbone: With an A+ rating from A.M. Best, The Hartford provides dependable claims service for Subaru Impreza insurance.

Cons

- Age-Specific Benefits: Primarily benefits older drivers, which might not align with younger Subaru Impreza owners seeking dynamic coverage options.

- Policy Cost: While offering robust coverage, The Hartford’s premiums can be higher, impacting affordability for some Subaru Impreza owners.

#9 – Amica: Best for Customer Service

Pros

- Customer Service Excellence: Amica is renowned for its customer service, providing an exceptional insurance experience for Subaru Impreza owners.

- High Retention Rates: Demonstrates high customer satisfaction and retention, suggesting a positive long-term experience for Subaru Impreza insurance.

- Strong Financial Rating: An A+ rating from A.M. Best ensures robust support for claims and policy stability for Subaru Impreza owners. Check out our article titled Amica auto insurance review to learn more about the company’s customer service and claims ratings.

Cons

- Premium Pricing: Amica’s focus on premium service can lead to higher costs for Subaru Impreza auto insurance.

- Limited Availability: Some specialized coverage options and discounts may not be available in all areas for Subaru Impreza owners.

#10 – Farmers: Best for Safe Driver

Pros

- Rewards for Safe Driving: Farmers offers discounts and incentives for Subaru Impreza owners with clean driving records. Take a look at our Farmers insurance company review to learn more.

- Customizable Policies: Allows for extensive customization of coverage to meet the specific needs of Subaru Impreza owners.

- Solid Financial Stability: Backed by an A rating from A.M. Best, ensuring reliable support for Subaru Impreza insurance claims.

Cons

- Higher Costs for Riskier Profiles: Subaru Impreza owners with past claims or infractions may face significantly higher rates.

- Coverage Complexity: Some customers might find the policy options complex, requiring more time to understand the best coverage for their Subaru Impreza.

Comparative Monthly Insurance Rates for Subaru Impreza

Exploring the diverse range of insurance rates offered by different providers can be critical when searching for the best coverage for a Subaru Impreza. The following breakdown illuminates the monthly costs associated with both minimum and full coverage policies.

Subaru Impreza Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $46 | $86 |

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Amica Mutual | $46 | $151 |

| Farmers | $53 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Safeco | $27 | $71 |

| The General | $54 | $232 |

| The Hartford | $43 | $113 |

The table presents a clear comparison of monthly insurance rates for Subaru Impreza from various providers. Starting with the most affordable, Safeco offers minimum coverage at just $27 and full coverage at $71, making it an appealing option for budget-conscious drivers. More company details are available in our article titled “Safeco Auto Insurance Discounts.”

On the other end, The General proposes the highest rates with minimum coverage at $54 and a substantial $232 for full coverage. Other notable mentions include Geico, which provides competitive rates of $30 for minimum and $80 for full coverage, and Liberty Mutual at the higher end with $68 for minimum and $174 for full coverage.

Each provider’s rates reflect a combination of base insurance costs and the extent of coverage, highlighting the importance of comparing multiple options to find the most suitable and cost-effective insurance for a Subaru Impreza.

Subaru Impreza Insurance Cost

The average Subaru Impreza auto insurance costs are $119 a month.

Subaru Impreza Auto Insurance Monthly Rates by Coverage Type| Category | Rates |

|---|---|

| Average Rate | $119 |

| Discount Rate | $70 |

| High Deductibles | $103 |

| High Risk Driver | $254 |

| Low Deductibles | $150 |

| Teen Driver | $435 |

To secure the most favorable rates for Subaru Impreza insurance, it is crucial to consider various factors such as discounts, deductible levels, and driver risk profiles. See more details on our article titled “How to Get a Membership Auto Insurance Discount.”

Are Subaru Imprezas Expensive to Insure

The chart below details how Subaru Impreza insurance rates compare to other sedans like the Chevrolet Impala, Toyota Corolla, and Chrysler 300. Check out insurance savings in our complete article titled “Best Toyota Corolla Insurance Facts.”

