Best Savannah, Georgia Auto Insurance in 2025 (Top 10 Companies for Savings)

The best car insurance in Savannah, Georgia, comes from Farmers, Erie, and AAA, which offer rates as low as $82 per month. Farmers also earn high marks for customer service. Erie is an affordable auto insurance option, and AAA gains the top spot due to member perks regarding car insurance in Savannah.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Mar 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Savanna Illinois

A.M. Best

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in Savanna Illinois

A.M. Best

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage in Savanna Illinois

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsFarmers are the top choice overall for the best Savannah, Georgia auto insurance, with monthly rates as low as $82. Erie is great for cheap rates and customer satisfaction, while AAA offers top-notch roadside service and full coverage insurance.

This article looks at each provider’s benefits and potential drawbacks to help you make an informed decision. Choosing wisely can save you a lot of money and help you gain peace of mind with the right insurance. Reading this is essential if you’re looking for cheap auto insurance, as the right coverage means a huge difference in cost and stress-free life.

Our Top 10 Company Picks: Best Savannah, Georgia Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A | Comprehensive Coverage | Farmers | |

| #2 | 10% | A+ | Customizable Plans | Erie |

| #3 | 25% | A | Innovative Tools | AAA |

| #4 | 20% | A | Competitive Rates | American Family | |

| #5 | 12% | A+ | Member Benefits | Progressive | |

| #6 | 25% | A | Flexible Options | Liberty Mutual |

| #7 | 25% | A+ | Nationwide Presence | Allstate | |

| #8 | 20% | B | Strong Reputation | State Farm | |

| #9 | 12% | A++ | High-End Coverage | Chubb | |

| #10 | 25% | A++ | Low Rates | Geico |

Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

- Farmers offer the best Savannah, Georgia auto insurance, starting at $95 per month

- Erie stands out for its competitive rates and high customer satisfaction in Savannah

- AAA enhances policies with exceptional roadside assistance and added benefits

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

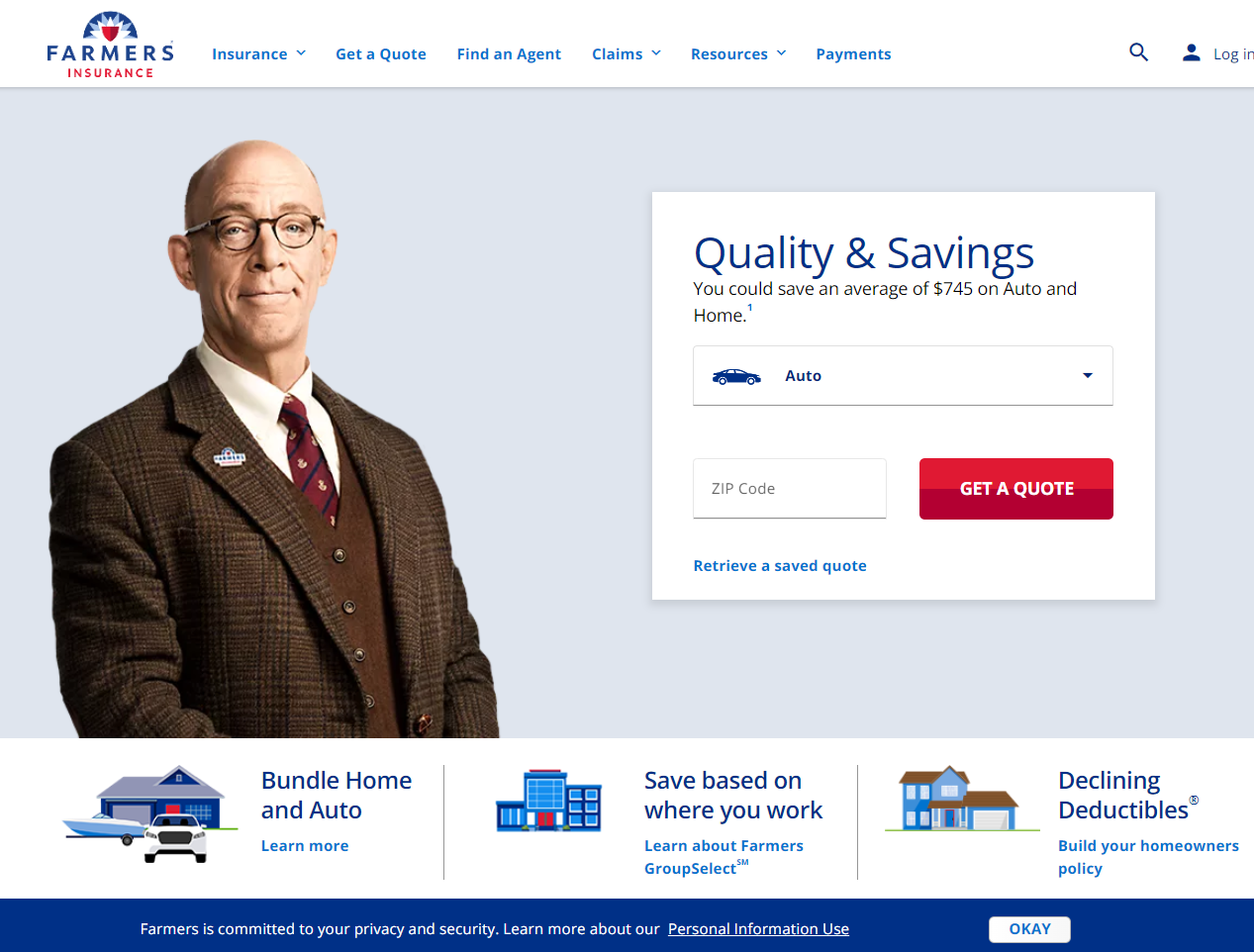

#1 – Farmers: Top Overall Pick

Pros

- Comprehensive Coverage Options: Farmers provide a wide range of insurance plans in Savannah, Georgia, that cover accidents, theft, and natural disasters.

- Generous Bundling Discount: In Savannah, Georgia, insurance owners can save up to 20% by bundling home and life insurance policies.

- Financial Stability: Rated A by A.M. Best, Farmers ensures reliable insurance payouts for Savannah, Georgia drivers. For extra details, check our Farmers auto insurance review.

Cons

- Higher Premiums: Farmers’ extensive coverage options often lead to higher Savannah, Georgia insurance rates.

- Limited Mobile App Features: The app lacks valuable functions, making it harder for insurance owners in Savannah, Georgia, to manage policies online.

#2 – Erie: Best for Customizable Plans

Pros

- Customizable Plans: Erie allows insurance owners in Savannah, Georgia, to personalize policies to fit unique coverage needs. To learn more, consult our Erie auto insurance review.

- Strong Financial Backing: Erie’s A+ rating ensures that drivers in Savannah, Georgia, can trust its reliability for insurance claims.

- Accident Forgiveness: In Savannah, Georgia, insurance owners won’t face increased rates after their first at-fault accident with Erie.

Cons

- Limited Availability: Erie may not be available to all insurance seekers in Savannah, Georgia, and options are restricted in some areas.

- Fewer Digital Tools: Insurance owners in Savannah, Georgia, may find Erie’s mobile app less user-friendly than competitors.

#3 – AAA: Best for Innovative Tools

Pros

- Innovative Driver Tools: Georgia insurance drivers can use tools to monitor their driving habits, be safer, and keep premiums low.

- Great Bundle Discount: Bundling auto and home insurance can get Savannah motorists a discount of 25% through AAA for more information about AAA auto insurance review.

