Best Windshield Replacement Coverage in Illinois (Top 10 Companies Ranked for 2026)

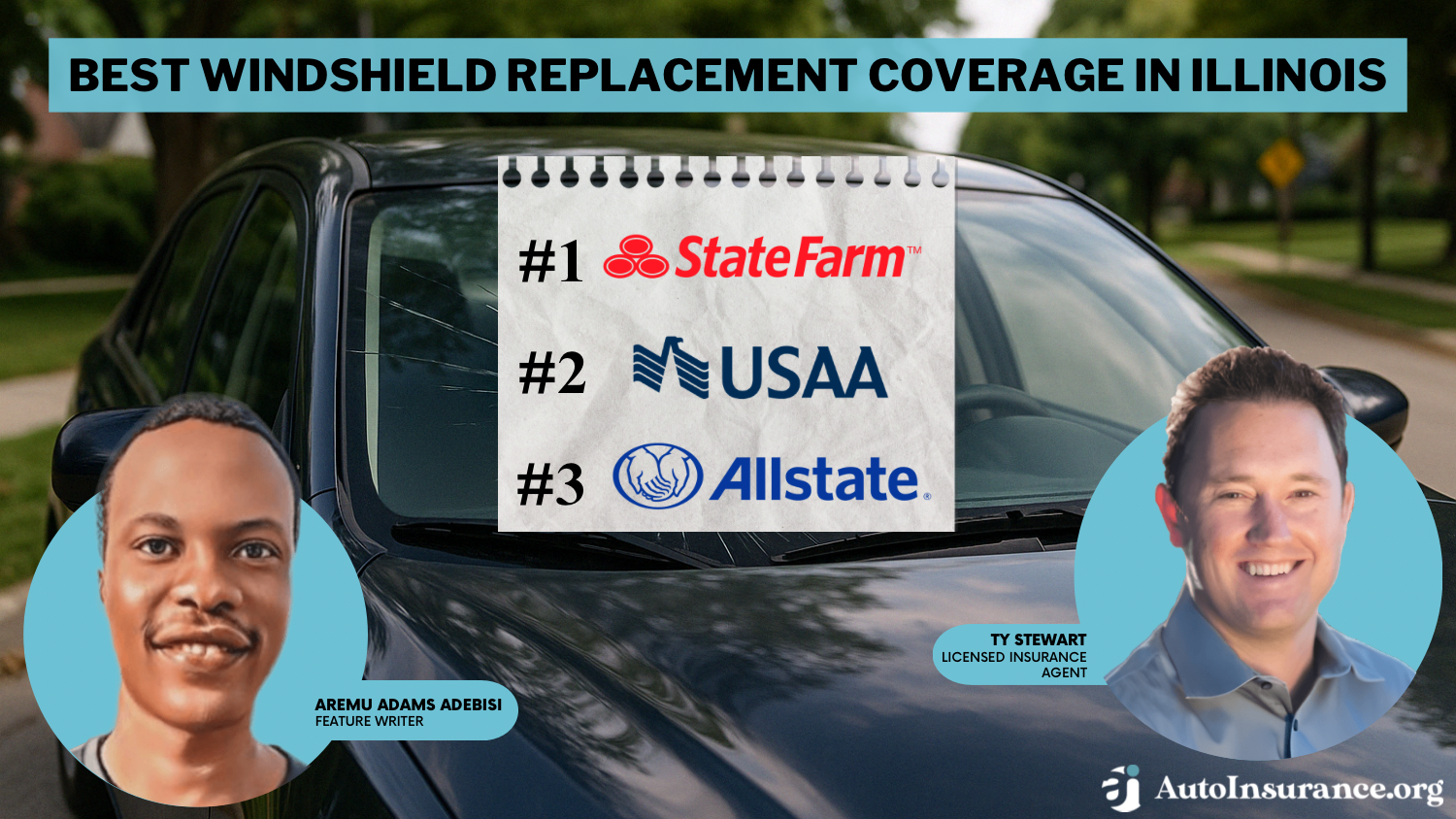

State Farm, USAA, and Allstate offer the best windshield replacement coverage in Illinois, starting as low as $70 per month. We aim to help you compare quotes from these insurers, ensuring you secure the optimal coverage and tailored discounts for your vehicle and your peace of mind.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Aremu Adams Adebisi graduated from college with a B.Sc in Economics. He's currently pursuing his MBA while writing insurance features covering trending topics in the car insurance industry. He's fascinated by the surges of insurtech in an era of decentralized finance (DeFi). Aremu has written for several insurance agencies and companies. He profiles startups on Insideropedia and serves as a con...