Subaru Impreza Auto Insurance Monthly Rates vs. Similar Vehicles by Coverage Type| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Subaru Impreza | $28 | $47 | $31 | $119 |

| Chevrolet Impala | $23 | $44 | $31 | $112 |

| Toyota Corolla | $25 | $45 | $33 | $115 |

| Chrysler 300 | $28 | $52 | $33 | $126 |

| Honda Accord | $23 | $42 | $31 | $109 |

| Nissan Maxima | $31 | $53 | $33 | $129 |

| Hyundai Elantra | $23 | $47 | $31 | $114 |

However, there are a few things you can do to find the cheapest Subaru insurance rates online.

Read more: Chrysler Auto Insurance

What Impacts the Cost of Subaru Impreza Insurance

The cost of Subaru Impreza insurance is influenced by several factors beyond just the model and trim. Your age, driving history, and location can significantly affect premiums. Younger drivers typically face higher rates due to their perceived risk, whereas older, more experienced drivers may benefit from lower premiums.

Additionally, drivers with clean records will generally receive more favorable rates than those with accidents or violations. Geographic location also plays a role, with areas having higher rates of accidents and thefts seeing increased insurance costs. Discover more about offerings in our article titled “How Auto Insurance Companies Check Driving Records.”

Finally, the level of coverage you choose—whether minimum liability or comprehensive—will also dictate the final insurance expense for your Subaru Impreza.

Age of the Vehicle

The average Subaru Impreza auto insurance rates are higher for newer models. For example, auto insurance rates for a 2020 Subaru Impreza cost $119 per month, while 2010 Subaru Impreza rates are $97 per month, a difference of $22.

Subaru Impreza Auto Insurance Monthly Rates by Age of the Vehicle| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Subaru Impreza | $29 | $48 | $32 | $121 |

| 2023 Subaru Impreza | $29 | $48 | $32 | $120 |

| 2022 Subaru Impreza | $28 | $48 | $31 | $120 |

| 2021 Subaru Impreza | $28 | $47 | $31 | $120 |

| 2020 Subaru Impreza | $28 | $47 | $31 | $119 |

| 2019 Subaru Impreza | $27 | $45 | $33 | $118 |

| 2018 Subaru Impreza | $26 | $45 | $33 | $117 |

| 2017 Subaru Impreza | $25 | $44 | $35 | $116 |

| 2016 Subaru Impreza | $24 | $42 | $36 | $115 |

| 2015 Subaru Impreza | $23 | $40 | $37 | $113 |

| 2014 Subaru Impreza | $22 | $38 | $38 | $110 |

| 2013 Subaru Impreza | $21 | $35 | $38 | $107 |

| 2012 Subaru Impreza | $20 | $32 | $38 | $103 |

| 2011 Subaru Impreza | $19 | $29 | $38 | $99 |

| 2010 Subaru Impreza | $18 | $27 | $39 | $97 |

As demonstrated by the data, the insurance rates for Subaru Impreza generally decrease as the vehicle ages, reflecting the lowered risk and value associated with older models.

Driver Age

Driver age can have a significant impact on the cost of Subaru Impreza auto insurance. For example, 20-year-old drivers pay as much as $151 more each month for their Subaru Impreza auto insurance than 40-year-old drivers. Access comprehensive insights into our article titled “What is the average auto insurance cost per month?”

Subaru Impreza Auto Insurance Monthly Rates by Age| Age | Rates |

|---|---|

| Age: 16 | $620 |

| Age: 18 | $435 |

| Age: 20 | $270 |

| Age: 30 | $124 |

| Age: 40 | $119 |

| Age: 45 | $115 |

| Age: 50 | $109 |

| Age: 60 | $106 |

Understanding the influence of driver age on insurance costs reveals that mature drivers typically benefit from significantly lower Subaru Impreza auto insurance rates compared to younger, less experienced drivers.

Driver Location

Where you live can have a large impact on Subaru Impreza insurance rates. For example, drivers in Houston may pay approximately $88 a month more than drivers in Columbus.

Subaru Impreza Auto Insurance Monthly Rates by City| City | Rates |

|---|---|

| Los Angeles, CA | $204 |

| New York, NY | $188 |

| Houston, TX | $187 |

| Jacksonville, FL | $173 |

| Philadelphia, PA | $160 |

| Chicago, IL | $157 |

| Phoenix, AZ | $138 |

| Seattle, WA | $115 |

| Indianapolis, IN | $101 |

| Columbus, OH | $99 |

Therefore, it’s crucial to consider your location when estimating the cost of Subaru Impreza insurance, as rates can vary significantly between different cities.

