Pay-Per-Mile Insurance in 2026 (Coverage Explained)

Pay-per-mile insurance gives low-mileage drivers a flexible option by charging a base rate plus a per-mile fee. An app or device tracks mileage, but pay-per-mile insurance rates vary by company. Some insurers charge as low as $0.02 per mile. Coverage options include liability-only or full, depending on the policy.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated March 2025

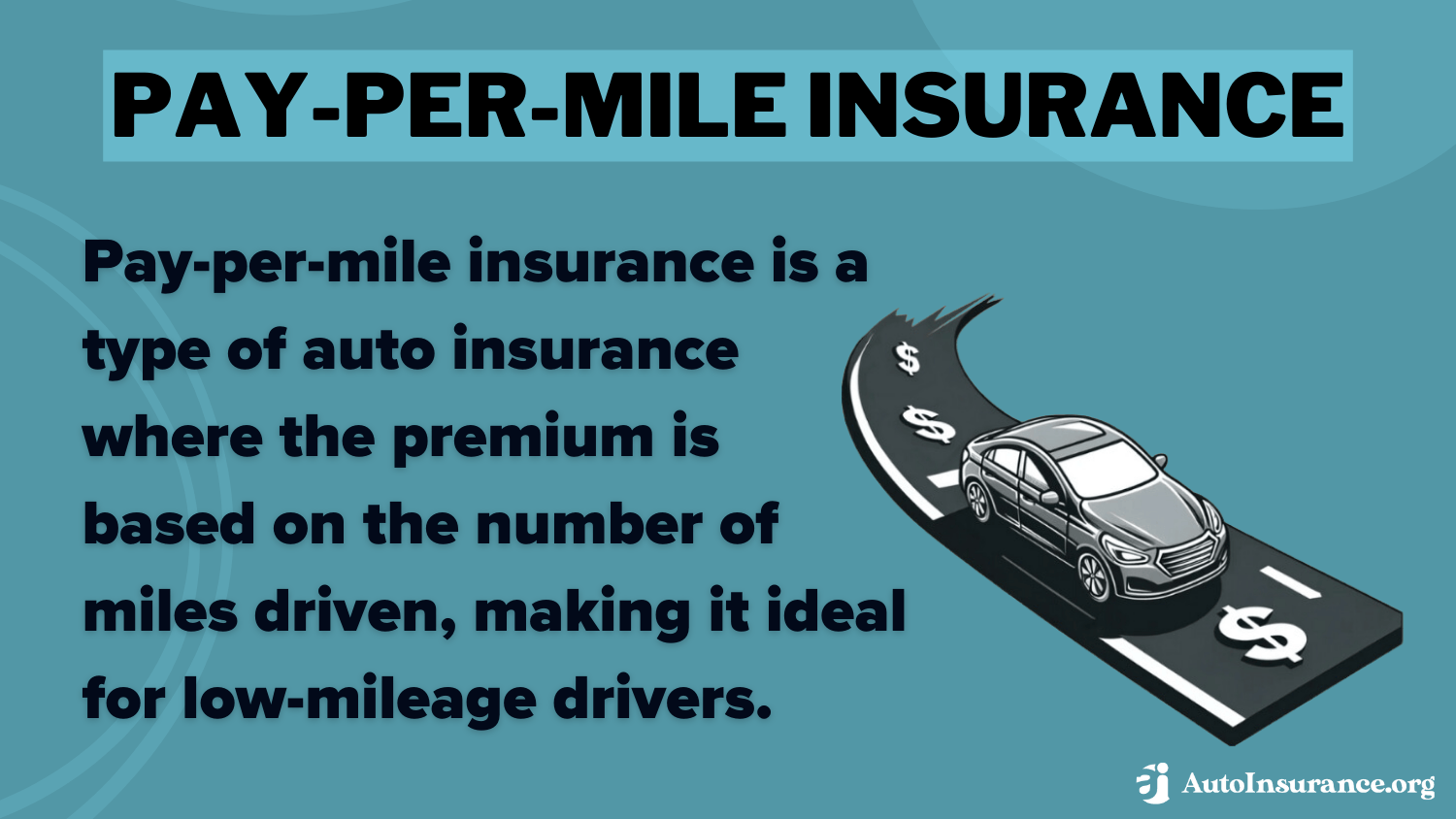

Pay-per-mile insurance offers a cost-effective option for those who drive less than 12,000 miles per year. Drivers are charged a base rate plus a per-mile fee, making it ideal for retirees, remote workers, and short-distance commuters.

