Best Chevrolet Silverado 2500HD Auto Insurance in 2026 (Compare the Top 10 Companies)

The best Chevrolet Silverado 2500HD auto insurance features top providers Erie, Geico, and USAA, with rates starting at $32per month, offering exceptional coverage and competitive pricing for Chevrolet Silverado 2500HD car insurance. Compare quotes to find the best fit for your needs.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated April 2025

Company Facts

Silverado 2500HD Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Silverado 2500HD Full Coverage

A.M. Best

Complaint Level

Pros & Cons

Company Facts

FSilverado 2500HD Full Coverage

A.M. Best

Complaint Level

Pros & Cons

The best Chevrolet Silverado 2500HD auto insurance providers are Erie, Geico, and USAA. With rates starting around $32 per month, they offer excellent value for your Chevy Silverado insurance cost. Erie stands out as the top pick overall for its comprehensive coverage and competitive rates.

The article also delves into how to lower your auto insurance rates, providing practical advice to reduce your Chevy Silverado insurance cost. Discover strategies for saving money and making the most of your coverage, ensuring you get the best value while protecting your vehicle effectively.

Our Top 10 Company Picks: Best Chevrolet Silverado 2500HD Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A+ Customer Satisfaction Erie

#2 25% A++ Affordable Rates Geico

#3 10% A++ Military Benefits USAA

#4 20% B Comprehensive Coverage State Farm

#5 10% A++ High Ratings Auto-Owners

#6 12% A+ Flexible Options Progressive

#7 20% A Customer Service American Family

#8 25% A+ Reliable Claims Amica

#9 25% A Extensive Options Liberty Mutual

#10 20% A+ Vanishing Deductible Nationwide

Find the best auto insurance company near you by entering your ZIP code into our free quote tool above.

- Vehicle value, usage, and location impact rates

- Erie offers the best rates and coverage

- Compare coverage options for the best car insurance for Chevy Silverado

#1 – Erie: Top Overall Pick

Pros

- Competitive Full Coverage Rates: Erie’s full coverage rate for the Chevrolet Silverado 2500HD is $154 per month, offering relatively affordable protection compared to other top insurers. This pricing helps Silverado 2500HD owners secure comprehensive coverage without overspending.

- Strong Customer Satisfaction: Erie is highly rated for customer satisfaction, especially in claims service and support. Silverado 2500HD owners benefit from reliable service and efficient claims handling, enhancing their insurance experience.

- Good Discount Options: As outlined in our Erie auto insurance review, Erie provides various discounts, including those for bundling home and auto insurance. Silverado 2500HD owners can leverage these discounts to lower their overall insurance costs and maximize savings.

Cons

- Limited National Presence: Erie’s coverage is restricted to certain states, which can be inconvenient if you move or travel frequently. Silverado 2500HD owners in non-served states may struggle with limited access to consistent insurance services.

- Less Known for High-Risk Coverage: Erie may not offer the most favorable rates for high-risk drivers, such as those with a history of accidents. Silverado 2500HD owners in this category might find more suitable options with other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Affordable Full Coverage Rate: Geico offers a competitive full coverage rate of $140 per month for the Chevrolet Silverado 2500HD. This pricing helps Silverado 2500HD owners manage their insurance expenses while ensuring solid coverage.

- Strong Online Tools and Resources: Geico provides extensive online tools, including a user-friendly website and mobile app. These resources are beneficial for Silverado 2500HD owners who prefer managing their insurance policies and claims online.

- Discount Opportunities: As mentioned in our Geico auto insurance review, Geico offers various discounts, such as for safe driving and multi-vehicle policies. Silverado 2500HD owners can take advantage of these discounts to reduce their premiums and save on insurance costs.

Cons

- Customer Service Mixed Reviews: Geico has mixed reviews regarding customer service, particularly for resolving complex claims. Silverado 2500HD owners might encounter challenges if they require extensive or personalized assistance.

- Potential for Higher Rates for Older Vehicles: Geico’s rates for older vehicles can be higher compared to other insurers. Silverado 2500HD owners with older models might experience less favorable rates with Geico.