Aremu Adams Adebisi

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated April 2025

Company Facts

Full Coverage Windshield Replacement in Illinois

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviewsCompany Facts

Full Coverage Windshield Replacement in Illinois

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 11,640 reviews

11,640 reviewsCompany Facts

Full Coverage Windshield Replacement in Illinois

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviews

- State Farm provides cost-effective rates beginning at $104 monthly

- Leading insurance companies offer choices for windshield replacements

- There are numerous savings for windshield replacement coverage

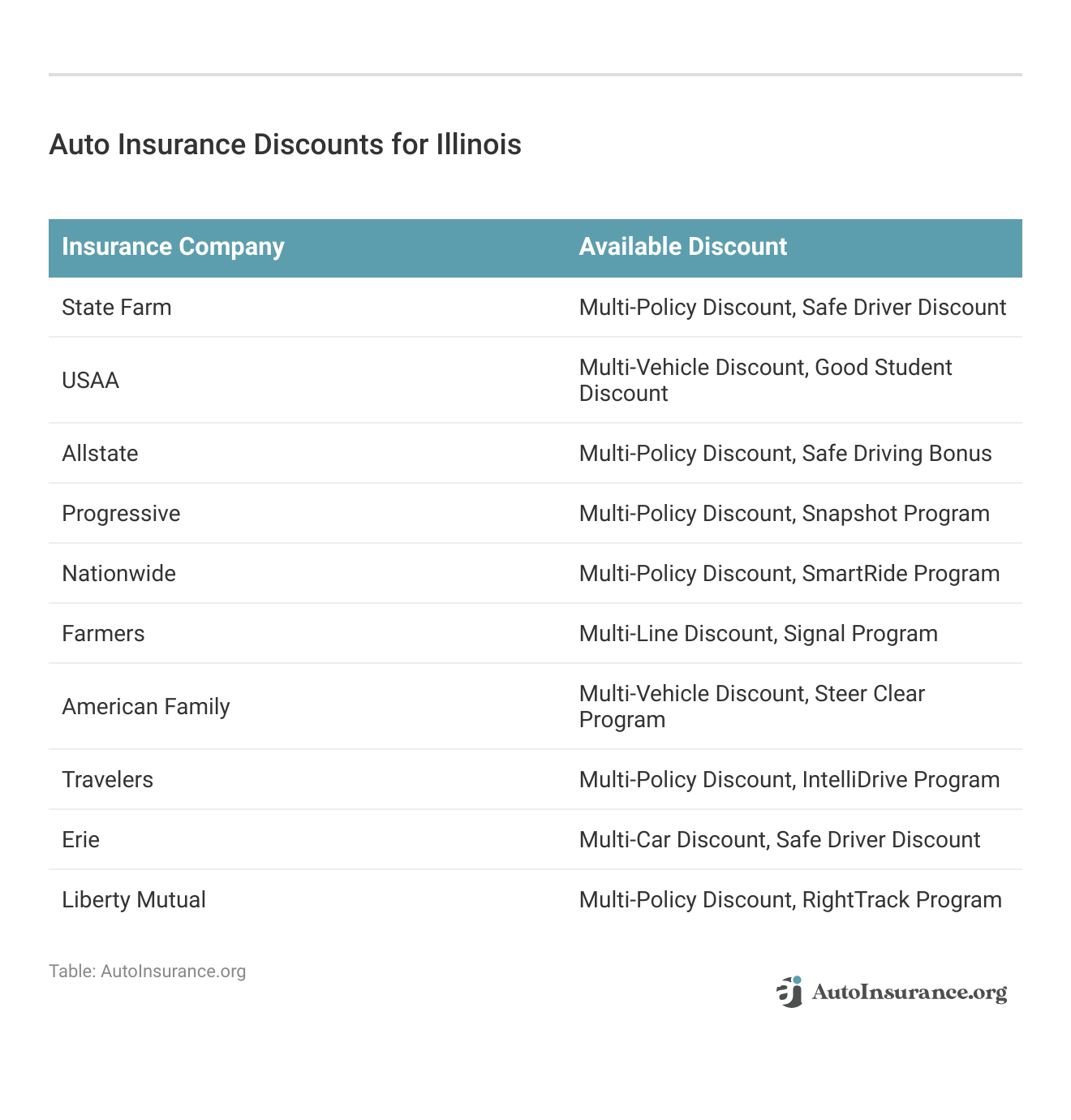

#1 – State Farm: Top Overall Pick

Pros

- Extensive Network: State Farm has a vast network of agents and service centers, making it convenient for customers to access support and file claims. Find out more in our State Farm auto insurance review.

- Customizable Policies: They offer a wide range of coverage options and discounts, allowing customers to tailor their policies to their specific needs.

- Strong Financial Stability: State Farm has a solid financial standing, providing assurance that they can fulfill claims promptly and efficiently.

