Best Mazda CX-9 Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

State Farm, Progressive, and Farmers have the best Mazda CX-9 auto insurance for drivers, with minimum coverage rates for Mazda CX-9s starting at $38/mo. Mazda CX-9 owners can compare auto insurance quotes from the best Mazda CX-9 insurance companies to find the best coverage deal.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Mazda CX-9

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Mazda CX-9

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Mazda CX-9

A.M. Best

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsState Farm, Progressive, and Farmers sell the best Mazda CX-9 auto insurance to drivers across the U.S.

There are plenty of car insurance options available to Mazda CX-9 owners. The best Mazda CX-9 auto insurance companies are listed below.

Our Top 10 Company Picks: Best Mazda CX-9 Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Many Discounts | State Farm | |

| #2 | 15% | A+ | Budgeting Tool | Progressive | |

| #3 | 10% | A | Local Agents | Farmers | |

| #4 | 18% | A++ | Online Convenience | Geico | |

| #5 | 12% | A+ | Usage Discount | Nationwide |

| #6 | 14% | A++ | Accident Forgiveness | Travelers | |

| #7 | 20% | A+ | Add-On Coverages | Allstate | |

| #8 | 11% | A | Customizable Polices | Liberty Mutual |

| #9 | 16% | A | Roadside Assistance | AAA |

| #10 | 13% | A++ | Military Savings | USAA |

Mazda CX-9 insurance rates are cheaper than the average vehicle. Continue reading to learn how you can find cheap Mazda auto insurance from the best companies. You can also start comparing quotes for Mazda CX-9 auto insurance rates from some of the best auto insurance companies by using our free online tool now.

- State Farm has the best Mazda CX-9 car insurance policies

- Good drivers can save as much as $50 per month by earning policy discounts

- Mazda CX-9 insurance costs less per year than the average vehicle

#1 – State Farm: Top Overall Pick

Pros

- Many Discounts: State Farm customers can save on Mazda CX-9 car insurance by applying for some of State Farm’s discounts.

- Local Agents: Agents are available locally to assist customers with their Mazda CX-9 insurance policies.

- Quick Claims: Mazda CX-9 claims can be filed online at any time. For more information about State Farm as a company, read our State Farm review.

Cons

- Online Tool Limitations: Mazda CX-9 owners will have to contact an agent in most situations.

- Coverage Options: Mazda CX-9 customers will find State Farm coverages more limited than at other companies. For example, State Farm doesn’t offer gap insurance or new car replacement insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Budgeting Tool

Pros

- Budgeting Tool: Progressive offers a free tool to help customers determine how much Mazda CX-9 insurance they can purchase.

- Snapshot Program: Mazda CX-9 customers can join Snapshot for free and earn rewards for safe driving.

- Coverage Options: Mazda CX-9 vehicles can be insured with extras like modified car insurance or trip interruption insurance.

Cons

- Snapshot Mazda CX-9 Rate Increases: Consistent poor driving habits in the program could raise Mazda CX-9 rates in some states.

- Customer Satisfaction: Mazda CX-9 customers should be aware that customer satisfaction levels could be higher at Progressive. Visit our Progressive review to learn more.

#3 – Farmers: Best for Local Agents

Pros

- Local Agents: Agents are available locally in most states to assist Mazda CX-9 owners with their policies and claims.

- Coverage Options: Mazda CX-9 owners can choose add-ons like new car replacement.

- Bundling Discount: Mazda CX-9 insurance can be bought with renters or home insurance.

Cons

- Service Quality: Mazda CX-9 customers may have a negative experience with some agents. Read our Farmers review for more information.

- Financial A.M. Best Rating: An A rating is decent, but other Mazda CX-9 companies on our list have better ratings for financial management.

#4 – Geico: Best for Online Convenience

Pros

- Online Convenience: Geico is highly rated for its convenient app and website. Learn more about how Mazda CX-9 can benefit in our Geico review.

- Discount Variety: Mazda CX-9 rates can be lowered if customers apply for some of Geico’s discounts.