#3 – USAA: Best for Military Benefits

Pros

- Excellent Coverage Options: USAA offers top-tier coverage for the Chevrolet Silverado 2500HD, including comprehensive and collision coverage at a rate of $135 per month. This ensures robust protection for your Silverado 2500HD.

- Exceptional Customer Service: As outlined in our USAA auto insurance review, USAA is known for outstanding customer service, especially for military members and their families. Silverado 2500HD owners benefit from high-quality support and efficient claims processing.

- Generous Discount Programs: USAA provides generous discount programs, including those for safe driving and multi-policy bundles. Silverado 2500HD owners can use these discounts to lower their insurance premiums effectively.

Cons

- Eligibility Restrictions: USAA insurance is available only to military members, veterans, and their families. Silverado 2500HD owners outside this group will not have access to USAA’s competitive rates and services.

- Limited Non-Insurance Services: USAA focuses primarily on insurance and financial services. Silverado 2500HD owners seeking additional non-insurance services might need to find alternatives to meet their comprehensive needs.

#4 – State Farm: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage at Competitive Rates: State Farm provides comprehensive coverage for the Chevrolet Silverado 2500HD at a rate of $155 per month. This ensures extensive protection against various risks for your Silverado 2500HD.

- Wide Availability and Local Agents: State Farm’s extensive network of local agents facilitates personalized service and support. Silverado 2500HD owners can benefit from face-to-face interactions and tailored insurance solutions.

- Multiple Discount Options: As mentioned in our State Farm auto insurance review, State Farm offers a range of discounts, including those for safe driving and bundling policies. These discounts help Silverado 2500HD owners lower their insurance premiums and save money.

Cons

- Higher Rates for Younger Drivers: State Farm’s rates for younger drivers can be significantly higher. Silverado 2500HD owners who are younger drivers might face elevated insurance costs compared to older drivers.

- Potential for Rate Increases: State Farm may raise rates more frequently after claims or policy changes. Silverado 2500HD owners could experience increased premiums over time if they frequently file claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Auto-Owners: Best for High Ratings

Pros

- Affordable Full Coverage Rates: As mentioned in our Auto-Owners auto insurance review, Auto-Owners offers full coverage for the Chevrolet Silverado 2500HD at a rate of $150 per month. This competitive pricing helps Silverado 2500HD owners secure strong coverage without high costs.

- High Customer Satisfaction: Auto-Owners is praised for high customer satisfaction, particularly regarding claims processing and customer support. Silverado 2500HD owners can expect reliable service and effective assistance.

- Flexible Coverage Options: Auto-Owners provides flexible coverage options, allowing Silverado 2500HD owners to customize their policies to meet specific needs, including comprehensive and collision coverage.

Cons

- Limited Discounts: Auto-Owners offers fewer discount options compared to some competitors. Silverado 2500HD owners may not find as many opportunities to reduce their premiums through discounts or bundling.

- Availability May Vary: Auto-Owners operates in a limited number of states. Silverado 2500HD owners in areas outside these states might need to explore other insurers with broader geographic coverage.

#6 – Progressive: Best for Flexible Options

Pros

- Competitive Full Coverage Pricing: Progressive provides full coverage for the Chevrolet Silverado 2500HD at a rate of $145 per month. This pricing helps Silverado 2500HD owners obtain comprehensive protection without excessive costs.

- Extensive Online Tools: Progressive offers a range of online tools, including a quote comparison tool and mobile app. These resources are valuable for Silverado 2500HD owners who prefer managing their insurance policies digitally.

- Varied Discount Opportunities: As mentioned in Progressive auto insurance review, Progressive provides a variety of discounts, such as those for safe driving and bundling policies. Silverado 2500HD owners can take advantage of these discounts to lower their insurance premiums.

Cons

- Customer Service Concerns: Some customers report issues with Progressive’s customer service, particularly with claim handling. Silverado 2500HD owners might encounter challenges if they require extensive support or personalized service.

