Best Chevrolet Impala Auto Insurance in 2026 (Compare the Top 10 Companies)

The best Chevrolet Impala auto insurance includes Travelers, Farmers, and The Hartford, with top rates starting at $95 per month. They stand out due to their competitive Chevy Impala insurance costs and comprehensive coverage options. Learn more about how Chevy Impala reliability influences your insurance rates.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated March 2025

Company Facts

Full Coverage for Chevrolet Impala

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Chevrolet Impala

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Chevrolet Impala

A.M. Best

Complaint Level

Pros & Cons

The best Chevrolet Impala auto insurance providers are Travelers, Farmers, and The Hartford, with rates starting at $95 per month. Travelers stands out as the top choice overall due to its competitive pricing and comprehensive coverage. Discover why Travelers offers the best value and explore if Chevy Impalas are good cars for your insurance needs.

This article also explores how other topics, such as the Chevy Impala’s reliability and various insurance coverage options, impact your rates. Learn how auto insurance competition helps customers get lower rates and choose the best coverage for your needs.

Our Top 10 Company Picks: Best Chevrolet Impala Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A++ IntelliDrive Program Travelers

#2 8% A Safe Drivers Farmers

#3 5% A+ AARP Discounts The Hartford

#4 10% A+ Deductible Rewards Allstate

#5 12% A Accident Forgiveness Liberty Mutual

#6 10% A+ Vanishing Deductible Nationwide

#7 15% A++ Military Perks USAA

#8 5% A+ Snapshot Program Progressive

#9 12% A Safe Driver American Family

#10 17% B Comprehensive Coverage State Farm

If you’re just looking for coverage to drive legally, enter your ZIP code above to compare cheap auto insurance quotes near you.

- Best Chevrolet Impala insurance starts at $95 per month

- Travelers is the top pick for rates and coverage

- Compare Chevy Impala insurance costs for tailored options

#1 – Travelers: Top Overall Pick

Pros

- Affordable Premiums: Travelers provides a competitive monthly rate of $185 for Chevrolet Impala insurance, making it an appealing option for drivers looking to manage their budget effectively while maintaining comprehensive coverage.

- Comprehensive Coverage Options: Travelers offers extensive coverage options, including comprehensive, collision, and liability, ensuring Chevrolet Impala owners are protected against a wide range of potential incidents and damages.

- Discounts for Safe Driving: As outlined in our Travelers auto insurance review, Travelers rewards safe driving habits with substantial discounts, which can lower insurance costs further for Chevrolet Impala owners with a clean driving record, promoting safer driving practices.

Cons

- Higher Rates for Younger Drivers: Travelers’ premiums can be significantly higher for younger drivers, which might make it less affordable for younger Chevrolet Impala owners compared to other insurance providers.

- Limited Regional Availability: Travelers may not be available in every region, potentially restricting access for Chevrolet Impala drivers in certain areas and necessitating a search for other insurance providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Farmers: Best for Safe Drivers

Pros

- Strong Customer Service: Farmers is well-regarded for its excellent customer service, providing Chevrolet Impala owners with responsive and helpful support for any insurance-related queries or issues. Check out this page Farmers auto insurance review to know more details.

- Customizable Coverage Plans: Farmers offers a variety of customizable coverage options for the Chevrolet Impala, allowing policyholders to adjust their insurance plans to better suit their specific needs and preferences.

- Discounts for Multi-Policy Holders: Farmers provides significant discounts for bundling auto insurance with other policies, such as home insurance, which can reduce the overall cost for Chevrolet Impala drivers.

Cons

- Higher Premium Costs: With an average monthly premium of $210, Farmers is on the higher end of the price spectrum for Chevrolet Impala insurance, which may not be ideal for those seeking more affordable options.

- Potential for Rate Increases: Farmers may increase rates over time, especially if claims are filed, potentially impacting the long-term affordability of insurance for Chevrolet Impala owners.

#3 – The Hartford: Best for AARP Discounts

Pros

- Excellent Claim Handling: The Hartford is known for its efficient and reliable claim handling process, ensuring that Chevrolet Impala owners experience a smooth and timely resolution if they need to file a claim.

- Senior Discounts Available: The Hartford offers specific discounts for senior drivers, which can be advantageous for older Chevrolet Impala owners seeking to reduce their insurance costs.

