Best Windshield Replacement Coverage in Alaska (Top 10 Companies Ranked for 2026)

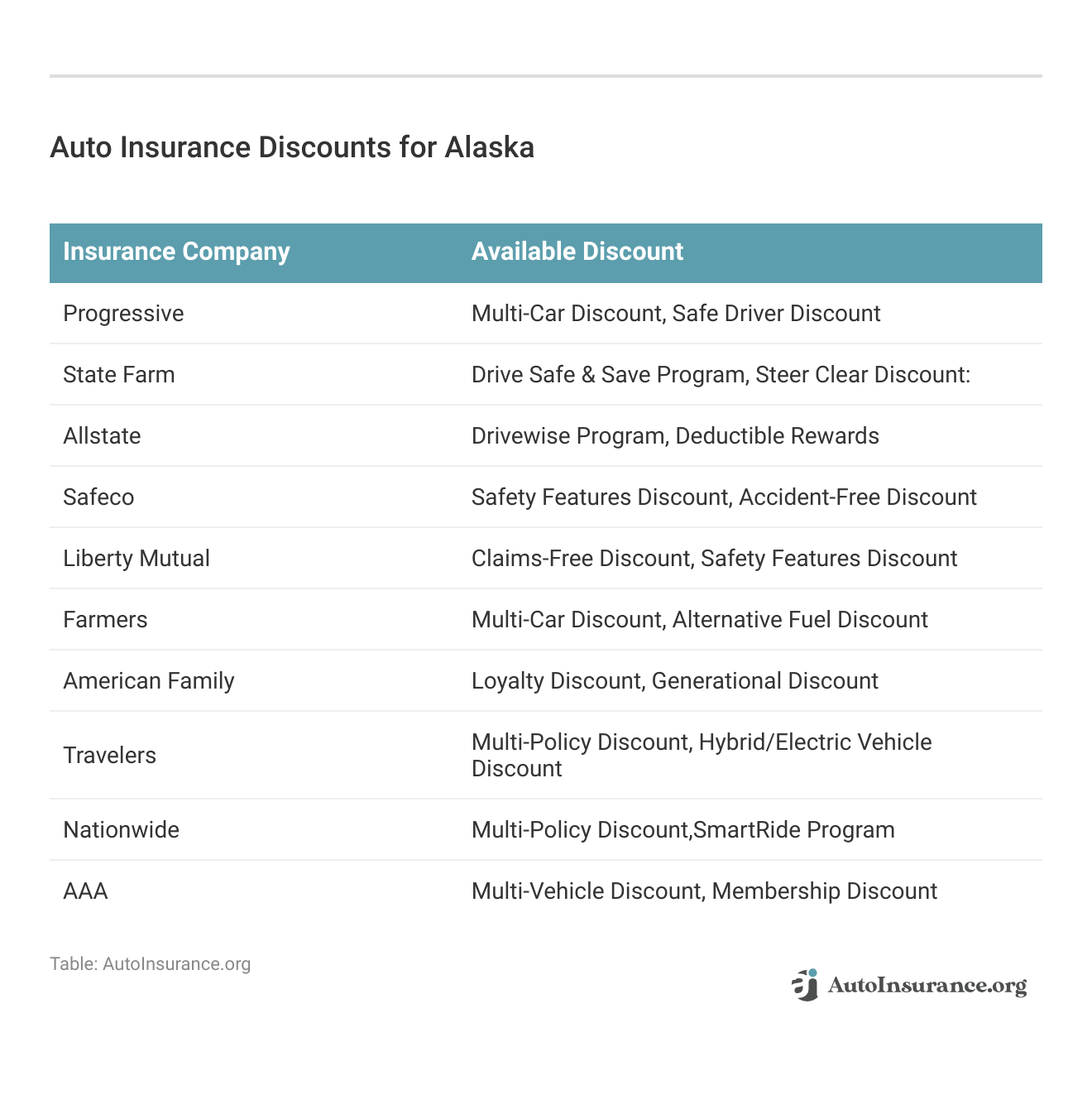

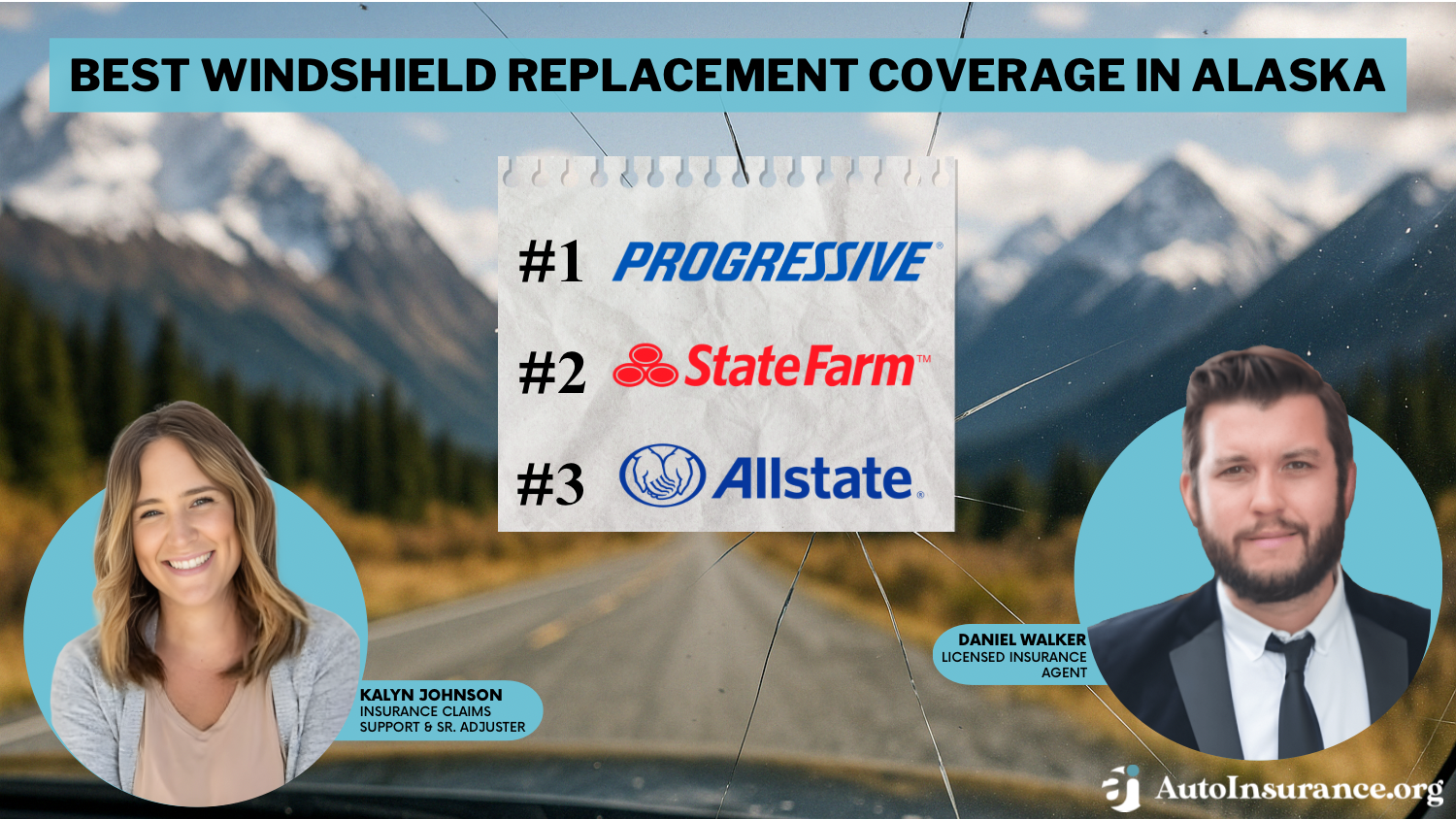

Progressive, State Farm, and Allstate offer the best windshield replacement coverage in Alaska, featuring monthly premiums for only $93. Our objective is to assist you in comparing quotes from these insurers, guaranteeing you secure the most suitable coverage and tailored discounts tailored to your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2025

