Best Augusta, Georgia Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

The top companies for the best Augusta, Georgia auto insurance are Safeco, Geico, and Allstate, with premiums starting at $75/month. These firms distinguish themselves through exceptional service, expansive coverage, and low rates. Opt for these insurers to achieve optimal value in Augusta, Georgia.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated March 2025

Company Facts

Full Coverage in Augusta Georgia

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Augusta Georgia

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 11,640 reviews

11,640 reviewsCompany Facts

Full Coverage in Augusta Georgia

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviews

If you’re searching for the best Augusta, Georgia auto insurance, check out Safeco, Geico, and Allstate, with rates as low as $75/month. Safeco is a favorite because of its solid coverage.

We have meticulously gathered all the pertinent information to assist you in finding the most suitable auto insurance in August, Georgia.

Our Top 10 Company Picks: Best Augusta, Georgia Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A Low Premiums Safeco

#2 25% A++ Comprehensive Coverage Geico

#3 25% A+ Competitive Rates Allstate

#4 20% B Strong Network State Farm

#5 10% A++ Customer Service Auto-Owners

#6 8% A++ Broad Options Travelers

#7 25% A Member Benefits AAA

#8 10% A+ High Ratings Erie

#9 20% A Customizable Plans Farmers

#10 10% A++ Military Discounts USAA

Please review the following options to identify the best option for your needs. Use our free comparison tool above to see what auto insurance quotes look like in your area.

- Safeco’s the top choice auto insurance in Augusta

- Augusta required auto owners to get at least the minimum, which is 25/50/25

- Average auto insurance rates for senior drivers in Augusta are $215/month

#1 – Safeco: Top Overall Pick

Pros

- Budget-Conscious Benefits:With premiums as low as $225 monthly, Safeco makes it simpler for Augusta drivers to maintain adequate coverage without overspending.

- Augusta-Oriented Options: From flood protection to low-mileage discounts, Safeco offers valuable coverage tailored to the specific needs and lifestyles of local residents.

- Augusta-Specific Discounts: As outlined in Safeco auto insurance review, Safeco offers savings opportunities that are tailored to the Augusta area, such as partnerships with local businesses and rewards for low-mileage drivers, which can help you save even more.

Cons

- Digital-Centric Service: With fewer local offices, Augusta customers may need to handle most policy management tasks online or by phone.

- Weather-Related Delays: During peak claim times after major storms, Augusta policyholders may experience slightly longer wait times for processing and payouts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Comprehensive Coverage

Pros

- Most Affordable Premiums: At just $215 per month, Geico’s rates are Augusta’s lowest, helping cost-conscious drivers secure quality coverage at a reduced expense.

- Plentiful Discount Potential: From safe driving rewards to multi-vehicle savings, Geico makes it easy for Augusta motorists to shrink their premiums.

- Streamlined Online Experience: As mentioned in our Geico auto insurance review, Geico’s intuitive web and mobile tools enable Augusta residents to manage policies and file claims with just a few clicks.

Cons

- One-Size-Fits-Most Service: Geico’s streamlined service model may not provide the personalized touch some Augusta drivers expect from their carrier.

- Narrow Policy Options: While sufficient for many, Geico’s straightforward coverage options may not be ideal for Augusta motorists with more complex insurance needs.

#3 – Allstate: Best for Competitive Rates

Pros

- Customizable Protection: With numerous ways to tailor coverage and limits, Allstate empowers Augusta drivers to design policies that fit their unique needs and budgets.

- Reward-Worthy Habits: As mentioned in our Allstate auto insurance review, they promote and incentivize responsible behavior, Allstate’s safe driving discounts help keep Augusta’s roads and premiums in check.

- Locally Accessible Agents: Allstate’s extensive Augusta agent network means personalized support and trustworthy service are always close at hand.

Cons

- Relatively Pricey Policies: At $235 per month, Allstate’s premiums fall on the higher end of Augusta’s pricing spectrum, which may not appeal to particularly frugal consumers.

- Potentially Climbing Costs: Some Augusta policyholders have noticed premium increases at renewal time, which can complicate long-term budgeting.

