Best Auto Insurance Companies That Don’t Charge Late Fees in 2026 (Top 10 Providers)

Amica, USAA, and Geico are the best auto insurance companies that don't charge late fees for missed payments. USAA offers the cheapest rates starting at $59 monthly. It also offers auto-pay car insurance discounts of 3%. Avoid auto insurance late fees with automatic bill pay.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated August 2025

1,883 reviews

1,883 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsAmica, USAA, and Geico are the best auto insurance companies that don’t charge late fees. They even offer small discounts if you sign up for automatic payments, reducing your risk of having late payments.

These companies offer grace periods that help drivers avoid lapses in coverage, keeping rates stable. USAA caters to military families, while Geico excels in digital payment management.

Amica stands out for its customer-friendly billing policies that eliminate late fees. Choosing a provider with no late penalties ensures financial flexibility and uninterrupted coverage.

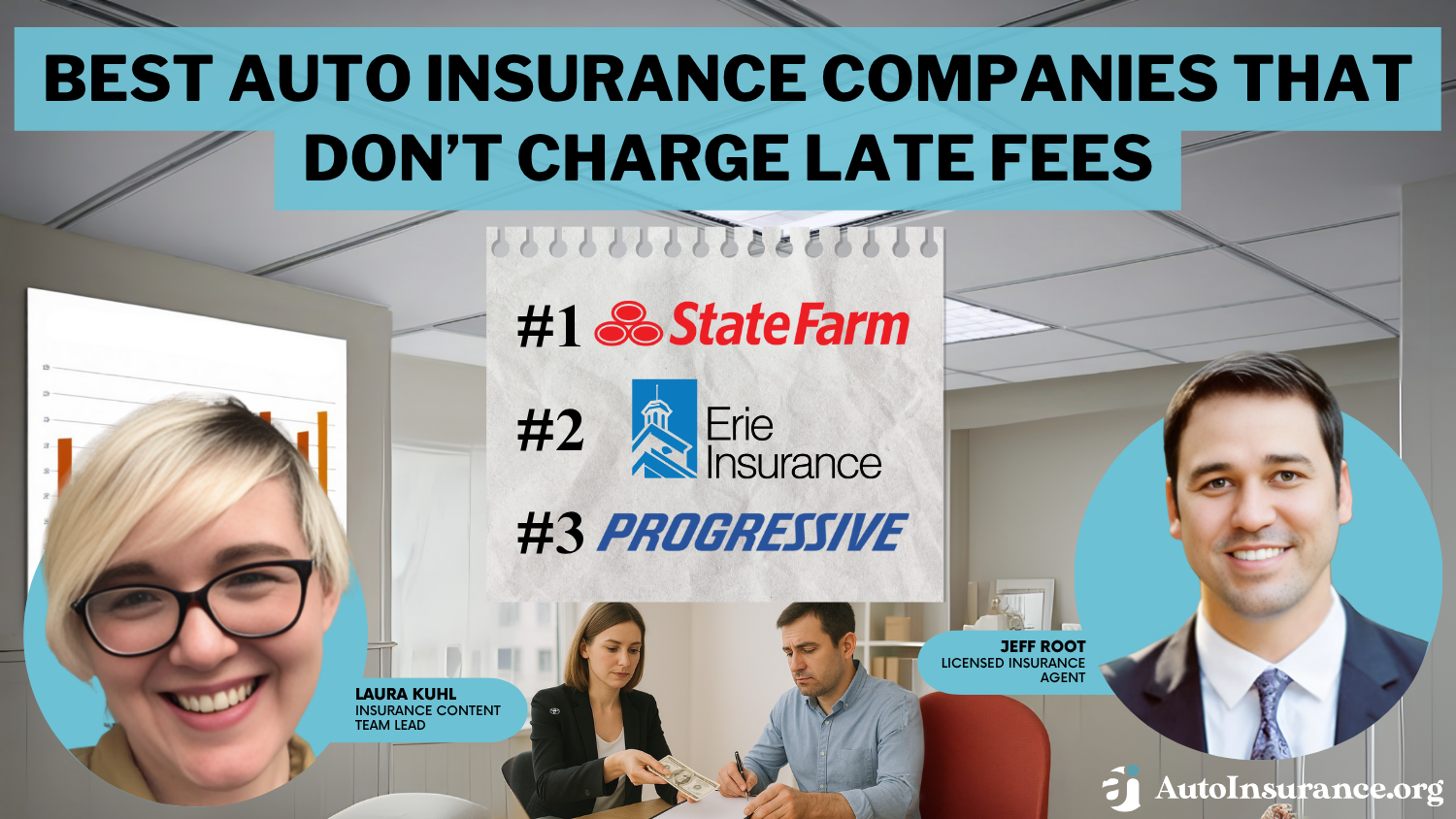

Our Top 10 Picks: Best Auto Insurance Companies That Don't Charge Late Fees

| Insurance Company | Rank | Safe Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | A++ | Agent Network | State Farm | |

| #2 | 30% | A+ | Personalized Service | Erie |

| #3 | 30% | A+ | Innovative Solutions | Progressive | |

| #4 | 25% | A++ | Online Services | Geico | |

| #5 | 25% | A+ | Customer Service | Amica | |

| #6 | 25% | A+ | AARP Members | The Hartford |

| #7 | 25% | A | Various Options | Liberty Mutual |

| #8 | 20% | A++ | Financial Stability | Auto-Owners | |

| #9 | 15% | A++ | Military Families | USAA | |

| #10 | 10% | A+ | Coverage Options | Nationwide |

You can find other auto insurance companies that don’t penalize for a lapse in coverage below. If you had a late payment and lapse in coverage, try our comparison tool to find the cheapest auto insurance after a lapse in coverage.

- Amica is the best company that doesn’t charge late fees

- USAA and Geico also don’t penalize with late fees

- Frequent late payments may result in being dropped

#1 – Amica: Top Pick Overall

Pros

- Customer Service: Amica has solid customer service ratings, and some companies that don’t charge late fees also provide highly rated support. Discover more in our Amica auto insurance review.

- Discounts: Amica offers a variety of discounts, which you can explore in our article on Amica auto insurance discounts.

- Add-On Coverages: Amica provides rideshare insurance, gap insurance, and other optional coverages, similar to companies that don’t charge late fees and offer flexible policy options.