- High A.M. Best Rating: As mentioned in our The Hartford auto insurance review, The Hartford holds a strong A.M. Best rating, reflecting its financial stability and reliability in handling claims, which provides peace of mind for Chevrolet Impala policyholders.

Cons

- Higher Average Premium: At $195 per month, The Hartford’s insurance costs are relatively high compared to some other providers, which could be a drawback for budget-conscious Chevrolet Impala owners.

- Limited Coverage Options for Older Models: The Hartford may offer fewer coverage options or discounts for older Chevrolet Impala models, which could affect the affordability of insurance for these vehicles.

#4 – Allstate: Best for Deductible Rewards

Pros

- Wide Range of Discounts: Allstate offers a variety of discounts, including those for safe driving, bundling, and vehicle safety features, which can help lower insurance costs for Chevrolet Impala owners. Learn more about their discounts in our Allstate auto insurance review.

- Extensive Coverage Options: Allstate provides comprehensive coverage plans for the Chevrolet Impala, including options for collision, comprehensive, and liability coverage, ensuring robust protection for drivers.

- Strong Customer Service: Allstate is known for its responsive and helpful customer service, assisting Chevrolet Impala owners with their insurance needs and providing support throughout the policy term.

Cons

- Higher Premiums: With an average monthly premium of $225, Allstate’s insurance costs are higher compared to many competitors, which could be a drawback for those seeking more affordable insurance options for their Chevrolet Impala.

- Potential for Premium Hikes: Allstate’s rates may increase over time, especially with claims or changes in driving habits, impacting long-term affordability for Chevrolet Impala drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Variety of Discounts: Liberty Mutual offers a range of discounts, including those for safe driving and bundling policies, which can help reduce the monthly premium for Chevrolet Impala insurance.

- Comprehensive Coverage Options: Liberty Mutual provides extensive coverage options for the Chevrolet Impala, including collision, comprehensive, and liability coverage, catering to various protection needs.

- Accident Forgiveness Program: As mentioned in our Liberty Mutual auto insurance review, Liberty Mutual’s accident forgiveness program can be beneficial for Chevrolet Impala owners, preventing rate increases after their first at-fault accident.

Cons

- Higher Premium Costs: With an average monthly premium of $230, Liberty Mutual is among the more expensive options for Chevrolet Impala insurance, which might not suit budget-conscious drivers.

- Potentially Limited Regional Availability: Liberty Mutual may not be available in all areas, potentially restricting options for Chevrolet Impala drivers in certain locations.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Discounts for Safe Drivers: Nationwide offers significant discounts for safe driving, which can reduce the monthly insurance cost for Chevrolet Impala owners with a clean driving history.

- Comprehensive Coverage Options: Nationwide provides a range of coverage options for the Chevrolet Impala, including comprehensive, collision, and liability, ensuring thorough protection against various risks.

- Roadside Assistance: Nationwide includes roadside assistance with many of its policies, offering added convenience and support for Chevrolet Impala drivers in case of emergencies. For more information, read our Nationwide auto insurance review.

Cons

- Higher Average Premium: At $200 per month, Nationwide’s insurance costs are higher compared to some other insurers, which might be a disadvantage for those seeking lower premiums for their Chevrolet Impala.

- Customer Service Variability: Some customers report variability in customer service quality, which could impact the overall experience for Chevrolet Impala owners when managing their insurance policies.

#7 – USAA: Best for Military Perks

Pros

- Lowest Premiums: USAA offers the most affordable monthly premium at $175 for Chevrolet Impala insurance, making it a cost-effective choice for drivers looking to save on their insurance expenses.

- Excellent Customer Service: USAA is renowned for its exceptional customer service, providing Chevrolet Impala owners with helpful and responsive support throughout their insurance experience.

- Military Discounts: As mentioned in our USAA auto insurance review, USAA provides special discounts for military members and their families, which can be particularly beneficial for those eligible Chevrolet Impala owners.

Cons

- Eligibility Restrictions: USAA insurance is only available to military members, veterans, and their families, which limits accessibility for non-military Chevrolet Impala owners.

