Best Prestonsburg, Kentucky Auto Insurance in 2026 (Top 10 Companies Ranked)

State Farm, USAA, and Geico are the best for auto insurance in Prestonsburg, Kentucky, with rates starting at $75 per month. These leading providers offer superior coverage and competitive pricing, ensuring you get the best value and protection for your auto insurance needs in Prestonsburg.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated March 2025

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage in Prestonsburg Kentucky

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage in Prestonsburg Kentucky

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Prestonsburg Kentucky

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsState Farm, USAA, and Geico stands out as the best Prestonsburg, Kentucky auto insurance, each offering unique advantages. State Farm leads as the top pick overall with its robust coverage options and personalized service, perfect for those seeking a reliable insurance partner.

USAA shines with outstanding rates tailored for military families and veterans, providing exceptional value and service. Geico rounds out the trio with its highly competitive rates and easy-to-use digital tools, making it an excellent choice for budget-conscious drivers.

Our Top 10 Company Picks: Best Prestonsburg, Kentucky Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Reliable Coverage | State Farm | |

| #2 | 10% | A++ | Military Savings | USAA | |

| #3 | 15% | A++ | Affordable Rates | Geico | |

| #4 | 20% | A++ | Reliability Focused | Auto-Owners | |

| #5 | 25% | A+ | Flexible Coverage | Nationwide |

| #6 | 12% | A+ | Diverse Discounts | Progressive | |

| #7 | 10% | A+ | Comprehensive Plans | Allstate | |

| #8 | 10% | A | Customized Coverage | Liberty Mutual |

| #9 | 13% | A++ | Broad Coverage | Travelers | |

| #10 | 10% | A+ | High-Risk Drivers | National General |

These top providers each bring distinct strengths, ensuring you can find the best Kentucky auto insurance suited to your needs in Prestonsburg.

Before you buy Prestonsburg, Kentucky auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Prestonsburg, Kentucky auto insurance quotes.

- State Farm is the top pick, providing excellent coverage at $114/month

- Best Prestonsburg, Kentucky auto insurance fits local risks and regulations

- Local driving conditions affect insurance premiums in Prestonsburg

#1 – State Farm: Top Overall Pick

Pros

- Reliable Coverage: State Farm offers some of the best auto insurance coverage in Prestonsburg, Kentucky, ensuring reliable protection for your vehicle.

- Comprehensive Service: Known for its strong customer service, State Farm provides one of the best auto insurance experiences in Prestonsburg, Kentucky.

- Local Expertise: With a long-standing presence in Prestonsburg, State Farm understands local needs and offers tailored auto insurance solutions. Unlock details in our State Farm auto insurance review.

Cons

- Limited Customization: The options for customizing your auto insurance policy with State Farm might not be as extensive as some other providers in Prestonsburg, Kentucky.

- Variable Coverage: Coverage options and rates can vary widely, which may lead to inconsistencies in what is considered the best auto insurance in Prestonsburg, Kentucky.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Military Savings: USAA provides the best auto insurance in Prestonsburg, Kentucky, for military families, offering specialized savings and benefits. View additional details in our USAA auto insurance review.

- Top-Rated Service: Known for exceptional service, USAA is frequently rated as providing the best auto insurance experience in Prestonsburg, Kentucky.

- Comprehensive Coverage: USAA offers comprehensive coverage that stands out as some of the best auto insurance available in Prestonsburg, Kentucky.

Cons

- Eligibility Restrictions: USAA’s coverage is limited to military members and their families, which excludes non-military residents of Prestonsburg, Kentucky.

- Limited Policy Options: The variety of auto insurance policies available through USAA might not be as broad as what is offered by other top providers in Prestonsburg, Kentucky.

#3 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico is known for offering some of the best auto insurance rates in Prestonsburg, Kentucky, making it a cost-effective choice for drivers. Explore further in our Geico auto insurance review.

- Broad Accessibility: With wide-ranging accessibility, Geico provides one of the best options for auto insurance in Prestonsburg, Kentucky.

- Convenient Services: Geico’s user-friendly online tools and mobile app contribute to its reputation for providing the best auto insurance experience in Prestonsburg, Kentucky.

Cons

- Service Quality: Customer service experiences may vary, and some users in Prestonsburg, Kentucky, report less satisfaction with Geico compared to other providers.

