Best Subaru Justy Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

Amica, Farmers, and USAA are the top picks for the best Subaru Justy auto insurance, with rates starting at $22/month. These companies stand out for their competitive pricing, comprehensive coverage options, and superior customer service, making them the leading choices for Subaru Justy drivers.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated October 2024

Company Facts

Full Coverage for Subaru Justy

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Subaru Justy

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Subaru Justy

A.M. Best

Complaint Level

Pros & Cons

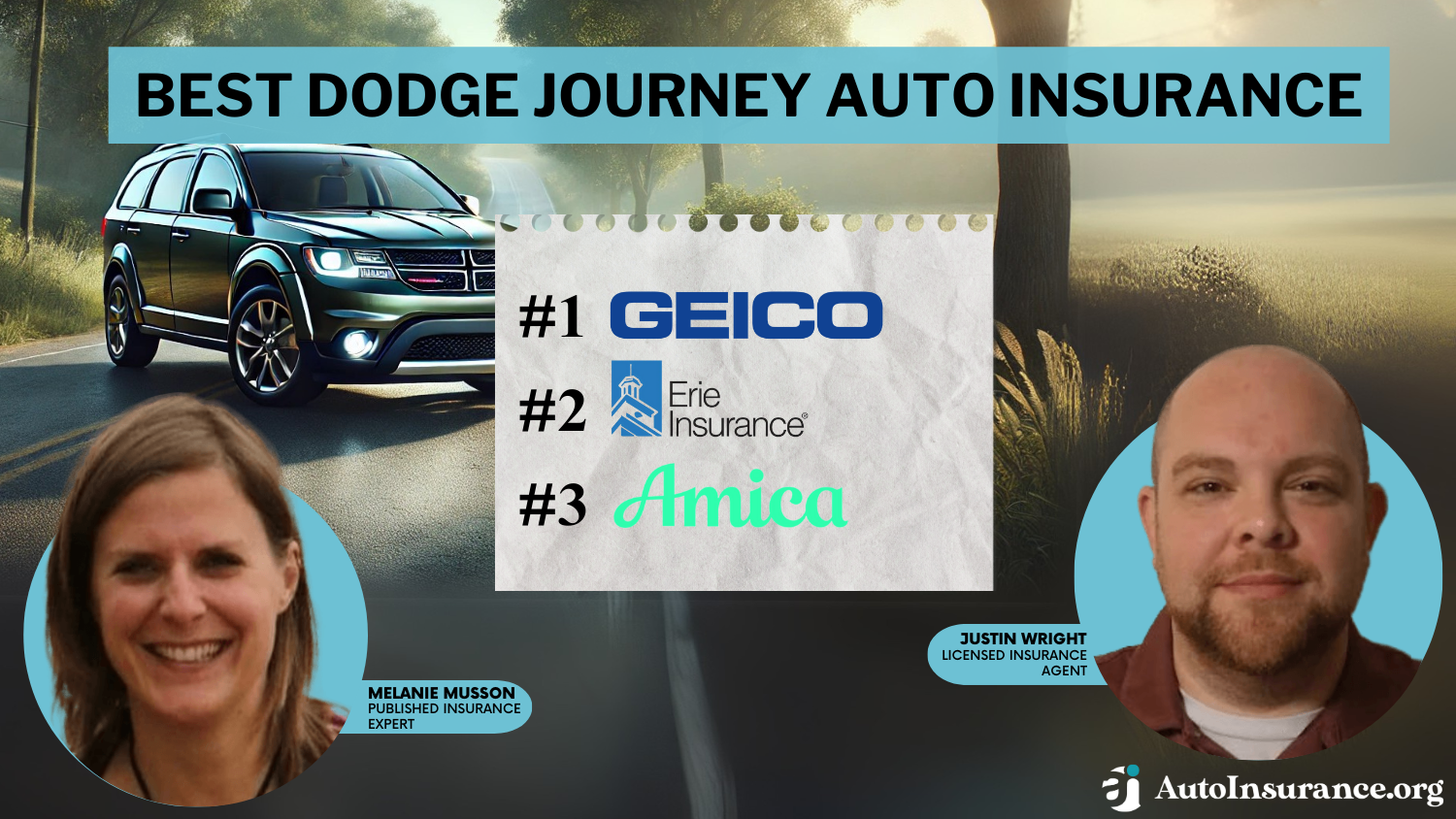

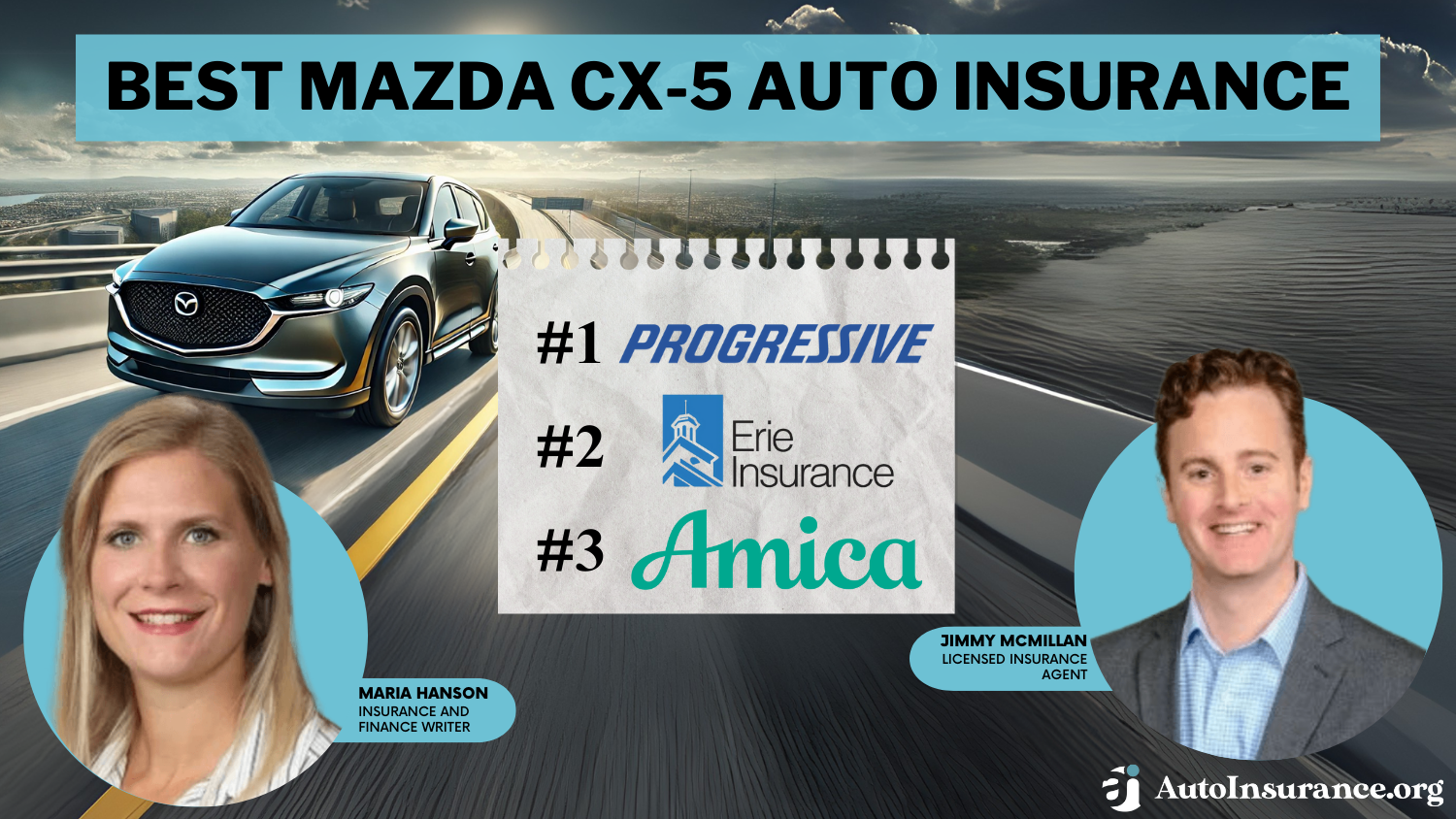

The top picks for the best Subaru Justy auto insurance are Amica, Farmers, and USAA, known for their reliability and comprehensive coverage options.