#4 – State Farm: Best for Strong Network

Pros

- Moderately Priced Premiums: State Farm’s $220 monthly rates strike an agreeable balance between affordability and value for Augusta motorists.

- Well-Rounded Coverage: With a diverse selection of protections and policy provisions, State Farm makes it simple for Augusta drivers to secure suitable coverage.

- Community-Focused Representatives: As outlined in our State Farm auto insurance review, State Farm’s team of Augusta-based representatives provides personalized service that reflects a deep understanding of local drivers’ needs.

Cons

- Fluctuating Rates: While initially competitive, some Augusta policyholders have encountered premium upticks over time, which can impact long-term affordability.

- Somewhat Slim Discounts: State Farm may offer fewer cost-cutting programs than certain Augusta competitors, potentially limiting policyholders’ savings opportunities.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Auto-Owners: Best for Customer Service

Pros

- Moderately-Priced Premiums: At $230 monthly, Auto-Owners’ rates align with Augusta’s average, offering a reasonable blend of affordability and value.

- Varied Coverage Choices: With a broad range of protections and policy provisions, Augusta drivers can look to Auto-Owners for suitable, well-rounded coverage.

- Consistently Caring Support: As mentioned in Auto-Owners auto insurance review, Auto-Owners’ attentive representatives ensure Augusta policyholders receive prompt, professional service at every interaction.

Cons

- Average-Exceeding Premiums: While not exorbitant, Auto-Owners’ $230 monthly rates do surpass those of Augusta’s most aggressively affordable providers.

- Smaller Savings Selections: Compared to competitors with expansive discount rosters, Auto-Owners may extend fewer opportunities for Augusta motorists to trim their premiums.

#6 – Travelers: Best for Broad Options

Pros

- Pocketbook-Friendly Premiums: At $225 per month, Travelers’ rates are among Augusta’s most affordable, helping drivers secure quality coverage without straining their budgets.

- Diverse Protection Packages: From basic liability to extensive umbrella coverage, Travelers’ varied policy options make it easy for Augusta motorists to find a suitable fit.

- Potential Price Breaks: With discounts for safe driving, multi-policy bundling, and more as outlined in our Travelers auto insurance review, Travelers offers Augusta policyholders numerous ways to reduce their premiums.

Cons

- Consolidated Physical Presence: With a smaller brick-and-mortar footprint, Travelers may have fewer offices and consultants available to assist Augusta residents in person.

- Strained Claims Experiences: During busier periods, some Augusta policyholders have encountered slight delays or disconnects in Travelers’ claims process.

#7 – AAA: Best for Member Benefits

Pros

- Thoroughly Protective Policies: AAA’s $240 monthly premiums grant Augusta drivers access to an extensive selection of discounts and supplemental coverage options.

- Membership Merits: AAA extends an array of valuable perks from waived deductibles to complimentary towing, to keep Augusta policyholders safer on the road.

- Service-Oriented Support: AAA’s strong reputation for attentive as mentioned in AAA auto insurance review, individualized support means Augusta motorists can expect top-tier assistance when they need it most.

Cons

- A little More Expensive: At $240 per month, AAA’s rates exceed those of some more affordability-focused Augusta auto insurance providers.

- Fairly Focused Discounts: While far from limited, AAA’s selection of cost-cutting programs may be a bit narrower than Augusta’s most discount-heavy carriers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Erie: Best for High Ratings

Pros

- Reasonably-Priced Policies: At $220 per month, Erie’s premiums come in just below Augusta’s average rates, offering a blend of affordability and value.

- Ample Coverage Choices: With numerous protections and plan provisions, Erie makes it easy for Augusta drivers to build policies that suit their needs and lifestyles.

- Top-Tier Customer Care: Erie’s exemplary claims satisfaction scores and service reputation instill confidence in Augusta policyholders. Learn more in our page titled Erie auto insurance review.

Cons

- Potentially Pricier: While generally competitive, Erie’s rates for certain Augusta driver segments may skew slightly higher than some budget-focused alternatives.