- Claims Processing: There can be delays or complications with claims processing, which might affect its standing as the best auto insurance provider in Prestonsburg, Kentucky.

#4 – Auto-Owners: Best for Reliability Focused

Pros

- Reliable Coverage: Auto-Owners is recognized for offering reliable and robust auto insurance coverage, making it one of the best choices in Prestonsburg, Kentucky.

- Strong Customer Support: Known for excellent customer service, Auto-Owners provides one of the best auto insurance experiences in Prestonsburg, Kentucky. Read more in our Auto-Owners auto insurance review.

- Flexible Policies: Auto-Owners offers flexible insurance options that are tailored to meet the diverse needs of drivers in Prestonsburg, Kentucky.

Cons

- Online Tools: The availability of online tools and resources might not be as extensive as those provided by other top auto insurance companies in Prestonsburg, Kentucky.

- Higher Premiums: Auto-Owners’ premiums may be higher compared to some other auto insurance providers in Prestonsburg, Kentucky.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Flexible Coverage

Pros

- Flexible Coverage: Nationwide offers flexible auto insurance coverage that can be tailored to fit various needs, making it a top choice in Prestonsburg, Kentucky.

- Comprehensive Plans: Nationwide’s range of insurance plans includes options that are considered some of the best in Prestonsburg, Kentucky. See more details on our Nationwide auto insurance review.

- Local Expertise: With a strong understanding of local needs, Nationwide provides one of the best auto insurance solutions in Prestonsburg, Kentucky.

Cons

- Variable Premiums: The premiums and coverage options can vary widely, which might lead to inconsistencies in what is considered the best auto insurance in Prestonsburg, Kentucky.

- Service Variability: Some customers report variations in service quality, which can affect its overall standing as a leading provider in Prestonsburg, Kentucky.

#6 – Progressive: Best for Diverse Discounts

Pros

- Diverse Coverage Options: Progressive offers a variety of coverage options, making it one of the best choices for auto insurance in Prestonsburg, Kentucky.

- Innovative Features: Known for its innovative insurance features, Progressive provides a unique auto insurance experience in Prestonsburg, Kentucky.

- Convenient Access: Progressive’s user-friendly online tools and customer service contribute to its reputation as providing some of the best auto insurance in Prestonsburg, Kentucky. Find out more in our Progressive auto insurance review.

Cons

- Complex Policies: The variety of options and discounts available through Progressive can be complex to navigate, potentially affecting its ranking as the best auto insurance in Prestonsburg, Kentucky.

- Claims Process: There may be challenges or delays in the claims process that could impact its standing as a top auto insurance provider in Prestonsburg, Kentucky.

#7 – Allstate: Best for Comprehensive Plans

Pros

- Comprehensive Coverage: Allstate provides a range of comprehensive auto insurance plans that are among the best available in Prestonsburg, Kentucky.

- Strong Customer Service: Known for its high level of customer service, Allstate is considered one of the best providers in Prestonsburg, Kentucky. Read more in our Allstate auto insurance review.

- Tailored Solutions: Allstate offers tailored insurance solutions that cater to diverse needs in Prestonsburg, Kentucky.

Cons

- Higher Premiums: Premiums with Allstate can be higher compared to some other insurance providers in Prestonsburg, Kentucky.

- Customer Experience: Some users report mixed experiences with customer service, which can affect its reputation as the best auto insurance provider in Prestonsburg, Kentucky.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customized Coverage

Pros

- Customized Coverage: Liberty Mutual offers highly customizable auto insurance policies, making it one of the best choices in Prestonsburg, Kentucky.

- Varied Options: The range of coverage options available through Liberty Mutual can meet various needs, positioning it as a top provider in Prestonsburg, Kentucky. Get more information in our Liberty Mutual auto insurance review.

- Reputable Service: Liberty Mutual’s strong reputation for service contributes to its standing as a leading auto insurance provider in Prestonsburg, Kentucky.

Cons

- Premium Costs: Insurance premiums with Liberty Mutual can be higher than those of some competitors in Prestonsburg, Kentucky.

- Service Consistency: There may be variability in service quality, which could affect its overall reputation as the best auto insurance provider in Prestonsburg, Kentucky.

#9 – Travelers: Best for Broad Coverage

Pros

- Broad Coverage Options: Travelers offers extensive auto insurance coverage that is among the best in Prestonsburg, Kentucky.

