Best Kansas Auto Insurance in 2026 (Find the Top 10 Companies Here!)

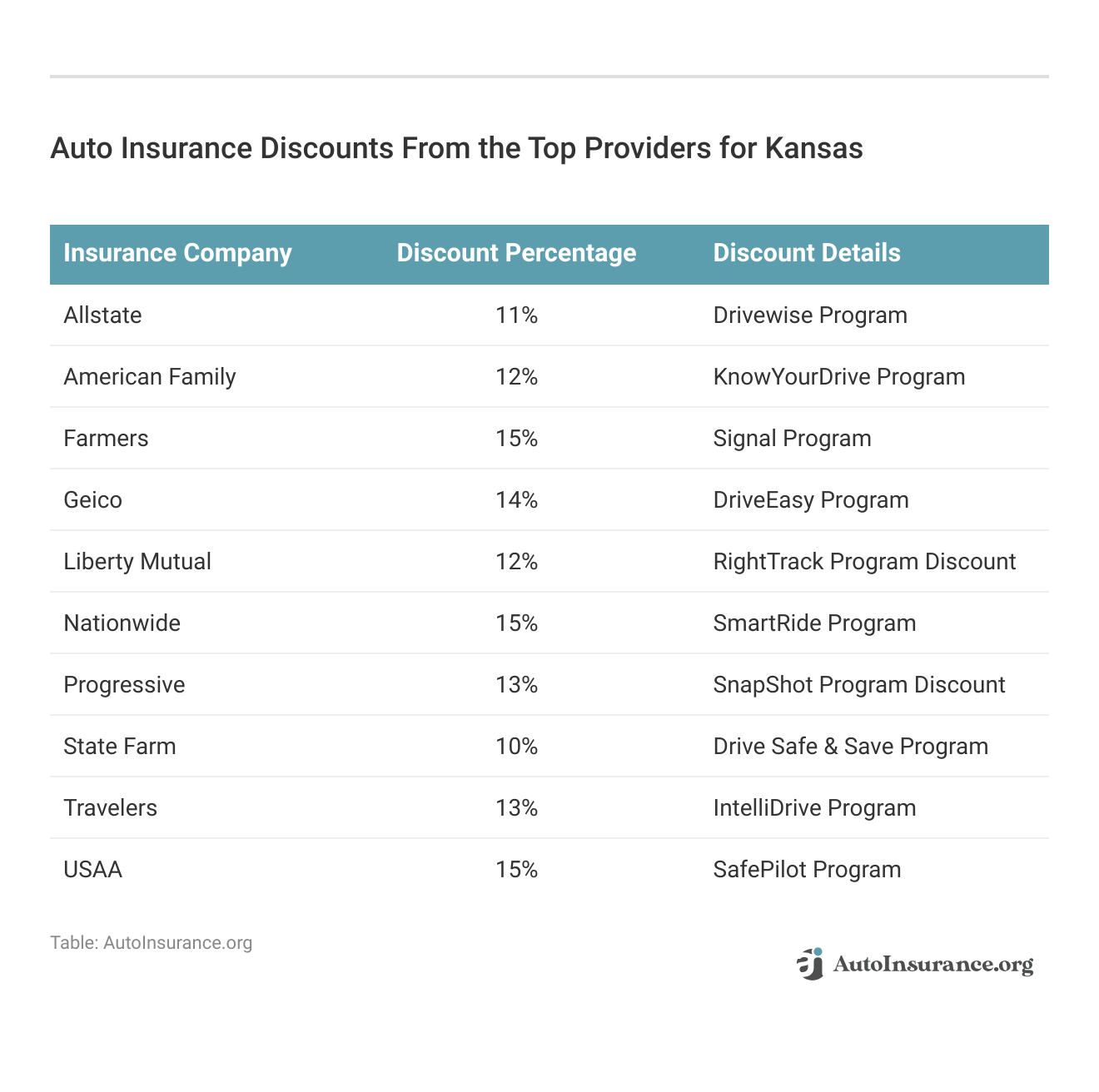

Progressive, Liberty Mutual, and Geico provide the best Kansas auto insurance, starting at just $24 per month. Our goal is to help you compare quotes from these trusted insurers, ensuring you get the best coverage suited to your vehicle, along with customized discounts for your reassurance.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated March 2025

Company Facts

Full Coverage for Kansas

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Kansas

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews

Company Facts

Full Coverage for Kansas

A.M. Best

Complaint Level

Pros & Cons

- All drivers in Kansas must carry liability insurance

- In Kansas, full coverage is roughly $24 per month

- Finding affordable insurance becomes difficult with a DUI

#1 – Progressive: Top Overall Pick

Pros

- Competitive Pricing: In our Progressive auto insurance review, Progressive offers competitive premiums compared to many other insurers.