Cons

- Higher Rates for Some: While State Farm offers competitive rates for many customers, some individuals may find their premiums to be slightly higher compared to other insurers.

- Limited Availability: State Farm is not available in all states, which may limit options for customers residing in areas where the company does not operate.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Excellent Customer Service: USAA is renowned for its exceptional customer service, consistently receiving high ratings for customer satisfaction.

- Exclusive Benefits: They offer unique benefits tailored to military members and their families, such as deployment discounts and specialized coverage options.

- Financial Strength: USAA has a strong financial stability rating, instilling confidence in customers regarding the company’s ability to meet its financial obligations. Read more through our USAA auto insurance review.

Cons

- Membership Eligibility: USAA membership is restricted to military personnel, veterans, and their families, excluding the general public from accessing their services.

- Limited Branch Locations: USAA primarily operates online and through phone services, which may be a drawback for individuals who prefer in-person interactions or live in areas without convenient access to physical branches.

#3 – Allstate: Best for Wide Network

Pros

- Innovative Features: Allstate offers innovative features such as Drivewise, which rewards safe driving habits with discounts and cashback.

- Wide Range of Coverage: They provide various coverage options beyond standard auto insurance, including home insurance and identity theft protection.

- User-Friendly Mobile App: Allstate’s mobile app offers convenient features like digital ID cards, claims tracking, and roadside assistance, enhancing the overall customer experience.

Cons

- Higher Premiums: Some customers may find Allstate’s premiums to be higher compared to other insurers, particularly for certain demographics or coverage levels. Use our Allstate auto insurance review as your guide.

- Mixed Customer Reviews: While Allstate has many satisfied customers, there are also some negative reviews regarding claim processing times and customer service experiences.

#4 – Progressive: Best for Technology Integration

Pros

- Advanced Technology: Progressive utilizes innovative technology such as Snapshot, which tracks driving habits to potentially lower premiums for safe drivers.

- Convenient Online Tools: In our Progressive auto insurance review, they offer a user-friendly website and mobile app with features like online quotes, policy management, and claims filing, providing convenience for customers.

- Discount Opportunities: Progressive provides various discounts, including multi-policy, multi-car, and good student discounts, helping customers save on their premiums.

Cons

- Higher Rates for Some: Progressive’s rates may be higher for certain demographics or drivers with less-than-perfect records, making it less competitive in some cases.

- Customer Service Concerns: Some customers have reported dissatisfaction with Progressive’s customer service, citing issues with claim processing and communication.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Flexibility Options

Pros

- Wide Range of Products: Nationwide offers not only auto insurance but also other insurance products such as home, life, and pet insurance, allowing customers to bundle policies for savings. Read more through our Nationwide auto insurance review.

- Strong Financial Stability: With a solid financial standing, Nationwide provides reassurance to customers that their claims will be handled promptly and efficiently.

- Member Benefits: Nationwide offers various member benefits, including accident forgiveness, vanishing deductibles, and roadside assistance, enhancing the overall value of their policies.

Cons

- Limited Availability: Nationwide may not be available in all areas, limiting options for customers who prefer a local insurer or reside in areas where Nationwide does not operate.

- Mixed Customer Reviews: While many customers are satisfied with Nationwide’s services, some have expressed concerns regarding claim processing times and communication with the company.

#6 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Farmers, as mentioned in our Farmers auto insurance review, provide personalized assistance, helping customers tailor their policies to their unique needs and offering guidance throughout the insurance process.

- Variety of Coverage Options: Farmers offers a wide range of coverage options beyond auto insurance, including home, renters, and life insurance, providing comprehensive protection for customers.

- Strong Community Presence: Farmers is known for its involvement in local communities and disaster relief efforts, fostering trust and loyalty among customers.

Cons

- Potentially Higher Rates: Some customers may find Farmers’ rates to be higher compared to other insurers, particularly for certain demographics or coverage levels.

- Limited Online Tools: Farmers’ online tools and digital resources may not be as advanced or user-friendly as those offered by some other insurers, potentially impacting the overall customer experience.

#7 – American Family: Best for Loyalty Discounts

Pros

- Personalized Service: American Family agents focus on providing personalized service, taking the time to understand each customer’s needs and offering tailored insurance solutions. Use our American Family auto insurance review as your guide.

- Variety of Discounts: They offer a wide range of discounts, including bundling, safe driving, and loyalty discounts, helping customers save on their premiums.

- Community Involvement: American Family is actively involved in supporting local communities through various initiatives and sponsorships, fostering a positive reputation and customer loyalty.

Cons

- Limited Availability: American Family may have limited availability in certain regions, restricting options for customers who prefer a local insurer or reside in areas where American Family does not operate.