- Adjustable Deductibles: Mazda CX-9 deductibles can be adjusted on coverages as needed.

Cons

- No Local Agents: Geico doesn’t have in-person assistance for Mazda CX-9 insurance.

- Coverage Options: Mazda CX-9 owners may find Geico’s coverages lacking, as it doesn’t have extras like gap coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Mazda CX-9 can join Nationwide’s free SmartRide program that discounts good drivers.

- Vanishing Deductible: Nationwide reduces Mazda CX-9 deductibles for safe, claims-free customers. Visit our Nationwide review to learn more about the company’s cost-saving options.

- Mileage-Based Insurance: Low-mileage Mazda CX-9 drivers may want to join SmartMiles to save on insurance.

Cons

- Availability of Local Offices: Most of the assistance offered to Mazda CX-9 will be virtual.

- Insurance Availability: Mazda CX-9 insurance is not available to purchase in all states.

#6 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Mazda CX-9 accidents may be forgiven if the owners were previously claims-free.

- IntelliDrive Program: Customers can join IntelliDrive and earn discounts that are calculated based on their driving.

- Financial Stability: Mazda CX-9 policies will be backed by a financially responsible company, as Travelers has an A++ rating from A.M. Best.

Cons

- IntelliDrive Mazda CX-9 Rate Increases: Mazda CX-9 rates could increase in some states if drivers drive badly in the program.

- Customer Satisfaction: Based on reviews, not all Mazda CX-9 customers will be happy with services. Read our Travelers review to learn more.

#7 – Allstate: Best for Add-On Coverages

Pros

- Add-On Coverages: Some of the many add-on coverages for Mazda CX-9 vehicles include roadside assistance and umbrella coverage. Visit our Allstate review to learn more.

- Mileage-Based Insurance: Mazda CX-9 drivers with low mileage can join Milewise for cheaper rates.

- Bundling Discount: Mazda CX-9 car insurance can be bought with home or renters insurance.

Cons

- Customer Complaints: Potential Mazda CX-9 customers should know that Allstate’s number of complaints is high.

- Discount Eligibility: Some Mazda CX-9 customers may find it harder to qualify for discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Mazda CX-9 customers can change coverages, deductibles, and more on their Mazda CX-9 policies.

- 24/7 Assistance: Mazda CX-9 customers can always reach out to a representative.

- Bundling Discount: Mazda CX-9 owners can also buy their home or renters insurance from Liberty Mutual.

Cons

- Expensive Rates: Liberty Mutual is a more expensive company for Mazda CX-9 insurance. Visit our Liberty Mutual review for more rate data.

- Customer Service: Not all Mazda CX-9 customers will be happy with services, as not all reviews about Liberty Mutual are positive.

#9 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: Mazda CX-9 will have access to 24/7 roadside assistance as AAA members.

- Local Agents: Most customers will have access to a local agent for assistance with Mazda CX-9 insurance.

- Discount Options: Mazda CX-9 car insurance rates can be lowered if customers apply for discounts. To see what AAA offers, visit our AAA review.

Cons

- Expensive Rates: AAA is one of the more expensive choices for Mazda CX-9 insurance.

- Membership Fee: Mazda CX-9 customers will have to pay an annual AAA membership fee.

#10 – USAA: Best for Military Savings

Pros

- Military Savings: Military and veteran owners of Mazda CX-9 vehicles will find the best deals at USAA. Discover more by reading our USAA review.

- Customer Service: Mazda CX-9 c customers should rest easy knowing USAA is ranked highly for customer satisfaction.

- Country-Wide Availability: USAA Mazda CX-9 insurance is sold in all states.

Cons

- No Local Agent Assistance: USAA services for Mazda CX-9 customers will be virtual.

- Eligibility Restrictions: Mazda CX-9 insurance is sold to veterans, military members, and their families.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Mazda CX-9 Insurance Cost

The average Mazda CX-9 auto insurance rates are $120 a month, as you can see in the table below.