- Potential Rate Increases: Progressive may increase rates after claims or policy adjustments. Silverado 2500HD owners could face higher premiums over time if they frequently file claims or make changes to their policies.

#7 – American Family: Best for Customer Service

Pros

- Reasonable Full Coverage Rate: As outlined in our American Family auto insurance review, American Family offers full coverage for the Chevrolet Silverado 2500HD at $148 per month, providing a balanced option for comprehensive protection at a reasonable cost.

- Wide Range of Discounts: American Family provides a broad array of discounts, including those for safe driving and bundling multiple policies. These discounts help Silverado 2500HD owners reduce their overall insurance costs.

- High Customer Satisfaction: American Family is recognized for strong customer service and satisfaction. Silverado 2500HD owners can expect responsive support and effective claims handling, enhancing their insurance experience.

Cons

- Higher Rates for High-Risk Drivers: American Family may charge higher rates for high-risk drivers, such as those with a history of accidents. Silverado 2500HD owners in this category might find better rates with other insurers.

- Limited Availability in Some States: American Family’s services are not available in all states. Silverado 2500HD owners in regions where American Family does not operate may need to seek alternative insurers for coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Amica: Best for Reliable Claims

Pros

- Affordable Full Coverage Premiums: Amica offers full coverage for the Chevrolet Silverado 2500HD at $152 per month. This competitive pricing ensures Silverado 2500HD owners receive comprehensive protection at a reasonable cost.

- Excellent Customer Service: Amica is known for its exceptional customer service and support. Silverado 2500HD owners benefit from responsive and effective assistance, making the insurance process smoother and more reliable.

- Discount Opportunities: As outlined in our Amica auto insurance review, Amica provides various discounts, such as for safe driving and multi-policy bundles. Silverado 2500HD owners can leverage these discounts to reduce their insurance premiums and save money.

Cons

- Higher Premiums for Some Coverage Options: Amica’s premiums may be higher for certain coverage types or additional add-ons. Silverado 2500HD owners seeking extensive coverage might face higher costs compared to some competitors.

- Limited Availability: Amica’s services may not be available in all states. Silverado 2500HD owners in regions where Amica does not operate might need to consider other insurers for their coverage needs.

#9 – Liberty Mutual: Best for Extensive Options

Pros

- Comprehensive Coverage with Competitive Rates: Liberty Mutual offers full coverage for the Chevrolet Silverado 2500HD at $160 per month. This rate, though higher, ensures extensive protection for your Silverado 2500HD.

- Wide Range of Discounts: Liberty Mutual provides numerous discounts, including those for safe driving and bundling multiple policies. These discounts help reduce the overall cost of insuring your Chevrolet Silverado 2500HD.

- Flexible Coverage Options: As mentioned in our Liberty Mutual auto insurance review, Liberty Mutual offers a range of customizable coverage options, allowing Silverado 2500HD owners to tailor their policies to fit specific needs and preferences.

Cons

- Higher Premiums for Some Drivers: Liberty Mutual’s premiums can be higher for certain drivers, particularly those with a history of claims or poor driving records. Silverado 2500HD owners in these categories might face elevated insurance costs.

- Mixed Customer Service Reviews: Liberty Mutual has received mixed reviews regarding its customer service, especially in claims processing. Silverado 2500HD owners might experience inconsistencies in service quality.

#10 – Nationwide: Best for Vanishing Deductible

Pros

- Affordable Full Coverage Premiums: Nationwide offers full coverage for the Chevrolet Silverado 2500HD at $151 per month. This rate provides Silverado 2500HD owners with comprehensive protection at a competitive price, making it a cost-effective choice for robust coverage.

- Wide Range of Discounts: Nationwide provides various discounts, including those for safe driving, multi-policy bundles, and more. Silverado 2500HD owners can take advantage of these discount opportunities to lower their overall insurance premiums and maximize savings. For more information, read our Nationwide auto insurance review.

- Strong Customer Satisfaction: Nationwide is well-regarded for its customer service and claims handling. Silverado 2500HD owners benefit from responsive support and efficient claims processing, contributing to a positive insurance experience.