- Limited Coverage Options: While USAA offers competitive rates, its range of coverage options may be more limited compared to some other insurers, which could impact customization for Chevrolet Impala policies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Progressive: Best for Snapshot Program

Pros

- Discounts for Bundling Policies: Progressive offers significant discounts for bundling auto insurance with other policies, such as home insurance, which can lower the monthly cost for Chevrolet Impala owners.

- Flexible Coverage Options: Progressive auto insurance review showcases the variety of coverage options for the Chevrolet Impala, including comprehensive, collision, and liability, allowing policyholders to tailor their insurance to their needs.

- Snapshot Program: Progressive’s Snapshot program offers additional savings based on driving habits, which can be beneficial for Chevrolet Impala owners who practice safe driving.

Cons

- Higher Premiums for Younger Drivers: Progressive’s rates can be higher for younger drivers, potentially making it less affordable for younger Chevrolet Impala owners compared to some competitors.

- Potential for Rate Fluctuations: Progressive’s rates may fluctuate based on driving behavior and claims history, which could lead to variability in monthly premiums for Chevrolet Impala drivers.

#9 – American Family: Best for Safe Driver

Pros

- Customizable Coverage Options: American Family offers a range of customizable coverage options for the Chevrolet Impala, allowing drivers to tailor their insurance policies to fit their specific needs.

- Discounts for Safe Driving and Bundling: American Family provides discounts for safe driving as well as bundling multiple policies, which can help reduce the monthly premium for Chevrolet Impala owners.

- Strong Customer Support: American Family is known for its reliable customer support, offering assistance to Chevrolet Impala owners with their insurance needs and inquiries. (Read More: American Family Auto Insurance Review).

Cons

- Higher Premiums for Some Drivers: With an average monthly premium of $190, American Family may be more expensive compared to some other insurance providers, potentially impacting affordability for Chevrolet Impala owners.

- Limited Regional Availability: American Family may not be available in all regions, which could limit options for Chevrolet Impala drivers in certain areas and require searching for other providers.

#10 – State Farm: Best for Comprehensive Coverage

Pros

- Affordable Premiums: State Farm auto insurance review highlights their competitive monthly premium of $180 for Chevrolet Impala insurance, providing a balance of cost-effectiveness and comprehensive coverage.

- Wide Range of Discounts: State Farm provides numerous discounts, including those for safe driving, bundling, and vehicle safety features, which can help reduce insurance costs for Chevrolet Impala owners.

- Strong Network of Agents: State Farm has a broad network of local agents, offering personalized service and support for Chevrolet Impala owners when managing their insurance policies.

Cons

- Rate Increases for Claims: State Farm may increase rates following claims, which could affect long-term affordability for Chevrolet Impala drivers who experience accidents or need to file claims.

- Potential for Higher Costs in Certain Areas: Insurance premiums with State Farm can vary significantly based on location, which might result in higher costs for Chevrolet Impala owners in certain regions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chevrolet Impala Insurance Cost

The table below compares monthly rates for minimum and full coverage car insurance for a Chevrolet Impala from various providers.

Chevrolet Impala Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $110 $225

American Family $95 $190

Farmers $105 $210

Liberty Mutual $115 $230

Nationwide $100 $200

Progressive $100 $205

State Farm $95 $180

The Hartford $100 $195

Travelers $95 $185

USAA $90 $175

When choosing auto insurance for your Chevrolet Impala, it’s essential to compare rates across different providers to find the best value for your needs. Providers offer varying rates for both minimum and full coverage, so evaluate the options to select the most cost-effective and comprehensive policy.

Chevrolet Impala Auto Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $112 |

| Discount Rate | $66 |

| High Deductibles | $96 |

| High Risk Driver | $238 |

| Low Deductibles | $141 |

| Teen Driver | $409 |

For Chevrolet Impala insurance, your premium can vary significantly based on your deductible amount and risk profile. By adjusting deductibles and exploring discounts, you can find a balance between coverage and cost that suits your needs.

Read More: Best Auto Insurance Companies for High-Risk Drivers

Why Chevrolet Impalas are Expensive to Insure

The chart below details how Chevrolet Impala insurance rates compare to other sedans like the Ford Taurus, Toyota Camry, and Chevrolet Blazer.

