Best Auto Insurance for Immigrants in 2026 (Top 10 Company Ranking)

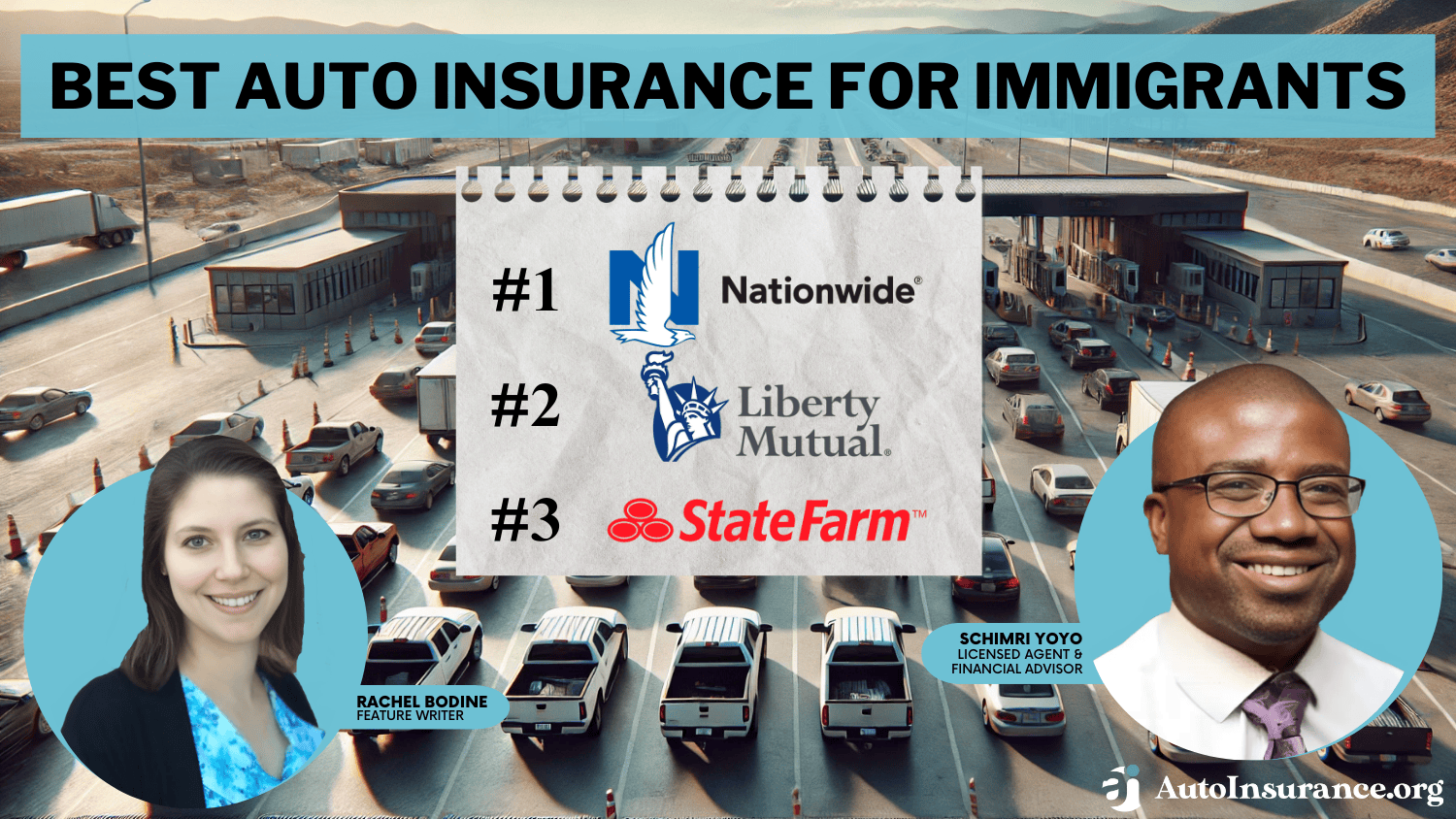

The winners for the best auto insurance for immigrants are Nationwide, Liberty Mutual, and State Farm. Immigrant auto insurance can be found for an affordable full coverage rate of $164 per month with Nationwide. Nationwide also takes the lead as the best auto insurance for immigrants for multilingual customer service.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Benjamin Carr

Updated October 2025

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Immigrants

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Immigrants

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Immigrants

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsNationwide, Liberty Mutual, and State Farm top the list for best auto insurance for immigrants. Liberty Mutual stands out with multi-policy discounts and multilingual customer service.

