Cheap Gap Insurance in Virginia (Find Savings With These 10 Companies in 2026)

Progressive, Auto-Owners, and Nationwide are the top picks for cheap gap insurance in Virginia. Progressive offers the most competitive rates, with coverage starting at $6/month. These leading companies provide affordable options and extensive coverage, making them the best choices for Virginia gap insurance.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated January 2025

13,285 reviews

13,285 reviewsCompany Facts

Gap Insurance in Virginia

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 563 reviews

563 reviewsCompany Facts

Gap Insurance in Virginia

A.M. Best

Complaint Level

Pros & Cons

563 reviews

563 reviews 3,071 reviews

3,071 reviewsCompany Facts

Gap Insurance in Virginia

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsThe best providers of cheap gap insurance in Virginia are Progressive, Auto-Owners, and Nationwide. Progressive saves Virginia drivers the most money with low rates and competitive discounts.

These companies offer a perfect blend of affordability, extensive guaranteed auto protection (gap) insurance coverage options, and excellent customer service. Progressive, in particular, is highlighted for its competitive rates and robust discount programs.

Our Top 10 Company Picks: Cheap Gap Insurance in Virginia

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $6 A+ Competitive Rates Progressive

#2 $8 A++ Low Costs Auto-Owners

#3 $10 A+ Extensive Add-Ons Nationwide

#4 $11 B Local Agents State Farm

#5 $12 A+ Discounts Available Allstate

#6 $13 A Flexible Payments Liberty Mutual

#7 $14 A++ Military Focus USAA

#8 $15 A+ Senior Benefits The Hartford

#9 $16 A Customizable Options American Family

#10 $18 A++ Premium Service Chubb

Keep reading to discover why these providers are the top picks for cheap Virginia gap insurance. Find cheap gap insurance quotes now by entering your ZIP code above.