- Less Savings: Erie may offer fewer discount options than some savings-focused Augusta carriers, potentially limiting policyholders’ price-trimming opportunities.

#9 – Farmers: Best for Customizable Plans

Pros

- Moderately-Priced Premiums: At $230 per month, Farmers’ rates align with Augusta’s average, balancing affordability and value for local motorists. See more details in our page titled Farmers auto insurance review.

- Adjustable Coverage Options: Farmers empowers Augusta drivers to personalize their protection with a diverse selection of policy provisions and optional add-ons.

- Area-Specific Service: With a locally oriented team of agents, Farmers delivers support that reflects an understanding of Augusta residents’ distinct needs and concerns.

Cons

- Slightly Higher Costs: While far from exorbitant, Farmers’ $230 average premium does exceed Augusta’s most affordably priced policies.

- Reduced Discount Roster: Farmers may offer Augusta motorists fewer cost-cutting opportunities than certain discount-focused competitors.

#10 – USAA: Best for Military Discounts

Pros

- Low-Cost Plans: As mentioned in our USAA auto insurance review, USAA provides Augusta, Georgia, drivers with highly affordable insurance options.

- Broad Policy Selections: USAA’s diverse range of coverage options in Augusta, Georgia, ensures that drivers can find the right plan for their needs.

- Superior Customer Care: USAA is known for providing excellent customer service to its Augusta, Georgia, policyholders.

Cons

- Military-Only Access: USAA’s insurance offerings are restricted to military members and their families, limiting access for other Augusta, Georgia, drivers.

- Sparse Local Offices: USAA’s presence in Augusta, Georgia, is limited, potentially affecting access to in-person services.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Basic Auto Insurance You Need in Augusta, Georgia

In Augusta, Georgia, the law is clear. Every driver must have at least the minimum auto insurance. This is to make sure you have some protection if you get into a wreck. In Augusta, you must have coverage of $25,000 for property damage liability, $25,000 for bodily injuries per person, and $50,000 for total bodily injury per accident.

Complying with the state’s minimum auto insurance requirements ensures your financial protection in case of an accident. Be sure to obtain coverage that meets or surpasses these minimums to stay compliant and protect your finances.

Augusta, Georgia Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $90 $240

Allstate $90 $235

Auto-Owners $88 $230

Erie $85 $220

Farmers $89 $230

Geico $80 $215

Safeco $85 $225

State Farm $85 $220

Travelers $87 $225

USAA $75 $205

The table above shows the monthly rates for both basic and full coverage auto insurance from the biggest insurance companies in Augusta, Georgia. This will help you compare your options.