Cons

- Not Available in Hawaii: Amica sells auto insurance in all states except Hawaii.

- Annual Policy Availability: Amica doesn’t offer 12-month policies in most states, but some companies that don’t charge late fees provide longer policy terms for added convenience.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Families

Pros

- Military Families: USAA provides top-tier coverage and competitive rates for military families, similar to companies that don’t charge late fees, ensuring affordability without added penalties.

- Non-Auto Discounts: USAA members receive exclusive discounts on shopping and travel, focusing on helping policyholders save beyond their insurance plans. Explore more of our USAA auto insurance review.

- Coverage Options: USAA offers a wide range of auto insurance coverages, just like companies that don’t charge late fees, which provide flexible policy options without extra costs for late payments.

Cons

- Eligibility: USAA coverage is limited to military members and veterans, but some companies that don’t charge late fees offer strong alternatives for a broader range of drivers.

- Mainly Virtual Communication: USAA operates primarily online, making in-person service less accessible, though many companies that don’t charge late fees also provide digital customer support to keep policyholders informed of their payments.

#3 – Geico: Best for Online Services

Pros

- Online Services: Geico’s app lets customers file claims and manage policies, similar to companies that don’t charge late fees, which also prioritize seamless digital access.

- Financial Stability: Geico is one of the largest and most financially stable insurers, ensuring reliability for policyholders. Learn about its financial ratings in our Geico auto insurance review.

- Discount Options: Geico offers various discounts for drivers, much like companies that don’t charge late fees, which also help customers save on overall costs.

Cons

- UBI Availability: Geico doesn’t offer its UBI discount in every state, but some companies that don’t charge late fees provide more widespread availability.

- Virtual Communication: Geico has fewer local agents than competitors, though companies that don’t charge late fees often provide strong online support for policyholders.

#4 – Auto-Owners: Best for Financial Stability

Pros

- Financial Stability: Auto-Owners has strong financial stability ratings, similar to companies that don’t charge late fees, which offer dependable coverage without penalty concerns.

- Local Agents: Most customers can find a local agent nearby, ensuring personalized service and policy management. Read more about these ratings in our Auto-Owners auto insurance review.

