Best Pay-As-You-Go Auto Insurance in Michigan for 2026 (Top 9 Companies Ranked)

Safeco, Nationwide, and Progressive offer the best pay-as-you-go auto insurance in Michigan at $61 per month. These insurers provide flexible payment options, competitive rates, and reliable coverage. Michigan pay-per-mile insurance helps low-mileage drivers save by charging based on actual vehicle usage.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated March 2025

1,278 reviews

1,278 reviewsCompany Facts

PAYG Full Coverage in MI

A.M. Best Rating

Complaint Level

Pros & Cons

1,278 reviews

1,278 reviews 3,071 reviews

3,071 reviewsCompany Facts

PAYG Full Coverage in MI

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 13,285 reviews

13,285 reviewsCompany Facts

PAYG Full Coverage in MI

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsYou will find the best pay-as-you-go auto insurance in Michigan at Safeco, Nationwide, and Progressive.

Our Top 10 Picks: Best Pay-As-You-Go Auto Insurance in Michigan

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A | Online Tools | Safeco | |

| #2 | 20% | A+ | Mileage Discounts | Nationwide |

| #3 | 12% | A+ | Loyalty Rewards | Progressive | |

| #4 | 25% | A | RightTrack Discounts | Liberty Mutual |

| #5 | 25% | A+ | Claims Satisfaction Guarantee | Allstate | |

| #6 | 25% | A++ | Young Drivers | Geico | |

| #7 | 20% | B | Safe Drivers | State Farm | |

| #8 | 10% | A++ | Military Coverage | USAA | |

| #9 | 20% | A | Safety Discounts | Farmers |

Infrequent drivers will find that Michigan auto insurance is the cheapest at companies that operate on pay-per-mile rates or offer usage-based discounts. If you drive less than 50 miles daily, you’ll want to check out the following companies.

- Safeco has the best Michigan pay-per-mile insurance reviews

- Nationwide and Progressive offer discounts for safe and high-risk drivers

- All drivers must meet Michigan auto insurance requirements

Continue reading to learn more about the best companies and how much coverage you need based on Michigan auto insurance laws, discount options, and more.

If you are ready to make the switch to pay-per-mile insurance today, use our free quote tool to find the best deal.

#1 – Safeco: Top Overall Pick

Pros

- Online Tools: Most policy changes can be handled online through Safeco’s online tools.

- Coverage Options: Safeco offers a number of coverages for Michigan drivers. Learn more in our Safeco auto insurance review.

- Usage-Based Discount: Participate in Safeco’s discount program and save more based on your mileage and driving habits.

Cons

- Customer Satisfaction: Safeco doesn’t rate customer satisfaction as highly as other companies.

- Agent Purchases: After starting a quote online, you must complete your purchase through an agent.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

