Best Hyundai Elantra Hybrid Auto Insurance in 2026 (Check Out These 10 Companies)

Geico, USAA, and Erie are the top picks for the best Hyundai Elantra Hybrid auto insurance, with rates starting at just $52 a month. They excel in providing competitive prices, comprehensive coverage, and high customer satisfaction specifically tailored for Hyundai Elantra Hybrid owners seeking reliable coverage.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated January 2025

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Hyundai Elantra Hybrid

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

Company Facts

Full Coverage for Hyundai Elantra Hybrid

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Hyundai Elantra Hybrid

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best Hyundai Elantra Hybrid auto insurance are Geico, USAA, and Erie, known for their exceptional coverage options and customer service.

These companies stand out in the competitive insurance market by balancing affordability with comprehensive benefits for Hyundai Elantra Hybrid owners. Learn more by reading our guide titled, “What are the benefits of auto insurance?“

Our Top 10 Company Picks: Best Hyundai Elantra Hybrid Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A++ Affordable Rates Geico

#2 10% A++ Military Savings USAA

#3 10% A+ Personalized Policies Erie

#4 12% A+ Coverage Options Progressive

#5 20% B Business Owners State Farm

#6 15% B Rural Expertise Farm Bureau

#7 20% A+ Vanishing Deductible Nationwide

#8 10% A+ Regional Leader Vermont Mutual

#9 20% A Costco Members American Family

#10 20% A- Customer Care Plymouth Rock

Each provider offers unique advantages, from Geico’s nationwide availability and competitive premiums to USAA’s exclusive services for military families and Erie’s highly personalized insurance policies. Opting for any of these insurers ensures that your Hyundai Elantra Hybrid is protected by a top-tier auto insurance company.

To see fast, free Hyundai Elantra Hybrid insurance quotes right now, just enter your ZIP code above.

- Geico is the top choice for Hyundai Elantra Hybrid auto insurance

- Coverage focuses on the specific needs of Hyundai Elantra Hybrid owners

- Tailored policies enhance protection and value for hybrid vehicles

#1 – Geico: Best for Affordable Rates

Pros

- Competitive Pricing: Geico offers Hyundai Elantra Hybrid owners a 25% multi-vehicle discount, making it highly affordable.

- Top Financial Stability: With an A++ rating from A.M. Best, Geico ensures strong financial backing for claims. Learn more by reading our guide titled, “Geico Auto Insurance Review.”

- Wide Coverage Options: Geico provides a range of insurance options that cater specifically to the needs of Hyundai Elantra Hybrid drivers.

Cons

- Generic Customer Service: Geico’s large customer base might lead to less personalized service.

- Policy Upselling: Some customers may experience frequent upselling of additional coverages.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Exclusive Military Benefits: USAA offers a 10% multi-vehicle discount exclusively to military members who own a Hyundai Elantra Hybrid.

- Exceptional Financial Rating: USAA’s A++ rating by A.M. Best guarantees reliability in claims handling for Hyundai Elantra Hybrid owners. Unlock details in our guide titled, USAA auto insurance review.

- Tailored Military Services: Insurance services are specially tailored for military families, enhancing the Hyundai Elantra Hybrid insurance experience.

Cons

- Limited Eligibility: USAA’s services are only available to military families, limiting accessibility for the general public.

- Coverage Limitations: Some potential gaps in coverage can affect Hyundai Elantra Hybrid owners seeking specific benefits.

#3 – Erie: Best for Personalized Policies

Pros

- Customizable Policies: Erie offers Hyundai Elantra Hybrid owners the ability to customize their policies with a 10% multi-vehicle discount. Discover insights in our guide titled, “Erie Auto Insurance Review.”

- Strong Financial Health: With an A+ rating from A.M. Best, Erie assures Hyundai Elantra Hybrid owners of their capability to handle claims.

- Personalized Customer Service: Known for exceptional customer relations, providing a more personalized insurance experience for Hyundai Elantra Hybrid owners.

Cons

- Geographic Limitations: Erie’s availability is more regional, which might not suit all Hyundai Elantra Hybrid owners.

- Higher Premiums for Customization: Customized policies can come at a higher cost, potentially making it more expensive than standardized options.

#4 – Progressive: Best for Coverage Options

Pros

- Diverse Coverage Selection: Progressive offers a 12% multi-vehicle discount and a variety of coverages tailored for Hyundai Elantra Hybrid owners.