Our Top 10 Company Picks: Best Auto Insurance for Immigrants

| Company | Rank | Claims Satisfaction | A.M. Best | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 728 / 1,000 | A+ | Multi-Policy Discounts | Nationwide | |

| #2 | 717 / 1,000 | A | 24/7 Support | Liberty Mutual |

| #3 | 710 / 1,000 | A++ | Many Discounts | State Farm | |

| #4 | 706 / 1,000 | A | Family Plans | Farmers | |

| #5 | 704 / 1,000 | A | Roadside Assistance | AAA |

| #6 | 701 / 1,000 | A+ | Exclusive Benefits | The Hartford |

| #7 | 692 / 1,000 | A++ | Cheap Rates | Geico | |

| #8 | 691 / 1,000 | A+ | Customer Service | Allstate | |

| #9 | 684 / 1,000 | A++ | Bundling Policies | Travelers | |

| #10 | 672 / 1,000 | A+ | Qualifying Coverage | Progressive |

Most immigrants need a car, but many states make getting a driver’s license difficult without proper documentation.

It can also be challenging to get auto insurance quotes without a driver’s license, leaving millions of immigrants without vital coverage.

- Immigrants with a valid driver’s license can easily secure auto insurance

- Undocumented immigrants in license-restricted states face insurance hurdles

- Immigrant auto insurance may cost more due to a driving record

Read below to learn how to get auto insurance as an undocumented immigrant. Then, enter your ZIP code into our free rate comparison tool above to get quotes and find out who really has the cheapest car insurance for newcomers to the U.S.