- AAA Membership Perks: Insurance customers in the Savannah area. Get free roadside assistance with insurance.

Cons

- Membership Only: In Savannah, Georgia, and with all insurance from AAA, you must be a member to have an active policy, and that means extra costs.

- More excellent Rates for Non-Members: Non-member rates are higher for insurance policies with Savannah, Georgia.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – American Family: Best for Competitive Rates

Pros

- Affordable Rates: American Family offers some of the most competitive insurance premiums for budget-conscious drivers in Savannah, Georgia.

- Generous Discounts: In Savannah, Georgia, insurance owners can save with a 20% discount by bundling home or life insurance. For further details, check our American Family auto insurance review.

- Excellent Customer Service: Known for strong support, American Family helps insurance policyholders in Savannah, Georgia, with claims and inquiries.

Cons

- Limited Coverage Area: American Family isn’t available everywhere, restricting insurance options for some drivers in Savannah, Georgia.

- Less Advanced Digital Tools: Insurance owners in Savannah, Georgia, may find online policy management less convenient than other insurers.

#5 – Progressive: Best for Member Benefits

Pros

- Use Member Benefits: Members enjoy special offers and can use loyalty rewards for service in Savannah, Georgia.

- Snapshot Program: This safe-driving program, offered to drivers in Savannah, Georgia, enables insurance savings from good driving.

- A.M. Best A+ Financial Rating: Savannah drivers can count on Progressive for financial security due to its excellent A.M. Best rating of A+. Get your learn on with Progressive auto insurance review.

Cons

- Spotty Customer Service: Many Savannah insurance owners have reported dissatisfaction with claim handling.

- Rates May Vary: Progressive in Savannah, GA, revolves around Driver Profile and Maintenance records.

#6 – Liberty Mutual: Best for Flexible Options

Pros

- Flexible Coverage: Liberty Mutual offers Savannah, Georgia, insurance owners customizable policies to match specific needs. For more information, read our Liberty Mutual auto insurance review.

- Great Bundling Discount: Liberty Mutual offers a 25% bundle discount, helping drivers in Savannah, Georgia, save significantly on insurance.

- A-rated Financial Strength: Liberty Mutual’s A rating by A.M. Best guarantees reliable payouts for insurance claims in Savannah, Georgia.

Cons

- Higher Premiums for Risky Drivers: In Savannah, Georgia, insurance owners with poor driving records may face steeper rates with Liberty Mutual.

- Average Customer Service: Some Savannah, Georgia drivers report average service experiences, especially during the claims process.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Allstate: Best for Nationwide Presence

Pros

- Nationwide Coverage: Allstate provides reliable Savannah, Georgia, insurance coverage across the country, perfect for frequent travelers.

- Strong Bundling Discounts: Savannah, Georgia drivers can save 25% by bundling Allstate home and auto insurance policies. Please read through our Allstate auto insurance review for more details.

- Excellent Financial Backing: Allstate’s A+ rating by A.M. Best ensures that insurance claims for Savannah, Georgia, will be reliably handled.

Cons

- Higher Premiums for Young Drivers: Allstate can charge higher rates for young or high-risk insurance policyholders in Savannah, Georgia.

- Slower Claims Process: Some insurance owners in Savannah, Georgia, report delays in resolving claims with Allstate.

#8 – State Farm: Best for Strong Reputation

Pros

- Strong Reputation: State Farm is a trusted name in Savannah, Georgia, and auto insurance is known for dependable coverage and service. Read our State Farm auto insurance review for more information.

- Wide Network of Agents: In Savannah, Georgia, insurance owners benefit from State Farm’s extensive local agent network for personalized assistance.

- Variety of Coverage Options: State Farm offers flexible insurance policies tailored to different driver needs in Savannah, Georgia.

Cons

- Lower Financial Rating: State Farm’s B rating by A.M. Best is lower than that of its competitors, which may concern some Savannah, Georgia insurance owners.

- Higher Premiums for Some Drivers: Certain Savannah, Georgia drivers, especially those with spotty driving records, may face higher rates.

#9 – Chubb: Best for High-End Coverage

Pros

- High-End Coverage: Chubb specializes in luxury car insurance for Savannah, Georgia drivers, with extensive protection for high-value vehicles. Uncover more insights in our Chubb auto insurance review.

- A++ Financial Strength: Chubb’s top rating by A.M. Best ensures that insurance claims for Savannah, Georgia, are handled with exceptional reliability.

- Comprehensive Options for Luxury Cars: Chubb offers high-end coverage to drivers in Savannah, Georgia, including agreed-value options for luxury cars.

Cons

- Expensive Premiums: Chubb’s specialized Savannah, Georgia insurance coverage for high-end cars has higher costs than standard insurers.

- Limited Appeal for Non-Luxury Drivers: Savannah, Georgia, insurance owners with regular vehicles may find Chubb’s high-end focus unnecessary.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Geico: Best for Low Rates

Pros

- Low Rates: Geico offers some of the most affordable Savannah, Georgia insurance premiums, ideal for drivers seeking cost-effective options.

- A++ Financial Rating: Geico’s top A.M. Best rating guarantees financial security for insurance policyholders in Savannah, Georgia. Gain further insights from our Geico auto insurance review.

- User-Friendly Digital Tools: Geico’s website and app make it easy for insurance owners in Savannah, Georgia, to manage their policies on the go.

Cons

- Limited Local Agent Support: Geico’s online focus means fewer agents are available locally for Savannah, Georgia, and insurance owners needing personal assistance.

- Fewer Add-On Options: In Savannah, Georgia, insurance owners may find fewer choices for customizing policies than competitors.

Savannah, Georgia Auto Insurance Rates: Compare Monthly Costs

To get this right, you need to know the average car insurance rates by provider for a range of coverage levels. Here is a detailed breakdown of the monthly prices for minimum and full coverage from different insurance companies so you can make an informed decision based on your budget.

Savannah, Georgia Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $90 | $225 |

| $89 | $220 | |

| $92 | $230 | |

| $95 | $240 | |

| $88 | $220 |

| $85 | $215 | |

| $82 | $205 | |

| $87 | $215 |

| $84 | $210 | |

| $83 | $208 |

Comparing rates can help you save money and increase your peace of mind when looking for the best auto insurance.

Top Discounts for Auto Insurance in Savannah, Georgia

When searching for the best auto insurance in Savannah, Georgia, it’s crucial to consider the available discounts to help you save money on your premiums.

Each insurance provider offers unique savings opportunities, such as multi-policy discounts, safe driver rewards, and incentives for good students. Understanding these discounts can guide you toward the most affordable options while ensuring you get the coverage you need.