Pay-as-you-go insurance companies track mileage through a device, app, or picture of your odometer to ensure accurate billing based on actual usage. Policies may include full coverage or just liability, with costs varying by insurer and driving habits.

High mileage can increase costs significantly, so this option may not suit frequent travelers or long-distance commuters. Before switching, drivers should review mileage caps, tracking methods, and policy terms to avoid unexpected charges. Enter your ZIP code for more information and to find pay-per-mile insurance options available in your area.

- Pay-per-mile insurance charges a base rate plus a per-mile fee based on usage

- Pay-as-you-go policies are ideal for low-mileage drivers and remote workers

- A tracking device or app may be required for accurate billing

How Pay-Per-Mile Insurance Works

What is pay-per-mile insurance in the U.S.? Pay-per-mile insurance charges drivers based on actual miles driven rather than a fixed monthly or annual premium. Insurers set a base rate, which covers basic policy costs, and add a per-mile fee calculated from your mileage.

This model benefits those who drive less, ensuring they only pay for what they use. Most providers track miles through a mobile app or a telematics device installed in the vehicle.

Unlike traditional policies, this setup gives drivers more control over their costs, making it a budget-friendly option for those who rarely drive.

Learn More: How to Lower Your Auto Insurance Rates

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pay-Per-Mile Insurance Cost Breakdown: Base Rate + Per-Mile Charges

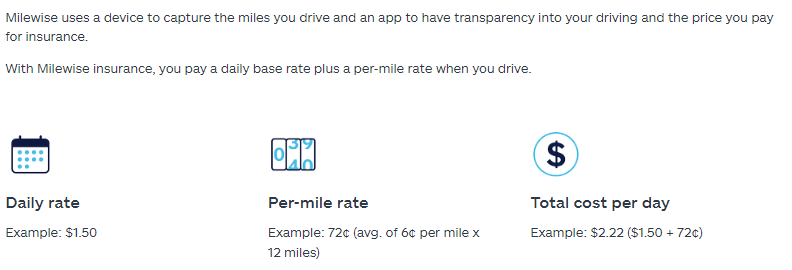

Pay-per-mile insurance rates vary based on factors like location and vehicle type. What is a good rate per mile? Some insurers charge as little as $0.02 per mile, while others may have rates closer to $0.06.

Pay-Per-Mile Insurance Costs by Provider & Base Rate

| Insurance Company | Base Rate | Per-Mile Charge | Monthly Cost |

|---|---|---|---|

| $29 | $0.06 | $125 | |

| $35 | $0.05 | $140 |

| $40 | $0 | $120 | |

| $35 | $0 | $135 | |

| $25 | $0.08 | $130 |

| $32 | $0.07 | $130 | |

| $38 | $0.05 | $145 | |

| $28 | $0 | $150 | |

| $32 | $0.07 | $140 | |

| $30 | $0 | $125 |

The base rate typically falls between $20 and $40 per month. Urban drivers might see higher rates due to increased accident risks, while rural drivers could pay less.

Discounts for safe driving, bundling policies, or maintaining a clean record can further reduce costs. Drivers should compare multiple quotes to find the best rate for their situation. Some top providers include:

- Metromile: One of the most well-known pay-per-mile insurers provides customizable coverage. Be sure to check Metromile auto insurance reviews and ratings to gauge customer satisfaction and service quality.

- Mile Auto: Uses odometer photos instead of GPS tracking for added privacy. Reviews of Mile Auto can help you assess their privacy practices and overall customer experience.

- Allstate Milewise: Allstate pay-per-mile bundles traditional coverage with per-mile pricing. Allstate Milewise reviews provide insights into policyholder experiences and pricing.