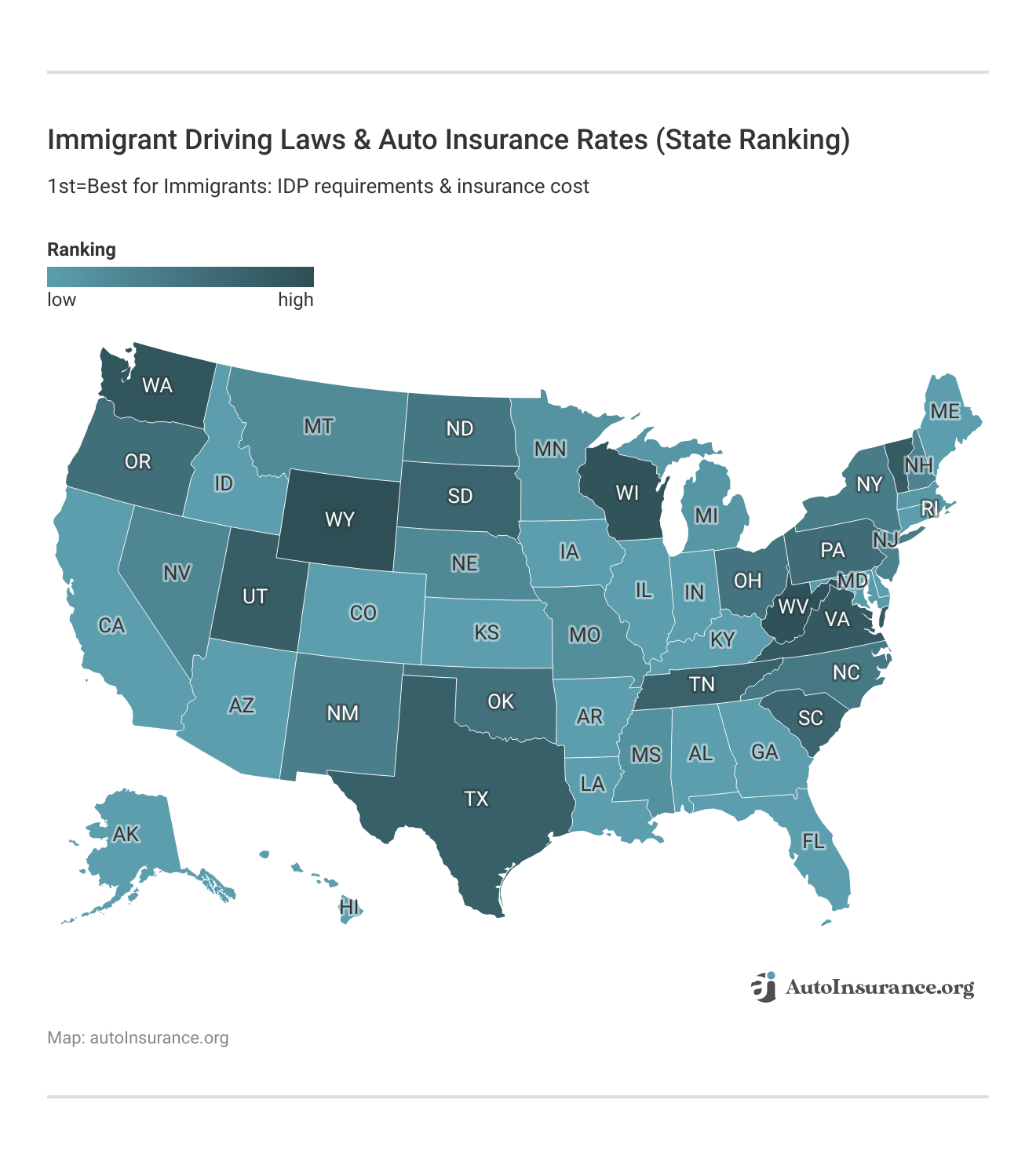

Top States to Get Auto Insurance for Immigrants

We looked at whether states will allow immigrants to get a driver’s license regardless of their immigration status, as well as whether they require drivers to have an International Driving Permit (IDP).

While we focused on the states that allow immigrants to drive with fewer restrictions, within that group of states, we also looked at car insurance rates. From there, we looked at the requirements for an IDP and rates. The number-one state is therefore the one with the cheapest rates on car insurance for newcomers among those states that have the least restrictive laws.

10 Best States for Immigrant Auto Insurance Coverage

| State | Rank | Monthly Rates | Notes |

|---|---|---|---|

| Vermont | #1 | $32 | Very low rates; licenses allowed |

| Idaho | #2 | $31 | Cheap rates; no license access |

| Maine | #3 | $38 | Low premiums; no licenses |

| North Carolina | #4 | $41 | Cheap rates; no licenses |

| Ohio | #5 | $30 | Low rates; limited license access |

| New Mexico | #6 | $38 | Moderate rates; licenses allowed |

| Oregon | #7 | $65 | Average rates; licenses allowed |

| Washington | #8 | $70 | Average rates; licenses allowed |

| Illinois | #9 | $92 | Higher than average; licenses allowed |

| Nevada | #10 | $110 | Costly but licenses allowed |

Vermont is the best option, with $32 monthly rates and full license access. Idaho ($31) and Ohio ($30) are cheaper but limit licenses, which can cause issues. Maine and North Carolina also have low premiums but no license access. For permanent residents, green card car insurance is available nationwide and often at affordable rates.

Some states give a good balance. New Mexico, Oregon, and Washington allow immigrants to get licenses, with insurance costs from $38 to $70. Illinois ($92) and Nevada ($110) are more expensive but provide full license access, which is important for staying legal.

All of the states in the top 10 allow drivers to get a license regardless of their immigration status.Daniel Walker Licensed Auto Insurance Agent

In other states, like Nevada, you aren’t required to have an IDP. And you can also apply for a Nevada driver’s license, no matter what your status. Even if you can get insurance on your vehicle, driving without a license is not worth the risk (Read More: What happens if you drive without a license and get stopped by the police?).

Overall, the best state depends on both rates and license access, with Vermont offering one of the most practical choices for immigrants.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Worst States to Get Auto Insurance for Immigrants

Louisiana is one of the worst states to get car insurance for migrants, as it doesn’t issue licenses to immigrants and has high rates. Florida is the second-worst state, with strict laws around licensing.

However, it is worth noting that while Florida’s undocumented immigrants cannot obtain a Florida state license, they can still purchase insurance if they hold another valid license and register their vehicle.

10 Worst States for Immigrant Auto Insurance Coverage

| State | Rank | Monthly Rates | Notes |

|---|---|---|---|

| Louisiana | #1 | $73 | Very high rates; no licenses |

| Florida | #2 | $108 | Costly rates; strict laws |

| Michigan | #3 | $109 | Expensive no-fault; no licenses |

| California | #4 | $60 | High rates; licenses allowed |

| New York | #5 | $95 | Costly rates; licenses allowed |

| Colorado | #6 | $57 | High rates; licenses allowed |

| Delaware | #7 | $84 | Expensive; limited access |

| Rhode Island | #8 | $65 | High rates; unclear access |

| New Jersey | #9 | $107 | Expensive; limited access |

| Oklahoma | #10 | $52 | Costly rates; no licenses |

Other states on our list of the worst states for car insurance for non-residents of the U.S. include states with limited licensing access, like Delaware, and states with extremely high rates, like car insurance in California for foreigners.

