High-Risk Auto Insurance in 2026 (What You Should Know)

High-risk auto insurance provides coverage for drivers with past traffic violations, DUIs, or accidents, but it comes at a higher cost, averaging $295 per month. This article explores affordable high-risk auto insurance options, helping drivers find the best rates by comparing top providers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated January 2026

High-risk auto insurance is a specialized coverage for drivers with a history of violations, accidents, or other risk factors that elevate their insurance premiums.

When shopping for high-risk auto insurance, you’ll find many coverage options from the best auto insurance companies for high-risk drivers, including full coverage insurance for high-risk drivers. Unfortunately, car insurance with a bad driving record is more expensive than coverage for drivers with a clean record.

This article covers what makes a driver high risk, how it affects rates, and ways to find affordable high-risk car insurance by comparing quotes. It helps drivers secure coverage when standard insurers won’t.

Get fast and cheap auto insurance coverage today with our quote comparison tool above.

- High-risk auto insurance covers drivers with violations, accidents, or poor credit

- Premiums for high-risk drivers are higher due to increased risks and claims

- Comparing quotes helps find affordable high-risk auto insurance coverage options

High-Risk Auto Insurance Defined

High-risk auto insurance is designed for drivers deemed more likely to file claims due to factors like multiple accidents, traffic violations, or DUIs. This type of coverage typically comes with higher premiums, reflecting the increased risk to insurers.

High-Risk Auto Insurance

| Insurance Company | Monthly Rates |

|---|---|

| $228 | |

| $114 | |

| $248 |

| $164 |

| $150 | |

| $123 | |

| $141 |

Companies like Geico, State Farm, and Progressive, known as high-risk car insurance companies, offer competitive high-risk auto insurance policies, ensuring even high-risk drivers can secure the necessary protection. By comparing high-risk insurance quotes, drivers can still find affordable options that meet their needs. Over time, maintaining a clean driving record can help lower these rates and shift drivers out of the high-risk category.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest High-Risk Auto Insurance Companies