- Nationwide SmartMiles: Nationwide pay-per-mile offers full coverage and discounts for safe driving. Looking at reviews for Nationwide SmartMiles can reveal how effective its discounts are for different driving habits.

Several insurers provide pay-per-mile auto insurance, each with unique pricing structures and coverage options. Drivers should compare features, rates, and customer reviews before selecting an insurer.

Compare Pay-Per-Mile vs. Traditional Auto Insurance

What is pay-as-you-go per mile? Like traditional car insurance, pay-per-mile policies meet state minimum requirements. Full coverage options include collision and comprehensive auto insurance, which cover damages to your own vehicle from accidents, theft, vandalism, or weather-related incidents.

However, pay-per-mile insurance differs from traditional policies in the way premiums are calculated. Traditional insurance sets fixed monthly or annual rates based on estimated risk factors such as age, location, and driving history.

Pay-Per-Mile Insurance vs. Traditional Car Insurance

| Feature | Pay-Per-Mile Insurance | Traditional Car Insurance |

|---|---|---|

| Pricing Model | Base rate + per-mile charge | Fixed monthly/annual premium |

| Best for | Low-mileage drivers (under 10,000 miles/year) | High-mileage or frequent drivers |

| Cost Predictability | Varies based on miles driven | Consistent, regardless of miles driven |

| Mileage Tracking | Required via app or device | Not required |

| Discounts Available | Low-mileage discounts, safe driving rewards | Multi-policy, good driver, loyalty discounts |

| Coverage Options | Similar to traditional policies | Full coverage, liability, and add-ons available |

| Flexibility | Adjusts based on usage | Fixed premium, no mileage adjustments |

| Potential Savings | High for infrequent drivers | May be cheaper for high-mileage drivers |

| Risk of Higher Costs | Costs increase with more miles | Premium stays the same regardless of miles |

| Availability | Limited to select states and insurers | Widely available across all insurers |

In contrast, pay-per-mile insurance quotes fluctuate based on actual mileage, making it a better fit for drivers who use their vehicles sparingly. Traditional policies may be more predictable for those who drive frequently. Understanding these differences helps drivers choose the best option for their needs.

Read More: Auto Insurance for Different Types of Drivers

Pay-Per-Mile Tracking Methods Used by Insurers

How do you price per mile? Pay-per-mile insurance includes two main pricing components: a base rate and a per-mile charge. The base rate covers essential costs like liability coverage, customer service, and administrative fees. The per-mile charge applies only to actual miles driven.

How many miles is best for insurance? Driving less than 1,000 miles per month is best. Some pay-per-mile insurance companies rely on advanced technology to accurately track mileage. Many offer either a plug-in telematics device or a mobile app that records miles driven in real-time.

Since tracking is essential for pay-per-mile car insurance, privacy-conscious drivers should check how insurers handle location data. Some insurers use odometer-based premiums, requiring drivers to submit periodic mileage photos without tracking their habits. Policies vary, so reading the fine print is crucial.

Read More: Factors That Affect Auto Insurance Rates

Advantages and Disadvantages of Pay-Per-Mile Insurance

Pay-per-mile insurance reviews find it to be a flexible alternative to traditional policies, especially for drivers who don’t use their cars often. Understanding the advantages of pay-per-mile auto insurance can help determine if it’s the right choice:

- Saves money for low-mileage drivers by charging based on actual usage

- Prevents overpayment by adjusting costs to match miles driven

- Encourages mindful driving and helps reduce vehicle wear and tear

- Offers flexibility with customizable coverage options

- Some insurers offer full coverage, not just liability-only options

Pay-per-mile insurance can be a great option for low-mileage drivers, but it’s not right for everyone. Weigh the drawbacks to decide if it fits your needs and budget:

- Costs more for high-mileage drivers than traditional policies

- Requires mileage tracking through GPS or an odometer device

- Limits availability since not all insurers offer it in every state

- May include additional fees that impact overall savings

- Could lack discounts available with standard auto insurance policies

By considering these factors, drivers can determine if pay-per-mile insurance provides a cost-effective and practical alternative to traditional coverage.