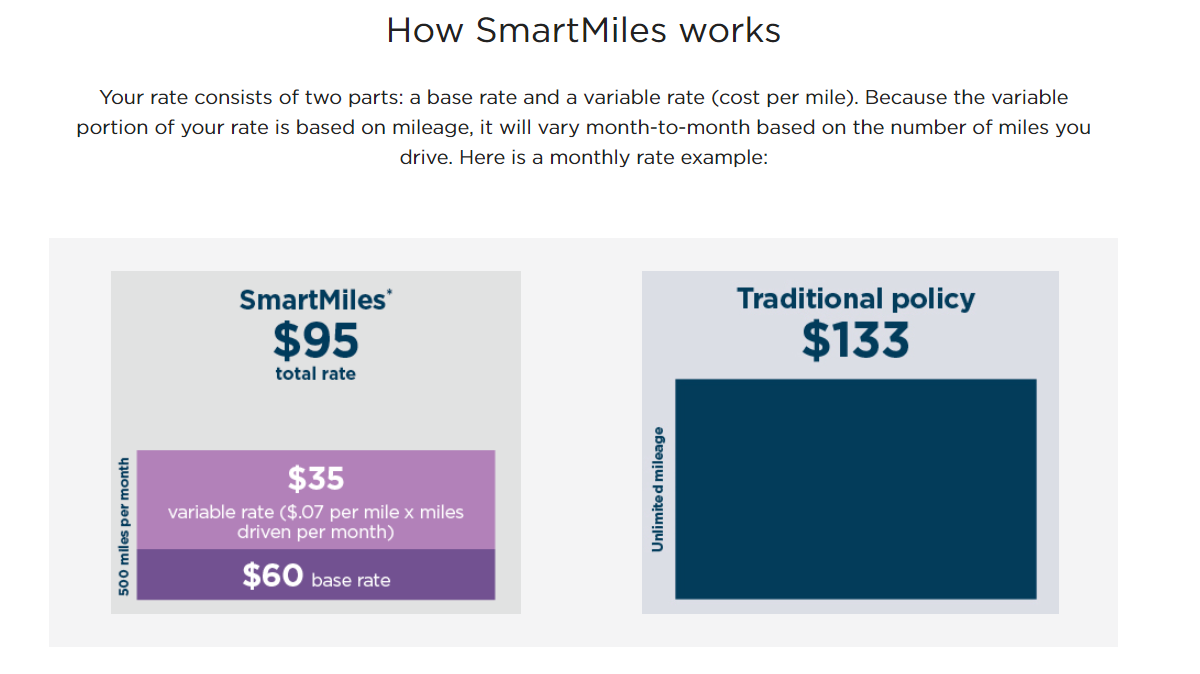

#2 – Nationwide: Best for Mileage Discounts

Pros

- Mileage Discounts: If you drive less, you can save on the average cost of auto insurance in Michigan on a normal policy.

- Pay-Per-Mile Insurance: Nationwide also offers SmartMiles, a pay-per-mile insurance option. Learn more in our Nationwide auto insurance review.

- Roadside Assistance: You can add roadside coverage to your policy for 24/7 help on Michigan roads.

Cons

- High-Mileage Drivers: SmartMiles is not as cost-effective for higher-mileage drivers.

- Telematics Tracking: You must be comfortable with your driving being tracked for pay-per-mile insurance or usage-based discounts.

#3 – Progressive: Best for Loyalty Rewards

Pros

- Loyalty Rewards: The longer you stay with Progressive, the more rewards you can qualify for.

- Coverage Options: Michigan drivers can purchase anything from roadside assistance to gap coverage.

- Snapshot Program: Michigan drivers can save on their auto insurance with this usage-based program. Learn more in our Progressive Snapshot review.

Cons

- Snapshot Rate Increases: Michigan drivers who perform poorly in the Snapshot program may receive rate increases.

- Telematics Tracking: Progressive tracks your data in its Snapshot program.

#4 – Liberty Mutual: Best for RightTrack Discounts

Pros

- RightTrack Discounts: The RightTrack program rewards Michigan drivers for good driving. Learn more in our Liberty Mutual RightTrack review.

- 24/7 Support: The company offers 24/7 support to Michigan drivers.

- Coverage Options: Michigan drivers have plenty of options to add to their policy.

Cons

- Telematics Tracking: You do have to let RightTrack track your data for the discount.

- High-Risk Rates: Drivers in Michigan with poor driving records will find Liberty Mutual expensive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Claims Satisfaction Guarantee

Pros

- Claims Satisfaction Guarantee: Allstate offers credits towards future policy bills to some unsatisfied customers.

- Milewise Insurance: Pay by the mile if you choose Allstate’s Milewise insurance. Learn more in our Allstate Milewise review.

- Online Convenience: Allstate offers a free app that lets customers perform various tasks.

Cons

- Claims Satisfaction Reviews: Allstate offers a claims satisfaction guarantee because it has a number of customer satisfaction complaints.

- High-Mileage Drivers: Milewise won’t be cost-effective for drivers with high mileage, as noted in various Milewise insurance reviews, which highlight its best value for low-mileage drivers.

#6 – Geico: Best for Young Drivers

Pros

- Young Drivers: Michigan teen drivers can save with good student discounts and more at Geico.