Cons

- Higher Premiums for High-Risk Drivers: Nationwide may charge higher premiums for high-risk drivers, such as those with a history of accidents or violations. Silverado 2500HD owners in this category might find more competitive rates with other insurers.

- Limited Customization Options: While Nationwide offers comprehensive coverage, there may be fewer options for customizing policies compared to some competitors. Silverado 2500HD owners seeking highly tailored coverage might need to explore other insurers for more flexible options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chevrolet Silverado 2500HD Insurance Cost

The table below compares monthly rates for minimum and full coverage car insurance for a Chevrolet Silverado 2500HD from various providers.

Chevrolet Silverado 2500HD Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$62 $166

$65 $215

$47 $124

$32 $83

$43 $114

$96 $248

$63 $164

$56 $150

$47 $123

$32 $84

Comparing monthly insurance rates for the Chevrolet Silverado 2500HD reveals significant differences between providers and coverage levels. Shopping around for the best rates and coverage options can help you find the most cost-effective insurance for your needs.

Chevrolet Silverado 2500HD Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Average Rate | $138 |

| Discount Rate | $81 |

| High Deductibles | $119 |

| High Risk Driver | $293 |

| Low Deductibles | $173 |

| Teen Driver | $503 |

Insurance rates for the Chevrolet Silverado 2500HD can vary widely based on factors like deductible levels and driver risk.

Auto insurance for different types of drivers helps you find the most cost-effective coverage for your situation. Understanding these variations ensures you secure the best insurance policy tailored to your specific needs.

Why Chevrolet Silverado 2500HDs Insurance are Expensive

The chart below details how Chevrolet Silverado 2500HD insurance rates compare to other trucks like the Chevrolet Silverado, Nissan Frontier, and GMC Canyon.

Chevrolet Silverado 2500HDs Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Chevrolet Silverado | $27 | $47 | $35 | $124 |

| GMC Canyon | $23 | $40 | $33 | $109 |

| GMC Sierra | $28 | $50 | $31 | $122 |

| Honda Ridgeline | $26 | $45 | $38 | $123 |

| Nissan Frontier | $25 | $42 | $35 | $116 |

| Toyota Tundra | $27 | $43 | $37 | $121 |

The Chevrolet Silverado 2500HD generally has higher insurance rates compared to other trucks like the Chevrolet Silverado and Nissan Frontier. Its higher repair costs and replacement value contribute to these elevated premiums.

Read More: Cheap Nissan Auto Insurance

Factors Influencing Chevrolet Silverado 2500HD Insurance Cost

The trim level and model year of your Chevrolet Silverado 2500HD can significantly impact your insurance premiums. Higher trims with advanced features and greater performance capabilities generally come with higher insurance costs due to increased repair expenses and higher replacement values. For instance, luxury trims like the LTZ and High Country often cost more to insure than the base WT trim.

Additionally, newer models typically have higher insurance rates due to their higher replacement values and advanced technology. Older models usually cost less to insure because of their lower replacement values and fewer high-cost features. Factors such as safety features, your location, driving history, and age also influence your insurance costs.

Age of the Vehicle

Older Chevrolet Silverado 2500HD models generally cost less to insure. For example, auto insurance for a 2020 Chevrolet Silverado 2500HD costs $137 per month, while 2010 Chevrolet Silverado 2500HD insurance costs $111 per month, a difference of $26 per month.

Chevrolet Silverado 2500HDs Auto Insurance Monthly Rates by Age of the Vehicle

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Chevrolet Silverado 2500HD | $32 | $59 | $36 | $140 |