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| $147 | $208 |

| $175 | $250 | |

| $157 | $223 | |

| $171 | $245 | |

| $172 | $245 | |

| $136 | $195 | |

| $186 | $265 |

| $151 | $215 | |

| $166 | $239 | |

| $143 | $204 | |

| $144 | $205 |

| $160 | $229 | |

U.S. Average | $165 | $251 |

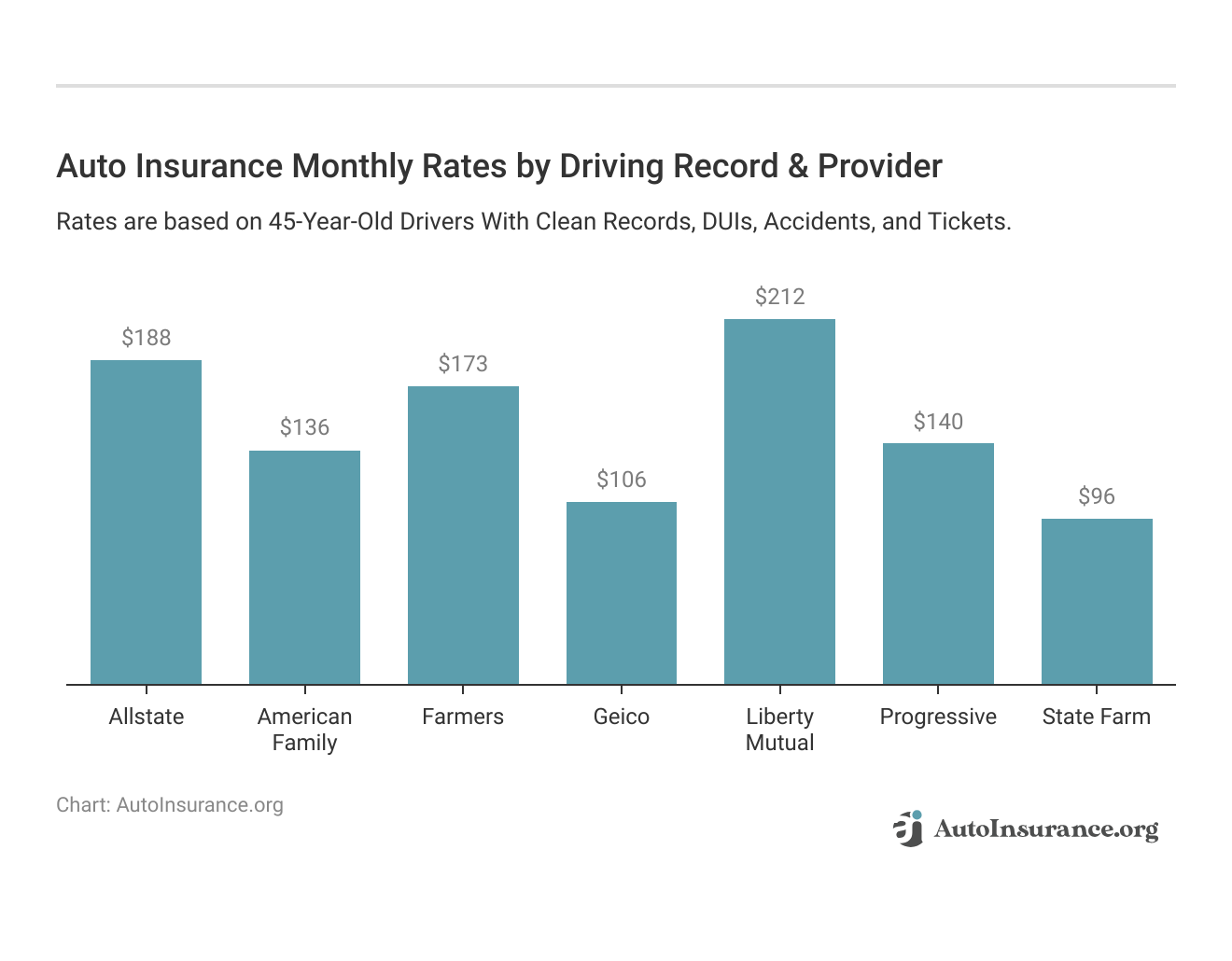

Geico offers the cheapest rates for people with a 30-day coverage lapse, two recent speeding tickets, a DUI, and teens with a recent traffic ticket. For more information, see our Geico auto insurance review.

Auto Insurance Monthly Rate Increases: Clean Record vs. One DUI

| Insurance Company | Clean Record | One DUI | Rate Increase |

|---|---|---|---|

| $87 | $152 | 75% | |

| $62 | $104 | 68% |

| $76 | $105 | 38% | |

| $43 | $117 | 172% | |

| $96 | $178 | 85% |

| $63 | $129 | 105% | |

| $56 | $75 | 34% | |

| $47 | $65 | 38% | |

| $53 | $112 | 111% | |

| $32 | $58 | 81% |

State Farm auto insurance is the next cheapest car insurance company on average, but rates can get expensive depending on a person’s driving record. For drivers looking for cheap high-risk car insurance, it’s essential to compare multiple providers to find the best deal based on individual risk factors.

If you’re looking for high-risk coverage, you may find that many companies are unwilling to offer you coverage. So it’s essential to get quotes from several companies to find the one offering the cheapest insurance for high-risk drivers in your area.

Companies only offering high-risk or non-standard coverage may not have competitive coverage rates. Still, if you’re looking for cheap auto insurance for high-risk drivers and other companies won’t cover you, you may need to pursue coverage with a company like The General.

How to Get High-Risk Auto Insurance if Standard Insurers Won’t Cover You

If you own a vehicle, you need proper auto insurance. However, you may have trouble getting coverage with most companies if you’re a high-risk driver. When this happens, your two options for finding car insurance are through a high-risk insurance company or a state-sponsored auto insurance plan.

Comparing quotes from multiple high-risk insurers is crucial for finding affordable high-risk coverage.Michelle Robbins Licensed Insurance Agent

Non-standard insurance companies specialize in providing coverage to high-risk drivers, often referred to as high-risk drivers insurance, and they’re typically region-specific companies. Some of the most common non-standard companies include:

You can read more about a state-sponsored plan in the Automobile Insurance Plan Service Office directory. Options vary by state.

Understanding What Constitutes a High-Risk Driver for Auto Insurance

Finding coverage for a high-risk driver is the same as finding cheap car insurance for high-risk drivers with a bad driving record: the worse your driving record looks to an insurance company, the higher your insurance rates will be.

Here’s a quick look at how your driving record may affect your auto insurance rates. We’ll dive into each of these in more detail below:

Below are several reasons a person might be considered a high-risk driver.

A DUI Offense

Your car insurance will be expensive if you get caught driving under the influence. You’ll also probably have to file an SR-22 in your state.

You may need to keep the SR-22 auto insurance coverage for several years, meaning you can expect to pay high coverage rates.

Multiple Tickets

One speeding ticket may not increase your insurance rates, but if you have several, expect to pay higher-than-average rates for coverage. Learn more about the best auto insurance companies for drivers with speeding tickets.