Your Driving Record

Your driving record can have an impact on the cost of Subaru Impreza auto insurance. Teens and drivers in their 20’s see the highest jump in their Subaru Impreza auto insurance rates with violations on their driving record.

Subaru Impreza Auto Insurance Monthly Rates by Age & Driving Record| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $620 | $810 | $1,100 | $750 |

| Age: 18 | $435 | $590 | $850 | $530 |

| Age: 20 | $270 | $410 | $660 | $350 |

| Age: 30 | $124 | $180 | $310 | $160 |

| Age: 40 | $119 | $170 | $300 | $155 |

| Age: 45 | $115 | $165 | $290 | $150 |

| Age: 50 | $109 | $155 | $280 | $145 |

| Age: 60 | $106 | $150 | $270 | $140 |

Maintaining a clean driving record is crucial, as violations and accidents can significantly increase Subaru Impreza auto insurance costs, especially for younger drivers.

Subaru Impreza Safety Ratings

Your Subaru Impreza auto insurance rates are tied to the safety ratings of the Subaru Impreza. See the breakdown below:

Subaru Impreza Safety Ratings| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The consistently high safety ratings of the Subaru Impreza across multiple test categories can lead to more favorable auto insurance rates due to the vehicle’s proven crashworthiness.

Subaru Impreza Crash Test Ratings

Good Subaru Impreza crash test ratings mean the VW is safer, which could mean cheaper Subaru Impreza auto insurance rates.

Subaru Impreza Crash Test Ratings| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Subaru Impreza SW AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2024 Subaru Impreza 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2023 Subaru Impreza SW AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2023 Subaru Impreza 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2022 Subaru Impreza SW AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2022 Subaru Impreza 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2021 Subaru Impreza SW AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2021 Subaru Impreza 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2020 Subaru Impreza SW AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2020 Subaru Impreza 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2019 Subaru Impreza SW AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2019 Subaru Impreza 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2018 Subaru Impreza SW AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2018 Subaru Impreza 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2017 Subaru Impreza SW AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2017 Subaru Impreza 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2016 Subaru Impreza SW AWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2016 Subaru Impreza 4 DR AWD | 5 stars | 4 stars | 5 stars | 5 stars |

The consistently high crash test ratings of the Subaru Impreza across various models and years underline its safety credentials, potentially leading to more affordable auto insurance rates for owners.

Subaru Impreza Safety Features

The more safety features you have on your Subaru Impreza, the more likely it is that you can earn a discount. The Subaru Impreza’s safety features include:

- Air Bags: Driver, Passenger, Front/Rear Head, Front Side

- Braking Systems: 4-Wheel ABS, Disc Brakes, Brake Assist

- Stability Features: Electronic Stability Control, Traction Control

- Safety Enhancements: Daytime Running Lights, Child Safety Locks

- Driving Assistance: Lane Departure Warning, Lane Keeping Assist

Equipping your Subaru Impreza with advanced safety features not only enhances your driving security but can also significantly reduce your insurance costs through various safety discounts.

Subaru Impreza Insurance Loss Probability

The Subaru Impreza’s insurance loss probability varies for each form of coverage. The lower percentage means lower Subaru Impreza auto insurance rates; higher percentages mean higher Subaru Impreza auto insurance rates.

Subaru Impreza Auto Insurance Loss Probability by Coverage Type| Coverage | Loss |

|---|---|

| Collision | -4% |

| Property Damage | -20% |

| Comprehensive | 10% |

| Personal Injury | -21% |

| Medical Payment | -22% |

| Bodily Injury | -19% |

Understanding the varying loss probabilities across different insurance coverage categories is crucial for effectively managing and potentially reducing the cost of your Subaru Impreza’s auto insurance rates.

Subaru Impreza Finance and Insurance Cost

When purchasing a Subaru Impreza, it’s important to consider both the financing and insurance costs, as they significantly impact the total ownership expenses. Financing a Subaru Impreza can vary based on credit score, down payment, loan term, and interest rates offered by financial institutions. These factors collectively determine the monthly payment for the vehicle.