| 2023 Chevrolet Silverado 2500HD | $31 | $58 | $35 | $138 |

| 2022 Chevrolet Silverado 2500HD | $31 | $58 | $35 | $138 |

| 2021 Chevrolet Silverado 2500HD | $30 | $57 | $35 | $138 |

| 2020 Chevrolet Silverado 2500HD | $30 | $57 | $35 | $138 |

| 2019 Chevrolet Silverado 2500HD | $29 | $55 | $37 | $136 |

| 2018 Chevrolet Silverado 2500HD | $28 | $55 | $38 | $135 |

| 2017 Chevrolet Silverado 2500HD | $27 | $53 | $39 | $134 |

| 2016 Chevrolet Silverado 2500HD | $26 | $51 | $41 | $132 |

| 2015 Chevrolet Silverado 2500HD | $24 | $49 | $42 | $130 |

| 2014 Chevrolet Silverado 2500HD | $24 | $46 | $43 | $127 |

| 2013 Chevrolet Silverado 2500HD | $23 | $43 | $43 | $123 |

| 2012 Chevrolet Silverado 2500HD | $22 | $39 | $43 | $119 |

| 2011 Chevrolet Silverado 2500HD | $20 | $36 | $43 | $114 |

| 2010 Chevrolet Silverado 2500HD | $20 | $33 | $44 | $112 |

Older Chevrolet Silverado 2500HD models typically have lower insurance costs compared to newer ones. For example, a 2010 model costs $26 less per month to insure than a 2020 model.

Driver Age

Driver age can significantly impact the cost of Chevrolet Silverado 2500HD auto insurance. For example, 20-year-old drivers may pay up to $174 more per month for their Chevrolet Silverado 2500HD insurance compared to 40-year-old drivers.

Chevrolet Silverado 2500HD Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $808 |

| Age: 18 | $656 |

| Age: 20 | $225 |

| Age: 30 | $191 |

| Age: 40 | $178 |

| Age: 45 | $165 |

| Age: 50 | $157 |

| Age: 60 | $152 |

Chevrolet Silverado 2500HD insurance rates vary significantly by driver age. Younger drivers can expect to pay substantially more compared to those in older age groups.

Driver Location

Where you live can have a large impact on Chevrolet Silverado 2500HD insurance rates. For example, drivers in Jacksonville may pay $83 a month more than drivers in Indianapolis.

Chevrolet Silverado 2500HD Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $182 |

| Columbus, OH | $114 |

| Houston, TX | $216 |

| Indianapolis, IN | $117 |

| Jacksonville, FL | $199 |

| Los Angeles, CA | $235 |

| New York, NY | $217 |

| Philadelphia, PA | $184 |

| Phoenix, AZ | $160 |

| Seattle, WA | $133 |

Insurance rates for the Chevrolet Silverado 2500HD vary significantly across different cities. Comparing rates based on your location can help you find the best deal for your vehicle.

Your Driving Record

Your driving record can have an impact on the cost of Chevrolet Silverado 2500HD auto insurance. Teens and drivers in their 20’s see the highest jump in their Chevrolet Silverado 2500HD auto insurance with violations on their driving record.

Chevrolet Silverado 2500HD Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $650 | $780 | $900 | $730 |

| Age: 18 | $503 | $600 | $750 | $570 |

| Age: 20 | $312 | $380 | $470 | $350 |

| Age: 30 | $144 | $180 | $220 | $160 |

| Age: 40 | $138 | $170 | $210 | $150 |

| Age: 45 | $130 | $160 | $200 | $140 |

| Age: 50 | $125 | $150 | $190 | $135 |

| Age: 60 | $123 | $145 | $185 | $130 |

Insurance costs for the Chevrolet Silverado 2500HD can rise significantly with accidents or violations. Maintaining a clean driving record is essential for keeping your insurance rates as low as possible.

Read More: Cheap Auto Insurance for Drivers Over 60

Safety Ratings

Your Chevrolet Silverado 2500HD auto insurance rates are tied to the safety ratings of the Chevrolet Silverado 2500HD. See the breakdown below:

Chevrolet Silverado 2500HD Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The safety ratings of your Chevrolet Silverado 2500HD significantly impact your auto insurance rates. Regularly check for updated safety ratings to ensure you’re informed and can secure the best insurance coverage.

Crash Test Ratings

Not only do good Chevrolet Silverado 2500HD crash test ratings mean you are better protected in a crash, but good crash ratings also mean cheaper Chevrolet Silverado 2500HD auto insurance rates.