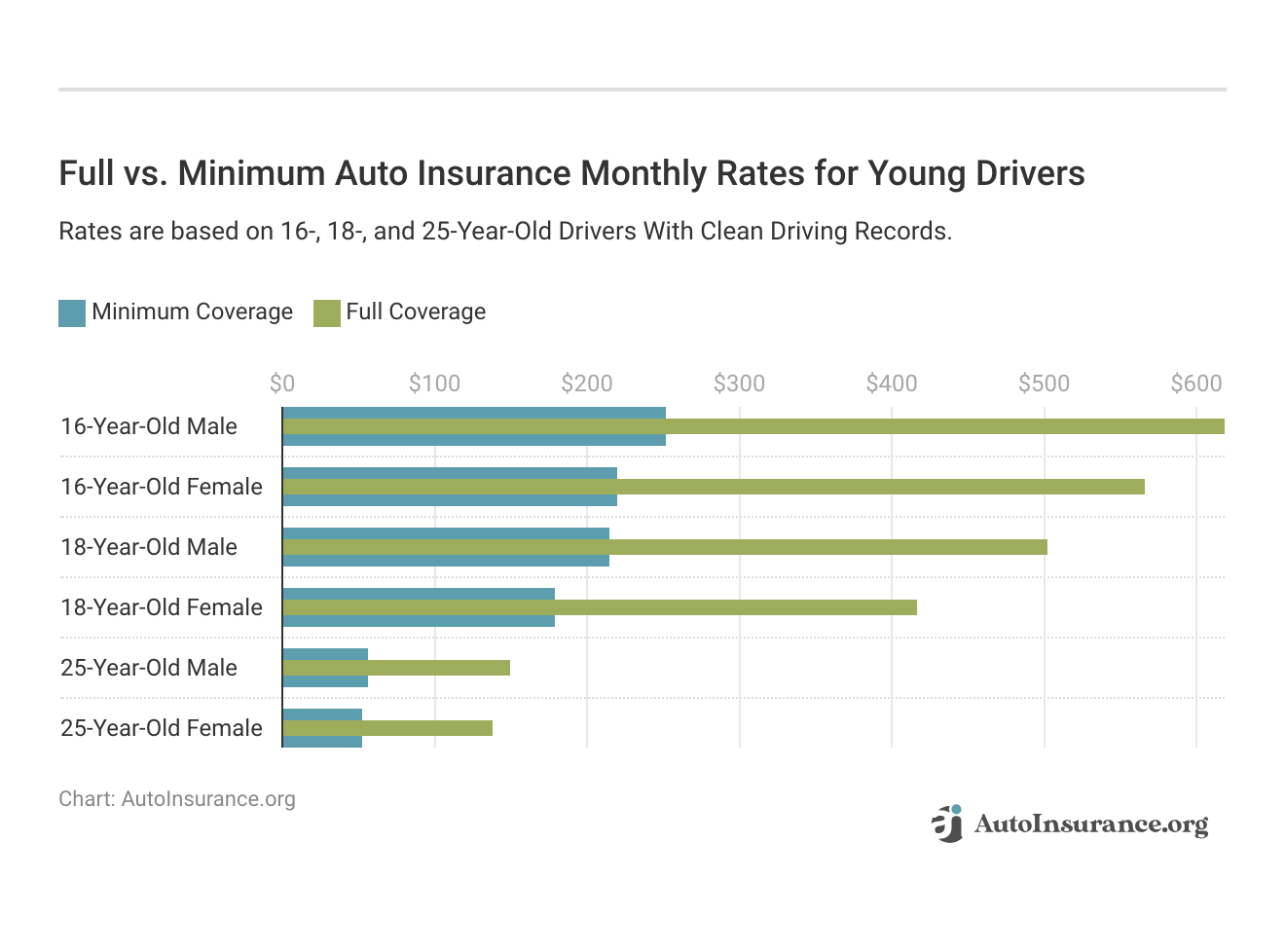

Young and First-Time Drivers

Young drivers are statistically more likely to get in a car accident. Consequently, auto insurance for drivers under 25 is more expensive. Take a look at the table below to compare rates for young drivers:

One way to avoid expensive rates is to add yourself to an experienced driver’s policy. If you can, join your parent’s insurance policy to help you save on your premiums.

Coverage Lapse

If you let your auto insurance lapse, expect to pay higher rates when searching for coverage again. Insurance companies will see you as a risk, and you may have difficulty finding a company willing to insure you, so compare rates from the best auto insurance companies that don’t penalize for a lapse in coverage.