On the insurance side, the cost to insure a Subaru Impreza depends on various factors including the driver’s age, driving history, and the level of coverage selected. The model year and trim of the Subaru Impreza affect insurance costs, as newer models are pricier to insure due to higher value and repair costs. Unlock details in our article titled “What are the recommended auto insurance coverage levels?”

It’s advisable for potential owners to get pre-approved for financing to better understand their budget constraints before making a purchase. Obtaining multiple quotes ensures you find the best, most competitive insurance for your Subaru Impreza. Combining financial savvy with smart insurance shopping makes owning a Subaru Impreza enjoyable and affordable.

Ways to Save on Subaru Impreza Insurance

There are many ways that you can save on Subaru Impreza auto insurance. Below are five actions you can take to find cheap Subaru Impreza auto insurance rates.

- Take public transit instead of driving your Subaru Impreza.

- Check the odometer on your Subaru Impreza.

- Bundle your Subaru Impreza auto insurance with home insurance.

- Buy winter tires for your Subaru Impreza.

- Pay your Subaru Impreza insurance rates upfront.

By adopting strategies like using public transit, monitoring mileage, bundling insurance policies, investing in winter tires, and paying upfront, you can significantly reduce your Subaru Impreza auto insurance costs. Delve into our evaluation of our guide titled “How to Get a Low Mileage Auto Insurance Discount.”