Chevrolet Silverado 2500HD Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Chevrolet Silverado 2500HD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2023 Chevrolet Silverado 2500HD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2022 Chevrolet Silverado 2500HD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2021 Chevrolet Silverado 2500HD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2020 Chevrolet Silverado 2500HD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2019 Chevrolet Silverado 2500HD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2018 Chevrolet Silverado 2500HD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2017 Chevrolet Silverado 2500HD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2016 Chevrolet Silverado 2500HD | 4 stars | 4 stars | 5 stars | 4 stars |

Good crash test ratings for the Chevrolet Silverado 2500HD can lead to better protection and lower auto insurance rates. Stay informed about your vehicle’s safety ratings to ensure you’re getting the best coverage and peace of mind.

Safety Features

Having a variety of safety features on your Chevrolet Silverado 2500HD can help lower your insurance costs. According to AutoBlog, the 2020 Chevrolet Silverado 2500HD’s safety features include:

- StabiliTrak System: Features stability control with Proactive Roll Avoidance, traction control, electronic trailer sway control, and hill start assist.

- Advanced Airbags: Dual-stage frontal airbags for driver and front outboard passenger, seat-mounted side-impact airbags, and head-curtain airbags for front and rear outboard seating positions. Includes Passenger Sensing System.

- Teen Driver: Configurable settings associated with a key fob to encourage safe driving. Limits certain vehicle features and prevents safety systems from being turned off, with an in-vehicle report card for monitoring.

- Rear Vision Camera & Hitch Guidance: Provides a dynamic single line to aid in trailer alignment during hitching.

- Tire Pressure Monitoring: Monitors tire pressure with a Tire Fill Alert, excluding the spare tire.

These comprehensive safety features of the Chevrolet Silverado 2500HD not only enhance driving safety but can also contribute to lower insurance costs. Investing in a vehicle with advanced safety technology is a smart move for both protection and savings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chevrolet Silverado 2500HD Finance and Insurance Cost

When financing a Chevrolet Silverado 2500HD, most lenders will require you to carry higher coverage options, including comprehensive and collision coverage, to protect their investment.

Comprehensive coverage includes protection against events such as vandalism, natural disasters, and theft, while collision coverage handles damages from collisions with other vehicles or objects.Jeff Root LICENSED INSURANCE AGENT

To ensure you get the best deal, it’s important to shop around and compare auto insurance rates from top companies. Use our free tool below to obtain quotes and find a policy that meets lender requirements while fitting your budget.

Consider factors such as deductibles, coverage limits, and customer service ratings to secure the best value and peace of mind.

Read More: Where can I find unbiased reviews of auto insurance companies?

Ways to Save on Chevrolet Silverado 2500HD Insurance

There are many ways that you can save on Chevrolet Silverado 2500HD auto insurance to get the best value possible. Below are five scenarios you can explore to help keep your Chevrolet Silverado 2500HD auto insurance rates low.

- Pay your Chevrolet Silverado 2500HD insurance rates upfront.

- Use paperless billing for your Chevrolet Silverado 2500HD insurance policy.

- Buy a Chevrolet Silverado 2500HD with an anti-theft device.

- Compare Chevrolet Silverado 2500HD insurance rates for free online.

- Talk to your credit card company to save on rental car costs.

