Best Auto Insurance for Firefighters in 2025 (Top 9 Companies)

The top providers of the best auto insurance for firefighters are California Casualty, AAA, and The Hartford, offering rates starting at $32 a month. California Casualty includes $500 gear replacement. AAA offers lifetime repair guarantees, and The Hartford gives up to 40% off at renewal with its TrueLane program.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated August 2025

146 reviews

146 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

146 reviews

146 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 765 reviews

765 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

765 reviews

765 reviewsCalifornia Casualty, AAA, and The Hartford stand out as top providers of the best auto insurance for firefighters due to their exclusive features specifically designed for first responders.

Our Top 9 Company Picks: Best Auto Insurance for Firefighters| Company | Rank | First Responder Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 18% | B | Auto Coverage | California Casualty | |

| #2 | 15% | A | Roadside Assistance | AAA |

| #3 | 12% | A+ | Tailored Policies | The Hartford |

| #4 | 12% | A | First-Responder Discount | Farmers | |

| #5 | 12% | A | Occupational Discount | Liberty Mutual |

| #6 | 10% | A+ | Customer Service | Country Financial |

| #7 | 9% | A++ | Lowest Rates | Geico | |

| #8 | 8% | A++ | Military Drivers | USAA | |

| #9 | 7% | A | Firefighter Spouses | Mercury |

California Casualty offers $500 in turnout gear coverage and waived deductibles near fire stations. AAA includes access to its Accident Assist program and certified repair networks.

The Hartford’s TrueLane program rewards safe drivers with renewal discounts of up to 40%, making it ideal for long-term value. Find out which companies offer the best first responder auto insurance discounts tailored specifically for volunteer firefighters.

- California Casualty offers gear coverage and lower deductibles

- Firefighters need coverage for off-duty emergency vehicle use

- Usage-based insurance can save firefighters up to 30% annually

Unlock major savings on firefighter auto insurance by comparing top-rated provider rates using our free quote comparison tool with your ZIP code.