- Gap insurance in Virginia covers car value and loan balance differences

- Tailor your VA gap insurance to match your vehicle’s depreciation

- Progressive is the top pick for gap insurance in Virginia, from $6/month

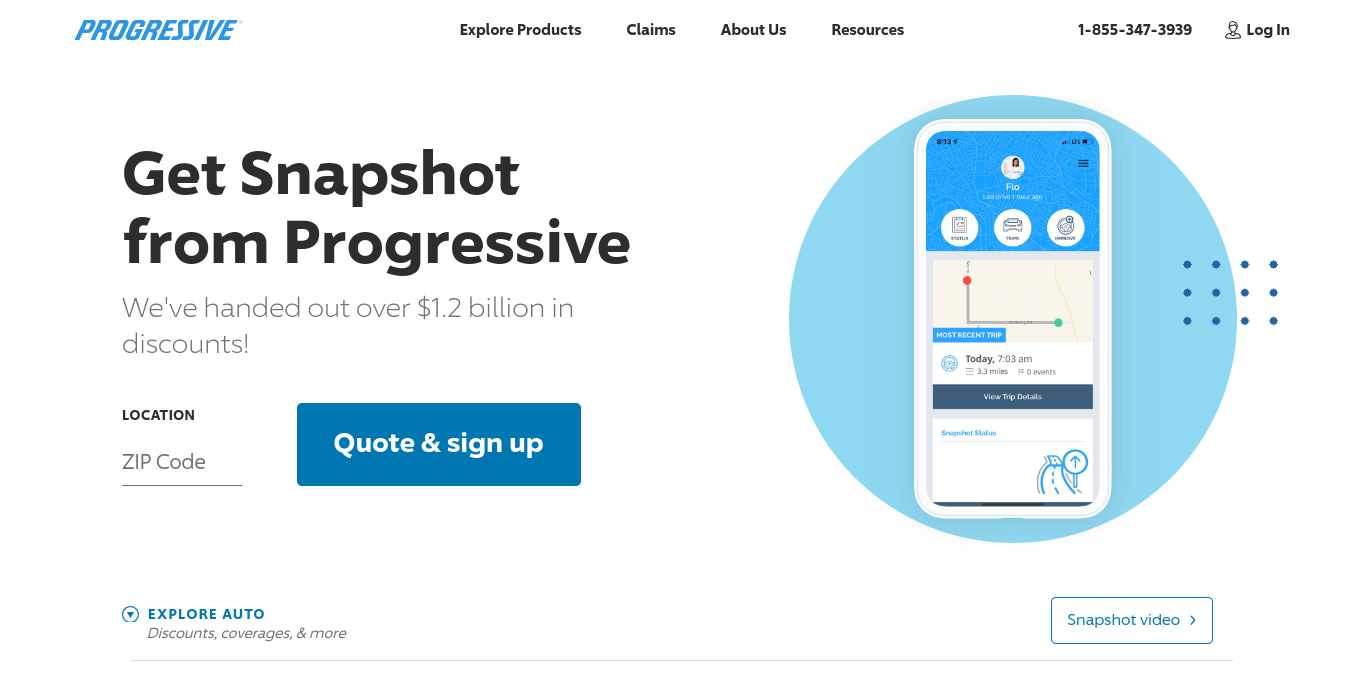

#1 – Progressive: Top Overall Pick

Pros

- Low Rates: Progressive offers some of the most competitive rates for gap insurance in Virginia, starting at $6 monthly.

- Usage-Based Insurance (UBI) Discounts: Multiple discounts, including savings through the Snapshot UBI program, can lower your gap insurance costs in Virginia.

- Easy Management: Explore our Progressive auto insurance review for strong customer service and gap insurance reviews in Virginia.

Cons

- Rate Increases: Premiums for gap insurance in Virginia may increase significantly after an accident.

- Eligibility Limits: Not all vehicles qualify for Virginia’s lowest gap insurance rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Auto-Owners: Cheap Full Coverage With Gap

Pros

- Cheap Full Coverage: Virginia gap insurance costs are affordable with Auto-Owners, especially full coverage starting at $8/month.

- Cheap for Students: Young drivers enrolled in Virginia schools can earn up to 20% off gap insurance rates.

- Reliable Service: With an A++ A.M. Best rating and stellar claims service reviews, Auto-Owners gap insurance in Virginia is among the best.

Cons

- Limited Availability: If you ever leave Virginia, you might not find Auto-Owners gap insurance in many other states.

- Limited Mobile Access: Auto-Owners mobile and online tools aren’t as streamlined as larger gap insurance companies in Virginia.

#3 – Nationwide: Cheapest Coverage Add-Ons

Pros

- Extensive Add-On Options: Nationwide offers extensive gap insurance coverage in Virginia, including benefits like vanishing deductibles.

- Flexible Coverage: Provides a wide range of gap insurance coverage levels to fit different needs and budgets in Virginia.

- Safe Driving Discounts: View our Nationwide auto insurance review for discounts that lower Virginia gap insurance rates.

Cons

- Higher Premiums: Gap insurance premiums in Virginia can be higher for some driving records than other providers.

- Varied Customer Service: Virginia gap insurance reviews are average to poor, and many drivers report more positive experiences with other companies.

#4 – State Farm: Best for Local Agents

Pros

- Personalized Service: Delve into our State Farm auto insurance review for local agents offering gap insurance in Virginia.

- Usage-Based Savings: The Drive Safe & Save program helps reduce gap insurance premiums in Virginia.

- Reliable Support: State Farm is known for dependable customer service and claims gap insurance handling in Virginia.

Cons

- Higher Costs: Gap insurance premiums in Virginia may be higher than those from online-only providers.

- Fewer Discounts: There are limited gap insurance discount opportunities in Virginia with State Farm compared to other companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best Discounts Available

Pros

- Broad Discounts: Allstate offers a wide range of discounts that can lower your gap insurance premiums in Virginia.

- Customer Service: Allstate has a strong reputation for customer support and claims assistance, specifically for gap insurance in Virginia.

- Flexible Coverage: See our Allstate auto insurance review for gap insurance coverage options in Virginia.

Cons

- Higher Base Premiums: Gap insurance premiums in Virginia can be higher without stacking multiple discounts.

- Complex Discount Structure: Navigating and qualifying for discounts on gap insurance in Virginia can be more complicated than other providers.

#6 – Liberty Mutual: Cheapest With Flexible Payments

Pros

- Flexible Payments: Liberty Mutual offers various payment plans for gap insurance in Virginia, making it easier to manage premiums.

- Customizable Coverage: Virginia drivers can tailor gap insurance to their needs based on our Liberty Mutual auto insurance review.

- Bundling Discounts: Multiple gap insurance discounts, including those for bundling with home or renters insurance in Virginia, are available.

Cons

- Higher Premiums: Virginia’s Gap insurance rates can be higher than those of some competitors.

- Customer Satisfaction: Mixed reviews on customer service and claims processing for gap insurance in Virginia.