Chevrolet Impala Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Discount Rate | $66 |

| High Deductibles | $96 |

| Average Rate | $112 |

| Low Deductibles | $141 |

| High Risk Driver | $238 |

| Teen Driver | $409 |

Chevrolet Impala insurance rates are competitive compared to similar sedans, often falling below the average cost of models like the Ford Taurus and Honda Civic. By comparing rates and considering various factors, you can effectively manage insurance costs for your Impala.

Read More: Best Toyota Camry Auto Insurance

Factors Influencing the Cost of Chevrolet Impala Insurance

The average monthly insurance rate for a Chevrolet Impala is $112, but several factors can influence this cost. Younger drivers often face higher premiums due to their increased risk profile. The location where you live also plays a role, with urban areas typically resulting in higher rates compared to rural ones.

A clean driving record can help lower premiums, whereas a history of traffic violations or accidents can lead to increased costs. Additionally, newer Impala models generally have higher insurance rates because of their greater repair and replacement costs.

Age of the Vehicle

Older Chevrolet Impala models generally cost less to insure. For example, auto insurance for a 2020 Chevrolet Impala costs $112 per month, while insurance for a 2010 Chevrolet Impala is $93 per month, a difference of $19.

Chevrolet Impala Auto Insurance Monthly Rates by Year & Coverage Type

Model Year Comprehensive Collision Minimum Coverage Full Coverage

2024 Chevrolet Impala $24 $46 $32 $114

2023 Chevrolet Impala $24 $45 $32 $113

2022 Chevrolet Impala $23 $45 $32 $113

2021 Chevrolet Impala $23 $44 $31 $112

2020 Chevrolet Impala $23 $44 $31 $112

2019 Chevrolet Impala $22 $43 $33 $111

2018 Chevrolet Impala $21 $42 $33 $110

2017 Chevrolet Impala $21 $41 $35 $110

2016 Chevrolet Impala $20 $40 $36 $109

2015 Chevrolet Impala $19 $38 $37 $107

2014 Chevrolet Impala $18 $35 $38 $104

2013 Chevrolet Impala $17 $33 $38 $102

2012 Chevrolet Impala $17 $30 $38 $98

2011 Chevrolet Impala $16 $28 $38 $95

2010 Chevrolet Impala $15 $26 $39 $93

Older Chevrolet Impala models typically have lower insurance premiums due to decreased repair and replacement costs. By choosing an older model, you can potentially save on your monthly insurance expenses.

Driver Age

Driver age plays a crucial role in determining Chevrolet Impala auto insurance rates. Younger drivers typically face significantly higher premiums compared to their older counterparts. The chart below provides a clear comparison of insurance costs across different age groups.

Chevrolet Impala Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $409 |

| Age: 18 | $345 |

| Age: 20 | $254 |

| Age: 30 | $117 |

| Age: 40 | $112 |

| Age: 45 | $108 |

| Age: 50 | $102 |

| Age: 60 | $100 |

Driver age significantly impacts Chevrolet Impala insurance rates, with younger drivers paying considerably more compared to older drivers. For example, 20-year-olds face premiums that are substantially higher than those for 30-year-olds.

Driver Location

Your location can greatly impact the cost of insuring a Chevrolet Impala. The following chart shows how insurance rates vary across different U.S. cities, highlighting significant differences in premiums.

Chevrolet Impala Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $564 | $626 | $712 | $845 |

| Age: 18 | $437 | $495 | $563 | $670 |

| Age: 20 | $254 | $276 | $320 | $403 |

| Age: 30 | $117 | $127 | $156 | $205 |

| Age: 40 | $112 | $122 | $148 | $192 |

| Age: 45 | $110 | $120 | $145 | $187 |

| Age: 50 | $102 | $111 | $135 | $175 |

| Age: 60 | $100 | $109 | $133 | $172 |

A clean driving record can help keep your Chevrolet Impala insurance rates lower, while violations and accidents lead to significantly higher premiums. The impact is especially pronounced for younger drivers compared to their older counterparts.

Read More: Motorcycle vs. Car Accident Statistics

Chevrolet Impala Safety Ratings

Your Chevrolet Impala auto insurance rates are influenced by the Chevrolet Impala’s safety ratings. See the breakdown below:

Chevrolet Impala Safety Ratings

| Test Type | Rating |

|---|---|

| Small overlap front: driver-side | Acceptable |

| Small overlap front: passenger-side | Not Tested |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The safety ratings of your Chevrolet Impala play a significant role in determining your insurance rates. Higher safety ratings typically lead to lower premiums, reflecting the vehicle’s overall crash protection and safety features.