- Strong Financial Standing: Progressive’s A+ rating from A.M. Best ensures reliability in handling claims. Delve into our evaluation of Progressive auto insurance review.

- Innovative Tools: Progressive provides advanced tools like the Name Your Price® tool, helping Hyundai Elantra Hybrid owners find coverage to fit their budget.

Cons

- Variable Customer Satisfaction: Customer satisfaction ratings for Progressive can vary widely based on region and individual experiences.

- Rate Fluctuations: Hyundai Elantra Hybrid owners might experience rate changes at renewal, depending on driving records and other factors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Business Owners

Pros

- Tailored Business Policies: State Farm offers a 20% multi-vehicle discount and policies that cater to Hyundai Elantra Hybrid business owners.

- Extensive Agent Network: A vast network of agents provides localized and personalized insurance advice for the Hyundai Elantra Hybrid.

- High Discounts for Low Mileage: Hyundai Elantra Hybrid owners can benefit from significant discounts for low-mileage usage. Discover insights in our guide State Farm auto insurance review.

Cons

- Higher Premiums: Despite discounts, State Farm’s premiums may still be higher for certain coverage levels for Hyundai Elantra Hybrid.

- Limited Multi-Policy Discount: The multi-policy discount is not as competitive as others in the industry for Hyundai Elantra Hybrid.

#6 – Farm Bureau: Best for Rural Expertise

Pros

- Rural Coverage Specialization: Farm Bureau offers a 15% multi-vehicle discount, specializing in areas where Hyundai Elantra Hybrids are popular in rural settings.

- Personalized Local Service: Strong focus on personalized customer service tailored for rural Hyundai Elantra Hybrid owners. See more details in our guide titled, “Farm Bureau Auto Insurance Review.”

- Flexible Policy Options: Farm Bureau provides flexible coverage options that cater to the unique needs of rural Hyundai Elantra Hybrid owners.

Cons

- Limited Availability: Coverage options and availability can be limited for Hyundai Elantra Hybrid owners outside of rural areas.

- Basic Online Services: Online services are less developed, which may not appeal to tech-savvy Hyundai Elantra Hybrid owners.

#7 – Nationwide: Best for Vanishing Deductibles

Pros

- Vanishing Deductible: Nationwide offers a vanishing deductible for every year of safe driving, which is beneficial for Hyundai Elantra Hybrid owners.

- Wide Network: Nationwide’s large network ensures comprehensive coverage availability for the Hyundai Elantra Hybrid. Read up on the Nationwide auto insurance review for more information.

- A+ Financial Rating: Strong financial backing by A.M. Best, ensuring reliable claims service for Hyundai Elantra Hybrid owners.

Cons

- Premium Costs: Despite the vanishing deductible, overall premiums may still be high for Hyundai Elantra Hybrid insurance.

- Customer Service Variability: The quality of customer service can vary, potentially affecting Hyundai Elantra Hybrid owners’ satisfaction.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Vermont Mutual: Best for Regional Leadership

Pros

- Strong Regional Presence: Vermont Mutual offers a 10% multi-vehicle discount and excels in providing tailored services in its regional markets for Hyundai Elantra Hybrid owners.

- Personalized Service: Known for its personalized customer interactions, Vermont Mutual provides attentive and customized insurance solutions.

- A+ Financial Rating: Maintains a strong A+ rating from A.M. Best, assuring Hyundai Elantra Hybrid owners of dependable claim processing. Learn more in our complete “Best Vermont Auto Insurance.”

Cons

- Limited Geographic Reach: Availability is constrained to specific regions, which might not suit all Hyundai Elantra Hybrid owners looking for nationwide coverage.

- Less Competitive on Pricing: Vermont Mutual’s rates may be higher than larger national insurers for Hyundai Elantra Hybrid insurance.

#9 – American Family: Best for Costco Members

Pros

- Exclusive Discounts for Costco Members: American Family offers significant discounts to Costco members who own a Hyundai Elantra Hybrid, enhancing affordability.

- Comprehensive Coverage Options: Provides a range of coverage choices that cater specifically to Hyundai Elantra Hybrid owners, including custom parts and equipment coverage.

- A Financial Rating: American Family’s strong financial health ensures reliable support and claim services for Hyundai Elantra Hybrid owners. See more details in our guide titled, “American Family Auto Insurance Review.”