- Accident Forgiveness: Auto-Owners rewards good drivers with accident forgiveness, just like companies that don’t charge late fees, providing policy benefits to responsible drivers.

Cons

- Agent-Only Quotes: Auto-Owners doesn’t offer online auto insurance quotes, but some companies that don’t charge late fees provide digital tools for easy comparisons.

- Availability: Auto-Owners’ auto insurance isn’t available in every state, limiting options for some drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Erie: Best for Personalized Service

Pros

- Personalized Service: Erie’s agents assist customers in creating customized policies, similar to companies that don’t charge late fees, which also prioritize flexible policy options.

- Rate Lock: Erie’s rate lock is a major benefit for customers, providing stable pricing regardless of claim history. Find out more in our Erie auto insurance review.

- Discount Options: Erie offers good student discounts and diminishing deductibles, similar to companies that don’t charge late fees, which helps drivers save in multiple ways.

Cons

- Availability: Erie isn’t available in all states, but some companies that don’t charge late fees offer nationwide coverage.

- UBI Availability: Erie’s UBI program isn’t offered in every state where it sells auto insurance, limiting potential savings for some drivers.

#6 – The Hartford: Best for AARP Members

Pros

- AARP Members: The Hartford is a strong choice for AARP members, similar to companies that don’t charge late fees, which also offer tailored benefits for senior drivers.

- Accident Forgiveness: Safe drivers can take advantage of The Hartford’s accident forgiveness, helping to maintain lower rates after an accident. Learn more in our review of The Hartford auto insurance.

- Coverage Options: Customers can customize policies to fit their needs, just like companies that don’t charge late fees, which provide flexible coverage without penalty risks.

Cons

- Best for Older Drivers: Younger drivers won’t find the cheapest rates at The Hartford, but some companies that don’t charge late fees offer competitive pricing across age groups.

- Customer Ratings: The Hartford has received some negative customer satisfaction ratings, particularly regarding claims handling and service responsiveness.

#7 – Nationwide: Best for Coverage Options

Pros

- Coverage Options: Nationwide provides a variety of auto coverages, similar to companies that don’t charge late fees, which also offer flexible policy options.

- Vanishing Deductibles: Nationwide reduces deductibles for safe drivers, helping them save over time. Read more about it in our Nationwide auto insurance review.

- Discount Options: Nationwide offers discounts for good drivers and students, much like companies that don’t charge late fees, which provide multiple ways to lower costs.

Cons

- Availability: Nationwide isn’t available in every state, but some companies that don’t charge late fees offer broader coverage.

- DUI Drivers: Nationwide’s rates for DUI drivers aren’t as competitive as some insurers, making it less ideal for high-risk drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Progressive: Best for Innovative Solutions

Pros

- Innovative Solutions: Progressive offers unique tools like the Name Your Price Tool, similar to companies that don’t charge late fees, which provide flexible pricing options.

- Add-On Coverages: Progressive includes extras like pet coverage, allowing customers to customize their policies to fit their needs. Learn more in our Progressive auto insurance review.

- Availability: Progressive sells auto insurance in every state, just like some companies that don’t charge late fees, ensuring broad accessibility for drivers.

Cons

- UBI Rate Increases: Progressive’s UBI program may raise rates for drivers who score poorly, whereas some companies that don’t charge late fees offer more forgiving usage-based pricing.

- Mixed Reviews: Progressive’s customer satisfaction ratings are only average, meaning service experiences may vary.

#9 – State Farm: Best for Agent Network

Pros

- Agent Network: State Farm has one of the strongest local agent networks, similar to companies that don’t charge late fees and prioritize accessible customer service.

- Financial Stability: The company holds high financial stability ratings, ensuring reliable coverage for policyholders. You can learn more about it in our State Farm auto insurance review.

- Coverage Options: Allows policy customization with various add-ons and deductible choices, just like companies that don’t charge late fees, which offer flexible coverage without penalty risks.

Cons

- Agent-Only Purchases: State Farm doesn’t offer online policy purchases, but some companies that don’t charge late fees provide digital tools for convenient enrollment.

- UBI Availability: State Farm’s UBI program discount isn’t available in a few states, limiting potential savings for some drivers.

#10 – Liberty Mutual: Best for Various Options

Pros

- Various Options: Liberty Mutual offers a range of insurance options for easy policy customization, similar to companies that don’t charge late fees and provide flexible coverage choices.

