Esurance vs. Progressive Auto Insurance in 2026 (Head-to-Head Review)

Esurance vs. Progressive auto insurance compares Progressive’s $56 basic plan and Snapshot savings to Esurance’s $69 full coverage option. Esurance no longer sells new policies, so new customers must use Allstate, while Progressive remains a strong choice for affordable, flexible coverage.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated April 2025

1,543 reviews

1,543 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,543 reviews

1,543 reviews 13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsEsurance vs. Progressive auto insurance gives drivers two different choices based on coverage needs and driving history.

Esurance vs. Progressive Auto Insurance

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.2 | 4.3 |

| Business Reviews | 4.0 | 4.0 |

| Claim Processing | 4.5 | 3.5 |

| Company Reputation | 4.0 | 4.5 |

| Coverage Availability | 4.9 | 5.0 |

| Coverage Value | 4.1 | 4.2 |

| Customer Satisfaction | 2.0 | 2.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.2 | 4.4 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.8 | 5.0 |

| Savings Potential | 4.5 | 4.6 |

| Esurance Review | Progressive Review |

Progressive stands out with tools like the Name Your Price feature, Snapshot program, and accident forgiveness. Esurance no longer sells new policies, but existing customers can still manage their coverage with customizable options and strong mobile support.

This comparison breaks down their rates, discounts, coverage features, and customer service to help you find the better fit for your situation.

- Esurance vs. Progressive addresses accident forgiveness & teen driver discounts

- Esurance offers at $56, covering liability and add-ons like roadside assistance

- Progressive provides at $69, including parts protection and deductible savings

You can find affordable auto insurance, no matter your driving record, by entering your ZIP code into our free quote comparison tool.

Progressive vs. Esurance Rates by Age & Market Share Comparison

Esurance and Progressive both provide competitive rates for auto insurance for 18-year-olds, giving something based on gender age. Overall, Progressive’s costs are low for young drivers compared to Esurance, saving $20 for males and $15 for females. This trend of lower rates continues as customers age, preserving Progressive’s pricing edge.

Esurance vs. Progressive Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| 16-Year-Old Female | $614 | $436 |

| 16-Year-Old Male | $614 | $478 |

| 30-Year-Old Female | $174 | $150 |

| 30-Year-Old Male | $174 | $150 |

| 45-Year-Old Female | $162 | $140 |

| 45-Year-Old Male | $162 | $140 |

| 60-Year-Old Female | $171 | $94 |

| 60-Year-Old Male | $171 | $94 |

The lower rates are particularly important to young drivers and families with teen drivers who want affordable coverage. The comparison of market share shows the share of each company in the market. Progressive Insurance (14.90%) could indicate a broader acceptance that may be inclusive of a wider variety of services offered or higher customer satisfaction.

Esurance Insurance Services, Inc., with its smaller 3.80% market share, might be focusing more on personalized service or unique offerings designed for specific customer needs. When you look at both pricing and market share together, it really helps potential customers figure out which insurer aligns best with what they’re looking for.

Consider how Esurance and Progressive's rate differences fit your budget and specific needs, especially with a complex driving history.Daniel Walker Licensed Auto Insurance Agent

For a more tailored decision-making process, obtaining an Esurance auto insurance quote allows for direct evaluation of costs and benefits. Similarly, using the Progressive quote comparison comprehensive data set at each end, so you know exactly where Progressive plays in the field and how it compares to competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