Auto Insurance Discounts From the Top Providers in Savannah, Georgia

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, Safe Driver, Membership, Anti-Theft, Good Student |

| Multi-Policy, Safe Driver, Good Student, Anti-Theft, Drivewise Program | |

| Multi-Policy, Safe Driver, Good Student, Defensive Driving, Anti-Theft | |

| Multi-Policy, Safe Driver, Good Student, Homeowner, Anti-Theft | |

| Multi-Car, Safe Driver, Good Student, Low Mileage, Anti-Theft |

| Multi-Policy, Safe Driver, Good Student, Anti-Theft, Multi-Car | |

| Multi-Policy, Safe Driver, Good Student, Military, Low Mileage | |

| Multi-Policy, Safe Driver, Good Student, Homeowner, Accident Forgiveness |

| Multi-Car, Safe Driver, Good Student, Snapshot Program, Homeowner | |

| Multi-Policy, Safe Driver, Good Student, Steer Clear, Drive Safe & Save |

Getting quotes from all of the car insurers in Savannah will help you save considerable money. Through research, you can get the best auto insurance for new drivers that grants ample coverage without depleting your budget. Learning about this means thinking long and hard before deciding and having a strategy to save even more.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

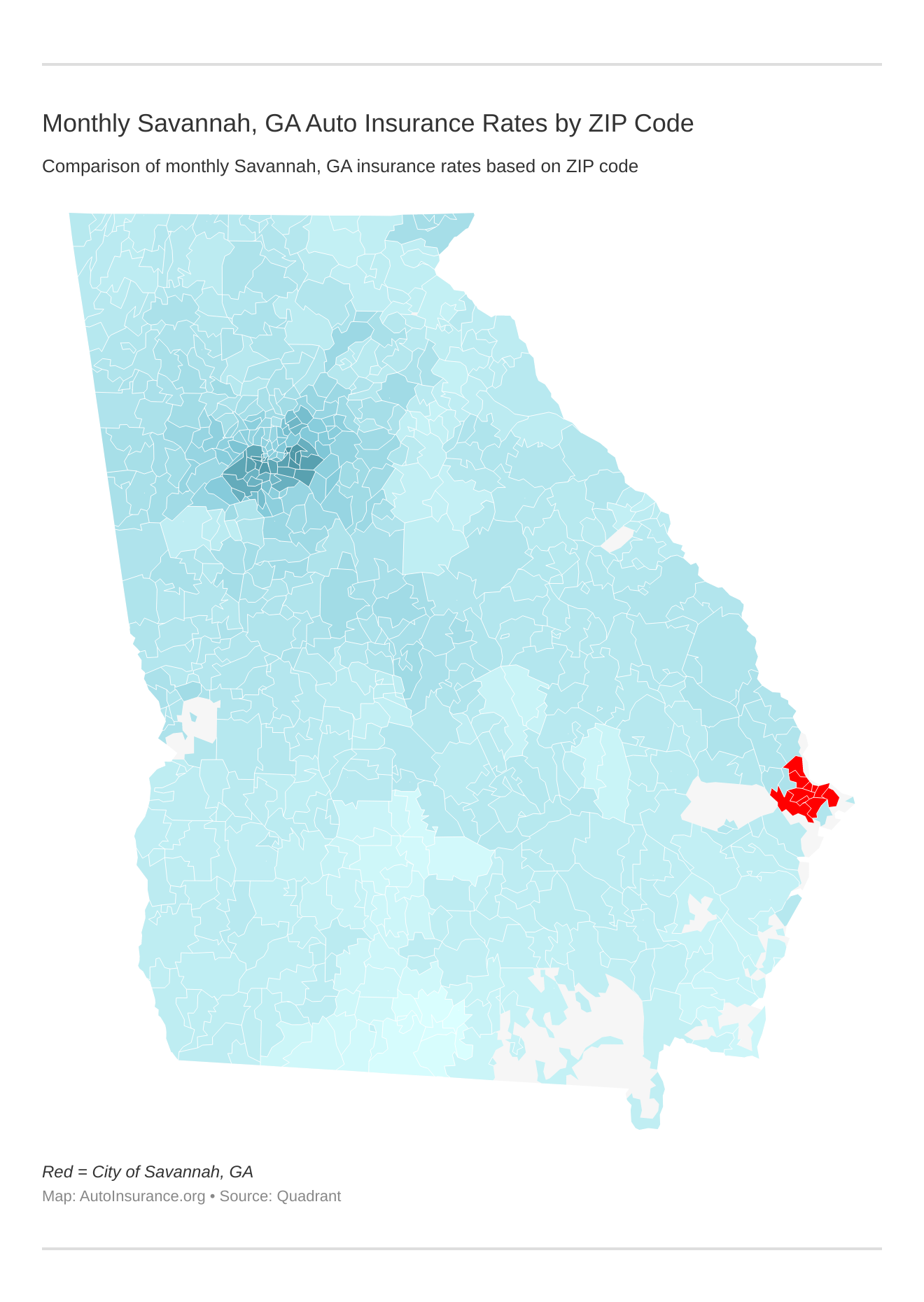

Monthly Savannah, GA Car Insurance Rates by ZIP Code

ZIP codes will play a significant role in your car insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly Savannah, Georgia auto insurance rates by ZIP Code below:

To wrap up, your ZIP code plays a big role in determining your car insurance rates in Savannah, GA, since it considers crime rates and local traffic. You can better understand how your location impacts your premiums by checking out the monthly auto insurance rates by ZIP code.

This is especially useful when searching for the best auto insurance for custom cars, as knowing how these factors affect rates will help you choose the right coverage for your unique needs.