Cons

- Membership Requirement: The best rates are available primarily to Costco members, limiting accessibility for non-members with a Hyundai Elantra Hybrid.

- Variable Rates: Some Hyundai Elantra Hybrid owners might find American Family’s rates higher than those of competitors, depending on the area and coverage options.

#10 – Plymouth Rock: Best for Customer Care

Pros

- Exceptional Customer Support: Plymouth Rock is celebrated for its outstanding customer service, providing dedicated support to Hyundai Elantra Hybrid owners.

- Flexible Policy Features: Offers a variety of flexible policy features that can be tailored to the specific needs of Hyundai Elantra Hybrid drivers. Unlock details in our guide titled, “Plymouth Rock Auto Insurance Review.”

- Innovative Claims Process: A streamlined and user-friendly claims process enhances the insurance experience for Hyundai Elantra Hybrid owners.

Cons

- Regional Limitations: While it excels in customer care, Plymouth Rock’s availability is limited to certain northeastern states.

- Premium Pricing: Premium levels may be higher than those of some larger competitors, reflecting the company’s focus on service rather than low-cost insurance for Hyundai Elantra Hybrid.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Hyundai Elantra Hybrid Insurance Rates Overview

This section provides a detailed breakdown of the monthly rates for both minimum and full coverage auto insurance for the Hyundai Elantra Hybrid, as offered by various providers. The information helps Hyundai Elantra Hybrid owners make informed decisions based on their coverage needs and budget.

Hyundai Elantra Hybrid Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

American Family $93 $250

Erie $67 $220

Geico $52 $187

Nationwide $92 $245

Plymouth Rock $97 $255

Progressive $65 $215

State Farm $68 $225

Tennessee Farmers $81 $230

USAA $62 $208

Vermont Mutual $93 $248

For Hyundai Elantra Hybrid owners seeking affordable insurance options, Geico offers the lowest monthly rate for minimum coverage at $52, while also presenting a competitive full coverage option at $187.

On the higher end, Plymouth Rock charges $97 for minimum and $255 for full coverage, reflecting the varied pricing strategies across different insurance companies. This variance in pricing underscores the importance of comparing rates to find the best fit for one’s specific insurance needs and budget constraints.

The table includes other providers like Erie, Progressive, and USAA, each offering different rates for their coverage levels, thereby providing a comprehensive overview for potential insurance buyers. Access comprehensive insights into our guide titled “What are the recommended auto insurance coverage levels?“