Comparing Auto Insurance Rates for Firefighters

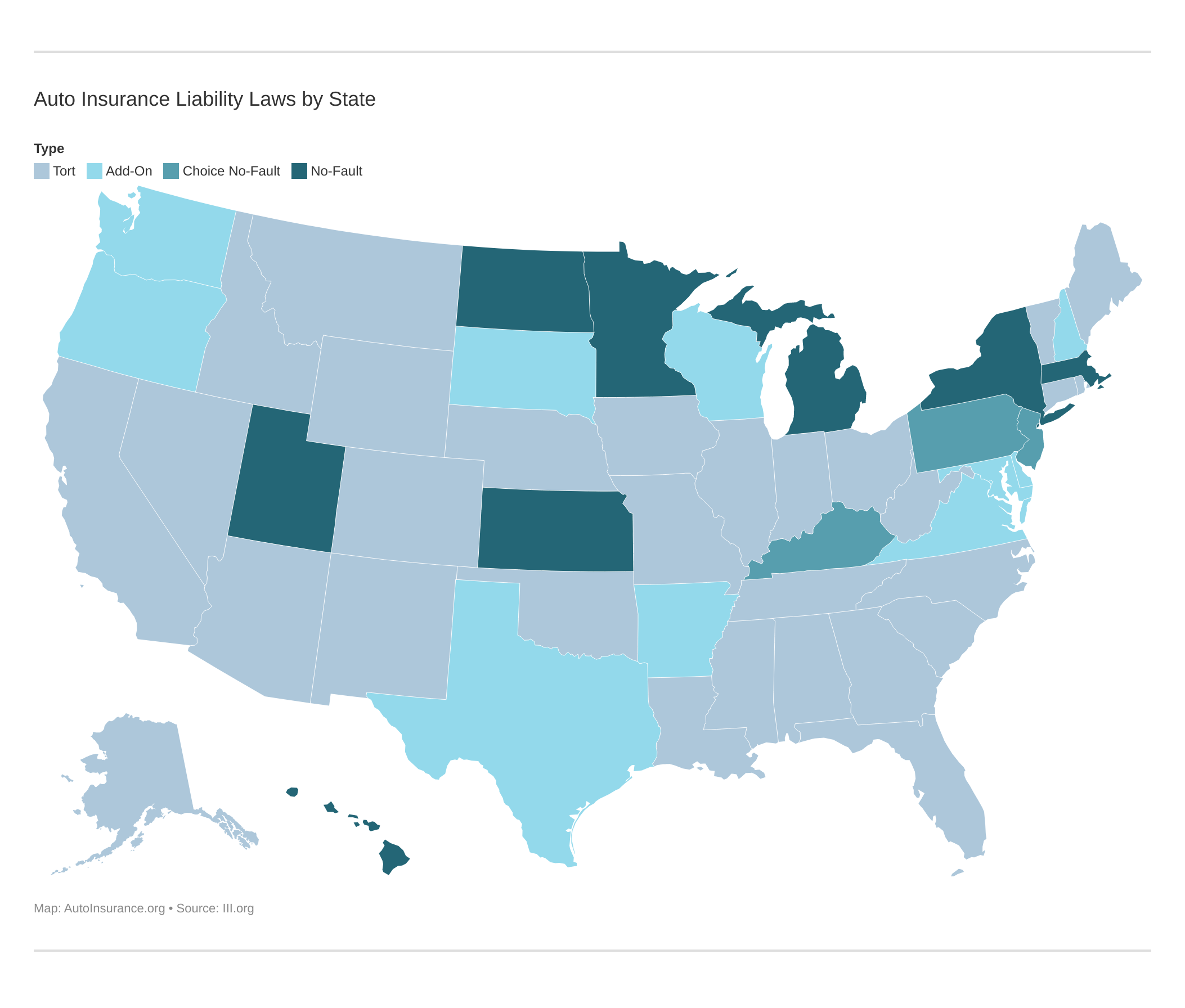

How does your job affect auto insurance? Insurers consider risk when setting rates, and where you work can impact how often you drive, which in turn affects your likelihood of being involved in an accident. For example, firefighters may have high-risk jobs but are usually low-risk drivers.

The table below displays the monthly insurance rates for firefighters from the top providers. USAA offers the most affordable minimum and full coverage, costing $32 and $84, respectively.

Auto Insurance Monthly Rates for Firefighters by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $120 | $200 | |

| $110 | $190 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $42 | $110 | |

| $61 | $161 |

| $32 | $84 |

Geico and Mercury also have affordable options. California Casualty and Liberty Mutual tend to cost more but offer extra benefits and features specifically for firefighters.

Best Auto Insurance Discounts for Firefighters

Some insurance companies consider firefighters and first responders safe drivers due to their additional emergency training and reward them with occupational or affinity discounts.

Auto Insurance Discounts for Firefighters

| Insurance Company | Occupational Discount | Safe Driver Discount |

|---|---|---|

| 7% | 10% |

| 10% | 15% | |

| 12% | 20% |

| 11% | 20% | |

| 10% | 15% | |

| 9% | 20% |

| 12% | 8% | |

| 12% | 8% |

| 10% | 10% |

However, occupational discounts aren’t the only way to save on auto insurance for volunteer firefighters. Most major insurers allow drivers to stack multiple discounts for the most affordable auto insurance rates for firefighters. Other discounts firefighters and first responders can earn include:

- Anti-Theft Discount: You could save 15% to 20% by installing additional anti-theft devices.

- Defensive Driver Discount: By taking a defensive driving course, you could earn a 5% to 30% discount on your rates.

- Usage-Based Discount: Tracks your driving habits and saves you an additional 5% to 30% off your annual rates.

- Paid-in-Full Discount: Paying your annual rates upfront can save you an average of $85 per year.