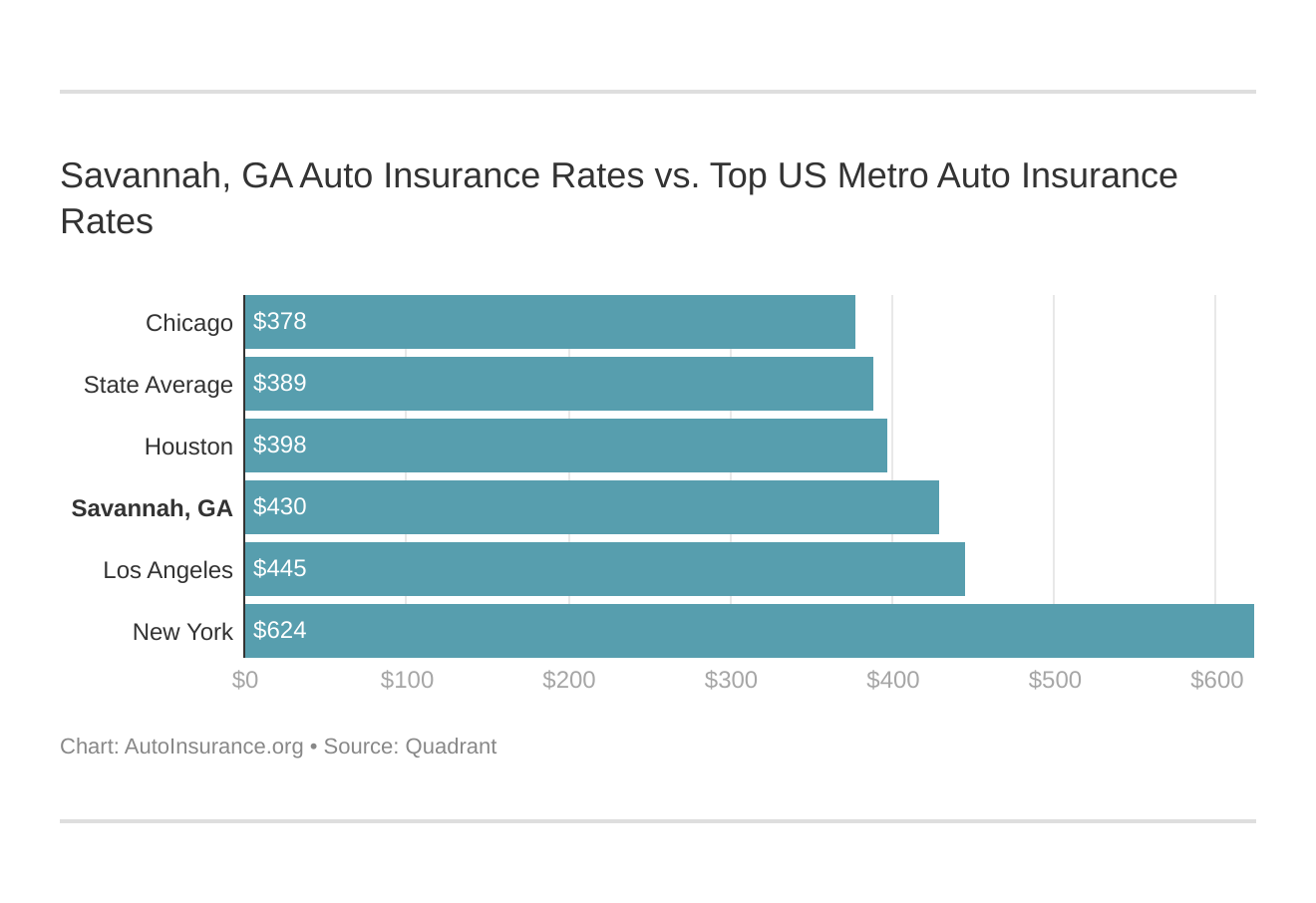

Savannah, GA Car Insurance Rates vs. Top US Metro Car Insurance Rates

You might wonder how my auto insurance rates in Savannah, Georgia, compare to those of other top US metro areas. We’ve got your answer below.

Looking for affordable Savannah, GA, auto insurance? Just enter your ZIP code into our free tool to compare rates instantly. It’s a great way to find the full overage auto insurance you need, ensuring you’re fully protected on the road.

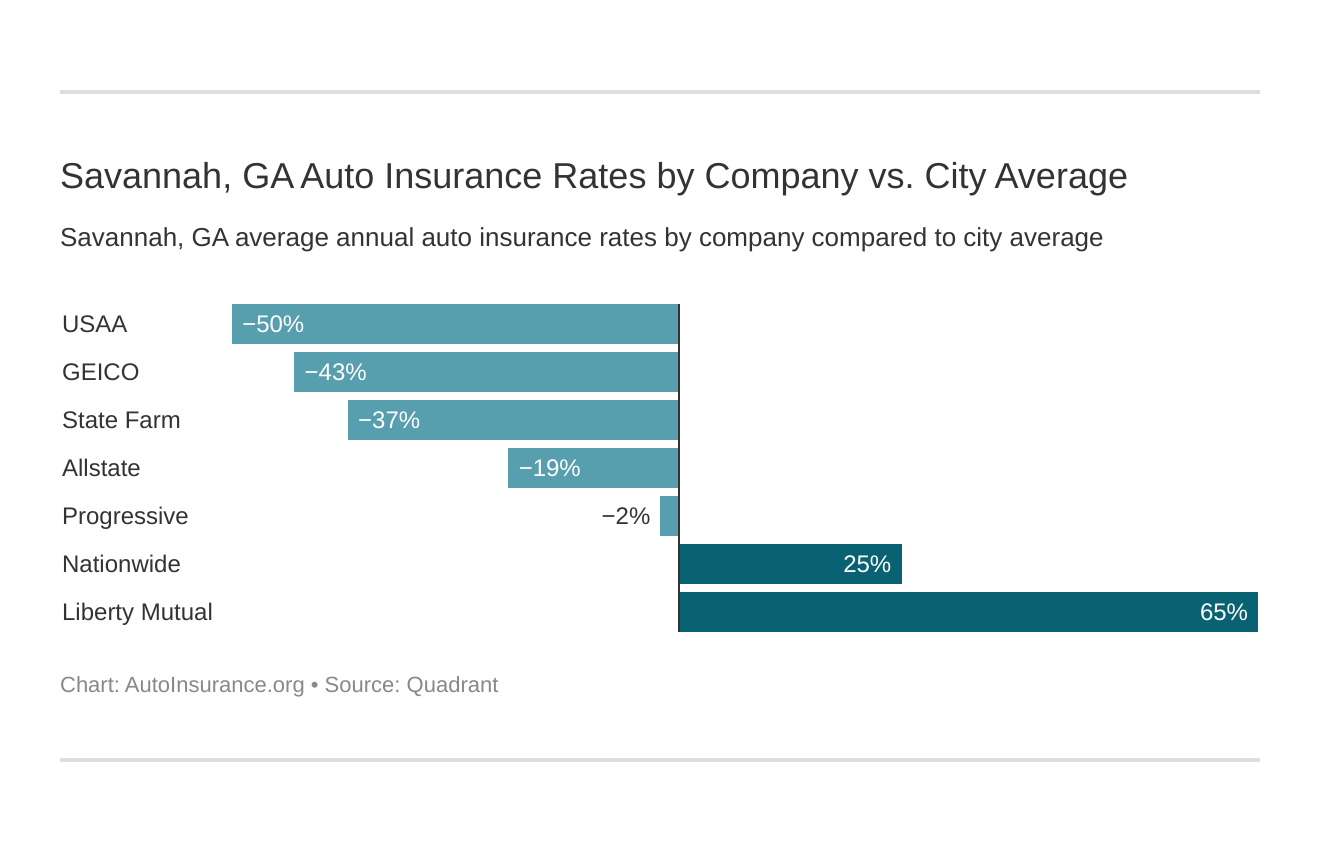

The Cheapest Auto Insurance Companies in Savannah, GA

When buying auto insurance in Savannah, GA, you must know which company offers the cheapest coverage. USAA and Geico offer the lowest rates in Savannah, but we’ve also pulled rates from some of the other major companies in the area for your review.

Which car insurance company in Savannah, GA, has the best rates? And how do those rates compare against the average Georgia car insurance company rates? We’ve got the answers below.

The top Savannah, GA, car insurance companies, ranked from cheapest to most expensive, are:

- USAA – $3,099.83

- Geico – $3,344.62

- State Farm – $3,548.57

- Allstate – $4,283.10

- Progressive – $5,086.26

- Nationwide – $6,657.01

- Liberty Mutual – $10,140.19

These numbers are a good baseline, but your payment will vary based on several factors, including age, marital status, coverage amount, credit score, driving history, and more.

Additionally, these rates are specific to Savannah, so if you live (or move to) Columbus, GA, these rates may change.