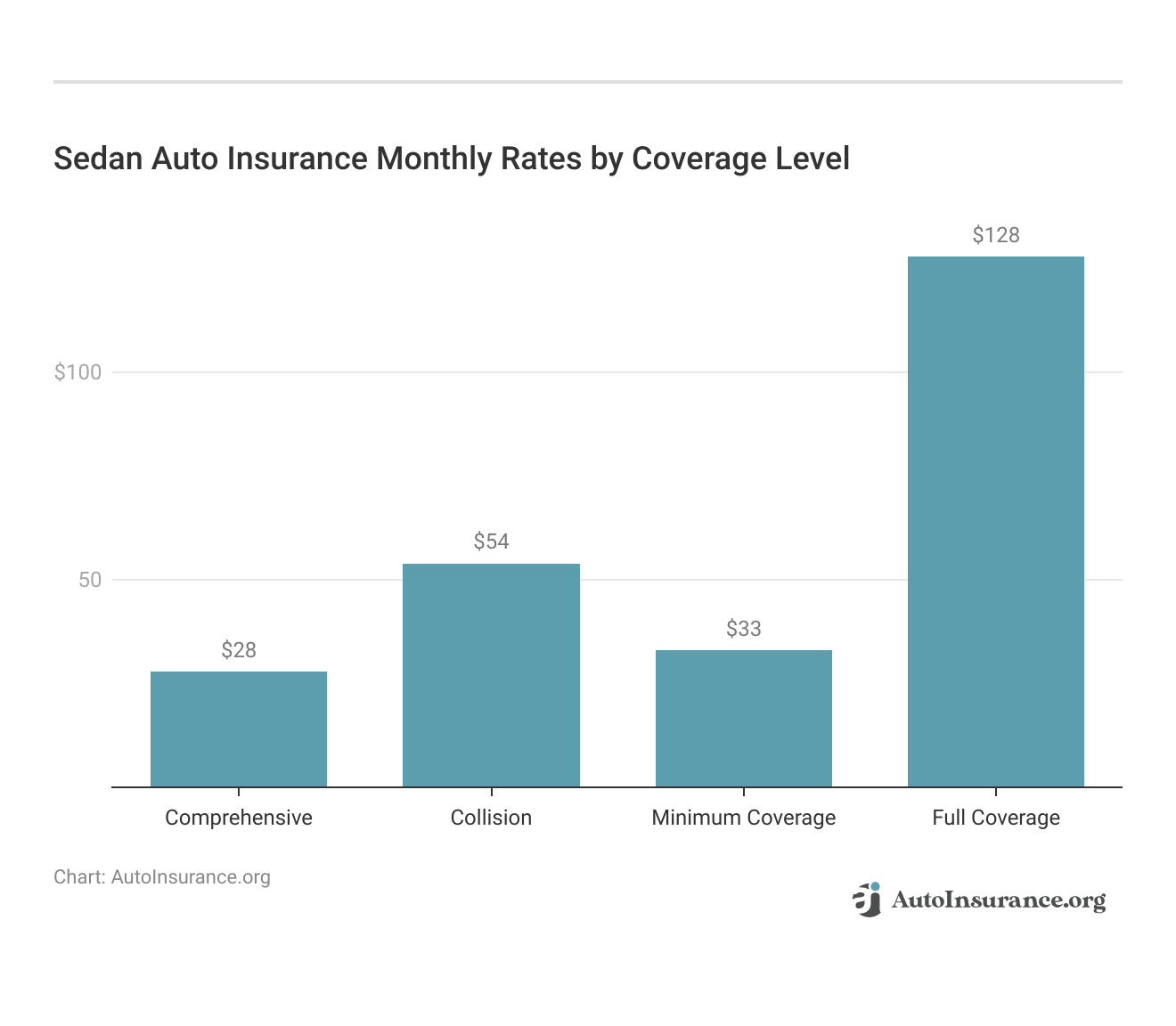

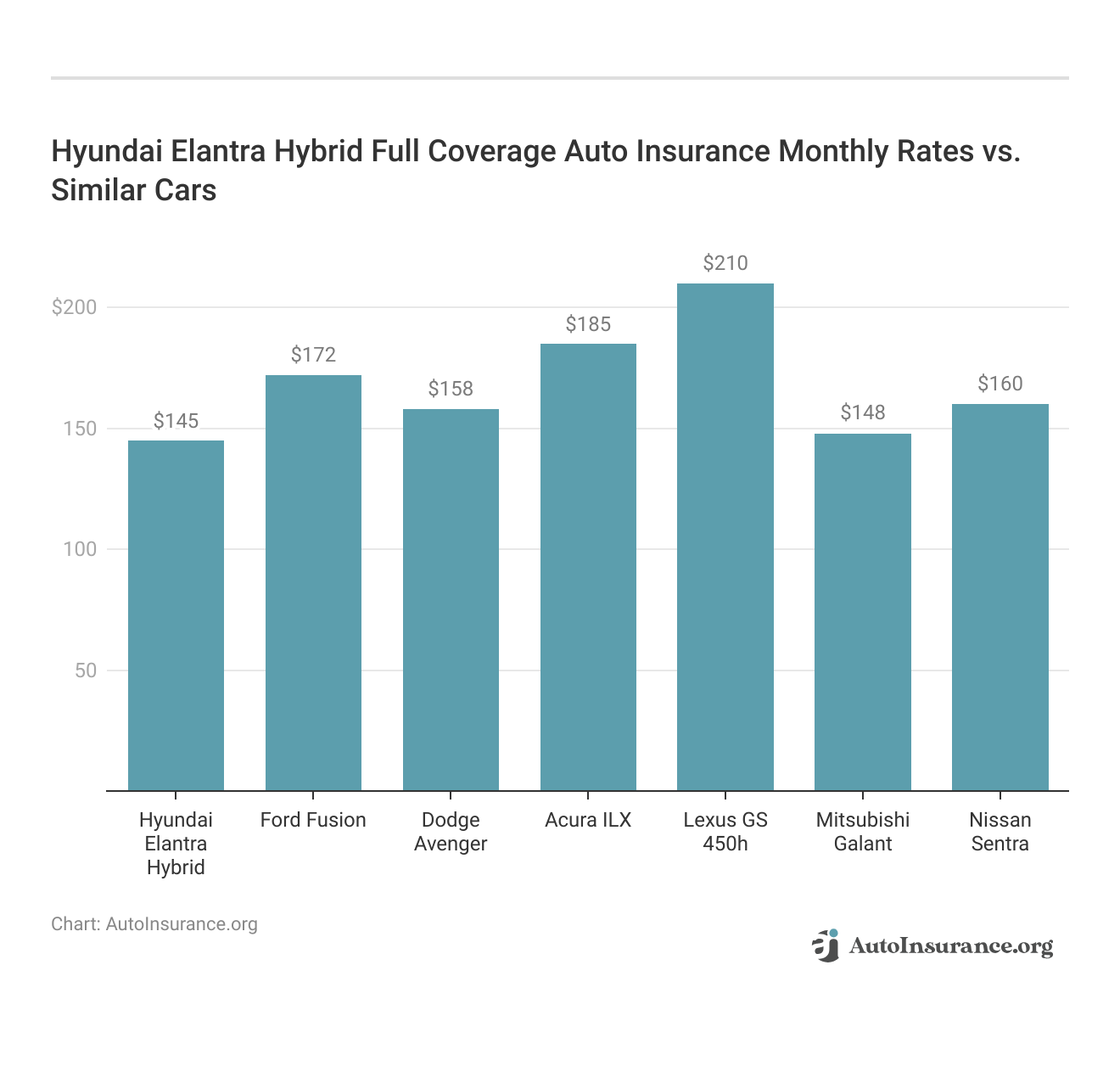

Are Vehicles Like the Hyundai Elantra Hybrid Expensive to Insure

Understanding the insurance costs for vehicles like the Hyundai Elantra Hybrid and other comparable sedans can help prospective buyers budget effectively. Here’s a look at how the insurance rates stack up for models such as the Volvo 740, Infiniti M37, and Cadillac Eldorado.

The comparative analysis of sedan insurance rates, including the Hyundai Elantra Hybrid, reveals that insurance costs can vary significantly across different models.

This information is crucial for those budgeting for ongoing vehicle expenses and looking to make an informed decision on their next car purchase.

This comparison highlights the diverse range of insurance premiums for various car models, emphasizing the importance of researching and understanding insurance expenses as part of the vehicle ownership experience. For additional details, explore our comprehensive resource titled “What is the average auto insurance cost per month?“

Insurance Rates for Vehicles Similar to the Hyundai Elantra Hybrid

When considering the purchase of a vehicle like the Hyundai Elantra Hybrid, it’s essential to explore the insurance costs associated with similar models. This comparison provides a snapshot of what buyers might expect to pay for vehicles like the Ford Fusion, Dodge Avenger, and Lexus GS 450h.