The list of auto insurance discounts for firefighters at major companies will vary, so always ask about which discounts are available to you.

Proximity to fire zones raises exposure. Specifically, providers may offer location-based discounts for garaging vehicles near fire stations.Daniel Walker Licensed Auto Insurance Agent

Many insurers automatically include discounts in quotes, so confirm that you’re getting every discount you’re eligible for before you buy.

Auto Insurance Coverage Options for Firefighters

Firefighters often require specialized auto insurance coverage due to the unique risks associated with their job. These policies can include protection for gear and additional coverage when using vehicles in emergencies, offering benefits beyond regular liability insurance. Here are six major auto insurance coverages commonly offered to firefighters:

- Turnout Gear Replacement Coverage: This pays up to $500 if firefighter gear stored in the insured vehicle gets damaged or stolen.

- Full Glass Replacement: This service handles windshield and window damage without requiring an auto insurance deductible.

- Accident Assist or Repair Concierge: This service offers 24/7 towing, help at accident scenes, and lifetime repair guarantees.

- Usage-Based Insurance (UBI): Programs like TrueLane from The Hartford monitor driving habits and offer safe drivers up to 40% off their premiums when they renew.

- Pet Injury Coverage: Provides up to $1,000 for injuries to pets when they are in a firefighter’s vehicle during an accident. This is included in some California Casualty policies.

- Emergency Response Deductible Waiver: This waiver waives collision or comprehensive deductibles if a loss occurs while the firefighter is responding to a duty call.

These coverage choices help firefighters safeguard their gear, passengers, and financial security both on and off the job.

Learn More: When do you need business auto insurance?

9 Best Auto Insurance Companies for Firefighters

Finding the best car insurance for firefighters means checking more than just basic coverage. The companies listed below offer special benefits, including gear protection, job-related discounts, and mileage-based savings.

All are designed specifically for first responders. Every company on this list gives special benefits suited to the needs of firefighters, whether they are working or not.

#1 – California Casualty: Top Pick Overall

Pros

- Gear Protection: In qualifying incidents, firefighters receive $500 in turnout gear replacement with no deductible applied. Explore more policy options in our California Casualty auto insurance review.

- Station Deductible Waiver: Firefighters with garaged vehicles within 500 feet of their station benefit from waived deductibles.

- Pet Injury Coverage: Policies for firefighters include $1,000 in pet injury protection, which covers injuries to pets in a covered accident.

Cons

- Limited Availability: California Casualty auto insurance for firefighters is not available in all 50 states, which limits access for some.

- No Accident Forgiveness in CA: Firefighters in California are excluded from accident forgiveness due to state restrictions.

#2 – AAA: Biggest Savings for Firefighters

Pros

- Roadside Coverage: Under the AAA Plus membership, firefighters get up to 100 miles of free towing and lockout assistance.

- Certified Repairs: Firefighters using AAA insurance access lifetime guarantees through Approved Auto Repair facilities.

- Accident Assist: AAA’s program helps firefighters manage claims and repairs faster, reducing downtime after a crash. Learn about membership fees and requirements in our AAA insurance review.

Cons

- Membership Required: Firefighters must pay annual dues to access AAA’s insurance perks and roadside programs.

- Regional Rate Variability: Auto insurance premiums for firefighters vary widely depending on the AAA club region and service area.

#3 – The Hartford: Best Insurance Policies

Pros

- TrueLane Rewards: Firefighters who enroll in The Hartford’s TrueLane program can save up to 40% for safe driving habits.

- AARP Access: Eligible firefighters can bundle with AARP benefits to secure multi-policy discounts and accident forgiveness.

- Lifetime Renewals: Firefighters with a clean record qualify for The Hartford’s Lifetime Renewability benefit. Get more rankings in our review of The Hartford auto insurance.

Cons

- Eligibility Restrictions: Only firefighters aged 50 or older or those with an AARP membership qualify for key discounts.