- Strong Customer Support: Known for its responsive customer service, Travelers is considered one of the best auto insurance providers in Prestonsburg, Kentucky. Discover more in our Travelers auto insurance review.

- Flexible Policies: Travelers provides flexible insurance policies that cater to diverse needs, making it a strong choice in Prestonsburg, Kentucky.

Cons

- Premiums: The cost of premiums may be higher compared to some other insurance providers in Prestonsburg, Kentucky.

- Service Quality: Variations in service quality may impact its ranking as the best auto insurance provider in Prestonsburg, Kentucky.

#10 – National General: Best for High-Risk Drivers

Pros

- Specialized Coverage: National General is known for providing some of the best coverage options for high-risk drivers in Prestonsburg, Kentucky. Learn more in our National General auto insurance review.

- Wide Accessibility: Offers a range of auto insurance options that cater to diverse needs in Prestonsburg, Kentucky.

- Responsive Service: National General’s customer service is designed to meet the needs of high-risk drivers effectively.

Cons

- Premium Costs for High-Risk Drivers: Premiums for high-risk drivers can be higher compared to standard coverage options in Prestonsburg, Kentucky.

- Limited Coverage Options: The range of coverage options may be more limited compared to other top providers in Prestonsburg, Kentucky.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Auto Insurance in Prestonsburg, Kentucky

In Prestonsburg, Kentucky, maintaining adequate auto insurance is not just a legal requirement but also a crucial step in protecting yourself and others on the road. Kentucky’s minimum auto insurance laws stipulate that all drivers must have bodily injury liability coverage of at least $25,000 per person and $50,000 per accident.

State Farm offers exceptional value for drivers seeking comprehensive coverage and competitive rates.Laura Berry Former Licensed Insurance Producer

This coverage helps manage medical expenses and other costs if you’re responsible for injuring someone in a crash. Additionally, property damage liability coverage must be at least $25,000 to cover repair costs for any damage you cause to another person’s vehicle or property. By meeting these minimum requirements, you ensure compliance with state laws and provide a safety net against the financial impact of unexpected accidents.

Prestonsburg, Kentucky Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $124 | $148 |

| Auto-Owners | $75 | $109 |

| Geico | $88 | $129 |

| Liberty Mutual | $123 | $156 |

| National General | $80 | $126 |

| Nationwide | $97 | $131 |

| Progressive | $117 | $142 |

| State Farm | $78 | $114 |

| Travelers | $122 | $164 |

| USAA | $76 | $140 |

Explore the monthly auto insurance rates in Prestonsburg, KY, featuring key providers like State Farm, USAA, and Geico. State Farm offers a competitive $78 for minimum coverage and $114 for full coverage. USAA provides the most affordable minimum coverage at $76, with full coverage costing $140.

Geico’s rates are $88 for minimum and $129 for full coverage, making it a solid choice for balanced coverage. For the best fit for your needs, consider these options and find the coverage that suits you best.