Hyundai Elantra Hybrid Auto Insurance Monthly Rates vs. Similar Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Ford Fusion | $28 | $52 | $31 | $124 |

| Dodge Avenger | $20 | $40 | $43 | $117 |

| Acura ILX | $26 | $46 | $35 | $120 |

| Lexus GS 450h | $33 | $65 | $33 | $144 |

| Mitsubishi Galant | $17 | $28 | $38 | $96 |

| Nissan Sentra | $22 | $50 | $31 | $116 |

| Kia Forte | $27 | $42 | $31 | $113 |

| Subaru Impreza | $28 | $47 | $31 | $119 |

This detailed breakdown of auto insurance premiums for vehicles comparable to the Hyundai Elantra Hybrid highlights the financial implications of owning different sedan models.

Prospective buyers can use this data to gauge the potential insurance expenses and make a more informed vehicle selection based on affordability and coverage needs.

What Impacts the Cost of Hyundai Elantra Hybrid Insurance

As with any car, your Hyundai Elantra Hybrid car insurance costs will be affected by personal factors like where you live, your driving record, and your driving habits. The Hyundai Elantra Hybrid trim level you buy will also have an impact on the total price you will pay for Hyundai Elantra Hybrid insurance coverage. See more details in our guide titled “Factors That Affect Auto Insurance Rates.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