- Discount Options: Liberty Mutual provides bundling and good driver discounts, helping policyholders save on premiums. Read more about its discounts in our review of Liberty Mutual auto insurance.

- Financial Stability: Liberty Mutual has strong financial ratings, much like companies that don’t charge late fees, which offer reliability without penalty concerns.

Cons

- UBI Availability: Liberty Mutual’s safe driving discount isn’t available in all states, but some companies that don’t charge late fees offer more widespread UBI programs.

- Customer Ratings: The company has received negative customer ratings, particularly regarding claims processing and support.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What to Do When You Miss an Auto Insurance Payment

If you miss an auto insurance payment, correcting the issue as soon as possible is important. If you don’t make a payment before the company’s grace period ends, it will drop you as a customer. This will result in a lapse of coverage, raising your future auto insurance rates.

If you are considering missing an auto insurance payment because you can’t afford to pay it, speak to your auto insurance company as soon as possible. An agent may be able to help you adjust coverages to make payments more affordable (Read more: What to do if You Can’t Pay Your Auto Insurance).

Pay Premiums on Time to Save Money on Auto Insurance

There are quite a few discounts offered that center around payments. Paying online, paying in full, and other payment methods can earn you a discount.

Autopay is a great way to avoid late payments and earn discounts. Read more on how to get an electronic automatic billing auto insurance discount. Paying automatically each month is often the best choice for most drivers.

If you aren’t sure how much your monthly automatic payments should be, below are the average month-by-month car insurance rates at the best companies that don’t charge late fees.

Auto Insurance Monthly Rates From Companies That Don’t Charge Late Fees

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $46 | $151 | |

| $33 | $87 | |

| $22 | $58 |

| $30 | $80 | |

| $68 | $174 |

| $45 | $115 | |

| $44 | $105 | |

| $33 | $86 | |

| $43 | $113 |

| $22 | $59 |

Most companies, such as Geico auto bill pay, make it easy to set up auto-pay no matter which coverage you purchase. They also offer plenty of discounts besides payment discounts that will help lower your rates.

Top Auto Insurance Discounts From Companies Without Late Fees

Finding auto insurance that rewards responsible driving while skipping late fees can feel like striking gold. This guide breaks down the most notable insurers that deliver these benefits, emphasizing cost-cutting opportunities across multiple categories.

Auto Insurance Discounts From Top Companies That Don’t Charge Late Fees

| Insurance Company | Available Discounts |

|---|---|

| Safe Driver, Loyalty, Multi-Vehicle, Paid-in-Full Discount | |

| Safe Driver, Bundling, Teen Driver, Green | |

| Safe Driver, Low Mileage, Bundling, Safety Features |

| Safe Driver, Multi-Vehicle, Defensive Driving, Good Student | |

| Safe Driver, Bundling, Multi-Vehicle, Newly Married |

| Safe Driver, Accident-Free, Defensive Driving, Anti-Theft |

| Safe Driver, Bundling, Snapshot Program, Multi-Vehicle | |

| Safe Driver, Defensive Driving, Steer Clear, Good Student | |

| Safe Driver, Anti-Theft, Defensive Driving, Bundling |

| Safe Driver, Low Mileage, Military Installation, Family |

Safe driving discounts are often among the biggest discounts possible at auto insurance companies. You can also look for auto insurance with no down payment to save further.

Did you know you can buy a car online in just five easy steps: https://t.co/TicUV2s2fE. #carshopping pic.twitter.com/kJ7VTr9tDA

— Amica Insurance (@Amica) December 10, 2021

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Avoid Auto Insurance Late Fees

Paying your insurance premium on time helps you avoid unnecessary penalties. Knowing how to avoid late insurance fees is important. There are a few ways to avoid late fees.

- Auto-Payments: When you set up auto-pay, you are charged automatically monthly for insurance (Read more about payment frequency: how often is auto insurance paid?).

- Payment-in-Full: You pay for the entire coverage period, often six months, so you don’t have to worry about monthly payments (Learn more: Should I pay my auto insurance in full?).

You can often easily set up auto-payments or pay in full on a company’s app, such as Geico’s mobile app. Company apps make it easy to make payments instantly from your phone and avoid late payments.