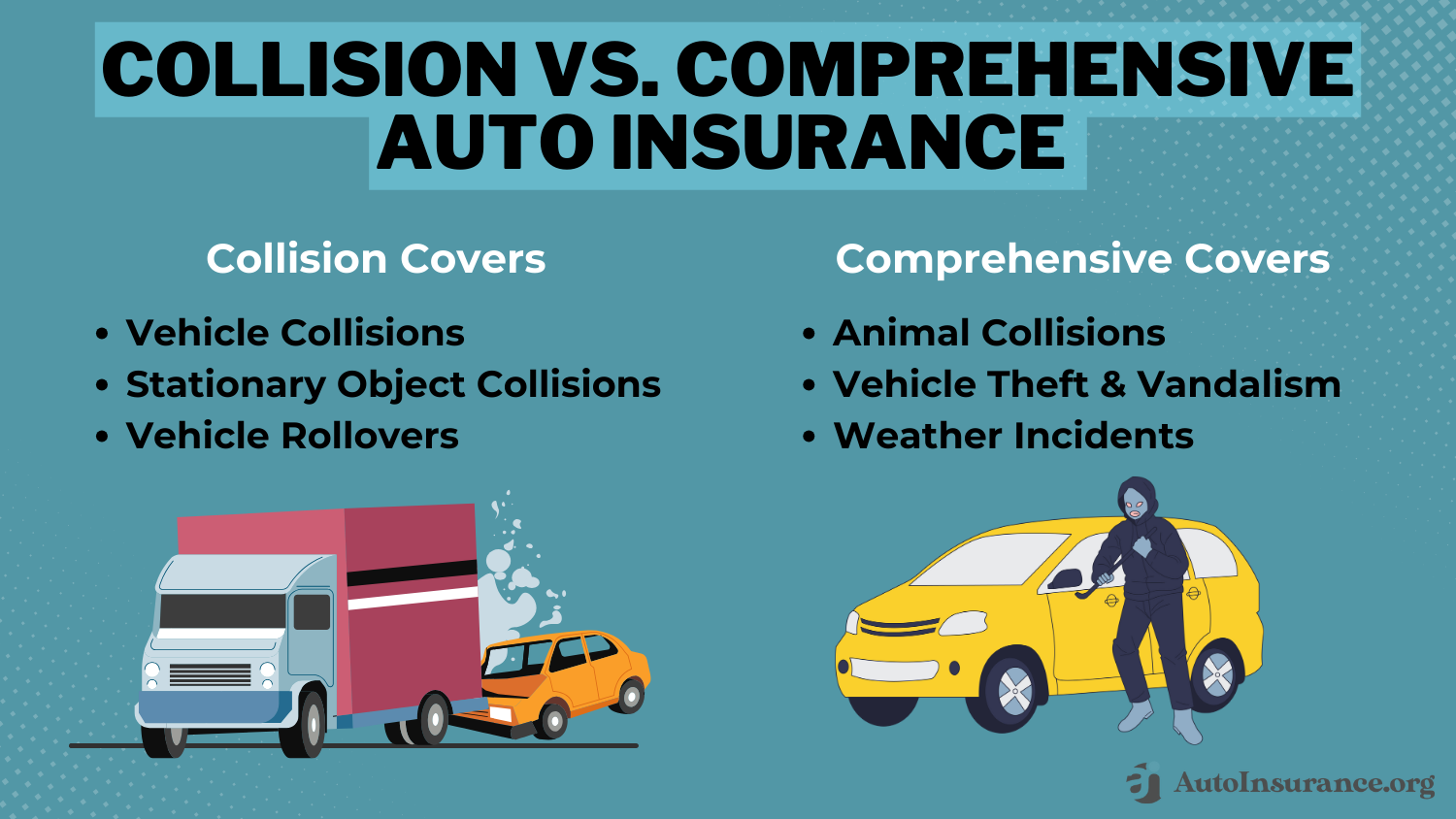

These companies have been recognized for their competitive advantages in terms of customer satisfaction and policy offerings. See more details in our guide titled, “Types of Auto Insurance.”