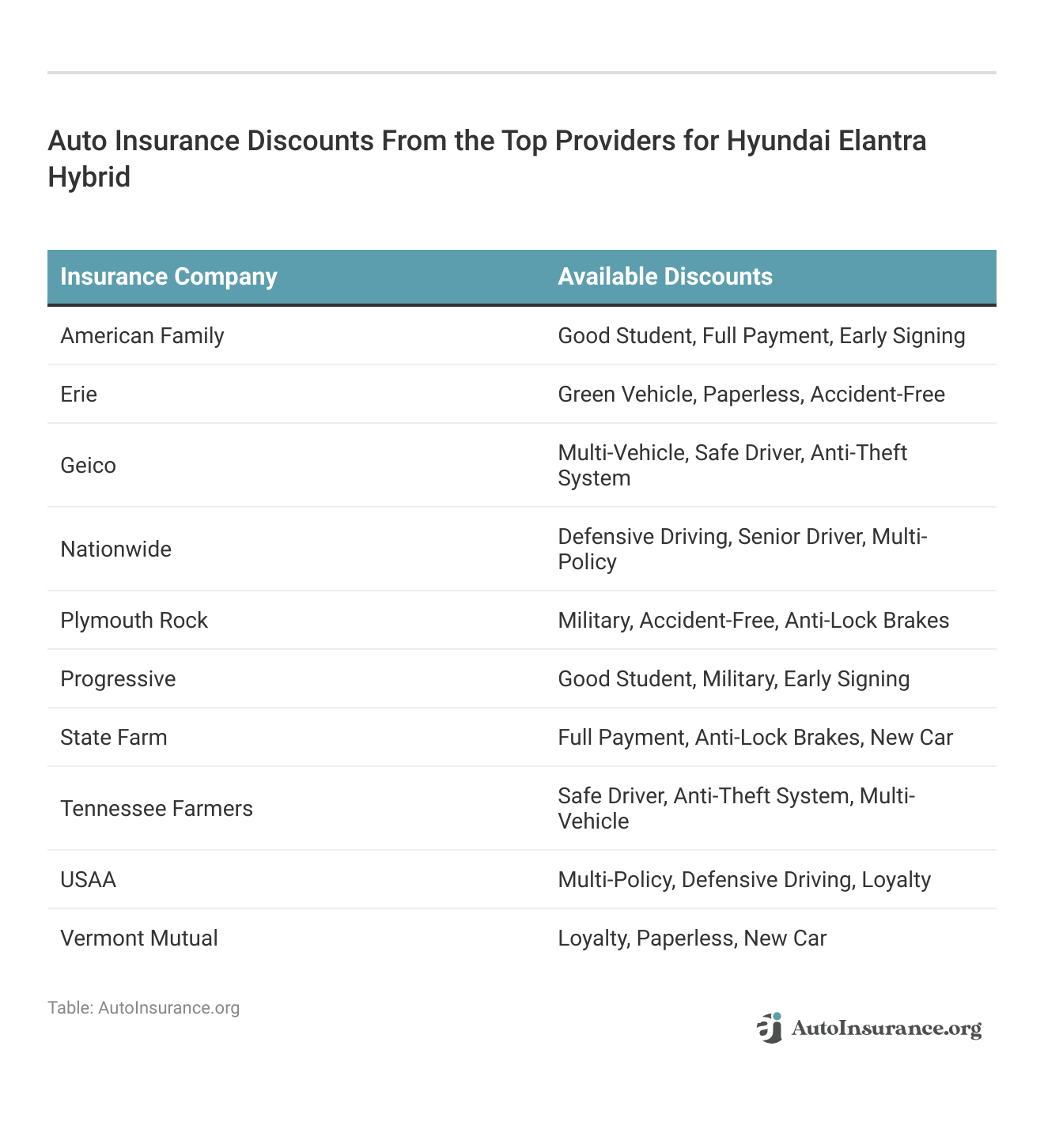

Ways to Save on Hyundai Elantra Hybrid Insurance

Reducing the insurance costs for your Hyundai Elantra Hybrid is achievable with strategic actions and mindful planning. Here are several effective tips to help you lower your premiums and save money.

- Wait six years for accidents to disappear from your record.

- Start searching for new Hyundai Elantra Hybrid car insurance a month before your renewal.

- Be picky about who drives your Hyundai Elantra Hybrid.

- Move to an area with a lower cost of living.

- Save money on young driver Hyundai Elantra Hybrid insurance with a good student discount.

Implementing these strategies can significantly decrease your Hyundai Elantra Hybrid insurance costs. By adjusting where and how you insure your vehicle, and who drives it, you can enjoy substantial savings and more affordable coverage. See more details in our guide titled, “How to Lower Your Auto Insurance Rates.”