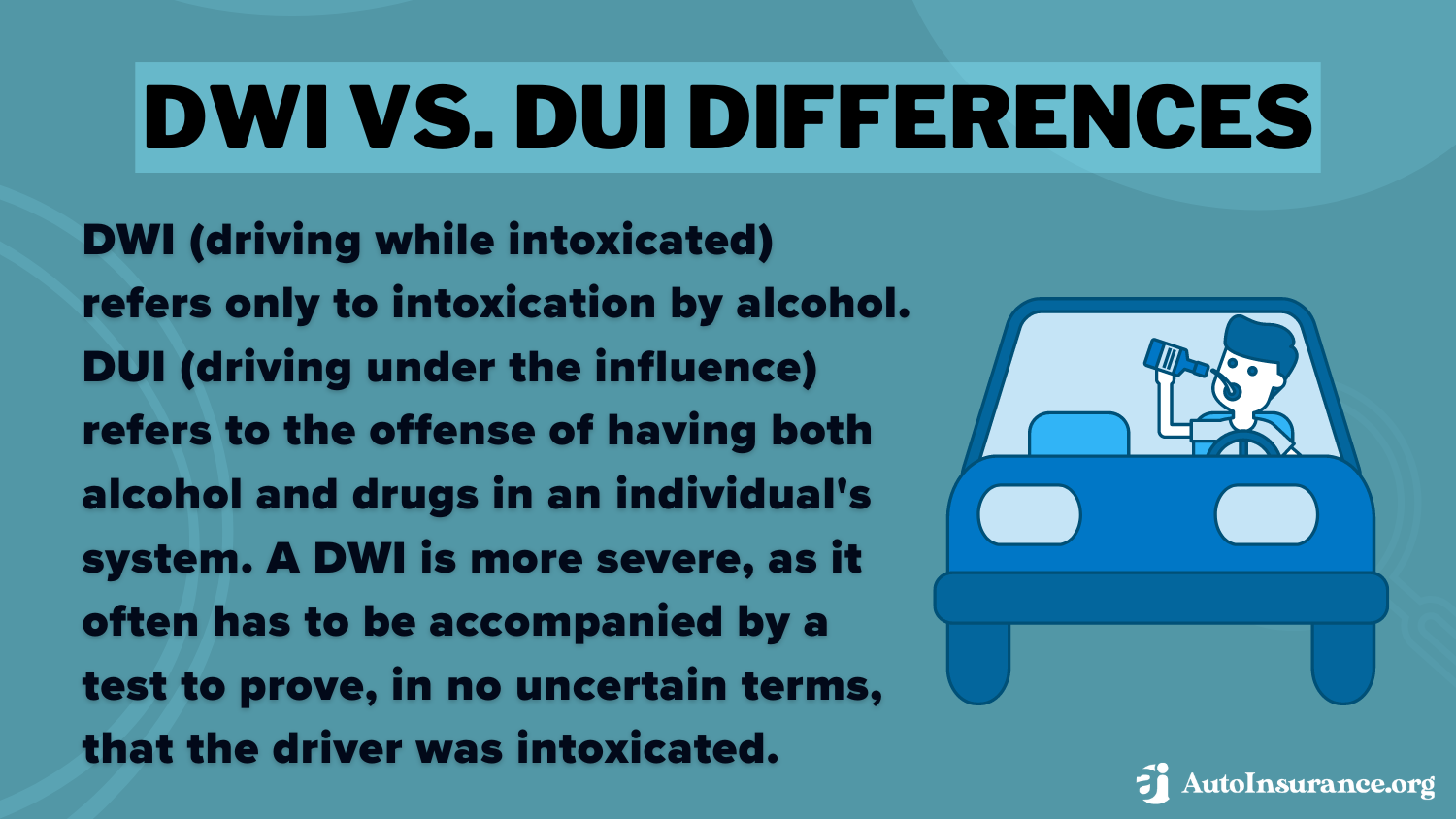

Esurance vs. Progressive Rates by Driving Record

When we examine the average monthly rates based on driving records for Esurance and Progressive, a pattern emerges that shows Progressive usually has lower rates than Esurance across the board, specifically for drivers with clean driving records and those who have recently received speeding tickets.

Esurance vs. Progressive Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $163 | $150 |

| Not-At-Fault Accident | $257 | $265 |

| Speeding Ticket | $208 | $199 |

| DUI/DWI | $298 | $200 |

A driver with a clean driving record, for example, can save $13 a month with Progressive vs. Esurance. This trend holds for more serious infractions; if those with DUI/DWI charges, Progressive’s rate is significantly lower, saving a driver about $98 each month.

Progressive has competitive pricing in a wide range of driving profiles, and given their continued appeal on the forgiving end post infraction, that’s going to be a major influencer in a lot of selections as they’re probably the best match.

Esurance vs. Progressive Rate by Credit Score

If you’re weighing your options between Esurance and Progressive based on how credit scores affect auto insurance rates, Progressive consistently offers lower rates across the board, from excellent to very poor credit scores. For those with top-notch credit, Progressive edges out a $10 monthly savings over Esurance. The savings become more pronounced as credit scores dip.

Esurance vs. Progressive Auto Insurance Monthly Rates by Credit Score

| Credit Score | ||

|---|---|---|

| Excellent (750+) | $120 | $110 |

| Good (700–749) | $135 | $125 |

| Poor (<700) | $200 | $185 |

Near the bottom end of the range, Progressive’s rates are roughly $20 lower than Esurance’s for people with terrible credit scores. This trend indicates that Progressive is not only favored by a lot of states across various financial profiles, but that it also positions itself as a less-expensive option among either credit category.