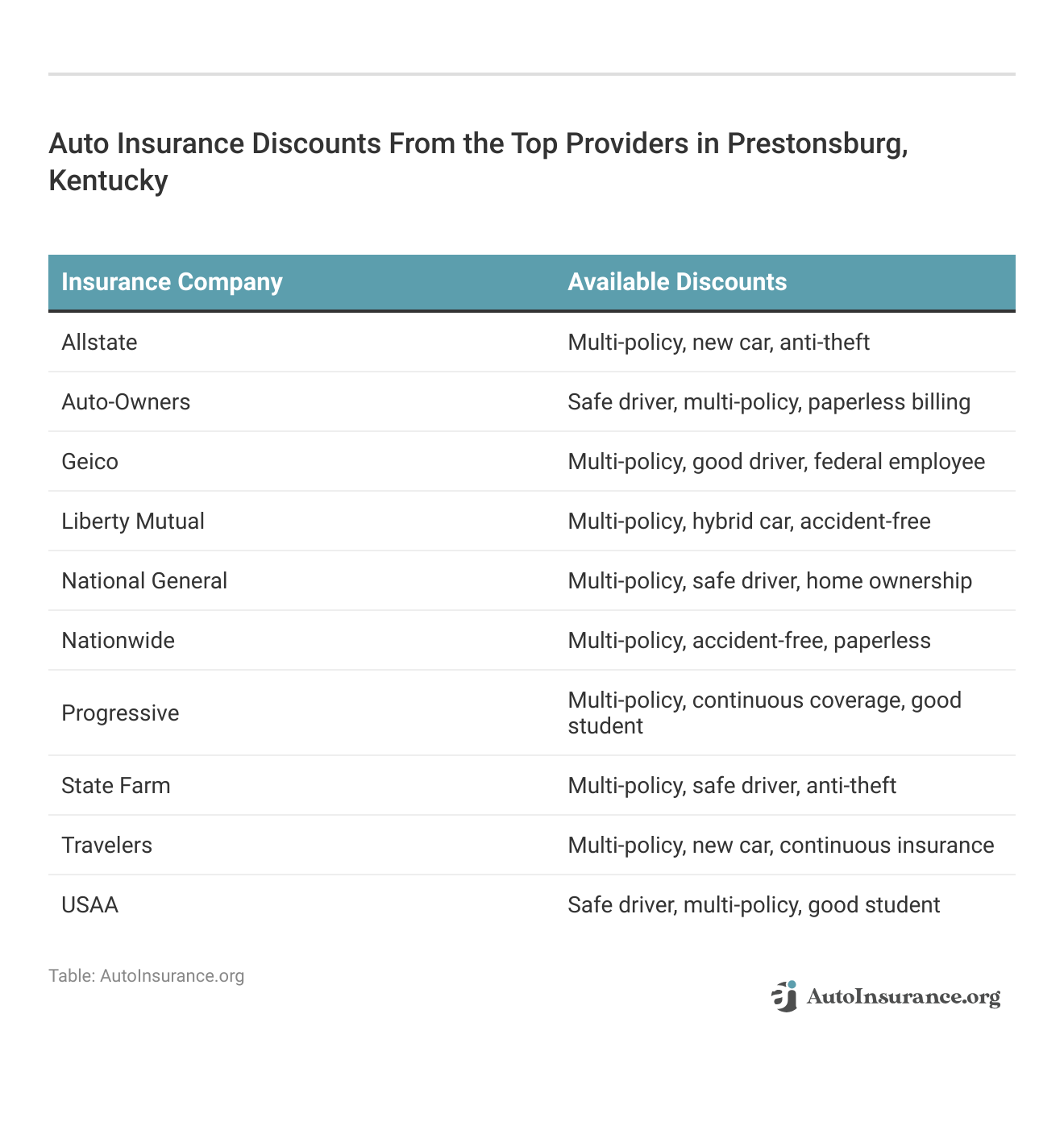

Know what types of auto insurance discounts major providers are offering in Prestonsburg, Kentucky. Our comprehensive overview lists ten major providers and the unique savings available to you—multi-policy and safe driver discounts, plus rewards for new cars and anti-theft devices. Learn how to maximize your savings through these tailored discounts.

Prestonsburg, Kentucky Auto Insurance by Age, Gender, and Marital Status

Auto insurance premiums in Prestonsburg, Kentucky, can vary significantly due to non-driving factors that affect auto insurance rates, such as age, gender, and marital status. Understanding how these demographics influence insurance rates can help you make more informed decisions about your coverage. Below is a breakdown of monthly insurance rates for different demographics provided by several major insurers.

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $449 | $442 | $413 | $439 | $1,653 | $1,831 | $485 | $506 |

| Geico | $366 | $338 | $383 | $347 | $742 | $868 | $296 | $255 |

| Liberty Mutual | $373 | $407 | $316 | $357 | $1,525 | $1,695 | $387 | $401 |

| Nationwide | $464 | $458 | $420 | $434 | $1,041 | $1,278 | $528 | $545 |

| Progressive | $276 | $261 | $250 | $250 | $1,403 | $1,591 | $343 | $345 |

| State Farm | $204 | $204 | $180 | $180 | $546 | $693 | $225 | $180 |

| Travelers | $335 | $341 | $330 | $331 | $1,715 | $2,788 | $350 | $406 |

| USAA | $174 | $175 | $157 | $161 | $460 | $484 | $221 | $243 |

Discover the variations in auto insurance premiums across different age groups and genders with this comprehensive breakdown from various providers in Prestonsburg. The data reveals how demographic factors significantly impact insurance rates, providing valuable insights into the cost differences.