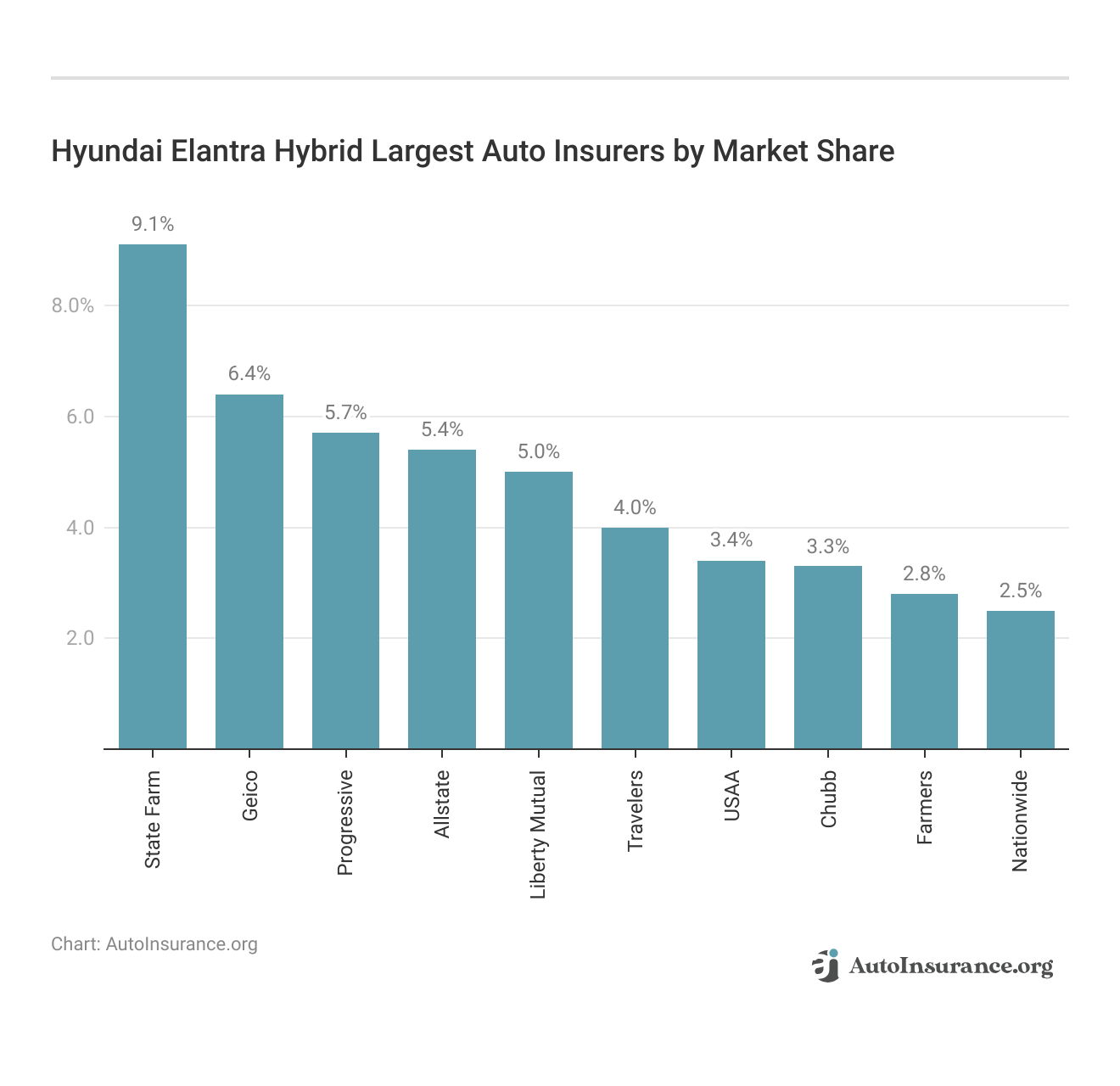

Top Hyundai Elantra Hybrid Insurance Companies

Choosing the right insurer for a Hyundai Elantra Hybrid involves understanding which companies offer the most affordable rates and the best coverage. This list ranks the top insurers by market share, highlighting those known for competitive pricing and discounts for safety features.

Identifying the best insurance provider for your Hyundai Elantra Hybrid depends on a variety of factors, including market share and the specific discounts they offer.