Chevrolet Impala Crash Test Ratings

Chevrolet Impala crash test ratings can impact your Chevrolet Impala auto insurance rates. See Chevrolet Impala crash test results below:

Chevrolet Impala Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Chevrolet Impala 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Chevrolet Impala 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Chevrolet Impala 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Chevrolet Impala 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Chevrolet Impala 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Chevrolet Impala 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Chevrolet Impala 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Chevrolet Impala 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Chevrolet Impala Limited 4 DR FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2016 Chevrolet Impala Eco eAssist 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Chevrolet Impala 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

The crash test ratings for your Chevrolet Impala significantly affect your insurance rates. Vehicles with higher ratings generally enjoy lower premiums due to their enhanced safety features and performance in crash tests.

Chevrolet Impala Safety Features

Good Chevrolet Impala safety features can result in insurers giving you insurance discounts. The safety features for the 2020 Chevrolet Impala are:

- Standard Air Bags: Includes driver and passenger air bags, front side air bags, and rear side air bags.

- Braking and Stability Features: Equipped with 4-wheel ABS, 4-wheel disc brakes, and brake assist for enhanced safety.

- Stability and Control Systems: Features electronic stability control, traction control, and blind spot monitoring.

- Safety Enhancements: Includes daytime running lights, child safety locks, and integrated turn signal mirrors.

- Advanced Alert Systems: Provides cross-traffic alert for added security while reversing.

The Chevrolet Impala’s comprehensive safety features not only enhance driving security but can also help you secure discounts on auto insurance. Leveraging these features may contribute to lower insurance premiums due to improved safety profiles.

Chevrolet Impala Insurance Loss Probability

The Chevrolet Impala’s insurance loss ratio varies between different coverage types. While some types of insurance loss ratios are higher for the Chevrolet Impala, others are more favorable and lead to lower insurance rates.

Chevrolet Impala Auto Insurance Loss Probability

| Coverage Type | Loss Rate |

|---|---|

| Collision | 4% |

| Property Damage | -11% |

| Comprehensive | 35% |

| Personal Injury | 22% |

| Medical Payment | 22% |

| Bodily Injury | 4% |

The Chevrolet Impala’s insurance loss ratios reveal a mix of higher and lower risk factors across different coverage types. This variation can influence your overall insurance premiums, making it essential to consider these rates when choosing your coverage.

Read More: Do you need medical payment coverage on auto insurance?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chevrolet Impala Finance and Insurance Cost

If you are financing a Chevrolet Impala, the cost of auto insurance can vary significantly. Purchasing insurance directly through the dealership might result in higher premiums due to limited options and potential markups.

To secure the best rates, it's advisable to compare Chevrolet Impala auto insurance quotes from multiple providers.Jeffrey Manola LICENSED INSURANCE AGENT

Using our free tool below, you can easily gather quotes from top insurance companies to find a policy that fits your budget and coverage needs. This comparison will help you save money and ensure you’re getting the most value for your insurance investment.

Read More: How to Evaluate Auto Insurance Quotes

5 Ways to Save on Chevrolet Impala Insurance

You can save more money on your Chevrolet Impala auto insurance rates by employing any of the following five strategies.

- Consider ride sharing services to lower your Chevrolet Impala mileage.

- Compare Chevrolet Impala insurance rates online.

- Save money on young driver Chevrolet Impala Insurance rates by mentioning grades or gpa.

- Purchase a roadside assistance coverage for your Chevrolet Impala.

- Ask about usage-based insurance for your Chevrolet Impala.