Make sure to contact your auto insurance company immediately if you miss a payment so that it doesn't lead to coverage lapse. Lapses in auto insurance are serious, as driving without insurance is illegal.Brandon Frady Licensed Insurance Producer

You can also pay online from your desktop or laptop (Learn about online payments: Can I pay my auto insurance online?).

Negotiating Auto Insurance Company Late Fees

If you are charged a late fee, there is often little you can do unless the company makes an error. However, if you are unable to pay the late fee, it doesn’t hurt to call the auto insurance company and try to negotiate the fee. The company may be able to drop the fee or work with you on a better payment plan.

Late fees aren’t as serious as a lapse in car insurance penalty, in which case you will need to get temporary auto insurance immediately to avoid driving illegally, so it may be easier to work something out with your auto insurance company.

Find the Best Auto Insurance Companies That Don’t Charge Late Fees

Amica, USAA, and Geico are the best auto insurance companies that don’t charge late fees. However, you still need to be careful in avoiding late payments, which can result in an auto insurance lapse. Auto insurance for lapsed coverage is much more expensive, so making payments on time is important.

For more information, check what you should do if your auto insurance expired yesterday.

If you want to find the best auto insurance after a lapse in coverage, check out our free quote comparison tool.

Frequently Asked Questions

What happens if you miss an auto insurance payment?

If you miss an auto insurance payment, most companies offer a short grace period for you to pay without penalty. If you don’t pay within that grace period, you could be charged a late fee or have your insurance dropped. Find out how auto insurance payments work and avoid potential late fees.

Does Progressive charge a late fee?

Progressive doesn’t charge a late fee if you pay within its grace period. You can avoid fees by signing up for Progressive auto bill pay.

How much is a late USAA auto insurance fee?

It depends on how late the payment is. USAA doesn’t charge a late fee if you are within the grace period. To avoid late fees, look at your auto insurance billing options.

Does Allstate have an auto insurance grace period for late fees?

Yes, Allstate has an auto insurance grace period during which you won’t be charged late fees. However, it is easier to avoid fees on month-to-month auto insurance if you sign up for autopay.

Do auto insurance companies charge late fees?

Yes, some auto insurance companies charge late fees, and if you still don’t pay, they will cancel for nonpayment. Discover what you need to do if your auto insurance company was canceled for nonpayment.

Does Nationwide have an insurance late payment policy?

Yes, Nationwide offers a grace period for car insurance. It will keep you covered under temporary car insurance for a certain period before terminating your coverage as a customer.

Can you dispute an auto insurance late fee?

If the late payment was due to a company error, such as its auto-payment not working, you may be able to dispute the fee.

How do you negotiate auto insurance late fees?

You can only negotiate auto insurance late fees if the company makes an error.

Does paying auto insurance late affect credit?

If auto insurance companies send your unpaid bills to debt collection, it can affect your credit score. Discover if not paying your auto insurance can negatively impact your credit.

Can I cancel my auto insurance at any time?

You can cancel your auto insurance anytime to switch to a better company. If you want to look for the best auto insurance with no deposit, try our comparison tool.

What is the State Farm late payment policy?

Does State Farm insurance have a grace period for autos?

How does the State Farm insurance lapse grace period work?

What is the USAA late payment forgiveness policy?

What is the Geico late payment policy?

What is the Geico new car grace period?

What are the major car insurance companies?

How does USAA compare to Erie?

What happens with an Auto-Owners late payment?

Does Direct Auto have a grace period?

What is the Liberty Mutual late payment policy?

Does Allstate car insurance have a grace period?

How do you pay your Amica bill?

What is the best car insurance after a lapse in coverage?

What is the cheapest auto insurance for a lapse in coverage?

What should you do if you haven’t had car insurance for 2 years?

How can you get car insurance after not having it?

How long does a lapse in car insurance stay on your record?

What happens if you can’t pay your car insurance this month?

What is the most trusted car insurance company?

How much is the late fee for Allstate auto insurance?

Can you avoid late fees?

Does Mercury Insurance have a grace period?

How long can you go without car insurance?

What is a reasonable 6-month premium for car insurance?

How can you waive a late fee?

Can you negotiate late fees?

Can late fees be removed?

What is the best car insurance in Georgia?

What is the car insurance grace period in Illinois?

What is the Progressive grace period for late payments?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.