We’re joining forces with @Lemonade_Inc! Together, we’ll be able to accelerate the growth of the most customer-centric, fair, and affordable car insurance to millions of drivers throughout the US. Key info: https://t.co/5OtnQAVRAY pic.twitter.com/jRdGYh350y

— Metromile (@Metromile) November 8, 2021

How do miles work in a car? Understanding how annual mileage affects your auto insurance rates is essential, as lower mileage often leads to lower premiums with many insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Key Considerations for Pay-Per-Mile Insurance

Not every driver benefits from pay-per-mile insurance. This coverage works best for individuals who drive fewer than 10,000 miles per year, such as remote workers, retirees, students, or those who rely on public transportation. Evaluate these key factors to see if you’ll benefit from cheap auto insurance for occasional drivers:

- Estimate Mileage and Compare Costs: Calculate your yearly mileage and compare it to the insurer’s rates to assess potential discounts and savings.

- Check Tracking Requirements: Check if the insurer tracks mileage with GPS or an odometer device, and then decide if you’re comfortable with it.

- Choose Coverage Options: Decide between liability-only coverage, which meets state minimum requirements, or full coverage (collision and comprehensive protection)

- Confirm State Availability: Availability varies by location, so check whether the insurer offers pay-per-mile policies in your state.

- Look for Discounts and Fees: Check for safe driving discounts or additional fees that could affect overall pay-per-mile insurance costs.

Frequent travelers, long-distance commuters, and rideshare drivers may find traditional policies more cost-effective. Before switching, drivers should analyze their mileage patterns to determine if this insurance type truly offers savings.

Pay-per-mile insurance lets low-mileage drivers save money by paying only for what they use, offering flexibility without compromising coverage.Michelle Robbins Licensed Insurance Agent

To choose a pay-per-mile policy, evaluate your driving patterns. What is the best mileage for insurance? If you consistently drive less than 10,000 miles per year, you can benefit the most. Enter your ZIP code to compare options and find the best pay-per-mile insurance in your area.

Frequently Asked Questions

What does pay-per-mile insurance mean?

What is pay by miles? It’s an insurance model where drivers pay a base rate plus a fee per mile driven.

How much is pay-per-mile auto insurance?

Pay-per-mile insurance rates vary by company, but base rates range between $25 and $40 per month, plus a few cents per mile fee.

What is the cheapest pay-per-mile insurance?

Nationwide and Allstate have the cheapest base rates for pay-per-mile coverage. What is the lowest mileage for insurance? Lower annual mileage, typically under 7,500 miles, can qualify for the cheapest rates. Many insurers offer low-mileage auto insurance discounts to reward drivers who use their vehicles sparingly.

Can your insurance go up because of mileage?

Yes, the more you drive, the more likely it is that you’ll get into an accident. This increased risk leads to higher insurance rates with standard companies. More mileage will raise your rates with pay-per-mile companies based on the per-mile rate.

What is the per-mile charge in pay-per-mile insurance?

It’s the fee you pay for each mile driven under a pay-per-mile insurance policy.

Read More: Can I pay my auto insurance online?

What does rate-per-mile mean in auto insurance?

It’s the cost assigned to each mile driven, affecting total insurance or travel costs.

Is mileage-based insurance worth it?

Pay-per-mile auto insurance is only worth it if you drive less than 12,000 miles a year. Drivers who are on the road less than 8,000 miles annually get the best pay-per-mile insurance. Enter your ZIP code to compare free auto insurance quotes by mileage.

How do you calculate annual mileage for insurance?

Estimate weekly miles, multiply by 52, and adjust for seasonal or occasional trips. Learn how to manage your auto insurance policy by updating mileage and reviewing discounts regularly.

Does State Farm offer pay-per-mile insurance?

No, State Farm only offers usage-based car insurance through its Drive Safe and Save program. Our State Farm Drive Safe and Save review explains how it tracks driving habits along with mileage and will shrink drivers’ discounts for things like speeding or hard braking.

What is mileage reimbursement?

Who pays for miles? Your employer will cover mileage reimbursement, which is compensation for work-related travel expenses based on the miles driven.

How much should I get paid per mile in the U.S.?

What is MilesPay?

What does pay in miles mean?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.