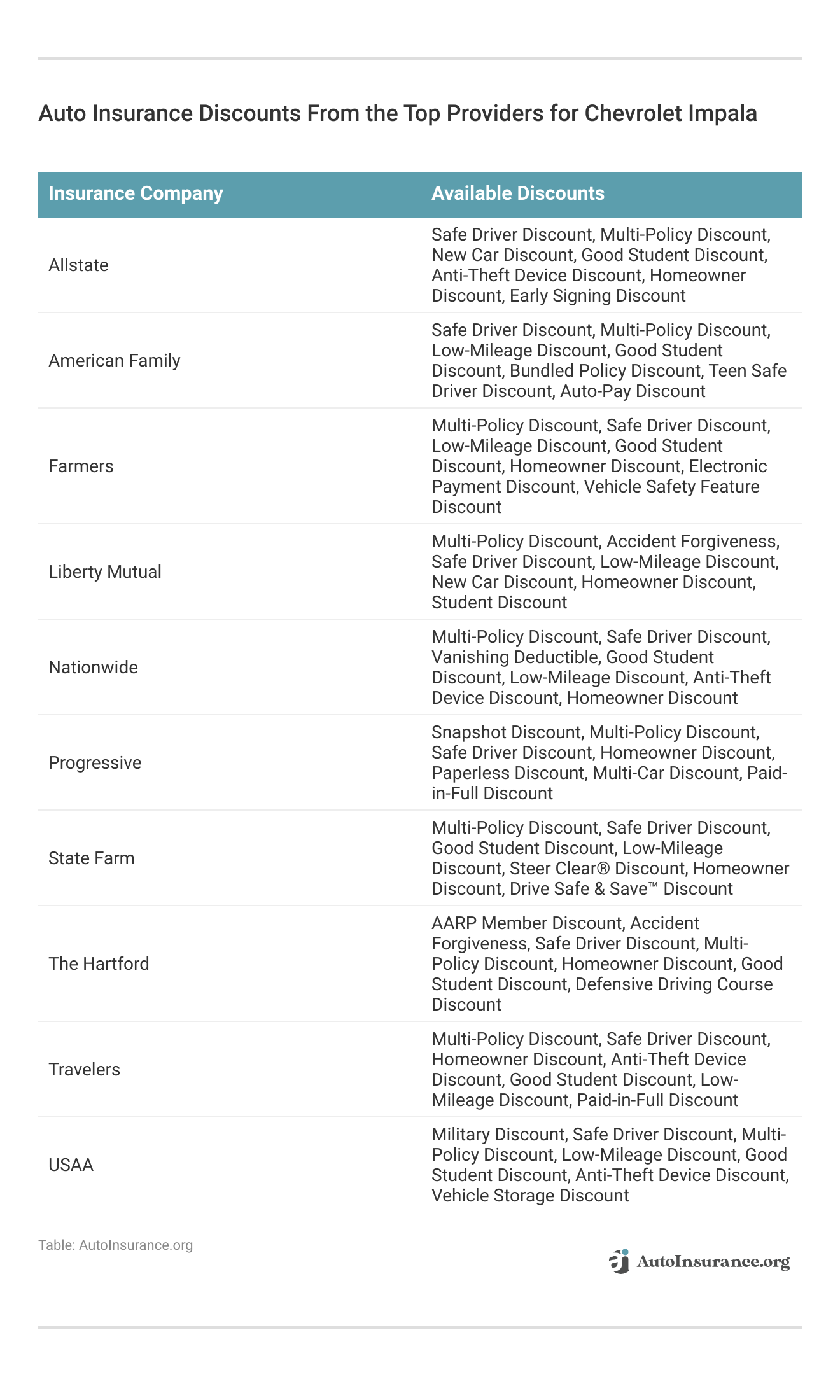

These discounts below can significantly impact rates by offering savings based on factors helping to lower monthly premiums.

These discounts from top insurance providers for Chevrolet Impala offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Top Chevrolet Impala Insurance Companies

The best auto insurance companies for Chevrolet Impala auto insurance rates will offer competitive rates, discounts, and account for the Chevrolet Impala’s safety features. The following list of auto insurance companies outlines which companies hold the highest market share.

Top Chevrolet Impala Auto Insurance Companies by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 milllion | 9% |

| #2 | Geico | $46.1 milllion | 7% |

| #3 | Progressive | $39.2 milllion | 6% |

| #4 | Liberty Mutual | $35.6 milllion | 5% |

| #5 | Allstate | $35 milllion | 5% |

| #6 | Travelers | $28 milllion | 4% |

| #7 | USAA | $23.4 milllion | 3% |

| #8 | Chubb | $23.3 milllion | 3% |

| #9 | Farmers | $20.6 milllion | 3% |

| #10 | Nationwide | $18.4 milllion | 3% |

Choosing the right insurance company for your Chevrolet Impala can significantly impact your coverage and costs. Consider these top providers to find the best rates and benefits tailored to your needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Free Chevrolet Impala Insurance Quotes Online

To ensure you get the best rates and coverage for your Chevrolet Impala, utilize our free online tool to compare quotes from top auto insurance companies. This tool allows you to evaluate different policies, auto insurance discounts, and coverage options quickly and easily, helping you make an informed decision based on your specific needs and budget.