Fortunately, your rates will decrease over time if you maintain a clean driving record.

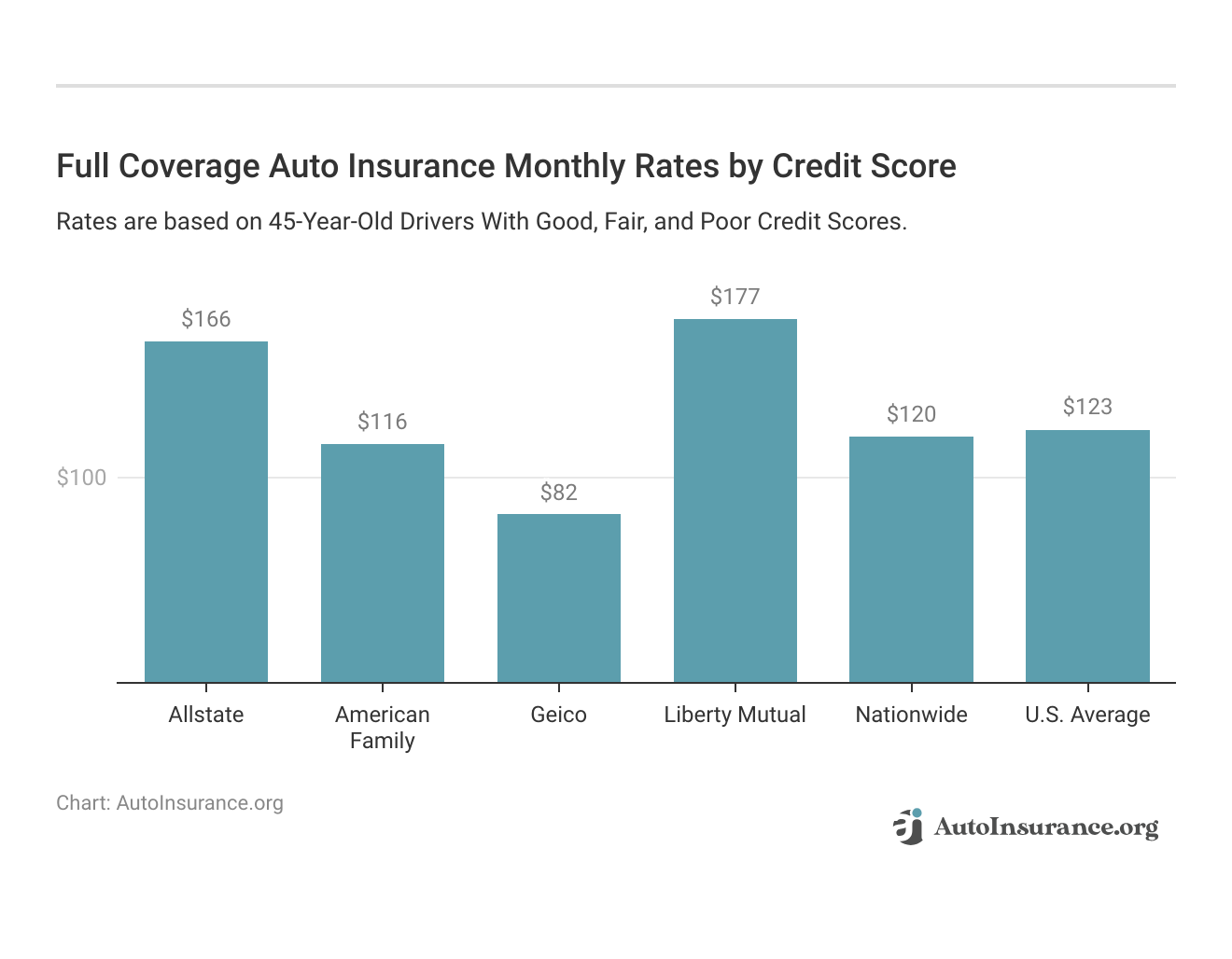

Poor Credit

While credit may not sound like it should affect auto insurance rates, people with bad credit are statistically more likely to get in a car accident.

You’ll probably pay higher rates for auto insurance coverage if you have a low credit score. Some insurance companies don’t check your credit, but you’ll have to shop around online and compare rates from the best auto insurance companies for drivers with bad credit.