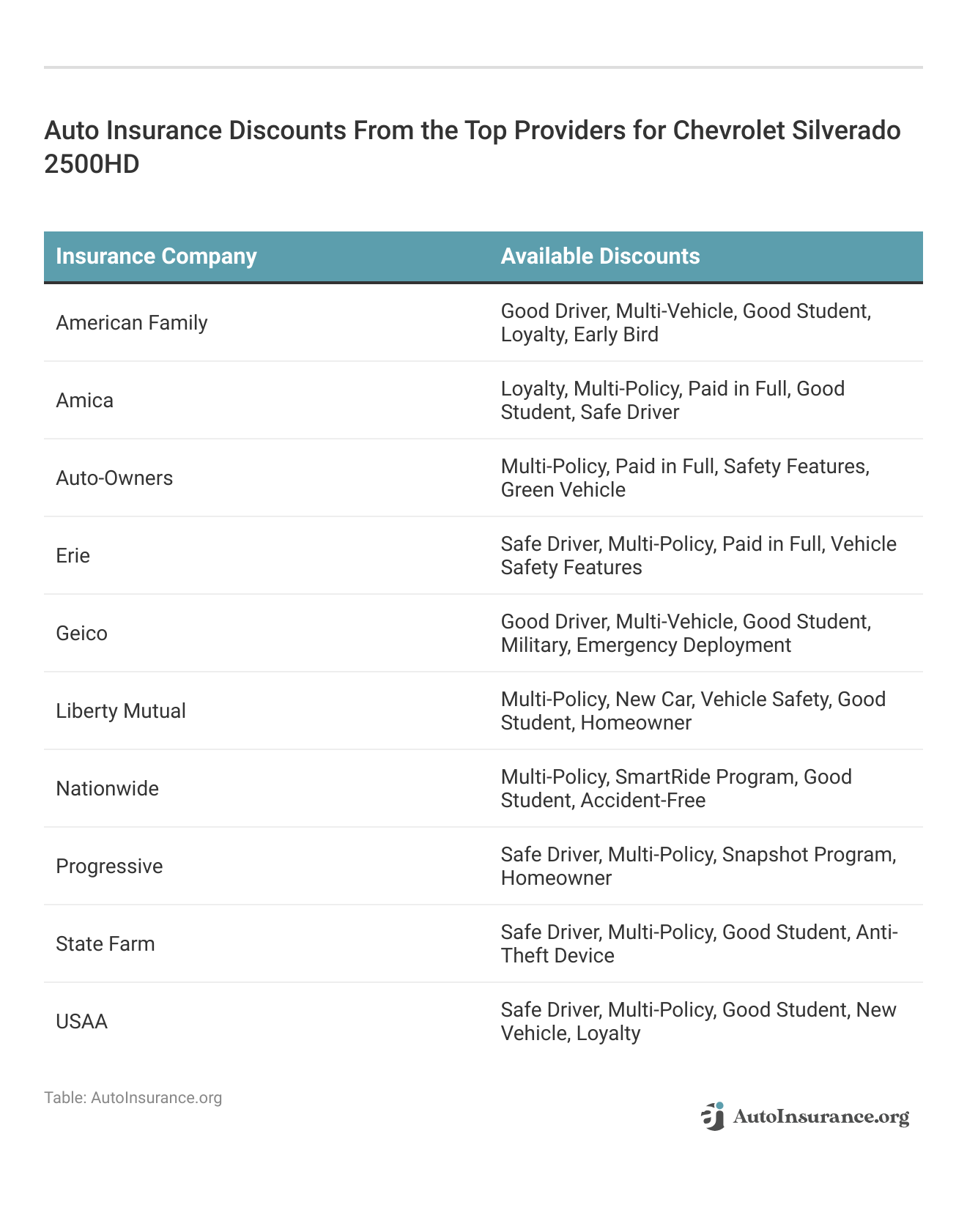

Discover the variety of auto insurance discounts offered by top providers for Chevrolet Silverado 2500HD to help you save on your premiums.

These discounts from top insurance providers for Chevrolet Silverado 2500HD offer valuable opportunities for auto owners to save money while maintaining comprehensive coverage and safety on the road.

Top Chevrolet Silverado 2500HD Insurance Companies

Who is the top auto insurance company for Chevrolet Silverado 2500HD insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Chevrolet Silverado 2500HD auto insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features that the Chevrolet Silverado 2500HD offers.