Our Top 10 Company Picks: Best Subaru Justy Auto Insurance

Company Rank Safe Driver Discount A.M. Best Best For Jump to Pros/Cons

#1 15% A+ Policy Perks Amica

#2 18% A Roadside Assistance Farmers

#3 12% A++ Local Agents USAA

#4 10% B Customer Service State Farm

#5 14% A+ Infrequent Drivers Nationwide

#6 17% A+ Safe-Driving Discounts Dairyland

#7 16% A++ Usage-Based Discount Travelers

#8 13% A++ Add-on Coverages Auto-Owners

#9 19% A+ Multi-Policies Discount Erie

#10 11% A+ Customized Policies Progressive

Each insurer offers unique features that cater specifically to Subaru Justy owners, ensuring optimal protection on the road. When choosing the right auto insurance, Subaru Justy owners should consider these providers for their established track records and specialized vehicle coverage.

Just enter your ZIP code above to see fast, free Subaru Justy insurance quotes right now.

- Amica is the top pick for the best Subaru Justy auto insurance

- Subaru Justy owners benefit from specialized coverage options

- Tailored policies address the unique needs of Subaru Justy drivers

#1 – Amica: Top Overall Pick

Pros

- Policy Flexibility: Amica offers a variety of add-ons specifically tailored for Subaru Justy, ensuring flexible coverage options.

- Safe Driver Rewards: Subaru Justy owners can benefit from a 15% discount for safe driving with Amica’s program. See more details in our guide titled, “Amica Auto Insurance Review.”

- High Industry Rating: With an A+ rating from A.M. Best, Amica assures strong financial stability for Subaru Justy insurance.

Cons

- Higher Premiums: While offering significant perks, Amica’s premiums may be higher for Subaru Justy compared to some competitors.

- Limited Availability: Amica’s specialized policy perks for Subaru Justy might not be available in all regions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Farmers: Best for Roadside Assistance

Pros

- Enhanced Roadside Assistance: Farmers provides comprehensive roadside help, ideal for Subaru Justy drivers.

- Safe Driver Discount: An 18% discount is available for Subaru Justy owners maintaining a safe driving record. More information is available about this provider in our Farmers auto insurance review.

- Robust Coverage Options: Farmers offers extensive coverage that benefits Subaru Justy owners looking for full protection.

Cons

- Costlier Options: Enhanced coverage and roadside assistance for Subaru Justy come at a higher price with Farmers.

- Policy Flexibility Issues: Farmers may have less flexible options for customizing Subaru Justy specific policies compared to others.

#3 – USAA: Best for Local Agent

Pros

- Local Expertise: USAA provides Subaru Justy owners with access to local agents who offer personalized service.

- Strong Financial Rating: With an A++ from A.M. Best, USAA is highly reliable for insuring your Subaru Justy.

- Loyalty Discounts: Subaru Justy owners can receive discounts for long-term policyholding with USAA. Unlock details in our guide titled, USAA auto insurance review.

Cons

- Eligibility Restrictions: USAA’s services for Subaru Justy are exclusive to military families, limiting broader access.

- Limited Global Reach: While excellent locally, USAA may not have the same support quality for Subaru Justy owners traveling or moving abroad.

#4 – State Farm: Best for Customer Service

Pros

- Comprehensive Customer Support: State Farm excels in customer service, providing Subaru Justy owners with extensive support.

- Bundling Policies: Subaru Justy owners benefit from discounts when bundling multiple insurance policies with State Farm. Discover insights in our guide titled, State Farm auto insurance review.

- Wide Coverage Options: Diverse insurance coverages are available for Subaru Justy, catering to different needs and preferences.

Cons

- Higher Premium Costs: Despite the availability of discounts, State Farm’s premiums may still be relatively high for Subaru Justy coverage.

- Limited Multi-Policy Discount: The discount for bundling policies with State Farm is not as competitive for Subaru Justy compared to other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Infrequent Drivers

Pros

- Low Mileage Discounts: Nationwide offers significant discounts for Subaru Justy owners who drive less frequently. Read up on the Nationwide auto insurance review for more information.

- Flexible Policy Options: Subaru Justy insurance Nationwide includes various flexible terms that can be tailored to less frequent drivers.