By comparing quotes, you can find the most competitive rates and ensure you’re getting the best value for your auto insurance investment. Avoid expensive auto insurance premiums by entering your ZIP code below to see the cheapest rates for you.

Frequently Asked Questions

Can I insure a Chevrolet Impala for business use?

Yes, it’s possible to insure a Chevrolet Impala for business use. However, it’s important to inform your insurance provider about the intended use of the vehicle. Business use may require additional coverage or policy modifications to ensure adequate protection for your business activities.

It’s recommended to discuss your specific needs and requirements with your insurance provider to ensure you have the appropriate coverage in place (Read More: Best Business Auto Insurance).

Is auto insurance more expensive for a Chevrolet Impala compared to other vehicles?

The cost of auto insurance for a Chevrolet Impala can vary depending on several factors. Insurance companies consider factors such as the vehicle’s value, repair costs, safety features, theft rates, and the driver’s profile. While the Chevrolet Impala is generally considered a midsize sedan with reasonable insurance rates, premiums can still be influenced by personal factors like your driving history, location, and coverage choices.

How do safety features of the Chevrolet Impala impact insurance premiums?

Safety features like anti-lock brakes, stability control, and airbags can lower premiums. Insurance companies offer discounts for vehicles with advanced safety features. If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Does the trim level of the Chevrolet Impala affect insurance rates?

The trim level of your Chevrolet Impala can potentially affect your insurance rates. Higher trim levels often come with more features and higher values, which can increase the cost of repairs or replacement in the event of an accident or theft.

As a result, insurance premiums may be slightly higher for higher-end trim levels. However, other factors such as safety features, the vehicle’s overall safety rating, and the driver’s profile will also impact insurance rates.

What types of coverage should I consider for my Chevrolet Impala?

When insuring your Chevrolet Impala, it’s important to consider comprehensive coverage, collision coverage, and liability coverage. Comprehensive coverage protects against non-collision incidents such as theft, vandalism, or weather damage.

Collision coverage helps cover the cost of repairs or replacement if your Impala is involved in an accident. Liability coverage is essential to meet the legal requirements and protect you financially in case you’re at fault in an accident that causes injury or property damage to others.

Read More: Does car insurance cover storm damage?

How does my credit score affect my Chevrolet Impala insurance rates?

A higher credit score often results in lower insurance rates, as insurers view those with better credit as less risky. Maintaining a good credit score can help reduce your premiums.

Is it more expensive to insure older or newer Chevrolet Impalas?

Generally, newer models cost more to insure due to higher replacement costs and advanced technology. However, older models might have fewer safety features, which can also affect premiums. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Are there any specific discounts available for insuring a Chevrolet Impala?

Insurance companies often offer various discounts that can help lower the cost of insuring a Chevrolet Impala. Some common discounts include safe driver discounts, multi-policy discounts (for bundling auto and home insurance), good student discounts (for eligible students), and discounts for having certain safety features installed in your Impala, such as anti-lock brakes, airbags, or an anti-theft system.

It’s recommended to inquire about available discounts with different insurance providers to maximize your savings (Read More: How to Get a Good Driver Auto Insurance Discount).

Are there any specific factors that can affect the cost of insurance for a Chevrolet Impala?

Several factors can influence the cost of insurance for a Chevrolet Impala. These factors may include the driver’s age, location, driving history, annual mileage, credit history, and coverage options chosen. Additionally, the vehicle’s safety rating, anti-theft features, and any modifications made to the Impala can impact insurance rates.

It’s advisable to discuss these factors with insurance providers to understand how they may affect your premiums.

Can I get insurance for a modified Chevrolet Impala?

Yes, but modifications may increase your premiums. Inform your insurer about any modifications to ensure you have adequate coverage and to avoid potential claim issues.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.