We want to note, though, that California has an AB 60 law, letting undocumented immigrants get a legal driver’s license. It also runs a Low-Cost Auto Program that helps low-income drivers, including immigrants, buy affordable liability coverage.

In some states, like Colorado or California, there’s a 90-day grace period on driving without an IDP. If you’re staying longer but don’t plan to make the state your home, the IDP will help you get insured.

If you live in one of the worst states for immigrant auto insurance, though, it will still be more difficult to secure coverage at the cheapest auto insurance companies and get a license.

Laws on Licensing and Car Insurance in the U.S.

License laws for immigrants vary by state, with some states requiring immigrants to have an international driving permit (IDP). Other states don’t allow non-citizens to get a driver’s license, but others have made it possible for undocumented immigrants to apply. This helps lower the risk for everyone on the road.

Coverage laws also vary by state. Regardless of immigration status, all drivers must carry the state-required coverages to drive legally.

In states that require more auto insurance coverage, all drivers can expect to pay more for an auto insurance policy (Learn More: How to Lower Your Auto Insurance Rates).

If you live in an expensive state for auto insurance with high requirements, the best thing you can do is keep a clean driving record and shop around periodically for cheaper auto insurance coverage.

U.S. Auto Insurance Requirements

Liability insurance is mandatory in almost every state to cover damages for injuries or property you may cause to others in an accident.

Only a few states, such as New Hampshire, offer alternatives to traditional auto insurance, such as bonds or cash deposits.

Another common insurance coverage that is required in some states is personal medical insurance coverage that helps pay for your and your passengers’ medical bills after an accident.

The two common forms of medical insurance are MedPay or Personal Injury Protection (PIP). MedPay helps pay medical bills if you or your passengers are injured, while PIP goes a step further and helps cover lost wages.

Another important coverage that is required in some states is uninsured or underinsured motorist coverage (Learn More: Best Uninsured and Underinsured Motorist (UM/UIM) Coverage). When undocumented immigrants can’t get a license, they usually can’t get insurance either, leaving many without proper protection.

Uninsured drivers often can’t afford to pay for damages after a crash. That means other drivers, even those who follow the rules, may end up paying out of pocket. Many immigrants face the same challenge when trying to get car insurance with a green card.

According to the Insurance Information Institute, about one in eight drivers in the U.S. is uninsured. That number is growing each year.

These accidents push insurance costs higher for everyone. For those new to the country, finding the cheapest car insurance in the USA for foreigners can be a real concern.

Factors That Affect Auto Insurance Rates for Immigrants

When it comes to car insurance for undocumented immigrants, navigating the process can be daunting. However, it’s crucial to know that there are options available. One common question is, can undocumented immigrants get car insurance?

Despite the challenges, there are insurers who understand the unique needs of this demographic and offer car insurance for non-citizens.

Finding the best auto insurance for undocumented immigrants involves thorough research and understanding the requirements. Some insurers may cater to car insurance for new immigrants in the US or even offer the best auto insurance for international drivers.

While car insurance for illegal immigrants may seem like a difficult prospect, there are policies designed to provide coverage.

For migrants, refugees, and others seeking car insurance for foreigners, it’s essential to explore all available options. Whether you’re looking for migrant car insurance or car insurance for refugees, understanding your rights and available policies is essential.

Providers who specialize in catering to the needs of immigrants and refugees can offer tailored solutions to ensure you have the coverage necessary for peace of mind on the road.

How Driving History Impacts Immigrant Insurance Cost

One of the best indications of your risk to a company is your driving record. Insurance companies look at past accidents, tickets, and DUIs to determine rates. If you have a poor driving record, you may even have to get SR-22 auto insurance, and it will be extremely hard to find low-cost SR-22 for immigrants in California and other states.

The offense that raises rates the most depends on the company, which is why drivers with a poor driving record should shop around to find the company that offers the best rate for their specific driving record offense.

Immigrant Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $65 | $71 | $81 | $58 |

| $87 | $103 | $124 | $152 | |

| $76 | $95 | $109 | $105 | |

| $43 | $56 | $71 | $117 | |

| $96 | $116 | $129 | $178 |

| $63 | $75 | $88 | $129 | |

| $56 | $74 | $98 | $75 | |

| $47 | $53 | $57 | $65 | |

| $61 | $89 | $93 | $74 |

| $53 | $72 | $76 | $112 |

Wondering, do immigrants pay more for car insurance? Immigrants usually don’t have a U.S. driving record, so they typically pay a higher price for car insurance in the USA for foreigners, as their risk level is unknown.