Prestonsburg, Kentucky Auto Insurance for Teen Drivers

Securing affordable auto insurance for teen drivers in Prestonsburg, Kentucky, can be challenging due to higher premiums for younger, less experienced drivers. To help you navigate this, here’s a breakdown of the monthly rates for 17-year-old drivers in Prestonsburg, including differences by gender and provider

Prestonsburg, Kentucky Teen Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| Allstate | $449 | $442 |

| Geico | $366 | $338 |

| Liberty Mutual | $373 | $407 |

| Nationwide | $464 | $458 |

| Progressive | $276 | $261 |

| State Farm | $204 | $204 |

| Travelers | $335 | $341 |

| USAA | $174 | $175 |

This is a straightforward comparison of auto insurance rates from top providers, making it easier to identify the best deals for teen drivers in Prestonsburg. Whether you’re looking to save on premiums or find the most budget-friendly option, this guide highlights the most cost-effective choices available.

Prestonsburg, Kentucky Auto Insurance for Seniors

Seniors in Prestonsburg, Kentucky can find a range of affordable auto insurance options. Here’s a breakdown of the monthly rates for drivers aged 60, highlighting the differences in premiums based on gender and insurance provider.

Prestonsburg, Kentucky Senior Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| Allstate | $485 | $506 |

| Geico | $296 | $255 |

| Liberty Mutual | $387 | $401 |

| Nationwide | $528 | $545 |

| Progressive | $343 | $345 |

| State Farm | $225 | $180 |

| Travelers | $350 | $406 |

| USAA | $221 | $243 |

Comparing these rates, seniors in Prestonsburg can make informed choices of their auto insurance coverage. With rates from budget plans to more inclusive ones, knowledge of this cost makes sure the senior has the right insurance solution needed.

Prestonsburg, Kentucky Auto Insurance By Driving Record

Driving record has a big impact on your auto insurance rates. See the annual auto insurance rates for a bad record in Prestonsburg, Kentucky compared to the annual auto insurance rates with a clean record in Prestonsburg, Kentucky.

Prestonsburg, Kentucky Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $644 | $839 | $899 | $727 |

| Geico | $271 | $477 | $716 | $332 |

| Liberty Mutual | $568 | $879 | $680 | $604 |

| Nationwide | $510 | $665 | $846 | $563 |

| Progressive | $486 | $728 | $554 | $591 |

| State Farm | $287 | $333 | $310 | $310 |

| Travelers | $717 | $738 | $1,075 | $770 |

| USAA | $195 | $277 | $330 | $235 |

Your driving record is one of the primary factors that can cause your monthly auto insurance premiums to vary between different carriers.

The cleaner your driving record, the lower the premiums usually are. On the other hand, having accidents, DUIs, or traffic tickets can increase the cost drastically.

Prestonsburg, Kentucky Auto Insurance Rates After a DUI

Getting the cheapest auto insurance after a DUI in Prestonsburg, Kentucky isn’t easy. To make that easier, we’ve compared prices for DUI-related auto insurance available in Prestonsburg and listed them below as monthly payments so that you are better equipped to find the best deal for your situation.

Prestonsburg, Kentucky DUI Auto Insurance Monthly Rates by Provider

| Insurance Company | Rates |

|---|---|

| Allstate | $899 |

| Geico | $716 |

| Liberty Mutual | $680 |

| Nationwide | $846 |

| Progressive | $554 |

| State Farm | $310 |

| Travelers | $1,075 |

| USAA | $330 |

These figures represent the monthly costs of auto insurance for drivers with a DUI conviction in Prestonsburg, Kentucky. They illustrate a spectrum of options across various insurance companies, offering insights into how rates can vary significantly.