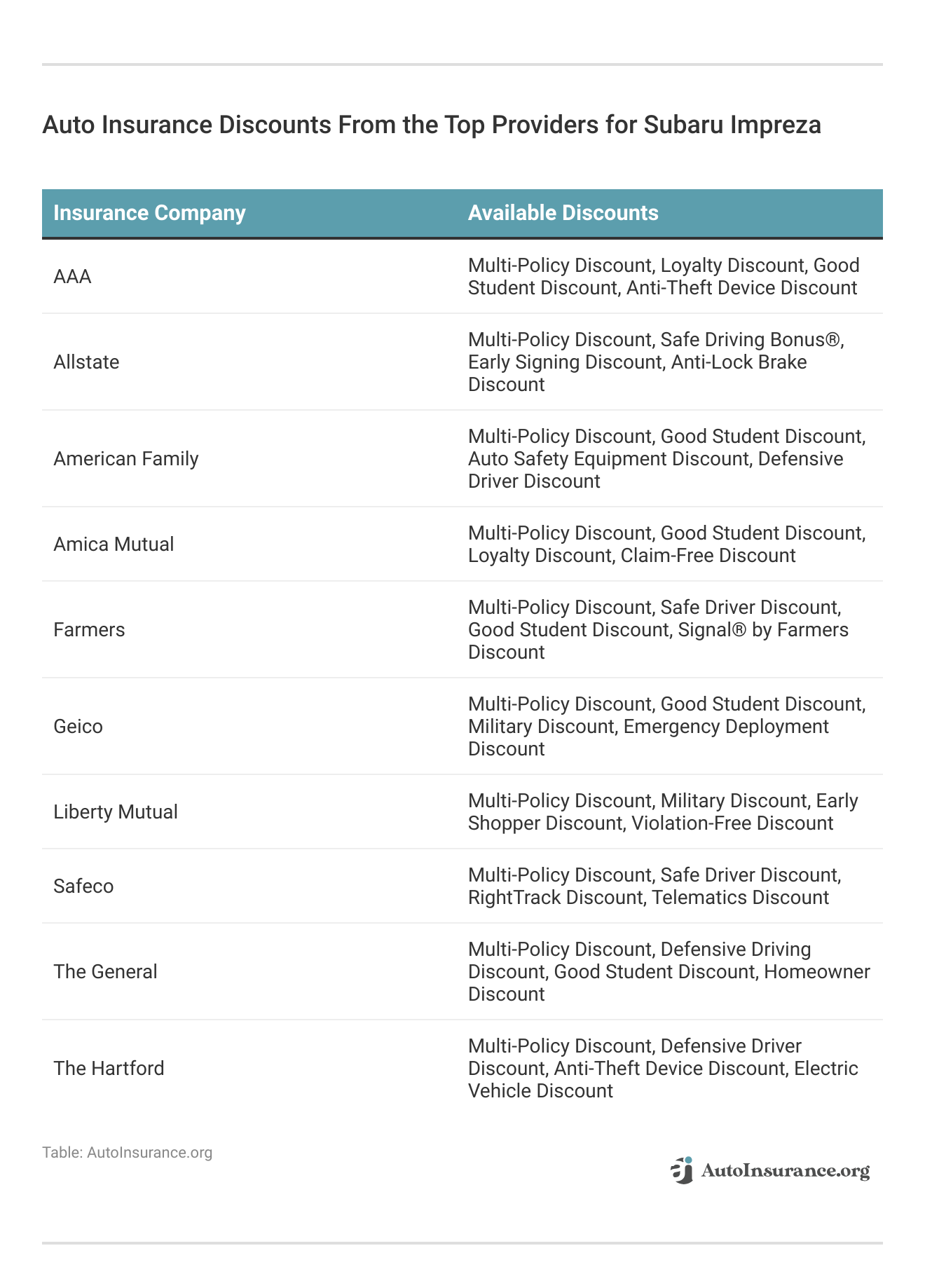

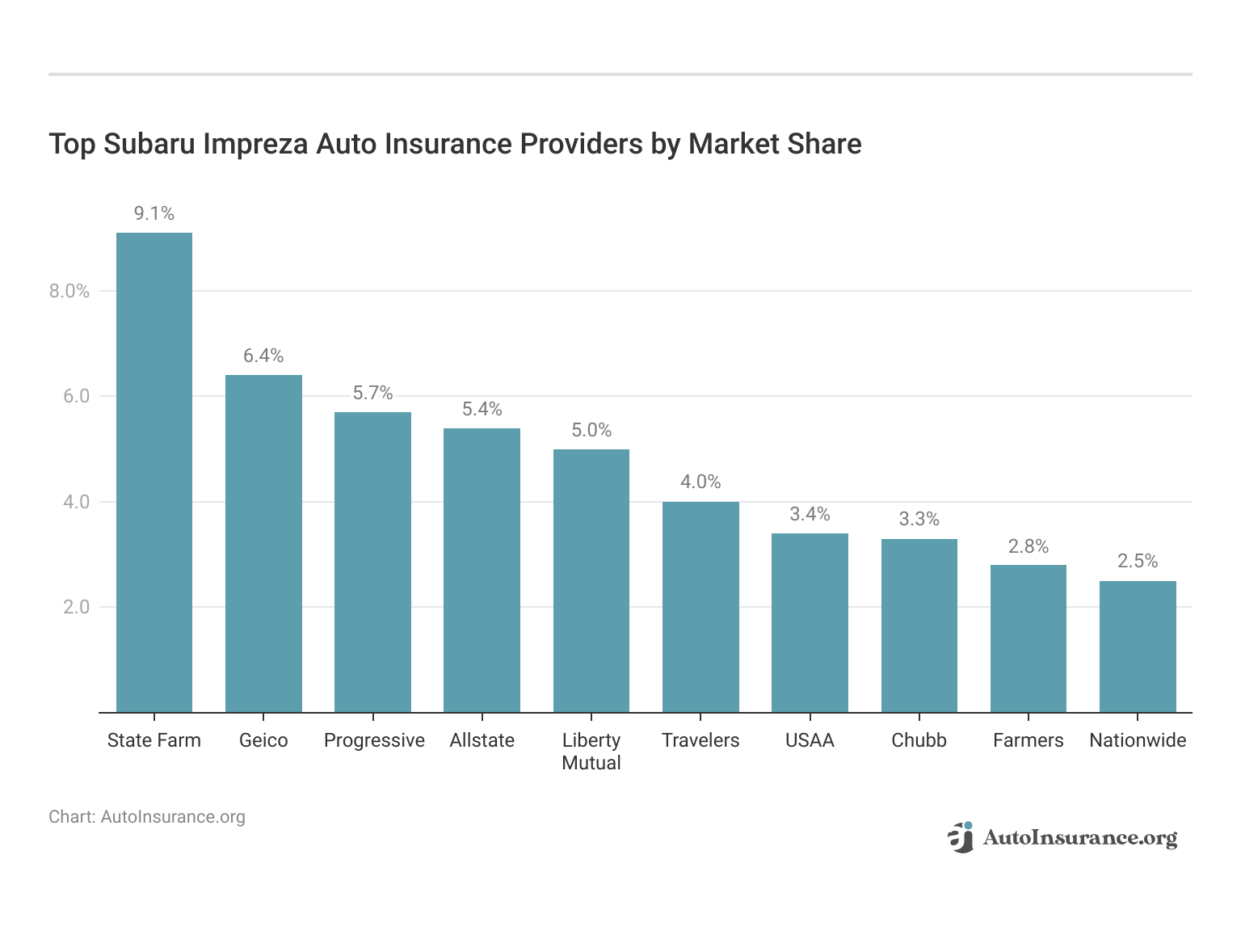

Top Subaru Impreza Insurance Companies

The best auto insurance companies for Subaru Impreza auto insurance rates will offer competitive rates, discounts, and account for the Subaru Impreza’s safety features. The following list of auto insurance companies outlines which companies hold the highest market share.

Top Subaru Impreza Auto Insurance Providers by Market Share| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

Selecting the right insurer for your Subaru Impreza involves considering not only the rates and discounts but also the market dominance and reliability of the provider.

Companies like State Farm and Geico lead the market in terms of share and volume, indicating their extensive customer base and potential for offering comprehensive coverage tailored to Subaru Impreza owners.

Compare Free Subaru Impreza Insurance Quotes Online

If you’re looking to insure your Subaru Impreza, comparing insurance quotes online is an efficient way to ensure you get the best deal tailored to your needs. By entering your information into a free online comparison tool, you can quickly receive quotes from various top insurance providers. Discover insights in our article titled “How to Ask an Auto Insurance Company for Quotes.”

Allstate leads the pack with robust coverage options, securing a 15% discount for Subaru Impreza owners who bundle their policies.Michelle Robbins Licensed Insurance Agent

This allows you to assess the coverage options, premiums, and discounts each company offers specifically for Subaru Impreza owners. Comparing quotes not only helps you understand the market but also empowers you to make an informed decision, potentially saving you money while securing the coverage that best suits your driving habits and vehicle specifics.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

Frequently Asked Questions

What is the average cost of Subaru Impreza auto insurance?

The average cost of Subaru Impreza auto insurance is $119 monthly.

Are Subaru Imprezas expensive to insure compared to other sedans?

Subaru Impreza insurance rates can vary, but they generally fall within a reasonable range compared to other sedans such as the Chevrolet Impala, Toyota Corolla, and Chrysler 300.