After a year or two of building a clean driving record, however, immigrants will likely see a drop in their auto insurance rates.

How Age Impacts Immigrant Auto Insurance Premiums

The higher the chances are of you filing a claim, the more your insurance will cost. Young people are statistically more likely to file a claim due to their inexperience as drivers (Read More: 6 Reasons Auto Insurance Costs More for Young Drivers).

Because of this, young immigrants will find that their rates are much higher than older drivers, often by hundreds of dollars.

Immigrant Auto Insurance Monthly Rates by Age

| Insurance Company | Age: 16 | Age: 25 | Age: 35 | Age: 45 | Age: 55 | Age: 65 |

|---|---|---|---|---|---|---|

| $269 | $59 | $55 | $65 | $43 | $45 |

| $371 | $102 | $95 | $87 | $82 | $86 | |

| $452 | $98 | $91 | $76 | $72 | $75 | |

| $178 | $50 | $46 | $43 | $41 | $42 | |

| $464 | $119 | $110 | $96 | $91 | $95 |

| $279 | $81 | $76 | $63 | $59 | $62 | |

| $467 | $77 | $72 | $56 | $52 | $55 | |

| $208 | $60 | $56 | $47 | $45 | $47 | |

| $335 | $77 | $72 | $61 | $57 | $59 |

| $517 | $62 | $58 | $53 | $50 | $53 |

If young drivers still live with their parents, then the best option is to join a parent’s policy, as it is much easier to get cheap car insurance for migrant families than having an individual policy as a teenage driver. Drivers can get car insurance quotes for immigrant families to secure the best rate.

However, young drivers who can’t stay on a parent’s policy can work to reduce rates by joining safe driver programs, shopping for quotes, and driving safe, reliable vehicles.

How Coverage Impacts Immigrant Auto Insurance Rates

The first step in purchasing a policy is to figure out what you need and get car insurance quotes for migrants. You will need a minimum amount of liability coverage in most states, while uninsured/underinsured motorist coverage is required in about half. If you have a tight budget, the minimum coverage is your cheapest option.

However, you probably need full coverage if you have a car loan or lease. Drivers with older, less valuable cars can get away with less insurance if they’re trying to save money.

Immigrant Auto Insurance Monthly Rates by Coverage Level

Insurance Company Minimum Coverage Full Coverage

$65 $122

$87 $228

$76 $198

$43 $114

$96 $248

$63 $164

$56 $150

$47 $123

$61 $161

$53 $141

Full coverage auto insurance, which usually includes everything except PIP, is ideal for people who can’t afford to replace their car, don’t own their vehicle outright, or have a valuable car.

Full coverage includes collision insurance and comprehensive insurance. After an accident, collision insurance helps pay for repairs to your vehicle. You’ll be eligible to make a claim no matter who is at fault for the collision (Read More: Collision Auto Insurance).

For damage not caused by an accident, there’s comprehensive auto insurance coverage. Comprehensive usually covers damage from weather, vandalism, animal contact, theft, and more.

In addition to the basic types of insurance, there are several add-ons that increase the value of your policy. Companies offer unique lists, but here are some of the most common you’ll find:

- Roadside Assistance

- Guaranteed Auto Protection (GAP)

- Rental Car Reimbursement

- New Car Replacement

As you can see, there are plenty of opportunities to increase your policy’s value (and price). Before you sign up for any, make sure you really need the coverage.

You can also speak with an insurance agent to get an idea of the cost for different situations, such as the cost of car insurance for migrant families or car insurance for expats in the USA.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

States That Allow Undocumented Immigrants to Get a Driver’s License

Which states allow undocumented immigrants to get a license? The following states allow undocumented immigrants to obtain a license: California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, Nevada, New Jersey, New Mexico, New York, Oregon, Utah, Vermont, Virginia, and Washington.

The requirements to get a license as an undocumented immigrant vary by state, so check with your local DMV’s site to see what you need. You can also check when the license will expire and how to renew it. States that permit undocumented residents to obtain driver’s licenses offer a smoother path to insurance coverage.

Undocumented immigrants can usually secure coverage if they have:

- A driver’s license issued by certain states

- An ITIN (Individual Taxpayer Identification Number) in place of a Social Security number

Unfortunately, there’s not much you can do if you live in a state that either doesn’t let undocumented immigrants get a license or get car insurance with a foreign license.

There are avenues to get coverage without a license, such as expat car insurance with an international driving permit, but policies like expat auto insurance may not cover as much as standard insurance.