- Usage-Based Discount: Michigan drivers can save with Geico’s DriveEasy program. Read our Geico DriveEasy review to learn more.

- Roadside Assistance: Michigan drivers can get simple repairs or tows 24/7 with this coverage.

Cons

- Local Agents: Few local agents are available in Michigan, but Geico provides online customer service in Michigan.

- DUI Rates: Geico customers may find it difficult to get affordable high-risk auto coverage in Michigan.

#7 – State Farm: Best for Safe Drivers

Pros

- Safe Drivers: State Farm offers great rates for Michigan drivers with clean driving records. Read our State Farm auto insurance review to learn more.

- Local Agents: Michigan agents are widely available throughout the state.

- Coverage Variety: State Farm offers Michigan drivers plenty of choices.

Cons

- Telematics Tracking: You must let State Farm track your driving for a usage-based discount.

- High-Risk Rates: State Farm charges much more for car insurance for high-risk drivers in Michigan.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – USAA: Best for Military Coverage

Pros

- Military Coverage: USAA offers great coverage at affordable rates to military service members and veterans.

- Usage-Based Discount: USAA offers discounts to Michigan drivers participating in its UBI program. Learn more in our USAA Safepilot review.

- Customer Service: Customers have rated USAA’s customer service highly.

Cons

- Eligibility: Coverage is sold exclusively to families of military service members and veterans.

- Telematics Tracking: USAA will track data in its Safepilot program.

#9 – Farmers: Best for Safety Discounts

Pros

- Safety Discounts: Michigan drivers with the latest safety upgrades on their cars will get a discounted rate.

- Usage-Based Discount: Michigan drivers can participate in the Farmers’ UBI program. Learn more in our Farmers Signal review.

- Coverage Options: Michigan drivers have plenty of options to customize their policies.

Cons

- Telematics Tracking: Enrollment in a usage-based discount plan entails ongoing monitoring of your driving behavior, such as speed, braking habits, and mileage, which can be privacy-invasive.

- Claims Processing: Certain MI customers have complained about poor communication, delays in processing claims, and difficulties getting reasonable settlements.

Why Michigan Auto Insurance is So Expensive

One of the reasons Michigan auto insurance costs more is because it is a no-fault auto insurance state.

Michigan's no-fault insurance requires drivers to cover their own injury and property damage costs, no matter who is at fault.Brandon Frady Licensed Insurance Agent

Because Michigan auto insurance law changes how accident fault is assigned, it is beneficial for drivers to carry more than the Michigan minimum auto insurance requirements. Below, you can see the prices at different companies for minimum and full coverage.

Michigan Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $749 | $1,527 |

| 16-Year-Old Male | $732 | $1,070 |

| 20-Year-Old Female | $532 | $1,120 |

| 20-Year-Old Male | $627 | $1,153 |

| 30-Year-Old Female | $171 | $358 |

| 30-Year-Old Male | $172 | $361 |

| 40-Year-Old Female | $210 | $430 |

| 40-Year-Old Male | $220 | $450 |

| 50-Year-Old Female | $164 | 341.04 |

| 50-Year-Old Male | $163 | $339 |

| 60-Year-Old Female | $152 | $145 |

| 60-Year-Old Male | $153 | $204 |

| 70-Year-Old Female | $162 | $353 |

| 70-Year-Old Male | $161 | $352 |

Always compare quotes from top auto insurance companies in Michigan and find affordable, no-fault auto insurance. Look for discounts on safe driving, bundling, and low mileage.

Competitive rates and coverage options are available for those needing cheap, high-risk auto insurance in Michigan.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Michigan Auto Insurance Rates

When comparing auto insurance rates in Michigan, be sure to know how annual mileage affects rates.