- Strong Financial Stability: With an A+ rating from A.M. Best, Nationwide provides reliable coverage for Subaru Justy owners.

Cons

- Premium Variability: Subaru Justy owners may experience variability in premium rates depending on driving frequency and location.

- Coverage Limitations: Some desirable extras for Subaru Justy might not be available under Nationwide’s standard policies.

#6 – Dairyland: Best for Safe-Driving Discount

Pros

- Aggressive Safe-Driving Discounts: Dairyland offers a robust 17% discount for Subaru Justy owners who maintain a clean driving record.

- Specialized Coverage Options: Tailored specifically to meet the needs of Subaru Justy drivers, Dairyland’s policies include unique coverage features.

- High Financial Rating: A+ rated by A.M. Best, Dairyland ensures strong backing for Subaru Justy insurance policies. See more details in our guide titled, “Dairyland Auto Insurance Review.”

Cons

- Higher Rate for Risk Profiles: Subaru Justy owners with less-than-perfect driving records might face steep premiums with Dairyland.

- Narrower Network: Limited agent availability can affect the service experience for some Subaru Justy insurance holders.

#7 – Travelers: Best for Usage-Based Discount

Pros

- Innovative Discounts: Travelers offers usage-based discounts that can significantly lower rates for Subaru Justy owners who drive less.

- Customizable Coverage: Subaru Justy insurance can be highly personalized with Travelers to match specific needs and usage patterns.

- Strong Insurer Reputation: Backed by an A++ rating from A.M. Best, Travelers ensures dependable coverage for Subaru Justy. See more details in our guide titled, “Travelers Auto Insurance Review.”

Cons

- Complexity in Policy Management: The detailed customization options for Subaru Justy insurance might complicate policy management for some owners.

- Premium Sensitivity: Travelers’ rates for Subaru Justy can fluctuate more with changes in driving habits compared to other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Auto-Owners: Best for Add-on Coverage

Pros

- Extensive Add-on Options: Auto-Owners offers a wide range of add-on coverages, enhancing the insurance for Subaru Justy.

- Personalized Service: Local agents provide highly personalized service to Subaru Justy owners, ensuring their needs are specifically met.

- High Financial Security: With an A++ rating, Auto-Owners is a robust choice for securing Subaru Justy insurance. Discover insights in our guide titled, “Auto-Owners Auto Insurance Review.”

Cons

- Cost of Extras: While offering many add-ons, the additional coverages for Subaru Justy can significantly increase the overall cost.

- Limited Availability: Auto-Owners’ specialized services for Subaru Justy may not be as accessible in all areas.

#9 – Erie: Best for Multi-Policies Discount

Pros

- Competitive Multi-Policy Discounts: Erie offers attractive discounts for Subaru Justy owners who bundle multiple policies.

- Tailored Policies: Erie provides customized policy options that are ideal for meeting the specific needs of Subaru Justy owners.

- Strong Local Presence: Erie maintains a strong local presence, offering accessible and responsive service to Subaru Justy owners. Unlock details in our guide titled, “Erie Auto Insurance Review.”

Cons

- Geographic Limitations: Erie’s coverage for Subaru Justy is not available in all states, which can be a limitation for some owners.

- Policy Adjustment Restrictions: Once a policy is set, making changes to Subaru Justy coverage can be less flexible with Erie compared to others.

#10 – Progressive: Best for Customized Policies

Pros

- Highly Customizable Policies: Progressive allows Subaru Justy owners to tailor their policies extensively to fit their specific needs.

- Dynamic Pricing Model: Progressive uses a dynamic pricing model that can benefit Subaru Justy owners with lower risk profiles. Delve into our evaluation of Progressive auto insurance review.

- Wide Network of Services: A broad network ensures that Subaru Justy insurance support is available widely and conveniently.

Cons

- Variable Customer Service Quality: The quality of customer service for Subaru Justy insurance can vary significantly across different regions.

- Complex Rate Structure: The pricing for Subaru Justy insurance with Progressive can be complex and unpredictable, making budgeting challenging.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Subaru Justy Insurance Costs by Coverage Level

When shopping for auto insurance for a Subaru Justy, understanding how rates vary between a minimum and full coverage can guide your decision. Below is a summary of monthly rates from various providers.