Mazda CX-9 Auto Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $120 |

| Discount Rate | $71 |

| High Deductibles | $103 |

| High Risk Driver | $257 |

| Low Deductibles | $151 |

| Teen Driver | $439 |

However, rates will vary based on which of the best companies you choose and which type of coverage you opt for. The table below displays rates by coverage at the best companies.

Mazda CX-9 Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $69 | $210 |

| Allstate | $60 | $185 |

| Farmers | $69 | $208 |

| Geico | $38 | $122 |

| Liberty Mutual | $91 | $288 |

| Nationwide | $67 | $190 |

| Progressive | $55 | $173 |

| State Farm | $48 | $140 |

| Travelers | $57 | $169 |

| USAA | $54 | $164 |

Minimum coverage is required by drivers’ states, while full coverage is required by lenders. If your Mazda CX-9 is completely paid off, then you can carry just minimum coverage, although full coverage is the best option in most cases (Read More: Full Coverage Auto Insurance Defined).

Full coverage for Mazda CX-9s includes collision and comprehensive insurance, which cover accidents with other vehicles, animals, and more.Brandon Frady Licensed Insurance Producer

The only time drivers should skip out on full coverage is if their Mazda CX-9 is greatly depreciated in value.

Mazda CX-9 Rates Compared to Other Brands

The chart below details how Mazda CX-9 insurance rates compare to other SUVs like the Toyota 4Runner, Nissan Pathfinder, and Lincoln Navigator.

Mazda CX-9 Auto Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Total |

|---|---|---|---|---|

| Mazda CX-9 | $29 | $47 | $31 | $120 |

| Toyota 4Runner | $28 | $43 | $28 | $109 |

| Nissan Pathfinder | $25 | $38 | $33 | $108 |

| Lincoln Navigator | $30 | $57 | $33 | $133 |

| GMC Yukon | $31 | $50 | $31 | $125 |

| Mitsubishi Outlander Sport | $23 | $43 | $28 | $105 |

| Honda Passport | $30 | $55 | $26 | $123 |

Vehicles like the Lincoln Navigator will cost more than Mazdas. However, Mazdas aren’t the cheapest brand. There are a few things you can do to find the cheapest Mazda insurance rates online, which we cover in the following sections.

Factors That Impact the Cost of Mazda CX-9 Insurance

You might have noticed that there is a multitude of factors that impact Mazda CX-9 auto insurance rates. Your age, location, driving record, and model year are all factors that affect auto insurance rates for your Mazda CX-9.

Age of the Vehicle

The average Mazda CX-9 auto insurance rates are higher for newer models. For example, full coverage auto insurance for a 2020 Mazda CX-9 costs $120/mo, while 2015Mazda CX-9 insurance costs $114/mo for full coverage.

Mazda CX-9 Auto Insurance Monthly Rates by Model Year & Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2024 Mazda CX-9 | $30 | $48 | $32 | $122 |

| 2023 Mazda CX-9 | $30 | $48 | $32 | $121 |

| 2022 Mazda CX-9 | $29 | $48 | $31 | $121 |

| 2021 Mazda CX-9 | $29 | $47 | $31 | $121 |

| 2020 Mazda CX-9 | $29 | $47 | $31 | $120 |

| 2019 Mazda CX-9 | $28 | $45 | $33 | $119 |

| 2018 Mazda CX-9 | $27 | $45 | $33 | $118 |

| 2017 Mazda CX-9 | $26 | $44 | $35 | $117 |

| 2016 Mazda CX-9 | $25 | $42 | $36 | $116 |

| 2015 Mazda CX-9 | $24 | $40 | $37 | $114 |

| 2014 Mazda CX-9 | $23 | $38 | $38 | $111 |

| 2013 Mazda CX-9 | $22 | $35 | $38 | $108 |

| 2012 Mazda CX-9 | $21 | $32 | $38 | $104 |

| 2011 Mazda CX-9 | $19 | $29 | $38 | $100 |

| 2010 Mazda CX-9 | $19 | $27 | $39 | $98 |

If you own a model that is older than 20 years, you may have to get classic car insurance for your vehicle (Learn More: Does my car qualify for classic auto insurance?).