Choosing Geico means opting for the most economical and comprehensive auto insurance for your Hyundai Elantra Hybrid.Michelle Robbins Licensed Insurance Agent

This ranking gives a snapshot of the industry’s major players, helping you make an informed decision based on their prevalence and customer offerings. Find more details in our complete guide titled, “Types of Auto Insurance.”

You can compare quotes for Hyundai Elantra Hybrid auto insurance rates from some of the best auto insurance companies by using our free online tool now.

Frequently Asked Questions

How does auto insurance for a Hyundai Elantra Hybrid differ from other car insurance policies?

Auto insurance for a Hyundai Elantra Hybrid follows the same general principles as insurance for other vehicles. However, there might be some variations in premium rates and coverage options specific to the hybrid nature of the vehicle.

Hybrids are known for their fuel efficiency and environmental benefits, which could potentially result in lower insurance rates. Additionally, some insurance companies offer specific discounts or incentives for hybrid vehicles.

For additional details, explore our comprehensive resource titled, “Best Auto Insurance for Hybrid Vehicles.”

Do I need special insurance coverage for the hybrid components of a Hyundai Elantra Hybrid?

In general, you do not need special insurance coverage for the hybrid components of a Hyundai Elantra Hybrid. The hybrid system is typically covered under the comprehensive or collision coverage of your auto insurance policy. However, it’s always recommended to review your policy and consult with your insurance provider to ensure that the hybrid components are adequately covered.

Will insuring a Hyundai Elantra Hybrid be more expensive than insuring a conventional Hyundai Elantra?

Insurance rates for a Hyundai Elantra Hybrid may or may not be more expensive than insuring a conventional Hyundai Elantra. While hybrids generally have lower fuel and maintenance costs, insurance rates can be influenced by various factors such as the vehicle’s safety features, repair costs, and theft rates. It’s best to compare insurance quotes for both models to determine the potential cost difference.

Are there any specific insurance requirements for owning a Hyundai Elantra Hybrid?

The insurance requirements for owning a Hyundai Elantra Hybrid are typically the same as those for any other vehicle. Most states require drivers to carry a minimum amount of liability coverage.

Additionally, if you have a loan or lease on your Hyundai Elantra Hybrid, the financing or leasing company may require you to carry comprehensive and collision coverage as well. It’s important to comply with your state’s insurance requirements and any obligations set by your financing or leasing agreement.

Should I notify my insurance company if I purchase a Hyundai Elantra Hybrid?

Yes, it’s essential to notify your insurance company when you purchase a Hyundai Elantra Hybrid or any new vehicle. This allows them to update your policy with accurate information and ensure that your vehicle is adequately covered. Failing to inform your insurance company about changes to your vehicle could potentially result in coverage gaps or issues with claims in the future.

To find out more, explore our guide titled, “How Changing Your Address Affects Auto Insurance.”

What is the expected insurance cost for a 2023 Hyundai Elantra Hybrid?

2023 Hyundai Elantra insurance cost per month can vary, influenced by factors such as driver age, location, and coverage level.

Can you estimate the insurance cost for a 2024 Hyundai Elantra?

Insurance costs for the 2024 Hyundai Elantra will depend on variables like your driving history, the insurance company, and your geographical area.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

What does it typically cost to insure an Acura ILX?

The cost to insure an Acura ILX varies based on your driving record, the car’s age, and the specific insurance provider.

Are Hyundai Elantras typically expensive to insure?

Generally, Hyundai Elantras are not expensive to insure; they tend to have lower insurance costs due to their favorable safety ratings and repair costs.

For additional details, explore our comprehensive resource titled, “What is full coverage auto insurance?“

What is the typical monthly insurance cost for a Hyundai Elantra?

Monthly insurance costs for a Hyundai Elantra can vary widely but are usually considered affordable for standard sedan coverage.

What are typical insurance rates for Hyundai Elantra?

How much does it cost to insure an Elantra?

What are the typical insurance premiums for a Hyundai Elantra?

How does the insurance cost for a Hyundai Elantra Hybrid compare?

What factors affect the Hyundai Elantra insurance cost?

What are typical Hyundai Elantra Touring car insurance rates?

What should I consider when looking for insurance for Hyundai Elantra?

Is a Hyundai Elantra expensive to insure?

Who insures Hyundai Elantras?

Why are Hyundai Elantras so expensive to insure?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.