Subaru Justy Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Amica Mutual | $46 | $151 |

| Auto-Owners | $33 | $87 |

| Dairyland | $85 | $237 |

| Erie | $22 | $58 |

| Farmers | $53 | $139 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

| USAA | $22 | $59 |

For Subaru Justy owners, monthly insurance rates differ significantly between minimum and full coverage options across several insurers. For instance, Erie and USAA offer the most affordable minimum coverage starting at $22, with full coverage at $58 and $59, respectively, making them excellent choices for budget-conscious drivers.

Conversely, Dairyland presents the highest rates, charging $85 for minimum and $237 for full coverage. Notably, State Farm and Auto-Owners both offer competitive rates at $33 for minimum coverage, with full coverage at $86 and $87, respectively.

This table highlights the substantial variability in insurance costs, emphasizing the importance of comparing rates to find the best fit for your insurance needs and budget. Learn more by reading our guide, “What is the average auto insurance cost per month?“

Are Vehicles Like the Subaru Justy Expensive to Insure

Understanding the insurance costs for compact cars like the Subaru Justy is essential for potential owners. By comparing it with similar models such as the Mazda Millenia, Nissan Cube, and Mazda 2, we can gauge the general expense of insuring vehicles in this category.

Examining the insurance rates of vehicles comparable to the Subaru Justy offers a clear perspective on what drivers can anticipate in terms of insurance expenses. This comparison helps in making informed decisions when choosing which car to buy and insure. Unlock details in our guide titled “How Vehicle Year Affects Auto Insurance Rates.”

Understanding the insurance cost landscape for vehicles like the Subaru Justy is crucial for budgeting and financial planning. By examining the rates of similar models, consumers can better navigate the complexities of auto insurance and choose a policy that aligns with their financial and vehicle needs.

Insurance Rates for Vehicles Similar to the Subaru Justy

Exploring auto insurance rates for vehicles comparable to the Subaru Justy provides valuable insights into potential costs across different car models.

This comparison covers various vehicles, examining their monthly rates for comprehensive, collision, minimum coverage, and full coverage.

Subaru Justy Similar Vehicles Auto Insurance Monthly Rates by Coverage Level

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| FIAT 500 | $20 | $39 | $39 | $113 |

| Kia Soul | $26 | $42 | $31 | $112 |

| Porsche Panamera | $43 | $87 | $33 | $177 |

| Toyota Prius | $27 | $44 | $26 | $109 |

| FIAT 500L | $21 | $40 | $38 | $114 |

| Toyota Yaris | $21 | $40 | $33 | $108 |

| Nissan Leaf | $27 | $53 | $35 | $128 |

| Nissan Cube | $19 | $31 | $38 | $101 |

This analysis of insurance rates reveals significant variations in costs depending on the vehicle type, highlighting the importance of comparing options to find the best insurance solution for similar cars like the Subaru Justy. Whether considering a Fiat, Nissan, or Toyota, understanding these cost differences can lead to more informed decisions on auto insurance purchases.

What Impacts the Cost of Subaru Justy Insurance

The Subaru Justy trim and model you choose can impact the total price you will pay for Subaru Justy insurance coverage. You can also expect your Subaru Justy rates to be affected by where you live, your driving history, and in most states your age and gender. To find out more, explore our guide titled, “Top 7 Factors That Affect Auto Insurance Rates.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Save on Subaru Justy Insurance

Reducing the cost of auto insurance for your Subaru Justy doesn’t have to be complicated. Here are five straightforward strategies that can help you secure lower rates on your Subaru Justy insurance.

- Add a more experienced driver to your Subaru Justy policy.

- Reduce modifications on your Subaru Justy.

- Never drink and drive your Subaru Justy.

- Ask about Subaru Justy discounts if you were listed on someone else’s policy.

- Purchase a roadside assistance program for your Subaru Justy.

By implementing these practical tips, such as adding a more experienced driver and minimizing modifications, you can effectively decrease your Subaru Justy insurance expenses.