State Farm stands out with its personalized service and robust coverage options, making it a top choice for reliable auto insurance.Dani Best Licensed Insurance Producer

By reviewing these rates, you can identify the most affordable and suitable insurance plans based on your budget and coverage needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Prestonsburg, Kentucky Auto Insurance By Credit History

Your credit history significantly impacts your auto insurance rates in Prestonsburg, Kentucky. To help you find the best rates, we’ve analyzed how different credit scores affect insurance costs from various providers. Here’s a breakdown of annual auto insurance rates in Prestonsburg by credit score:

Prestonsburg, Kentucky Auto Insurance by Provider & Credit History

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $1,048 | $704 | $579 |

| Geico | $738 | $369 | $240 |

| Liberty Mutual | $982 | $597 | $469 |

| Nationwide | $793 | $615 | $529 |

| Progressive | $658 | $575 | $536 |

| State Farm | $444 | $272 | $214 |

| Travelers | $921 | $778 | $775 |

| USAA | $385 | $216 | $176 |

Understanding the impact of your credit history on auto insurance rates allows you to make informed decisions and find opportunities to save significantly. By comparing rates across different credit scores, you can better assess how improving your credit can lead to lower premiums and potentially identify the most cost-effective insurance options for your situation.

Prestonsburg, Kentucky Auto Insurance Rates By ZIP Code

Auto insurance rates by ZIP code in Prestonsburg, Kentucky can vary. Compare the annual cost of auto insurance by ZIP code in Prestonsburg, Kentucky to see how car insurance rates are affected by location.

Prestonsburg, Kentucky Auto Insurance Monthly Rates by ZIP Code

| ZIP Code | Rates |

|---|---|

| 41653 | $518 |

Comparing auto insurance rates by ZIP code in Prestonsburg, Kentucky, may help you make more informed decisions about your insurance. Knowing how much your location does affect the cost of a premium is what will let you get cheap options catering mostly to your region.

For correct pricing and a tailored quote, consider getting multiple quotes based on your exact ZIP code to acquire the best value for your insurance needs.

Prestonsburg, Kentucky Auto Insurance Rates By Commute

Your commute length and annual mileage can significantly impact your auto insurance rates in Prestonsburg, Kentucky. To help you find the most budget-friendly options, we’ve compiled a comparison of annual insurance costs based on different mileage levels. Discover the best rates for various annual mileage scenarios in Prestonsburg.

Prestonsburg, Kentucky Auto Insurance Monthly Rates by Provider & Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $777 | $777 |

| Geico | $445 | $453 |

| Liberty Mutual | $683 | $683 |

| Nationwide | $646 | $646 |

| Progressive | $590 | $590 |

| State Farm | $303 | $317 |

| Travelers | $825 | $825 |

| USAA | $249 | $269 |

This table offers a detailed snapshot of monthly auto insurance rates across various annual mileage levels, giving you a comprehensive look at how each provider stacks up.

By comparing these rates, you can easily pinpoint which insurance company delivers the best value tailored to your specific driving patterns and mileage needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Cheapest Prestonsburg, Kentucky Auto Insurance Companies

When searching for affordable auto insurance in Prestonsburg, Kentucky, it’s crucial to compare rates from various providers to ensure you’re getting the best deal. The top companies offering the cheapest auto insurance in Prestonsburg include USAA, Geico, and State Farm, with annual rates starting as low as $195.

Below is a table listing the leading providers and their respective rates to help you find the best option for your budget.

The Cheapest Prestonsburg, Kentucky Auto Insurance Companies

| Insurance Company | Rates |

|---|---|

| USAA | $195 |

| Geico | $271 |

| State Farm | $287 |

| Progressive | $486 |

| Nationwide | $510 |

| Liberty Mutual | $568 |

| Allstate | $644 |

| Travelers | $717 |

By comparing these auto insurance rates in Prestonsburg, Kentucky, you can make an informed decision that suits your financial needs. Whether you prioritize the lowest price with USAA or prefer the coverage options from other providers like Geico or State Farm, this breakdown gives you a clear picture of your options.

Don’t hesitate to reach out to these companies to explore discounts and tailor a policy that offers both affordability and the coverage you need.

Factors Influencing Auto Insurance Rates in Prestonsburg, Kentucky

Auto insurance rates in Prestonsburg, Kentucky, can vary significantly due to several factors that affect auto insurance rates unique to the area. Understanding these factors that affect auto insurance rates can help you get a clearer picture of what influences your insurance premiums.

Local Risk Factors

Prestonsburg, Kentucky’s auto insurance rates are influenced by local risk factors such as traffic congestion and vehicle theft rates. Areas with higher traffic density or elevated crime rates, particularly vehicle theft, often see increased insurance premiums. These local risks contribute to the overall cost of auto insurance in the city.