Driver Age

Driver age can have a significant effect on the cost of Mazda CX-9 auto insurance. For example, a 20-year-old driver could pay around $147 more each month for their Mazda CX-9 auto insurance than 30-year-old driver.

Mazda CX-9 Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $620 |

| Age: 18 | $439 |

| Age: 20 | $272 |

| Age: 30 | $125 |

| Age: 40 | $120 |

| Age: 45 | $115 |

| Age: 50 | $109 |

| Age: 60 | $107 |

Younger drivers are considered high-risk drivers due to driving inexperience, which is why their auto insurance costs are so much higher at insurance companies.

Driver Location

Where you live can have a large impact on Mazda CX-9 insurance rates. For example, drivers in New York may pay $73 more per month than drivers in Seattle.

Mazda CX-9 Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $205 |

| New York, NY | $190 |

| Houston, TX | $188 |

| Jacksonville, FL | $174 |

| Philadelphia, PA | $161 |

| Chicago, IL | $158 |

| Phoenix, AZ | $139 |

| Seattle, WA | $116 |

| Indianapolis, IN | $102 |

| Columbus, OH | $100 |

If rates in your area are expensive, the best thing you can do is shop around for auto insurance quotes from the top companies in your area.

Your Driving Record

Your driving record can have an impact on the cost of Mazda CX-9 auto insurance. Teens and drivers in their 20’s see sees the highest jump in their Mazda CX-9 auto insurance with violations on their driving record.

Mazda CX-9 Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $620 | $810 | $1,150 | $780 |

| Age: 18 | $439 | $600 | $850 | $520 |

| Age: 20 | $272 | $410 | $670 | $350 |

| Age: 30 | $125 | $180 | $310 | $160 |

| Age: 40 | $120 | $170 | $300 | $155 |

| Age: 45 | $115 | $165 | $290 | $150 |

| Age: 50 | $109 | $155 | $280 | $145 |

| Age: 60 | $107 | $150 | $270 | $140 |

If you have multiple driving infractions on your driving record, you may have to purchase high-risk insurance from a company.

High-risk insurance is expensive, and high-risk drivers often have to pay increased high-risk rates for a few years after the accident, ticket, or DUI.

Mazda CX-9 Safety Ratings

The Mazda CX-9’s safety ratings will affect your Mazda CX-9 auto insurance rates. See the chart below for safety ratings for the Mazda CX-9.

Mazda CX-9 Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Mazda CX-9 has decent ratings for safety from the IIHS, which will help keep rates affordable for most customers.

Mazda CX-9 Crash Test Ratings

Mazda CX-9 crash test ratings will affect your Mazda CX-9 auto insurance rates. Cars that do poorly in crashes will have higher insurance rates.

Mazda CX-9 Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Mazda CX-9 SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2024 Mazda CX-9 SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Mazda CX-9 SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Mazda CX-9 SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Mazda CX-9 SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Mazda CX-9 SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Mazda CX-9 SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Mazda CX-9 SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Mazda CX-9 SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Mazda CX-9 SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Mazda CX-9 SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Mazda CX-9 SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Mazda CX-9 SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Mazda CX-9 SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Mazda CX-9 SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Mazda CX-9 SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

The Mazda CX-9 models all have similar crash test ratings in testing, with an overall crash score of five stars from the NHTSA.

Mazda CX-9 Safety Features

The Mazda CX-9 safety features play a vital role in keeping passengers safe in crashes, but they can also help lower your Mazda CX-9 auto insurance rates. The Mazda CX-9’s safety features include the following.