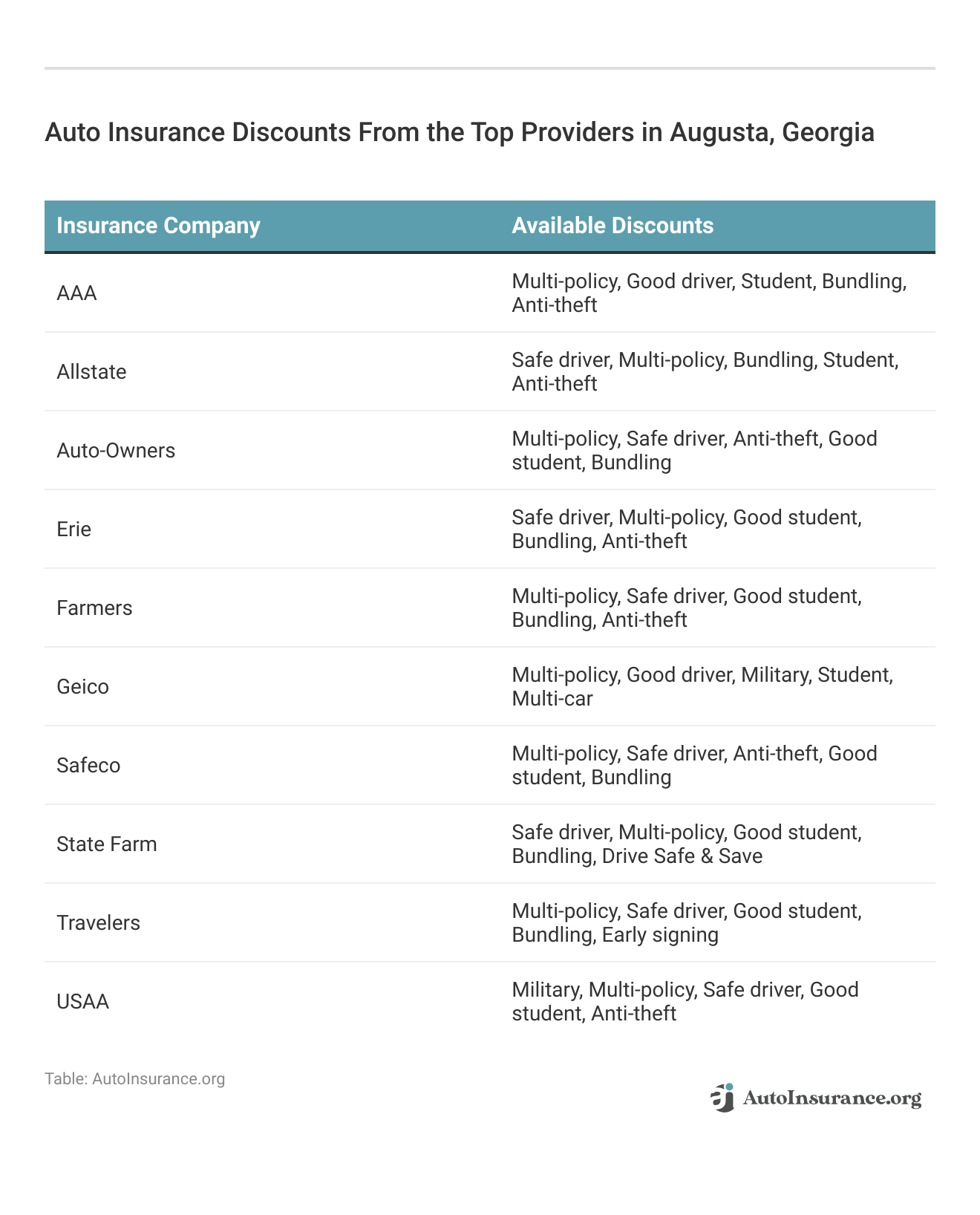

A variety of insurance companies provide special discounts for drivers residing in Augusta, aiming to assist them in reducing their auto insurance premiums. These discounts can be based on several factors, including safe driving records, completion of defensive driving courses, or even the installation of specific safety features in vehicles.

Augusta Auto Insurance Rates: ZIP Code Breakdown

The cost that you pay for car insurance in Augusta, Georgia is heavily dependent on your zip code. You may observe the impact of location on premiums by comparing them across different neighborhoods in the area.

Augusta, Georgia Full Coverage Auto Insurance Rates by ZIP Code

| ZIP Code | Monthly Rates |

|---|---|

| 30805 | $384 |

| 30815 | $385 |

| 30901 | $379 |

| 30904 | $377 |

| 30905 | $377 |

| 30906 | $381 |

| 30907 | $368 |

| 30909 | $376 |

| 30912 | $378 |

Simply evaluating regional rates, you can find cheaper options that are perfectly suited to your particular ZIP code. For more information, read our article titled “Auto Insurance Rates by ZIP Code.”

Augusta, Georgia: Low-Cost Auto Insurance by Driving History

Examine how accidents, DUIs, and tickets push up insurance costs by looking at the monthly premiums given by providers in Augusta, Georgia.

Augusta, Georgia Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| Allstate | $291 | $448 | $306 | $364 |

| Geico | $150 | $188 | $168 | $383 |

| Liberty Mutual | $638 | $872 | $849 | $1,001 |

| Nationwide | $337 | $395 | $408 | $605 |

| Progressive | $274 | $490 | $320 | $326 |

| State Farm | $259 | $311 | $285 | $285 |

| USAA | $194 | $245 | $216 | $356 |

Your driving history plays a big role in how much you pay for car insurance in Augusta, Georgia. Major offenses like DUIs can really hike up your rates. If you keep your record clean, you can get cheaper coverage and avoid expensive rate jumps.