Top Chevrolet Silverado 2500HD Insurance Companies by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 milllion | 9% |

| #2 | Geico | $46.1 milllion | 7% |

| #3 | Progressive | $39.2 milllion | 6% |

| #4 | Liberty Mutual | $35.6 milllion | 5% |

| #5 | Allstate | $35 milllion | 5% |

| #6 | Travelers | $28 milllion | 4% |

| #7 | USAA | $23.4 milllion | 3% |

| #8 | Chubb | $23.3 milllion | 3% |

| #9 | Farmers | $20.6 milllion | 3% |

| #10 | Nationwide | $18.4 milllion | 3% |

These top insurance companies offer competitive rates and valuable discounts for Chevrolet Silverado 2500HD owners. By exploring these options, you can find the best coverage and savings for your vehicle.

These insurers dominate the market, offering substantial coverage and various discounts to policyholders. By considering these top companies, you can find the best and cheap Chevrolet auto insurance options tailored to your needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Free Chevrolet Silverado 2500HD Insurance Quotes Online

You can start comparing quotes for Chevrolet Silverado 2500HD auto insurance rates from top companies using our free online tool now. This tool allows you to quickly obtain multiple quotes tailored to your specific needs, helping you see how different insurers price their policies based on coverage options, deductibles, and customer service ratings.

By comparing quotes online, you can find the best coverage at the most competitive rate. Our tool also highlights potential discounts you may qualify for, such as multi-policy or safe driver discounts.

Read More: Best Auto Insurance for Good Drivers

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

How does a DUI affect my Chevrolet Silverado insurance?

A DUI can raise your Chevrolet Silverado insurance rates significantly and may lead to policy cancellation. You might also need an SR-22 certificate to prove financial responsibility. Consult your insurer to understand the specific impact on your coverage and premiums.

How much does it cost to insure a Chevrolet Silverado?

The cost of insuring a Chevrolet Silverado varies based on factors like location, driving record, age, coverage options, deductibles, and the insurance company you choose. The trim level and model year of the Silverado can also impact rates. Obtaining quotes from different providers can help you find the best coverage and price.

What types of coverage do I need for my Chevrolet Silverado?

For a Chevrolet Silverado, recommended coverages include liability, collision, and comprehensive. Liability coverage is required by law and covers bodily injury and property damage if you’re at fault. Collision covers repair or replacement costs if damaged in an accident, while comprehensive covers non-collision incidents like theft or weather damage.

Can I get specialized insurance for a modified Chevrolet Silverado?

If your Chevrolet Silverado has modifications like performance upgrades or cosmetic changes, inform your insurance provider. Modifications can affect the vehicle’s value or safety features, which may impact insurance rates and coverage. You might need specialized coverage, such as customized parts and equipment coverage, to protect the value of these modifications.

Are there any discounts available for insuring a Chevrolet Silverado?

Insurance companies offer discounts for insuring a Chevrolet Silverado, such as safe driver, multi-policy, good student, and safety feature discounts. Discussing these options with your provider can help you maximize your savings.

Are older Chevrolet Silverados more expensive to insure?

Typically, older Chevrolet Silverados have lower insurance rates compared to newer models due to their lower market value and less costly repairs or replacement parts.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

What makes Erie the top pick for Chevrolet Silverado 2500HD auto insurance?

Erie offers competitive rates and comprehensive coverage specifically tailored for heavy-duty trucks like the Chevrolet Silverado 2500HD. Their customer service and claims handling are also highly rated, making them the best choice for this vehicle.

How can I determine the best coverage options for my Chevrolet Silverado 2500HD?

To find the best coverage for your Chevrolet Silverado 2500HD, consider factors such as vehicle value, usage, and location. Comparing quotes from different insurers will help you identify which coverage options offer the best protection and cost-effectiveness.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

What factors influence the cost of Chevrolet Silverado 2500HD insurance?

Insurance costs for the Chevrolet Silverado 2500HD are influenced by several factors including the truck’s value, its usage (personal vs. commercial), and your location. Additionally, your driving history and credit score may also impact the overall premium.

Read More: Best Commercial Auto Insurance Companies

How does choosing the right insurance affect my Chevrolet Silverado 2500HD?

Selecting the right insurance ensures that you have adequate coverage for potential repairs, accidents, or liability claims. Proper insurance not only protects your investment but can also offer peace of mind by covering the unique needs of your Chevrolet Silverado 2500HD.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.