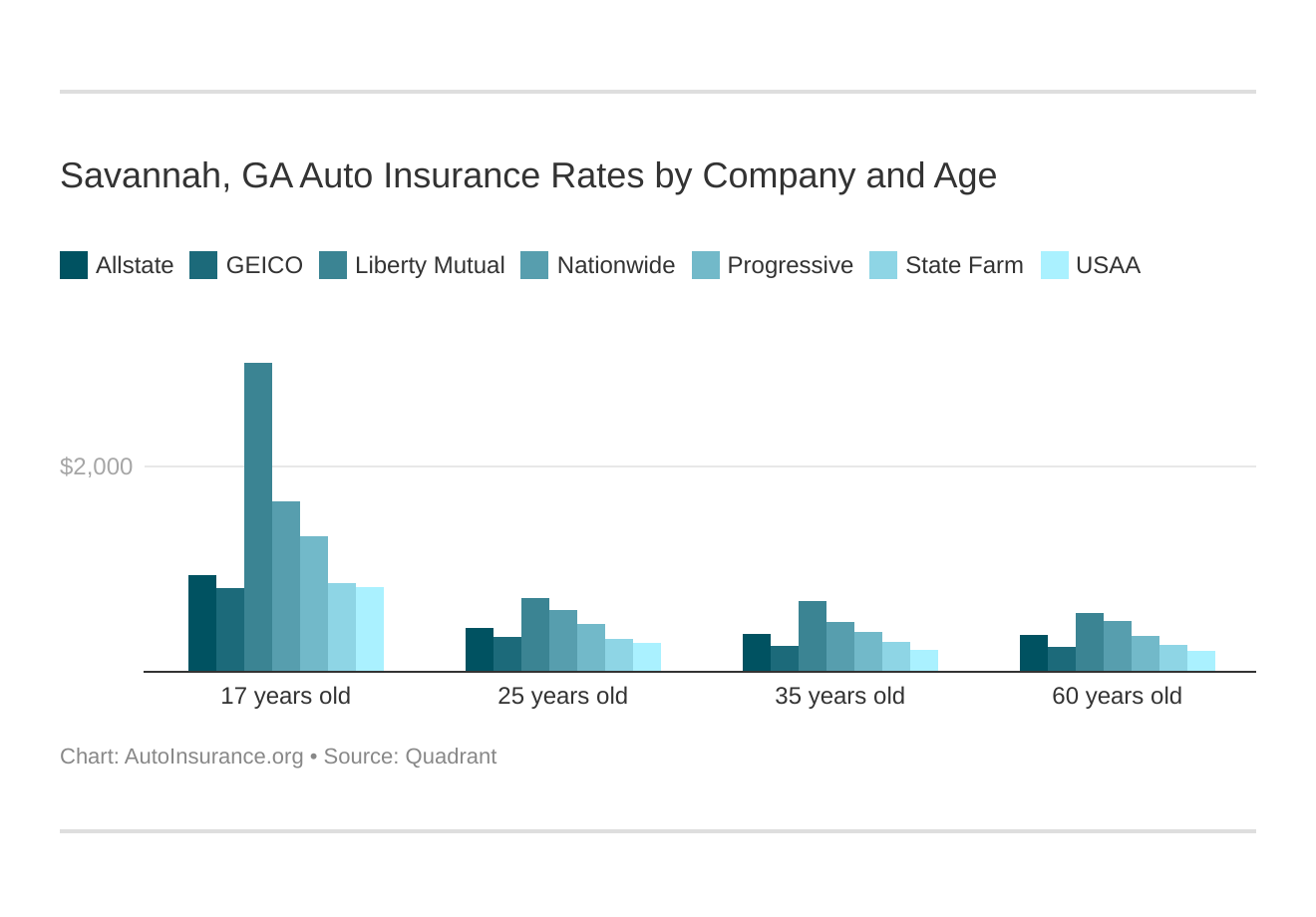

Savannah, GA, car insurance rates by company and age are an essential comparison because the top company for one age group may not be the best for another.

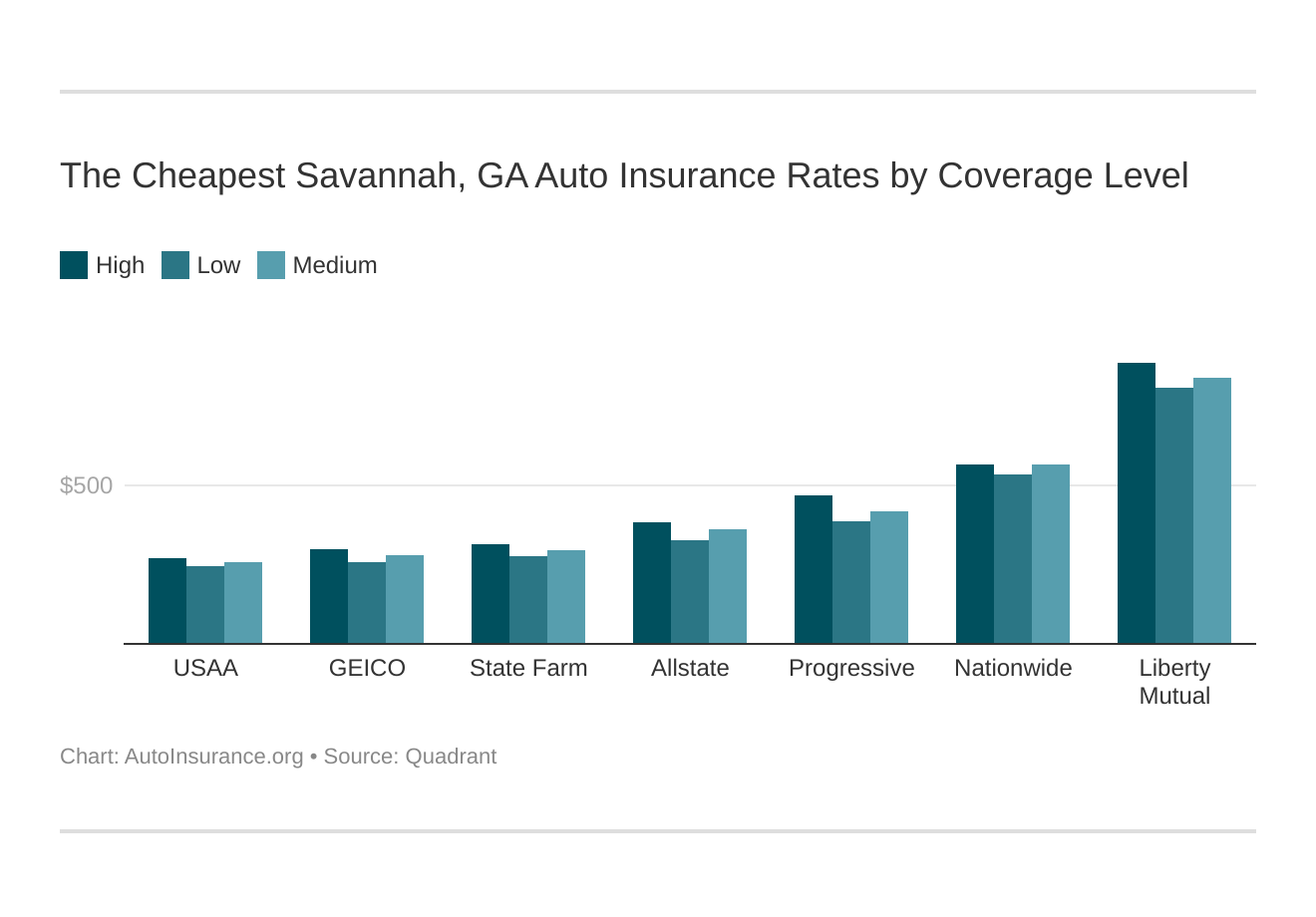

Your coverage level will majorly affect your Savannah car insurance rates. Find the cheapest Savannah, GA car insurance rates by coverage level below:

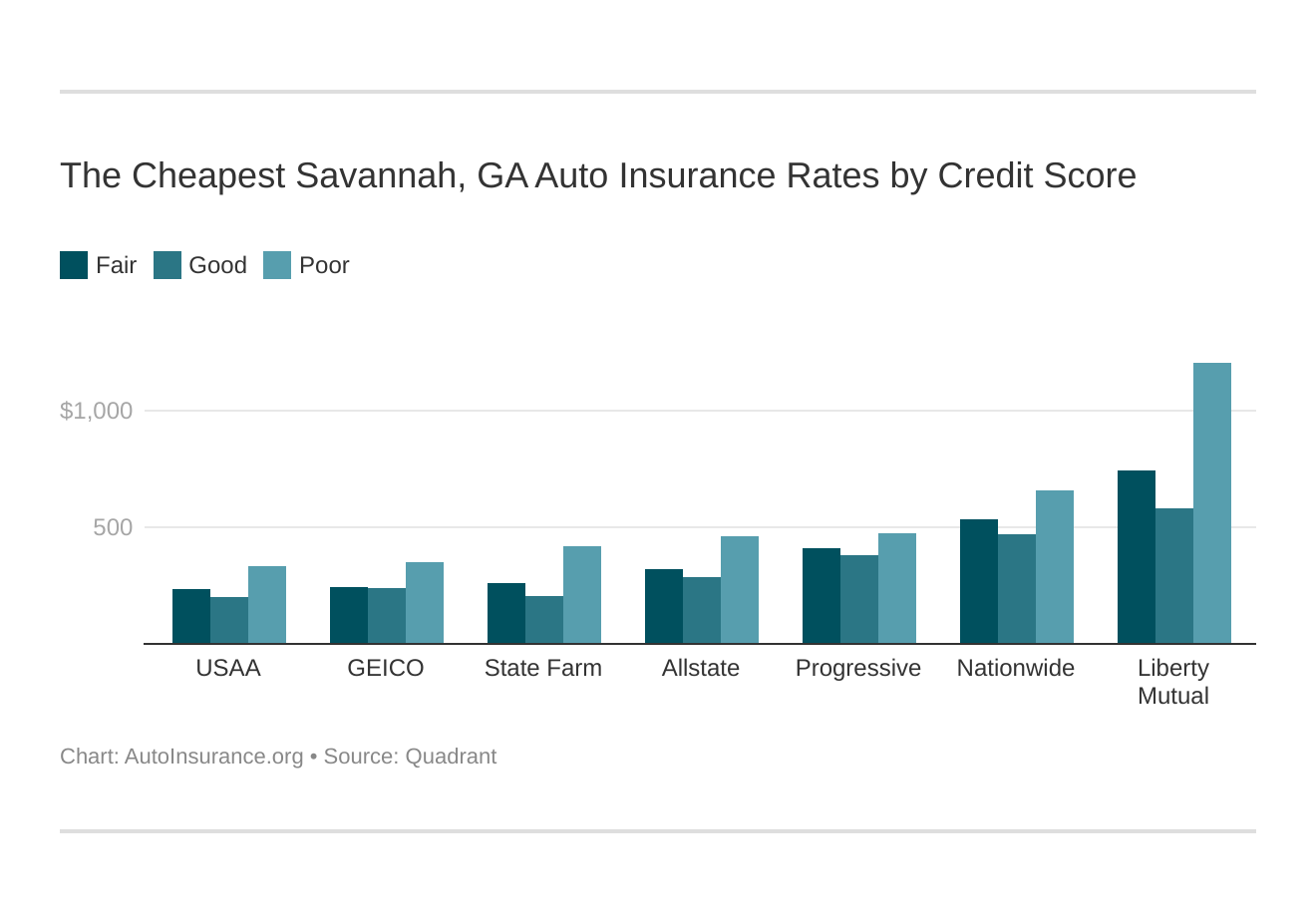

Your credit score will play a significant role in your Savannah car insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Savannah, GA car insurance rates by credit score below.

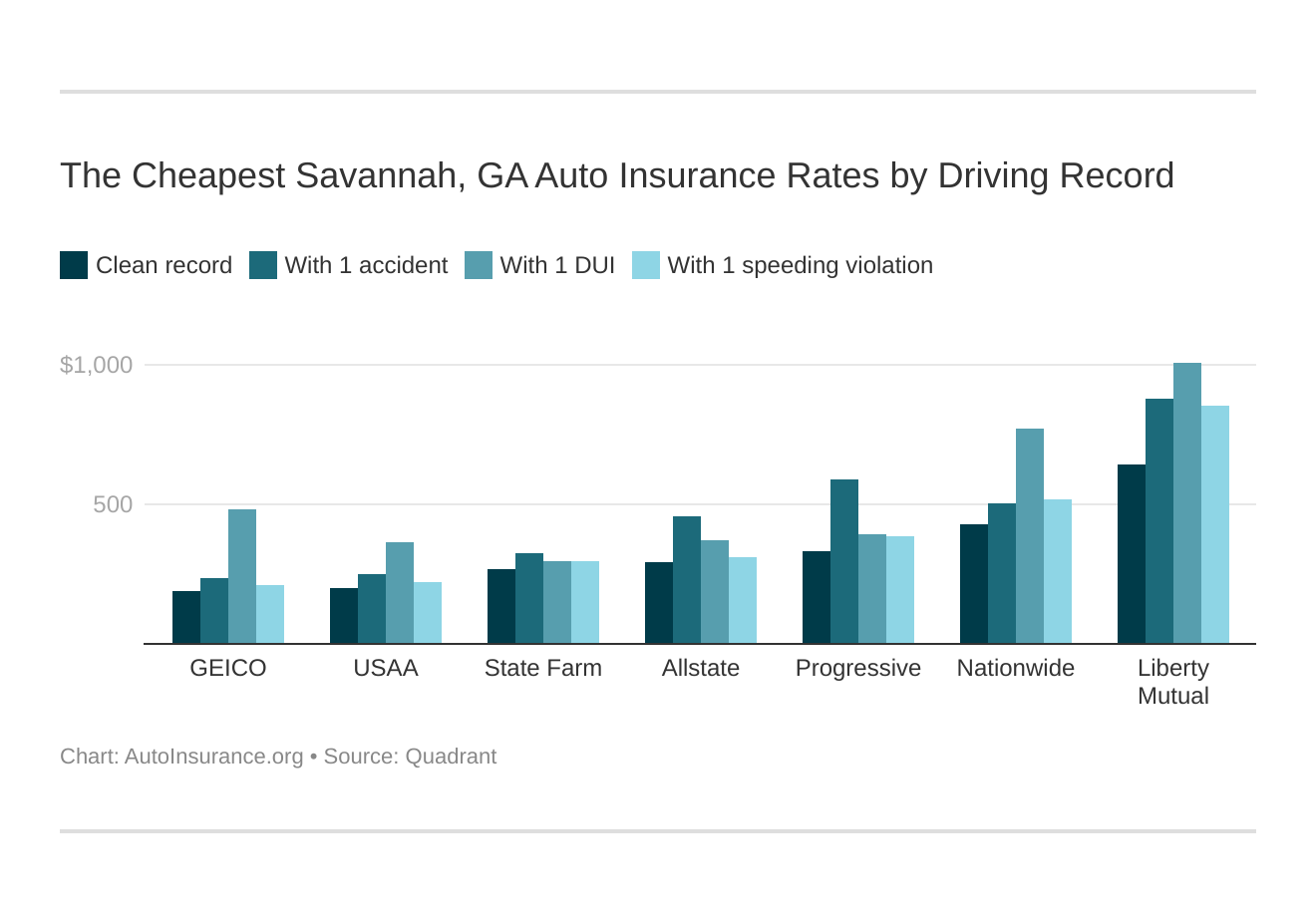

Your driving record will majorly affect your Savannah car insurance rates. For example, other factors aside, a Savannah, GA DUI may increase your car insurance rates by 40 to 50 percent. Find the cheapest Savannah, GA car insurance rates by driving record.