Prestonsburg Commute Time

Commute time plays a crucial role in determining auto insurance rates. In cities where drivers experience longer commutes, insurance costs are generally higher. For Prestonsburg, Kentucky, the average commute length is approximately 16.0 minutes, as reported by City-Data. This relatively short commute can potentially keep insurance rates lower compared to cities with longer average commute times.

Understanding these factors can help you anticipate and manage your auto insurance costs more effectively in Prestonsburg.

Compare Prestonsburg, Kentucky Auto Insurance Quotes

When selecting auto insurance in Prestonsburg, Kentucky, comparing quotes from multiple insurance companies is essential to finding the best coverage at the most competitive rates. Each insurer offers different pricing, discounts, and coverage options, so evaluating a variety of quotes will help you make an informed decision.

To get started, simply enter your ZIP code below. You will receive free, customized auto insurance quotes tailored to your specific needs and preferences in Prestonsburg. By comparing these quotes, you can identify the most cost-effective insurance plans and ensure you have the right coverage for your vehicle and personal circumstances. Take advantage of this opportunity to secure the best auto insurance deal available in your area.

Frequently Asked Questions

How often should I review my auto insurance policy in Prestonsburg, Kentucky?

It’s advisable to review your auto insurance policy annually or after significant life changes, such as moving, purchasing a new vehicle, or changes in your driving habits. Regular reviews ensure you maintain the best coverage for your needs and the best Prestonsburg, Kentucky auto insurance rates.

Can I get comprehensive coverage for my vehicle in Prestonsburg, Kentucky?

Yes, comprehensive coverage is available for vehicles in Prestonsburg, Kentucky. This type of coverage protects against damage not caused by a collision, such as theft, vandalism, or natural disasters. It’s one of the coverage options to consider when looking for the best Prestonsburg, Kentucky auto insurance.

For more detailed information, refer to our in-depth guide titled “Comprehensive Auto Insurance Defined.”

What is the most basic car insurance?

The minimum amount of car insurance you’ll typically need is state-required liability coverage. This allows you to pay for some, if not all, injuries and damages you’re liable for in an accident.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code below into our comparison tool today.

How can I get a lower auto insurance rate in Prestonsburg, Kentucky?

Improving your chances of getting a lower rate involves maintaining a clean driving record, improving your credit score, and taking advantage of available discounts. Additionally, choosing a higher deductible and evaluating your coverage needs regularly can help manage your insurance costs effectively.

How can I find affordable auto insurance in Prestonsburg, Kentucky?

To find affordable auto insurance in Prestonsburg, Kentucky, compare quotes from multiple providers, consider bundling policies, and look for discounts such as safe driver or multi-vehicle discounts. The best Prestonsburg, Kentucky auto insurance options often balance cost and coverage.

For a deeper understanding, review our thorough guide called “How to Save Money by Bundling Insurance Policies.”

What is full coverage in Kentucky?

Sometimes, a complete package of car insurance is called full coverage, but what does that mean in Kentucky? Here’s the word from our lawyers. Full coverage is a shorthand for a combination of liability, collision, and comprehensive insurance.

Are there auto insurance discounts in Prestonsburg, Kentucky?

Yes, many auto insurance providers offer discounts in Prestonsburg, Kentucky, such as for safe driving, multi-car policies, or good student discounts. Checking with insurers about these discounts can help you secure the best Prestonsburg, Kentucky auto insurance rates.

What is the best auto insurance company in Prestonsburg, Kentucky?

The best auto insurance company in Prestonsburg, Kentucky, is determined by various factors including coverage options, customer service, and cost. Companies such as State Farm, Geico, and Allstate are often recognized for providing top-notch coverage and competitive rates in the area.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

What factors affect auto insurance rates in Prestonsburg, Kentucky?

Auto insurance rates in Prestonsburg, Kentucky, are influenced by factors such as your driving record, the type of vehicle you drive, your age, and the level of coverage you choose. Maintaining a clean driving record and opting for higher deductibles can help lower rates.

For additional details, see our extensive guide titled “Factors That Affect Auto Insurance Rates.”

How does my credit score affect auto insurance rates in Prestonsburg, Kentucky?

In Prestonsburg, Kentucky, as in many areas, your credit score can impact your auto insurance premium. A higher credit score typically leads to lower premiums, while a lower score might result in higher rates. Improving your credit score can potentially help reduce your insurance costs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.