- UBI Limitations: TrueLane savings for firefighters may be minimal without consistently high driving scores over time.

#4 – Farmers: Best Discounts for Firefighters

Pros

- Up to 18% Off: Firefighters may receive occupational discounts of up to 18% on their auto insurance premiums with Farmers.

- Customized Deductibles: Farmers offers decreasing deductibles for firefighters who remain claim-free year after year.

- Enhanced Glass Coverage: For cracked windshields, firefighters can opt for full glass replacement without paying a deductible. Use our Farmers insurance review to find local coverage.

Cons

- High Base Rates: Even with occupational discounts, firefighters may find Farmers’ base premiums higher than national averages.

- Digital Tools Lacking: Firefighters seeking mobile-first claims tools may find Farmers’ tech less streamlined than competitors.

#5 – Liberty Mutual: Most Customizable Coverage

Pros

- RightTrack Savings: Firefighters using Liberty Mutual’s telematics program can save up to 30% for monitored safe driving. Compare policy options in our Liberty Mutual review.

- Add-On Flexibility: Liberty Mutual allows firefighters to add roadside assistance, rental car reimbursement, and accident forgiveness.

- Group Savings: Firefighters affiliated with certain unions or departments may be eligible for affinity discounts not publicly advertised.

Cons

- Discount Clarity: Firefighters may struggle to confirm exact eligibility for Liberty Mutual’s occupation-based discounts.

- Claim Satisfaction Variance: Firefighters report inconsistent claims handling depending on region and adjuster assignment.

#6 – Country Financial: Best for Customer Service

Pros

- Personalized Agents: Firefighters benefit from local agents familiar with regional risk factors and station-based vehicle use.

- Bundled Savings: Country Financial offers multi-policy bundles that can reduce firefighters’ total insurance costs by up to 25%.

- Equipment Protection: Firefighters who transport personal safety gear in their vehicles can secure extended property coverage. Find local protection in our Country Financial company review.

Cons

- Limited National Reach: Firefighters outside Country Financial’s core service states may not have access to auto policies.

- Digital Access Gaps: Firefighters looking for robust app-based policy management may find fewer online tools available.

#7 – Geico: Lowest Rates for Firefighters

Pros

- Federal Discounts: Geico offers firefighter-specific savings to those working for federal departments or associated agencies (See more discounts: Geico Auto Insurance Discounts).

- Defensive Driving Incentives: Firefighters who complete approved safety courses can qualify for rate reductions of up to 15%.

- Claims Efficiency: Geico’s 24/7 claims center ensures firefighters receive quick roadside support or accident processing at any time.

Cons

- Limited Firefighter Perks: Compared to niche carriers, Geico’s firefighter-specific benefits are fewer and not widely promoted.

- Affinity Access Required: To unlock discounts, firefighters may need to provide proof of association or employment with qualifying agencies.

#8 – USAA: Best for Firefighters in the Military

Pros

- Lowest Rates: USAA consistently offers some of the lowest premiums for military personnel, including firefighters, and their family members.

- Deployment Flexibility: Firefighters in the reserves or on active duty benefit from flexible coverage suspension options.

- Claims Satisfaction: USAA ranks highly among firefighters for claims support, especially in emergency response cases. Compare quotes in our USAA insurance review.

Cons

- Membership Eligibility: Firefighters must be military-affiliated or have a qualifying family connection to access USAA.

- No Civilian Access: Civilian or municipal firefighters without military ties are not eligible for USAA auto insurance.

#9 – Mercury: Best for Firefighter Spouses

Pros

- Household Coverage: Mercury allows firefighter spouses to receive discounts even if the firefighter isn’t the policyholder.

- Repair Partner Network: Firefighters get access to certified shops with guaranteed workmanship on repairs.

- Low-Mileage Discounts: Firefighters with short commutes or those who use their vehicles off-duty may save through verified mileage reductions. Explore more in our Mercury auto insurance review.