Remember to inquire about any specific discounts for which you might be eligible to maximize your savings. Delve into our evaluation of “How do auto insurance payments work?“

Top Subaru Justy Insurance Companies

Selecting the right auto insurance provider is crucial for Subaru Justy owners seeking optimal coverage and affordability. This guide lists the top insurance companies that specialize in offering competitive rates for the Subaru Justy, highlighting the benefits of each. Learn more by reading our guide titled, “What are the benefits of auto insurance?“

While the best insurance rates for your Subaru Justy will depend on a variety of personal factors, understanding the offerings from leading insurers can help you make an informed decision. Remember to explore the discounts available for safety features and security systems to further enhance your savings and protection.

Largest Auto Insurers by Market Share

Exploring the landscape of auto insurance, the following data presents the largest insurers by market share, specifically focusing on coverage for Subaru Justy vehicles. This analysis helps identify which companies dominate the market in terms of premiums written.

Top Subaru Justy Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premium Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9.1% |

| #2 | Geico | $46.3 million | 6.4% |

| #3 | Progressive | $41.7 million | 5.7% |

| #4 | Allstate | $39.2 million | 5.4% |

| #5 | Liberty Mutual | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3.4% |

| #8 | Chubb | $24.1 million | 3.3% |

| #9 | Farmers | $20.0 million | 2.8% |

| #10 | Nationwide | $18.4 million | 2.5% |

This comprehensive look at the largest auto insurers for Subaru Justy vehicles reveals a diverse range of companies leading the market.

Amica leads the market with unmatched policy flexibility and solid financial backing, making it the top choice for Subaru Justy insurance.Michelle Robbins Licensed Insurance Agent

From State Farm at the forefront with a 9.1% market share to Nationwide rounding out the top ten, each company’s presence underscores its impact and customer reach within the auto insurance industry. You can start comparing quotes for Subaru Justy insurance from some of the top car insurance companies by using our free online tool today.

Frequently Asked Questions

What factors should I consider when buying insurance for a Subaru Justy?

Consider coverage limits, deductibles, optional coverage, insurer reputation, customer reviews, and overall cost when buying Subaru Justy insurance. Compare quotes for best rates. Unlock details in our guide titled “How Vehicle Year Affects Auto Insurance Rates.”

Where can I find more information about Subaru auto insurance?

Visit insurance company websites, consult insurance agents, or refer to online resources for Subaru auto insurance information.

Do crash test ratings affect Subaru Justy auto insurance rates?

Yes, better crash test ratings can potentially lead to lower auto insurance rates for the Subaru Justy. If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

How does the trim level of the Subaru Justy affect insurance costs?

Insurance costs can vary based on the Subaru Justy’s trim level. Higher trims may result in higher rates.

Do safety features of the Subaru Justy impact insurance rates?

Yes, safety features can earn you a car insurance discount for the Subaru Justy. To learn more, explore our comprehensive resource on “Where to Compare Auto Insurance Rates.”

What is the cheapest Subaru to insure?

The Subaru Justy is one of the most affordable Subarus to insure, known for its low-risk factors and modest repair costs.

What color Subaru is most expensive to insure?

Insurance costs for the Subaru Justy are not significantly affected by color; rates are more influenced by the car’s safety features and the driver’s record.

Which Subaru is the safest to insure?

Subaru Justy models equipped with comprehensive safety features such as advanced airbags and stability control are deemed the safest to insure.

What is the safest Subaru model to insure?

The 2024 Subaru Justy, with updated safety technologies and enhanced protective features, is considered the safest model to insure. Access comprehensive insights into our guide titled, “Understanding Auto Insurance Premiums.”

Which Subaru has the longest insurance life?

The Subaru Justy is noted for its longevity, which can lead to lower insurance premiums over time as the vehicle proves its durability and reliability.

What is the most reliable Subaru to insure?

Which Subaru Justy color is considered premium for insurance purposes?

What is the most economical Subaru to insure?

Is insuring a Subaru Justy expensive?

Is it cheaper to insure a Toyota or a Subaru Justy?

What Subaru lasts the longest?

Are Subaru Justy spare parts expensive?

How long will a Subaru Justy engine last?

What is special about the Subaru Justy?

Is the Subaru Justy owned by Toyota now?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.