Lowering Auto Insurance Costs in Augusta, Georgia After a DUI

Had a bit too much fun at The Indian Queen and got a DUI? The table below helps you compare local insurance options to find the best deals that fit your budget.

Augusta, Georgia Full Coverage Auto Insurance Rates After a DUI

| Insurance Company | Monthly Rates |

|---|---|

| $364 | |

| $383 | |

| $832 |

| $605 |

| $326 | |

| $285 | |

| $356 |

Checking out local rates can help you find the best discounts and get back behind the wheel of your vehicle, even if it might be difficult to find affordable auto insurance in Augusta, Georgia.

Read More: Best Auto Insurance in Georgia After a DUI

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance in Augusta, Georgia With Your Credit Score

To obtain the best rates in Augusta based on your financial situation, you must first analyze how credit scores affect auto insurance rates.

Your credit score have an important effect on how much you pay for your auto insurance, so knowing it might help you get a better offer. See the table below:

Augusta, Georgia Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $456 | $317 | $283 |

| Geico | $279 | $196 | $191 |

| Liberty Mutual | $1,202 | $739 | $579 |

| Nationwide | $517 | $421 | $370 |

| Progressive | $395 | $343 | $319 |

| State Farm | $404 | $252 | $199 |

| USAA | $328 | $232 | $198 |

Lower scores generally leads to higher premiums so improving your credit can help reduce insurance costs, it’s helpful to review and manage your credit regularly.

Age and Gender Factors in Augusta, Georgia Auto Insurance

Learning the effect of age and gender on auto insurance rates can be helpful for making wise choices. Find out the monthly premiums provided by providers in Augusta, Georgia through the table below:

Augusta, Georgia Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $244 | $244 | $233 | $233 | $564 | $726 | $273 | $298 |

| Geico | $133 | $132 | $129 | $129 | $405 | $485 | $173 | $192 |

| Liberty Mutual | $443 | $482 | $363 | $412 | $1,914 | $2,137 | $469 | $498 |

| Nationwide | $256 | $265 | $254 | $279 | $783 | $1,006 | $311 | $337 |

| Progressive | $219 | $201 | $189 | $199 | $709 | $784 | $253 | $265 |

| State Farm | $185 | $185 | $166 | $166 | $499 | $656 | $203 | $220 |

| USAA | $141 | $141 | $131 | $132 | $508 | $600 | $175 | $193 |

Auto insurance rates depend on age, gender, and the company you pick. Teenagers pay more. Seniors might pay less. Men and women are treated differently. It all shows how personalized coverage can be.

By evaluating quotes from various insurers, you can tailor your policy to fit your demographic profile and potentially secure significant savings.Michelle Robbins LICENSED INSURANCE AGENT

Augusta residents who take the time to compare insurance rates based on age and marital status can discover personalized and budget-friendly options. Being knowledgeable and strategic helps them stay ahead, ensuring they get the best coverage at a reasonable price.

Read More: Male vs. Female Auto Insurance Rates

Commute-Based Auto Insurance Rates in Augusta, Georgia

As a seasoned driver familiar with the bustling roads of Washington Road and the I-20 corridor, it’s important to consider how your daily commute and yearly mileage can impact your auto insurance premiums in Augusta, Georgia.

Explore the impact of various commute lengths on your insurance premiums and find the most economical choices for your driving patterns.

Augusta, Georgia Full Coverage Auto Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $344 | $360 |

| Geico | $218 | $226 |

| Liberty Mutual | $840 | $840 |

| Nationwide | $436 | $436 |

| Progressive | $352 | $352 |

| State Farm | $285 | $285 |

| USAA | $241 | $264 |

When you get auto insurance, checking out quotes for different commute situations can help you snag the best deal for how you drive the roads in Augusta.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Drives Auto Insurance Prices in Augusta, Georgia

Auto insurance rates in Augusta, Georgia can differ significantly from other cities due to various factors. These factors include the level of traffic congestion on Bobby Jones Expressway and the rate of vehicle theft in neighborhoods like Harrisburg.