Cons

- State Limitations: Mercury is only available in select states, restricting access for many firefighters nationwide.

- Add-On Complexity: Firefighters may need to navigate complex optional coverages to achieve full protection.

Finding the Best Auto Insurance for Firefighters

California Casualty and The Hartford are the top auto insurance companies for firefighters, offering specialized policies and coverage options tailored to first responders.

AAA, Farmers, and Liberty Mutual offer bigger discounts to help lower rates and reduce repair costs for firefighters who have been in an accident. On average, firefighters can save 3% to 18% on auto insurance simply by virtue of their occupation.

You can stack an additional 10% discount for staying accident-free or bundling auto insurance with a home or renters policy. Firefighters can also earn up to 30% off their auto insurance premiums by signing up for usage-based auto insurance.

Volunteers drive long distances to rural calls. For instance, usage-based plans with mileage tracking ensure fairer rates for firefighter travel.Michelle Robbins Licensed Insurance Agent

Firefighters who use their personal vehicles for work and don’t have a policy with California Casualty or The Hartford may need additional business coverage. Business auto insurance can be more expensive, so shop around with multiple local companies to find the most affordable car insurance for firefighters in your area.

Get firefighter car insurance discount offers by comparing personalized quotes using your ZIP code in our free and easy-to-use rate comparison tool.

Frequently Asked Questions

What is the best car insurance for first responders?

You can find the best auto insurance for first responders with companies offering dedicated discounts, priority claims service, and average minimum rates.

What firefighter insurance benefits can you access?

You can access firefighter car insurance benefits, including specialized discounts, gap coverage, and accident forgiveness, often starting at a monthly rate of $52.

Where can you find trustworthy reviews of firefighter insurance services?

You can find trustworthy firefighter insurance services reviews on verified platforms that highlight customer satisfaction, claim efficiency, and savings. Get connected with the best auto insurance companies for firefighters by entering your ZIP code into our free rate finder tool.

How does IAFF auto insurance work for members like you?

IAFF car insurance offers union-specific discounts, group rate coverage options, and partner insurer benefits.

Do firefighters get a discount on car insurance?

Yes, you can receive a firefighter discount on car insurance, which can lower your monthly premium by 5% to 15%, depending on the insurer. Explore the best membership auto insurance discounts made for firefighters.

What is the best insurance company for firefighters?

You can find the best insurance company for firefighters through providers offering firefighter-specific discounts. Average monthly rates start around $56.

Is fire covered under auto insurance?

Yes, your comprehensive auto insurance policy covers fire damage if the incident is non-collision related, and coverage typically starts at around $50 per month.

What is the cheapest car insurance for firefighters?

You can obtain cheap car insurance for firefighters through companies offering occupation-based discounts, with monthly premiums starting as low as $49. Discover the cheapest auto insurance companies that support firefighter savings.

Is fire insurance expensive?

Fire insurance is typically not expensive when added to homeowners or renters coverage, with monthly premiums starting as low as $20, depending on location and property value.

What is the best car insurance?

You can find the best car insurance by comparing coverage options, discounts, and rates. Top providers offer plans starting at just $48 per month.

Are firefighter benefits good?

What type of insurance do you need for a fire?

Can anyone get USAA car insurance?

What happened to Fireman’s Fund insurance?

Do police officers get a discount on car insurance?

Do EMTs get insurance discounts?

Does car insurance give discounts?

Do firefighters automatically get life insurance?

Can you get firefighter home insurance at a lower rate?

How does The Hartford compare to USAA for firefighter insurance?

Can you use the IAFF rental car discount as a firefighter?

Is Country Financial customer service helpful for firefighters like you?

Can you access IAFF insurance discounts as a member?

How do you use the IAFF car rental discount?

Do firefighters need professional liability insurance?

Can you get volunteer firefighter discounts on insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.