13,285 reviews

13,285 reviewsCompany Facts

Full Windshield Replacement Coverage in Alaska

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Windshield Replacement Coverage in Alaska

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 11,640 reviews

11,640 reviewsCompany Facts

Full Windshield Replacement Coverage in Alaska

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviews- Progressive offers competitive rates starting at $138 per month

- Leading insurance providers offer options for windshield replacements

- Various discount opportunities are available for windshield replacement coverage

#1 – Progressive: Top Overall Pick

Pros

- Customizable Coverage Options: In our Progressive auto insurance review, Progressive offers a wide range of coverage options, allowing customers to tailor their policies to their specific needs.

- Name Your Price Tool: Their Name Your Price tool enables customers to find a policy that fits their budget by adjusting coverage levels and deductibles.

- Snapshot Program: Progressive’s Snapshot program rewards safe driving habits with potential discounts on premiums.

Cons

- Customer Service Concerns: Some customers have reported dissatisfaction with Progressive’s customer service, citing long wait times and difficulty reaching representatives.

- Limited Agent Availability: Progressive primarily operates online and through phone sales, which may not suit customers who prefer face-to-face interactions with agents.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Coverage Options

Pros

- Extensive Network of Agents: State Farm boasts a vast network of local agents, providing personalized assistance and support to customers.

- Variety of Discounts: State Farm offers numerous discounts, including multi-policy, safe driving, and student discounts, helping customers save on premiums. Find out more in our State Farm auto insurance review.

- Strong Financial Stability: With a long-standing reputation and high financial ratings, State Farm provides peace of mind to customers regarding claim payouts and policy stability.

Cons

- Higher Premiums: While State Farm offers comprehensive coverage, some customers may find their premiums to be slightly higher compared to other insurers.

- Limited Online Tools: State Farm’s online platform may lack some of the advanced features and tools offered by competitors, making it less convenient for tech-savvy customers.

#3 – Allstate: Best for Deductible Waiver

Pros

- Innovative Features: Allstate offers innovative features like Drivewise and Milewise, which track driving habits and mileage to potentially lower premiums.

- Wide Range of Coverage Options: Allstate provides a diverse range of coverage options, allowing customers to customize their policies according to their needs and preferences.

- Excellent Mobile App: Allstate’s mobile app offers convenient access to policy information, claims filing, and roadside assistance, enhancing customer experience and accessibility. Use our Allstate auto insurance review as your guide.

Cons

- Higher Premiums for Some: While Allstate offers comprehensive coverage, some customers may find their premiums to be relatively higher compared to other insurers, especially for certain demographics.

- Mixed Customer Service Reviews: While some customers praise Allstate’s customer service, others have reported dissatisfaction with claim handling and responsiveness, indicating room for improvement.

#4 – Safeco: Best for Glass Coverage

Pros

- Transparent Pricing: Safeco is known for its transparent pricing, providing customers with clear and competitive rates for their coverage.

- Claims Satisfaction: Safeco has received positive feedback for its efficient claims process and satisfactory resolution of claims, ensuring customers feel supported during challenging times.

- Variety of Discounts: Safeco offers a variety of discounts, including multi-policy, anti-theft device, and accident-free discounts, helping customers save on their premiums.

Cons

- Limited Availability: Safeco’s coverage may not be available in all states, limiting options for customers residing in certain regions. Read more through our Safeco auto insurance review.