Michigan Auto Insurance Monthly Rates by Age, Gender, & Annual Mileage

| Age & Gender | 6,000 Miles | 10,000 Miles | 12,000 Miles | 15,000 Miles |

|---|---|---|---|---|

| 16-Year-Old Female | $350 | $375 | $390 | $410 |

| 16-Year-Old Male | $380 | $405 | $420 | $440 |

| 20-Year-Old Female | $300 | $320 | $335 | $355 |

| 20-Year-Old Male | $330 | $350 | $365 | $385 |

| 30-Year-Old Female | $250 | $265 | $275 | $290 |

| 30-Year-Old Male | $260 | $275 | $285 | $300 |

| 40-Year-Old Female | $230 | $240 | $250 | $265 |

| 40-Year-Old Male | $235 | $245 | $255 | $270 |

| 50-Year-Old Female | $220 | $230 | $240 | $255 |

| 50-Year-Old Male | $225 | $235 | $245 | $260 |

| 60-Year-Old Female | $210 | $220 | $230 | $245 |

| 60-Year-Old Male | $215 | $225 | $235 | $250 |

| 70-Year-Old Female | $215 | $225 | $235 | $250 |

| 70-Year-Old Male | $220 | $230 | $240 | $255 |

Rates drop in price the less you drive, although where you live will also affect your rates.

Michigan Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Ann Arbor | Detroit | Flint | Grand Rapids | Lansing |

|---|---|---|---|---|---|

| 16-Year-Old Female | $320 | $410 | $380 | $340 | $330 |

| 16-Year-Old Male | $340 | $435 | $405 | $360 | $350 |

| 20-Year-Old Female | $270 | $350 | $325 | $290 | $280 |

| 20-Year-Old Male | $290 | $370 | $340 | $310 | $300 |

| 30-Year-Old Female | $220 | $290 | $270 | $240 | $230 |

| 30-Year-Old Male | $230 | $305 | $285 | $250 | $240 |

| 40-Year-Old Female | $210 | $275 | $255 | $225 | $220 |

| 40-Year-Old Male | $215 | $285 | $265 | $230 | $225 |

| 50-Year-Old Female | $200 | $260 | $245 | $215 | $210 |

| 50-Year-Old Male | $205 | $270 | $250 | $220 | $215 |

| 60-Year-Old Female | $190 | $250 | $235 | $205 | $200 |

| 60-Year-Old Male | $195 | $260 | $240 | $210 | $205 |

| 70-Year-Old Female | $195 | $260 | $240 | $210 | $205 |

| 70-Year-Old Male | $200 | $265 | $245 | $215 | $210 |

Ann Arbor and Lansing typically offer the cheapest rates for Michigan drivers, making them great places to explore insurance options. Comparing car insurance quotes in Ann Arbor, MI, can help you find the best coverage.

Whether you’re considering pay-as-you-drive insurance or temporary car insurance in Michigan, these cities provide competitive pricing for flexible coverage.