Regardless of immigration status, car insurance requirements apply equally to all individuals.Dani Best Licensed Insurance Producer

For example, some companies might sell you a policy if you list someone else as the primary driver. Regardless, driving without auto insurance or a license is a crime and should be avoided.

Below, you’ll find the licensing laws as well as the average cost of car insurance for each state. Take a look at the map to see the data for each state.

It’s notable that most of the friendliest states for immigrant drivers are found along the west and northeast coasts of the country. Also notable is that among states that border Mexico, only two allow undocumented immigrants to obtain a driver’s license (learn more: Best Auto Insurance When Traveling to Mexico).

Rates are averages, so it’s important to remember that there are a lot of variables involved. The best way to shop for auto insurance as an immigrant is to carefully compare your options.

10 Best Auto Insurance Companies for Immigrants

Nationwide, Liberty Mutual, and State Farm are among the top companies for immigrants seeking auto insurance coverage. The best companies have perks like multilingual support, savings programs, and more that can help make it easier for immigrants to get a policy.

Read on to learn more about the best immigrant insurance companies and discover which is best for your needs.

#1 – Nationwide: Top Pick Overall

Pros

- Variety of Coverage Options: Nationwide offers a wide range of coverage options to meet different needs. You can read more in our Nationwide auto insurance review.

- Strong Financial Stability: Nationwide is a well-established company with a solid financial reputation.

- Multilingual Support: They offer customer service in multiple languages, making them one of the top 10 best car insurance companies for immigrants.

Cons

- Potentially Higher Rates: Premiums may be higher compared to some direct insurers.

- Limited Discounts: Nationwide may offer fewer discounts compared to some competitors.

#2 – Liberty Mutual: Best for Multilingual Support

Pros

- Comprehensive Coverage Options: Liberty Mutual offers various coverage options to suit different needs.

- Multilingual Support: They provide customer service in multiple languages.

- Online Tools: Liberty Mutual offers convenient online tools for managing policies and claims.

Cons

- Potentially Higher Rates: Premiums may be higher compared to some direct insurers.

- Limited Discounts: Liberty Mutual may offer fewer discounts compared to some competitors. Read more in our Liberty Mutual auto insurance review.

#3 – State Farm: Best for Extensive Agent Network

Pros

- Extensive Agent Network: State Farm has a large network of local agents offering personalized assistance.

- Diverse Insurance Products: They offer various insurance products besides auto insurance.

- Strong Financial Stability: State Farm is known for its financial strength and reliability. You can learn more in our State Farm auto insurance review.

Cons

- Potentially Higher Rates: The State Farm international car insurance cost may be higher compared to some direct insurers.

- Limited Discounts: State Farm may offer fewer discounts than some competitors.

#4 – Farmers: Best for Personalized Assistance

Pros

- Customizable Policies: Farmers Insurance offers customizable policies to meet individual needs. You can read more in our Farmers auto insurance review.

- Strong Agent Support: They have a network of local agents providing personalized assistance.

- Multilingual Support: Farmers Insurance offers customer service in multiple languages.

Cons

- Potentially Higher Rates: Premiums may be higher compared to some direct insurers.

- Limited Online Tools: Online self-service options may be less robust compared to some competitors.

#5 – AAA: Best for Roadside Assistance Services

Pros

- Roadside Assistance Services: AAA is renowned for its roadside assistance services, providing peace of mind to drivers in emergencies.

- Competitive Rates for Members: AAA often offers competitive rates on auto insurance to its members, such as multi-vehicle insurance for migrant families. Learn more in our AAA auto insurance review.

- Multilingual Support: AAA typically provides customer service in multiple languages to accommodate diverse member needs.

Cons

- Membership Requirement: Access to AAA’s auto insurance policies requires membership in the American Automobile Association, which comes with associated fees.

- Limited Availability: AAA coverage may not be available in all areas, potentially limiting options for some drivers.

#6 – The Hartford: Best for Specialized Insurance Products

Pros

- Specialized Insurance Products: The Hartford offers specialized insurance products, including options for AARP members. You can learn more in our The Hartford auto insurance review.

- Strong Financial Stability: The Hartford is a financially stable company with a solid reputation.

- Multilingual Support: They provide customer service in multiple languages.

Cons

- Limited Availability: Coverage may not be available in all areas.

- Potentially Higher Rates: Premiums may be higher compared to some direct insurers.

#7 – Geico: Best for Multilingual Customer Service

Pros

- Competitive Rates: Geico is often praised for offering affordable premiums, making it easier to get cheap car insurance for immigrant families.

- Easy-to-Use Online Tools: Their website and mobile app make managing policies convenient, which is useful for managing multi-car insurance for immigrant families.