#7 – USAA: Cheapest for Military Members

Pros

- Military Discounts: Find special savings on gap insurance in Virginia for military families in our USAA auto insurance review.

- Exceptional Service: USAA has the highest customer satisfaction ratings, especially for claims handling on gap insurance in Virginia.

- Comprehensive Coverage: USAA offers robust gap insurance options in Virginia, often at lower rates for eligible members.

Cons

- Eligibility Restrictions: Gap insurance in Virginia is only available to military members, veterans, and their families, limiting access for others.

- Limited Local Presence: There are fewer offices in Virginia for in-person assistance with gap insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The Hartford: Best Senior Benefits

Pros

- AARP Discounts: In our The Hartford auto insurance review, you’ll find AARP discounts on gap insurance in Virginia.

- Senior-Focused Service: The Hartford tailors services and benefits to senior drivers seeking gap insurance in Virginia.

- Reputable Service: The Hartford has a strong track record in customer service, especially for older adults needing gap insurance in Virginia.

Cons

- Age-Specific Benefits: Only seniors with AARP memberships can buy The Hartford gap insurance in Virginia.

- Higher Rates: Virginia’s Hartford gap insurance premiums can be higher than other companies.

#9 – American Family: Cheapest Customizable Options

Pros

- Customizable Policies: Shop for a wide range of gap insurance options tailored to fit your specific needs in Virginia.

- Family Discounts: American Family offers discounts specifically aimed at families, including multi-policy savings on gap insurance in Virginia.

- Local Support: According to our American Family auto insurance review, local agents offer personalized gap insurance in Virginia.

Cons

- Premium Costs: Gap insurance premiums in Virginia may be higher without applying multiple discounts.

- Limited Availability: American Family isn’t as widely available as larger national insurers, so you might have to shop for gap insurance elsewhere if you leave Virginia.

#10 – Chubb: Best for Premium Service

Pros

- Top-Tier Coverage: Discover our Chubb auto insurance review for premium gap insurance in Virginia with luxury benefits.

- High Claim Satisfaction: Chubb is known for excellent claims service, especially for high-value vehicles requiring gap insurance in Virginia.

- Comprehensive Policies: Virginia’s Chubb gap insurance coverage options are ideal for those seeking maximum protection.

Cons

- Higher Costs: Chubb insurance rates for gap coverage in Virginia are typically higher, reflecting the luxury service.

- Limited Discounts: Chubb offers fewer discount opportunities for gap insurance in Virginia than other providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Balancing Virginia Gap Insurance Costs and Coverage

Minimum coverage options range from $6/month with Progressive, the cheapest gap insurance company in Virginia, to $18/month with Chubb.

Gap Insurance Monthly Rates in Virginia by Provider

Insurance Company Monthly Rates

$12

$16

$8

$18

$13

$10

$6

$11

$15

$14

USAA, known for its military-focused services, offers a balanced approach with coverage at $14. In Virginia, gap insurance rates vary significantly based on coverage level and provider. Understanding the auto insurance coverage will help you make an informed choice. Consider your vehicle’s depreciation rate and loan terms to determine the appropriate level of gap coverage.

One of the easiest ways to save on gap coverage is to compare rates from cheap pay-as-you-go auto insurance companies in Virginia. For instance, Progressive offers a Snapshot telematics program that lowers rates based on safe driving habits, while Nationwide offers SmartMiles that sets rates based on monthly mileage.

Understanding how to compare auto insurance quotes will ensure you get the best value for your gap coverage in Virginia. Keep reading for more ways to save on Virginia auto insurance.

How to Get Affordable Gap Insurance in Virginia

Here are some more effective tips when searching for cheap gap insurance in Virginia. By following these strategies, you can find affordable Virginia gap coverage that provides the protection you need while staying within your budget:

- Compare Multiple Providers: Always gather quotes from various insurance companies. This helps you identify the most competitive rates and comprehensive coverage options.

- Consider Telematics Programs: Some insurers, like Progressive Snapshot, offer cheap usage-based auto insurance that tracks and rewards safe driving habits.

- Evaluate Coverage Needs: Assess whether you need coverage, based on your vehicle’s depreciation rate and loan terms.

- Maintain a Good Credit Score: Insurers often consider your credit score when calculating premiums. A higher score can lead to lower insurance costs.

- Leverage Discounts: Take advantage of discounts based on your driving record, policy type, or occupation. Many providers offer significant savings when you qualify for these incentives.

Explore available discounts below, like multi-policy, safe driver, and vehicle safety features, which can significantly reduce your gap insurance premiums in Virginia.