Save Money With Michigan Pay-As-You-Go Auto Insurance

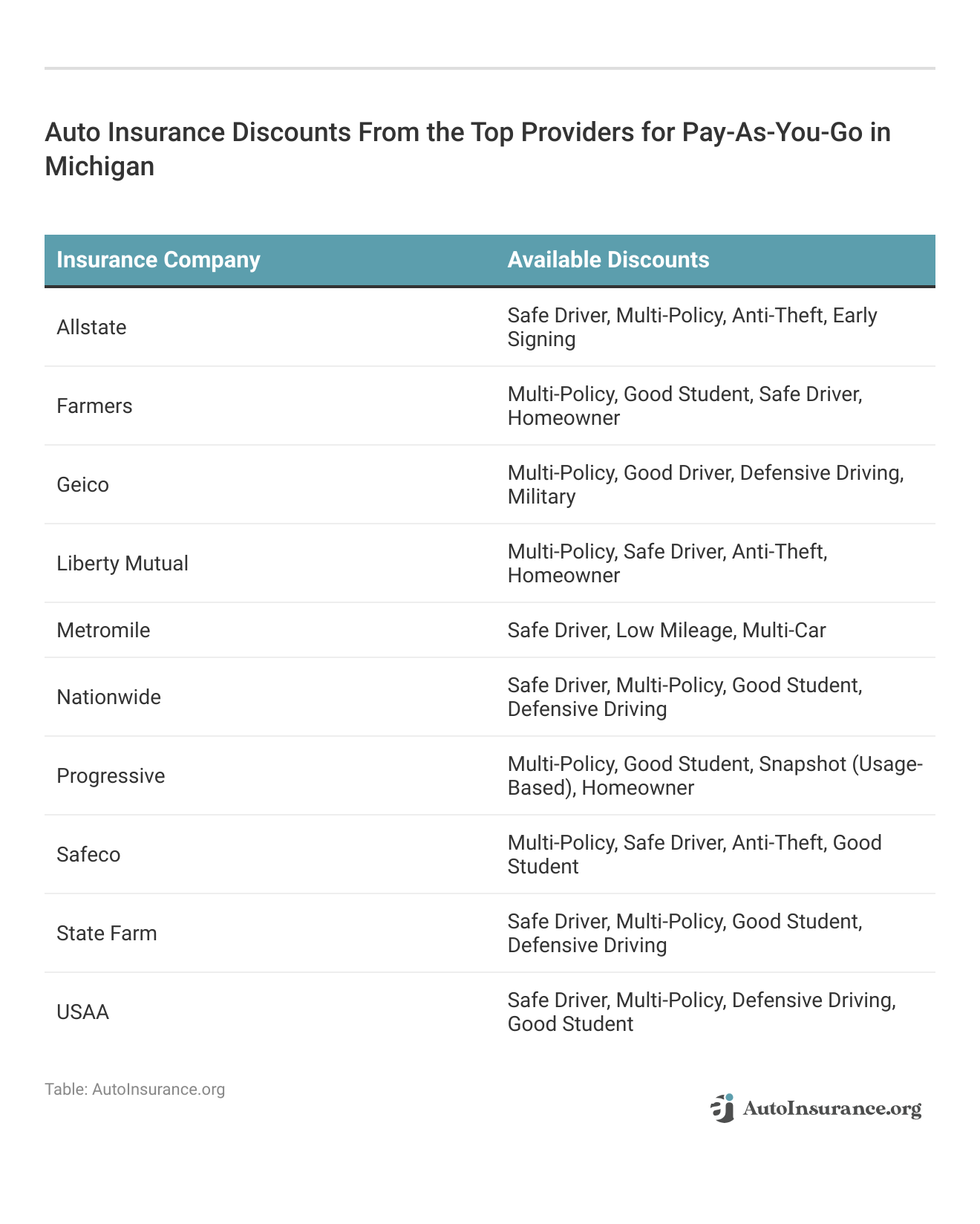

When shopping for cheap usage-based auto insurance, consider the following companies.

MI Pay-As-You-Go Auto Insurance: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $278 | $579 | |

| $229 | $478 | |

| $68 | $141 | |

| $291 | $606 |

| $176 | $367 |

| $104 | $217 | |

| $61 | $134 | |

| $143 | $298 | |

| $73 | $152 |

These companies will offer either pay-per-mile insurance, such as Nationwide’s SmartMiles, or usage-based discounts.

With Michigan pay-per-mile insurance companies, drivers will pay a base rate and then a per-mile fee.

Cheap Pay-As-You-Go Insurance With Discounts

Applying auto insurance discounts can help lower your Michigan low-mileage auto insurance costs. Michigan’s cheapest auto insurance companies often provide savings for low-mileage drivers, making it easier to find affordable Michigan car insurance.

You can also pay GoAuto Insurance online or set up a GoAuto Insurance payment plan.

A popular auto insurance discount in Michigan is the low-mileage discount, commonly offered by the best pay-as-you-go car insurance plans. Drivers who drive less can save on premiums, and comparing car insurance quotes in Michigan helps find the best rates.