- Multilingual Customer Service: The Geico helpline offers support in various languages, catering to immigrants.

Cons

- Limited Agent Interaction: Some customers may prefer more personalized assistance with more complex situations, such as if they were shopping for Geico car insurance with a foreign license.

- Fewer Discounts: Geico may offer fewer discounts compared to some competitors. You can learn more about Geico’s discounts in our Geico auto insurance review.

#8 – Allstate: Best for Comprehensive Coverage Options

Pros

- Comprehensive Coverage Options: Allstate offers a wide range of coverage options to suit different needs. You can learn more about Allstate’s coverage options in our Allstate auto insurance review.

- Strong Financial Stability: Allstate is a financially stable company with a solid reputation.

- Multilingual Support: They provide customer service in multiple languages.

Cons

- Potentially Higher Rates: Premiums may be higher compared to some competitors.

- Limited Discounts: Allstate may offer fewer discounts compared to some other insurers.

#9 – Travelers: Best for Flexibility

Pros

- Customizable Policies: Travelers offers customizable policies to meet individual needs, such as multi-vehicle insurance for immigrant families.

- Strong Financial Stability: Travelers is a financially stable company with a solid reputation.

- Multilingual Support: They provide customer service in multiple languages.

Cons

- Potentially Higher Rates: Premiums may be higher compared to some direct insurers. Learn more in our Travelers auto insurance review.

- Limited Discounts: Travelers may offer fewer discounts compared to some competitors.

#10 – Progressive: Best for Customizable Policies

Pros

- Wide Range of Coverage Options: Progressive Insurance offers customizable policies to meet diverse needs. You can learn more in our Progressive auto insurance review.

- Name Your Price Tool: This feature allows customers to find auto insurance for foreign drivers in the USA that fits their budget.

- Multilingual Support: They provide assistance in multiple languages.

Cons

- Higher Rates for Some Drivers: Rates may be higher for drivers with certain risk factors.

- Limited Agent Availability: Face-to-face interactions may be less common compared to some competitors.

Get the Best Car Insurance for U.S. Immigrants

While getting car insurance for immigrants takes more work, it’s well worth the effort. The best U.S. car insurance for foreigners can save you thousands of dollars if you’re ever involved in an accident. It also makes sure that you can legally drive on American roads.

Exploring car insurance in the USA for foreigners is crucial, guaranteeing that newcomers attain the appropriate coverage to navigate their journeys with confidence.

Read More: Auto Insurance for Different Types of Drivers

When it comes to insurance, companies treat immigrants the same as anyone else. There are several factors insurance companies use to craft a rate specific to you, such as ZIP code, vehicle, or credit score. To get the best immigrant auto insurance, make sure to follow the tips below.

- Check State DMV Laws: Consult with your state’s DMV to determine if foreign or undocumented drivers are eligible to obtain a license.

- Consult Agents: See if you can find an agent who works with foreign or undocumented applicants to help guide you on documents like ITINs, deposits, or alternative proofs.

- Shop Around: Some insurance companies may be more flexible in working with non-citizens.

- Compare Coverages: Review coverage options and limits, particularly for essential protections like UM/UIM and PIP.

It’s so important to compare quotes with as many companies as possible to get the cheapest car insurance in the USA for foreigners. You can see vastly different prices for the same coverage level by shopping around.

Since most companies offer immigrant auto insurance, you’ll have a wide selection to compare when you’re ready for a quote. As long as you figure out what coverage you need first, you’ll be ready to find the perfect policy for you.

Enter your ZIP code to get quotes for the best auto insurance for immigrants coverage, whether you are looking for auto insurance quotes in Prospect, KY, or car insurance quotes in Prospect, CT.

Frequently Asked Questions

Can an immigrant get car insurance?

You can get car insurance for new immigrants by researching insurance providers that offer coverage to individuals without a driver’s license and providing necessary documentation, such as a passport.

Insurance companies consider various factors such as driving history, identification documents, and residency status when determining eligibility. Immigrants, including those with work visas, green cards, or student visas, can often secure auto insurance by providing the necessary documentation required by insurance providers (Read more: How to Get Auto Insurance Without a License).

Are there any specific considerations for auto insurance for immigrants?

Immigrants should be aware of any state-specific requirements or laws related to auto insurance. Some states may have different regulations or additional documentation requirements for immigrants. It’s important to understand and comply with the specific rules and regulations of the state where you reside to ensure proper coverage (learn more: Minimum Auto Insurance Requirements by State).