- Mixed Customer Reviews: While many customers are satisfied with American Family’s services, some have raised concerns about claim processing times and communication with the company.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Affordability Options

Pros

- Flexible Coverage Options: Our Travelers auto insurance review reveals that Travelers offers flexible coverage options, allowing customers to customize their policies to meet their specific needs and budget.

- Strong Financial Stability: With a solid financial standing, Travelers provides assurance to customers that their claims will be handled promptly and efficiently.

- Additional Benefits: They provide various additional benefits, such as roadside assistance, rental car reimbursement, and new car replacement coverage, enhancing the overall value of their policies.

Cons

- Potentially Higher Rates: Some customers may find Travelers’ rates to be higher compared to other insurers, particularly for certain demographics or coverage levels.

- Complex Claims Process: Travelers’ claims process may be more complex or time-consuming compared to some other insurers, potentially causing frustration for customers filing claims.

#9 – Erie: Best for Financial Stability

Pros

- Exceptional Customer Service: Erie is known for its exceptional customer service, consistently receiving high ratings for customer satisfaction and responsiveness.

- Competitive Rates: They offer competitive rates for many customers, making Erie an attractive option for individuals seeking affordable auto insurance coverage.

- Generous Policy Features: Erie includes generous policy features such as accident forgiveness, diminishing deductibles, and pet injury coverage, providing added value to their policies.

Cons

- Limited Availability: Erie may have limited availability in certain regions, restricting options for customers who prefer a local insurer or reside in areas where Erie does not operate.

- Fewer Digital Tools: Erie’s online tools and digital resources may be less extensive or advanced compared to those offered by some other insurers, potentially impacting the overall customer experience. Read more through our Erie auto insurance review.

#10 – Liberty Mutual: Best for Policy Discounts

Pros

- Customizable Policies: Liberty Mutual offers customizable policies, allowing customers to tailor their coverage to their specific needs and budget. For further insights, refer to our Liberty Mutual auto insurance review.

- Discount Opportunities: They provide various discount opportunities, including multi-policy, multi-car, and safety feature discounts, helping customers save on their premiums.

- Online Tools and Resources: Liberty Mutual offers a user-friendly website and mobile app with features such as online quotes, policy management, and claims filing, providing convenience for customers.

Cons

- Mixed Customer Reviews: Liberty Mutual has received mixed reviews regarding customer service experiences and claim handling, with some customers reporting dissatisfaction with communication and resolution times.

- Higher Premiums for Some: While Liberty Mutual offers competitive rates for many customers, some individuals may find their premiums to be higher compared to other insurers, particularly for certain demographics or coverage levels.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Illinois Law About Full Glass Coverage

Illinois’ Law About Driving with Damaged Glass

Illinois Law About Vehicle Parts

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Final Thoughts on Illinois Full Glass Coverage

Frequently Asked Questions

Does auto insurance in Illinois cover windshield replacement?

Yes, auto insurance in Illinois typically covers windshield replacement under certain circumstances. However, coverage for windshield replacement may vary depending on the specific policy and coverage options chosen by the insured.

What types of coverage in auto insurance can cover windshield replacement?

Two common types of coverage in auto insurance that can cover windshield replacement are comprehensive coverage and full glass coverage. Comprehensive coverage generally includes protection against damages caused by non-collision incidents, such as theft, vandalism, and certain types of accidents. Full glass coverage specifically focuses on providing coverage for glass damage, including windshield replacement. Enter your ZIP code now to begin.

What is the deductible for windshield replacement coverage?

Are there any restrictions or limitations on windshield replacement coverage?

Certain restrictions or limitations may apply to windshield replacement coverage. These can include limits on the number of claims per policy period, requirements for using approved repair facilities, limitations on the type of glass used for replacement, and exclusions for pre-existing damage or wear and tear. It is crucial to review your policy or discuss these details with your insurance provider to understand any restrictions or limitations that may apply.

Which three insurance companies are highlighted as offering the best windshield replacement coverage in Illinois?

State Farm, USAA, and Allstate are highlighted as offering the best windshield replacement coverage in Illinois. Enter your ZIP code now to begin.

What is the starting monthly rate for windshield replacement coverage with State Farm?

What are some common types of coverage in auto insurance that can cover windshield replacement?

Common types of coverage in auto insurance that can cover windshield replacement include comprehensive coverage and full glass coverage.

According to Illinois law, what is the requirement regarding driving with damaged glass obstructing vision?

According to Illinois law, drivers are prohibited from driving if windshield damage obstructs their vision, with exceptions for certain devices like toll payment devices and GPS mechanisms. Enter your ZIP code now to start.

What are some potential limitations or restrictions on windshield replacement coverage mentioned?

Besides auto insurance, what other types of insurance products does Nationwide offer?

Besides auto insurance, Nationwide also offers other types of insurance products such as home, life, and pet insurance.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.