Other discounts that offer significant savings on car insurance for high-risk drivers in Michigan include good driver and bundling discounts. These can also help lower rates for those looking for car insurance in Ann Arbor, MI.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Affordable Pay-As-You-Go Auto Insurance Options in Michigan

Pay-as-you-go auto insurance, also known as pay-per-mile insurance, offers Michigan drivers a flexible and cost-effective alternative to traditional policies.

Companies like Safeco, Nationwide, and Progressive provide coverage that adjusts based on mileage and driving habits, making it ideal for low-mileage drivers looking to save.

With average rates of around $61 monthly, the best Michigan auto insurance options include pay-as-you-go car insurance, which can significantly reduce costs for low-mileage drivers.

This type of policy is ideal for remote workers, retirees, and occasional drivers who need affordable and flexible coverage from the best auto insurance in Michigan, like GoAuto car insurance.

Get The Best Pay-As-You-Go Auto Insurance in Michigan

Michigan’s best pay-as-you-go auto insurance companies include Safeco, Nationwide, and Progressive. These Michigan companies offer saving opportunities through low-mileage discounts or pay-per-mile coverage.

Ready to find the cheapest car insurance in Michigan for low-mileage drivers? Find the cheapest pay-per-mile insurance with our free quote tool.

Frequently Asked Questions

What city in Michigan has the cheapest auto insurance?

On average, Ann Arbor has the cheapest rates.

Where can I find cheap car insurance in Ann Arbor, MI?

You can find affordable car insurance in Ann Arbor, MI, by comparing quotes from insurers like Geico, Progressive, and State Farm. Local providers and online comparison tools also help find competitive rates.

How much auto insurance coverage do I need in Michigan?

Michigan drivers must carry liability insurance of 50/100/10 and personal injury protection (PIP).

What are the best options for cheap auto insurance for high-risk drivers in Michigan?

High-risk drivers in Michigan can find affordable insurance through non-standard insurers like The General, Bristol West, and Dairyland. Some major insurers, like Progressive and Geico, also offer high-risk coverage.

How can I get a Countrywide Insurance quote?

You can get a Countrywide Insurance quote by visiting their website, calling customer service, or contacting a licensed agent who offers their policies.

How do I reduce my car insurance rates in Michigan?

Shopping for no-down payment car insurance may help reduce initial costs. Our free tool allows you to quickly compare quotes for no-down-payment auto insurance by entering your ZIP code.

Who has the cheapest pay-as-you-go auto insurance in Michigan?

USAA has the cheapest rates on average when looking at a Michigan pay-per-mile insurance calculator.

Is Metromile pay-as-you-go insurance available in Michigan?

No, Metromile is not yet available in Michigan. However, suppose you have Metromile insurance and move to Michigan. In that case, you may be able to keep it as temporary car insurance in Michigan for a few days until you purchase new insurance.

Is USAA pay-as-you-go auto insurance available in Michigan?

Yes, USAA auto insurance is available in Michigan. Compare rates in our USAA auto insurance review.

Does GoAuto offer full coverage insurance?

GoAuto mainly provides basic liability coverage but does offer full coverage, including comprehensive and collision, in select states.

What are the details of Geico pay-per-mile insurance plans?

Is Geico pay-per-mile insurance cheaper than Progressive in Michigan?

What information do Michigan pay-as-you-go car insurance companies collect?

How do Michigan pay-as-you-go companies verify mileage?

What affects auto insurance rates in Michigan?

How does 7-day car insurance in Michigan work?

Does credit score affect Michigan auto insurance?

Is Michigan getting rid of no-fault insurance?

Where can I get temporary car insurance in Michigan?

What coverage options does The General Insurance in Michigan offer?

Who has the cheapest auto insurance in Michigan?

How much is car insurance in Michigan for a 20-year-old?

Where can I find the lowest auto insurance in Michigan?

What does Hugo Insurance offer to Michigan drivers?

How can I find inexpensive auto insurance in Michigan?

What are the best Michigan car insurance options for drivers who travel less than 50 miles a day?

Where can I get cheap 7-day car insurance in Detroit?

How can I use a car insurance calculator for Michigan rates?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.