Can immigrants with international driver’s licenses obtain auto insurance?

Immigrants with valid international driver’s licenses may be able to obtain auto insurance, depending on the insurance provider and state regulations. However, some states may require immigrants to obtain a driver’s license from that particular state within a certain period to continue driving legally. It’s advisable to check the specific requirements of the state where you reside.

Will an immigrant’s immigration status be reported to immigration authorities when getting auto insurance?

Insurance companies typically do not report an individual’s immigration status to immigration authorities when providing auto insurance. Their primary concern is assessing the driving record, vehicle information, and other relevant factors to determine premiums and coverage. Immigration status is generally not a factor considered in the insurance underwriting process.

Can immigrants be denied auto insurance coverage based on their immigration status?

Insurance companies cannot typically deny auto insurance coverage based solely on an individual’s immigration status. However, insurance providers may have their own underwriting criteria and eligibility requirements.

Immigrants should research and contact insurance companies that are known to provide coverage to individuals with their particular immigration status to ensure they can obtain the necessary coverage (Read more: Can you be denied auto insurance?).

What are the best states for immigrant auto insurance?

While insurance rates can vary based on various factors, including location, some states tend to be more immigrant-friendly when it comes to auto insurance. Here are a few states known for offering competitive rates and coverage options for immigrants:

- Vermont: Vermont has implemented laws and regulations to protect immigrant rights. Many Vermont companies offer affordable auto insurance options tailored to meet the needs of immigrants.

- Idaho: The state has various insurance options available, and its regulations aim to provide fair and accessible coverage for all residents, including immigrants.

- Maine: Insurance companies in the state often provide policies suitable for immigrants.

- North Carolina: New Jersey insurance providers in the state offer cheap options specifically designed for immigrants.

Other good states for immigrant auto insurance include Ohio, New Mexico, Oregon, Washington, Illinois, and Nevada. It is much easier to get auto insurance for newly licensed immigrants in these states. Shop for affordable auto insurance in your state today by entering your ZIP code in our free tool.

What other factors should immigrants consider when purchasing auto insurance?

There are several factors to consider when buying auto insurance for foreign drivers who have recently immigrated. When purchasing auto insurance as an immigrant, consider the following factors:

- Coverage Options: Look for policies that provide adequate coverage tailored to your needs and state requirements. Consider liability, collision, and comprehensive coverage.

- Premium Rates: Compare rates from different companies to find the most affordable option. Factors such as your age, driving history, type of vehicle, and location can influence rates.

- Deductibles: Evaluate the deductible amounts offered by insurance providers. A higher deductible can lower your premium, but may require you to pay more out of pocket in case of a claim.

- Customer Service: Read reviews and consider the reputation of the insurance companies you’re considering. Good customer service is essential for prompt claims handling and overall satisfaction.

As well, some insurance companies may offer additional benefits, such as roadside assistance or accident forgiveness. Consider these extras when comparing policies.

Can you get car insurance with no SSN?

An SSN is not always required to get car insurance (Learn More: 8 Best Auto Insurance Companies That Don’t Ask for Your SSN). Wondering what documents are needed to get auto insurance as an immigrant? The documentation requirements can vary depending on the insurance provider and the immigrant’s status.

Generally, common documents that may be requested include a valid driver’s license, proof of residency or legal presence in the country, and identification documents such as a passport or visa. It’s important to contact insurance providers directly to understand their specific documentation requirements, as it can be harder to secure the best car insurance for undocumented immigrants than for documented immigrants.

Can immigrants get the same coverage options and discounts as other drivers?

Immigrants can generally access the same coverage options and discounts as other drivers, provided they meet the eligibility criteria set by the insurance provider. Factors such as driving history, vehicle safety features, and bundling multiple policies may still apply to immigrants.

It’s advisable to inquire about available coverage options and discounts directly with insurance providers.

Can immigrants be listed as drivers on someone else’s auto insurance policy?

Immigrants can often be listed as drivers on someone else’s auto insurance policy, such as a family member or friend. Insurance providers typically allow policyholders to add additional drivers to their policies, including immigrants.

However, it’s important to check with the insurance company directly to understand their policies regarding adding drivers with different immigration statuses and any specific documentation requirements that may apply.

Are there any resources or organizations that can assist immigrants with auto insurance?

What states allow undocumented immigrants to get a license?

Can you get car insurance for immigrants if your state doesn’t allow you to get a license?

How do you get the right car insurance for immigrants?

How much does car insurance for immigrants cost?

Can illegal immigrants get car insurance in New York?

Is New Mexico a good state for immigrant auto insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.