Esurance vs. Progressive Auto Insurance Discounts

When you look at the discounts offered by Esurance and Progressive for auto insurance, you’ll notice some key differences that could influence which provider might suit you better. Both companies offer competitive discounts across a variety of categories, but Progressive Advantage Agency, Inc. generally edges out Esurance slightly in most areas, such as multi-policy and multi-car discounts, which are both 2% higher at Progressive.

Esurance vs. Progressive: Auto Insurance Discounts

| Discount Type | ||

|---|---|---|

| Multi-Policy | 10% | 12% |

| Multi-Car | 10% | 12% |

| Good Driver | 20% | 31% |

| Good Student | 10% | 10% |

| Defensive Driving Course | 5% | 10% |

| Homeowner | 10% | 10% |

| Usage-Based | 13% | 30% |

| Pay-in-Full | 10% | 3% |

| Paperless Billing | 4% | 4% |

| Automatic Payments | 10% | 2% |

| Online Quote | 5% | 9% |

| Anti-Theft Device | 25% | 25% |

| Continuous Coverage | 20% | 8% |

Notably, Progressive’s usage-based discount through telematics is significantly more generous at 30% compared to Esurance’s 10%. Esurance outshines the competition with a massive 40% discount for safe drivers, while Progressive’s savings in this area are more varied with little predictability.

That variation in discount structures shows that it’s prudent to shop for the best deal, based on your situation and driving patterns, from the insurers who do business in your market.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Esurance vs. Progressive: Customer Ratings and Financial Strength

When making decisions about which insurance company to choose, it helps to consider ratings and reviews for companies such as Esurance and Progressive. Esurance comes in high on J.D. Power’s satisfaction index with a score of 810 out of 1,000 points, far ahead of Progressive’s 672 (and higher average satisfaction among its customers).

Insurance Business Ratings & Consumer Reviews: Esurance vs. Progressive Auto Insurance

| Agency | ||

|---|---|---|

| Score: 810 / 1,000 Avg. Satisfaction | Score: 672 / 1,000 Avg. Satisfaction |

|

| Score: A Good Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 72/100 Mixed Customer Feedback | Score: 72/100 Avg. Customer Feedback |

|

| Score: 1.20 Avg. Complaints | Score: 1.11 Avg. Complaints |

|

| Score: A- Excellent Financial Strength | Score: A+ Superior Financial Strength |

However, Progressive pulls ahead in the Better Business Bureau ratings with an A+ and Esurance a step below, at an A, indicating better business practices. Both companies got the same score from Consumer Reports — 72 out of 100 — and the customers had similar feedback.

The National Association of Insurance Commissioners (NAIC) reports fewer complaints for Progressive, which scores 1.11 compared with Esurance’s 1.20. Financial strength is important, too, and both insurers do well here, with Esurance earning an A- and Progressive slightly better at A+, showing their ability to honor financial obligations.

This performance snapshot provides a nuanced perspective on their strengths and weaknesses as the top auto insurance companies for you, so that you can decide according to which parts of service and reliability you value most.

Pros and Cons of Esurance Auto Insurance

When you’re considering auto insurance options, Esurance car insurance presents itself as a compelling choice with a mix of modern tech integration and flexible policy options. Here’s a straightforward rundown of the strengths and areas where they might not hit the mark.

Pros

- Perfect for Full Coverage: Esurance offers affordable full coverage policies to high-risk drivers, which can provide added protection.

- Tech-Savvy Approach: The mobile app is rated highly on iOS and Android, allowing management of policies and filing claims to be easy, which appeals to tech-savvy customers.

- Discount Opportunities: The Esurance DriveSense program provides safe-driving discounts by giving you discounted rates on insurance if you are a cautious driver.

Cons

- Limited Availability: The biggest downside is that Esurance isn’t offered in all states. The geographic limitation could be a bone of contention for customers outside the states covered.

- Customer Service Concerns: The service technology is highly rated, but some users report inconsistent customer service, which may concern those who value personal interaction and support.

Esurance appeals to tech-savvy drivers and those eligible for discounts, but limited availability and inconsistent customer service may pose challenges.

A Reddit user shared a positive experience and said that “gap insurance” saved them a ton of money—they totaled their car, and Esurance paid off the remaining car loan. Gap insurance is good for everyone, but you should keep these items in mind and consider your own unique situation while choosing an auto insurance company.

Pros and Cons of Progressive Auto Insurance

Progressive auto insurance stands out as a major player in the insurance industry, known for its extensive range of options and forward-thinking approach. If you’re mulling over whether Progressive might be the right fit for your auto insurance needs, here’s a balanced view to help guide your decision.

Pros

- Diverse Coverage Options: Progressive Casualty Insurance Company includes liability, comprehensive, collision, and uninsured driver coverage, protecting drivers with the necessary coverage.