Auto Insurance Discounts From the Top Providers for Gap in Virginia

| Insurance Company | Available Discounts |

|---|---|

| Safe Driver, Multi-Policy, Anti-Theft, New Car, Good Student, Drivewise (telematics) | |

| Safe Driver, Multi-Policy, Good Student, Defensive Driving Course, Teen Safe Driver, Vehicle Safety Features | |

| Safe Driver, Multi-Policy, Good Student, Military, Vehicle Safety Features, Emergency Deployment, Anti-Theft | |

| Multi-Policy, Safe Driver, Good Student, Anti-Theft, Vehicle Safety Features, Accident-Free | |

| Safe Driver, Multi-Policy, Good Student, New Car, Vehicle Safety Features, Accident-Free, Defensive Driving |

| Safe Driver, Multi-Policy, Good Student, Vanishing Deductible, Vehicle Safety Features, Accident-Free |

| Safe Driver, Multi-Policy, Snapshot (telematics), Good Student, Home Ownership, Vehicle Safety Features | |

| Safe Driver, Multi-Policy, Good Student, Vehicle Safety Features, Drive Safe & Save (telematics), Accident-Free | |

| Safe Driver, Multi-Policy, Good Student, Anti-Theft, Vehicle Safety Features, Defensive Driving |

| Safe Driver, Multi-Policy, Good Student, Military, Vehicle Safety Features, Accident-Free |

Nationwide offers big safe driver discounts of up to 40%, more than other insurers on this list. Allstate also provides competitive good driver and low-mileage discounts, especially UBI discounts.

How Virginia Rates on Auto Insurance Risks

The table provides a graded overview of factors affecting auto insurance rates across the state. It rates the vehicle theft rate as ‘B’, indicating a moderate level that increases in urban areas. Weather-related risks also receive a ‘B’, generally reflecting mild conditions with occasional severe storms. The average claim size is similarly graded ‘B’, with costs rising in urban settings.

Virginia Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Vehicle Theft Rate | B | Moderate theft rate, higher in urban areas. |

| Weather-Related Risks | B | Mostly mild weather, occasional severe storms. |

| Average Claim Size | B | Moderate claims, with higher costs in urban areas. |

| Traffic Density | C | Congestion in cities like Richmond and Northern VA. |

| Uninsured Drivers Rate | C- | Relatively high rate of uninsured drivers in the state. |

Traffic density in Richmond and Northern Virginia scores a ‘C’, indicating congestion that impacts accident rates, a key factor that affects auto insurance rates. The uninsured driver’s rate, marked as ‘C-‘, highlights the high number of uninsured motorists, another significant factor influencing rates. These grades help insurers and policyholders assess coverage needs in Virginia.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Accident and Insurance Claim Trends in Virginia Cities

The table provides statistics on traffic accidents and insurance claims, which are key to understanding how to file a car insurance claim in Virginia. Annually, Chesapeake reports 5,500 accidents and 4,500 claims, while Newport News records 6,800 accidents and 5,600 claims, reflecting the frequency and potential need for such processes in these cities.

Virginia Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Chesapeake | 5,500 | 4,500 |

| Newport News | 6,800 | 5,600 |

| Norfolk | 7,000 | 5,800 |

| Richmond | 15,000 | 12,000 |

| Virginia Beach | 9,500 | 7,500 |

Norfolk has similar figures with 7,000 accidents and 5,800 claims annually. Richmond has significantly higher numbers, recording 15,000 accidents and 12,000 claims yearly. Virginia Beach also reports many traffic incidents and claims with 9,500 and 7,500 respectively. This data helps understand the frequency of traffic-related incidents and subsequent insurance claims within these urban areas.

Unlock Savings With Virginia’s Top Auto Insurance Discounts

The table lists discount types, savings, and participating providers. Multi-Policy and Safe Driver discounts offer 22% and 20% savings, respectively, from providers like State Farm, Nationwide, and Progressive. Good Student and Anti-Theft Device discounts provide 16% and 12% savings and are available from State Farm, Allstate, and Geico.