Mazda CX-9 Safety Features

| Feature |

|---|

| Auto-Leveling Headlights |

| Blind Spot Monitor |

| Brake Assist |

| Child Safety Locks |

| Cross-Traffic Alert |

| Daytime Running Lights |

| Driver Air Bag |

| Electronic Stability Control |

| Front Head Air Bag |

| Front Side Air Bag |

| Integrated Turn Signal Mirrors |

| Lane Departure Warning |

| Lane Keeping Assist |

| Passenger Air Bag |

| Rear Head Air Bag |

| Traction Control |

| 4-Wheel ABS |

| 4-Wheel Disc Brakes |

Most car insurance companies will offer a safety feature discount for Mazda CX-9s, especially if drivers install anti-theft devices.

Installing these devices in your car reduces your risk of theft and earns you a discount at most companies. (Read More: How to Get an Anti-Theft Auto Insurance Discount).

Mazda CX-9 Insurance Loss Probability

The Mazda CX-9’s insurance loss ratio varies between different coverage types. Take a look below to see which coverages have the best lost ratios.

Mazda CX-9 Auto Insurance Loss Probability by Coverage Type

| Coverage | Loss |

|---|---|

| Collision | -13% |

| Property Damage | 8% |

| Comprehensive | -26% |

| Personal Injury | -13% |

| Medical Payment | -5% |

| Bodily Injury | -11% |

While some types of insurance loss ratios are higher for the Mazda CX-9, others are more favorable and lead to lower insurance rates.

Mazda CX-9 Finance and Insurance Cost

If you are financing a Mazda CX-9, you will pay more if you purchase Mazda CX-9 auto insurance at the dealership, so be sure to shop around and compare Mazda CX-9 auto insurance quotes from the best companies using our free tool below.