- Innovative Tools and Discounts: Progressive’s Name Your Price Tool and Snapshot program allow the company to offer personalized rates based on driving behavior, which can help drivers save.

- Online Tools and Resources: Progressive has some of the best digital experiences anywhere, so managing and filing a claim is straightforward, just like its excellent online tools that prioritize easier access to coverage.

Cons

- Cost Fluctuations: Progressive offers cost management tools, but rates can fluctuate based on conditions like driving history, potentially limiting competitiveness.

- Mixed Customer Service Reviews: Customer service experience is varied; while some have offered the potential for excellent service, others faced issues with claims and support, and customers are looking for reliability.

Progressive is unique for its extensive coverage selections and also for its innovative discounts, making it an ideal candidate for a Progressive car insurance comparison, especially for tech-savvy clients. But prospective customers would have to weigh this benefit against price differences and mixed reviews for customer service.

A Yelp review also highlighted the effectiveness and the helpfulness of a team in assisting users after an accident, with the user noting the ease of message communication and a great response feeling, making the overall experience better. Keep these factors in mind along with your own needs as an individual or a family to select an insurer that will hopefully measure up to your expectations.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Esurance vs. Progressive: Choosing the Right Auto Insurance

Choosing between Esurance and Progressive for auto insurance, you’ll need to consider what’s most important to you. For those who want the cheapest rates possible, Progressive usually has the most affordable rates for basic liability auto insurance coverage, which could significantly reduce your expenses.

Progressive's Snapshot program offers savings on premiums for safe drivers by personalizing rates based on actual driving behavior.Tonya Sisler Insurance Content Team Lead

However, Esurance could be better if your coverage needs are more extensive, as they tend to have lower rates when it comes to full coverage policies; this makes Esurance a good candidate if you need to pack more protection or if you own a more valuable vehicle. In other words, the right insurer may offer a compromise between price and the degree of coverage you need.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

Frequently Asked Questions

Why is Esurance often cheaper than other insurers like Progressive?

Esurance may offer cheaper rates due to its primarily online presence, which reduces overhead costs associated with physical branches, allowing savings to be passed on to consumers.

Can you guide me on how to install the Esurance DriveSense app?

The Esurance DriveSense app can be installed directly on your smartphone. Simply download the app from your phone’s app store, sign in to your Esurance account, and follow the directions in the app to begin tracking your driving habits and possibly saving money for safe driving.

How do Esurance and Progressive auto insurance compare in terms of price and coverage?

Progressive often offers lower rates for basic coverage and utilizes tools like the Name Your Price tool and Snapshot to tailor rates. Esurance tends to provide more competitive rates for full coverage, which is especially beneficial for younger drivers or high-risk auto insurance.

How can I add a driver to my Esurance policy?

If you already have an online account, you can add a driver to your Esurance policy simply by logging in, locating your policy details, and supplying information for the driver you want to add, including their driving history and license number.

How does Progressive’s auto insurance app enhance the customer experience?

The Progressive auto insurance app allows users to manage their policies, file claims, check the status of a claim, and even use the Snapshot program to track driving habits and save money on premiums.

What is included in Esurance’s accident forgiveness program?

Esurance’s accident forgiveness program prevents your insurance rates from increasing after your first at-fault accident if you have been an Esurance customer for at least six months without any at-fault accidents.

What are the key auto insurance coverage options available with Progressive?

Progressive offers extensive auto insurance coverage options, including liability, comprehensive, collision, uninsured motorist coverage, and personal injury protection, along with unique add-ons like pet injury protection and custom parts coverage.

Is there any insurance that’s cheaper than Progressive while offering similar benefits?

Some regional insurers may offer rates cheaper than Progressive with similar benefits, especially for drivers with specific needs or those living in certain areas where local insurers can provide more tailored, cost-effective coverage.

Does Esurance offer roadside assistance, and what does it cover?

Yes, Esurance provides roadside assistance, which includes services like towing, tire changes, battery jump-starts, and lockout assistance to help drivers manage car troubles on the road.

How does Progressive’s price comparison tool help consumers?

Progressive’s price comparison tool allows consumers to compare their Progressive quote against other insurers’ rates directly on Progressive’s website, helping them to find the most cost-effective policy.

Is Drive Insurance integrated with Progressive’s services?

How can I ensure getting an A+ rating on Progressive’s Snapshot program?

How do customer reviews on BBB differ for Esurance and Progressive?

Esurance vs. Nationwide: Which offers better value for auto insurance?

What does Esurance’s rideshare insurance cover that makes it unique?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.