- Wide Range of Discounts: They provide various discounts such as multi-policy, safe driver, and online quote discounts.

- User-Friendly Technology: Progressive’s website and mobile app are user-friendly, offering easy policy management and claims filing.

Cons

- Average Customer Service: While generally good, customer service can be inconsistent based on customer feedback.

- Limited Agent Interaction: Those preferring in-person agent support may find Progressive’s reliance on online services less appealing.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Liberty Mutual: Best for Customizable Coverage

Pros

- Customizable Coverage: Liberty Mutual offers a variety of coverage options that can be tailored to individual needs.

- Additional Benefits: They provide additional benefits such as new car replacement and better car replacement coverage.

- Strong Financial Stability: Liberty Mutual has a strong financial rating, indicating stability in handling claims. For further insights, refer to our Liberty Mutual auto insurance review.

Cons

- Higher Premiums: Their premiums tend to be higher compared to some other insurers, which may not be budget-friendly for all.

- Mixed Customer Service Reviews: Customer feedback on service can vary, with some reporting issues with claims processing and support.

#3 – Geico: Best for Cheap Rates

Pros

- Low Premiums: Geico is known for its consistently low premiums, making it a budget-friendly option.

- Strong Financial Stability: They have a strong financial backing, ensuring stability in handling claims and payouts.

- Convenient Online Tools: Geico’s online platform is highly rated for ease of use and efficiency in managing policies and claims.

Cons

- Limited Personalized Service: Geico primarily operates online, which may not cater to individuals who prefer face-to-face interactions with agents.

- Rate Increases: Despite initial low rates, some customers report potential increases upon policy renewal. Read more through our Geico auto insurance review.

#4 – State Farm: Best for Many Discounts

Pros

- Extensive Agent Network: State Farm boasts a vast network of local agents, providing personalized service and support.

- Comprehensive Coverage Options: They offer a wide range of coverage options, ensuring customization to individual needs.

- Strong Reputation: State Farm has a solid reputation for reliability and customer satisfaction. Find out more in our State Farm auto insurance review.

Cons

- Higher Premiums for Some Drivers: Rates may be slightly higher compared to direct competitors offering similar coverage.

- Limited Online Tools: Their online tools and mobile app may not be as robust or user-friendly as those of some other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Usage Discount

Pros

- Affordable Rates: Nationwide offers competitive rates, making it accessible for a broad range of drivers. Read more through our Nationwide auto insurance review.

- Wide Range of Discounts: They provide various discounts such as multi-policy, safe driver, and good student discounts.

- Strong Customer Satisfaction: Nationwide is well-regarded for its customer service and claims handling.

Cons

- Limited Coverage Options: Some customers may find their coverage options slightly less customizable compared to other insurers.

- Regional Variability: Premiums and service quality can vary by region, which may impact overall satisfaction depending on location.

#6 – Allstate: Best for Add-on Coverages

Pros

- Comprehensive Coverage Options: Allstate offers extensive coverage options, including unique features like accident forgiveness.

- User-Friendly Technology: Their website and mobile app are praised for ease of use and functionality. Use our Allstate auto insurance review as your guide.

- Stable Financial Standing: Allstate is financially stable, ensuring reliable claims processing and payouts.

Cons

- Higher Premiums: They tend to have higher premiums compared to some competitors, particularly for certain demographics.

- Mixed Customer Reviews: Customer experiences with Allstate’s claims process and customer service can vary.

#7 – USAA: Best for Military Savings

Pros

- Low Premiums: USAA consistently offers some of the lowest premiums in the industry. Read more through our USAA insurance review.

- Excellent Customer Service: They are known for their top-notch customer service and high customer satisfaction ratings.

- Exclusive Benefits for Military: USAA provides special benefits tailored for military members and their families.

Cons

- Limited Eligibility: USAA membership is limited to military members, veterans, and their families, excluding the general public.

- Coverage Limitations: Their coverage options may not be as extensive or customizable compared to larger insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Student Savings

Pros

- Personalized Service: American Family emphasizes personalized service through their network of local agents.

- Good Coverage Options: They offer a range of coverage options, including unique add-ons like rideshare insurance. Read more through our American Family auto insurance review.

- Strong Community Involvement: American Family is known for its community-focused initiatives and support.

Cons

- Moderate Premiums: While competitive, premiums may be slightly higher than some direct competitors.