Ways to Save on Mazda CX-9 Insurance

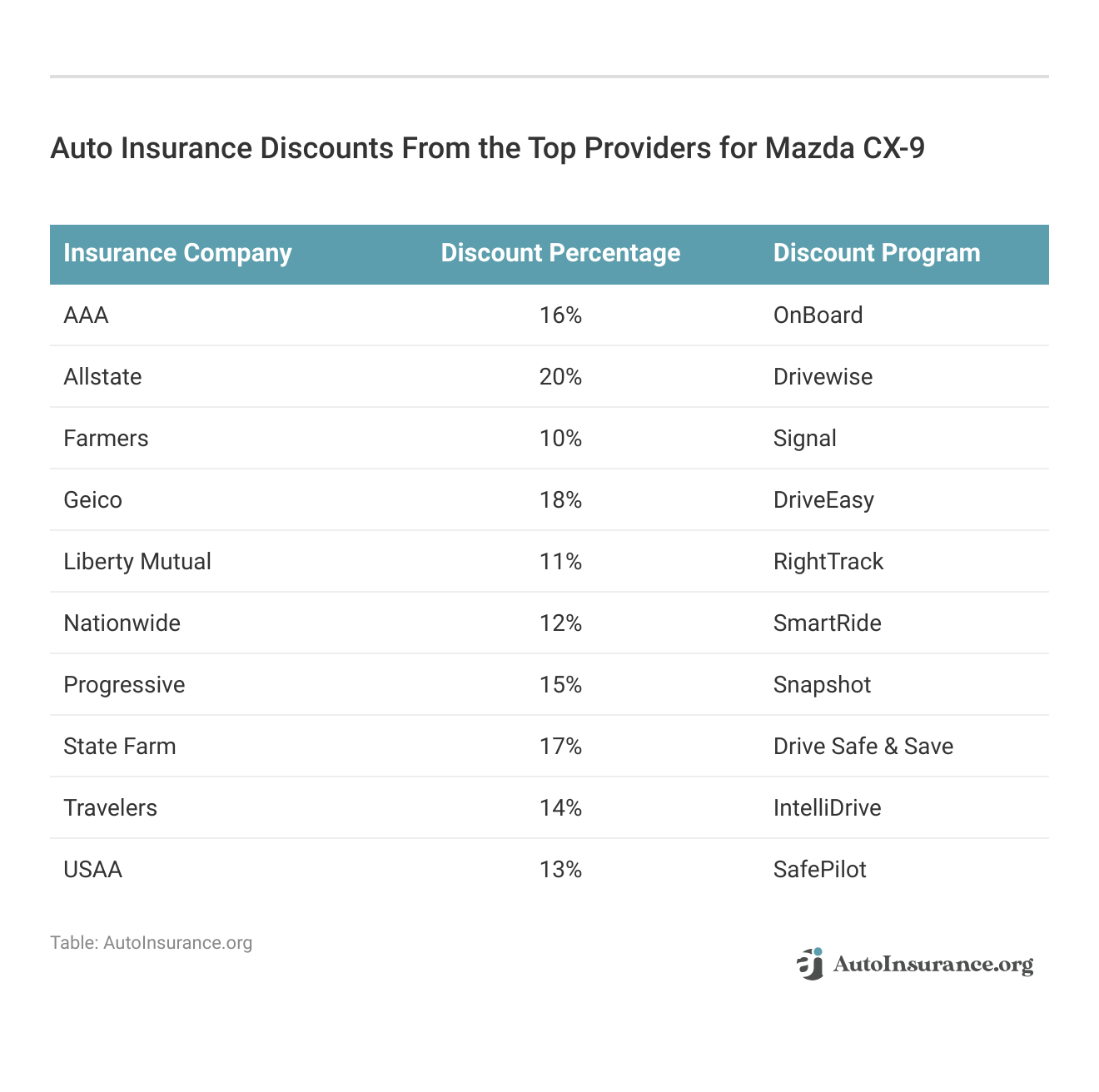

To save on Mazda CX-9 auto insurance, start by applying for auto insurance discounts. The table below displays popular discounts at the best Mazda CX-9 insurance companies.

If you want to reduce the cost of your Mazda CX-9 insurance rates further, follow the additional insurance saving tips below:

- Buy a dashcam for your Mazda CX-9.

- Check the odometer on your Mazda CX-9.

- Be picky about who drives your Mazda CX-9.

- Understand that insurance companies can’t change your Mazda CX-9 auto insurance rates mid-term based on changes to your credit score.

- Get married and ask for a discount.

Shopping around for Mazda CX-9 auto insurance quotes will also help you save on your auto insurance costs. You can get quotes directly from companies or use a free quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Other Top Mazda CX-9 Insurance Companies

Who is the best company for Mazda CX-9 insurance rates? While the actual rates you pay will depend on many factors, here are some more options for the top companies offering Mazda CX-9 insurance coverage (ordered by market share).

Top 10 Mazda CX-9 Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

Many of these companies offer discounts for security systems and other safety features that the Mazda CX-9 offers, helping keep costs low. State Farm is the biggest company in the U.S., followed by Geico and Progressive. State Farm is also our top pick for Mazda CX-9s.

Finding the Best Mazda CX-9 Insurance For You

State Farm, Progressive, and Farmers are our top three companies for Mazda CX-9 insurance policies. They offer great coverage options for Mazda CX-9s and plenty of car insurance discounts for savings, such as good driver discounts (Read More: How to Get a Good Driver Auto Insurance Discount).

Ready to get quotes for your Mazda CX-9? You can start comparing quotes for Mazda CX-9s from some of the best Mazda auto insurance companies by using our free online tool now.

Frequently Asked Questions

How much does auto insurance for a Mazda CX-9 typically cost?

The cost of auto insurance for a Mazda CX-9 can vary depending on various factors, including your location, driving history, age, coverage options, and insurance provider. It’s best to obtain quotes from different insurers to get an accurate idea of the cost for your specific circumstances.

Are Mazdas generally expensive to insure compared to other vehicles?

Insurance rates can vary between different vehicle makes and models, and while Mazdas generally offer good safety ratings and reasonable repair costs, insurance premiums can still be influenced by factors such as the vehicle’s popularity, performance, and theft rates. It’s advisable to compare insurance quotes from multiple providers to determine the best rate for your Mazda CX-9. Enter your ZIP in our free quote tool to get started.