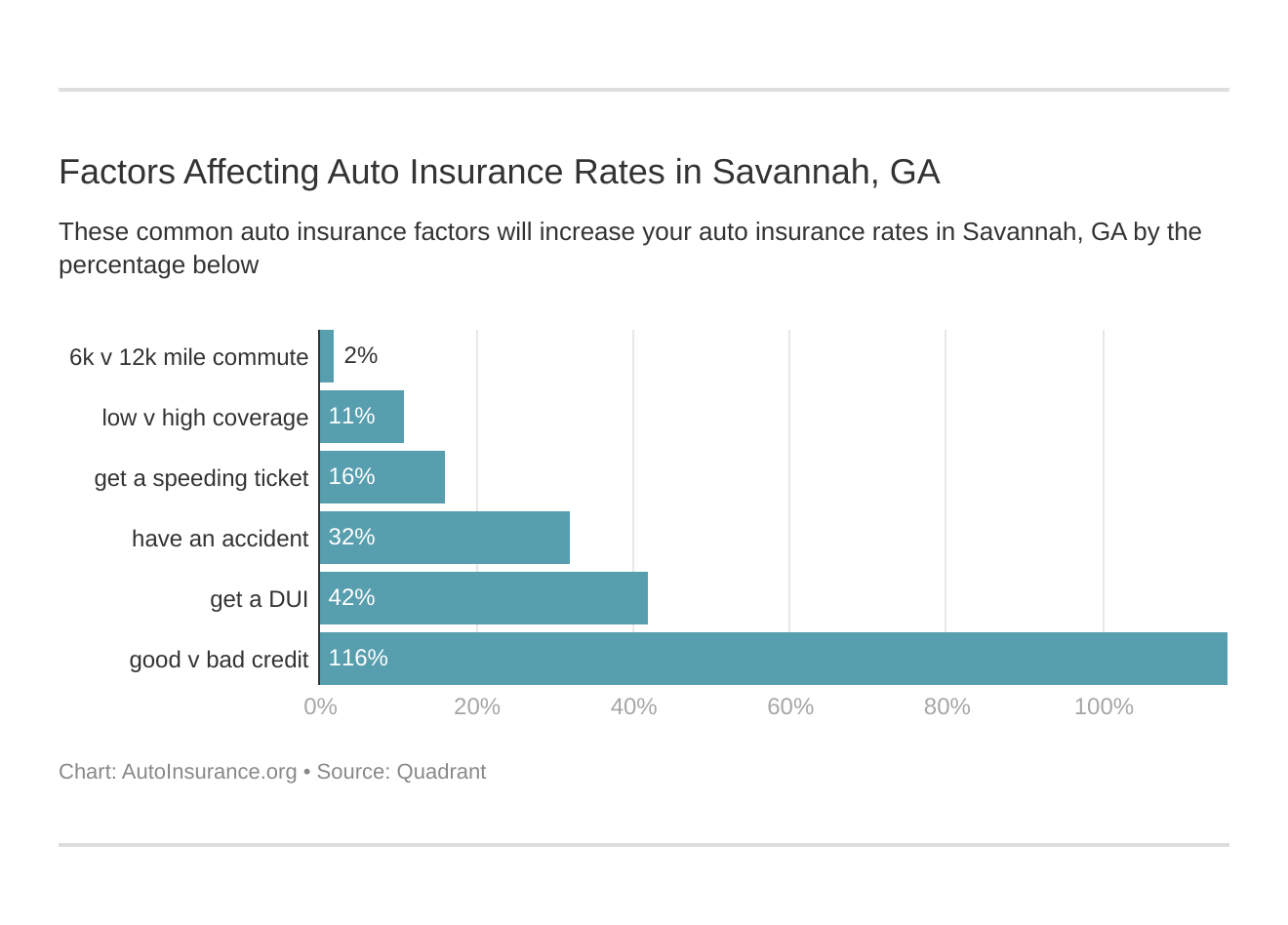

Factors affecting car insurance rates in Savannah, GA, may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Savannah, Georgia car insurance.

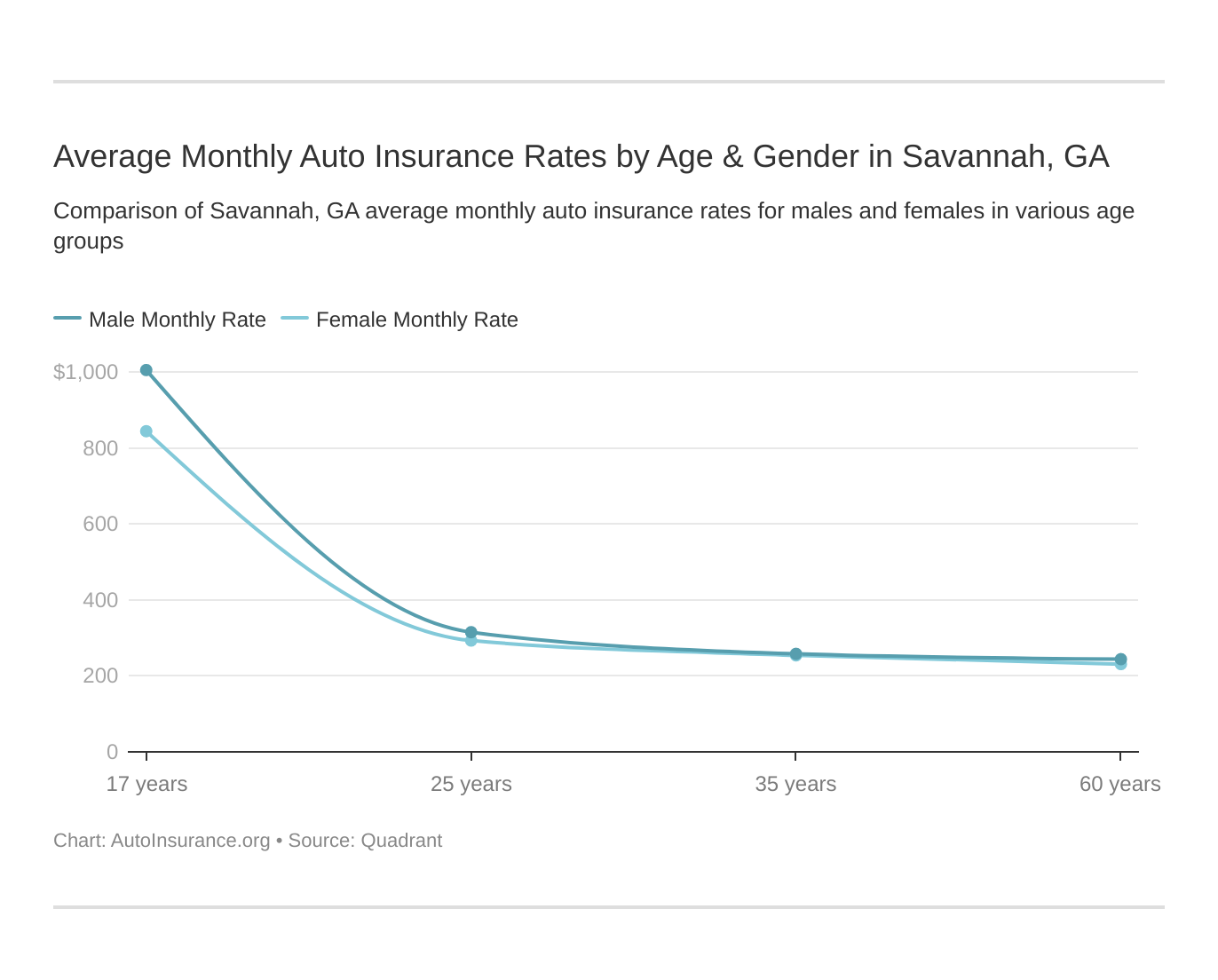

These states no longer use gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. However, age is still a major factor because young drivers are often considered high-risk. GA does use gender, so check out the average monthly car insurance rates by age and gender in Savannah, GA.