Access comprehensive insights into our guide titled “Chevrolet Auto Insurance.”

What factors impact the cost of Subaru Impreza insurance?

Several factors influence the cost of Subaru Impreza insurance, including the trim and model of the vehicle, driver age, location, driving record, safety ratings, and safety features.

How can I save on Subaru Impreza insurance?

To find cheaper Subaru Impreza insurance rates, consider maintaining a good driving record, taking advantage of safety features, comparing quotes from different insurance companies, and exploring available discounts.

Which are the top insurance companies for Subaru Impreza coverage?

The best auto insurance companies for Subaru Impreza coverage offer competitive rates, discounts, and consider the vehicle’s safety features. It’s recommended to compare quotes from multiple insurers to find the best fit for your needs.

Learn more by reading our guide titled “Can you have two auto insurance policies?”

How can I compare Subaru Impreza insurance quotes online?

You can easily compare Subaru Impreza auto insurance quotes online by using our free online comparison tool. Simply enter your ZIP code to get started on obtaining quotes from several top-rated auto insurance companies.

What is the 2019 Subaru Impreza insurance cost?

The average insurance cost for a 2019 Subaru Impreza is around $117 per month, but rates can vary based on your location and driving history.

Where can I find cheap car insurance for Subaru Impreza?

To find cheap car insurance for a Subaru Impreza, compare quotes from multiple insurers and look for discounts like multi-car or safe driver.

To find out more, explore our guide titled “How to Get a Multi-Vehicle Auto Insurance Discount.”

What are typical insurance rates for a Subaru Impreza?

Typical insurance rates for a Subaru Impreza average between $100 and $133 monthly, depending on factors such as age, driving record, and coverage level.

Is a Subaru Impreza expensive to insure?

A Subaru Impreza is moderately expensive to insure, generally costing slightly less than the average for compact cars.

What is the Subaru Impreza insurance group?

What is the Subaru Impreza WRX insurance cost?

Why is Impreza insurance so high?

How much does it cost to insure a Subaru Impreza?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.