- Regional Availability: Coverage and service quality may vary depending on the region, impacting customer satisfaction.

#9 – Travelers: Best for Accident Forgiveness

Pros

- Affordable Premiums: Travelers provides competitive rates, making it an economical choice for many drivers.

- Good Claims Handling: They have a reputation for efficient claims processing and customer support.

- Wide Range of Coverage Options: Travelers offers comprehensive coverage options, including specialized policies for various needs.

Cons

- Customer Service Concerns: Some customers report mixed experiences with customer service responsiveness. Find out more through our Travelers insurance review.

- Limited Online Tools: Their online platform may not offer as many features or be as user-friendly compared to some competitors.

#10 – Farmers: Best for Local Agents

Pros

- Wide Range of Coverage Options: Farmers, as mentioned in our Farmers auto insurance review, offers a variety of coverage options, including customizable policies to suit individual needs.

- Strong Customer Service: They have a reputation for good customer service and efficient claims processing.

- Local Agent Support: Farmers provides support through a network of local agents, offering personalized assistance.

Cons

- Higher Premiums: Their premiums tend to be on the higher side compared to some other insurers, which may not fit everyone’s budget.

- Discount Availability: Some customers may find fewer discount opportunities compared to larger insurers, impacting overall affordability.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheap Full Coverage Kansas Auto Insurance

Cheap Kansas Auto Insurance for Bad Credit

Cheap Kansas Auto Insurance for Bad Driving Records

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheap Kansas Auto Insurance for Young Drivers

Frequently Asked Questions

Which company offers the cheapest auto insurance rates in Kansas?

Nationwide offers the cheapest car insurance rates in Kansas. Still, you may find that smaller companies offer more competitive rates in certain areas and when driving without auto insurance.

You’ll likely get different rates depending on where you live, your age, your driving record, and other factors. Therefore, comparing quotes from several companies is best before you make any final decisions on coverage.

How much does car insurance cost in Kansas?

If you live and drive in Kansas, you can expect to pay around $1,647 annually or $137 each month for coverage. Your rates will be impacted by other factors like your ZIP code, credit score, and driving history.

Rates will be lower if you purchase a minimum coverage policy and have a clean driving record. If you want a full coverage policy but need cheaper coverage rates, you may be able to save money by choosing a higher deductible or pursuing discounts with certain car insurance companies.

What’s the best car insurance company in Kansas?

There are several auto insurance providers in Kansas, and any one of them could be your best option for coverage. The only way to know which company is best for you is to compare quotes and coverage options from several providers.

You may want specific coverage options that only certain companies provide. If that’s the case, you’ll want to speak with representatives from different companies to see which one offers the coverage you want at a reasonable price. Enter your ZIP code now.

Can I get a cheap full coverage policy in Kansas?

Full coverage auto insurance or collision insurance costs more than a minimum coverage policy, but you may be able to find competitive rates. Nationwide offers the cheapest full coverage policies on average in Kansas, with an annual cost of around $1,217 or $101 per month. Other options include State Farm, Geico, Farmers, and Progressive.

Can I get cheap auto insurance in Kansas if I have bad credit?

Your credit score can impact your car insurance rates, but some insurance companies offer more competitive rates for individuals with bad credit. Geico offers the cheapest rates in Kansas for someone with bad credit, with an annual cost of around $1,789 or $149 per month. Nationwide, Farmers, State Farm, and Progressive are other options to consider.

Can I get cheap auto insurance in Kansas with an at-fault accident on my record?

Your driving record affects your car insurance rates, and an at-fault accident can increase your rates. State Farm often offers the cheapest rates in Kansas for coverage after an accident, with an annual cost of around $1,679 or $140 per month. Nationwide, Geico, Farmers, and Progressive are also options to explore. Enter your ZIP code now.

Can I get cheap auto insurance in Kansas as a teen or young adult driver?

Teens and young adults usually pay higher rates for different types of auto insurance in Kansas, but some companies offer competitive rates for this demographic. Nationwide offers the most affordable rates in Kansas for teens and young adults, with an annual cost of around $3,183 or $265 per month. Geico, State Farm, Farmers, and Allstate are other options to consider.

Is it illegal to drive in Kansas without insurance?

Yes, it is illegal to drive without Kansas auto insurance coverage.

Is Kansas a no-fault state?

Yes, Kansas is a no-fault auto insurance state. Enter your ZIP code now to begin.

What are the requirements for auto insurance in Kansas?

All Kansas drivers must have liability insurance, uninsured motorist insurance, and PIP insurance given that they are aware of at-fault accident.

How much is liability insurance in Kansas?

Is Kansas a PIP state?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.