Virginia Report Card: Auto Insurance Discounts

| Discount Name | Grade | Savings | Participating Providers |

|---|---|---|---|

| Multi-Policy | A | 22% | State Farm, Nationwide, Progressive |

| Safe Driver | A- | 20% | Geico, Progressive, Liberty Mutual |

| Good Student | B+ | 16% | State Farm, Allstate, Geico |

| Anti-Theft Device | B | 12% | Progressive, Liberty Mutual, USAA |

| Defensive Driving | B- | 10% | Geico, State Farm, Nationwide |

| Pay-As-You-Go | C+ | 8% | Nationwide, Allstate, Liberty Mutual |

| Low Mileage | C | 7% | Geico, USAA, Allstate |

| Military/First Responder | C- | 5% | USAA, Geico, Farmers |

| Vehicle Safety Features | D+ | 4% | Liberty Mutual, Nationwide |

| New Vehicle | D | 3% | Progressive, Allstate |

The table highlights various auto insurance discounts, including those tailored for specific groups or driving behaviors like Military/First Responder and New Vehicle discounts, which offer smaller savings. This overview allows policyholders to identify potential savings with different insurers based on their eligibility for these discounts.

Maximizing Savings With the Best Virginia Gap Insurance Companies

Companies like Progressive, Auto-Owners, and Nationwide offer cheap gap insurance in Virginia. Competitive rates with ample discounts set these providers apart and make it possible to secure comprehensive coverage while keeping costs low.

Progressive offers the best balance of affordability and comprehensive gap coverage in Virginia, making it a top choice for savvy drivers.Dani Best Licensed Insurance Producer

Understanding how to lower your auto insurance rates can help you maximize savings. To find the best auto insurance rates for gap coverage in Virginia, it’s crucial to compare quotes from multiple providers.

It’s summer, and that means it’s time for adventure! But before you ride off into the sunset, make sure you’re as safe and protected as possible 🏍️ #motorcyclelife #moto

▶️ https://t.co/iFZ2rGromU pic.twitter.com/iM2Oo32OCh

— Flo from Progressive (@ItsFlo) June 24, 2024

Don’t forget to take advantage of discounts like safe driver, multi-policy, and vehicle safety features. Ready to find cheaper Virginia car insurance coverage? Enter your ZIP code below to begin.

Frequently Asked Questions

Does Virginia have gap insurance?

Yes, Virginia offers gap insurance through various auto insurance providers. Gap insurance is an optional coverage that you can purchase to cover the difference between your car’s actual cash value and the amount you owe on your auto loan or lease.

What is gap insurance in Virginia?

Gap coverage is a type of auto insurance that protects you if your car is totaled or stolen and you owe more on your loan or lease than the car’s current market value. It pays the difference between your car’s actual cash value and the remaining balance on your loan or lease.

How is Virginia gap coverage calculated?

Gap insurance is calculated based on the difference between your car’s actual cash value (ACV) and the remaining balance on your auto loan or lease. If your car is totaled or stolen, the gap insurance pays this difference, ensuring you don’t have to pay out of pocket for a car you no longer have.

What is the most Virginia gap insurance will pay?

The most gap insurance will pay is typically the entire difference between your car’s actual cash value and the remaining balance on your loan or lease. Some policies may have limits, so it’s important to review your policy details to understand the maximum payout.

Will gap insurance cover a blown engine?

Does auto insurance cover engine failure? No, gap insurance does not cover mechanical failures like a blown engine. Gap insurance only applies if your car is totaled or stolen and you owe more on the loan or lease than the car’s value. Mechanical issues would be covered under a separate warranty or mechanical breakdown insurance.

What is the minimum auto insurance coverage in Virginia?

Virginia minimum required car insurance includes $30,000 per person and $60,000 per accident for bodily injury liability and $20,000 for property damage liability. However, it’s often recommended to carry higher coverage to better protect yourself financially.

What is the cheapest full coverage insurance in Virginia?

The cheapest full-coverage insurance in Virginia varies by provider and personal factors, but companies like Progressive and Geico are often among the most affordable options. Shopping around and comparing quotes can help you find the best rates for your situation. Get started today by entering your ZIP code below into our free comparison tool.

How much is auto insurance in Virginia?

Car insurance costs in Virginia vary depending on factors like your driving history, vehicle type, coverage levels, and location. On average, drivers in Virginia can expect to pay around $83 to $125 per month for full coverage, but this can vary widely.

Is Virginia auto insurance expensive?

Insurance costs in Virginia are generally lower than the national average. However, your specific insurance rates depend on factors like your driving record, vehicle type, coverage levels, and location. Gap insurance typically adds a small amount to your overall monthly premium.

How long can you go without auto insurance in Virginia?

Driving without auto insurance is illegal in Virginia, but you have up to 30 days to provide proof of coverage before you face a penalty.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.