Other Serious Driving Violations

Other serious violations — like a hit and run, excessive speeding, reckless driving, and road rage — will increase your insurance premiums. Depending on your violation, you could also face severe penalties, like significant fines, a suspended or revoked license, or jail time.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get Cheap High-Risk Auto Insurance Quotes

Finding car insurance with a bad driving record can be difficult, and cheap rates may seem impossible. Shopping and comparing quotes online is the best way to find affordable insurance rates in your area. However, you could also consider one or more of the following options:

- Raise Your Deductible: If you increase your auto insurance deductible, your rates will decrease. Unfortunately, you’ll pay more out of pocket if you’re in an accident.

- Take a Safe Driving Course: Some companies offer cheaper rates if you take a defensive driving course. Search for high-risk insurance companies near me to compare local providers and discounts. Learn more about how to get a defensive driver auto insurance discount.

- Bundle Your Insurance: Save on high-risk auto insurance by bundling it with your homeowners or renters insurance from the same company. To find the best deals, search for high-risk car insurance near me and compare rates from local providers offering bundling discounts.

- Improve Your Credit Score: If you pay down your debts and improve your credit score, your high-risk auto insurance cost could decrease.

If you follow the steps above, you can find cheap insurance for high-risk drivers with certain high-risk auto insurance companies. However, your rates will likely be more expensive than those for drivers with a clean driving record.

After three to five years, your driving record may be completely clean, allowing you to apply for cheap car insurance companies with virtually any company.

How Auto Insurance for High-Risk Drivers Works

Expect to pay higher coverage rates if you’re a high-risk driver. However, finding affordable car insurance for high-risk drivers with a suspended license or DUI on your record could be tricky, even if you’re willing to pay high coverage rates. Consider looking into specific states for affordable DUI auto insurance to find better options and lower rates.

When shopping for car insurance for high-risk drivers, the best way to find cheap rates is to shop online and compare quotes from multiple companies.

National General Auto Insurance specializes in writing policies for high-risk drivers🚘. If you’re having trouble ❌finding coverage, give them a call. Check out our review to learn more👉: https://t.co/sLTdPL2aMI pic.twitter.com/vaAO7LGonI

— AutoInsurance.org (@AutoInsurance) September 17, 2024

Your car insurance rates should decrease as time passes and your driving record improves. However, shopping around and comparing high-risk car insurance quotes is always a good idea to ensure you aren’t paying too much for coverage.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

Frequently Asked Questions

What is high-risk car insurance?

High-risk car insurance is a type of insurance coverage designed for drivers who are considered to be at a higher risk of getting into accidents or filing claims. This includes drivers with a history of traffic violations, accidents, poor credit scores, or newly licensed drivers. High-risk insurance typically has higher premiums to account for the increased risk.

How does high-risk auto insurance differ from regular auto insurance?

High-risk auto insurance differs from regular auto insurance in terms of coverage availability and cost. High-risk insurance often comes with higher premiums due to the increased risk associated with insuring drivers who have a history of accidents or violations.

Additionally, some insurance companies may choose not to offer coverage to high-risk drivers, leading them to seek specialized insurers who cater specifically to high-risk individuals.

Is Allstate good for high-risk drivers?

Allstate is an excellent choice for high-risk drivers looking to improve their driving skills with safe driving discounts. However, the company has some of the highest rates for drivers with a bad driving record.

Find out mor on how to get Allstate accident forgiveness.

How much is high-risk insurance a month?

High-risk drivers pay $187 monthly for car insurance, while standard drivers pay around $119 monthly.

How can I reduce my high-risk status?

While improving your risk profile may take time, there are steps you can take to gradually reduce your high-risk status. These include maintaining a clean driving record, attending defensive driving courses, paying all fines and tickets promptly, and avoiding traffic violations or accidents.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

What is the best insurance company for bad driving records?

The best auto insurance companies for bad driving records are Geico, State Farm, and Progressive.

Get further details in our comprehensive guide, “Does Progressive cover windshield replacement?”

How does auto insurance for high-risk drivers in Florida work?

Auto insurance for high-risk drivers in Florida typically involves higher premiums and may require SR-22 filings after serious violations.

How do I get auto insurance for high-risk drivers in Maryland?

To get auto insurance for high-risk drivers in Maryland, shop around for quotes from companies that specialize in non-standard coverage.

How does auto insurance for high-risk drivers in Michigan differ?

Auto insurance for high-risk drivers in Michigan is expensive due to the state’s no-fault insurance laws and higher risk levels. Learn how to get the best car insurance in Michigan.

What are my options for auto insurance for high-risk drivers in Texas?

Auto insurance for high-risk drivers in Texas can be found through non-standard insurance companies or by comparing multiple quotes.

How do I get auto insurance quotes for high-risk drivers?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.