- Online Experience: Some customers have reported difficulties navigating Safeco’s online platform, citing issues with account management and policy access.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Car Replacement

Pros

- Multi-Policy Discounts: Liberty Mutual offers significant discounts for customers bundling multiple policies, such as auto and home insurance, helping them save on overall premiums. For further insights, refer to our Liberty Mutual auto insurance review.

- 24/7 Claims Assistance: Liberty Mutual provides around-the-clock claims assistance, ensuring customers can file claims and receive support whenever they need it.

- Educational Resources: Liberty Mutual offers educational resources and tools to help customers understand insurance terms, coverage options, and claims processes, empowering them to make informed decisions.

Cons

- Higher Premiums for New Customers: Some new customers may find Liberty Mutual’s initial premiums to be higher compared to other insurers, although discounts may offset this over time.

- Limited Discounts for Safe Drivers: While Liberty Mutual offers various discounts, customers with exceptional driving records may find fewer opportunities for additional savings compared to other insurers.

#6 – Farmers: Best for Competitive Rates

Pros

- Customized Coverage Options: Farmers provides customizable coverage options, allowing customers to tailor their policies to their unique needs and preferences.

- Claims Handling: Farmers has a reputation for efficient claims handling and prompt payouts, ensuring customers receive timely assistance during challenging situations.

- Additional Perks: Farmers offers additional perks such as accident forgiveness, new car replacement, and roadside assistance, enhancing the overall value of their policies.

Cons

- Higher Premiums for Certain Demographics: Some customers may find Farmers’ premiums to be higher, especially for younger drivers or those with less driving experience.

- Limited Online Tools: Farmers’ online platform may lack some advanced features and tools offered by competitors, making it less convenient for tech-savvy customers to manage their policies and claims. Read more through our Farmers auto insurance review.

#7 – American Family: Best for Customer Service

Pros

- Personalized Service: American Family provides personalized service through a network of local agents, offering tailored advice and support to meet customers’ individual needs. Read more through our American Family auto insurance review.

- Innovative Coverage Options: American Family offers innovative coverage options, such as rideshare insurance and gap coverage, catering to the evolving needs of modern drivers.

- Community Involvement: American Family is actively involved in community initiatives and sponsorships, fostering a sense of trust and goodwill among customers and local communities.

Cons

- Limited Availability: American Family’s coverage may not be available in all states, limiting options for customers residing in certain regions.

- Mixed Customer Service Reviews: While many customers praise American Family’s personalized service, others have reported dissatisfaction with claim handling and responsiveness, indicating room for improvement.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Policy Options

Pros

- Financial Strength: Our Travelers auto insurance review reveals that Travelers boasts strong financial stability and high ratings from leading credit rating agencies, providing customers with confidence in their ability to fulfill claims and maintain policy stability.

- Flexible Policy Options: Travelers offers flexible policy options and customizable coverage, allowing customers to tailor their insurance plans to their specific needs and budget.

- Discount Opportunities: Travelers provides various discount opportunities, including multi-policy, safe driver, and hybrid/electric vehicle discounts, helping customers save on their premiums.

Cons

- Limited Agent Network: Travelers’ agent network may be limited compared to some competitors, potentially impacting accessibility for customers who prefer in-person assistance.

- Online Experience: Some customers have reported challenges with Travelers’ online platform, citing difficulties with account management, policy access, and online claims filing.

#9 – Nationwide: Best for Vanishing Deductible

Pros

- Nationwide Network: Nationwide offers a nationwide network of agents and branches, providing customers with accessibility and personalized support regardless of their location. Read more through our Nationwide auto insurance review.

- Vanishing Deductible: Nationwide’s Vanishing Deductible program rewards safe driving behavior by reducing deductibles over time, incentivizing responsible driving habits.

- Comprehensive Coverage Options: Nationwide provides comprehensive coverage options, including optional add-ons like roadside assistance and rental reimbursement, ensuring customers have peace of mind on the road.