With the presence of military personnel from Fort Gordon and the influx of tourists during events like The Masters, regional differences can have an impact on your insurance premiums.

Augusta Commuting Duration

Extended distances can result in higher auto insurance expenses. In Augusta, Georgia, where the average commute lasts just over 20 minutes, whether you’re crossing the Savannah River or navigating the city’s suburban sprawl, this element can have a significant impact on the cost of your insurance.

Augusta’s Traffic Conditions

Inrix ranks Augusta, Georgia as the 513th most congested city in the world. Even if Augusta’s traffic isn’t as bad as that in other international cities, drivers should nevertheless expect delays on peak days.

Read More: Worst States for Traffic-Related Fatalities

Local traffic patterns and infrastructure can influence commute times, so staying informed about traffic conditions can help manage your travel efficiently.

Before you buy Augusta, Georgia auto insurance, get vehicle protection at the best prices by entering your ZIP code into our free auto insurance quote comparison tool below.

Frequently Asked Questions

How can I lower my car insurance in Georgia?

You can lower your car insurance in Augusta, Georgia by maintaining a clean driving record, bundling multiple policies (like home and auto insurance), taking advantage of discounts, improving your credit score, and shopping around for better rates. Read our article titled “Can you have two auto insurance policies?”

How can I save money on auto insurance in Augusta, GA?

You can save money by comparing car insurance quotes in Augusta, GA from different insurers, maintaining a clean driving record, bundling your auto insurance Augusta, GA with other policies, taking advantage of discounts, and considering higher deductibles.

What factors can affect my auto insurance premiums in Augusta, GA?

Several factors can influence your auto insurance premiums in Augusta, GA, including your driving record, age, gender, marital status, vehicle type, credit history, and coverage level. Insurers assess these factors to determine the risk associated with insuring you and set your premium accordingly.

What age does car insurance go down in Georgia?

Car insurance in Georgia typically starts to decrease when drivers reach their mid-20s. However, the most significant reductions often occur when drivers turn 25, assuming they have a good driving record.

Do I need insurance to buy a car in Georgia?

Yes, in Georgia, you need to show proof of insurance before you can legally drive your newly purchased car. If you’re financing the vehicle, the lender may also require you to carry comprehensive and collision coverage.

Read More: Do I need proof of insurance when buying a used car?

How long do you have to insure a car in Georgia?

In Georgia, you are required to have insurance in place before driving your car off the lot. If you’re purchasing a vehicle, you should have insurance ready on the day of purchase to comply with state laws.

What should I do if I’m involved in an auto accident in Augusta, GA?

If you’re involved in an auto accident in Augusta, GA, first ensure everyone’s safety and call 911 if necessary. Exchange information with the other driver(s), document the scene with photos, and notify your insurance company as soon as possible to start the claims process.

How does my credit score affect auto insurance rates in Augusta, GA?

Your credit score can significantly impact your auto insurance rates in Augusta, GA. Insurance companies often use credit scores to assess the likelihood of a policyholder filing a claim. A higher credit score generally leads to lower premiums, while a lower score may result in higher rates.

Read More: Best Auto Insurance Companies

Is auto insurance mandatory in Augusta, GA?

Yes, auto insurance is mandatory in Augusta, GA, as it is in most states. The minimum required coverage typically includes liability insurance to cover bodily injury and property damage caused to others in an accident for which you are at fault.

Use our free comparison tool below to see what auto insurance quotes look like in your area.

What are the different types of auto insurance coverage available?

The most common types of auto insurance coverage include liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage. Each type serves a different purpose, from covering damages to others’ property to protecting your own vehicle in the event of an accident.

How much auto insurance coverage do I need in Augusta, GA?

Can I use my auto insurance policy to cover rental cars?

How can I save money on auto insurance in Augusta, GA?

What factors can affect my auto insurance premiums in Augusta, GA?

Can I purchase auto insurance online in Augusta, GA?

What should I do if I’m involved in an auto accident in Augusta, GA?

How does my credit score affect auto insurance rates in Augusta, GA?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.