What factors can affect the insurance premium for a Mazda CX-9?

Several factors can impact the insurance premium for a Mazda CX-9 besides what coverage types you choose for you policy, such as:

- Your Driving Record: A clean driving record with no accidents or traffic violations generally leads to lower premiums.

- Location: Insurance rates can vary based on where you live, including factors like crime rates and traffic congestion.

- Age and Gender: Younger and less experienced drivers often pay higher premiums.

- Vehicle Features: Safety features and anti-theft devices in the Mazda CX-9 may qualify for discounts.

- Deductible Amount: A higher deductible typically leads to lower premiums, but you’ll pay more out of pocket in case of a claim (Learn More: What is a good deductible for auto insurance?).

Insurance companies will take all of these factors into consideration when calculating your Mazda CX-9 car insurance rates.

What type of insurance coverage is recommended for a Mazda CX-9?

It’s generally recommended to have the following types of coverage for a Mazda CX-9:

- Liability Coverage: This covers injuries and property damage you may cause to others in an accident where you’re at fault.

- Collision Coverage: This covers repairs or replacement costs if your Mazda CX-9 is damaged in a collision, regardless of fault.

- Comprehensive Coverage: This covers non-collision-related damages, such as theft, vandalism, or weather-related incidents.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who has insufficient or no insurance.

Liability insurance is required coverage in most states, and lenders require collision and comprehensive coverage.

Can I get discounts on insurance for my Mazda CX-9?

Yes, insurance companies often offer various discounts that you may qualify for when insuring a Mazda CX-9. These Mazda CX-9 auto insurance discounts can include:

- Safety Features Discount: If your CX-9 has advanced safety features, such as anti-lock brakes, airbags, or a backup camera, you may be eligible for a discount.

- Anti-Theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, can help reduce your premium.

- Multi-Policy Discount: If you have multiple policies with the same insurer, such as auto and home insurance, you may qualify for a discount.

- Good Driver Discount: Maintaining a clean driving record can often lead to discounted rates.

Make sure to ask your insurance company for a list of discounts to make sure you are qualifying for as many discounts as possible.

Can I transfer my current auto insurance to my new Mazda CX-9?

If you already have an auto insurance policy, you can typically contact your insurance provider to update your policy with the details of your new Mazda CX-9. They will adjust the coverage and premium accordingly. However, it’s always a good idea to compare quotes from other insurers to ensure you’re getting the best coverage and rates for your new vehicle (Read More: How to Compare Auto Insurance Quotes).

Are there any specific Mazda CX-9 insurance considerations I should be aware of?

While insurance considerations can vary based on your location and insurer, there are a few specific factors to be aware of for a Mazda CX-9:

- Repair Costs: The cost of repairs for the Mazda CX-9 can impact insurance rates. Consider choosing comprehensive coverage to protect against potential repair expenses.

- Vehicle Value: The value of your Mazda CX-9 will influence the coverage options and premiums. Newer or higher-trim models may require additional coverage.

- Safety Features: The advanced safety features of the Mazda CX-9, such as lane departure warning or adaptive cruise control, may contribute to lower insurance rates.

Be sure to inquire about potential discounts for these features, as this will help you get cheap Mazda CX-9 auto insurance.

What should I do if I have further questions about Mazda CX-9 auto insurance?

If you have additional questions about Mazda CX-9 auto insurance, it’s recommended to reach out to insurance providers directly. They can provide you with specific information based on your location, driving history, and coverage preferences. Additionally, speaking with an insurance agent or broker can offer personalized guidance and help you find the best insurance solution for your Mazda CX-9.

Are Mazdas expensive to insure?

Mazda auto insurance is generally affordable. If your rates are high, make sure you read our article on how to lower your auto insurance rates.

Is the Mazda CX-9 a reliable car?

Yes, the Mazda CX-9 is a reliable car, which makes it easy to get good rates when shopping for the best auto insurance for a Mazda CX-9.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.