Cons

- Higher Premiums: Some customers may find Nationwide’s premiums to be higher compared to other insurers, particularly for certain demographics or coverage types.

- Claims Handling: While Nationwide offers comprehensive coverage, some customers have reported issues with claims handling, citing delays or disputes in claim resolution.

#10 – AAA: Best for Member Discounts

Pros

- Member Discounts: AAA offers exclusive discounts and benefits to its members, including savings on insurance premiums, travel services, and roadside assistance. Read more through our AAA auto insurance review.

- Roadside Assistance: AAA is renowned for its reliable roadside assistance services, providing peace of mind to customers in case of emergencies such as breakdowns, flat tires, or lockouts.

- Bundle Options: AAA allows customers to bundle their insurance policies with other AAA services, such as travel insurance or membership benefits, maximizing convenience and potential savings.

Cons

- Membership Requirement: Access to AAA’s insurance products and benefits requires membership, which may not be appealing to customers who prefer standalone insurance options without additional membership fees.

- Limited Coverage Area: AAA’s insurance coverage may be limited to certain regions or states, restricting options for customers outside of these areas and potentially limiting their choices for insurance providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zero Deductible Full Glass Coverage Law in Alaska

Law Governing Replacement Parts in Alaska

Law Governing Choice of Repair Vendor in Alaska

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Full Glass Coverage Laws in Alaska: The Bottom Line

“Will my insurance cover a cracked windshield?” is a common question among drivers in Alaska. While the state doesn’t have specific requirements for windshield repairs or replacements, your policy terms dictate deductible payments.

To ensure peace of mind and avoid high expenses, consider obtaining full glass coverage in Alaska.

Jeff Root Licensed Insurance Agent

Before approving repairs, file a claim through your comprehensive auto insurance and inquire about the approval process. Compare rates for windshield replacement coverage by entering your ZIP code below.

Frequently Asked Questions

Is windshield replacement covered by auto insurance in Alaska?

Yes, windshield replacement is typically covered by comprehensive auto insurance in Alaska, subject to your specific policy terms and conditions.

What is comprehensive auto insurance?

Comprehensive auto insurance is an optional coverage that protects you against damage to your vehicle that is not caused by a collision. It usually covers events such as theft, vandalism, fire, and damage from falling objects, including windshield damage. Enter your ZIP code now to begin.

Will my comprehensive auto insurance policy cover windshield damage caused by a rock chip?

Do I need to pay a deductible for windshield replacement claims?

Many insurance policies have preferred or approved repair shops that they work with. However, Alaska law allows you the freedom to choose the repair shop for windshield replacement. It’s recommended to consult with your insurance provider to understand if they have any specific requirements or recommendations.

Can I repair a chipped windshield instead of replacing it?

In some cases, a chipped windshield can be repaired rather than replaced, depending on the size, location, and severity of the chip. Insurance companies often prefer windshield repair over replacement as it is more cost-effective. However, if the damage is extensive or obstructs the driver’s vision, replacement may be necessary. Your insurance provider can guide you on the best course of action. Enter your ZIP code now to begin.

What are the top three insurance providers for windshield replacement coverage in Alaska?

What innovative features does Allstate offer to potentially lower premiums for customers?

Allstate offers innovative features like Drivewise and Milewise, which track driving habits and mileage to potentially lower premiums.

What is the law governing windshield replacement deductible in Alaska?

In Alaska, drivers aren’t required to pay a deductible for windshield repairs under auto insurance, but specific laws on coverage are absent. Enter your ZIP code now to begin.

How does Liberty Mutual differentiate itself in terms of discounts and policy bundling?

What are some potential drawbacks of choosing AAA for insurance coverage?

Some potential drawbacks of choosing AAA for insurance coverage, according to the article, include the membership requirement for access to benefits and the limited coverage area, which may not be available in all regions or states.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.