An idea of the average monthly auto insurance rates by age and gender in Savannah, GA, is crucial for making intelligent decisions about coverage. For example, younger males pay more than females, while older drivers benefit from lower premiums.

By knowing these trends, you can explore the best auto insurance by age and find the most affordable options for your situation. Understanding this information will help you make a more informed choice regarding your coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Required Auto Insurance Coverage in Savannah, GA

To drive legally as a Savannah resident, you must meet the minimum coverage requirements set in Georgia. Georgia requires resident drivers to carry at least:

- $25,000 per person and $50,000 per incident for bodily injury liability

- $25,000per incident for property damage

- $25,000 per person and $50,000 per incident for uninsured/underinsured motorist bodily injury

- $25,000 per person with a deductible of $250, $500, or $1,000 for uninsured/underinsured motorist property damage

Georgia follows an at-fault system, which means the person responsible for an accident must cover the damages and injuries. To avoid high out-of-pocket expenses, it’s a good idea to consider carrying more than the state’s minimum coverage. Comprehensive auto insurance can help protect you from unexpected costs in these situations, so it’s worth understanding the full benefits.

External factors like crime and traffic can affect your insurance rates. We’ve compiled some basic Savannah, GA, driving facts to give you the information you need to make an informed decision.

According to INRIX, Savannah is the 209th most congested city in the U.S.

Recent auto theft statistics from the FBI indicate that an average of 387 vehicles are stolen per 100,000 population in the Savannah-Chatham metropolitan area (statistics for Savannah alone were not available).

How to Secure the Best Savannah, GA Auto Insurance for Your Needs

When searching for the best auto insurance in Savannah, Georgia, it’s essential to consider various factors that can influence your choices. One of the most effective methods is exploring car insurance options in Savannah that cater to your needs.

By comparing prices and features from multiple insurance companies in Savannah, GA, you can find the most suitable coverage for your vehicle. Additionally, looking into cheap auto insurance in Savannah, GA, can lead you to significant savings, especially if you’re seeking average car insurance in GA prices without sacrificing quality coverage.

Understanding the local context can also help you make informed decisions. For example, the crime rate in Savannah, Georgia, can impact your car insurance premiums, as higher rates may lead to increased insurance costs.

You can also consider the help of auto insurance agent Savannah to navigate your options effectively. Gathering Savannah car insurance quotes can provide a clearer picture of what’s available.

Farmers is the best overall choice for Savannah drivers, offering competitive rates, excellent customer service, and comprehensive coverage starting at just $82 per month.Heidi Mertlich Licensed Insurance Agent

Whether you’re interested in auto insurance in Savannah, Georgia, or specific plans like accident insurance in Savannah, GA, knowing the zip code map can help you find the best coverage tailored to your area. Don’t forget to request auto insurance quotes in Savannah to ensure you get the best deal possible!

The easiest way to find affordable Savannah, GA, car insurance is to compare quotes from multiple companies and ask about discounts.

Understanding how to get a good driver auto insurance discount can help you save money, so read on for tips and insights that can lead you to the best deals. Before you go, enter your ZIP code in the free tool on this page to start comparing Savannah, GA, car insurance quotes today.

Frequently Asked Questions

What is auto insurance?

Auto insurance is a contract between a policyholder and an insurance provider that offers financial protection against physical damage or bodily injury resulting from a car accident or other incidents involving a vehicle. It covers repairs, medical expenses, and liability costs that may arise from accidents.

Reading about auto insurance discounts is important because understanding how these discounts work can help you save money while ensuring you have the coverage you need.

Is auto insurance mandatory in Savannah, GA?

Yes, auto insurance is mandatory in Savannah, GA, as it is in most states. The Georgia Department of Driver Services requires all drivers to carry a minimum amount of liability insurance coverage. Failure to comply with this requirement can result in penalties and potential legal consequences.

What is the minimum auto insurance coverage required in Savannah, GA?

In Savannah, GA, the minimum auto insurance coverage required is as follows:

- $25,000 bodily injury liability coverage per person

- $50,000 bodily injury liability coverage per accident

- $25,000 property damage liability coverage per accident

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

What does liability coverage mean?

Liability coverage is a component of auto insurance that pays for the costs associated with injuries to other people or damage to their property in an accident where you are at fault. It does not cover your own injuries or vehicle damage. The minimum liability coverage requirements in Savannah, GA, help ensure that you can financially compensate others for their losses if you cause an accident.

How are auto insurance rates determined in Savannah, GA?

Auto insurance rates in Savannah, GA are determined by various factors, including:

- Your driving record

- Your age and gender

- The type of vehicle you drive

- Your credit history

- The coverage options you select

- Your location (Savannah, GA) and the area’s crime rate and traffic congestion

Insurance providers use these factors, among others, to assess the level of risk you pose as a driver and calculate your premium accordingly. To understand how credit scores affect auto insurance rates, it’s important to understand how these assessments play a role in your insurance costs.

Can my auto insurance premium change over time?

Yes, your auto insurance premium can change over time. Insurance companies may review your policy annually and adjust your premium based on various factors, such as changes in your driving record, claims history, and the overall risk landscape. Additionally, factors such as inflation, insurance market conditions, and changes to state laws can also impact premium rates.

How much is car insurance in Savannah, Georgia?

The average car insurance cost in Savannah, GA, ranges from $1,300 to $1,800 annually, depending on factors like driving history and coverage options. Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

How can I lower my car insurance in Georgia?

You can lower your car insurance by comparing quotes, increasing deductibles, bundling policies, maintaining a clean driving record, and taking advantage of available discounts.

What happens if you don’t have car insurance in Georgia?

In Georgia, driving without car insurance can lead to fines reaching $1,000, a suspended license, and the necessity of acquiring an SR-22 Auto Insurance certificate, which might raise your insurance premiums. Reading this information is essential because understanding these consequences can help you make informed decisions about your insurance coverage.

What are the two types of insurance required by Georgia law?

Georgia law requires liability insurance, which covers damages to others if you’re at fault, and uninsured motorist coverage, which protects you if you’re in an accident with an uninsured driver.

How long do you have to insure a car in Georgia?

You must have insurance before registering your vehicle in Georgia, with no grace period for insuring a car after purchase.

Do you need insurance before buying a car in Georgia?

While not required before buying a car, you will need insurance to register and legally drive it in Georgia.

Is it expensive to buy a car in Georgia?

When considering the price of purchasing a car in Georgia, keep in mind that it can differ depending on the make, model, and condition of the vehicle; however, the state typically offers competitive prices. It’s also essential to account for taxes, registration fees, and insurance expenses.

This is important to understand, especially when looking into how to buy auto insurance online instantly—you’ll want to make sure you’re fully informed about all the associated costs.

Can I take insurance off my car if I’m not driving it in Georgia?

Yes, you can drop your insurance if not driving the car, but it’s advisable to keep at least liability coverage to avoid penalties if the vehicle is involved in an incident while uninsured.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.